Key Insights

The global food platform-to-consumer delivery market is poised for significant expansion, fueled by widespread smartphone adoption, evolving consumer preferences for convenience, and a broadening array of digital food offerings. This dynamic sector is projected to reach $467.67 billion by 2025, demonstrating a robust CAGR of 9.6% through 2033. Key growth accelerators include the increasing prevalence of online food ordering, the widespread adoption of digital payment systems, and substantial investments in advanced technology and logistics by industry leaders. Market analysis indicates strong demand across product categories such as meals, snacks, and beverages, with home delivery emerging as the dominant channel. However, challenges like price volatility, intense market competition, and stringent food safety regulations present ongoing considerations. The competitive arena is characterized by major global players including Uber Eats, DoorDash, Just Eat Takeaway.com, Delivery Hero, Zomato, Swiggy, Deliveroo, Grubhub, and Meituan, with market dynamics shaped by continuous innovation and strategic acquisitions. Geographic expansion, particularly in emerging economies with growing middle-class populations and increasing internet access, represents a significant avenue for future growth.

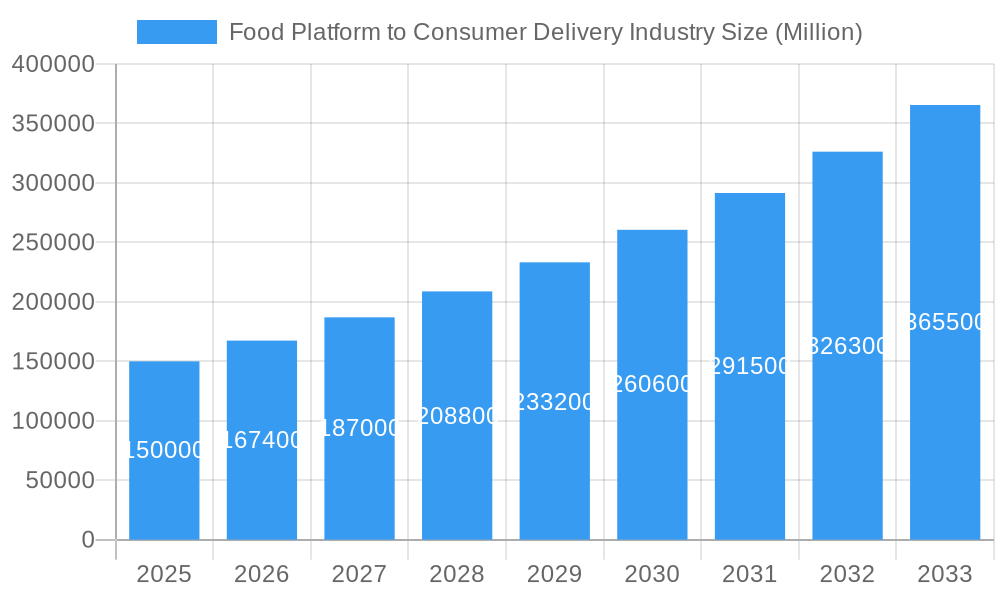

Food Platform to Consumer Delivery Industry Market Size (In Billion)

Market performance varies regionally, influenced by distinct technological penetration rates and consumer behaviors. North America and Asia-Pacific are expected to maintain their leading positions, supported by strong consumer spending and rapid e-commerce growth. Europe and other regions are also anticipated to experience considerable growth, driven by rising disposable incomes and increasing uptake of online food delivery services. Future market success will depend on effectively navigating challenges such as optimizing delivery times, managing operational expenditures, promoting sustainable practices, and delivering exceptional customer experiences to ensure sustained competitiveness and long-term market leadership. The integration of emerging delivery technologies, including drones and autonomous vehicles, will further shape the future landscape of the food delivery industry.

Food Platform to Consumer Delivery Industry Company Market Share

Food Platform to Consumer Delivery Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Food Platform to Consumer Delivery Industry, covering market size, segmentation, competitive landscape, and future growth projections from 2019 to 2033. The report utilizes data from the historical period (2019-2024), the base year (2025), and forecasts the market's trajectory through the estimated year (2025) and forecast period (2025-2033). This report is crucial for industry stakeholders, investors, and anyone seeking a nuanced understanding of this rapidly evolving sector. The total market value in 2025 is estimated at $XX Million.

Food Platform to Consumer Delivery Industry Market Structure & Competitive Dynamics

The global food platform to consumer delivery industry is characterized by a dynamic interplay of established players and emerging startups. Market concentration is moderate, with several key players holding significant market share but facing intense competition. Uber Eats (Uber Eats), DoorDash Inc, Just Eat Takeaway.com N.V, Delivery Hero SE, and Meituan Inc are amongst the major players, each vying for dominance through strategic acquisitions and technological innovation. The industry exhibits a high level of innovation, driven by advancements in technology, logistics optimization, and consumer demand for convenience.

Regulatory frameworks vary across regions, influencing operations and costs. Food safety regulations, labor laws, and data privacy concerns are significant factors impacting businesses. Substitute products, such as restaurant dine-in or grocery store purchases, pose a continuous challenge. End-user trends, such as increasing mobile adoption and preference for personalized experiences, are driving the demand for more sophisticated delivery platforms. M&A activities are frequent, with deal values reaching billions of dollars annually. For instance, the recent investments in Swiggy indicate a strong appetite for consolidation within the industry. Market share fluctuates significantly based on regional penetration, strategic partnerships, and promotional campaigns. For example, Uber Eats may hold a larger share in certain regions while DoorDash dominates others. M&A deal values vary dramatically depending on the size and strategic value of the acquired company, ranging from tens of millions to several billion dollars.

Food Platform to Consumer Delivery Industry Industry Trends & Insights

The food platform to consumer delivery industry is experiencing rapid growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be XX%. Increasing urbanization, rising disposable incomes, and changing lifestyles contribute significantly to market expansion. Technological advancements, such as AI-powered delivery optimization and improved mobile applications, enhance efficiency and customer experience. Consumer preferences are shifting towards convenience, personalized options, and diverse food choices, pushing platforms to innovate and expand their offerings. Market penetration continues to grow, especially in emerging markets where online food ordering is gaining significant traction. Competitive dynamics are characterized by fierce rivalry, strategic alliances, and technological advancements, leading to continuous innovation and improved service offerings. The increasing adoption of contactless delivery, fueled by health concerns, has become a significant trend during and after the pandemic. Furthermore, the integration of different services such as grocery delivery and quick commerce is shaping the market. The shift toward sustainable practices such as using eco-friendly packaging and electric vehicles is gaining momentum. This trend is pushing companies to adopt green initiatives to appeal to environmentally-conscious customers.

Dominant Markets & Segments in Food Platform to Consumer Delivery Industry

Dominant Region/Country: Asia, particularly India and China, are predicted to be the most dominant markets due to high population density, rising smartphone penetration, and increasing disposable income. The Western markets continue to be significant contributors, as well.

Dominant Segment (By Product Type): Meals currently represent the largest segment. However, the snack and beverage segments are expected to show considerable growth in the forecast period driven by increased snacking trends and convenience needs.

Dominant Segment (By Delivery Method): Home delivery remains the dominant delivery method. However, office delivery and pickup options are gaining traction, catering to the evolving needs of consumers and businesses.

Key Drivers:

- Economic Policies: Government initiatives supporting digital infrastructure and e-commerce facilitate industry growth.

- Infrastructure: Efficient logistics networks and advanced technological infrastructure are crucial for supporting a robust delivery ecosystem.

- Consumer Behavior: The shift toward digital channels, convenience, and personalized experiences drives market growth.

- Technological Advancements: AI-powered logistics and advanced mobile apps are instrumental in optimizing operations and enhancing the user experience.

Food Platform to Consumer Delivery Industry Product Innovations

The industry is witnessing rapid product innovation, primarily focused on enhancing convenience, personalization, and efficiency. This includes AI-powered recommendation engines, advanced order management systems, contactless delivery options, and integration with other services such as grocery delivery and quick commerce. The adoption of drone technology and autonomous vehicles for delivery is also being explored, potentially revolutionizing logistics and reducing delivery times. Companies are constantly striving to improve order accuracy, enhance delivery speed, and expand food options to cater to diverse customer preferences. These innovations improve user satisfaction and solidify market position for businesses.

Report Segmentation & Scope

By Product Type: The report segments the market into Meals, Snacks, and Beverages, providing detailed analysis of each segment's market size, growth projections, and competitive dynamics. Each segment exhibits unique growth trajectories based on consumer preferences and trends.

By Delivery Method: The market is further segmented into Home Delivery, Office Delivery, and Pickup. Home delivery currently dominates, but other methods are expected to see significant growth, driven by changing work patterns and consumer preferences. Each method represents a different approach to delivering goods, with varying cost structures and customer preferences.

Key Drivers of Food Platform to Consumer Delivery Industry Growth

Several factors drive the growth of the food platform to consumer delivery industry. Technological advancements, like sophisticated mobile apps and AI-powered delivery optimization, play a key role in improving efficiency and customer experience. The increasing penetration of smartphones and internet access expands the market reach and access for a wider customer base. Favorable economic conditions and rising disposable incomes empower consumers to spend more on convenient food delivery services. Government policies that support e-commerce and digital infrastructure play a significant role in shaping the sector's growth trajectory, fostering a supportive environment for industry expansion.

Challenges in the Food Platform to Consumer Delivery Industry Sector

The industry faces several challenges. Stringent food safety and hygiene regulations increase operational costs and compliance burdens. Supply chain disruptions can lead to delays and affect service quality, impacting profitability and customer satisfaction. Intense competition puts pressure on profit margins and requires continuous innovation to maintain market share. Fluctuating fuel prices and driver shortages present significant operational challenges and impact delivery costs. High commission fees for restaurants and intense competition impact profitability for platforms.

Leading Players in the Food Platform to Consumer Delivery Industry Market

- Uber Eats (Uber Technologies Inc)

- DoorDash Inc

- Just Eat Takeaway.com N.V

- Delivery Hero SE

- Zomato Limited

- Swiggy

- Deliveroo

- Grubhub Inc

- Meituan Inc

Key Developments in Food Platform to Consumer Delivery Industry Sector

- January 2022: Swiggy raised USD 700 million in funding, accelerating its expansion and instant delivery services.

- March 2022: Deliveroo launched its India Engineering Centre, bolstering its technological capabilities and global operations.

Strategic Food Platform to Consumer Delivery Industry Market Outlook

The food platform to consumer delivery industry is poised for significant growth over the forecast period. Continued technological innovation, strategic partnerships, and expansion into new markets will drive this growth. Companies are focusing on enhancing personalization, diversifying offerings, and improving sustainability, creating opportunities for market leadership. The increasing demand for convenience and the integration of new technologies such as AI and automation promise a robust future for the industry. The emphasis on user experience, efficient logistics, and improved service delivery will remain crucial factors in determining market success.

Food Platform to Consumer Delivery Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Food Platform to Consumer Delivery Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Netherlands

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

Food Platform to Consumer Delivery Industry Regional Market Share

Geographic Coverage of Food Platform to Consumer Delivery Industry

Food Platform to Consumer Delivery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Smartphone Penetration and Surge in Internet Penetration; Launch of Appealing and User-friendly Apps

- 3.3. Market Restrains

- 3.3.1. Uncertain Regulatory Standards and Frameworks

- 3.4. Market Trends

- 3.4.1. Growing Prominence of Online Food Delivery Apps along with Rising Internet Penetration

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Platform to Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Latin America

- 5.6.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Food Platform to Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Food Platform to Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Food Platform to Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Latin America Food Platform to Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Middle East and Africa Food Platform to Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 UberEats (Uber Technologies Inc )

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DoorDash Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Just Eat Takeaway com N V

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Delivery Hero SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Just Eat Takeaway com *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Zomato Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Swiggy

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Deliveroo

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Grubhub Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Meituan Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 UberEats (Uber Technologies Inc )

List of Figures

- Figure 1: Global Food Platform to Consumer Delivery Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Food Platform to Consumer Delivery Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 3: North America Food Platform to Consumer Delivery Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Food Platform to Consumer Delivery Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 5: North America Food Platform to Consumer Delivery Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Food Platform to Consumer Delivery Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Food Platform to Consumer Delivery Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Food Platform to Consumer Delivery Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Food Platform to Consumer Delivery Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Food Platform to Consumer Delivery Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Food Platform to Consumer Delivery Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Food Platform to Consumer Delivery Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Food Platform to Consumer Delivery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Food Platform to Consumer Delivery Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 15: Europe Food Platform to Consumer Delivery Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: Europe Food Platform to Consumer Delivery Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 17: Europe Food Platform to Consumer Delivery Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: Europe Food Platform to Consumer Delivery Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: Europe Food Platform to Consumer Delivery Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: Europe Food Platform to Consumer Delivery Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: Europe Food Platform to Consumer Delivery Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: Europe Food Platform to Consumer Delivery Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 23: Europe Food Platform to Consumer Delivery Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: Europe Food Platform to Consumer Delivery Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Food Platform to Consumer Delivery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Food Platform to Consumer Delivery Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 27: Asia Pacific Food Platform to Consumer Delivery Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Asia Pacific Food Platform to Consumer Delivery Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 29: Asia Pacific Food Platform to Consumer Delivery Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Asia Pacific Food Platform to Consumer Delivery Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Asia Pacific Food Platform to Consumer Delivery Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Asia Pacific Food Platform to Consumer Delivery Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Asia Pacific Food Platform to Consumer Delivery Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Asia Pacific Food Platform to Consumer Delivery Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 35: Asia Pacific Food Platform to Consumer Delivery Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Asia Pacific Food Platform to Consumer Delivery Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Food Platform to Consumer Delivery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Latin America Food Platform to Consumer Delivery Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 39: Latin America Food Platform to Consumer Delivery Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Latin America Food Platform to Consumer Delivery Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 41: Latin America Food Platform to Consumer Delivery Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Latin America Food Platform to Consumer Delivery Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Latin America Food Platform to Consumer Delivery Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Latin America Food Platform to Consumer Delivery Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Latin America Food Platform to Consumer Delivery Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Latin America Food Platform to Consumer Delivery Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 47: Latin America Food Platform to Consumer Delivery Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Latin America Food Platform to Consumer Delivery Industry Revenue (billion), by Country 2025 & 2033

- Figure 49: Latin America Food Platform to Consumer Delivery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Food Platform to Consumer Delivery Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 51: Middle East and Africa Food Platform to Consumer Delivery Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Middle East and Africa Food Platform to Consumer Delivery Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 53: Middle East and Africa Food Platform to Consumer Delivery Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Middle East and Africa Food Platform to Consumer Delivery Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Middle East and Africa Food Platform to Consumer Delivery Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Middle East and Africa Food Platform to Consumer Delivery Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Middle East and Africa Food Platform to Consumer Delivery Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Middle East and Africa Food Platform to Consumer Delivery Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 59: Middle East and Africa Food Platform to Consumer Delivery Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Middle East and Africa Food Platform to Consumer Delivery Industry Revenue (billion), by Country 2025 & 2033

- Figure 61: Middle East and Africa Food Platform to Consumer Delivery Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United States Food Platform to Consumer Delivery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Canada Food Platform to Consumer Delivery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 16: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 20: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: United Kingdom Food Platform to Consumer Delivery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Germany Food Platform to Consumer Delivery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: France Food Platform to Consumer Delivery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Italy Food Platform to Consumer Delivery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Netherlands Food Platform to Consumer Delivery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Food Platform to Consumer Delivery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 28: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 29: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 30: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 31: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 32: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 33: India Food Platform to Consumer Delivery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: China Food Platform to Consumer Delivery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Japan Food Platform to Consumer Delivery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Korea Food Platform to Consumer Delivery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Asia Pacific Food Platform to Consumer Delivery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 39: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 40: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 41: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 42: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 43: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Brazil Food Platform to Consumer Delivery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Mexico Food Platform to Consumer Delivery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 47: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 48: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 49: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 50: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 51: Global Food Platform to Consumer Delivery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 52: Saudi Arabia Food Platform to Consumer Delivery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: South Africa Food Platform to Consumer Delivery Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Platform to Consumer Delivery Industry?

The projected CAGR is approximately 9.6%.

2. Which companies are prominent players in the Food Platform to Consumer Delivery Industry?

Key companies in the market include UberEats (Uber Technologies Inc ), DoorDash Inc, Just Eat Takeaway com N V, Delivery Hero SE, Just Eat Takeaway com *List Not Exhaustive, Zomato Limited, Swiggy, Deliveroo, Grubhub Inc, Meituan Inc.

3. What are the main segments of the Food Platform to Consumer Delivery Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 467.67 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Smartphone Penetration and Surge in Internet Penetration; Launch of Appealing and User-friendly Apps.

6. What are the notable trends driving market growth?

Growing Prominence of Online Food Delivery Apps along with Rising Internet Penetration.

7. Are there any restraints impacting market growth?

Uncertain Regulatory Standards and Frameworks.

8. Can you provide examples of recent developments in the market?

March 2022 - Deliveroo, a global food delivery company operating across Europe, the Middle East, Asia, and Australia, launched its India Engineering Centre in Hyderabad. The company's multi-year plan is to expand its world-class engineering capabilities with a new team focused on delivering superior experiences for Deliveroo customers, restaurant and grocery partners, and delivery riders. It would also build highly scalable, reliable, and innovative next-generation products for its worldwide operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Platform to Consumer Delivery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Platform to Consumer Delivery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Platform to Consumer Delivery Industry?

To stay informed about further developments, trends, and reports in the Food Platform to Consumer Delivery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence