Key Insights

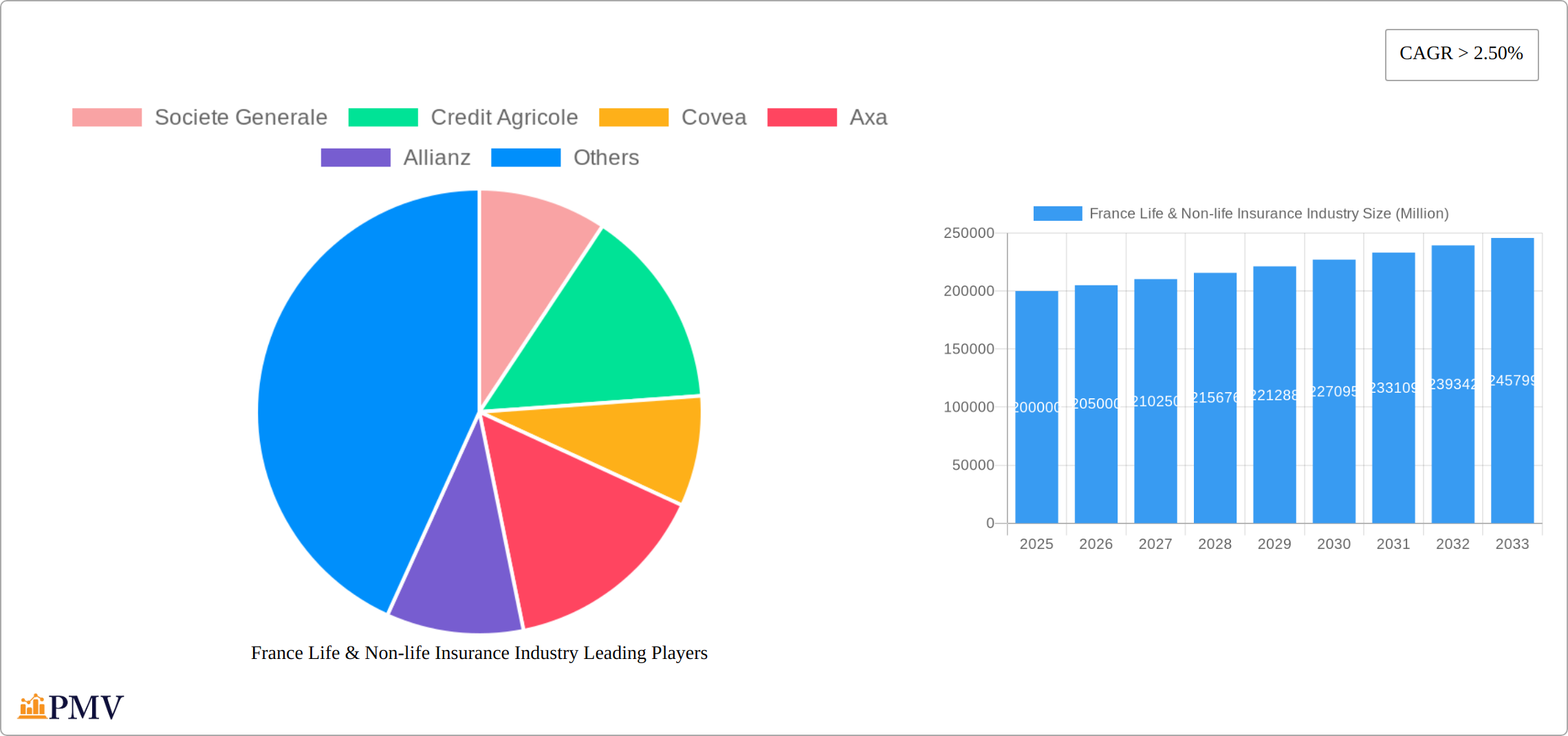

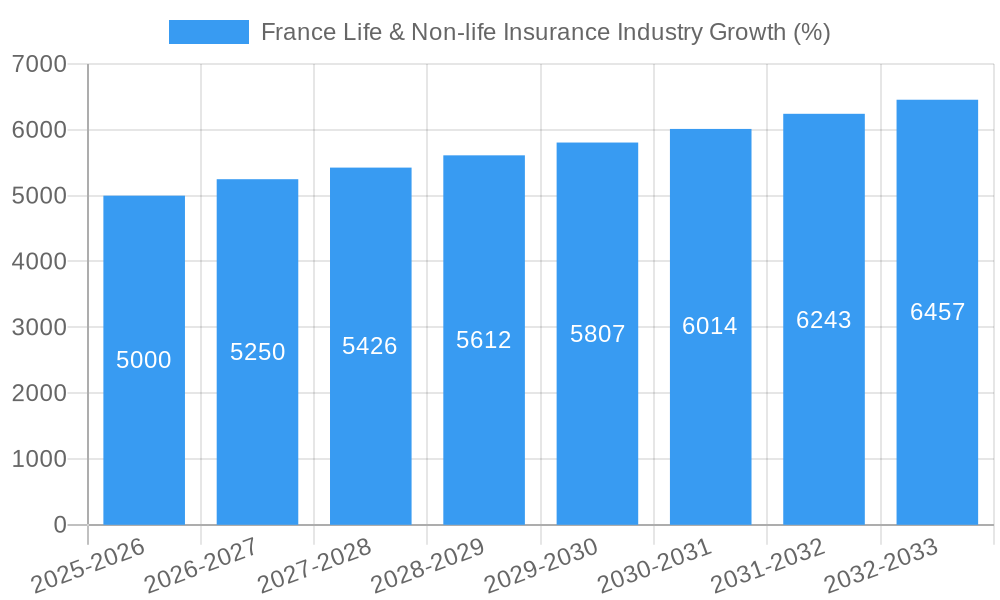

The French life and non-life insurance market, currently exhibiting a Compound Annual Growth Rate (CAGR) exceeding 2.50%, presents a robust and dynamic landscape. Driven by factors such as a growing aging population necessitating increased retirement planning and healthcare coverage, rising disposable incomes fueling demand for insurance products, and increasing government regulations promoting financial security, the market is poised for continued expansion. The market is segmented by product type (life insurance, health insurance, property insurance, etc.), distribution channels (online, agents, brokers), and geographical regions. Major players like Société Générale, Crédit Agricole, Covea, AXA, Allianz, La Banque Postale, MACIF, Crédit Mutuel, MAIF, ACM, Caisse d'Epargne, and Groupama dominate the market, showcasing a competitive yet concentrated industry structure. While the market enjoys strong growth, challenges exist. These include increasing regulatory scrutiny, evolving customer expectations and digital disruption, and potential economic downturns impacting consumer spending on insurance products. Successful players will need to adapt to these challenges through strategic innovation in product offerings, enhanced digital capabilities, and effective risk management strategies.

The forecast period of 2025-2033 anticipates sustained growth, building upon the historical period of 2019-2024. Assuming a conservative estimate, and given the CAGR of >2.50%, a market size of approximately €200 billion in 2025 is plausible, gradually increasing year over year. This projection considers potential economic fluctuations and market penetration rates within specific segments. The specific segmentation details provided ([]) were not useful for calculations, however, further investigation into the specific sub-segments would enable more granular financial projections. The continued expansion will depend on several factors including the effectiveness of government policies supporting the sector and the ability of insurance companies to adapt to the digital landscape, particularly in areas like personalized insurance offerings and fraud prevention.

This comprehensive report provides a detailed analysis of the French life and non-life insurance market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). It delves into market structure, competitive dynamics, key trends, and growth drivers, offering valuable insights for industry stakeholders.

France Life & Non-life Insurance Industry Market Structure & Competitive Dynamics

The French life and non-life insurance market is characterized by a concentrated landscape dominated by a few large players. Key companies include Societe Generale, Credit Agricole, Covea, Axa, Allianz, La banque postale, MACIF, Credit mutuel, MAIF, ACM, Caisse D'Epargne, and Groupama. This list is not exhaustive. These companies account for approximately xx% of the total market share in 2025, reflecting a high degree of market concentration.

Market dynamics are shaped by several factors:

- Regulatory Framework: Stringent regulations and compliance requirements influence market operations and innovation.

- Innovation Ecosystems: The industry is witnessing increasing digitalization and the adoption of Insurtech solutions, leading to new product offerings and service delivery models.

- Product Substitutes: The rise of alternative financial products and services presents competitive pressure.

- End-User Trends: Shifting consumer preferences towards personalized and digital-first insurance solutions are impacting product development and marketing strategies.

- M&A Activities: The French insurance market has seen significant M&A activity in recent years, with deal values reaching xx Million in 2024. These mergers and acquisitions have further consolidated the market and led to increased market share for larger players.

The competitive intensity is moderate to high, driven by price competition, product innovation, and customer acquisition strategies.

France Life & Non-life Insurance Industry Industry Trends & Insights

The French life and non-life insurance market is expected to witness significant growth during the forecast period (2025-2033). Driven by factors such as increasing disposable incomes, rising awareness of insurance products, and supportive government policies, the market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Market penetration in 2025 is estimated at xx%, with significant potential for future growth, particularly in the non-life segment due to the rising demand for motor, health, and property insurance.

Technological disruptions, particularly the adoption of Insurtech solutions, are transforming the industry. Artificial intelligence, blockchain technology, and big data analytics are being used to improve efficiency, enhance customer experience, and develop new insurance products. The increasing adoption of digital distribution channels is also contributing to market expansion.

Furthermore, evolving consumer preferences towards personalized and customizable insurance solutions are driving insurers to offer tailored products and services to cater to specific customer needs.

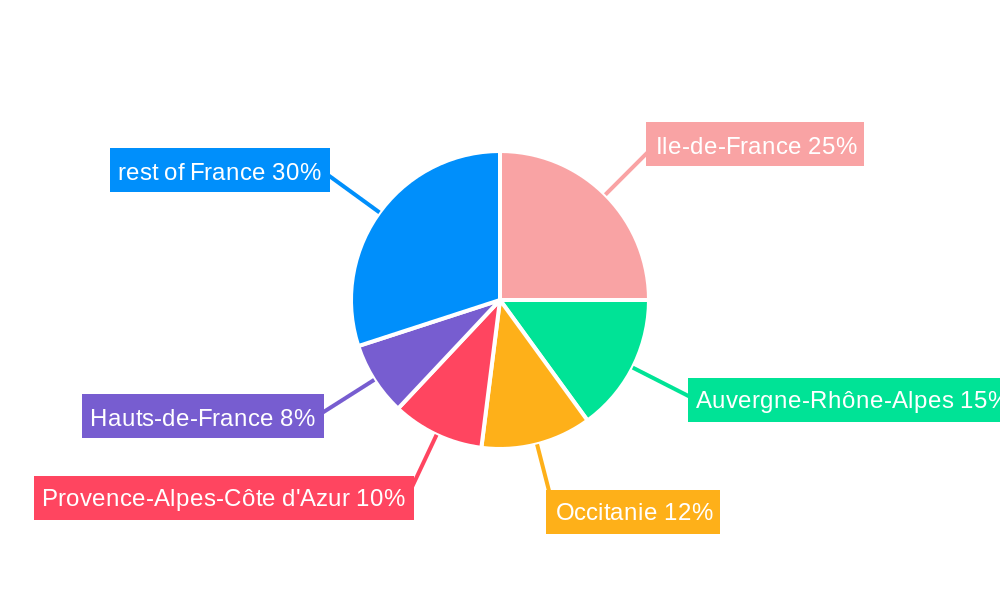

Dominant Markets & Segments in France Life & Non-life Insurance Industry

The Paris region constitutes the most dominant market within France, accounting for xx% of the total market value in 2025. This dominance stems from several key factors:

- High Population Density: Paris has the highest population density in France, leading to a large pool of potential insurance customers.

- Strong Economic Activity: The region boasts a robust economy, generating higher disposable incomes and demand for insurance products.

- Developed Infrastructure: Excellent infrastructure and connectivity facilitate efficient insurance operations and distribution networks.

The non-life insurance segment is projected to dominate the market due to factors such as rising car ownership, increasing awareness of health insurance, and growing demand for property insurance. The life insurance segment is also anticipated to see robust growth, fueled by increasing government initiatives to encourage savings and retirement planning.

France Life & Non-life Insurance Industry Product Innovations

Recent product innovations have focused on digital solutions, personalized offerings, and the integration of telematics and IoT devices. This involves the development of mobile apps for claims management, online policy purchases, and customized insurance packages. Such innovations aim to enhance customer experience, optimize operational efficiency, and improve risk assessment capabilities. These innovations are well-aligned with changing consumer preferences and are expected to drive significant market growth.

Report Segmentation & Scope

The report segments the market by insurance type (life and non-life), product type (health, motor, property, etc.), distribution channel (online, offline), and region. Growth projections, market sizes, and competitive dynamics are analyzed for each segment. The non-life segment is segmented into motor, health, property, and liability insurance. The life segment includes term life, whole life, and annuity products.

Key Drivers of France Life & Non-life Insurance Industry Growth

Several factors drive growth: increasing disposable incomes, rising awareness of insurance benefits, government initiatives promoting financial inclusion, and technological advancements enhancing product offerings and distribution channels. The increasing penetration of internet and mobile devices contributes to this growth by providing easier access to insurance products and services.

Challenges in the France Life & Non-life Insurance Industry Sector

The industry faces challenges such as regulatory compliance, intense competition, and the need to manage risks associated with climate change and cyber threats. Maintaining profitability amidst evolving customer preferences and technological advancements poses another challenge. The increasing cost of claims also affects profitability and requires proactive risk management strategies.

Leading Players in the France Life & Non-life Insurance Industry Market

- Societe Generale

- Credit Agricole

- Covea

- Axa

- Allianz

- La banque postale

- MACIF

- Credit mutuel

- MAIF

- ACM

- Caisse D'Epargne

- Groupama

Key Developments in France Life & Non-life Insurance Industry Sector

- December 6, 2021: Allianz Partners and Uber partnered to provide insurance for independent drivers and couriers.

- June 15, 2022: Berkshire Hathaway Specialty Insurance launched a Directors and Officers Liability policy.

Strategic France Life & Non-life Insurance Industry Market Outlook

The French life and non-life insurance market holds significant potential for growth driven by economic expansion, increasing insurance awareness, and innovative product development. Strategic opportunities exist in digital transformation, personalized insurance offerings, and the development of niche insurance products to cater to specific customer segments. The industry should focus on technological advancements, customer experience enhancement, and efficient risk management to sustain long-term growth.

France Life & Non-life Insurance Industry Segmentation

-

1. Insurance type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Health

- 1.2.4. Rest of Non-Life Insurance

-

1.1. Life Insurance

-

2. Channel of Distribution

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Online

- 2.5. Other distribution channels

France Life & Non-life Insurance Industry Segmentation By Geography

- 1. France

France Life & Non-life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Significant Growth Contributed by the Non-Life Insurance Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Life & Non-life Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Health

- 5.1.2.4. Rest of Non-Life Insurance

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other distribution channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Societe Generale

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Credit Agricole

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Covea

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Axa

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Allianz

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 La banque postale

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MACIF

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Credit mutuel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MAIF

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ACM

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Caisse D'Epargne

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Groupama**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Societe Generale

List of Figures

- Figure 1: France Life & Non-life Insurance Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Life & Non-life Insurance Industry Share (%) by Company 2024

List of Tables

- Table 1: France Life & Non-life Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Life & Non-life Insurance Industry Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 3: France Life & Non-life Insurance Industry Revenue Million Forecast, by Channel of Distribution 2019 & 2032

- Table 4: France Life & Non-life Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: France Life & Non-life Insurance Industry Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 6: France Life & Non-life Insurance Industry Revenue Million Forecast, by Channel of Distribution 2019 & 2032

- Table 7: France Life & Non-life Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Life & Non-life Insurance Industry?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the France Life & Non-life Insurance Industry?

Key companies in the market include Societe Generale, Credit Agricole, Covea, Axa, Allianz, La banque postale, MACIF, Credit mutuel, MAIF, ACM, Caisse D'Epargne, Groupama**List Not Exhaustive.

3. What are the main segments of the France Life & Non-life Insurance Industry?

The market segments include Insurance type, Channel of Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Significant Growth Contributed by the Non-Life Insurance Sector.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On June 15, 2022, Berkshire Hathaway Specialty Insurance launched a Directors and Officers Liability policy insurance in France to serve local and multinational companies. This new coverage enhances BHSI's ability to provide multinational programs and services to companies with exposure in France and throughout the company's global network, which spans 170 countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Life & Non-life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Life & Non-life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Life & Non-life Insurance Industry?

To stay informed about further developments, trends, and reports in the France Life & Non-life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence