Key Insights

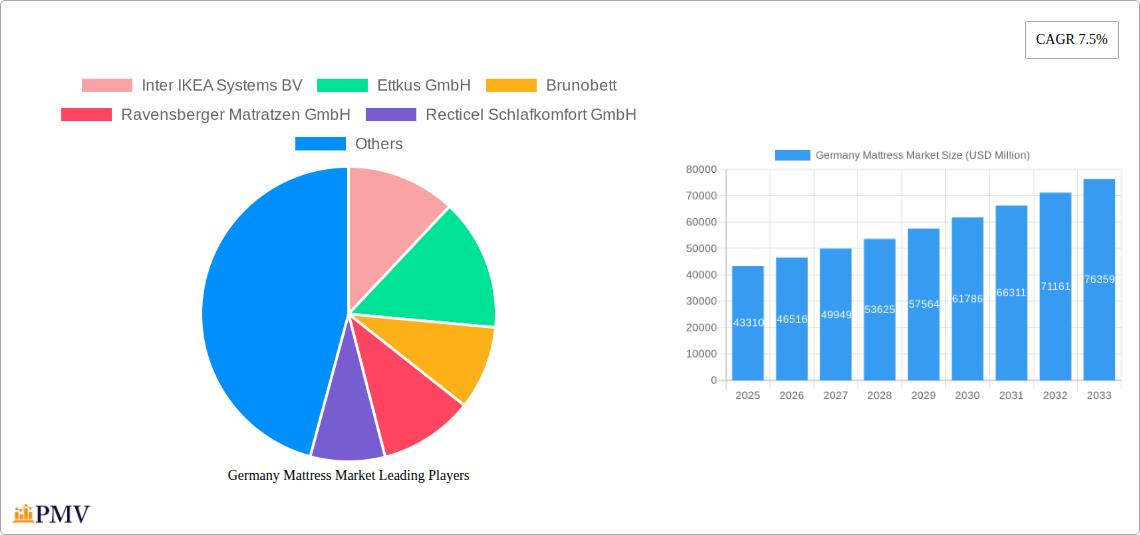

The Germany Mattress Market is poised for substantial growth, with an estimated market size of USD 43.31 billion in 2025. This growth trajectory is driven by a robust Compound Annual Growth Rate (CAGR) of 7.5%, projected to continue throughout the forecast period of 2025-2033. Key factors propelling this expansion include increasing consumer disposable income, a growing awareness of sleep health and its impact on overall well-being, and a sustained demand for premium and technologically advanced sleep solutions. The market is witnessing a significant shift towards innovative materials such as memory foam and latex, offering enhanced comfort and support, which are highly sought after by consumers. Furthermore, the rising trend of home renovation and interior design upgrades, particularly post-pandemic, is stimulating the replacement and upgrade of existing mattresses, contributing to market volume. The commercial sector, including hotels and healthcare facilities, also represents a consistent demand driver due to renovation cycles and the need for durable, high-quality sleep surfaces.

Germany Mattress Market Market Size (In Billion)

The market segmentation reveals a diverse landscape catering to various consumer needs and preferences. Innerspring mattresses continue to hold a significant share, but memory foam and latex mattresses are experiencing accelerated adoption due to their superior ergonomic properties. Hybrid and gel-infused mattresses are emerging as popular choices, combining the benefits of different materials. Across all types, the demand for queen and king-size mattresses is strong, reflecting a preference for larger, more comfortable sleeping arrangements in residential settings. The distribution channel analysis indicates a strong and growing presence of specialty stores and online platforms, which offer wider selections and competitive pricing, alongside traditional furniture retailers. Companies like Inter IKEA Systems BV and Ettkus GmbH are prominent players, actively shaping market trends through product innovation and strategic market penetration. Despite the positive outlook, potential restraints such as fluctuating raw material costs and intense market competition necessitate strategic agility from industry participants.

Germany Mattress Market Company Market Share

Here is the SEO-optimized, detailed report description for the Germany Mattress Market, designed for immediate use without further modification.

Germany Mattress Market Market Structure & Competitive Dynamics

The Germany Mattress Market is characterized by a moderate to high level of concentration, with key players like Inter IKEA Systems BV, Ettkus GmbH, Brunobett, Ravensberger Matratzen GmbH, Recticel Schlafkomfort GmbH, Dehler, Badenia Bettcomfort GmbH & Co KG, Agro International GmbH & Co Kg, and Allnatura Vertriebs GmbH & Co KG, among others, holding significant market share. Innovation plays a crucial role, with companies investing in R&D for enhanced comfort, durability, and sustainability. The regulatory framework in Germany emphasizes product safety and environmental standards, influencing manufacturing processes and material choices. Product substitutes, such as futons and sleeping bags, exist but have a limited impact on the core mattress market. End-user trends are shifting towards premium, health-conscious, and eco-friendly options, driving demand for memory foam and latex mattresses. Merger and acquisition (M&A) activities are sporadic, with smaller brands being acquired by larger entities to expand product portfolios and market reach, particularly in the online and direct-to-consumer segments. The estimated M&A deal value in this sector is projected to reach a modest sum in the low billions by the forecast period, reflecting strategic consolidations rather than aggressive takeovers. Market share distribution indicates a robust presence of established brands alongside a growing number of agile online retailers.

- Market Concentration: Moderate to High, with key players dominating market share.

- Innovation Ecosystem: Driven by R&D in comfort, sustainability, and health-focused features.

- Regulatory Framework: Strict product safety and environmental standards influence market operations.

- Product Substitutes: Limited impact on the core mattress market.

- End-User Trends: Growing demand for premium, healthy, and eco-friendly mattress options.

- M&A Activities: Sporadic consolidations focusing on expanding market reach and product lines, with estimated deal values in the low billions.

Germany Mattress Market Industry Trends & Insights

The Germany Mattress Market is poised for steady growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033. This upward trajectory is fueled by several key industry trends and insights. A primary growth driver is the increasing disposable income and a growing consumer emphasis on sleep quality and overall well-being. Germans are increasingly viewing mattresses as a long-term investment in health, leading to a premiumization of the market. Technological disruptions are significantly shaping the industry, with advancements in materials science leading to the development of more sophisticated memory foam, gel-infused, and hybrid mattresses that offer superior pressure relief and temperature regulation. The integration of smart technology, such as sleep tracking sensors and adjustable firmness, is an emerging trend gaining traction.

Consumer preferences are evolving rapidly. There's a pronounced shift towards customization and personalization, with consumers seeking mattresses tailored to their specific sleep needs, body types, and preferences. Sustainability is no longer a niche concern but a core purchasing criterion; consumers are actively seeking mattresses made from organic, recycled, and ethically sourced materials. This has given rise to brands focused on eco-friendly production processes and certifications. The competitive dynamics are intensifying, with both traditional brick-and-mortar retailers and a burgeoning online mattress sector vying for market share. Direct-to-consumer (DTC) brands are leveraging digital marketing and innovative business models to disrupt the established players. The market penetration of premium and technologically advanced mattresses is expected to increase significantly as consumer awareness and acceptance grow.

Furthermore, the "aging in place" trend, coupled with a growing awareness of ergonomic support for back and joint health, is driving demand for specialized mattresses. The rise of e-commerce has democratized access to a wider variety of mattress types and brands, increasing competition and offering consumers more choices. While challenges like rising raw material costs and logistics complexity exist, the overarching trend indicates a robust and evolving market driven by conscious consumerism, technological innovation, and a persistent focus on health and wellness. The market penetration of specialized mattresses, such as those designed for specific health conditions or sleep issues, is projected to see substantial growth.

Dominant Markets & Segments in Germany Mattress Market

The Germany Mattress Market exhibits dominance across several key segments, driven by evolving consumer needs and market dynamics.

Type Dominance:

- Memory Foam Mattresses: This segment is expected to continue its strong performance, driven by superior pressure relief, contouring comfort, and motion isolation properties. German consumers increasingly value personalized comfort and therapeutic benefits, making memory foam a preferred choice for those seeking to alleviate back pain and improve sleep posture. The innovation in gel-infused memory foam, which addresses heat retention issues, further solidifies its dominance.

- Innerspring Mattresses: While traditionally dominant, innerspring mattresses are seeing a resurgence with advancements in pocketed coil technology that offer better motion separation and targeted support. Hybrid constructions incorporating innerspring support with comfort layers of foam or latex are also gaining traction, appealing to consumers who desire the responsiveness of springs with the comfort of foam.

- Latex Mattresses: Natural and synthetic latex mattresses are gaining significant market share due to their hypoallergenic properties, durability, and breathability. The growing consumer preference for natural and organic products aligns perfectly with the attributes of latex, positioning it as a high-growth segment for environmentally conscious buyers.

Size Dominance:

- Double Size Mattress & Queen Size Mattress: These sizes remain the most popular for residential use, catering to couples and individuals seeking ample sleeping space. The German household structure and average bedroom sizes contribute to the sustained demand for these mid-range mattress dimensions.

- Single Size Mattress: This segment continues to be significant, driven by demand for children's beds, guest rooms, and smaller living spaces.

End User Dominance:

- Residential: This is unequivocally the largest and most dominant end-user segment. The primary focus of mattress manufacturers and retailers is the consumer market, driven by household purchases, upgrades, and new home furnishings. Factors like increasing homeownership, interior design trends, and the emphasis on creating comfortable home environments fuel this segment's growth.

- Commercial: While smaller in comparison, the commercial segment, including hotels, hospitals, and student accommodations, represents a steady demand stream. The increasing focus on guest comfort in the hospitality sector and the need for durable, hygienic, and supportive mattresses in healthcare facilities contribute to the growth of this segment.

Distribution Channel Dominance:

- Online: The online channel has witnessed exponential growth and is rapidly becoming a dominant distribution method. Direct-to-consumer (DTC) brands have leveraged e-commerce to bypass traditional retail markups, offering convenience, competitive pricing, and a wider selection. This channel appeals to a tech-savvy consumer base seeking ease of purchase and home delivery.

- Specialty Stores & Furniture Retailers: These traditional channels continue to hold a significant market share, offering consumers the opportunity to physically test mattresses and receive expert advice. However, they face increasing competition from online retailers.

Germany Mattress Market Product Innovations

Product innovations in the Germany Mattress Market are primarily centered on enhancing sleep quality, promoting health and wellness, and improving sustainability. Companies are developing advanced memory foam formulations that offer superior cooling properties and faster response times. Hybrid designs that expertly blend pocketed coil support with innovative foam layers, such as gel-infused memory foam or responsive latex, are gaining prominence. The integration of natural and eco-friendly materials, like organic cotton, wool, and Tencel, is a significant trend, catering to the growing demand for sustainable bedding solutions. Furthermore, advancements in mattress construction are focusing on zoned support systems to provide targeted comfort and spinal alignment, while some premium offerings are incorporating smart technology for sleep tracking and personalized adjustments. These innovations provide competitive advantages by addressing specific consumer needs for comfort, support, health, and environmental consciousness.

Report Segmentation & Scope

The Germany Mattress Market is segmented comprehensively to provide detailed market analysis.

By Type: This segmentation includes Innerspring Mattresses, Memory Foam Mattresses, Latex Mattresses, and Other Types (Gel and Hybrid). Each type is analyzed for its market size, growth projections, and competitive landscape, with memory foam and hybrid categories expected to show robust growth due to consumer demand for advanced comfort and health features.

By Size: The market is segmented into Single Size Mattress, Double Size Mattress, Queen Size Mattress, and King Size Mattress. Double and Queen sizes are projected to maintain their dominance in the residential sector, while the demand for single sizes in guest rooms and children's areas remains consistent.

By End User: Key end-user segments include Residential and Commercial. The residential segment is the largest and fastest-growing, driven by consumer spending on home comfort and wellness. The commercial segment, comprising hospitality and healthcare, offers steady, albeit slower, growth.

By Distribution Channel: Segmentation covers Specialty Stores, Furniture Retailers, Owned Franchise Stores, Online, and Other Distribution Channels. The online channel is expected to experience the highest growth rate, revolutionizing how mattresses are purchased, while traditional retail channels continue to adapt to evolving consumer buying habits.

Key Drivers of Germany Mattress Market Growth

Several factors are propelling the growth of the Germany Mattress Market. Increasing consumer awareness and prioritization of sleep quality as a cornerstone of overall health and well-being is a significant driver. This has led to a willingness to invest in premium, supportive, and technologically advanced mattresses. The rising disposable income of German households allows for greater discretionary spending on home furnishings and comfort products. Furthermore, the growing trend of home improvement and the focus on creating comfortable living spaces contribute to consistent demand for new and upgraded mattresses. Innovations in mattress technology, such as memory foam and hybrid constructions offering enhanced comfort and pressure relief, are attracting new customers and driving upgrades. The burgeoning e-commerce landscape provides wider accessibility and competitive pricing, further stimulating market expansion.

Challenges in the Germany Mattress Market Sector

Despite the positive growth outlook, the Germany Mattress Market faces certain challenges. Fluctuations in the cost of raw materials, such as foam components and natural latex, can impact manufacturing costs and profit margins. Supply chain disruptions, exacerbated by global events, can affect production schedules and delivery times, leading to potential customer dissatisfaction. Intense competition, particularly from online direct-to-consumer brands, puts pressure on pricing strategies for traditional retailers. Moreover, the lengthy product lifecycle of mattresses means that consumers do not replace them frequently, requiring manufacturers and retailers to focus on driving replacement purchases through innovation and marketing. Evolving consumer preferences require continuous adaptation in product development and marketing strategies.

Leading Players in the Germany Mattress Market Market

- Inter IKEA Systems BV

- Ettkus GmbH

- Brunobett

- Ravensberger Matratzen GmbH

- Recticel Schlafkomfort GmbH

- Dehler

- Badenia Bettcomfort GmbH & Co KG

- Agro International GmbH & Co Kg

- Allnatura Vertriebs GmbH & Co KG

- Setex Textil Gmbh

- CIMO Schaumstoffe GmbH

Key Developments in Germany Mattress Market Sector

- 2023 (Q4): Increased focus on sustainable materials and certifications by major manufacturers, responding to growing consumer demand for eco-friendly products.

- 2024 (Q1): Launch of new hybrid mattress models integrating advanced cooling technologies and zoned support systems by leading brands.

- 2024 (Q2): Expansion of direct-to-consumer (DTC) online sales channels by established furniture retailers to compete with online-native brands.

- 2024 (Q3): Partnerships between mattress brands and sleep technology companies to integrate smart features like sleep tracking and adjustable firmness.

- 2025 (Ongoing): Continued investment in R&D for next-generation foam materials offering improved durability, comfort, and breathability.

Strategic Germany Mattress Market Market Outlook

The strategic outlook for the Germany Mattress Market is promising, driven by an increasing consumer focus on health, wellness, and sustainable living. The market is expected to benefit from continued product innovation, particularly in areas of personalized comfort, advanced material science, and eco-friendly production. The ongoing digital transformation of retail will further empower consumers with choice and convenience through online platforms, while traditional retailers will need to enhance in-store experiences and omnichannel strategies. The premiumization trend is likely to persist, with consumers willing to invest more in high-quality mattresses that offer tangible health benefits and durability. Strategic opportunities lie in developing innovative sleep solutions that address specific demographic needs, such as aging populations and individuals with sleep disorders, and in leveraging partnerships to expand into complementary product categories. The market's resilience and adaptability to evolving consumer preferences and technological advancements will be key to sustained growth.

Germany Mattress Market Segmentation

-

1. Type

- 1.1. Innerspring Mattresses

- 1.2. Memory Foam Mattresses

- 1.3. Latex Mattresses

- 1.4. Other Types (Gel and Hybrid)

-

2. Size

- 2.1. Single Size Mattress

- 2.2. Double Size Mattress

- 2.3. Queen Size Mattress

- 2.4. King Size Mattress

-

3. End User

- 3.1. Residential

- 3.2. Commercial

-

4. Distribution Channel

- 4.1. Specialty Stores

- 4.2. Furniture Retailers

- 4.3. Owned Franchise Stores

- 4.4. Online

- 4.5. Other Distribution Channels

Germany Mattress Market Segmentation By Geography

- 1. Germany

Germany Mattress Market Regional Market Share

Geographic Coverage of Germany Mattress Market

Germany Mattress Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in E-commerce is Driving the Market; Rise in Construction and Real Estate Sector Drives the Furniture Market

- 3.3. Market Restrains

- 3.3.1. Economic Fluctuations; High Competition in the Furniture Market

- 3.4. Market Trends

- 3.4.1. Memory Foam Mattress is Taking the Large Market Share in Germany

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Mattress Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Innerspring Mattresses

- 5.1.2. Memory Foam Mattresses

- 5.1.3. Latex Mattresses

- 5.1.4. Other Types (Gel and Hybrid)

- 5.2. Market Analysis, Insights and Forecast - by Size

- 5.2.1. Single Size Mattress

- 5.2.2. Double Size Mattress

- 5.2.3. Queen Size Mattress

- 5.2.4. King Size Mattress

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Specialty Stores

- 5.4.2. Furniture Retailers

- 5.4.3. Owned Franchise Stores

- 5.4.4. Online

- 5.4.5. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Inter IKEA Systems BV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ettkus GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Brunobett

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ravensberger Matratzen GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Recticel Schlafkomfort GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dehler

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Badenia Bettcomfort GmbH & Co KG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agro International GmbH & Co Kg

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Allnatura Vertriebs GmbH & Co KG**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Setex Textil Gmbh

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CIMO Schaumstoffe GmbH

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Inter IKEA Systems BV

List of Figures

- Figure 1: Germany Mattress Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Germany Mattress Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Mattress Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Germany Mattress Market Revenue undefined Forecast, by Size 2020 & 2033

- Table 3: Germany Mattress Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Germany Mattress Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 5: Germany Mattress Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Germany Mattress Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: Germany Mattress Market Revenue undefined Forecast, by Size 2020 & 2033

- Table 8: Germany Mattress Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 9: Germany Mattress Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 10: Germany Mattress Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Mattress Market?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Germany Mattress Market?

Key companies in the market include Inter IKEA Systems BV, Ettkus GmbH, Brunobett, Ravensberger Matratzen GmbH, Recticel Schlafkomfort GmbH, Dehler, Badenia Bettcomfort GmbH & Co KG, Agro International GmbH & Co Kg, Allnatura Vertriebs GmbH & Co KG**List Not Exhaustive, Setex Textil Gmbh, CIMO Schaumstoffe GmbH.

3. What are the main segments of the Germany Mattress Market?

The market segments include Type, Size, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in E-commerce is Driving the Market; Rise in Construction and Real Estate Sector Drives the Furniture Market.

6. What are the notable trends driving market growth?

Memory Foam Mattress is Taking the Large Market Share in Germany.

7. Are there any restraints impacting market growth?

Economic Fluctuations; High Competition in the Furniture Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Mattress Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Mattress Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Mattress Market?

To stay informed about further developments, trends, and reports in the Germany Mattress Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence