Key Insights

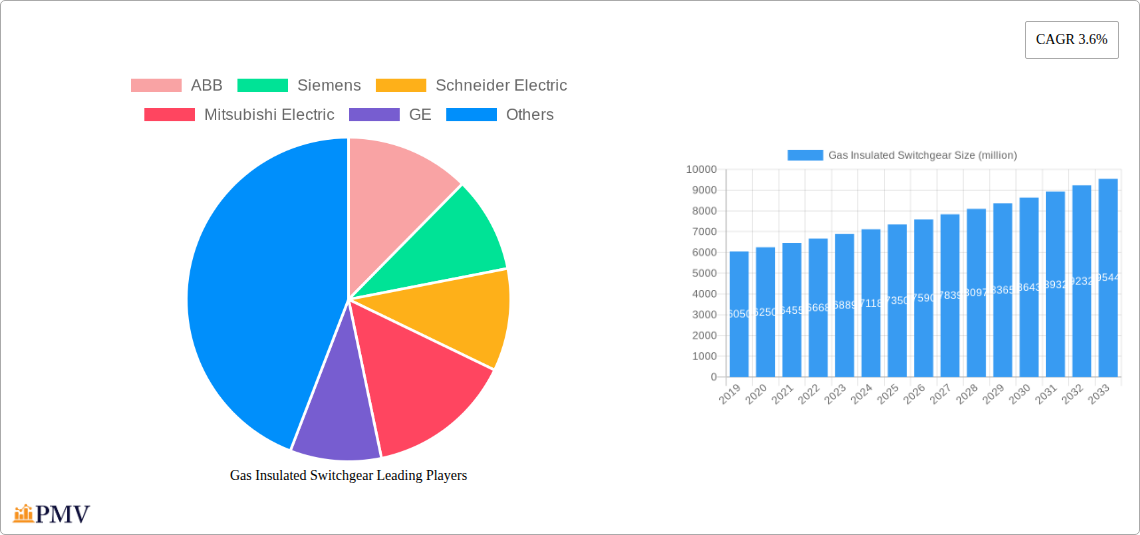

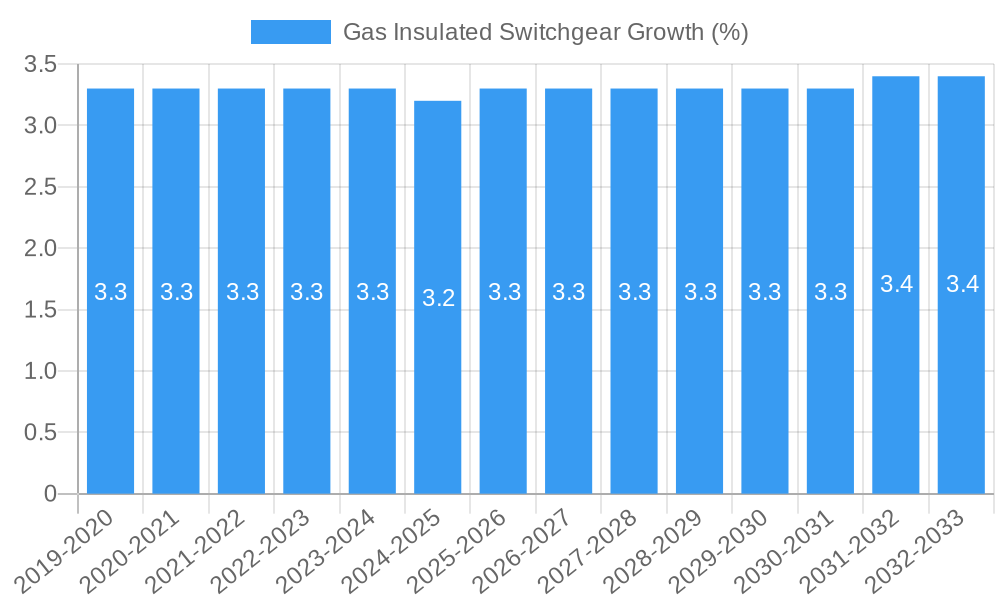

The global Gas Insulated Switchgear (GIS) market is poised for steady expansion, projected to reach an estimated market size of $7,151 million by 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 3.6% from 2019 to 2033, indicating a robust and sustained demand for GIS technology. The primary drivers behind this upward trajectory are the escalating global electricity demand, coupled with the imperative for modernizing aging power infrastructure. As grids become more complex and require enhanced reliability, the compact, safe, and efficient nature of GIS solutions makes them increasingly indispensable, especially in densely populated urban areas and space-constrained industrial facilities. The ongoing shift towards renewable energy sources also fuels GIS adoption, as these advanced switchgear systems are crucial for integrating intermittent power generation into the grid effectively and ensuring grid stability.

The market is characterized by a strong focus on technological advancements, with manufacturers continually innovating to improve GIS performance, environmental sustainability, and cost-effectiveness. Key trends include the integration of smart grid technologies, such as advanced monitoring, control, and communication capabilities, which allow for proactive maintenance and optimized grid operations. Furthermore, the development of more environmentally friendly insulating gases, reducing the reliance on traditional SF6, is a significant emerging trend. While the market benefits from robust demand, certain restraints, such as the high initial cost of GIS installation compared to conventional air-insulated switchgear (AIS) and the specialized technical expertise required for deployment and maintenance, could temper rapid adoption in certain regions or segments. Nevertheless, the long-term operational benefits and enhanced safety offered by GIS are expected to outweigh these challenges, driving sustained market growth across various applications and end-user industries.

Here is the SEO-optimized, detailed report description for Gas Insulated Switchgear, incorporating your requirements:

Gas Insulated Switchgear Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth market research report provides a comprehensive analysis of the global Gas Insulated Switchgear (GIS) market, covering historical trends, current market dynamics, and future projections from 2019 to 2033. The study delves into market size, segmentation, competitive landscapes, and key growth drivers, offering valuable insights for stakeholders across the electrical power transmission and distribution industry. Our extensive research covers major players including ABB, Siemens, Schneider Electric, Mitsubishi Electric, GE, Hitachi, HYUNDAI ELECTRIC, Fuji Electric, Nissin Electric, CG, Hyosung, Chint, Larsen & Toubro, Toshiba, and Meidensha, examining their market share and strategic initiatives.

Gas Insulated Switchgear Market Structure & Competitive Dynamics

The global GIS market exhibits a moderate to high concentration, with leading companies like Siemens and ABB holding significant market share, estimated to be in the hundreds of million dollars range each. Innovation ecosystems are robust, driven by continuous R&D in areas such as advanced insulating gases, digital integration, and compact designs for urban environments. Regulatory frameworks, particularly those focused on grid modernization and environmental impact of SF6 alternatives, play a crucial role in shaping market entry and product development. Product substitutes, such as Air Insulated Switchgear (AIS) and Vacuum Insulated Switchgear (VIS), present competitive challenges, particularly in specific voltage ranges and cost-sensitive applications. End-user trends are shifting towards smart grid integration, enhanced reliability, and reduced maintenance, driving demand for sophisticated GIS solutions. Merger and acquisition (M&A) activities are observed, with deal values often reaching hundreds of million dollars, aimed at expanding product portfolios and geographical reach. Key M&A transactions in the historical period (2019-2024) have consolidated market positions.

Gas Insulated Switchgear Industry Trends & Insights

The Gas Insulated Switchgear market is projected to witness robust growth, with an estimated Compound Annual Growth Rate (CAGR) of over 6% during the forecast period (2025-2033). Market penetration is steadily increasing, particularly in developing economies and for high-voltage applications where space constraints and environmental considerations are paramount. The demand for GIS is intrinsically linked to investments in power infrastructure development, including new substations, grid expansions, and renewable energy integration projects. Technological disruptions are at the forefront, with advancements in eco-friendly insulating gases (such as vacuum and CO2 mixtures) gaining traction to mitigate the environmental impact of traditional SF6 gas. Digitalization is another key trend, with GIS increasingly incorporating smart sensors, IoT connectivity, and advanced diagnostic capabilities for real-time monitoring, predictive maintenance, and remote control, thereby enhancing grid efficiency and reliability. Consumer preferences are leaning towards integrated solutions offering higher safety standards, reduced footprint, and lower lifecycle costs. Competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on emerging markets with significant infrastructure development needs. The smart grid market and the renewable energy sector are major growth engines, driving the demand for advanced GIS solutions capable of handling intermittent power generation and complex grid configurations. The estimated market size for GIS in the base year (2025) is expected to reach several thousand million dollars.

Dominant Markets & Segments in Gas Insulated Switchgear

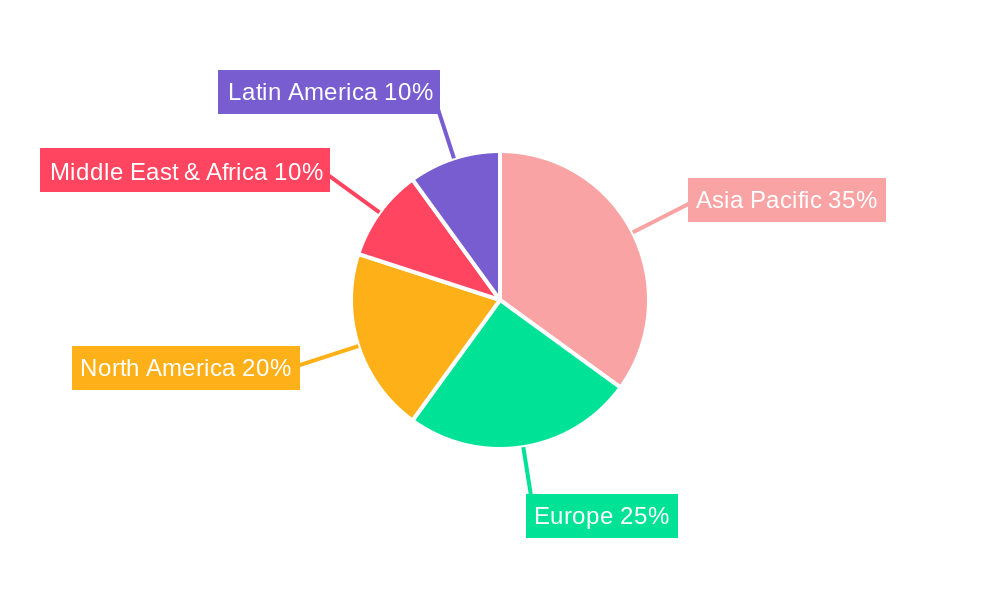

The Gas Insulated Switchgear market is dominated by Asia Pacific, with China and India being the leading countries. This dominance is driven by substantial investments in electricity transmission and distribution infrastructure, rapid industrialization, and the increasing adoption of renewable energy sources. Economic policies promoting grid modernization and electrification further bolster demand.

Dominant Region: Asia Pacific

- Key Drivers: Massive government spending on grid expansion and upgrades, a growing renewable energy portfolio requiring advanced grid management, and a large industrial base demanding reliable power supply.

- Market Size Influence: Accounts for an estimated 40% of the global GIS market, with a projected market size in the thousands of million dollars for the region in the base year (2025).

- Growth Projections: Expected to maintain its lead throughout the forecast period, with continued significant investments in substations and transmission lines.

Dominant Application: High Voltage GIS

- Key Drivers: Superior insulation properties, compact design for urban substations, reduced maintenance requirements, and enhanced safety compared to traditional switchgear.

- Market Share: High Voltage GIS constitutes the largest segment, holding over 60% of the total GIS market.

- Strategic Importance: Essential for efficient power transmission over long distances and in space-constrained urban areas.

Dominant Type: SF6 Gas Insulated Switchgear

- Key Drivers: Proven reliability, excellent dielectric strength, and established manufacturing processes, making it the incumbent technology for decades.

- Market Penetration: Despite environmental concerns, SF6-based GIS still dominates due to its performance characteristics and widespread acceptance.

- Future Outlook: While SF6 remains dominant, the market is witnessing a gradual shift towards alternative eco-friendly gases as regulations tighten.

Country-Specific Dominance: China

- Key Drivers: Extensive investment in ultra-high voltage (UHV) transmission lines, development of a robust domestic manufacturing base for GIS, and a nationwide push for smart grid technologies.

- Market Impact: China's demand significantly influences global GIS market trends and pricing.

Gas Insulated Switchgear Product Innovations

Recent product developments in the Gas Insulated Switchgear sector focus on enhancing sustainability, digitalization, and performance. Innovations include the development of eco-friendly GIS utilizing vacuum interrupters combined with alternative insulating media, aiming to reduce reliance on SF6 gas. Companies are also integrating advanced digital functionalities, such as IoT sensors for real-time condition monitoring and predictive analytics, enabling smarter grid operations and reduced maintenance. Compact designs and modular architectures are further optimized for space-constrained applications and ease of installation. These innovations offer competitive advantages by meeting evolving environmental regulations and the demand for more reliable and efficient power distribution systems, with market adoption expected to grow significantly.

Report Segmentation & Scope

This report meticulously segments the global Gas Insulated Switchgear market across various key parameters to provide granular insights. The segmentation includes:

- Application: This segment is categorized into High Voltage GIS, Medium Voltage GIS, and Low Voltage GIS. The High Voltage GIS segment is projected to exhibit the highest growth rate, driven by infrastructure development and the need for efficient power transmission. Its market size in the base year (2025) is estimated in the thousands of million dollars.

- Type: This segmentation focuses on GIS based on insulating medium, primarily SF6 Gas Insulated Switchgear and alternatives like vacuum and gas mixtures. While SF6 remains dominant, the market share of alternative types is expected to increase due to environmental regulations, with growth projections for eco-friendly GIS in the high single digits.

- Voltage Level: Further segmentation includes GIS for specific voltage ranges (e.g., 132 kV, 220 kV, 400 kV, 765 kV and above). High voltage segments (400 kV and above) are experiencing significant demand due to large-scale power projects.

Key Drivers of Gas Insulated Switchgear Growth

The Gas Insulated Switchgear market is propelled by several significant growth drivers. Firstly, increasing global investments in electricity transmission and distribution infrastructure, particularly in emerging economies, create a strong demand for reliable and efficient switchgear solutions. Secondly, the rapid expansion of the renewable energy sector, including solar and wind power, necessitates advanced grid management systems, including GIS, to handle the intermittent nature of these sources and integrate them seamlessly into the grid. Thirdly, the ongoing trend of urbanization and industrialization leads to higher electricity demand and space constraints in urban substations, favoring the compact designs of GIS. Finally, stricter environmental regulations and a growing focus on sustainability are driving the adoption of eco-friendly GIS technologies and alternatives to SF6 gas.

Challenges in the Gas Insulated Switchgear Sector

Despite its strong growth trajectory, the Gas Insulated Switchgear sector faces several challenges. The high initial cost of GIS equipment compared to traditional switchgear can be a barrier, particularly for smaller utilities or in price-sensitive markets. The environmental concerns associated with SF6 gas, a potent greenhouse gas, pose a significant regulatory challenge, pushing manufacturers to invest in and develop alternative technologies. Supply chain disruptions and the availability of critical raw materials can also impact production and pricing. Furthermore, intense competition among established players and new entrants can lead to price pressures. The need for specialized installation and maintenance expertise also presents a hurdle for widespread adoption in regions with limited technical capabilities.

Leading Players in the Gas Insulated Switchgear Market

- ABB

- Siemens

- Schneider Electric

- Mitsubishi Electric

- GE

- Hitachi

- HYUNDAI ELECTRIC

- Fuji Electric

- Nissin Electric

- CG

- Hyosung

- Chint

- Larsen & Toubro

- Toshiba

- Meidensha

Key Developments in Gas Insulated Switchgear Sector

- 2023-2024: Increased focus on R&D for SF6-free GIS technologies by major manufacturers, driven by evolving environmental regulations.

- 2022-2023: Several strategic partnerships and collaborations announced to develop and market advanced digital GIS solutions for smart grids.

- 2021-2022: Significant investments by leading players in expanding manufacturing capacity for high-voltage GIS to meet growing demand in Asia Pacific.

- 2020-2021: Launch of new compact and modular GIS designs, offering enhanced flexibility and reduced footprint for urban substation applications.

- 2019-2020: Several acquisitions and mergers aimed at consolidating market share and expanding product portfolios in the GIS sector.

Strategic Gas Insulated Switchgear Market Outlook

The strategic outlook for the Gas Insulated Switchgear market remains highly optimistic, driven by the sustained global demand for reliable and efficient power infrastructure. Key growth accelerators include the accelerating transition towards renewable energy sources, which requires advanced grid management capabilities, and the ongoing trend of grid modernization and smart grid implementation. Companies focusing on the development and deployment of eco-friendly GIS alternatives and integrated digital solutions will likely gain a significant competitive edge. Strategic investments in emerging markets with substantial infrastructure development needs, coupled with a focus on innovation in product design and functionality, will be crucial for sustained growth and market leadership. The market is poised for continued expansion, with opportunities in high-voltage applications and smart grid integration remaining particularly strong.

Gas Insulated Switchgear Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Gas Insulated Switchgear Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Gas Insulated Switchgear REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gas Insulated Switchgear Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Gas Insulated Switchgear Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Gas Insulated Switchgear Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Gas Insulated Switchgear Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Gas Insulated Switchgear Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Gas Insulated Switchgear Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ABB

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Siemens

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Schneider Electric

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mitsubishi Electric

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hitachi

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 HYUNDAI ELECTRIC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fuji Electric

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nissin Electric

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hyosung

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Chint

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Larsen & Toubro

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Toshiba

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Meidensha

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 ABB

List of Figures

- Figure 1: Global Gas Insulated Switchgear Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Gas Insulated Switchgear Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: undefined Gas Insulated Switchgear Revenue (million), by Application 2024 & 2032

- Figure 4: undefined Gas Insulated Switchgear Volume (K), by Application 2024 & 2032

- Figure 5: undefined Gas Insulated Switchgear Revenue Share (%), by Application 2024 & 2032

- Figure 6: undefined Gas Insulated Switchgear Volume Share (%), by Application 2024 & 2032

- Figure 7: undefined Gas Insulated Switchgear Revenue (million), by Type 2024 & 2032

- Figure 8: undefined Gas Insulated Switchgear Volume (K), by Type 2024 & 2032

- Figure 9: undefined Gas Insulated Switchgear Revenue Share (%), by Type 2024 & 2032

- Figure 10: undefined Gas Insulated Switchgear Volume Share (%), by Type 2024 & 2032

- Figure 11: undefined Gas Insulated Switchgear Revenue (million), by Country 2024 & 2032

- Figure 12: undefined Gas Insulated Switchgear Volume (K), by Country 2024 & 2032

- Figure 13: undefined Gas Insulated Switchgear Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Gas Insulated Switchgear Volume Share (%), by Country 2024 & 2032

- Figure 15: undefined Gas Insulated Switchgear Revenue (million), by Application 2024 & 2032

- Figure 16: undefined Gas Insulated Switchgear Volume (K), by Application 2024 & 2032

- Figure 17: undefined Gas Insulated Switchgear Revenue Share (%), by Application 2024 & 2032

- Figure 18: undefined Gas Insulated Switchgear Volume Share (%), by Application 2024 & 2032

- Figure 19: undefined Gas Insulated Switchgear Revenue (million), by Type 2024 & 2032

- Figure 20: undefined Gas Insulated Switchgear Volume (K), by Type 2024 & 2032

- Figure 21: undefined Gas Insulated Switchgear Revenue Share (%), by Type 2024 & 2032

- Figure 22: undefined Gas Insulated Switchgear Volume Share (%), by Type 2024 & 2032

- Figure 23: undefined Gas Insulated Switchgear Revenue (million), by Country 2024 & 2032

- Figure 24: undefined Gas Insulated Switchgear Volume (K), by Country 2024 & 2032

- Figure 25: undefined Gas Insulated Switchgear Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Gas Insulated Switchgear Volume Share (%), by Country 2024 & 2032

- Figure 27: undefined Gas Insulated Switchgear Revenue (million), by Application 2024 & 2032

- Figure 28: undefined Gas Insulated Switchgear Volume (K), by Application 2024 & 2032

- Figure 29: undefined Gas Insulated Switchgear Revenue Share (%), by Application 2024 & 2032

- Figure 30: undefined Gas Insulated Switchgear Volume Share (%), by Application 2024 & 2032

- Figure 31: undefined Gas Insulated Switchgear Revenue (million), by Type 2024 & 2032

- Figure 32: undefined Gas Insulated Switchgear Volume (K), by Type 2024 & 2032

- Figure 33: undefined Gas Insulated Switchgear Revenue Share (%), by Type 2024 & 2032

- Figure 34: undefined Gas Insulated Switchgear Volume Share (%), by Type 2024 & 2032

- Figure 35: undefined Gas Insulated Switchgear Revenue (million), by Country 2024 & 2032

- Figure 36: undefined Gas Insulated Switchgear Volume (K), by Country 2024 & 2032

- Figure 37: undefined Gas Insulated Switchgear Revenue Share (%), by Country 2024 & 2032

- Figure 38: undefined Gas Insulated Switchgear Volume Share (%), by Country 2024 & 2032

- Figure 39: undefined Gas Insulated Switchgear Revenue (million), by Application 2024 & 2032

- Figure 40: undefined Gas Insulated Switchgear Volume (K), by Application 2024 & 2032

- Figure 41: undefined Gas Insulated Switchgear Revenue Share (%), by Application 2024 & 2032

- Figure 42: undefined Gas Insulated Switchgear Volume Share (%), by Application 2024 & 2032

- Figure 43: undefined Gas Insulated Switchgear Revenue (million), by Type 2024 & 2032

- Figure 44: undefined Gas Insulated Switchgear Volume (K), by Type 2024 & 2032

- Figure 45: undefined Gas Insulated Switchgear Revenue Share (%), by Type 2024 & 2032

- Figure 46: undefined Gas Insulated Switchgear Volume Share (%), by Type 2024 & 2032

- Figure 47: undefined Gas Insulated Switchgear Revenue (million), by Country 2024 & 2032

- Figure 48: undefined Gas Insulated Switchgear Volume (K), by Country 2024 & 2032

- Figure 49: undefined Gas Insulated Switchgear Revenue Share (%), by Country 2024 & 2032

- Figure 50: undefined Gas Insulated Switchgear Volume Share (%), by Country 2024 & 2032

- Figure 51: undefined Gas Insulated Switchgear Revenue (million), by Application 2024 & 2032

- Figure 52: undefined Gas Insulated Switchgear Volume (K), by Application 2024 & 2032

- Figure 53: undefined Gas Insulated Switchgear Revenue Share (%), by Application 2024 & 2032

- Figure 54: undefined Gas Insulated Switchgear Volume Share (%), by Application 2024 & 2032

- Figure 55: undefined Gas Insulated Switchgear Revenue (million), by Type 2024 & 2032

- Figure 56: undefined Gas Insulated Switchgear Volume (K), by Type 2024 & 2032

- Figure 57: undefined Gas Insulated Switchgear Revenue Share (%), by Type 2024 & 2032

- Figure 58: undefined Gas Insulated Switchgear Volume Share (%), by Type 2024 & 2032

- Figure 59: undefined Gas Insulated Switchgear Revenue (million), by Country 2024 & 2032

- Figure 60: undefined Gas Insulated Switchgear Volume (K), by Country 2024 & 2032

- Figure 61: undefined Gas Insulated Switchgear Revenue Share (%), by Country 2024 & 2032

- Figure 62: undefined Gas Insulated Switchgear Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Gas Insulated Switchgear Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Gas Insulated Switchgear Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Gas Insulated Switchgear Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Gas Insulated Switchgear Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Gas Insulated Switchgear Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Gas Insulated Switchgear Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Gas Insulated Switchgear Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Gas Insulated Switchgear Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Gas Insulated Switchgear Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Gas Insulated Switchgear Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Gas Insulated Switchgear Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Gas Insulated Switchgear Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Gas Insulated Switchgear Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Gas Insulated Switchgear Volume K Forecast, by Country 2019 & 2032

- Table 15: Global Gas Insulated Switchgear Revenue million Forecast, by Application 2019 & 2032

- Table 16: Global Gas Insulated Switchgear Volume K Forecast, by Application 2019 & 2032

- Table 17: Global Gas Insulated Switchgear Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Gas Insulated Switchgear Volume K Forecast, by Type 2019 & 2032

- Table 19: Global Gas Insulated Switchgear Revenue million Forecast, by Country 2019 & 2032

- Table 20: Global Gas Insulated Switchgear Volume K Forecast, by Country 2019 & 2032

- Table 21: Global Gas Insulated Switchgear Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Gas Insulated Switchgear Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Gas Insulated Switchgear Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Gas Insulated Switchgear Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Gas Insulated Switchgear Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Gas Insulated Switchgear Volume K Forecast, by Country 2019 & 2032

- Table 27: Global Gas Insulated Switchgear Revenue million Forecast, by Application 2019 & 2032

- Table 28: Global Gas Insulated Switchgear Volume K Forecast, by Application 2019 & 2032

- Table 29: Global Gas Insulated Switchgear Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Gas Insulated Switchgear Volume K Forecast, by Type 2019 & 2032

- Table 31: Global Gas Insulated Switchgear Revenue million Forecast, by Country 2019 & 2032

- Table 32: Global Gas Insulated Switchgear Volume K Forecast, by Country 2019 & 2032

- Table 33: Global Gas Insulated Switchgear Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Gas Insulated Switchgear Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Gas Insulated Switchgear Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Gas Insulated Switchgear Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Gas Insulated Switchgear Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Gas Insulated Switchgear Volume K Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gas Insulated Switchgear?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the Gas Insulated Switchgear?

Key companies in the market include ABB, Siemens, Schneider Electric, Mitsubishi Electric, GE, Hitachi, HYUNDAI ELECTRIC, Fuji Electric, Nissin Electric, CG, Hyosung, Chint, Larsen & Toubro, Toshiba, Meidensha.

3. What are the main segments of the Gas Insulated Switchgear?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7151 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gas Insulated Switchgear," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gas Insulated Switchgear report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gas Insulated Switchgear?

To stay informed about further developments, trends, and reports in the Gas Insulated Switchgear, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence