Key Insights

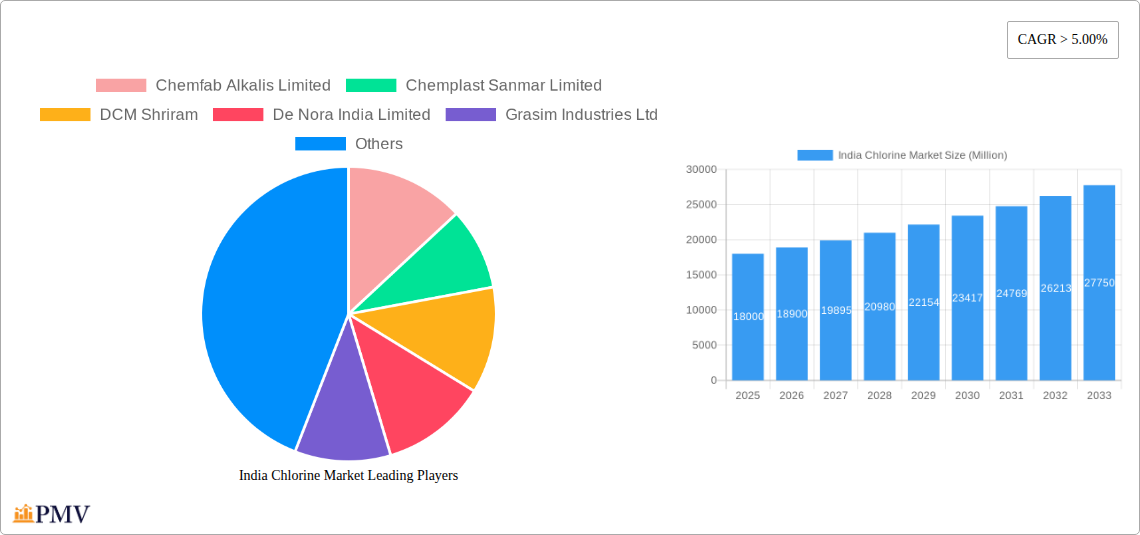

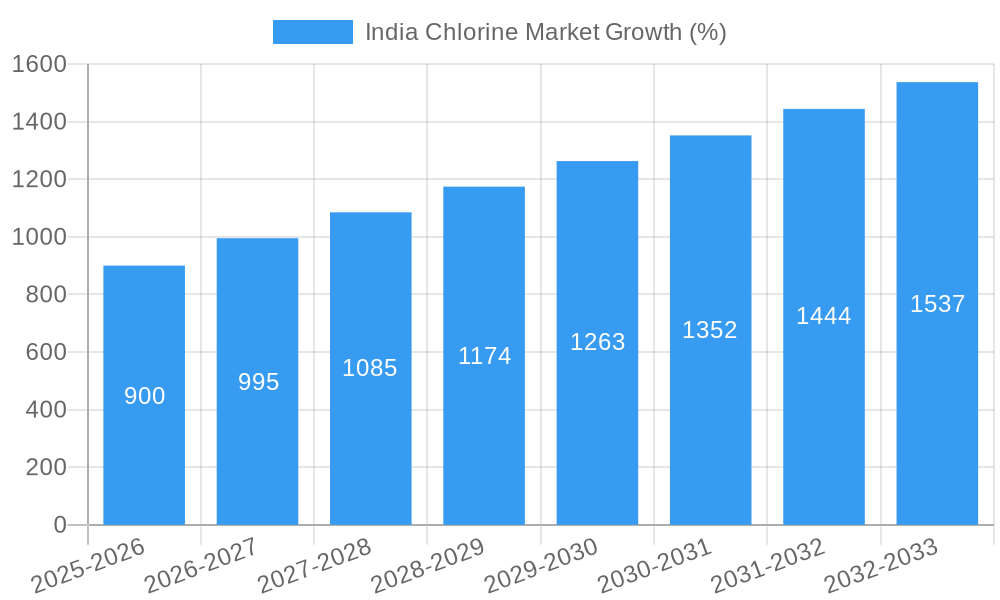

The India chlorine market, valued at approximately ₹150 billion (USD 18 billion) in 2025, is experiencing robust growth, projected to expand at a CAGR exceeding 5% from 2025 to 2033. This surge is primarily driven by the burgeoning demand from key downstream sectors, including PVC (polyvinyl chloride) manufacturing, which constitutes a significant portion of chlorine consumption. The increasing construction activity across India, particularly in infrastructure development and housing, fuels the high demand for PVC pipes and fittings, thereby boosting chlorine demand. Furthermore, the growth of water treatment facilities and the expanding chemical industry contribute significantly to market expansion. Government initiatives promoting industrial development and infrastructure modernization further act as catalysts. However, fluctuating raw material prices, stringent environmental regulations, and potential supply chain disruptions pose challenges to consistent market growth. The competitive landscape is shaped by a mix of large established players like Tata Chemicals and Grasim Industries, alongside several medium-sized and smaller companies. The market is segmented geographically, with significant variations in demand based on regional industrial development and infrastructure spending. Future growth will likely depend on sustained infrastructure investment, technological advancements in chlorine production, and the effective management of environmental concerns.

The competitive intensity in the Indian chlorine market is moderate to high, with companies vying for market share through capacity expansion, technological upgrades, and strategic partnerships. While the dominance of large players is evident, smaller companies are focusing on niche applications and regional markets to carve out their position. The market is characterized by both organic and inorganic growth strategies, with mergers, acquisitions, and joint ventures expected to shape the future competitive landscape. Maintaining cost-effectiveness and operational efficiency amidst fluctuating raw material prices is crucial for companies to sustain profitability and market share. Sustainable practices and adherence to stringent environmental norms are increasingly becoming key differentiators in the market, influencing consumer and investor perceptions. Innovation in chlorine-based applications and exploration of alternative technologies will be pivotal for long-term growth and sustainability in this dynamic sector.

India Chlorine Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Chlorine Market, offering valuable insights for stakeholders across the value chain. Covering the period from 2019 to 2033, with 2025 as the base year, this report analyzes historical data (2019-2024), current market estimations (2025), and future forecasts (2025-2033). The report meticulously examines market structure, competitive dynamics, industry trends, segment performance, and key growth drivers, equipping businesses with actionable intelligence for strategic decision-making. The report’s detailed analysis covers key players, including Chemfab Alkalis Limited, Chemplast Sanmar Limited, DCM Shriram, De Nora India Limited, Grasim Industries Ltd, Gujarat Alkali and Chemicals Limited, Gujarat Fluorochemicals Ltd, Lords Chloro Alkali Limited, Meghmani Finechem Limited, Nirma Limited, Sree Rayalaseema Alkalies and Chemicals Limited, and Tata Chemicals Limited (List Not Exhaustive).

India Chlorine Market Market Structure & Competitive Dynamics

The India chlorine market exhibits a moderately concentrated structure, with a few large players holding significant market share. The competitive landscape is characterized by intense rivalry, driven by factors such as pricing pressures, capacity expansions, and technological advancements. Innovation plays a crucial role, with companies investing in improving production efficiency and exploring new applications for chlorine and its derivatives. The regulatory framework, including environmental regulations and safety standards, significantly influences market operations. Product substitution, primarily from alternative disinfectants and bleaching agents, poses a challenge. End-user trends, particularly in water treatment, plastics, and pulp & paper industries, significantly impact chlorine demand. Mergers and acquisitions (M&A) activity has been moderate, with deal values ranging from USD 47 Million to USD 268 Million in recent years. For instance, the expansion of GACL's caustic soda production capacity demonstrates significant capital investment in the sector. Market share data for individual players are currently unavailable (xx) but are expected to be included in the full report.

India Chlorine Market Industry Trends & Insights

The India Chlorine Market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors, including the expanding industrial sector, particularly in the water treatment, plastics, and pulp & paper industries. Technological disruptions, such as advancements in membrane cell technology and improved energy efficiency, are driving production cost reductions and enhancing overall market competitiveness. Consumer preferences for high-quality products and stringent environmental regulations are also shaping market dynamics. The market penetration of chlorine in various applications continues to grow steadily, further contributing to the market's expansion. Competitive dynamics remain intense, with companies focusing on cost optimization, product differentiation, and strategic partnerships to enhance their market positions. Detailed analysis of market segmentation by applications is provided in the full report.

Dominant Markets & Segments in India Chlorine Market

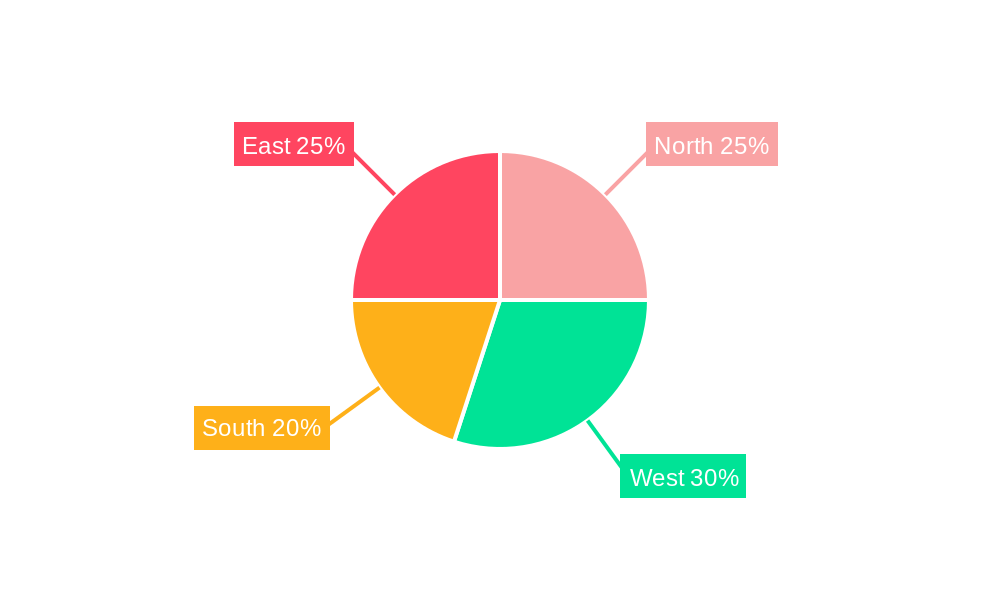

While a detailed breakdown of regional dominance requires the full report, preliminary analysis suggests that the western region of India, driven by strong industrial activity and infrastructure development, is a dominant market. This is corroborated by recent major investments in the region.

- Key Drivers of Western Region Dominance:

- Robust industrial growth, particularly in chemicals and manufacturing sectors.

- Well-developed infrastructure, facilitating efficient transportation and logistics.

- Proximity to major ports, enabling easy import/export of raw materials and finished products.

- Favorable government policies and incentives promoting industrial development.

The full report will offer a detailed analysis of regional and segmental dominance, including market size and growth projections for each segment.

India Chlorine Market Product Innovations

Recent innovations in the India chlorine market focus on enhancing production efficiency, improving product quality, and expanding applications. Advancements in membrane cell technology have enabled the production of higher-quality chlorine with reduced energy consumption. New applications of chlorine in various industries, such as water purification and disinfection, are driving product demand. The competitive advantage lies in offering cost-effective, high-quality chlorine products that meet the stringent regulatory requirements of the Indian market.

Report Segmentation & Scope

The report segments the India chlorine market by various parameters including:

By Product Type: Liquid Chlorine, Gaseous Chlorine, Solid Chlorine, others. This section includes growth projections, market sizes, and competitive analysis for each segment.

By Application: Water Treatment, Pulp & Paper, Plastics, Healthcare, others. Each segment’s projected growth and market dynamics are detailed in the report.

By Region: North, South, East, West. Regional variations in market size, growth rates, and key players are analyzed.

Key Drivers of India Chlorine Market Growth

Several factors propel the growth of the India chlorine market:

Expanding Industrial Sector: The rapid growth of industries like water treatment, textiles, and paper necessitates a surge in chlorine demand.

Rising Population and Urbanization: This translates into increased water treatment requirements and heightened demand for chlorine-based disinfectants.

Government Initiatives: Policies encouraging industrial growth and infrastructure development indirectly bolster chlorine demand.

Challenges in the India Chlorine Market Sector

The India chlorine market faces several challenges:

Stringent Environmental Regulations: Compliance with environmental norms requires substantial investment in pollution control equipment.

Fluctuating Raw Material Prices: Price volatility of raw materials impacts production costs and profit margins.

Intense Competition: The presence of numerous players leads to pricing pressure and necessitates constant innovation.

Leading Players in the India Chlorine Market Market

- Chemfab Alkalis Limited

- Chemplast Sanmar Limited

- DCM Shriram

- De Nora India Limited

- Grasim Industries Ltd

- Gujarat Alkali and Chemicals Limited

- Gujarat Fluorochemicals Ltd

- Lords Chloro Alkali Limited

- Meghmani Finechem Limited

- Nirma Limited

- Sree Rayalaseema Alkalies and Chemicals Limited

- Tata Chemicals Limited

Key Developments in India Chlorine Market Sector

June 2022: Gujarat Alkalies and Chemicals (GACL) announced a INR 20 billion (USD 268 Million) investment to expand its caustic soda production capacity to 900,000 MTPA by the end of 2022. This signifies a significant capacity expansion in the sector.

May 2022: Chemfab Alkalis Limited unveiled plans for a new chlor-alkali plant in Puducherry, with an estimated investment of INR 3.5 billion (USD 47 Million). This expansion aims to increase the supply of liquid chlorine and hydrogen.

Strategic India Chlorine Market Market Outlook

The India chlorine market presents significant growth opportunities in the coming years. Continued industrial expansion, rising urbanization, and government support for infrastructure development will drive demand. Strategic investments in production capacity, technological upgrades, and exploration of new applications will be crucial for success. Companies focusing on sustainable practices and environmental compliance will gain a competitive edge. The market's long-term outlook remains positive, presenting substantial opportunities for existing and new entrants.

India Chlorine Market Segmentation

-

1. Application

- 1.1. EDC/PVC

- 1.2. Isocyanates and Oxygenates

- 1.3. Chloromethanes

- 1.4. Solvent and Epichlorohydrin

- 1.5. Inorganic Chemicals

- 1.6. Other Applications

-

2. End-user Industry

- 2.1. Water Treatment

- 2.2. Pharmaceuticals

- 2.3. Chemicals

- 2.4. Pulp and Paper

- 2.5. Plastics

- 2.6. Pesticides

- 2.7. Other End-user Industries

India Chlorine Market Segmentation By Geography

- 1. India

India Chlorine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Pharmaceutical Industry; Widening Usage in Water Treatment Industry

- 3.3. Market Restrains

- 3.3.1. Growth in the Pharmaceutical Industry; Widening Usage in Water Treatment Industry

- 3.4. Market Trends

- 3.4.1. Growing Pharmaceutical Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Chlorine Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. EDC/PVC

- 5.1.2. Isocyanates and Oxygenates

- 5.1.3. Chloromethanes

- 5.1.4. Solvent and Epichlorohydrin

- 5.1.5. Inorganic Chemicals

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Water Treatment

- 5.2.2. Pharmaceuticals

- 5.2.3. Chemicals

- 5.2.4. Pulp and Paper

- 5.2.5. Plastics

- 5.2.6. Pesticides

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Chemfab Alkalis Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chemplast Sanmar Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DCM Shriram

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 De Nora India Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grasim Industries Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gujarat Alkali and Chemicals Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gujarat Fluorochemicals Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lords Chloro Alkali Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Meghmani Finechem Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nirma Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sree Rayalaseema Alkalies and Chemicals Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Tata Chemicals Limited*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Chemfab Alkalis Limited

List of Figures

- Figure 1: India Chlorine Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Chlorine Market Share (%) by Company 2024

List of Tables

- Table 1: India Chlorine Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Chlorine Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: India Chlorine Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: India Chlorine Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Chlorine Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: India Chlorine Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 7: India Chlorine Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Chlorine Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the India Chlorine Market?

Key companies in the market include Chemfab Alkalis Limited, Chemplast Sanmar Limited, DCM Shriram, De Nora India Limited, Grasim Industries Ltd, Gujarat Alkali and Chemicals Limited, Gujarat Fluorochemicals Ltd, Lords Chloro Alkali Limited, Meghmani Finechem Limited, Nirma Limited, Sree Rayalaseema Alkalies and Chemicals Limited, Tata Chemicals Limited*List Not Exhaustive.

3. What are the main segments of the India Chlorine Market?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Pharmaceutical Industry; Widening Usage in Water Treatment Industry.

6. What are the notable trends driving market growth?

Growing Pharmaceutical Industry.

7. Are there any restraints impacting market growth?

Growth in the Pharmaceutical Industry; Widening Usage in Water Treatment Industry.

8. Can you provide examples of recent developments in the market?

June 2022: Gujarat Alkalies and Chemicals (GACL) announced that it would expand its installed capacity of caustic soda production to 900,000 MTPA by 2022 end. The project will reportedly be completed with an investment of INR 20 billion (USD 268 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Chlorine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Chlorine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Chlorine Market?

To stay informed about further developments, trends, and reports in the India Chlorine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence