Key Insights

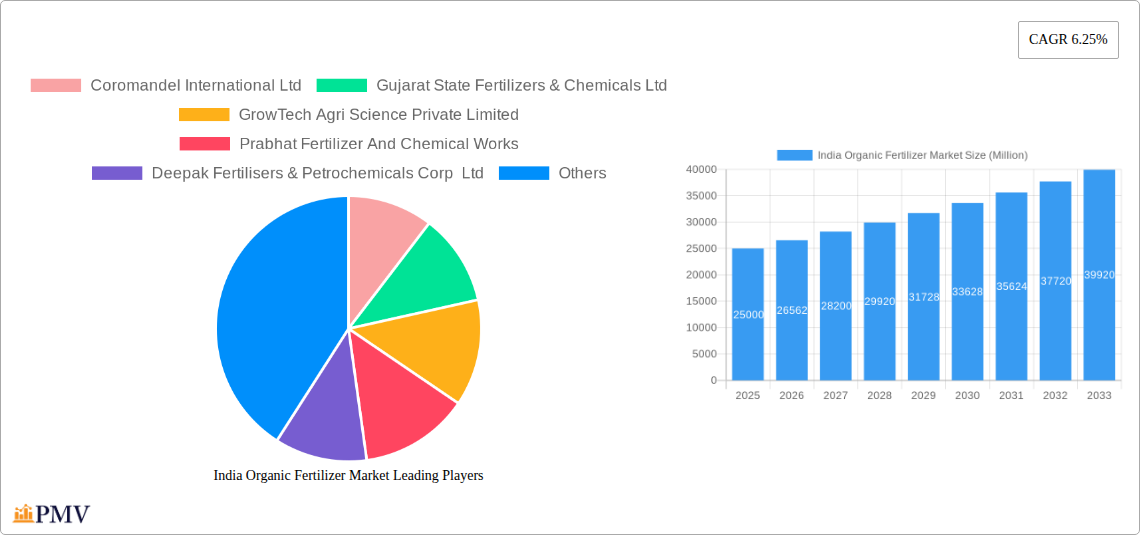

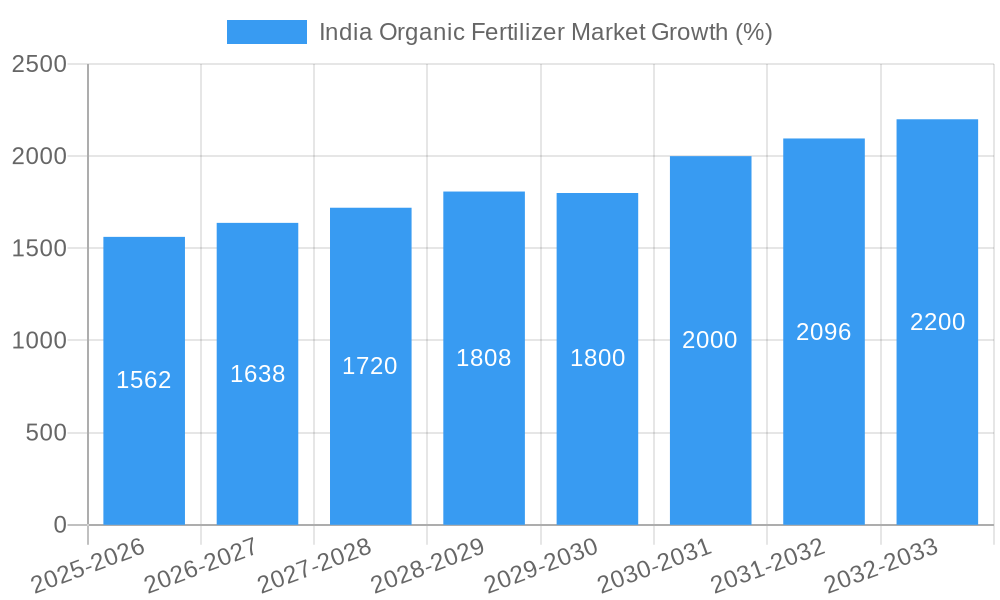

The India organic fertilizer market, valued at approximately ₹25000 million (estimated) in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.25% from 2025 to 2033. This expansion is fueled by several key factors. Increasing consumer awareness regarding the environmental impact of chemical fertilizers and the rising demand for organically grown crops are primary drivers. Government initiatives promoting sustainable agriculture and stricter regulations on chemical fertilizer usage further bolster market growth. The market segmentation reveals strong demand across various crop types, including cash crops, horticultural crops, and row crops, with manure and meal-based fertilizers holding significant market share. Regional variations exist, with potentially higher growth observed in regions with intensive agricultural practices and a strong focus on organic farming. While challenges like inconsistent supply chains and higher production costs for organic fertilizers exist, the overall market outlook remains positive, indicating significant potential for growth in the coming years.

The competitive landscape is characterized by a mix of established players like Coromandel International Ltd, Gujarat State Fertilizers & Chemicals Ltd, and Deepak Fertilisers & Petrochemicals Corp Ltd, alongside smaller, specialized organic fertilizer producers. These companies are increasingly focusing on product innovation, distribution network expansion, and strategic partnerships to cater to the growing demand. The market is expected to witness further consolidation and increased investments in research and development for the development of more efficient and sustainable organic fertilizer products. The rising demand for traceable and certified organic products presents an opportunity for producers to differentiate themselves and command premium prices. The long-term outlook for the India organic fertilizer market is exceptionally promising, with continued growth expected as consumer preferences and government policies shift towards more environmentally friendly agricultural practices.

India Organic Fertilizer Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India organic fertilizer market, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers invaluable insights for stakeholders, including manufacturers, distributors, investors, and policymakers, seeking to navigate this dynamic and rapidly expanding market. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033).

India Organic Fertilizer Market Market Structure & Competitive Dynamics

The Indian organic fertilizer market exhibits a moderately fragmented structure, with several large players and a multitude of smaller regional producers. Market concentration is relatively low, with no single dominant player controlling a significant majority of the market share. However, larger companies like Coromandel International Ltd and Gujarat State Fertilizers & Chemicals Ltd hold a considerable share, leveraging their established distribution networks and brand recognition. The market is witnessing increasing consolidation through mergers and acquisitions (M&A), as larger players seek to expand their product portfolios and geographical reach. For instance, the April 2022 merger between Liberty Pesticides and Fertilizers Limited and Coromandel SQM (India) Private Limited significantly impacted the market dynamics. The deal value of this merger was XX Million.

Innovation is driven by a combination of established players investing in R&D and smaller startups focusing on niche applications and sustainable practices. The regulatory framework, while increasingly supportive of organic farming, presents some challenges related to standardization and certification. The market also faces competition from conventional chemical fertilizers, although consumer awareness of environmental sustainability and the benefits of organic farming is driving a gradual shift towards organic alternatives. End-user trends reveal a growing preference for organic fertilizers among both smallholder farmers and large-scale agricultural operations, fueled by rising consumer demand for organically grown produce. Recent M&A activities have centered around expanding product lines, strengthening distribution networks, and gaining access to new technologies. The total M&A deal value in the organic fertilizer sector over the historical period (2019-2024) was estimated to be XX Million.

- Market Concentration: Low to Moderate

- Innovation Ecosystem: Active, with participation from both established players and startups.

- Regulatory Framework: Supportive but with room for improvement in standardization.

- Product Substitutes: Conventional Chemical Fertilizers

- End-User Trends: Increasing preference for organic fertilizers.

- M&A Activities: Increasing consolidation among market players.

India Organic Fertilizer Market Industry Trends & Insights

The India organic fertilizer market is experiencing robust growth, driven by several key factors. Government initiatives promoting sustainable agriculture and organic farming practices are playing a crucial role, along with rising consumer awareness of the environmental and health benefits of organic produce. Technological advancements in organic fertilizer production and application methods are also contributing to market expansion. The increasing adoption of precision agriculture techniques and the development of specialized organic fertilizers for various crops are further accelerating market growth.

Consumer preferences are shifting towards high-quality, certified organic fertilizers that provide proven results. This is encouraging companies to invest in research and development to improve product efficacy and value-added attributes. The competitive landscape is becoming more intense, with both established players and new entrants vying for market share. Pricing strategies, distribution networks, and brand building are playing crucial roles in determining market success.

The market is also witnessing a growing adoption of organic fertilizers in diverse agricultural segments, including cash crops, horticultural crops, and row crops. Specific regional growth rates may vary based on factors like agricultural practices, consumer demand, and governmental support schemes. The overall market penetration of organic fertilizers remains relatively low compared to conventional fertilizers, however, the growth is considerable, indicating significant untapped potential.

Dominant Markets & Segments in India Organic Fertilizer Market

The Indian organic fertilizer market is dominated by several key segments. Based on form, manure holds a significant share owing to its widespread availability and affordability. Meal-based fertilizers and oilcakes are also gaining popularity due to their nutrient-rich composition. Other organic fertilizers, such as compost and biofertilizers, are witnessing increasing demand, driven by their efficacy and sustainability features.

In terms of crop type, cash crops like cotton, sugarcane, and spices are significant consumers of organic fertilizers, owing to their high value and sensitivity to environmental factors. Horticultural crops and row crops, including vegetables and cereals, represent substantial market segments.

- Key Drivers for Dominant Segments:

- Manure: Wide availability, affordability, and traditional farming practices.

- Meal-based fertilizers: Nutrient density and proven efficacy.

- Oilcakes: Cost-effective and readily available organic source.

- Cash Crops: High value and sensitivity to environmental impacts.

- Horticultural Crops: Growing consumer demand for organic produce.

- Row Crops: Increased focus on sustainable farming practices.

The dominance of these segments is largely driven by factors like economic policies supporting organic farming, increasing government expenditure on agricultural research & development, and the expansion of irrigation infrastructure in key agricultural regions. Furthermore, the growing awareness among farmers about the long-term benefits of organic fertilizers is a crucial factor driving segment-specific growth.

India Organic Fertilizer Market Product Innovations

Recent product innovations in the Indian organic fertilizer market focus on enhancing nutrient efficiency, improving ease of application, and providing targeted solutions for specific crops and soil types. These innovations include the development of slow-release fertilizers, biofertilizers enriched with beneficial microorganisms, and the use of organic waste materials to create high-quality fertilizers. The introduction of value-added features, such as improved nutrient solubility and enhanced pest and disease resistance, is further driving market growth. The integration of technology into organic fertilizer production, including automation and precision application methods, is also playing a crucial role. These improvements translate into competitive advantages by enhancing product efficacy, reducing environmental impact, and improving farmer profitability.

Report Segmentation & Scope

This report segments the India organic fertilizer market by form (Manure, Meal Based Fertilizers, Oilcakes, Other Organic Fertilizers) and crop type (Cash Crops, Horticultural Crops, Row Crops). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. The market size is estimated to be XX Million in 2025, with the manure segment holding the largest share. The meal-based fertilizers segment is anticipated to register strong growth during the forecast period due to its effectiveness and increasing awareness. Oilcakes, due to their cost-effectiveness, are expected to maintain a stable market share. The 'other organic fertilizers' segment encompasses compost and biofertilizers and shows promising growth prospects due to their sustainable nature and increasing demand for ecologically sound farming practices. Regarding crop type, the cash crops segment is anticipated to remain dominant due to the higher value of these crops. However, horticultural and row crops will experience notable growth as sustainable agricultural practices gain traction. Competitive dynamics within each segment are shaped by factors like pricing, product quality, and distribution networks.

Key Drivers of India Organic Fertilizer Market Growth

Several factors are driving the growth of the India organic fertilizer market. Government initiatives promoting organic farming, such as subsidies and certification programs, are significantly boosting market adoption. Rising consumer awareness about the health and environmental benefits of organic produce is creating strong demand. Technological advancements in organic fertilizer production and application methods are enhancing efficacy and sustainability. The growing popularity of precision farming techniques is enabling efficient fertilizer use, further fueling market growth. Increasing disposable incomes and a rising middle class are also contributing to increased demand for premium quality organic agricultural products. Finally, the favorable regulatory environment and initiatives supporting sustainable agriculture in India provide a fertile ground for market expansion.

Challenges in the India Organic Fertilizer Market Sector

Despite the significant growth potential, the Indian organic fertilizer market faces several challenges. The lack of standardized quality control and certification mechanisms can lead to inconsistencies in product quality, hindering consumer trust. The high cost of organic fertilizers compared to their conventional counterparts poses a significant barrier for adoption, particularly for smallholder farmers. The fragmented supply chain and limited access to efficient distribution channels restrict market reach and access. These factors, alongside the ongoing competition from established chemical fertilizer manufacturers, require strategic interventions for successful market penetration and growth. The lack of sufficient awareness about the benefits of organic fertilizers in certain regions presents an additional hurdle. Estimates suggest that these factors collectively result in a loss of approximately XX Million in annual potential revenue.

Leading Players in the India Organic Fertilizer Market Market

- Coromandel International Ltd

- Gujarat State Fertilizers & Chemicals Ltd

- GrowTech Agri Science Private Limited

- Prabhat Fertilizer And Chemical Works

- Deepak Fertilisers & Petrochemicals Corp Ltd

- Southern Petrochemical Industries Corp Ltd

- Swaroop Agrochemical Industrie

- Gujarat Narmada Valley Fertilizers & Chemicals Ltd

- Amruth Organic Fertilizers

Key Developments in India Organic Fertilizer Market Sector

- February 2022: Gujarat State Fertilizers & Chemicals Ltd launched Urban Sardar, an organic fertilizer for flowering plants and gardening.

- April 2022: Coromandel International Ltd approved the merger of Liberty Pesticides and Fertilizers Limited and Coromandel SQM (India) Private Limited, expanding its organic fertilizer portfolio.

- September 2022: Gujarat State Fertilizers & Chemicals Ltd planned to enter the organic fertilizer market by setting up a 2x200 MTPD PROM plant.

Strategic India Organic Fertilizer Market Market Outlook

The India organic fertilizer market presents significant growth opportunities in the coming years. Continued government support, increasing consumer awareness, and technological advancements will drive market expansion. Strategic opportunities exist for companies to focus on product innovation, supply chain optimization, and brand building. Investment in research and development, particularly in developing region-specific and crop-specific organic fertilizers, is crucial for achieving a competitive advantage. Companies that successfully address the challenges of standardization, affordability, and distribution will be best positioned to capitalize on the substantial market potential. The long-term outlook remains positive, with sustained growth driven by increasing adoption of sustainable agricultural practices and growing demand for organically produced food.

India Organic Fertilizer Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Organic Fertilizer Market Segmentation By Geography

- 1. India

India Organic Fertilizer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Rising Prevalence of Insect-borne Diseases

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Organic Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

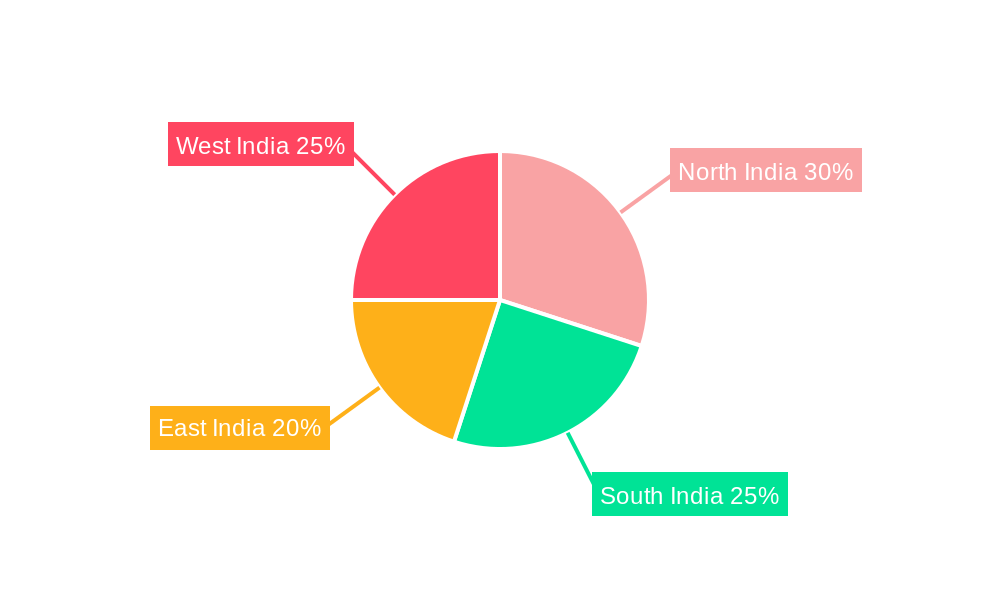

- 6. North India India Organic Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Organic Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Organic Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Organic Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Coromandel International Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Gujarat State Fertilizers & Chemicals Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 GrowTech Agri Science Private Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Prabhat Fertilizer And Chemical Works

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Deepak Fertilisers & Petrochemicals Corp Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Southern Petrochemical Industries Corp Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Swaroop Agrochemical Industrie

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Gujarat Narmada Valley Fertilizers & Chemicals Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Amruth Organic Fertilizers

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Coromandel International Ltd

List of Figures

- Figure 1: India Organic Fertilizer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Organic Fertilizer Market Share (%) by Company 2024

List of Tables

- Table 1: India Organic Fertilizer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Organic Fertilizer Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: India Organic Fertilizer Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: India Organic Fertilizer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: India Organic Fertilizer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: India Organic Fertilizer Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: India Organic Fertilizer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Organic Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: North India India Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South India India Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: East India India Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: West India India Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: India Organic Fertilizer Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: India Organic Fertilizer Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 15: India Organic Fertilizer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 16: India Organic Fertilizer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 17: India Organic Fertilizer Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 18: India Organic Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Organic Fertilizer Market?

The projected CAGR is approximately 6.25%.

2. Which companies are prominent players in the India Organic Fertilizer Market?

Key companies in the market include Coromandel International Ltd, Gujarat State Fertilizers & Chemicals Ltd, GrowTech Agri Science Private Limited, Prabhat Fertilizer And Chemical Works, Deepak Fertilisers & Petrochemicals Corp Ltd, Southern Petrochemical Industries Corp Ltd, Swaroop Agrochemical Industrie, Gujarat Narmada Valley Fertilizers & Chemicals Ltd, Amruth Organic Fertilizers.

3. What are the main segments of the India Organic Fertilizer Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Rising Prevalence of Insect-borne Diseases.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

September 2022: To expand GSFC's Agro-product portfolio, the company planned to enter into organic fertilizers by setting up a 2x200 MTPD PROM plant at a polymer unit by using available existing infrastructure.April 2022: The company approved the merger between Liberty Pesticides and Fertilizers Limited (LPFL) and Coromandel SQM (India) Private Limited (CSQM) (wholly-owned subsidiaries), which came into effect on April 01, 2021. This merger is anticipated to expand the company's product portfolio, including its organic fertilizers, in the long run.February 2022: Gujarat State Fertilizers & Chemicals Ltd launched the Urban Sardar organic fertilizer, an eco-friendly and non-toxic product containing organic sources of nutrients best suited for all flowering plants and ornamental plants, gardens, and kitchen gardening.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Organic Fertilizer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Organic Fertilizer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Organic Fertilizer Market?

To stay informed about further developments, trends, and reports in the India Organic Fertilizer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence