Key Insights

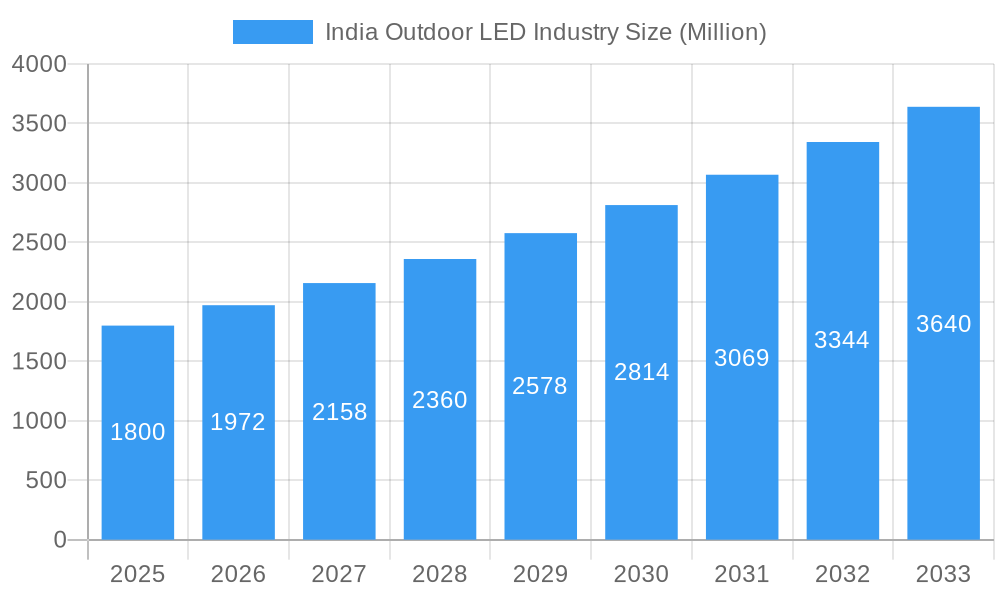

The Indian outdoor LED lighting market is poised for substantial expansion, propelled by government-led energy efficiency mandates, smart city initiatives, and escalating demand for advanced public safety and infrastructure. The market registered a Compound Annual Growth Rate (CAGR) of 9.80% between 2019 and 2024, with projections indicating sustained growth through 2033. Key market segments include public spaces, streets and roadways, and specialized outdoor applications in industrial and commercial zones. Leading players such as Syska, Bajaj, Wipro, Havells, Surya Roshni, OPPLE, Eveready, Crompton Greaves, Orient Electric, and Signify (Philips) are actively fostering innovation and competitive pricing. Growth is anticipated to be most dynamic in rapidly urbanizing regions like North and West India. While precise figures are unavailable, based on a projected market size of $1.56 billion in 2025, with an estimated CAGR of 8.56% from a base year of 2025, the market size is expected to reach $11.56 billion by 2033. Increasing consumer and commercial awareness of LED's energy-saving advantages and declining costs are significant growth drivers. Supportive government regulations for energy-efficient technologies further bolster market momentum. However, challenges include infrastructural inconsistencies in some areas and the ongoing need for maintenance and replacement of LED fixtures.

India Outdoor LED Industry Market Size (In Billion)

The future outlook for the Indian outdoor LED lighting market is highly promising, with robust growth anticipated until 2033. Technological advancements, including smart lighting solutions and IoT integration, are expected to significantly accelerate market penetration. Increased private sector investment in infrastructure and smart city development will be critical in stimulating demand. Furthermore, a burgeoning middle class with growing disposable income will drive demand for aesthetically superior and energy-efficient outdoor lighting in both residential and commercial sectors. Key considerations for market participants include potential supply chain volatility, fluctuating raw material prices, and the necessity for a skilled workforce for installation and maintenance. Strategic imperatives for success in this evolving market encompass technological innovation, forging strategic alliances, and cultivating localized manufacturing capabilities.

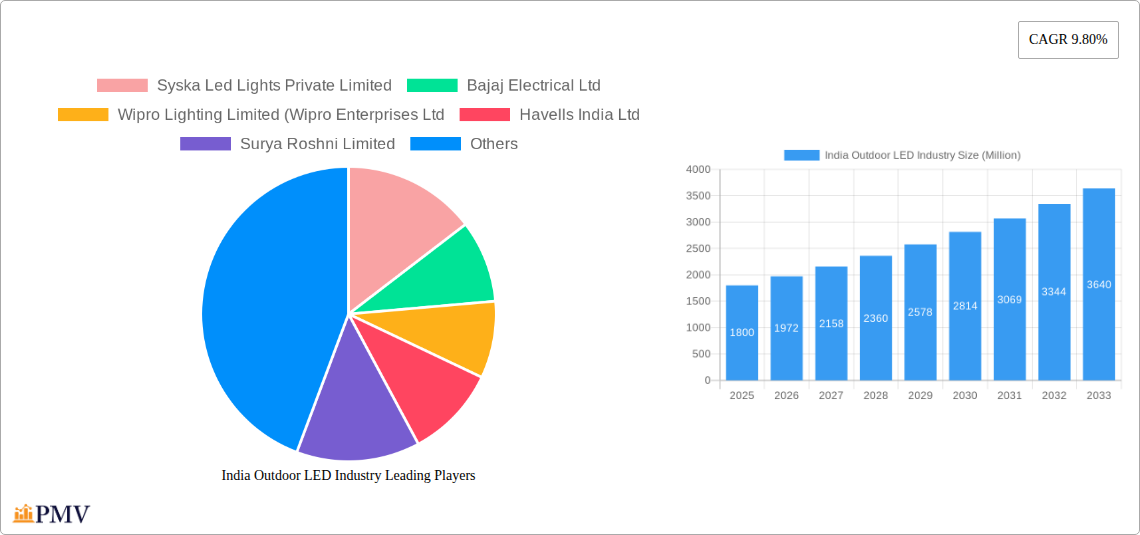

India Outdoor LED Industry Company Market Share

India Outdoor LED Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Outdoor LED Industry, covering market structure, competitive dynamics, growth drivers, challenges, and future outlook. The report uses 2025 as the base year, with a forecast period extending from 2025 to 2033 and historical data spanning 2019-2024. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033. This detailed analysis offers actionable insights for industry stakeholders, including manufacturers, investors, and policymakers.

India Outdoor LED Industry Market Structure & Competitive Dynamics

The Indian outdoor LED lighting market is characterized by a moderately concentrated structure with several major players and numerous smaller participants. Key players such as Syska Led Lights Private Limited, Bajaj Electrical Ltd, Wipro Lighting Limited, Havells India Ltd, Surya Roshni Limited, OPPLE Lighting Co Ltd, Eveready Industries India Limited, Crompton Greaves Consumer Electricals Limited, Orient Electric Limited, and Signify Holding (Philips) compete based on product features, pricing, brand recognition, and distribution networks. Market share is dynamic, with leading players holding significant portions (xx% collectively in 2025), while smaller companies focus on niche segments.

The industry witnesses continuous innovation, driven by advancements in LED technology, smart lighting solutions, and energy efficiency standards. Government regulations, such as energy efficiency mandates and emphasis on smart city initiatives, significantly impact market growth. Product substitutes include traditional lighting technologies (e.g., high-pressure sodium lamps), but their market share is declining due to LED's superior efficiency and cost savings in the long run. End-user trends favor energy-efficient and smart lighting solutions, pushing manufacturers to incorporate IoT and smart control features in their offerings.

Mergers and acquisitions (M&A) activity remains moderate. While major transactions exceeding xx Million are infrequent, smaller acquisitions and strategic partnerships contribute to market consolidation and expansion into new segments. For example, in the period 2019-2024, there were approximately xx M&A deals, with a total estimated value of xx Million.

India Outdoor LED Industry Industry Trends & Insights

The India outdoor LED industry demonstrates robust growth, driven by various factors. The compound annual growth rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%, indicating a significant expansion of the market. This growth is fueled by increasing government spending on infrastructure projects, particularly in smart cities, urban renewal, and rural electrification initiatives. The rising adoption of energy-efficient lighting solutions, supported by government incentives and awareness campaigns, further bolsters market expansion. Market penetration of LED outdoor lighting is steadily increasing, reaching an estimated xx% in 2025 and projected to reach xx% by 2033.

Technological disruptions, particularly the development of smart lighting systems with IoT capabilities and advanced control features, significantly influence market dynamics. Consumers increasingly prefer smart and energy-efficient solutions that offer cost savings, improved safety, and remote control functionalities. Competitive dynamics are characterized by intense rivalry among major players, resulting in continuous product innovation, price adjustments, and strategic partnerships to gain a larger market share.

Dominant Markets & Segments in India Outdoor LED Industry

The Indian outdoor LED market is geographically diverse, with significant growth across various regions. However, urban areas and rapidly developing cities experience the highest demand, reflecting the focus on smart city initiatives and infrastructure modernization.

- Public Places: This segment dominates the market due to high government spending and increasing focus on improving public safety and aesthetics in urban areas. Key drivers include government policies promoting energy-efficient street lighting, smart city initiatives, and rising safety concerns.

- Streets and Roadways: This segment represents a significant portion of the market, driven by extensive road networks and government projects focused on upgrading street lighting infrastructure. Economic policies promoting energy efficiency and sustainable development contribute to its growth.

- Others: This segment encompasses various applications, including commercial, industrial, and residential outdoor lighting, each with specific market characteristics and growth potential.

The dominance of urban centers is largely attributed to robust infrastructure development plans and implementation of smart city projects. Government regulations and policies play a critical role in driving demand, particularly in the public places and streets and roadways segments. Furthermore, the rising adoption of smart lighting solutions in these areas provides considerable growth momentum.

India Outdoor LED Industry Product Innovations

The Indian outdoor LED industry showcases continuous product innovation driven by technological advancements. Recent developments include the integration of smart features, such as remote control, dimming capabilities, and IoT connectivity in outdoor LED fixtures. Manufacturers emphasize energy efficiency, durability, and long-term cost savings. Products are designed to meet specific needs for various applications, catering to diverse lighting requirements in public places, streets, roadways, and other outdoor environments. These innovations help manufacturers gain a competitive advantage and cater to evolving consumer preferences.

Report Segmentation & Scope

This report segments the India outdoor LED market based on application.

- Outdoor Lighting: Public Places: This segment includes street lights, park lighting, and other public area lighting solutions. Growth is driven by smart city initiatives and government investment in public infrastructure.

- Outdoor Lighting: Streets and Roadways: This segment focuses on street lighting solutions for roadways. It exhibits strong growth potential due to government focus on infrastructure development.

- Outdoor Lighting: Others: This segment encompasses other outdoor lighting applications, including commercial and industrial settings. This is a diverse area, with growth rates differing by application.

Each segment’s market size, growth projection, and competitive dynamics are analyzed in detail within the report.

Key Drivers of India Outdoor LED Industry Growth

The growth of the India outdoor LED industry is primarily driven by several factors:

- Government Initiatives: Policies promoting energy efficiency and smart city development strongly support LED adoption.

- Infrastructure Development: Massive investments in road infrastructure, urban renewal, and rural electrification create significant demand.

- Technological Advancements: Continuous innovation in LED technology leads to enhanced efficiency, durability, and smart features.

These factors collectively contribute to increased market penetration and sustained growth of the industry.

Challenges in the India Outdoor LED Industry Sector

Despite strong growth potential, several challenges impede the industry's progress:

- Supply Chain Disruptions: Global supply chain volatility can impact component availability and production costs.

- Competitive Pressure: Intense competition among players requires constant innovation and cost optimization.

- High Initial Investment: The upfront cost of installing LED lighting systems can be a barrier for some projects.

These factors need to be considered for effective market strategy.

Leading Players in the India Outdoor LED Industry Market

- Syska Led Lights Private Limited

- Bajaj Electrical Ltd

- Wipro Lighting Limited

- Havells India Ltd

- Surya Roshni Limited

- OPPLE Lighting Co Ltd

- Eveready Industries India Limited

- Crompton Greaves Consumer Electricals Limited

- Orient Electric Limited

- Signify Holding (Philips)

Key Developments in India Outdoor LED Industry Sector

- April 2023: Signify launched High Performance Lighting Solutions "Philips Skyline e-Way" for safer highways, enhancing safety and efficiency.

- March 2023: An unnamed company launched LED track lights, expanding product offerings and enhancing ambiance creation in various areas.

- January 2023: Orient Electric illuminated iconic buildings across India in tricolor for Republic Day as part of the #OrientLightsUpIndia campaign, highlighting brand visibility and national pride.

Strategic India Outdoor LED Industry Market Outlook

The future of the India outdoor LED industry is exceptionally promising, driven by sustained government investment in infrastructure, the burgeoning adoption of smart city initiatives, and continuous technological advancements. Strategic opportunities lie in developing innovative smart lighting solutions with IoT integration, focusing on energy efficiency and sustainability, and targeting expanding rural electrification projects. By adapting to evolving consumer preferences and technological disruptions, industry players can capitalize on the significant growth potential of this dynamic market.

India Outdoor LED Industry Segmentation

-

1. Outdoor Lighting

- 1.1. Public Places

- 1.2. Streets and Roadways

- 1.3. Others

India Outdoor LED Industry Segmentation By Geography

- 1. India

India Outdoor LED Industry Regional Market Share

Geographic Coverage of India Outdoor LED Industry

India Outdoor LED Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Consumer Awareness and Government Regulations Mandating the Installation of Smart Meters; Increased Investments in Smart Grid Projects; Investments in Smart City Developments

- 3.3. Market Restrains

- 3.3.1. High Installation Cost and Longer ROI Period; Longer Replacement Cycle of Water Meters

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Outdoor LED Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 5.1.1. Public Places

- 5.1.2. Streets and Roadways

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Syska Led Lights Private Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bajaj Electrical Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wipro Lighting Limited (Wipro Enterprises Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Havells India Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Surya Roshni Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OPPLE Lighting Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Eveready Industries India Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Crompton Greaves Consumer Electricals Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Orient Electric Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Signify Holding (Philips)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Syska Led Lights Private Limited

List of Figures

- Figure 1: India Outdoor LED Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Outdoor LED Industry Share (%) by Company 2025

List of Tables

- Table 1: India Outdoor LED Industry Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 2: India Outdoor LED Industry Volume K Unit Forecast, by Outdoor Lighting 2020 & 2033

- Table 3: India Outdoor LED Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Outdoor LED Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: India Outdoor LED Industry Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 6: India Outdoor LED Industry Volume K Unit Forecast, by Outdoor Lighting 2020 & 2033

- Table 7: India Outdoor LED Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: India Outdoor LED Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Outdoor LED Industry?

The projected CAGR is approximately 8.56%.

2. Which companies are prominent players in the India Outdoor LED Industry?

Key companies in the market include Syska Led Lights Private Limited, Bajaj Electrical Ltd, Wipro Lighting Limited (Wipro Enterprises Ltd, Havells India Ltd, Surya Roshni Limited, OPPLE Lighting Co Ltd, Eveready Industries India Limited, Crompton Greaves Consumer Electricals Limited, Orient Electric Limited, Signify Holding (Philips).

3. What are the main segments of the India Outdoor LED Industry?

The market segments include Outdoor Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Higher Consumer Awareness and Government Regulations Mandating the Installation of Smart Meters; Increased Investments in Smart Grid Projects; Investments in Smart City Developments.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Installation Cost and Longer ROI Period; Longer Replacement Cycle of Water Meters.

8. Can you provide examples of recent developments in the market?

April 2023: Signify launched High Performance Lighting Solutions "Philips Skyline e-Way" For Safer Highways.March 2023: In 2023, the company launched LED track lights. The design of these track lights is aimed at producing a luminous and ambient illumination, which renders them ideal for generating a radiant ambiance in any area.January 2023: In 2023, the company Lights up Iconic Buildings Across India in Tricolour for Republic Day as a part of #OrientLightsUpIndia campaign.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Outdoor LED Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Outdoor LED Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Outdoor LED Industry?

To stay informed about further developments, trends, and reports in the India Outdoor LED Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence