Key Insights

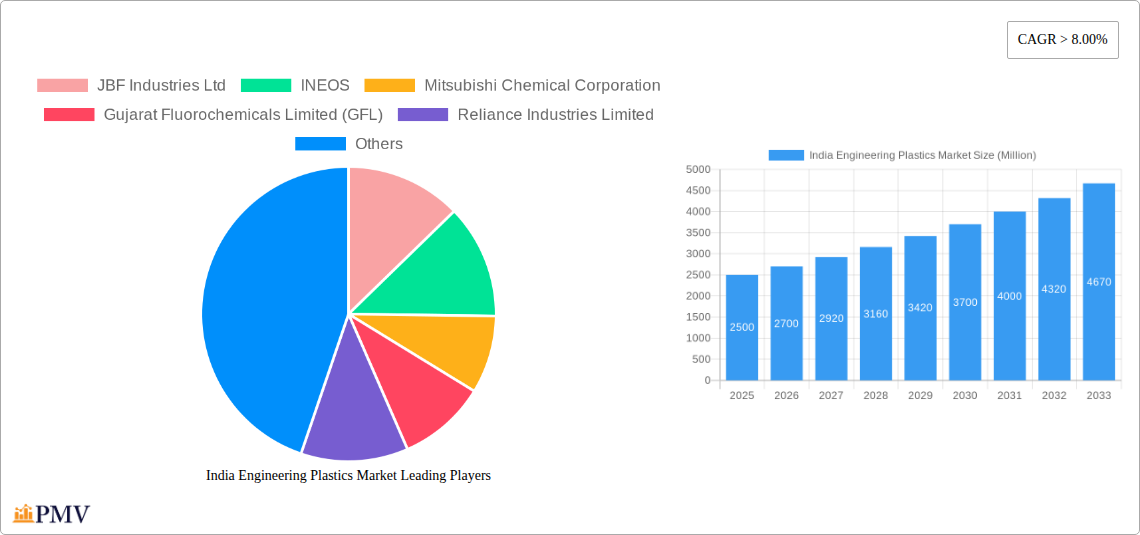

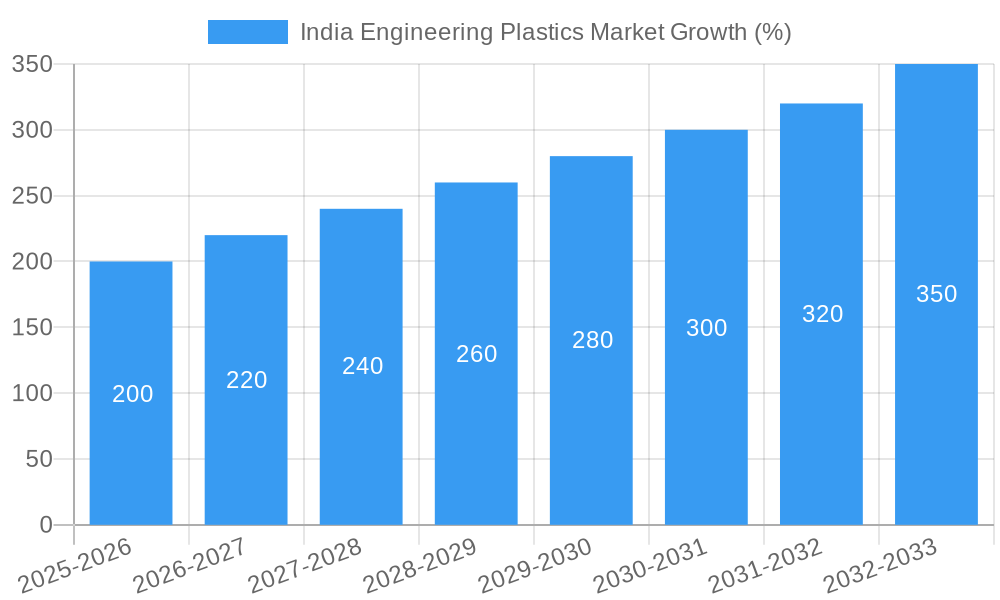

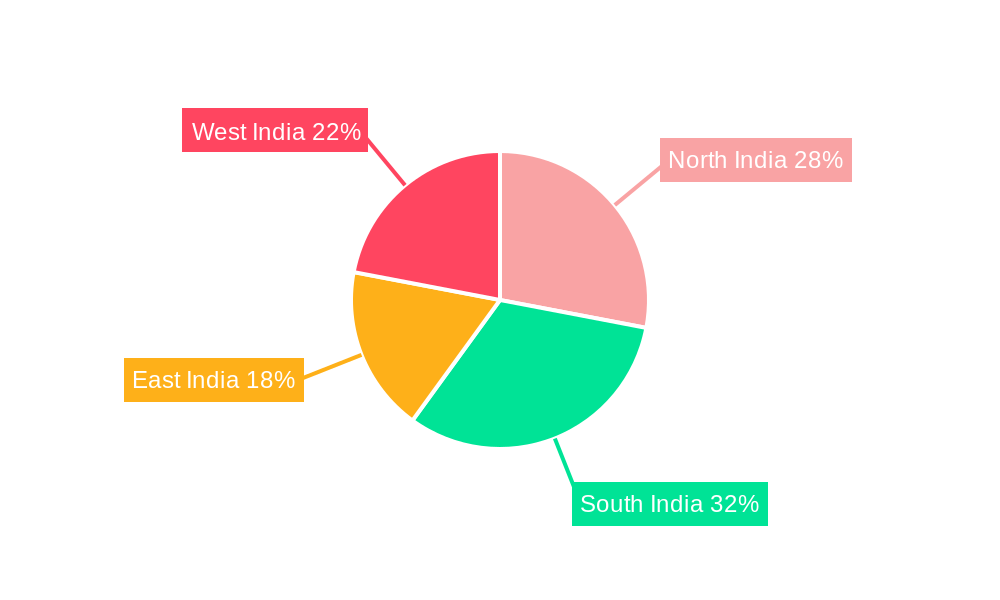

The India engineering plastics market is experiencing robust growth, driven by the nation's expanding automotive, electrical and electronics, and building and construction sectors. A compound annual growth rate (CAGR) exceeding 8% from 2019 to 2024 indicates significant market expansion, projected to continue into the forecast period (2025-2033). Key drivers include increasing demand for lightweight and high-performance materials in automobiles, the burgeoning electronics manufacturing industry, and the growth of infrastructure projects. The diverse resin types used in engineering plastics, including fluoropolymers, polyamides, and polycarbonates, cater to a wide range of applications, further fueling market expansion. While potential restraints like fluctuating raw material prices and environmental concerns related to plastic waste exist, the overall market outlook remains positive due to the sustained demand from key end-use industries. The market is segmented geographically, with North, South, East, and West India each contributing to the overall growth, though specific regional market shares would require further data analysis. Leading companies such as JBF Industries, Ineos, and Reliance Industries are key players shaping the competitive landscape through innovation, capacity expansion, and strategic partnerships.

The market's future trajectory will likely be influenced by government initiatives promoting sustainable manufacturing practices and the adoption of advanced materials in various sectors. The rising focus on electric vehicles and renewable energy infrastructure further presents growth opportunities for engineering plastics with specific properties like heat resistance and electrical insulation. Continued technological advancements in resin formulations are likely to enhance the performance characteristics of engineering plastics, broadening their applications and contributing to the overall market growth. Competitive intensity is expected to remain high, with existing players striving for market share dominance through product diversification and strategic acquisitions while new entrants explore niche segments. A comprehensive understanding of these factors will be crucial for successful market navigation.

India Engineering Plastics Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India engineering plastics market, covering the period from 2019 to 2033. It offers invaluable insights into market size, growth drivers, competitive dynamics, and future trends, equipping stakeholders with actionable intelligence for strategic decision-making. The report incorporates meticulous data analysis and forecasts, utilizing the base year 2025 and estimating the market size for 2025. The forecast period spans from 2025 to 2033, while the historical period encompasses 2019 to 2024. The total market size in 2025 is estimated at xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

India Engineering Plastics Market Market Structure & Competitive Dynamics

The Indian engineering plastics market exhibits a moderately concentrated structure, with a few dominant players alongside several smaller regional and specialized firms. Key players like JBF Industries Ltd, INEOS, Mitsubishi Chemical Corporation, Gujarat Fluorochemicals Limited (GFL), Reliance Industries Limited, Gujarat State Fertilizers & Chemicals Limited (GSFC), LANXESS, DuPont, Ester Industries Limited, IVL Dhunseri Petrochem Industries Private Limited (IDPIPL), Polyplex, Chiripal Poly Film, Bhansali Engineering Polymers Limited, Solva, and Hindustan Fluorocarbons Limited compete intensely, focusing on product differentiation, technological innovation, and cost optimization.

The market's innovation ecosystem is evolving rapidly, driven by the increasing demand for high-performance plastics in diverse sectors. Stringent regulatory frameworks concerning environmental sustainability and product safety influence market dynamics. Substitutes, such as metal alloys and composites, present competitive pressure, though engineering plastics maintain a significant advantage in terms of weight, durability, and design flexibility. End-user trends favor lightweight, high-strength materials, boosting demand for advanced engineering plastics. M&A activities are relatively frequent, with deal values ranging from xx Million to xx Million in recent years, driven by the desire to expand market share, acquire new technologies, and access wider distribution networks. Market share data reveals that the top five players account for approximately xx% of the total market.

India Engineering Plastics Market Industry Trends & Insights

The Indian engineering plastics market is experiencing robust growth, driven by several key factors. The booming automotive industry, the expanding construction sector, and the rapid growth of the electrical and electronics sector are significant contributors to this growth. Technological advancements, specifically in material science and manufacturing processes, are leading to the development of higher-performance, more sustainable engineering plastics. Consumer preferences are increasingly shifting towards lighter, more durable, and environmentally friendly products, prompting manufacturers to innovate and develop eco-friendly solutions. The market witnesses intense competitive dynamics, with companies investing heavily in R&D to maintain a competitive edge. This leads to improved product quality, enhanced functionality, and competitive pricing. The increasing adoption of electric vehicles and the growing demand for energy-efficient solutions are further accelerating market growth. The estimated market size for 2025 is xx Million, and the CAGR during the forecast period (2025-2033) is projected to be xx%, indicating strong future potential. Market penetration in key sectors like automotive and electronics is increasing steadily, further fueling the expansion. The government's initiatives focused on infrastructure development and "Make in India" also contribute to the market's upward trajectory.

Dominant Markets & Segments in India Engineering Plastics Market

Leading End-User Industry: The automotive sector is the dominant end-user industry for engineering plastics in India. This is driven by the increasing demand for lightweight vehicles, enhanced fuel efficiency, and sophisticated designs.

Leading Resin Type: Polybutylene Terephthalate (PBT) holds a significant market share due to its excellent mechanical properties, thermal stability, and cost-effectiveness, making it suitable for a wide range of applications.

Key Regional Dominance: The Western region of India, encompassing states like Maharashtra and Gujarat, dominates the market due to a high concentration of manufacturing facilities, automotive production hubs, and a supportive business environment. Economic policies promoting industrial growth, improved infrastructure, and a skilled workforce within these regions are key drivers. The region’s robust industrial base, coupled with supportive government policies and growing consumer demand for advanced materials, provides a fertile ground for the expansion of the engineering plastics market.

India Engineering Plastics Market Product Innovations

Recent innovations in engineering plastics have focused on improving material properties, enhancing sustainability, and expanding application possibilities. Key trends include the development of bio-based polymers, recycled content incorporation, and the creation of specialized compounds with improved heat resistance, impact strength, and chemical resistance. Companies are actively working on developing lightweight materials for automotive applications and high-performance materials for demanding industrial uses. These innovations cater to the growing need for eco-friendly and high-performing materials, driving market growth.

Report Segmentation & Scope

This report segments the India engineering plastics market based on End-User Industry (Aerospace, Automotive, Building & Construction, Electrical & Electronics, Industrial & Machinery, Packaging, Other End-user Industries) and Resin Type (Fluoropolymer, Polyphthalamide, PBT, PC, PEEK, PET, PI, PMMA, POM, Styrene Copolymers (ABS and SAN)). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail, providing a comprehensive overview of the market landscape. For instance, the Automotive segment is projected to witness significant growth due to the rising demand for lightweight and fuel-efficient vehicles. Similarly, the PBT resin type is expected to maintain a dominant market share due to its cost-effectiveness and versatile properties. The report provides detailed breakdowns of market size and growth projections for each segment across the study period.

Key Drivers of India Engineering Plastics Market Growth

Several factors are fueling the growth of the India engineering plastics market. Technological advancements in materials science, enabling the creation of high-performance plastics with enhanced properties, are a key driver. The booming automotive and construction sectors are generating substantial demand. Favorable government policies promoting industrial growth and infrastructure development play a crucial role. Furthermore, the rising disposable incomes of the Indian population are boosting consumer demand for durable and high-quality goods made from engineering plastics.

Challenges in the India Engineering Plastics Market Sector

Despite its growth potential, the Indian engineering plastics market faces certain challenges. Fluctuations in raw material prices and supply chain disruptions pose significant risks. Intense competition from both domestic and international players adds pressure on profit margins. Environmental concerns and regulations related to plastic waste management are increasingly impacting the industry. Furthermore, the need for continuous innovation to meet the evolving demands of end-users and the challenge of maintaining cost-competitiveness pose ongoing challenges for market participants.

Leading Players in the India Engineering Plastics Market Market

- JBF Industries Ltd

- INEOS

- Mitsubishi Chemical Corporation

- Gujarat Fluorochemicals Limited (GFL)

- Reliance Industries Limited

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

- LANXESS

- DuPont

- Ester Industries Limited

- IVL Dhunseri Petrochem Industries Private Limited (IDPIPL)

- Polyplex

- Chiripal Poly Film

- Bhansali Engineering Polymers Limited

- Solva

- Hindustan Fluorocarbons Limited

Key Developments in India Engineering Plastics Market Sector

- September 2022: LANXESS launched Durethan ECO, a sustainable polyamide resin using recycled glass fibers.

- September 2022: LANXESS introduced Pocan E, a PBT compound with excellent tracking resistance for e-mobility and electronics.

- August 2022: INEOS expanded its Novodur line with Novodur E3TZ, an extrusion grade ABS for food trays and sanitary applications. These developments highlight the industry’s focus on sustainability and innovation, impacting market dynamics by introducing competitive, high-performance products.

Strategic India Engineering Plastics Market Market Outlook

The India engineering plastics market holds significant growth potential, driven by continued expansion in key end-user industries and technological advancements. Strategic opportunities exist for players focusing on sustainability, product differentiation, and cost optimization. The increasing adoption of lightweight materials in automotive and other sectors, coupled with government initiatives promoting industrial growth, will further propel market expansion. Companies investing in R&D and focusing on specialized applications are well-positioned to capture significant market share in the years to come.

India Engineering Plastics Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Resin Type

-

2.1. Fluoropolymer

-

2.1.1. By Sub Resin Type

- 2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 2.1.1.3. Polytetrafluoroethylene (PTFE)

- 2.1.1.4. Polyvinylfluoride (PVF)

- 2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 2.1.1.6. Other Sub Resin Types

-

2.1.1. By Sub Resin Type

- 2.2. Liquid Crystal Polymer (LCP)

-

2.3. Polyamide (PA)

- 2.3.1. Aramid

- 2.3.2. Polyamide (PA) 6

- 2.3.3. Polyamide (PA) 66

- 2.3.4. Polyphthalamide

- 2.4. Polybutylene Terephthalate (PBT)

- 2.5. Polycarbonate (PC)

- 2.6. Polyether Ether Ketone (PEEK)

- 2.7. Polyethylene Terephthalate (PET)

- 2.8. Polyimide (PI)

- 2.9. Polymethyl Methacrylate (PMMA)

- 2.10. Polyoxymethylene (POM)

- 2.11. Styrene Copolymers (ABS and SAN)

-

2.1. Fluoropolymer

India Engineering Plastics Market Segmentation By Geography

- 1. India

India Engineering Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand in Automotive Industry; Rising Use in Electronics and Electrical Applications

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Increased Focus on High-Performance Materials

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Fluoropolymer

- 5.2.1.1. By Sub Resin Type

- 5.2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3. Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4. Polyvinylfluoride (PVF)

- 5.2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6. Other Sub Resin Types

- 5.2.1.1. By Sub Resin Type

- 5.2.2. Liquid Crystal Polymer (LCP)

- 5.2.3. Polyamide (PA)

- 5.2.3.1. Aramid

- 5.2.3.2. Polyamide (PA) 6

- 5.2.3.3. Polyamide (PA) 66

- 5.2.3.4. Polyphthalamide

- 5.2.4. Polybutylene Terephthalate (PBT)

- 5.2.5. Polycarbonate (PC)

- 5.2.6. Polyether Ether Ketone (PEEK)

- 5.2.7. Polyethylene Terephthalate (PET)

- 5.2.8. Polyimide (PI)

- 5.2.9. Polymethyl Methacrylate (PMMA)

- 5.2.10. Polyoxymethylene (POM)

- 5.2.11. Styrene Copolymers (ABS and SAN)

- 5.2.1. Fluoropolymer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North India India Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 JBF Industries Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 INEOS

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mitsubishi Chemical Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Gujarat Fluorochemicals Limited (GFL)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Reliance Industries Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Gujarat State Fertilizers & Chemicals Limited (GSFC)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 LANXESS

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 DuPont

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ester Industries Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 IVL Dhunseri Petrochem Industries Private Limited (IDPIPL)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Polyplex

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Chiripal Poly Film

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Bhansali Engineering Polymers Limited

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Solva

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Hindustan Fluorocarbons Limited

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 JBF Industries Ltd

List of Figures

- Figure 1: India Engineering Plastics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Engineering Plastics Market Share (%) by Company 2024

List of Tables

- Table 1: India Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Engineering Plastics Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: India Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 4: India Engineering Plastics Market Volume K Tons Forecast, by End User Industry 2019 & 2032

- Table 5: India Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 6: India Engineering Plastics Market Volume K Tons Forecast, by Resin Type 2019 & 2032

- Table 7: India Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Engineering Plastics Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: India Engineering Plastics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Engineering Plastics Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: North India India Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North India India Engineering Plastics Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: South India India Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South India India Engineering Plastics Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: East India India Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: East India India Engineering Plastics Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: West India India Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: West India India Engineering Plastics Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: India Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 20: India Engineering Plastics Market Volume K Tons Forecast, by End User Industry 2019 & 2032

- Table 21: India Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 22: India Engineering Plastics Market Volume K Tons Forecast, by Resin Type 2019 & 2032

- Table 23: India Engineering Plastics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: India Engineering Plastics Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Engineering Plastics Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the India Engineering Plastics Market?

Key companies in the market include JBF Industries Ltd, INEOS, Mitsubishi Chemical Corporation, Gujarat Fluorochemicals Limited (GFL), Reliance Industries Limited, Gujarat State Fertilizers & Chemicals Limited (GSFC), LANXESS, DuPont, Ester Industries Limited, IVL Dhunseri Petrochem Industries Private Limited (IDPIPL), Polyplex, Chiripal Poly Film, Bhansali Engineering Polymers Limited, Solva, Hindustan Fluorocarbons Limited.

3. What are the main segments of the India Engineering Plastics Market?

The market segments include End User Industry, Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand in Automotive Industry; Rising Use in Electronics and Electrical Applications.

6. What are the notable trends driving market growth?

Increased Focus on High-Performance Materials.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

September 2022: LANXESS introduced a sustainable polyamide resin, Durethan ECO, which consists of recycled fibers made from waste glass to reduce its carbon footprint.September 2022: LANXESS introduced Pocan E, a new polybutylene terephthalate (PBT) compound with excellent tracking resistance that is particularly suited to applications in e-mobility and the electrical and electronics industry.August 2022: INEOS announced the introduction of an extension to its high-performance Novodur line of specialty ABS products. The new Novodur E3TZ is an extrusion grade that is suitable for a variety of applications, including food trays, sanitary applications, and suitcases.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Engineering Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Engineering Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Engineering Plastics Market?

To stay informed about further developments, trends, and reports in the India Engineering Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence