Key Insights

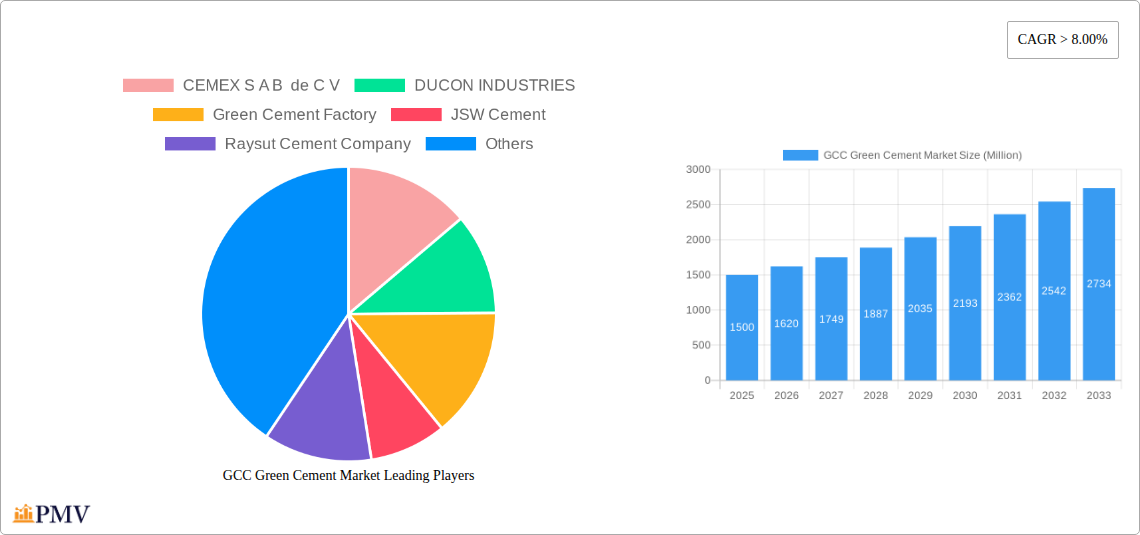

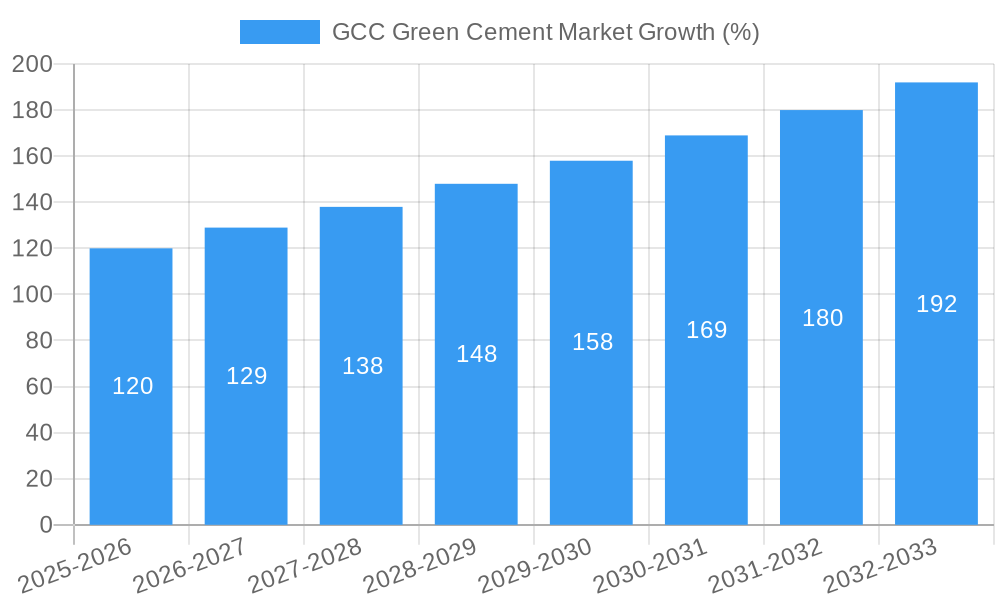

The GCC (Gulf Cooperation Council) green cement market is experiencing robust growth, driven by increasing environmental awareness, stringent government regulations aimed at reducing carbon emissions, and a surge in construction activities across the region. The market's Compound Annual Growth Rate (CAGR) exceeding 8% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by the rising demand for sustainable building materials, particularly in large-scale infrastructure projects and the burgeoning real estate sector. Key players like CEMEX, Holcim, and UltraTech Cement are actively investing in green cement technologies and expanding their production capacities to meet this growing demand. Furthermore, government initiatives promoting sustainable development and incentives for adopting eco-friendly construction practices are further accelerating market expansion. While the initial investment costs associated with green cement production may present a restraint, the long-term benefits in terms of reduced environmental impact and improved brand image are compelling factors encouraging adoption. The market segmentation likely includes various types of green cement (e.g., geopolymer cement, supplementary cementitious materials (SCMs) based cements) and applications across residential, commercial, and infrastructure projects.

Looking ahead to 2033, the GCC green cement market is poised for continued expansion, propelled by ongoing urbanization, population growth, and a sustained focus on environmental sustainability. Technological advancements in green cement production, including innovations in material sourcing and manufacturing processes, will further enhance efficiency and reduce costs. The market will likely see increased collaborations between cement manufacturers and technology providers to develop innovative and cost-effective solutions. However, challenges remain, including the need for greater awareness among consumers and builders regarding the benefits of green cement, and ensuring consistent supply chain stability to support large-scale project implementations. Addressing these challenges will be crucial for unlocking the full potential of the GCC green cement market and achieving its ambitious growth projections.

GCC Green Cement Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the GCC Green Cement market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, competitive dynamics, and future growth potential. The study incorporates extensive data analysis, encompassing historical data (2019-2024) and projected figures, ensuring a robust understanding of this rapidly evolving market. Key players such as CEMEX S A B de C V, DUCON INDUSTRIES, Green Cement Factory, JSW Cement, Raysut Cement Company, HOLCIM, Hoffmann Green Cement Technologies, Heidelberg Materials, Sharjah Cement & Industrial Development Co, UltraTech Cement Ltd, and Kiran Global Chem Limited (list not exhaustive) are analyzed for their market share, strategies, and contributions to innovation.

GCC Green Cement Market Market Structure & Competitive Dynamics

The GCC green cement market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the emergence of numerous smaller, innovative companies is fostering a dynamic competitive landscape. The market is characterized by ongoing mergers and acquisitions (M&A) activities, with deal values exceeding xx Million in the past five years. These activities demonstrate a strategic focus on expansion, technological acquisition, and market consolidation. Innovation ecosystems are evolving rapidly, with significant investment in research and development of sustainable cement alternatives. Regulatory frameworks in the GCC are increasingly supportive of green technologies, incentivizing the adoption of eco-friendly cement solutions. Product substitutes, such as geopolymer cement and other alternative binders, are gaining traction, adding further competitive pressure. End-user trends show a growing preference for sustainable construction materials driven by environmental concerns and stringent building codes.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- M&A Activity: Significant M&A activity observed, with total deal values exceeding xx Million (2019-2024).

- Innovation Ecosystems: Rapidly developing, with focus on clinker-free and low-carbon cement technologies.

- Regulatory Frameworks: Supportive of green building initiatives and sustainable cement adoption.

GCC Green Cement Market Industry Trends & Insights

The GCC green cement market is experiencing robust growth, driven by factors such as increasing government regulations targeting carbon emissions, growing environmental awareness amongst consumers and businesses, and a booming construction sector across the GCC. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is further fueled by technological advancements in green cement production, leading to reduced production costs and enhanced product quality. Consumer preferences are shifting towards sustainable construction materials, increasing the demand for green cement. The competitive landscape is dynamic, with both established players and new entrants vying for market share through innovation and strategic partnerships. Market penetration of green cement is gradually increasing, reaching an estimated xx% in 2024 and projected to reach xx% by 2033. The rising cost of traditional cement and the benefits of using green alternatives further contribute to the market's growth trajectory.

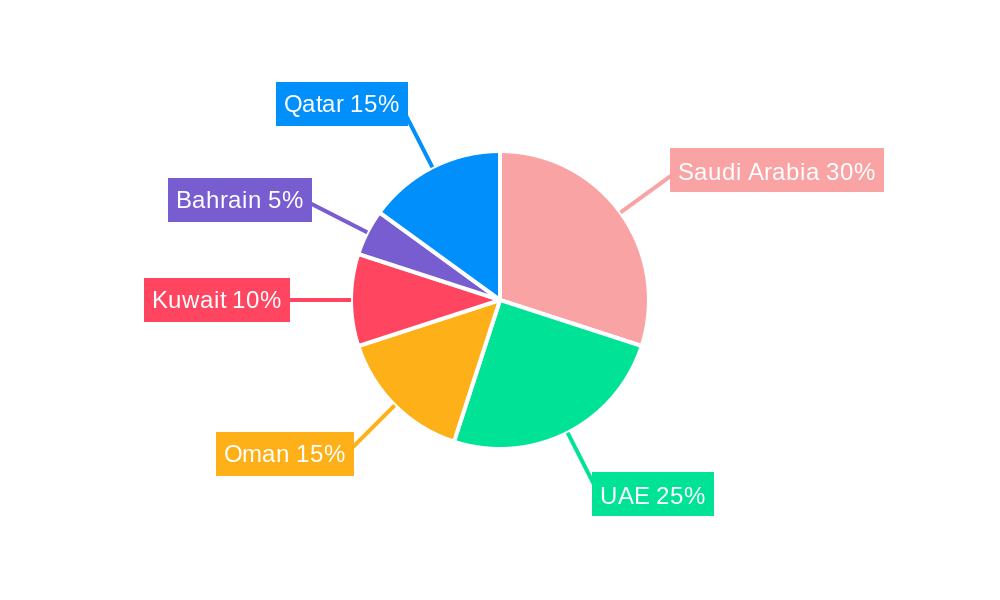

Dominant Markets & Segments in GCC Green Cement Market

The UAE and Saudi Arabia currently dominate the GCC green cement market, driven by substantial investments in infrastructure development and stringent environmental regulations. The construction sector in these nations accounts for the largest share of green cement consumption.

- Key Drivers in UAE & Saudi Arabia:

- Extensive government investments in infrastructure projects (e.g., Expo 2020 Dubai, Vision 2030).

- Stringent environmental regulations promoting sustainable construction practices.

- High demand for eco-friendly building materials from both public and private sectors.

- Growing awareness of the environmental impact of traditional cement.

The dominance of these markets is largely attributed to their proactive government policies promoting sustainable construction and the substantial investments in large-scale infrastructure projects. While other GCC nations are showing growth, the UAE and Saudi Arabia maintain a significant lead due to their advanced infrastructure and regulatory frameworks.

GCC Green Cement Market Product Innovations

Recent product innovations in the GCC green cement market focus on developing clinker-free and low-carbon alternatives to traditional Portland cement. These innovations leverage alternative materials and production processes to minimize the carbon footprint and enhance the overall sustainability of cement production. The use of supplementary cementitious materials (SCMs) like fly ash and slag, as well as the development of geopolymer cements, are key areas of focus. These innovations not only offer environmental benefits but also enhance the performance and durability of the final product, leading to improved market fit and competitive advantages for manufacturers.

Report Segmentation & Scope

This report segments the GCC green cement market based on several key parameters, including product type (e.g., Portland cement, blended cement, geopolymer cement), application (e.g., residential, commercial, industrial), and country. Growth projections and market sizes are provided for each segment, along with an in-depth analysis of competitive dynamics within each segment. The report also provides a granular analysis of the market across different GCC countries.

Key Drivers of GCC Green Cement Market Growth

Several key factors are driving the growth of the GCC green cement market. Stringent environmental regulations aimed at reducing carbon emissions in the construction industry are compelling the adoption of sustainable alternatives. Government initiatives promoting green building practices, coupled with increasing consumer awareness of environmental concerns, are driving demand for eco-friendly construction materials. Technological advancements leading to cost-effective green cement production also play a crucial role in accelerating market growth. The rapid expansion of the construction sector in the GCC further fuels the demand for sustainable cement solutions.

Challenges in the GCC Green Cement Market Sector

Despite the substantial growth potential, the GCC green cement market faces several challenges. The high initial investment costs associated with adopting new technologies can be a barrier to entry for some players. Supply chain disruptions can impact the availability and price stability of raw materials. Competition from established players in the traditional cement market poses a significant challenge for new entrants. Furthermore, while regulations are supportive, consistent and standardized implementation across all GCC nations is crucial to sustain growth.

Leading Players in the GCC Green Cement Market Market

- CEMEX S A B de C V

- DUCON INDUSTRIES

- Green Cement Factory

- JSW Cement

- Raysut Cement Company

- HOLCIM

- Hoffmann Green Cement Technologies

- Heidelberg Materials

- Sharjah Cement & Industrial Development Co

- UltraTech Cement Ltd

- Kiran Global Chem Limited

Key Developments in GCC Green Cement Market Sector

- June 2023: Hoffmann Green Cement Technologies partnered with Shurfah Holding to produce green cement in Saudi Arabia, planning four new production units starting in 2024. This significantly expands their market presence and capacity.

- December 2023: Hoffmann Green Cement Technologies extended its partnership with the Centre Scientifique et Technique du Bâtiment (CSTB) for another three years, reinforcing its commitment to research and development in green cement technology. This strengthens their technological edge and credibility.

Strategic GCC Green Cement Market Market Outlook

The GCC green cement market is poised for significant expansion over the next decade, driven by supportive government policies, increasing environmental awareness, and technological advancements. Strategic opportunities exist for companies to invest in innovative technologies, expand their production capacity, and develop sustainable supply chains. Focusing on efficient production processes, strategic partnerships, and market diversification will be key to capturing a larger share of this expanding market. The potential for growth is particularly strong in nations actively pursuing sustainable development goals and investing heavily in infrastructure projects.

GCC Green Cement Market Segmentation

-

1. Product Type

- 1.1. Fly Ash-based

- 1.2. Slag-based

- 1.3. Limestone-based

- 1.4. Silica fume-based

- 1.5. Other Pr

-

2. Construction Sector

- 2.1. Residential

- 2.2. Non-residential

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. Qatar

- 3.4. Rest of GCC

GCC Green Cement Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. Rest of GCC

GCC Green Cement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Construction Activities in GCC Countries; Favorable Government Policies for Green Building Construction; Abundance of Availability of Raw Materials

- 3.3. Market Restrains

- 3.3.1. Growing Construction Activities in GCC Countries; Favorable Government Policies for Green Building Construction; Abundance of Availability of Raw Materials

- 3.4. Market Trends

- 3.4.1. Residential Construction to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Green Cement Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fly Ash-based

- 5.1.2. Slag-based

- 5.1.3. Limestone-based

- 5.1.4. Silica fume-based

- 5.1.5. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by Construction Sector

- 5.2.1. Residential

- 5.2.2. Non-residential

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Qatar

- 5.3.4. Rest of GCC

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Qatar

- 5.4.4. Rest of GCC

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia GCC Green Cement Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Fly Ash-based

- 6.1.2. Slag-based

- 6.1.3. Limestone-based

- 6.1.4. Silica fume-based

- 6.1.5. Other Pr

- 6.2. Market Analysis, Insights and Forecast - by Construction Sector

- 6.2.1. Residential

- 6.2.2. Non-residential

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. Qatar

- 6.3.4. Rest of GCC

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates GCC Green Cement Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Fly Ash-based

- 7.1.2. Slag-based

- 7.1.3. Limestone-based

- 7.1.4. Silica fume-based

- 7.1.5. Other Pr

- 7.2. Market Analysis, Insights and Forecast - by Construction Sector

- 7.2.1. Residential

- 7.2.2. Non-residential

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. Qatar

- 7.3.4. Rest of GCC

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Qatar GCC Green Cement Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Fly Ash-based

- 8.1.2. Slag-based

- 8.1.3. Limestone-based

- 8.1.4. Silica fume-based

- 8.1.5. Other Pr

- 8.2. Market Analysis, Insights and Forecast - by Construction Sector

- 8.2.1. Residential

- 8.2.2. Non-residential

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. Qatar

- 8.3.4. Rest of GCC

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of GCC GCC Green Cement Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Fly Ash-based

- 9.1.2. Slag-based

- 9.1.3. Limestone-based

- 9.1.4. Silica fume-based

- 9.1.5. Other Pr

- 9.2. Market Analysis, Insights and Forecast - by Construction Sector

- 9.2.1. Residential

- 9.2.2. Non-residential

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. Qatar

- 9.3.4. Rest of GCC

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 CEMEX S A B de C V

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 DUCON INDUSTRIES

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Green Cement Factory

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 JSW Cement

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Raysut Cement Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 HOLCIM

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hoffmann Green Cement Technologies

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Heidelberg Materials

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sharjah Cement & Industrial Development Co

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 UltraTech Cement Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Kiran Global Chem Limited*List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 CEMEX S A B de C V

List of Figures

- Figure 1: Global GCC Green Cement Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Saudi Arabia GCC Green Cement Market Revenue (Million), by Product Type 2024 & 2032

- Figure 3: Saudi Arabia GCC Green Cement Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 4: Saudi Arabia GCC Green Cement Market Revenue (Million), by Construction Sector 2024 & 2032

- Figure 5: Saudi Arabia GCC Green Cement Market Revenue Share (%), by Construction Sector 2024 & 2032

- Figure 6: Saudi Arabia GCC Green Cement Market Revenue (Million), by Geography 2024 & 2032

- Figure 7: Saudi Arabia GCC Green Cement Market Revenue Share (%), by Geography 2024 & 2032

- Figure 8: Saudi Arabia GCC Green Cement Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Saudi Arabia GCC Green Cement Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: United Arab Emirates GCC Green Cement Market Revenue (Million), by Product Type 2024 & 2032

- Figure 11: United Arab Emirates GCC Green Cement Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: United Arab Emirates GCC Green Cement Market Revenue (Million), by Construction Sector 2024 & 2032

- Figure 13: United Arab Emirates GCC Green Cement Market Revenue Share (%), by Construction Sector 2024 & 2032

- Figure 14: United Arab Emirates GCC Green Cement Market Revenue (Million), by Geography 2024 & 2032

- Figure 15: United Arab Emirates GCC Green Cement Market Revenue Share (%), by Geography 2024 & 2032

- Figure 16: United Arab Emirates GCC Green Cement Market Revenue (Million), by Country 2024 & 2032

- Figure 17: United Arab Emirates GCC Green Cement Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Qatar GCC Green Cement Market Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Qatar GCC Green Cement Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Qatar GCC Green Cement Market Revenue (Million), by Construction Sector 2024 & 2032

- Figure 21: Qatar GCC Green Cement Market Revenue Share (%), by Construction Sector 2024 & 2032

- Figure 22: Qatar GCC Green Cement Market Revenue (Million), by Geography 2024 & 2032

- Figure 23: Qatar GCC Green Cement Market Revenue Share (%), by Geography 2024 & 2032

- Figure 24: Qatar GCC Green Cement Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Qatar GCC Green Cement Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Rest of GCC GCC Green Cement Market Revenue (Million), by Product Type 2024 & 2032

- Figure 27: Rest of GCC GCC Green Cement Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 28: Rest of GCC GCC Green Cement Market Revenue (Million), by Construction Sector 2024 & 2032

- Figure 29: Rest of GCC GCC Green Cement Market Revenue Share (%), by Construction Sector 2024 & 2032

- Figure 30: Rest of GCC GCC Green Cement Market Revenue (Million), by Geography 2024 & 2032

- Figure 31: Rest of GCC GCC Green Cement Market Revenue Share (%), by Geography 2024 & 2032

- Figure 32: Rest of GCC GCC Green Cement Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of GCC GCC Green Cement Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global GCC Green Cement Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global GCC Green Cement Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global GCC Green Cement Market Revenue Million Forecast, by Construction Sector 2019 & 2032

- Table 4: Global GCC Green Cement Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global GCC Green Cement Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global GCC Green Cement Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Global GCC Green Cement Market Revenue Million Forecast, by Construction Sector 2019 & 2032

- Table 8: Global GCC Green Cement Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 9: Global GCC Green Cement Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global GCC Green Cement Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: Global GCC Green Cement Market Revenue Million Forecast, by Construction Sector 2019 & 2032

- Table 12: Global GCC Green Cement Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Global GCC Green Cement Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global GCC Green Cement Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Global GCC Green Cement Market Revenue Million Forecast, by Construction Sector 2019 & 2032

- Table 16: Global GCC Green Cement Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Global GCC Green Cement Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global GCC Green Cement Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Global GCC Green Cement Market Revenue Million Forecast, by Construction Sector 2019 & 2032

- Table 20: Global GCC Green Cement Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Global GCC Green Cement Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Green Cement Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the GCC Green Cement Market?

Key companies in the market include CEMEX S A B de C V, DUCON INDUSTRIES, Green Cement Factory, JSW Cement, Raysut Cement Company, HOLCIM, Hoffmann Green Cement Technologies, Heidelberg Materials, Sharjah Cement & Industrial Development Co, UltraTech Cement Ltd, Kiran Global Chem Limited*List Not Exhaustive.

3. What are the main segments of the GCC Green Cement Market?

The market segments include Product Type, Construction Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Construction Activities in GCC Countries; Favorable Government Policies for Green Building Construction; Abundance of Availability of Raw Materials.

6. What are the notable trends driving market growth?

Residential Construction to Dominate the Market.

7. Are there any restraints impacting market growth?

Growing Construction Activities in GCC Countries; Favorable Government Policies for Green Building Construction; Abundance of Availability of Raw Materials.

8. Can you provide examples of recent developments in the market?

December 2023: Hoffmann Green Cement Technologies announced that the partnership contract signed in 2021 with the Centre Scientifique et Technique du Bâtiment (CSTB) has been extended for a further three years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Green Cement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Green Cement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Green Cement Market?

To stay informed about further developments, trends, and reports in the GCC Green Cement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence