Key Insights

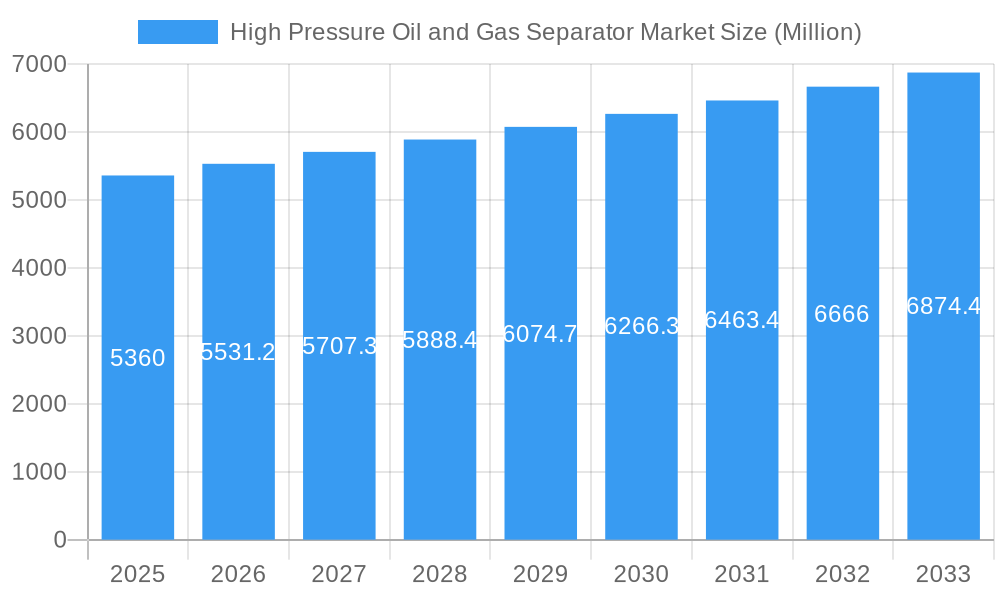

The global High Pressure Oil and Gas Separator Market is poised for significant expansion, projected to reach $5.36 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 3.22%. This growth is primarily propelled by the increasing global demand for energy, necessitating efficient extraction and processing of crude oil and natural gas, particularly from challenging offshore and unconventional onshore reserves. Key drivers include advancements in separator technology, leading to higher efficiency and reduced operational costs, alongside a growing focus on environmental regulations that demand superior separation of oil, gas, and water to minimize emissions and waste. The market is further fueled by substantial investments in upstream oil and gas exploration and production activities worldwide, especially in regions actively developing their hydrocarbon resources. Technological innovations, such as the development of advanced multi-phase separators and intelligent control systems, are also playing a crucial role in enhancing operational performance and driving market adoption.

High Pressure Oil and Gas Separator Market Market Size (In Billion)

The market's trajectory is shaped by a dynamic interplay of growth drivers and prevailing trends. The increasing complexity of oil and gas reservoirs, often characterized by higher water cut and sour gas content, necessitates the deployment of sophisticated high-pressure separation systems capable of handling diverse fluid compositions. The market segmentation reveals a strong demand for two-phase and three-phase separators, with a notable shift towards horizontal and vertical vessel types due to their operational advantages in specific applications. While the upstream sector's volatility and fluctuating commodity prices present potential restraints, the unwavering global energy requirement, coupled with the ongoing transition towards cleaner energy sources that still rely on fossil fuels during this period, ensures sustained demand for efficient separation technologies. Furthermore, the ongoing expansion of infrastructure in emerging economies, particularly in the Asia Pacific and Middle East & Africa regions, is creating substantial opportunities for market players.

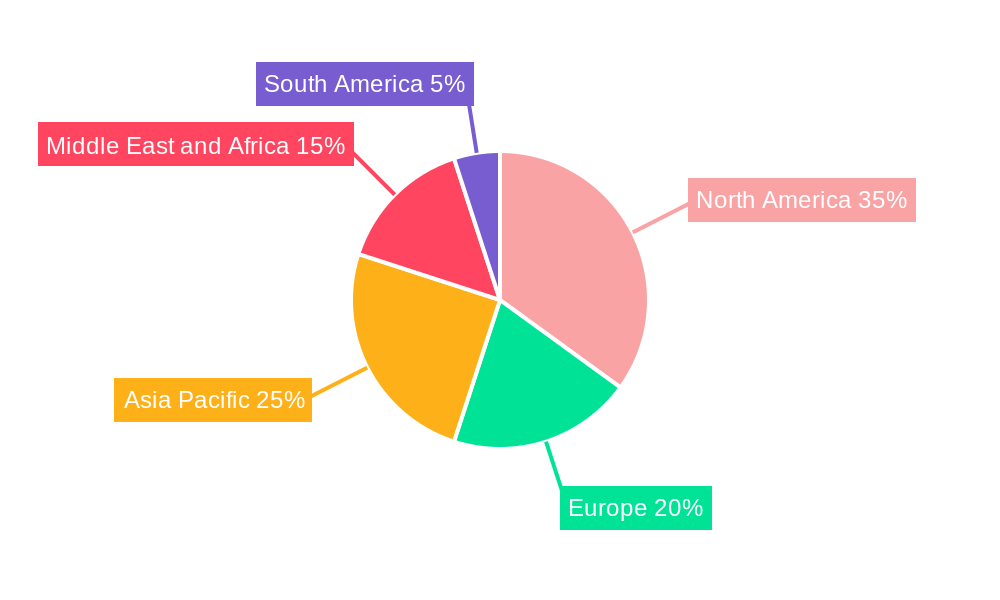

High Pressure Oil and Gas Separator Market Company Market Share

Here is the detailed, SEO-optimized report description for the High Pressure Oil and Gas Separator Market:

This comprehensive market research report offers a deep dive into the global High Pressure Oil and Gas Separator Market, providing critical insights for stakeholders navigating this dynamic sector. Covering the period from 2019 to 2033, with a base year of 2025, the report delivers precise data, actionable strategies, and future projections. The High Pressure Oil and Gas Separator Market is projected to reach $XX.X billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX.X% from 2025 to 2033. This surge is driven by increasing global energy demand, advancements in separation technologies, and the ongoing development of upstream oil and gas exploration and production (E&P) activities, particularly in challenging offshore and remote onshore environments.

High Pressure Oil and Gas Separator Market Structure & Competitive Dynamics

The High Pressure Oil and Gas Separator Market exhibits a moderately concentrated structure, with a blend of large, established global players and specialized regional manufacturers. Innovation ecosystems are thriving, driven by the constant need for enhanced efficiency, safety, and environmental compliance in oil and gas operations. Regulatory frameworks, while evolving to meet stringent environmental standards, play a significant role in shaping product development and market entry strategies. Product substitutes, such as advanced multi-stage separation systems, are emerging but currently face challenges in matching the cost-effectiveness and reliability of dedicated high-pressure separators for bulk processing. End-user trends are leaning towards modular and skid-mounted solutions for easier deployment and maintenance, especially in offshore and remote onshore locations. Mergers and acquisitions (M&A) activities are a key feature, with $XX.X billion in M&A deal values observed during the historical period (2019-2024), as companies seek to consolidate market share, acquire new technologies, and expand their geographical reach. Notable M&A targets include companies with specialized expertise in high-pressure separation or those serving niche segments of the oil and gas industry. The market share of leading players is significant, with the top five entities holding an estimated XX% of the global market.

High Pressure Oil and Gas Separator Market Industry Trends & Insights

The High Pressure Oil and Gas Separator Market is experiencing a significant upward trajectory, fueled by a confluence of key industry trends and insights. The escalating global demand for oil and natural gas, spurred by industrial growth and rising energy consumption in developing economies, directly translates into increased upstream E&P activities, necessitating robust and efficient separation solutions. Technological disruptions are a major catalyst, with continuous advancements in materials science, automation, and intelligent monitoring systems enabling the development of more durable, energy-efficient, and high-performance separators. For instance, the integration of IoT sensors for real-time performance monitoring and predictive maintenance is becoming increasingly prevalent, optimizing operational uptime and reducing costly unplanned shutdowns. Consumer preferences are shifting towards solutions that offer a lower environmental footprint, higher separation efficiency for a wider range of fluid compositions, and greater operational flexibility. This is leading to a demand for customizable and modular separator designs that can be readily adapted to varying project requirements. The competitive dynamics within the market are intensifying, characterized by strategic collaborations, product differentiation, and a focus on cost optimization to maintain market share. Leading companies are investing heavily in R&D to develop next-generation separators that address the unique challenges of deepwater exploration, unconventional resource extraction, and increasingly stringent environmental regulations. The market penetration of advanced separation technologies is steadily increasing, with a projected XX% market penetration for smart, integrated separation systems by 2030. The overall CAGR of XX.X% underscores the robust growth potential driven by these transformative forces. Furthermore, the increasing complexity of extracted crude oil and natural gas, with higher water cut and the presence of valuable byproducts, necessitates sophisticated separation capabilities that high-pressure separators are uniquely positioned to provide.

Dominant Markets & Segments in High Pressure Oil and Gas Separator Market

The High Pressure Oil and Gas Separator Market is characterized by distinct dominant markets and segments, each contributing significantly to overall market value and growth.

Dominant Region: North America currently leads the High Pressure Oil and Gas Separator Market, primarily driven by the extensive shale oil and gas production in the United States and Canada. This region's dominance is underpinned by a favorable regulatory environment, significant investments in E&P, and a mature technological infrastructure. Economic policies supporting domestic energy production and substantial infrastructure development for the transportation and processing of hydrocarbons further solidify its leading position.

Dominant Segment by Type: The Two-Phase Separator segment holds the largest market share.

- Key Drivers: This dominance is attributed to its widespread application in primary separation of oil and gas, where the initial separation of liquid hydrocarbons from natural gas is a fundamental step across numerous E&P operations. The cost-effectiveness and simplicity of two-phase separation make it a go-to solution for many upstream facilities.

Dominant Segment by Vessel Type: Horizontal vessel types are the most prevalent in the High Pressure Oil and Gas Separator Market.

- Key Drivers: Horizontal separators offer a larger liquid-holding capacity and a more stable interface for effective liquid-liquid or liquid-gas separation, which is crucial for high-pressure applications. Their design also facilitates easier maintenance and inspection compared to some vertical configurations.

Dominant Segment by Location of Deployment: The Onshore segment accounts for the largest share of the High Pressure Oil and Gas Separator Market.

- Key Drivers: The sheer volume of onshore oil and gas production globally, coupled with the ongoing development of new fields and the need for efficient processing at wellheads and gathering stations, drives this dominance. The relative ease of installation and access for maintenance in onshore settings also contributes significantly.

While onshore operations dominate, the Offshore segment is experiencing a robust growth rate, driven by the increasing exploration of deepwater reserves and the development of complex offshore fields. Technological advancements are enabling the deployment of more compact and efficient separators in challenging offshore environments, where space and weight are critical constraints. The growing demand for Three-Phase Separators and Four-Phase Separators is also on the rise, reflecting the industry's need for more sophisticated separation of oil, gas, water, and sediment in complex production streams.

High Pressure Oil and Gas Separator Market Product Innovations

Product innovations in the High Pressure Oil and Gas Separator Market are focused on enhancing efficiency, safety, and environmental performance. Manufacturers are developing advanced coalescing media and internal baffling systems to improve phase separation efficiency, reducing the carryover of liquids and gases. The integration of smart sensors for real-time monitoring of pressure, temperature, and fluid levels allows for predictive maintenance and optimized operation. Furthermore, the use of advanced materials, such as corrosion-resistant alloys, is extending the lifespan of separators, particularly in harsh environments. These innovations are crucial for meeting the increasingly stringent environmental regulations and the demand for higher purity hydrocarbon streams.

Report Segmentation & Scope

This report meticulously segments the High Pressure Oil and Gas Separator Market by key categories. The segmentation includes:

- Type: This covers Two-Phase Separators, Three-Phase Separators, and Four-Phase Separators. Each type caters to different separation needs within the oil and gas value chain, with distinct growth projections and market sizes.

- Vessel Type: The analysis includes Horizontal, Spherical, and Vertical vessel configurations. Understanding the market share and competitive dynamics within each vessel type is crucial for identifying specific application strengths and development opportunities.

- Location of Deployment: The report differentiates between Onshore and Offshore deployments. This segmentation highlights the varying demands and growth potential driven by different operational environments, infrastructure, and regulatory landscapes.

Key Drivers of High Pressure Oil and Gas Separator Market Growth

The growth of the High Pressure Oil and Gas Separator Market is propelled by several significant factors. Firstly, the ever-increasing global demand for energy, particularly from oil and natural gas, necessitates expanded upstream exploration and production activities, thereby driving the need for efficient separation technologies. Secondly, advancements in separation technology, including the development of more efficient internal components and advanced materials, enhance the performance and reliability of these separators. Thirdly, the ongoing exploitation of unconventional oil and gas reserves, such as shale oil, often involves more complex fluid compositions that require sophisticated high-pressure separation capabilities. Finally, stringent environmental regulations worldwide are pushing for cleaner production processes and reduced emissions, which in turn drives the demand for separators that can achieve higher separation efficiencies and minimize waste.

Challenges in the High Pressure Oil and Gas Separator Market Sector

Despite its robust growth, the High Pressure Oil and Gas Separator Market faces several challenges. Significant capital investment is required for the manufacturing and installation of high-pressure separators, which can be a barrier for smaller companies. Fluctuations in global oil prices can impact E&P spending, consequently affecting the demand for new separation equipment. Moreover, increasingly stringent environmental regulations, while driving innovation, also impose compliance costs and can necessitate costly retrofits or upgrades to existing infrastructure. Supply chain disruptions, as witnessed in recent global events, can lead to delays in material sourcing and increased manufacturing costs, impacting delivery timelines and profitability. Finally, intense competition from established players and emerging manufacturers can exert downward pressure on pricing.

Leading Players in the High Pressure Oil and Gas Separator Market Market

- R&H Technical Sales Inc

- Sulzer Ltd

- Energy Weldfab Inc

- TechnipFMC plc

- ENCE GmbH

- HydroFlo Tech LLC

- Exterran Corporation

- Frames Group BV

- Halliburton Company

- Schlumberger Limited

Key Developments in High Pressure Oil and Gas Separator Market Sector

- 2023 (Q4): TechnipFMC plc announces a strategic partnership to develop advanced subsea processing solutions, potentially impacting offshore separator technologies.

- 2023 (Q3): Sulzer Ltd unveils a new generation of high-efficiency liquid-gas separators designed for enhanced energy savings in upstream operations.

- 2023 (Q2): Exterran Corporation expands its modular separation skid offerings, catering to the growing demand for flexible onshore solutions.

- 2023 (Q1): Halliburton Company integrates advanced digital twins for its separation equipment, enabling remote monitoring and predictive maintenance.

- 2022 (Q4): Frames Group BV acquires a specialized manufacturer of compact offshore separation systems, strengthening its offshore portfolio.

Strategic High Pressure Oil and Gas Separator Market Market Outlook

The High Pressure Oil and Gas Separator Market is poised for continued robust growth, driven by sustained global energy demand and ongoing technological advancements. Strategic opportunities lie in the development of highly integrated and intelligent separation systems that offer superior efficiency and reduced environmental impact. The increasing focus on deepwater and unconventional resource extraction presents significant growth avenues for specialized, high-performance separators. Furthermore, the growing emphasis on modularity and skid-mounted solutions for faster deployment and easier maintenance will continue to shape product development. Companies that invest in R&D, focus on sustainability, and forge strategic partnerships are best positioned to capitalize on the evolving landscape of the global High Pressure Oil and Gas Separator Market.

High Pressure Oil and Gas Separator Market Segmentation

-

1. Type

- 1.1. Two-Phase Separator

- 1.2. Three-Phase Separator

- 1.3. Four-Phase Separator

-

2. Vessel Type

- 2.1. Horizontal

- 2.2. Spherical

- 2.3. Vertical

-

3. Location of Deployment

- 3.1. Onshore

- 3.2. Offshore

High Pressure Oil and Gas Separator Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. South America

High Pressure Oil and Gas Separator Market Regional Market Share

Geographic Coverage of High Pressure Oil and Gas Separator Market

High Pressure Oil and Gas Separator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Focus On Unconventional Resources4.; Global Energy Demand And Exploration Activities

- 3.3. Market Restrains

- 3.3.1. 4.; High Implementation Costs

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Pressure Oil and Gas Separator Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Two-Phase Separator

- 5.1.2. Three-Phase Separator

- 5.1.3. Four-Phase Separator

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Horizontal

- 5.2.2. Spherical

- 5.2.3. Vertical

- 5.3. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.3.1. Onshore

- 5.3.2. Offshore

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America High Pressure Oil and Gas Separator Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Two-Phase Separator

- 6.1.2. Three-Phase Separator

- 6.1.3. Four-Phase Separator

- 6.2. Market Analysis, Insights and Forecast - by Vessel Type

- 6.2.1. Horizontal

- 6.2.2. Spherical

- 6.2.3. Vertical

- 6.3. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.3.1. Onshore

- 6.3.2. Offshore

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe High Pressure Oil and Gas Separator Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Two-Phase Separator

- 7.1.2. Three-Phase Separator

- 7.1.3. Four-Phase Separator

- 7.2. Market Analysis, Insights and Forecast - by Vessel Type

- 7.2.1. Horizontal

- 7.2.2. Spherical

- 7.2.3. Vertical

- 7.3. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.3.1. Onshore

- 7.3.2. Offshore

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific High Pressure Oil and Gas Separator Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Two-Phase Separator

- 8.1.2. Three-Phase Separator

- 8.1.3. Four-Phase Separator

- 8.2. Market Analysis, Insights and Forecast - by Vessel Type

- 8.2.1. Horizontal

- 8.2.2. Spherical

- 8.2.3. Vertical

- 8.3. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.3.1. Onshore

- 8.3.2. Offshore

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa High Pressure Oil and Gas Separator Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Two-Phase Separator

- 9.1.2. Three-Phase Separator

- 9.1.3. Four-Phase Separator

- 9.2. Market Analysis, Insights and Forecast - by Vessel Type

- 9.2.1. Horizontal

- 9.2.2. Spherical

- 9.2.3. Vertical

- 9.3. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.3.1. Onshore

- 9.3.2. Offshore

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America High Pressure Oil and Gas Separator Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Two-Phase Separator

- 10.1.2. Three-Phase Separator

- 10.1.3. Four-Phase Separator

- 10.2. Market Analysis, Insights and Forecast - by Vessel Type

- 10.2.1. Horizontal

- 10.2.2. Spherical

- 10.2.3. Vertical

- 10.3. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.3.1. Onshore

- 10.3.2. Offshore

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 R&H Technical Sales Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sulzer Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Energy Weldfab Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TechnipFMC plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ENCE GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HydroFlo Tech LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Exterran Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Frames Group BV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Halliburton Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Schlumberger Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 R&H Technical Sales Inc

List of Figures

- Figure 1: Global High Pressure Oil and Gas Separator Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America High Pressure Oil and Gas Separator Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America High Pressure Oil and Gas Separator Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America High Pressure Oil and Gas Separator Market Revenue (undefined), by Vessel Type 2025 & 2033

- Figure 5: North America High Pressure Oil and Gas Separator Market Revenue Share (%), by Vessel Type 2025 & 2033

- Figure 6: North America High Pressure Oil and Gas Separator Market Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 7: North America High Pressure Oil and Gas Separator Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 8: North America High Pressure Oil and Gas Separator Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America High Pressure Oil and Gas Separator Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe High Pressure Oil and Gas Separator Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Europe High Pressure Oil and Gas Separator Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe High Pressure Oil and Gas Separator Market Revenue (undefined), by Vessel Type 2025 & 2033

- Figure 13: Europe High Pressure Oil and Gas Separator Market Revenue Share (%), by Vessel Type 2025 & 2033

- Figure 14: Europe High Pressure Oil and Gas Separator Market Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 15: Europe High Pressure Oil and Gas Separator Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 16: Europe High Pressure Oil and Gas Separator Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe High Pressure Oil and Gas Separator Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific High Pressure Oil and Gas Separator Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Asia Pacific High Pressure Oil and Gas Separator Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific High Pressure Oil and Gas Separator Market Revenue (undefined), by Vessel Type 2025 & 2033

- Figure 21: Asia Pacific High Pressure Oil and Gas Separator Market Revenue Share (%), by Vessel Type 2025 & 2033

- Figure 22: Asia Pacific High Pressure Oil and Gas Separator Market Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 23: Asia Pacific High Pressure Oil and Gas Separator Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 24: Asia Pacific High Pressure Oil and Gas Separator Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific High Pressure Oil and Gas Separator Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa High Pressure Oil and Gas Separator Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa High Pressure Oil and Gas Separator Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa High Pressure Oil and Gas Separator Market Revenue (undefined), by Vessel Type 2025 & 2033

- Figure 29: Middle East and Africa High Pressure Oil and Gas Separator Market Revenue Share (%), by Vessel Type 2025 & 2033

- Figure 30: Middle East and Africa High Pressure Oil and Gas Separator Market Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 31: Middle East and Africa High Pressure Oil and Gas Separator Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 32: Middle East and Africa High Pressure Oil and Gas Separator Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa High Pressure Oil and Gas Separator Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America High Pressure Oil and Gas Separator Market Revenue (undefined), by Type 2025 & 2033

- Figure 35: South America High Pressure Oil and Gas Separator Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America High Pressure Oil and Gas Separator Market Revenue (undefined), by Vessel Type 2025 & 2033

- Figure 37: South America High Pressure Oil and Gas Separator Market Revenue Share (%), by Vessel Type 2025 & 2033

- Figure 38: South America High Pressure Oil and Gas Separator Market Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 39: South America High Pressure Oil and Gas Separator Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 40: South America High Pressure Oil and Gas Separator Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America High Pressure Oil and Gas Separator Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Vessel Type 2020 & 2033

- Table 3: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 4: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Vessel Type 2020 & 2033

- Table 7: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 8: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Vessel Type 2020 & 2033

- Table 11: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 12: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Vessel Type 2020 & 2033

- Table 15: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 16: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Vessel Type 2020 & 2033

- Table 19: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 20: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Vessel Type 2020 & 2033

- Table 23: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 24: Global High Pressure Oil and Gas Separator Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Pressure Oil and Gas Separator Market?

The projected CAGR is approximately 3.22%.

2. Which companies are prominent players in the High Pressure Oil and Gas Separator Market?

Key companies in the market include R&H Technical Sales Inc, Sulzer Ltd, Energy Weldfab Inc, TechnipFMC plc, ENCE GmbH, HydroFlo Tech LLC, Exterran Corporation, Frames Group BV, Halliburton Company, Schlumberger Limited.

3. What are the main segments of the High Pressure Oil and Gas Separator Market?

The market segments include Type, Vessel Type, Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Focus On Unconventional Resources4.; Global Energy Demand And Exploration Activities.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Implementation Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Pressure Oil and Gas Separator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Pressure Oil and Gas Separator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Pressure Oil and Gas Separator Market?

To stay informed about further developments, trends, and reports in the High Pressure Oil and Gas Separator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence