Key Insights

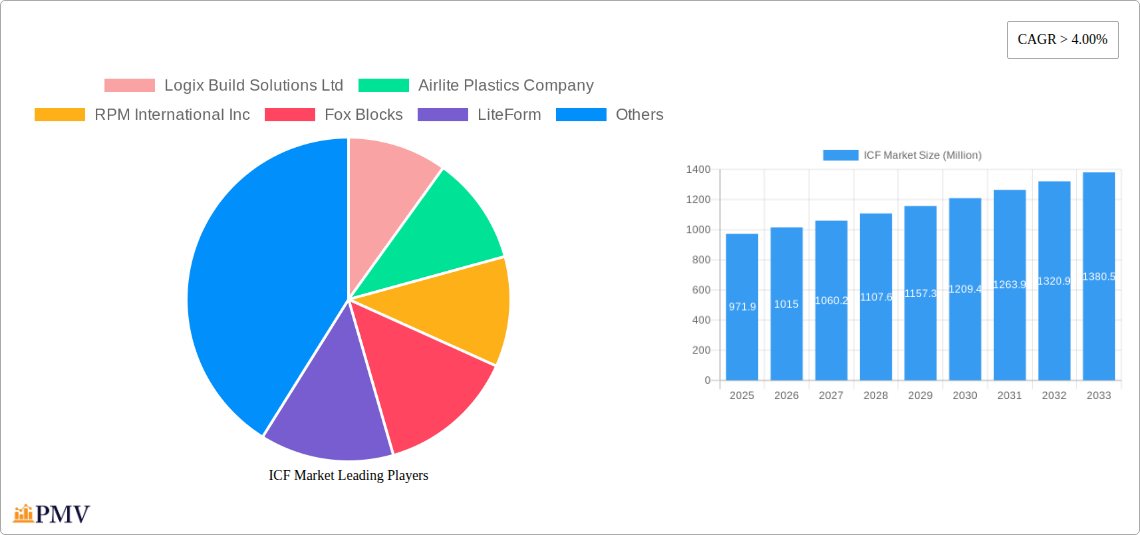

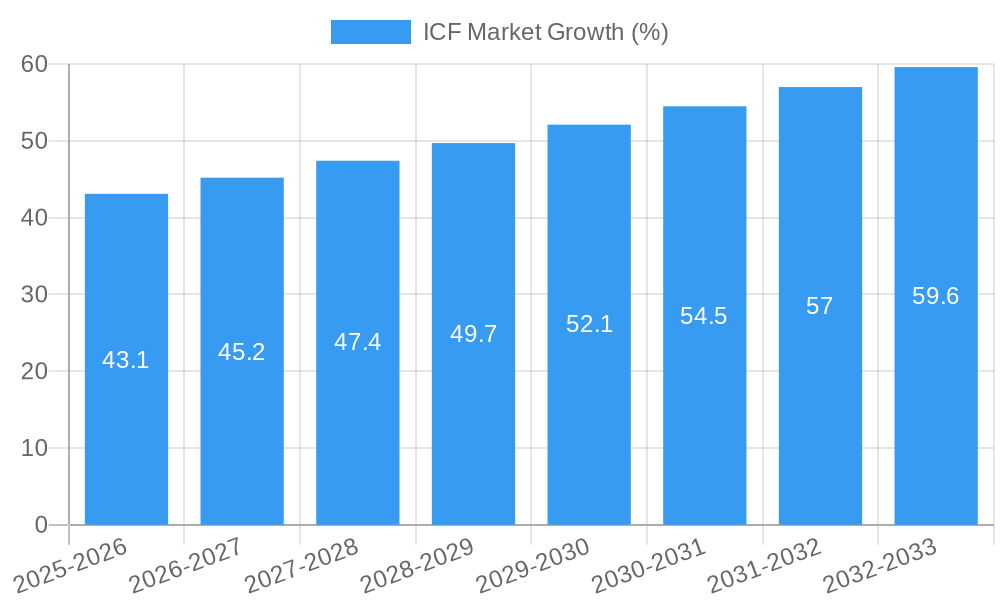

The Insulating Concrete Form (ICF) market, valued at $971.9 million in 2025, is projected to experience robust growth, exceeding a 4% CAGR through 2033. This expansion is driven by several key factors. The increasing demand for energy-efficient buildings, coupled with stringent building codes promoting sustainable construction practices, is a major catalyst. ICF's inherent thermal performance, superior sound insulation, and resistance to extreme weather conditions significantly contribute to reduced operational costs and enhanced building durability, making them increasingly attractive to both residential and commercial developers. Furthermore, advancements in ICF technology, incorporating lighter and more efficient materials like expanded polystyrene (EPS) and polyurethane, alongside innovative construction techniques, are streamlining the building process and reducing overall project timelines and costs. The growth is further fueled by rising awareness of ICF's resilience against natural disasters, such as hurricanes and earthquakes, strengthening its appeal in geographically vulnerable regions.

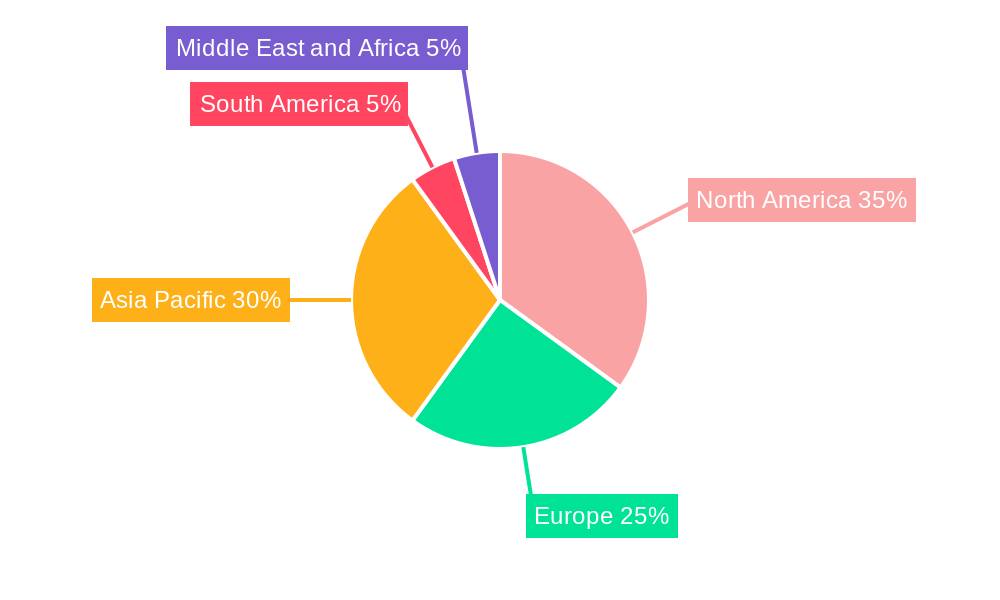

Market segmentation reveals a strong preference for polystyrene foam and polyurethane foam as primary materials, driven by their cost-effectiveness and ease of installation. The residential segment currently holds a significant market share, but the commercial and institutional sectors are expected to witness accelerated growth in the coming years due to the increasing adoption of ICF in large-scale projects. Geographically, the Asia-Pacific region, particularly China and India, are poised for substantial growth due to rapid urbanization and ongoing infrastructural development. North America and Europe, while already established markets, will continue to contribute significantly, driven by consistent demand and ongoing innovation. Competition within the market is moderately intense, with established players like BASF SE and RPM International Inc. vying with regional manufacturers and specialized ICF suppliers. Challenges remain, including the need for skilled labor and potential regional variations in building codes and material availability. However, the overall market outlook remains positive, driven by compelling value propositions and a growing global emphasis on sustainable and resilient construction.

ICF Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Insulated Concrete Form (ICF) market, covering market size, segmentation, competitive landscape, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and researchers. The report values are expressed in Millions.

ICF Market Structure & Competitive Dynamics

This section analyzes the structure and competitive dynamics of the ICF market, encompassing market concentration, innovation, regulatory landscapes, and key industry activities. We delve into the interplay of various factors affecting market players, including:

- Market Concentration: The ICF market exhibits a [xx]% concentration ratio, with the top 5 players holding a combined market share of approximately [xx]%. This indicates a [competitive/oligopolistic] market structure.

- Innovation Ecosystems: Significant innovations are driven by material advancements (e.g., enhanced insulation properties, improved interlocking systems) and manufacturing process optimization. This leads to a dynamic environment where companies constantly seek to improve efficiency and reduce costs.

- Regulatory Frameworks: Building codes and energy efficiency standards significantly influence ICF adoption. Stringent regulations in regions prioritizing energy conservation contribute to higher market growth. Variations across regions create diverse market opportunities.

- Product Substitutes: Traditional building materials like concrete blocks, wood framing, and other prefabricated systems compete with ICFs. The competitive advantage of ICFs lies in their superior insulation, strength, and speed of construction, but price can be a factor.

- End-User Trends: The growing preference for sustainable and energy-efficient buildings is driving demand for ICFs across residential, commercial, and institutional sectors. The increasing awareness of environmental impacts is also pushing consumers to favor greener building options.

- M&A Activities: The ICF market has witnessed significant mergers and acquisitions (M&A) activity in recent years, with deal values totaling [xx Million] during the 2019-2024 historical period. Notable examples include the acquisition of Amvic Inc. by Foam Holdings in November 2022, significantly altering the market landscape. Future M&A activity is expected to continue as larger players consolidate their market share and expand their geographical reach.

ICF Market Industry Trends & Insights

The ICF market is poised for substantial growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at [xx]%, indicating significant market expansion. Market penetration currently stands at approximately [xx]%, with considerable room for growth, particularly in emerging markets.

Key trends include:

- Technological Disruptions: Advancements in material science continue to improve ICF performance, leading to lighter, stronger, and more energy-efficient systems. This includes innovations in material composition, manufacturing processes, and the incorporation of smart technologies.

- Consumer Preferences: The growing preference for eco-friendly and sustainable building practices is directly propelling ICF adoption, alongside the desire for superior energy efficiency and lower long-term energy costs. Consumers are increasingly aware of the environmental and economic benefits of ICF construction.

- Competitive Dynamics: The market is characterized by a mix of large multinational corporations and specialized ICF manufacturers. Competition is focused on product innovation, cost reduction, and market expansion.

Dominant Markets & Segments in ICF Market

The North American region currently holds the dominant position in the global ICF market, driven by stringent building codes, growing awareness of energy-efficient construction, and a robust construction industry. Within North America, the United States holds the largest market share, benefiting from strong housing demand and investments in infrastructure projects.

By Material Type:

- Polystyrene Foam: This segment currently holds the largest market share due to its cost-effectiveness and excellent insulation properties. Growth is fueled by ongoing technological advancements, leading to lighter and stronger foam variations.

- Polyurethane Foam: This segment offers superior insulation and strength, appealing to high-performance building applications. Higher cost compared to polystyrene foam currently limits wider adoption.

- Cement-bonded Wood Fiber: This segment is characterized by environmentally friendly materials, although its higher cost and regional availability can affect growth.

- Cement-bonded Polystyrene Beads: This niche segment combines the properties of polystyrene beads with the strength of cement, offering a unique value proposition, though it may not be as widespread as other options.

By Application:

- Residential: This segment contributes the largest share to the overall ICF market, driven by increasing construction of single-family homes and apartments.

- Commercial: This segment exhibits steady growth driven by demand for energy-efficient and durable buildings in commercial sectors.

- Institutional: The institutional sector, encompassing educational buildings and government projects, presents a significant opportunity due to the emphasis on energy efficiency and sustainability.

Key drivers for regional dominance include supportive government policies, investments in infrastructure development, and a flourishing construction sector.

ICF Market Product Innovations

Recent product developments emphasize improved insulation performance, enhanced interlocking systems for faster construction, and the integration of smart building technologies. The introduction of graphite-enhanced EPS blocks by Amvic Inc. in September 2022 exemplifies this trend. These innovations contribute to increased market competitiveness and broader product appeal across various applications.

Report Segmentation & Scope

This report segments the ICF market by material type (Polystyrene Foam, Polyurethane Foam, Cement-bonded Wood Fiber, Cement-bonded Polystyrene Beads) and by application (Residential, Commercial, Institutional). Growth projections, market sizes, and competitive dynamics are analyzed for each segment, providing a detailed understanding of the market's structure and evolution. Each segment's growth is heavily dependent on factors such as material costs, technological advancements, and specific regional building regulations.

Key Drivers of ICF Market Growth

The ICF market is fueled by multiple factors, including:

- Stringent building codes and energy efficiency standards: Governments worldwide are implementing stricter regulations to promote energy conservation, pushing adoption of high-performance building materials like ICFs.

- Growing awareness of sustainable building practices: Consumers are becoming increasingly conscious of environmental concerns, driving demand for green building solutions.

- Technological advancements resulting in improved ICF products: Innovations in material science and manufacturing processes have enhanced the performance, cost-effectiveness, and ease of installation of ICFs.

Challenges in the ICF Market Sector

The ICF market faces several challenges, including:

- High initial cost compared to traditional building materials: The initial investment for ICF construction can be higher than for traditional methods, representing a barrier for some projects.

- Supply chain constraints and material availability: Fluctuations in raw material prices and potential supply chain disruptions can impact the overall cost and availability of ICFs.

- Lack of skilled labor for ICF installation: Specialized knowledge and training are required for efficient ICF construction. A shortage of skilled installers can lead to project delays and increased costs.

Leading Players in the ICF Market Market

- Logix Build Solutions Ltd

- Airlite Plastics Company

- RPM International Inc

- Fox Blocks

- LiteForm

- Polycrete International

- BuildBlock Building Systems LLC

- Mikey Block Co

- RASTRA

- Quad-Lock Building Systems

- BASF SE

- PFB Corporation

- Beco Products Ltd

- Amvic Inc

- Sunbloc Ltd

- Durisol UK

- Sismo

Key Developments in ICF Market Sector

- November 2022: Foam Holdings acquired Amvic Inc., strengthening its position in the North American ICF market. This acquisition is expected to significantly impact market share and competition.

- September 2022: Amvic Inc. launched its new Amvic ICF system, featuring improved interlocking and flame retardance, enhancing its product offerings and market competitiveness.

Strategic ICF Market Outlook

The ICF market presents significant growth potential. Future market expansion will be driven by continuous innovation in materials and manufacturing processes, increasing demand for sustainable building solutions, and supportive government policies. Strategic opportunities lie in expanding into emerging markets, developing specialized ICF systems for specific applications, and establishing strong partnerships with builders and contractors. Further M&A activity is anticipated, leading to greater market consolidation.

ICF Market Segmentation

-

1. Material Type

- 1.1. Polystyrene Foam

- 1.2. Polyurethane Foam

- 1.3. Cement-bonded Wood Fiber

- 1.4. Cement-bonded Polystyrene Beads

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Institutional

ICF Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. United Kingdom

- 3.4. Italy

- 3.5. Rest of the Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

ICF Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Hi-rise Energy-efficient Buildings; Increasing Preparedness Toward Disasters; Reduced Construction Time

- 3.3. Market Restrains

- 3.3.1. High Cost Association; Other Restraints

- 3.4. Market Trends

- 3.4.1. Residential Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ICF Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Polystyrene Foam

- 5.1.2. Polyurethane Foam

- 5.1.3. Cement-bonded Wood Fiber

- 5.1.4. Cement-bonded Polystyrene Beads

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Institutional

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Asia Pacific ICF Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Polystyrene Foam

- 6.1.2. Polyurethane Foam

- 6.1.3. Cement-bonded Wood Fiber

- 6.1.4. Cement-bonded Polystyrene Beads

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Institutional

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. North America ICF Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Polystyrene Foam

- 7.1.2. Polyurethane Foam

- 7.1.3. Cement-bonded Wood Fiber

- 7.1.4. Cement-bonded Polystyrene Beads

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Institutional

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Europe ICF Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Polystyrene Foam

- 8.1.2. Polyurethane Foam

- 8.1.3. Cement-bonded Wood Fiber

- 8.1.4. Cement-bonded Polystyrene Beads

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Institutional

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. South America ICF Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Polystyrene Foam

- 9.1.2. Polyurethane Foam

- 9.1.3. Cement-bonded Wood Fiber

- 9.1.4. Cement-bonded Polystyrene Beads

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Institutional

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa ICF Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Polystyrene Foam

- 10.1.2. Polyurethane Foam

- 10.1.3. Cement-bonded Wood Fiber

- 10.1.4. Cement-bonded Polystyrene Beads

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Institutional

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Asia Pacific ICF Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 China

- 11.1.2 India

- 11.1.3 Japan

- 11.1.4 South Korea

- 11.1.5 ASEAN Countries

- 11.1.6 Rest of Asia Pacific

- 12. North America ICF Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe ICF Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 France

- 13.1.3 United Kingdom

- 13.1.4 Italy

- 13.1.5 Rest of the Europe

- 14. South America ICF Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa ICF Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 South Africa

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Logix Build Solutions Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Airlite Plastics Company

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 RPM International Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Fox Blocks

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 LiteForm

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Polycrete International

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 BuildBlock Building Systems LLC

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Mikey Block Co

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 RASTRA

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Quad-Lock Building Systems

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 BASF SE

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 PFB Corporation

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Beco Products Ltd

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Amvic Inc

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Sunbloc Ltd*List Not Exhaustive

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Durisol UK

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.17 Sismo

- 16.2.17.1. Overview

- 16.2.17.2. Products

- 16.2.17.3. SWOT Analysis

- 16.2.17.4. Recent Developments

- 16.2.17.5. Financials (Based on Availability)

- 16.2.1 Logix Build Solutions Ltd

List of Figures

- Figure 1: Global ICF Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global ICF Market Volume Breakdown (K Tons, %) by Region 2024 & 2032

- Figure 3: Asia Pacific ICF Market Revenue (Million), by Country 2024 & 2032

- Figure 4: Asia Pacific ICF Market Volume (K Tons), by Country 2024 & 2032

- Figure 5: Asia Pacific ICF Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific ICF Market Volume Share (%), by Country 2024 & 2032

- Figure 7: North America ICF Market Revenue (Million), by Country 2024 & 2032

- Figure 8: North America ICF Market Volume (K Tons), by Country 2024 & 2032

- Figure 9: North America ICF Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America ICF Market Volume Share (%), by Country 2024 & 2032

- Figure 11: Europe ICF Market Revenue (Million), by Country 2024 & 2032

- Figure 12: Europe ICF Market Volume (K Tons), by Country 2024 & 2032

- Figure 13: Europe ICF Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe ICF Market Volume Share (%), by Country 2024 & 2032

- Figure 15: South America ICF Market Revenue (Million), by Country 2024 & 2032

- Figure 16: South America ICF Market Volume (K Tons), by Country 2024 & 2032

- Figure 17: South America ICF Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America ICF Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Middle East and Africa ICF Market Revenue (Million), by Country 2024 & 2032

- Figure 20: Middle East and Africa ICF Market Volume (K Tons), by Country 2024 & 2032

- Figure 21: Middle East and Africa ICF Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East and Africa ICF Market Volume Share (%), by Country 2024 & 2032

- Figure 23: Asia Pacific ICF Market Revenue (Million), by Material Type 2024 & 2032

- Figure 24: Asia Pacific ICF Market Volume (K Tons), by Material Type 2024 & 2032

- Figure 25: Asia Pacific ICF Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 26: Asia Pacific ICF Market Volume Share (%), by Material Type 2024 & 2032

- Figure 27: Asia Pacific ICF Market Revenue (Million), by Application 2024 & 2032

- Figure 28: Asia Pacific ICF Market Volume (K Tons), by Application 2024 & 2032

- Figure 29: Asia Pacific ICF Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific ICF Market Volume Share (%), by Application 2024 & 2032

- Figure 31: Asia Pacific ICF Market Revenue (Million), by Country 2024 & 2032

- Figure 32: Asia Pacific ICF Market Volume (K Tons), by Country 2024 & 2032

- Figure 33: Asia Pacific ICF Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Asia Pacific ICF Market Volume Share (%), by Country 2024 & 2032

- Figure 35: North America ICF Market Revenue (Million), by Material Type 2024 & 2032

- Figure 36: North America ICF Market Volume (K Tons), by Material Type 2024 & 2032

- Figure 37: North America ICF Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 38: North America ICF Market Volume Share (%), by Material Type 2024 & 2032

- Figure 39: North America ICF Market Revenue (Million), by Application 2024 & 2032

- Figure 40: North America ICF Market Volume (K Tons), by Application 2024 & 2032

- Figure 41: North America ICF Market Revenue Share (%), by Application 2024 & 2032

- Figure 42: North America ICF Market Volume Share (%), by Application 2024 & 2032

- Figure 43: North America ICF Market Revenue (Million), by Country 2024 & 2032

- Figure 44: North America ICF Market Volume (K Tons), by Country 2024 & 2032

- Figure 45: North America ICF Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: North America ICF Market Volume Share (%), by Country 2024 & 2032

- Figure 47: Europe ICF Market Revenue (Million), by Material Type 2024 & 2032

- Figure 48: Europe ICF Market Volume (K Tons), by Material Type 2024 & 2032

- Figure 49: Europe ICF Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 50: Europe ICF Market Volume Share (%), by Material Type 2024 & 2032

- Figure 51: Europe ICF Market Revenue (Million), by Application 2024 & 2032

- Figure 52: Europe ICF Market Volume (K Tons), by Application 2024 & 2032

- Figure 53: Europe ICF Market Revenue Share (%), by Application 2024 & 2032

- Figure 54: Europe ICF Market Volume Share (%), by Application 2024 & 2032

- Figure 55: Europe ICF Market Revenue (Million), by Country 2024 & 2032

- Figure 56: Europe ICF Market Volume (K Tons), by Country 2024 & 2032

- Figure 57: Europe ICF Market Revenue Share (%), by Country 2024 & 2032

- Figure 58: Europe ICF Market Volume Share (%), by Country 2024 & 2032

- Figure 59: South America ICF Market Revenue (Million), by Material Type 2024 & 2032

- Figure 60: South America ICF Market Volume (K Tons), by Material Type 2024 & 2032

- Figure 61: South America ICF Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 62: South America ICF Market Volume Share (%), by Material Type 2024 & 2032

- Figure 63: South America ICF Market Revenue (Million), by Application 2024 & 2032

- Figure 64: South America ICF Market Volume (K Tons), by Application 2024 & 2032

- Figure 65: South America ICF Market Revenue Share (%), by Application 2024 & 2032

- Figure 66: South America ICF Market Volume Share (%), by Application 2024 & 2032

- Figure 67: South America ICF Market Revenue (Million), by Country 2024 & 2032

- Figure 68: South America ICF Market Volume (K Tons), by Country 2024 & 2032

- Figure 69: South America ICF Market Revenue Share (%), by Country 2024 & 2032

- Figure 70: South America ICF Market Volume Share (%), by Country 2024 & 2032

- Figure 71: Middle East and Africa ICF Market Revenue (Million), by Material Type 2024 & 2032

- Figure 72: Middle East and Africa ICF Market Volume (K Tons), by Material Type 2024 & 2032

- Figure 73: Middle East and Africa ICF Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 74: Middle East and Africa ICF Market Volume Share (%), by Material Type 2024 & 2032

- Figure 75: Middle East and Africa ICF Market Revenue (Million), by Application 2024 & 2032

- Figure 76: Middle East and Africa ICF Market Volume (K Tons), by Application 2024 & 2032

- Figure 77: Middle East and Africa ICF Market Revenue Share (%), by Application 2024 & 2032

- Figure 78: Middle East and Africa ICF Market Volume Share (%), by Application 2024 & 2032

- Figure 79: Middle East and Africa ICF Market Revenue (Million), by Country 2024 & 2032

- Figure 80: Middle East and Africa ICF Market Volume (K Tons), by Country 2024 & 2032

- Figure 81: Middle East and Africa ICF Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: Middle East and Africa ICF Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global ICF Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global ICF Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Global ICF Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 4: Global ICF Market Volume K Tons Forecast, by Material Type 2019 & 2032

- Table 5: Global ICF Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Global ICF Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: Global ICF Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global ICF Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Global ICF Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global ICF Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: China ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: India ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: India ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Japan ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: South Korea ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: ASEAN Countries ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: ASEAN Countries ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Global ICF Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global ICF Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 25: United States ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 27: Canada ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 29: Mexico ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Mexico ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 31: Global ICF Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global ICF Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 33: Germany ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Germany ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: France ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: United Kingdom ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Italy ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Italy ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Rest of the Europe ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of the Europe ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Global ICF Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global ICF Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 45: Brazil ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Brazil ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: Argentina ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Argentina ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 49: Rest of South America ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of South America ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 51: Global ICF Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Global ICF Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 53: Saudi Arabia ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Saudi Arabia ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 55: South Africa ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Africa ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 57: Rest of Middle East and Africa ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Middle East and Africa ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 59: Global ICF Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 60: Global ICF Market Volume K Tons Forecast, by Material Type 2019 & 2032

- Table 61: Global ICF Market Revenue Million Forecast, by Application 2019 & 2032

- Table 62: Global ICF Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 63: Global ICF Market Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Global ICF Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 65: China ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: China ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 67: India ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: India ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 69: Japan ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Japan ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 71: South Korea ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: South Korea ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 73: ASEAN Countries ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: ASEAN Countries ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 75: Rest of Asia Pacific ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Rest of Asia Pacific ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 77: Global ICF Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 78: Global ICF Market Volume K Tons Forecast, by Material Type 2019 & 2032

- Table 79: Global ICF Market Revenue Million Forecast, by Application 2019 & 2032

- Table 80: Global ICF Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 81: Global ICF Market Revenue Million Forecast, by Country 2019 & 2032

- Table 82: Global ICF Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 83: United States ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: United States ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 85: Canada ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Canada ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 87: Mexico ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Mexico ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 89: Global ICF Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 90: Global ICF Market Volume K Tons Forecast, by Material Type 2019 & 2032

- Table 91: Global ICF Market Revenue Million Forecast, by Application 2019 & 2032

- Table 92: Global ICF Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 93: Global ICF Market Revenue Million Forecast, by Country 2019 & 2032

- Table 94: Global ICF Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 95: Germany ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Germany ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 97: France ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: France ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 99: United Kingdom ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: United Kingdom ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 101: Italy ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 102: Italy ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 103: Rest of the Europe ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 104: Rest of the Europe ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 105: Global ICF Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 106: Global ICF Market Volume K Tons Forecast, by Material Type 2019 & 2032

- Table 107: Global ICF Market Revenue Million Forecast, by Application 2019 & 2032

- Table 108: Global ICF Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 109: Global ICF Market Revenue Million Forecast, by Country 2019 & 2032

- Table 110: Global ICF Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 111: Brazil ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 112: Brazil ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 113: Argentina ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 114: Argentina ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 115: Rest of South America ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 116: Rest of South America ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 117: Global ICF Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 118: Global ICF Market Volume K Tons Forecast, by Material Type 2019 & 2032

- Table 119: Global ICF Market Revenue Million Forecast, by Application 2019 & 2032

- Table 120: Global ICF Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 121: Global ICF Market Revenue Million Forecast, by Country 2019 & 2032

- Table 122: Global ICF Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 123: Saudi Arabia ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 124: Saudi Arabia ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 125: South Africa ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 126: South Africa ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 127: Rest of Middle East and Africa ICF Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 128: Rest of Middle East and Africa ICF Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ICF Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the ICF Market?

Key companies in the market include Logix Build Solutions Ltd, Airlite Plastics Company, RPM International Inc, Fox Blocks, LiteForm, Polycrete International, BuildBlock Building Systems LLC, Mikey Block Co, RASTRA, Quad-Lock Building Systems, BASF SE, PFB Corporation, Beco Products Ltd, Amvic Inc, Sunbloc Ltd*List Not Exhaustive, Durisol UK, Sismo.

3. What are the main segments of the ICF Market?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 971.9 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Hi-rise Energy-efficient Buildings; Increasing Preparedness Toward Disasters; Reduced Construction Time.

6. What are the notable trends driving market growth?

Residential Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

High Cost Association; Other Restraints.

8. Can you provide examples of recent developments in the market?

November 2022: Foam Holdings, a Wynnchurch Capital, L.P. company, announced the acquisition of Amvic Inc. (North America's leading manufacturer of expanded polystyrene ("EPS") insulated concrete forms) and Concrete Block Insulating Systems Inc. This acquisition will help the company to get a lead in the insulated concrete form (ICF) market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ICF Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ICF Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ICF Market?

To stay informed about further developments, trends, and reports in the ICF Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence