Key Insights

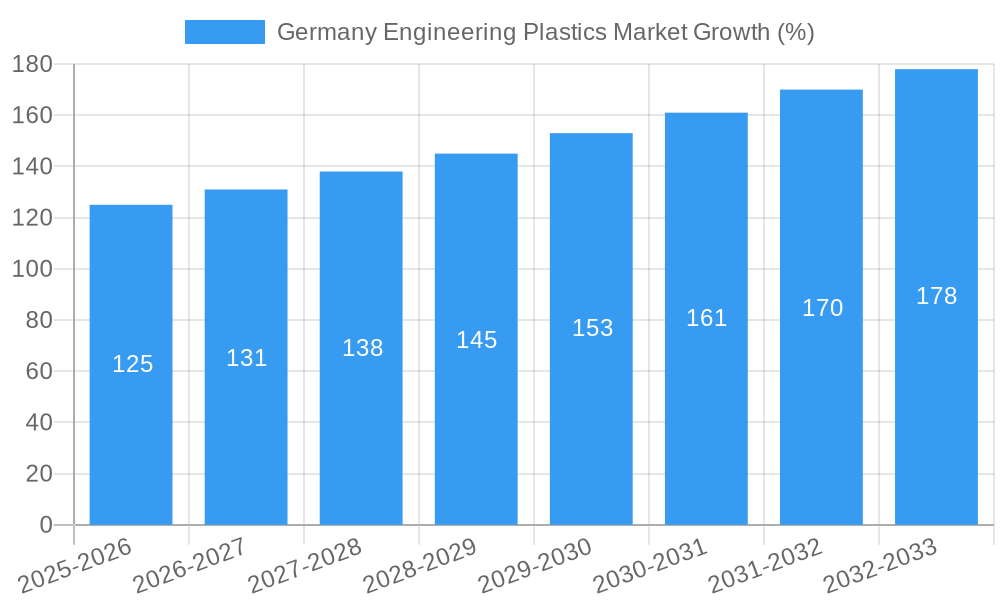

The Germany engineering plastics market is experiencing robust growth, driven by the nation's robust automotive, electrical & electronics, and packaging industries. The market's expansion is fueled by increasing demand for lightweight, high-performance materials in these sectors. Technological advancements leading to the development of more durable and specialized engineering plastics, coupled with stringent regulations promoting sustainability and recyclability, are also key drivers. While the precise market size for 2025 is not provided, considering a plausible CAGR of 5% (a reasonable estimate given general growth in the European plastics market) and a base year of 2025, we can project a steady increase in market value over the forecast period of 2025-2033. This growth trajectory will likely be influenced by fluctuations in raw material prices and global economic conditions. However, the long-term outlook remains positive, fueled by continuous innovation in material science and the expanding applications of engineering plastics across diverse industries.

Major players like BASF, Covestro, and Ineos are key contributors to the market, leveraging their established manufacturing capabilities and research & development efforts to meet the evolving demands of their customers. The market is segmented based on material type (e.g., polyethylene, polypropylene, polycarbonate), application (e.g., automotive parts, electrical components), and end-use industry. Competitive intensity is high, with companies focusing on product differentiation, cost optimization, and strategic partnerships to gain market share. Potential restraints include the price volatility of raw materials, environmental concerns surrounding plastic waste, and increasing competition from alternative materials like bioplastics. Nevertheless, the market's inherent resilience and the continued demand for advanced engineering plastics in crucial sectors suggest a promising future for the Germany engineering plastics market.

Germany Engineering Plastics Market: A Comprehensive Market Report (2019-2033)

This detailed report provides an in-depth analysis of the Germany engineering plastics market, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is essential for businesses operating in or planning to enter this dynamic market.

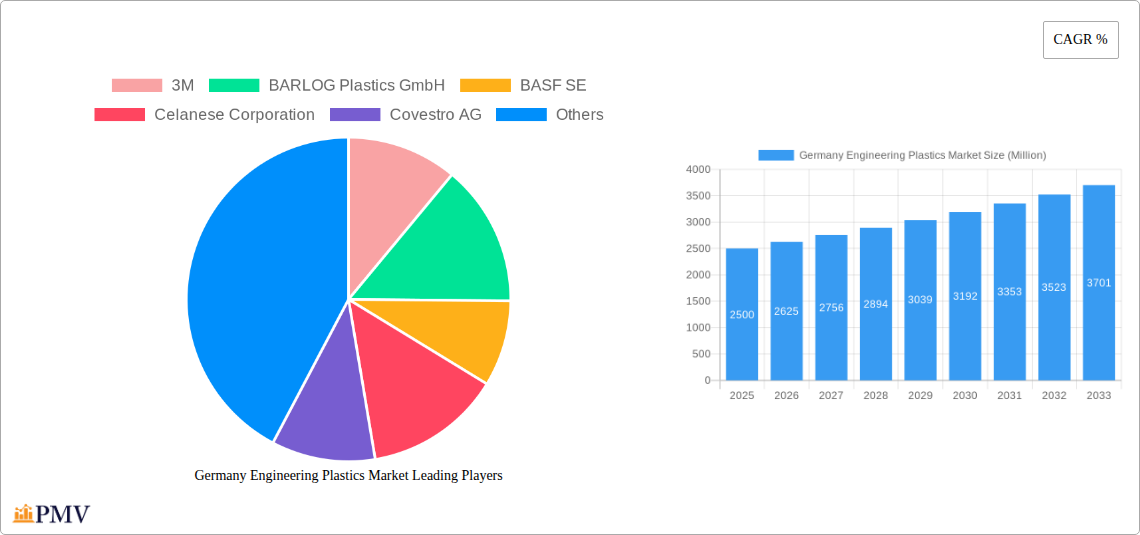

Germany Engineering Plastics Market Market Structure & Competitive Dynamics

The German engineering plastics market exhibits a moderately concentrated structure, with several multinational corporations and regional players holding significant market share. Market leaders such as BASF SE, Covestro AG, and Evonik Industries AG benefit from economies of scale and extensive R&D capabilities. However, smaller specialized companies are also thriving by focusing on niche applications and innovative materials. The market is characterized by a robust innovation ecosystem, fostering the development of high-performance engineering plastics tailored to specific industry needs. Stringent environmental regulations in Germany incentivize the development and adoption of sustainable engineering plastics, creating opportunities for companies focusing on bio-based and recycled materials.

The regulatory framework governing the production and use of engineering plastics in Germany is rigorous, aiming to ensure product safety and environmental protection. This includes regulations concerning the use of hazardous substances and waste management. The presence of several substitute materials, such as metals and composites, presents competitive pressure, driving continuous innovation to improve the cost-effectiveness and performance characteristics of engineering plastics. End-user trends towards lightweighting and improved material properties are key drivers of market growth.

Mergers and acquisitions (M&A) activity within the German engineering plastics market has been substantial in recent years, with deals primarily focused on expanding product portfolios, enhancing technological capabilities, and achieving greater market reach. While precise M&A deal values are proprietary, significant acquisitions have consolidated market power and broadened product offerings. For example, the xx Million acquisition of DuPont's Mobility & Materials business by Celanese in November 2022 significantly increased Celanese's presence in the market. The market share of the top 5 players is estimated at xx%.

Germany Engineering Plastics Market Industry Trends & Insights

The German engineering plastics market is experiencing robust growth, driven by increasing demand from key sectors such as automotive, electronics, and healthcare. The market is expected to register a CAGR of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. This growth is fueled by several factors: the rising adoption of lightweight materials in the automotive industry to improve fuel efficiency, the increasing demand for high-performance electronics components, and the growing use of engineering plastics in medical devices and pharmaceuticals.

Technological disruptions, including advancements in additive manufacturing (3D printing) and the development of novel materials with enhanced properties, are transforming the landscape. Consumer preferences are shifting towards sustainable and eco-friendly solutions, leading to increased demand for bio-based and recycled engineering plastics. The market's competitive dynamics are shaped by intense rivalry among major players, driving innovation and price competition. Market penetration of sustainable engineering plastics is projected to reach xx% by 2033.

Dominant Markets & Segments in Germany Engineering Plastics Market

The automotive sector remains the dominant end-use segment in the German engineering plastics market, accounting for approximately xx% of total consumption. This dominance is driven by the industry's ongoing focus on lightweighting, which reduces fuel consumption and emissions. The electronics sector is also a significant contributor, driven by the increasing demand for high-performance plastics in electronic devices and components.

Key Drivers for Automotive Sector Dominance:

- Stringent fuel efficiency regulations.

- Growing demand for lightweight vehicles.

- Technological advancements in automotive design.

Key Drivers for Electronics Sector Growth:

- Increasing adoption of electronic devices.

- Growing demand for high-performance electronics components.

- Miniaturization trends in electronics.

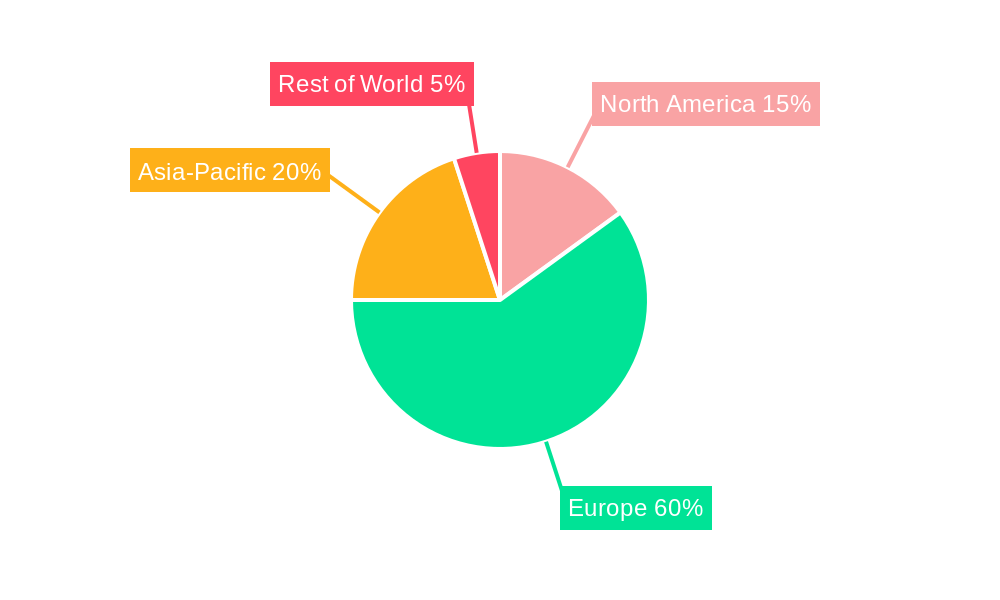

The southern region of Germany exhibits the strongest market growth due to a high concentration of manufacturing industries and automotive production facilities. Government policies promoting sustainable manufacturing and technological innovation further contribute to the market's dynamism.

Germany Engineering Plastics Market Product Innovations

Recent innovations in engineering plastics focus on enhancing material properties like strength, durability, and sustainability. Several companies have introduced bio-based and recycled materials to meet growing environmental concerns. For instance, BASF SE launched sustainable POM products with reduced carbon footprints, while Covestro AG introduced a polycarbonate for healthcare applications. These innovations reflect the market's trend towards high-performance, eco-friendly solutions. The development of new polymers with improved processability and recyclability is also gaining traction.

Report Segmentation & Scope

The Germany engineering plastics market is segmented by material type (e.g., polycarbonate, polyethylene terephthalate (PET), polyamide, etc.), application (e.g., automotive, electronics, healthcare, packaging, etc.), and region. Growth projections for each segment vary, with the automotive and electronics segments experiencing faster growth due to increased demand. Competitive dynamics differ across segments, influenced by the specific requirements and technological advancements in each application area. Market sizes for individual segments are estimated using a combination of top-down and bottom-up approaches. These segments are further analyzed and detailed in the complete report.

Key Drivers of Germany Engineering Plastics Market Growth

The German engineering plastics market is propelled by several key factors. The automotive industry's drive towards lightweighting to improve fuel efficiency and reduce emissions is a significant driver. Advances in material science, leading to higher-performing plastics with improved properties, are also crucial. Furthermore, growing demand for high-performance plastics in the electronics and healthcare sectors contributes to market expansion. Finally, supportive government policies promoting sustainable manufacturing practices are facilitating the adoption of eco-friendly engineering plastics.

Challenges in the Germany Engineering Plastics Market Sector

The German engineering plastics market faces challenges such as fluctuating raw material prices, impacting production costs and profitability. Competition from alternative materials like metals and composites creates pressure on pricing and market share. Stringent environmental regulations, while driving innovation, can also increase compliance costs. Supply chain disruptions can impact production and lead to delays in meeting market demand. These factors pose challenges for companies operating in this market.

Leading Players in the Germany Engineering Plastics Market Market

- 3M

- BARLOG Plastics GmbH

- BASF SE

- Celanese Corporation

- Covestro AG

- Domo Chemicals

- DuBay Polymer GmbH

- Equipolymers

- Evonik Industries AG

- Grupa Azoty S A

- Indorama Ventures Public Company Limited

- INEOS

- LANXESS

- Röhm GmbH

- Trinse

Key Developments in Germany Engineering Plastics Market Sector

- October 2022: BASF SE introduced two new sustainable POM products, Ultraform LowPCF (Low Product Carbon Footprint) and Ultraform BMB (Biomass Balance), to reduce the carbon footprint, save fossil resources, and support the reduction of greenhouse gas (GHG) emissions.

- November 2022: Celanese Corporation completed the acquisition of the Mobility & Materials (“M&M”) business of DuPont. This acquisition enhanced the company's product portfolio of engineered thermoplastics through the addition of well-recognized brands and intellectual properties of DuPont.

- February 2023: Covestro AG introduced Makrolon 3638 polycarbonate for healthcare and life sciences applications such as drug delivery devices, wellness and wearable devices, and single-use containers for biopharmaceutical manufacturing.

Strategic Germany Engineering Plastics Market Market Outlook

The German engineering plastics market presents significant growth potential driven by ongoing technological advancements, increasing demand from key industries, and a supportive regulatory environment. Strategic opportunities exist for companies focusing on sustainable materials, innovative product development, and efficient supply chain management. Companies adopting a proactive approach to sustainability and digitalization are poised to capture a larger market share and achieve significant growth in the coming years. The market's future is bright, with sustained growth expected throughout the forecast period.

Germany Engineering Plastics Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Resin Type

-

2.1. Fluoropolymer

-

2.1.1. By Sub Resin Type

- 2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 2.1.1.3. Polytetrafluoroethylene (PTFE)

- 2.1.1.4. Polyvinylfluoride (PVF)

- 2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 2.1.1.6. Other Sub Resin Types

-

2.1.1. By Sub Resin Type

- 2.2. Liquid Crystal Polymer (LCP)

-

2.3. Polyamide (PA)

- 2.3.1. Aramid

- 2.3.2. Polyamide (PA) 6

- 2.3.3. Polyamide (PA) 66

- 2.3.4. Polyphthalamide

- 2.4. Polybutylene Terephthalate (PBT)

- 2.5. Polycarbonate (PC)

- 2.6. Polyether Ether Ketone (PEEK)

- 2.7. Polyethylene Terephthalate (PET)

- 2.8. Polyimide (PI)

- 2.9. Polymethyl Methacrylate (PMMA)

- 2.10. Polyoxymethylene (POM)

- 2.11. Styrene Copolymers (ABS and SAN)

-

2.1. Fluoropolymer

Germany Engineering Plastics Market Segmentation By Geography

- 1. Germany

Germany Engineering Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of % from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Fluoropolymer

- 5.2.1.1. By Sub Resin Type

- 5.2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3. Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4. Polyvinylfluoride (PVF)

- 5.2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6. Other Sub Resin Types

- 5.2.1.1. By Sub Resin Type

- 5.2.2. Liquid Crystal Polymer (LCP)

- 5.2.3. Polyamide (PA)

- 5.2.3.1. Aramid

- 5.2.3.2. Polyamide (PA) 6

- 5.2.3.3. Polyamide (PA) 66

- 5.2.3.4. Polyphthalamide

- 5.2.4. Polybutylene Terephthalate (PBT)

- 5.2.5. Polycarbonate (PC)

- 5.2.6. Polyether Ether Ketone (PEEK)

- 5.2.7. Polyethylene Terephthalate (PET)

- 5.2.8. Polyimide (PI)

- 5.2.9. Polymethyl Methacrylate (PMMA)

- 5.2.10. Polyoxymethylene (POM)

- 5.2.11. Styrene Copolymers (ABS and SAN)

- 5.2.1. Fluoropolymer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 3M

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BARLOG Plastics GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BASF SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Celanese Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Covestro AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Domo Chemicals

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DuBay Polymer GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Equipolymers

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Evonik Industries AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Grupa Azoty S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Indorama Ventures Public Company Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 INEOS

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 LANXESS

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Röhm GmbH

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Trinse

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 3M

List of Figures

- Figure 1: Germany Engineering Plastics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Engineering Plastics Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Germany Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 4: Germany Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Germany Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 6: Germany Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 7: Germany Engineering Plastics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Engineering Plastics Market?

The projected CAGR is approximately N/A%.

2. Which companies are prominent players in the Germany Engineering Plastics Market?

Key companies in the market include 3M, BARLOG Plastics GmbH, BASF SE, Celanese Corporation, Covestro AG, Domo Chemicals, DuBay Polymer GmbH, Equipolymers, Evonik Industries AG, Grupa Azoty S A, Indorama Ventures Public Company Limited, INEOS, LANXESS, Röhm GmbH, Trinse.

3. What are the main segments of the Germany Engineering Plastics Market?

The market segments include End User Industry, Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Covestro AG introduced Makrolon 3638 polycarbonate for healthcare and life sciences applications such as drug delivery devices, wellness and wearable devices, and single-use containers for biopharmaceutical manufacturing.November 2022: Celanese Corporation completed the acquisition of the Mobility & Materials (“M&M”) business of DuPont. This acquisition enhanced the company's product portfolio of engineered thermoplastics through the addition of well-recognized brands and intellectual properties of DuPont.October 2022: BASF SE introduced two new sustainable POM products, Ultraform LowPCF (Low Product Carbon Footprint) and Ultraform BMB (Biomass Balance), to reduce the carbon footprint, save fossil resources, and support the reduction of greenhouse gas (GHG) emissions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Engineering Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Engineering Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Engineering Plastics Market?

To stay informed about further developments, trends, and reports in the Germany Engineering Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence