Key Insights

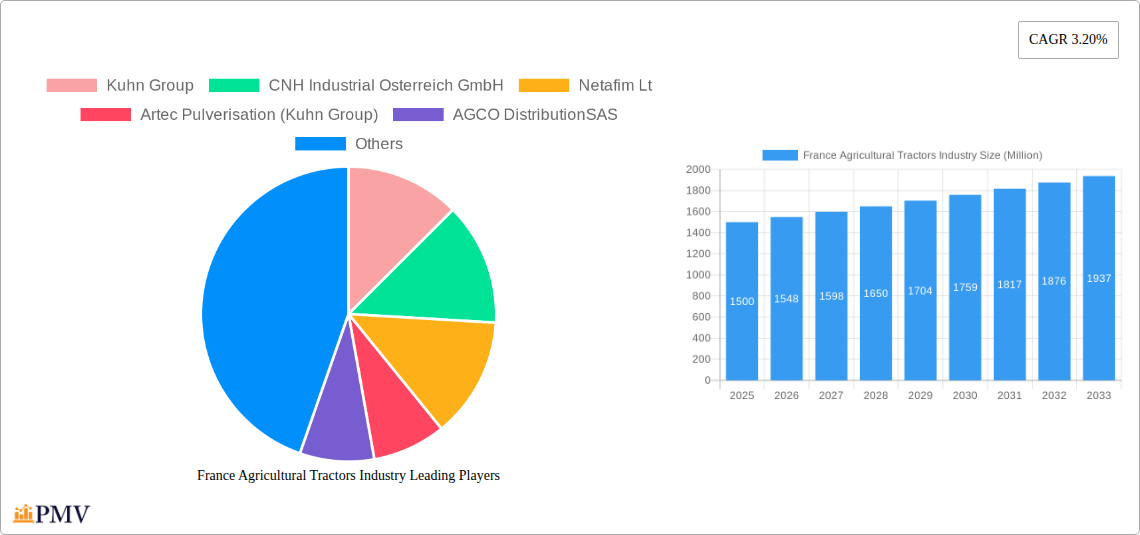

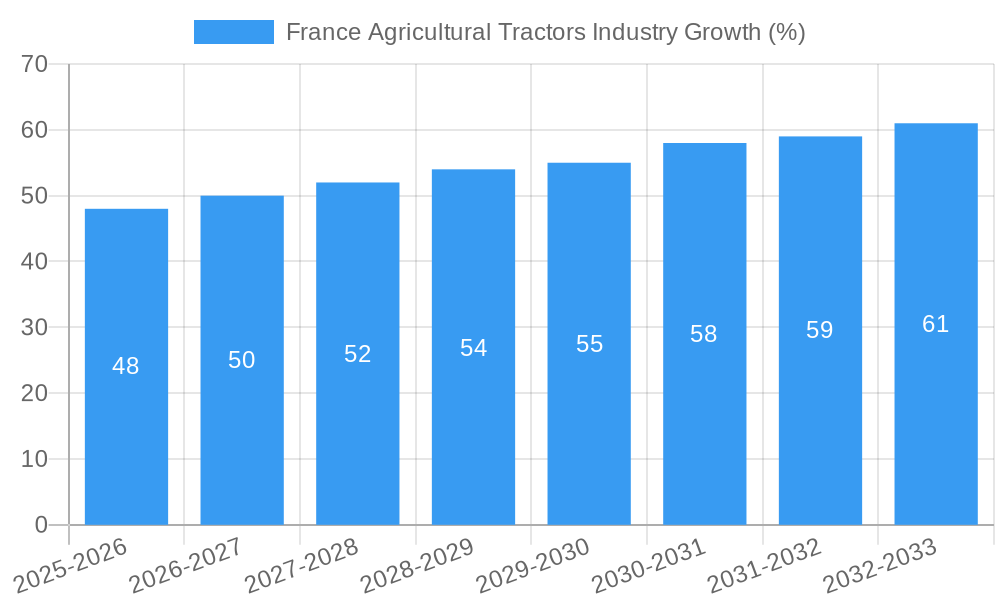

The French agricultural tractor market, valued at approximately €[Estimate based on market size XX and currency conversion. Let's assume XX = 1500 Million for example purposes] million in 2025, exhibits a steady growth trajectory with a CAGR of 3.20%. This growth is fueled by several key drivers. Firstly, increasing government subsidies and support for modernizing farming practices are encouraging farmers to invest in high-efficiency tractors. Secondly, the growing demand for increased agricultural output to meet domestic and export needs necessitates the adoption of mechanized farming solutions. Finally, technological advancements, such as precision farming technologies integrated into tractors (GPS guidance, auto-steering), are enhancing productivity and efficiency, further stimulating demand. While favorable government policies and technological progress drive the market, potential restraints include fluctuating fuel prices, which impact operational costs, and the availability of skilled labor to operate sophisticated machinery. The market is segmented by horsepower (less than 50 HP, 50-79 HP, 80-99 HP, 100-120 HP, and greater than 120 HP), reflecting the varied needs of different farming operations and land sizes. Major players like John Deere, Kubota, and CNH Industrial dominate the market, leveraging their brand recognition and technological expertise. The forecast period of 2025-2033 anticipates continued growth, driven by factors such as increasing farm consolidation and a growing focus on sustainable agricultural practices.

The competitive landscape is characterized by both established international players and domestic manufacturers. International companies benefit from economies of scale and advanced technology, while domestic firms often possess superior knowledge of local market conditions and farmer preferences. This leads to a dynamic interplay between established brands and regional players. Future market growth will depend on continued government investment in agricultural modernization, further technological advancements in tractor design and automation, and the stability of fuel and labor markets. The diverse segmentation of the market by horsepower reflects the varying needs of French farmers, catering to both small-scale and large-scale operations. This segmentation allows manufacturers to target specific niches and adapt their product offerings to meet the unique demands of various farming contexts.

France Agricultural Tractors Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the France agricultural tractors industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a base year of 2025, this report forecasts market trends and identifies key opportunities within this dynamic sector. The report leverages extensive market research and data analysis to deliver actionable intelligence, focusing on market size (in Millions), segment performance, competitive dynamics, and future growth prospects.

France Agricultural Tractors Industry Market Structure & Competitive Dynamics

The French agricultural tractor market exhibits a moderately concentrated structure, with several multinational players and several domestic companies vying for market share. Market concentration is influenced by factors like brand recognition, technological capabilities, distribution networks, and pricing strategies. The estimated market share of the top five players is approximately 60%, indicative of some consolidation. However, smaller specialized manufacturers cater to niche segments, maintaining a degree of market fragmentation. Innovation ecosystems are active, with companies investing in R&D to improve machine efficiency, precision farming technologies, and automation. The regulatory framework, including environmental regulations and safety standards, influences product development and market access. Substitute products such as drones and robotics are gradually impacting the market. Consumer preferences are shifting toward fuel-efficient, technologically advanced, and sustainable equipment. M&A activities within the industry have been relatively modest over the past few years, with the total value of deals estimated to be around XX Million, primarily involving smaller acquisitions to broaden product portfolios or expand geographic reach. Recent key mergers and acquisitions include [Include specific examples if available, otherwise state "data unavailable"].

France Agricultural Tractors Industry Industry Trends & Insights

The France agricultural tractors industry is witnessing significant transformation fueled by technological advancements, evolving consumer preferences, and changing agricultural practices. The market experienced a CAGR of approximately XX% during the historical period (2019-2024), and is projected to grow at a CAGR of XX% during the forecast period (2025-2033). This growth is driven by increasing demand for high-efficiency machinery, rising adoption of precision farming technologies (e.g., GPS-guided systems, automated steering), and government initiatives promoting sustainable agriculture. Technological disruptions, such as the integration of IoT and AI in farm equipment, are improving efficiency and productivity. Consumer preferences are shifting toward robust and reliable machines with enhanced features for improved operator comfort and reduced maintenance costs. Market penetration of precision farming technologies is steadily increasing, with an estimated XX% of farms adopting these technologies in 2024. Competitive dynamics are characterized by intense competition among major players focused on product differentiation, cost reduction, and effective marketing strategies. The market faces challenges like fluctuating raw material prices, economic downturns, and regulatory changes, creating both opportunities and risks for players in the industry.

Dominant Markets & Segments in France Agricultural Tractors Industry

- Tractors: The tractor segment dominates the French agricultural machinery market, with the 100-120 HP and greater than 120 HP segments showing strongest growth. This dominance stems from their versatility across various farming operations. Regional variations exist, with intensive farming regions exhibiting higher demand for higher horsepower tractors. Key drivers include:

- Increased farm sizes leading to the requirement of higher capacity machinery.

- Government subsidies and incentives for adopting modern equipment.

- Development of improved infrastructure facilitating the use of larger equipment.

- Harvesting Machinery: Combine harvesters and forage harvesters are key components within this segment. Demand is heavily influenced by harvest yields and the prevalent crops in different regions. Growth is driven by increasing demand for efficient harvesting solutions capable of handling larger volumes.

- Plowing and Cultivating Machinery: This segment shows consistent demand driven by the continuous need for land preparation. The disc plow and MB plow sub-segments hold significant market share due to their effectiveness across various soil types.

- Planting Machinery: Seed drills and planters are primary drivers within this segment. Technological advancements in precision seeding and planting systems are boosting growth.

Other segments, such as haymaking and forage machinery and irrigation machinery, hold significant market shares, each influenced by specific agricultural practices and environmental conditions. The less than 50 HP tractor segment experiences more modest growth due to the market shift toward larger, more powerful machines for improved efficiency in larger farms.

France Agricultural Tractors Industry Product Innovations

Recent innovations focus on improving fuel efficiency, integrating advanced technologies, and enhancing operator experience. Manufacturers are incorporating precision farming technologies like GPS guidance, automated steering, and variable rate application systems to optimize resource use and improve yields. Emphasis is also placed on designing user-friendly interfaces, reducing machine maintenance requirements, and improving operator comfort through advanced cab designs and ergonomic features. These innovations aim to increase productivity, reduce operating costs, and meet environmental regulations, securing a competitive advantage in the market.

Report Segmentation & Scope

This report segments the France agricultural tractors market comprehensively. The segmentation covers various machinery types including plowing and cultivating machinery (plows, harrows, cultivators, tillers, and other equipment), planting machinery (seed drills, planters, spreaders, and other equipment), harvesting machinery (combine harvesters, forage harvesters, and other equipment for root crops and fruits/vegetables), haying and forage machinery (mowers, balers, and other equipment), and irrigation machinery (sprinkler and drip irrigation systems). The tractor segment is further categorized by horsepower: less than 50 HP, 50-79 HP, 80-99 HP, 100-120 HP, and greater than 120 HP. Each segment's market size, growth projections, and competitive dynamics are analyzed in detail.

Key Drivers of France Agricultural Tractors Industry Growth

Several factors drive the growth of the French agricultural tractors industry. Technological advancements leading to higher efficiency and precision farming are key. Government support through subsidies and incentives for modernizing agricultural practices also significantly contributes. Increasing farm sizes and the demand for higher yields necessitate the adoption of more powerful and advanced machinery. Finally, favorable climate conditions in certain agricultural regions enhance crop production, boosting demand for agricultural machinery.

Challenges in the France Agricultural Tractors Industry Sector

The industry faces challenges, including volatile commodity prices that directly affect the cost of production and machine pricing. Supply chain disruptions can lead to production delays and shortages. Furthermore, stringent environmental regulations and the need to meet sustainability goals place pressure on manufacturers to develop eco-friendly machines. Lastly, intense competition from established multinational players and the emerging presence of new players increases pricing pressures.

Leading Players in the France Agricultural Tractors Industry Market

- Kuhn Group

- CNH Industrial Osterreich GmbH

- Netafim Lt

- Artec Pulverisation (Kuhn Group)

- AGCO Distribution SAS

- CLAAS Group

- Yanmar Co Ltd

- Same Deutz-Fahr France

- Kubota Europe SAS

- John Deere SAS

- Lely France

Key Developments in France Agricultural Tractors Industry Sector

- February 2022: John Deere launched the new 6R 185 tractors, focusing on fuel efficiency for machines under 250 hp.

- March 2022: KUHN SAS announced a new 12m Optimer minimum tillage stubble cultivator with the Steady Control system.

- November 2022: AGCO launched the Geo-Bird operational planning tool for farmers in Western Europe, including France.

Strategic France Agricultural Tractors Industry Market Outlook

The French agricultural tractors industry presents significant growth potential, driven by technological innovation, increasing demand for efficient and sustainable equipment, and supportive government policies. Strategic opportunities exist for manufacturers to invest in R&D to develop advanced precision farming technologies, expand into niche markets, and leverage digital technologies to enhance customer service and support. Focus on sustainable solutions and environmentally friendly practices will be crucial for long-term success. Companies with strong innovation capabilities, efficient distribution networks, and a focus on customer needs will be best positioned to capitalize on the industry's growth prospects.

France Agricultural Tractors Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

France Agricultural Tractors Industry Segmentation By Geography

- 1. France

France Agricultural Tractors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization

- 3.3. Market Restrains

- 3.3.1. Heavy Initial Procurement Cost and High Expenditure on Maintenance

- 3.4. Market Trends

- 3.4.1. Large-scale Agricultural Production is Driving Mechanization

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Agricultural Tractors Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. France

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Kuhn Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CNH Industrial Osterreich GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Netafim Lt

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Artec Pulverisation (Kuhn Group)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AGCO DistributionSAS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CLAAS Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yanmar Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Same Deutz-Fahr France

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kubota Europe SAS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 John Deere SAS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lely France

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Kuhn Group

List of Figures

- Figure 1: France Agricultural Tractors Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Agricultural Tractors Industry Share (%) by Company 2024

List of Tables

- Table 1: France Agricultural Tractors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Agricultural Tractors Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: France Agricultural Tractors Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: France Agricultural Tractors Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: France Agricultural Tractors Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: France Agricultural Tractors Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: France Agricultural Tractors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: France Agricultural Tractors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: France Agricultural Tractors Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: France Agricultural Tractors Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: France Agricultural Tractors Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: France Agricultural Tractors Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: France Agricultural Tractors Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: France Agricultural Tractors Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Agricultural Tractors Industry?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the France Agricultural Tractors Industry?

Key companies in the market include Kuhn Group, CNH Industrial Osterreich GmbH, Netafim Lt, Artec Pulverisation (Kuhn Group), AGCO DistributionSAS, CLAAS Group, Yanmar Co Ltd, Same Deutz-Fahr France, Kubota Europe SAS, John Deere SAS, Lely France.

3. What are the main segments of the France Agricultural Tractors Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization.

6. What are the notable trends driving market growth?

Large-scale Agricultural Production is Driving Mechanization.

7. Are there any restraints impacting market growth?

Heavy Initial Procurement Cost and High Expenditure on Maintenance.

8. Can you provide examples of recent developments in the market?

November 2022: AGCO Launched a online Free Operational Planning Tool called Geo-Bird for Farmers in Western Europe. In France, this has launched on the Valtra Stand in Paris.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Agricultural Tractors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Agricultural Tractors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Agricultural Tractors Industry?

To stay informed about further developments, trends, and reports in the France Agricultural Tractors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence