Key Insights

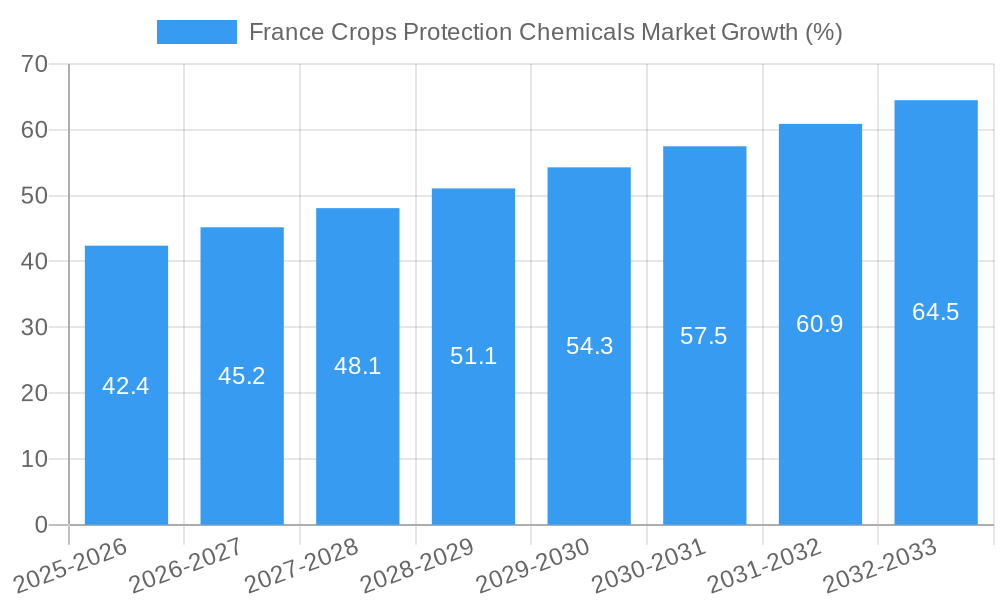

The France Crops Protection Chemicals market, valued at approximately €[Estimate based on market size XX and currency conversion; for example, €800 million] in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.31% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing prevalence of crop diseases and pest infestations necessitates the consistent application of crop protection chemicals to ensure yield and quality. Secondly, the growing demand for high-quality agricultural produce to meet the needs of a burgeoning population fuels the market's expansion. Furthermore, advancements in chemical formulations, leading to more targeted and environmentally friendly solutions, contribute positively to market growth. The market segmentation reveals that while commercial crops remain a dominant segment, the fruits and vegetables segment is exhibiting particularly strong growth due to increasing consumer awareness regarding food safety and quality. Within application modes, chemigation and foliar application are the largest segments, although seed treatment and soil treatment are poised for significant expansion due to their efficiency and sustainability benefits. Finally, the presence of major players like FMC Corporation, Sumitomo Chemical, and Bayer AG contributes to market competitiveness and technological innovation.

However, market growth is not without its challenges. Regulatory scrutiny regarding the environmental impact of certain chemicals is a significant constraint. Furthermore, the increasing adoption of biopesticides and integrated pest management (IPM) strategies represents a potential threat to the traditional chemical-based crop protection market. To mitigate these challenges, market players are focusing on developing more sustainable and environmentally friendly solutions, while also investing in research and development to improve the efficacy and safety of their products. The French agricultural landscape, characterized by its diversity of crops and varying climate conditions, presents both opportunities and challenges for crop protection chemical manufacturers, necessitating tailored solutions for specific regional and crop needs. The forecast period (2025-2033) will likely witness a continued expansion, driven by technological advancements and growing awareness of the vital role of crop protection in ensuring food security.

France Crops Protection Chemicals Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the France Crops Protection Chemicals Market, offering invaluable insights for stakeholders across the agricultural and chemical industries. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report meticulously examines market dynamics, segmentation, competitive landscapes, and future growth trajectories, incorporating detailed analysis of key players, industry trends, and emerging technologies. The market size is projected to reach xx Million by 2033.

France Crops Protection Chemicals Market Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the France crops protection chemicals market, focusing on market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is characterized by a moderately consolidated structure with several major players holding significant market share. FMC Corporation, Sumitomo Chemical Co Ltd, Adama Agricultural Solutions Ltd, Bayer AG, and Syngenta Group are key players. The market share of the top 5 players is estimated at xx%. The market witnesses continuous innovation driven by the need for effective and sustainable solutions. Stringent regulatory frameworks govern the use and registration of crop protection chemicals in France, impacting market dynamics. The market is also subject to pressures from the adoption of biopesticides and integrated pest management (IPM) practices, creating a growing market for environmentally friendly alternatives.

- Market Concentration: Moderately consolidated, with a few major players dominating the market.

- Innovation Ecosystem: Driven by R&D investments and collaborations focusing on sustainable solutions.

- Regulatory Framework: Stringent regulations impacting product registration and usage.

- Product Substitutes: Biopesticides and IPM practices are posing increasing competition.

- M&A Activities: Significant M&A activity observed in recent years, with deal values estimated at xx Million in the last five years. For example, the recent partnership between Bayer and Oerth Bio highlights the industry’s focus on sustainable solutions.

France Crops Protection Chemicals Market Industry Trends & Insights

The France crops protection chemicals market is characterized by significant growth driven by several factors. Increasing agricultural productivity, the rising demand for food, and the prevalence of crop diseases and pests are primary drivers. Technological advancements, such as the development of precision application technologies and the introduction of novel active ingredients, are also contributing to market expansion. The market is witnessing a shift towards sustainable and eco-friendly crop protection solutions, influenced by environmental concerns and stricter regulatory norms. The adoption of integrated pest management (IPM) is also gaining momentum. The market exhibits a steady CAGR of xx% during the forecast period. Market penetration of new, eco-friendly solutions is projected to reach xx% by 2033. Competitive dynamics are shaped by innovation, product differentiation, and strategic partnerships.

Dominant Markets & Segments in France Crops Protection Chemicals Market

The French crops protection chemicals market exhibits varied segmental dominance across application modes, crop types, and functions.

- Application Mode: Foliar application holds the largest market share due to its ease of use and effectiveness across various crops. Chemigation is gaining traction due to its precision and efficiency.

- Crop Type: Grains & Cereals and Fruits & Vegetables represent the largest segments driven by high crop production volumes and susceptibility to pests and diseases.

- Function: Herbicides dominate the market due to the prevalence of weed infestation across various crops. Fungicides and insecticides also hold significant market shares.

Key Drivers:

- Favorable Economic Policies: Government support for agricultural modernization and sustainable farming practices.

- Developed Agricultural Infrastructure: Efficient supply chains and distribution networks facilitating market growth.

- High Crop Production: Significant production of grains, fruits, and vegetables driving the demand for crop protection chemicals.

France Crops Protection Chemicals Market Product Innovations

Recent innovations emphasize sustainable and targeted solutions. Companies are focusing on developing biopesticides, low-toxicity formulations, and precision application technologies to minimize environmental impact. There's a strong push towards products with improved efficacy and reduced reliance on traditional broad-spectrum chemicals. The market is witnessing the introduction of novel active ingredients with unique modes of action to combat pest resistance.

Report Segmentation & Scope

This report segments the France Crops Protection Chemicals Market across various parameters:

- Application Mode: Chemigation, Foliar, Fumigation, Seed Treatment, Soil Treatment, each with individual growth projections and market size analysis. Foliar application is projected to grow at xx% CAGR.

- Crop Type: Commercial Crops, Fruits & Vegetables, Grains & Cereals, Pulses & Oilseeds, Turf & Ornamental, each with respective growth rates and competitive assessments. Grains & Cereals segment is expected to dominate.

- Function: Fungicide, Herbicide, Insecticide, Molluscicide, Nematicide, with detailed analysis of market share, growth trends, and competitive dynamics within each function. Herbicides show the highest market share.

Key Drivers of France Crops Protection Chemicals Market Growth

Growth is spurred by factors including the rising demand for food, the increasing prevalence of crop diseases and pests, and technological advancements in crop protection solutions. Government initiatives promoting sustainable agriculture and stringent regulations against harmful chemicals also play a role. The increasing adoption of precision farming techniques contributes significantly to market expansion.

Challenges in the France Crops Protection Chemicals Market Sector

The market faces challenges such as stringent regulations on pesticide use, increasing environmental concerns, and the emergence of pest resistance. Supply chain disruptions and price fluctuations of raw materials can also impact market growth. The growing adoption of biopesticides poses competitive pressure to traditional chemical-based solutions. Estimated losses due to regulatory hurdles in the last 5 years total approximately xx Million.

Leading Players in the France Crops Protection Chemicals Market Market

- FMC Corporation

- Sumitomo Chemical Co Ltd

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- Wynca Group (Wynca Chemicals)

- Syngenta Group

- UPL Limited

- Corteva Agriscience

- Nufarm Ltd

- BASF SE

Key Developments in France Crops Protection Chemicals Market Sector

- August 2022: BASF and Corteva Agriscience collaborated on soybean weed control solutions.

- November 2022: Syngenta launched A.I.R. TM technology for sunflower weed management.

- January 2023: Bayer partnered with Oerth Bio for eco-friendly crop protection solutions.

Strategic France Crops Protection Chemicals Market Market Outlook

The France crops protection chemicals market presents substantial growth potential driven by continuous innovation, the adoption of sustainable practices, and increasing government support for agricultural development. Strategic opportunities lie in developing and marketing eco-friendly products, investing in precision agriculture technologies, and exploring strategic partnerships to enhance market reach and competitiveness. The market’s future trajectory is positive, with significant scope for expansion in the coming years.

France Crops Protection Chemicals Market Segmentation

-

1. Function

- 1.1. Fungicide

- 1.2. Herbicide

- 1.3. Insecticide

- 1.4. Molluscicide

- 1.5. Nematicide

-

2. Application Mode

- 2.1. Chemigation

- 2.2. Foliar

- 2.3. Fumigation

- 2.4. Seed Treatment

- 2.5. Soil Treatment

-

3. Crop Type

- 3.1. Commercial Crops

- 3.2. Fruits & Vegetables

- 3.3. Grains & Cereals

- 3.4. Pulses & Oilseeds

- 3.5. Turf & Ornamental

-

4. Function

- 4.1. Fungicide

- 4.2. Herbicide

- 4.3. Insecticide

- 4.4. Molluscicide

- 4.5. Nematicide

-

5. Application Mode

- 5.1. Chemigation

- 5.2. Foliar

- 5.3. Fumigation

- 5.4. Seed Treatment

- 5.5. Soil Treatment

-

6. Crop Type

- 6.1. Commercial Crops

- 6.2. Fruits & Vegetables

- 6.3. Grains & Cereals

- 6.4. Pulses & Oilseeds

- 6.5. Turf & Ornamental

France Crops Protection Chemicals Market Segmentation By Geography

- 1. France

France Crops Protection Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.31% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Various social and economic factors are reasons for the increased use of herbicides in the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Crops Protection Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Fungicide

- 5.1.2. Herbicide

- 5.1.3. Insecticide

- 5.1.4. Molluscicide

- 5.1.5. Nematicide

- 5.2. Market Analysis, Insights and Forecast - by Application Mode

- 5.2.1. Chemigation

- 5.2.2. Foliar

- 5.2.3. Fumigation

- 5.2.4. Seed Treatment

- 5.2.5. Soil Treatment

- 5.3. Market Analysis, Insights and Forecast - by Crop Type

- 5.3.1. Commercial Crops

- 5.3.2. Fruits & Vegetables

- 5.3.3. Grains & Cereals

- 5.3.4. Pulses & Oilseeds

- 5.3.5. Turf & Ornamental

- 5.4. Market Analysis, Insights and Forecast - by Function

- 5.4.1. Fungicide

- 5.4.2. Herbicide

- 5.4.3. Insecticide

- 5.4.4. Molluscicide

- 5.4.5. Nematicide

- 5.5. Market Analysis, Insights and Forecast - by Application Mode

- 5.5.1. Chemigation

- 5.5.2. Foliar

- 5.5.3. Fumigation

- 5.5.4. Seed Treatment

- 5.5.5. Soil Treatment

- 5.6. Market Analysis, Insights and Forecast - by Crop Type

- 5.6.1. Commercial Crops

- 5.6.2. Fruits & Vegetables

- 5.6.3. Grains & Cereals

- 5.6.4. Pulses & Oilseeds

- 5.6.5. Turf & Ornamental

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. France

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 FMC Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sumitomo Chemical Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ADAMA Agricultural Solutions Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wynca Group (Wynca Chemicals

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Syngenta Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UPL Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Corteva Agriscience

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nufarm Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 FMC Corporation

List of Figures

- Figure 1: France Crops Protection Chemicals Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Crops Protection Chemicals Market Share (%) by Company 2024

List of Tables

- Table 1: France Crops Protection Chemicals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Crops Protection Chemicals Market Revenue Million Forecast, by Function 2019 & 2032

- Table 3: France Crops Protection Chemicals Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 4: France Crops Protection Chemicals Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 5: France Crops Protection Chemicals Market Revenue Million Forecast, by Function 2019 & 2032

- Table 6: France Crops Protection Chemicals Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 7: France Crops Protection Chemicals Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 8: France Crops Protection Chemicals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 9: France Crops Protection Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: France Crops Protection Chemicals Market Revenue Million Forecast, by Function 2019 & 2032

- Table 11: France Crops Protection Chemicals Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 12: France Crops Protection Chemicals Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 13: France Crops Protection Chemicals Market Revenue Million Forecast, by Function 2019 & 2032

- Table 14: France Crops Protection Chemicals Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 15: France Crops Protection Chemicals Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 16: France Crops Protection Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Crops Protection Chemicals Market?

The projected CAGR is approximately 5.31%.

2. Which companies are prominent players in the France Crops Protection Chemicals Market?

Key companies in the market include FMC Corporation, Sumitomo Chemical Co Ltd, ADAMA Agricultural Solutions Ltd, Bayer AG, Wynca Group (Wynca Chemicals, Syngenta Group, UPL Limited, Corteva Agriscience, Nufarm Ltd, BASF SE.

3. What are the main segments of the France Crops Protection Chemicals Market?

The market segments include Function, Application Mode, Crop Type, Function, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Various social and economic factors are reasons for the increased use of herbicides in the country.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.November 2022: Syngenta launched the new A.I.R. TM technology, which is the most powerful herbicide tolerance system for sunflower agriculture that helps farmers in Europe overcome the difficulties associated with weed management.August 2022: BASF and Corteva Agriscience collaborated to provide soybean farmers with the weed control of the future. By working together, BASF and Corteva aim to satisfy farmers' demand for specialized weed control solutions that are distinct from those that are currently available or being developed.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Crops Protection Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Crops Protection Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Crops Protection Chemicals Market?

To stay informed about further developments, trends, and reports in the France Crops Protection Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence