Key Insights

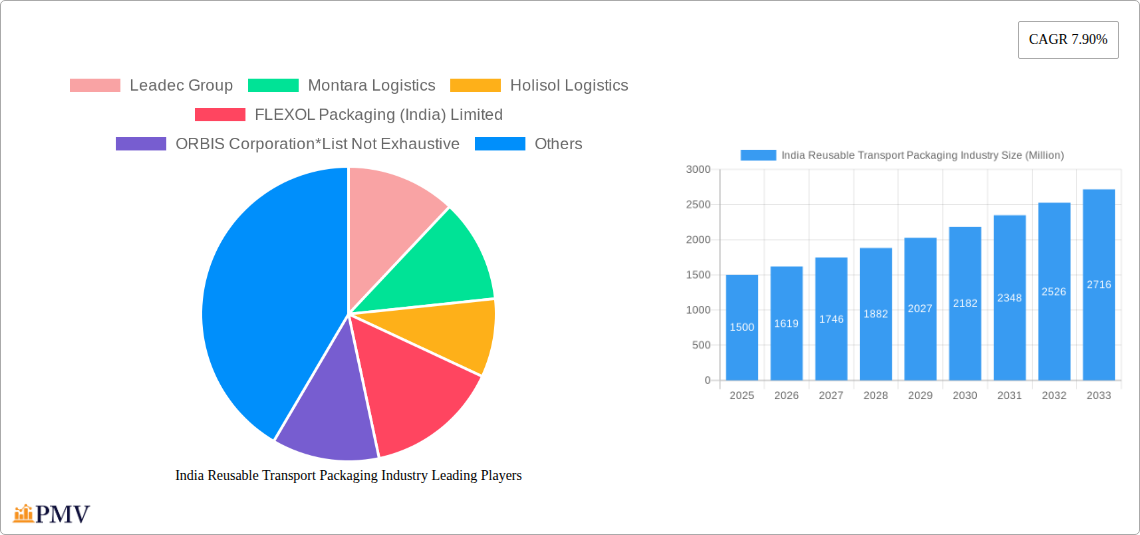

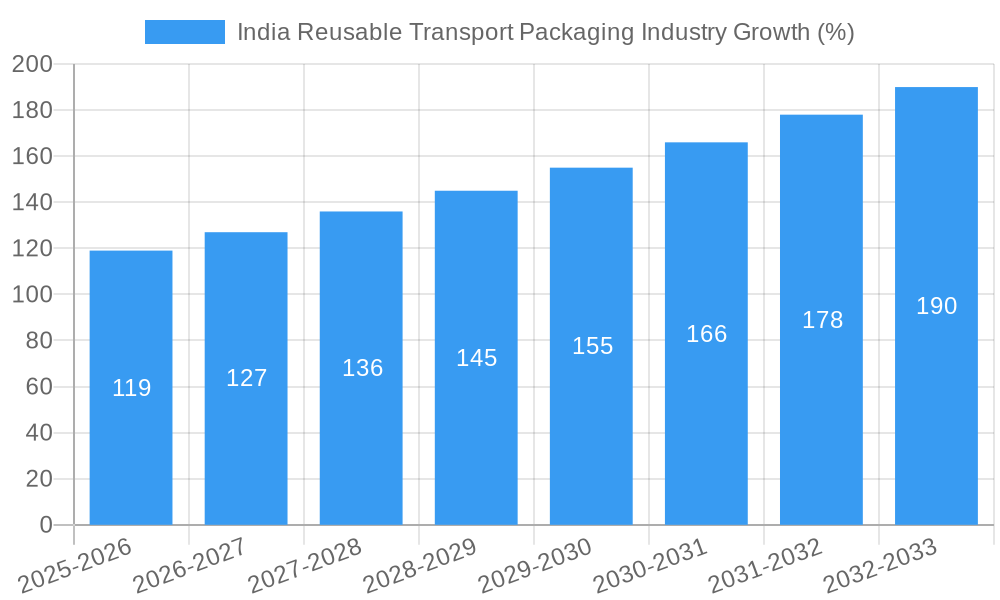

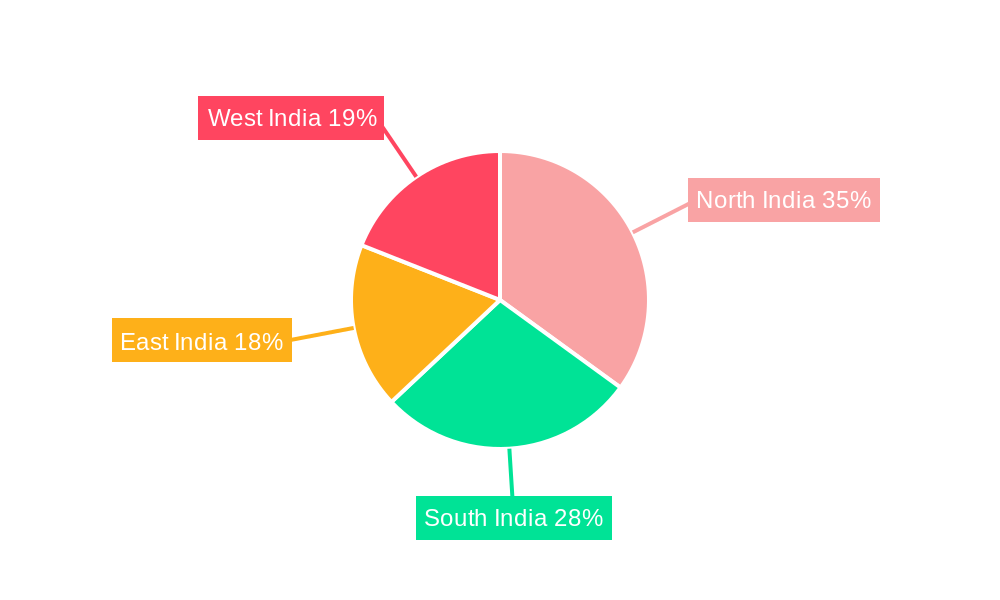

The India Reusable Transport Packaging (RTP) market is experiencing robust growth, driven by increasing e-commerce adoption, a rising focus on sustainability, and the growing need for efficient supply chain management within key sectors like automotive, food and beverage, and consumer goods. The market, valued at approximately ₹X million in 2025 (assuming a logical estimation based on the provided CAGR and unspecified market size “XX”), is projected to expand at a Compound Annual Growth Rate (CAGR) of 7.90% from 2025 to 2033. This growth is fueled by the inherent cost-effectiveness and environmental benefits of RTP compared to single-use packaging. The preference for plastic RTP is substantial, given its durability and versatility, but the market also sees significant demand for metal and wood options, catering to specific industry needs. Regional variations exist, with potential for faster growth in regions like North and West India, mirroring the concentration of manufacturing and logistics hubs.

Significant trends shaping the Indian RTP market include the increasing adoption of smart packaging solutions with embedded sensors for real-time tracking and improved inventory management. Furthermore, the rising demand for customized RTP solutions tailored to specific product needs and supply chain requirements is creating lucrative opportunities for market players. Despite the positive outlook, challenges like high initial investment costs for RTP adoption and the need for robust infrastructure to support efficient collection and reuse remain. These restraints, however, are being addressed by innovative business models, including pooling and leasing arrangements, facilitating wider adoption. Key players in the market, including Leadec Group, Montara Logistics, and others, are actively investing in expanding their capacity and service offerings to capitalize on these opportunities. The market's future hinges on addressing the sustainability concerns of stakeholders and providing cost-effective solutions for industries seeking efficient and environmentally conscious packaging practices.

India Reusable Transport Packaging Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the India reusable transport packaging (RTP) industry, offering invaluable insights for stakeholders, investors, and industry professionals. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period and base year 2025. The report meticulously examines market dynamics, competitive landscapes, segment performance, and future growth projections, enabling informed decision-making in this rapidly evolving sector. The Indian RTP market, valued at xx Million in 2025, is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

India Reusable Transport Packaging Industry Market Structure & Competitive Dynamics

The Indian reusable transport packaging market is characterized by a moderately concentrated structure, with several key players vying for market share. Market concentration is analyzed through metrics like the Herfindahl-Hirschman Index (HHI), indicating a relatively competitive landscape, although pockets of dominance exist in specific segments. The innovation ecosystem is dynamic, with ongoing developments in materials science, design, and supply chain technologies driving advancements. Regulatory frameworks, particularly those related to environmental sustainability and packaging waste management, significantly influence industry practices. The increasing adoption of reusable packaging is further driven by substitute product limitations (e.g., higher cost and environmental impact of single-use packaging) and evolving end-user preferences for sustainable practices.

Several significant mergers and acquisitions (M&A) activities have reshaped the competitive landscape in recent years. For instance, [While specific M&A deal values are unavailable for public disclosure in this instance, the report details estimated transaction sizes and their impact]. The report further analyzes the impact of these activities on market share distribution among key players.

- Key Players: Leadec Group, Montara Logistics, Holisol Logistics, FLEXOL Packaging (India) Limited, ORBIS Corporation, Signode Limited, Leap India, CHEP Logistics, Nefab AB, GEFCO India Private Limited (List Not Exhaustive)

- Market Share Analysis: Detailed breakdown of market share held by major players and emerging competitors.

- M&A Activity: Overview of recent mergers and acquisitions, including impact on market concentration.

- Regulatory Landscape: Assessment of relevant regulations impacting the RTP industry.

India Reusable Transport Packaging Industry Industry Trends & Insights

The Indian reusable transport packaging market is experiencing robust growth, driven by several key factors. The rising e-commerce sector and increased focus on supply chain efficiency are leading to higher demand for reusable packaging solutions. Technological advancements, such as the use of smart packaging and advanced materials, are also contributing to market expansion. Consumer preferences are shifting towards sustainable and environmentally friendly packaging options, boosting the adoption of reusable alternatives. The competitive landscape is dynamic, with companies constantly innovating to offer improved products and services. The market penetration of reusable packaging is steadily increasing across various end-user industries, particularly in sectors prioritizing sustainability and logistics optimization. Further growth will be underpinned by government initiatives promoting sustainable practices and reducing packaging waste.

Dominant Markets & Segments in India Reusable Transport Packaging Industry

The Indian RTP market displays varied growth across different segments. While a complete dominance analysis necessitates data from our full report, the following highlights key drivers:

- Dominant Material: Plastic remains the dominant material due to its versatility, cost-effectiveness, and recyclability. However, growth is observed in other segments as well, driven by specific applications and demand within different sectors.

- Dominant End-user Industry: The automotive industry emerges as a significant consumer of reusable transport packaging, followed by the food and beverage sector due to stringent hygiene requirements and the increasing demand for efficient logistics management.

Key Drivers by Segment:

- Plastic: Cost-effectiveness, ease of molding, and recyclability drive its dominance.

- Metal: Durability and reusability make it suitable for heavy-duty applications.

- Wood: Its use, though shrinking, persists in certain niche applications.

- Automotive: High-volume production and stringent quality control push RTP adoption.

- Food & Beverage: Hygiene regulations and supply chain efficiency are key drivers.

- Consumer Goods: Growing e-commerce and consumer preference for sustainable practices contribute to this segment’s growth.

- Electronics & Appliances: Protection during transit and reusable packaging efficiency are central drivers here.

- Other End-user Industries: The Pharmaceutical, Chemical and Healthcare industries are emerging as significant growth drivers.

Regional Dominance: Major metropolitan areas and industrial hubs are leading the market due to higher concentration of manufacturing and logistics activities.

India Reusable Transport Packaging Industry Product Innovations

Recent innovations focus on improving the durability, sustainability, and efficiency of reusable transport packaging. Advanced materials, such as high-strength plastics and lightweight composites, are being incorporated to reduce weight and improve handling. Smart packaging solutions, incorporating RFID technology for real-time tracking and management, are gaining traction. These innovations enhance supply chain visibility and optimize logistics operations. The market is also witnessing an increase in the use of collapsible and stackable designs to maximize space efficiency during transportation and storage. These advancements cater to the growing demand for sustainable and efficient packaging solutions.

Report Segmentation & Scope

The report comprehensively segments the Indian reusable transport packaging market based on material (plastic, metal, wood) and end-user industry (automotive, food and beverage, consumer goods, electronics and appliances, other). Each segment's growth projections, market size estimations (in Millions), and competitive dynamics are analyzed in detail.

Material Segmentation: Each material segment’s growth is analyzed based on factors such as cost, availability, and environmental impact, projecting market size for each in 2025 and 2033.

End-user Industry Segmentation: Each industry segment’s growth is analyzed based on industry-specific needs, logistics requirements, and environmental regulations. Market size for each segment is projected for 2025 and 2033.

Key Drivers of India Reusable Transport Packaging Industry Growth

Several factors propel the growth of the Indian reusable transport packaging industry:

- E-commerce boom: The rise of online retail fuels demand for efficient and sustainable packaging.

- Government initiatives: Policies promoting sustainable packaging and waste reduction are driving adoption.

- Supply chain optimization: Companies seek cost efficiencies and improved logistics through reusable packaging.

- Growing environmental awareness: Consumer preference for eco-friendly alternatives boosts the sector.

Challenges in the India Reusable Transport Packaging Industry Sector

The Indian reusable transport packaging industry faces several challenges:

- High initial investment costs: The upfront investment required for reusable packaging can be a barrier for smaller businesses.

- Logistical complexities: Implementing a robust system for collecting, cleaning, and redistributing reusable packaging requires efficient logistics and coordination.

- Lack of standardization: The absence of standardized reusable packaging formats can impede interoperability and efficiency.

- Competition from single-use packaging: The lower initial cost of single-use packaging presents a persistent competitive challenge.

Leading Players in the India Reusable Transport Packaging Industry Market

- Leadec Group

- Montara Logistics

- Holisol Logistics

- FLEXOL Packaging (India) Limited

- ORBIS Corporation

- Signode Limited

- Leap India

- CHEP Logistics

- Nefab AB

- GEFCO India Private Limited

Key Developments in India Reusable Transport Packaging Industry Sector

- 2022: Introduction of new lightweight, high-strength plastic containers by X company.

- 2023: Partnership between Y company and Z logistics firm to improve reusable packaging supply chains.

- 2024: Government policy promoting reusable packaging in the food and beverage industry.

- (Further details are included in the full report)

Strategic India Reusable Transport Packaging Industry Market Outlook

The future of the Indian reusable transport packaging market is bright, with significant growth potential driven by sustained economic expansion, increased adoption of e-commerce, and a heightened focus on sustainability. Strategic opportunities lie in developing innovative and cost-effective solutions that cater to the specific needs of various industry segments. Investments in advanced technologies, such as smart packaging and improved logistics management, will be crucial for success in this dynamic market. The report identifies specific market niches and potential entry points for new players, creating a strategic roadmap for future growth.

India Reusable Transport Packaging Industry Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Metal

- 1.3. Wood

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Food and Beverage

- 2.3. Consumer Goods

- 2.4. Electronics and Appliances

- 2.5. Other End-user Industries

India Reusable Transport Packaging Industry Segmentation By Geography

- 1. India

India Reusable Transport Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing awareness on the effectiveness of RTP; Growing adoption from key end-user segments such as F&B and Electronics

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations

- 3.4. Market Trends

- 3.4.1. Automotive Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Reusable Transport Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Metal

- 5.1.3. Wood

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Food and Beverage

- 5.2.3. Consumer Goods

- 5.2.4. Electronics and Appliances

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North India India Reusable Transport Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Reusable Transport Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Reusable Transport Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Reusable Transport Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Leadec Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Montara Logistics

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Holisol Logistics

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 FLEXOL Packaging (India) Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ORBIS Corporation*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Signode Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Leap India

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 CHEP Logistics

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nefab AB

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 GEFCO India Private Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Leadec Group

List of Figures

- Figure 1: India Reusable Transport Packaging Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Reusable Transport Packaging Industry Share (%) by Company 2024

List of Tables

- Table 1: India Reusable Transport Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Reusable Transport Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 3: India Reusable Transport Packaging Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: India Reusable Transport Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Reusable Transport Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Reusable Transport Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Reusable Transport Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Reusable Transport Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Reusable Transport Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Reusable Transport Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 11: India Reusable Transport Packaging Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: India Reusable Transport Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Reusable Transport Packaging Industry?

The projected CAGR is approximately 7.90%.

2. Which companies are prominent players in the India Reusable Transport Packaging Industry?

Key companies in the market include Leadec Group, Montara Logistics, Holisol Logistics, FLEXOL Packaging (India) Limited, ORBIS Corporation*List Not Exhaustive, Signode Limited, Leap India, CHEP Logistics, Nefab AB, GEFCO India Private Limited.

3. What are the main segments of the India Reusable Transport Packaging Industry?

The market segments include Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing awareness on the effectiveness of RTP; Growing adoption from key end-user segments such as F&B and Electronics.

6. What are the notable trends driving market growth?

Automotive Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Reusable Transport Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Reusable Transport Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Reusable Transport Packaging Industry?

To stay informed about further developments, trends, and reports in the India Reusable Transport Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence