Key Insights

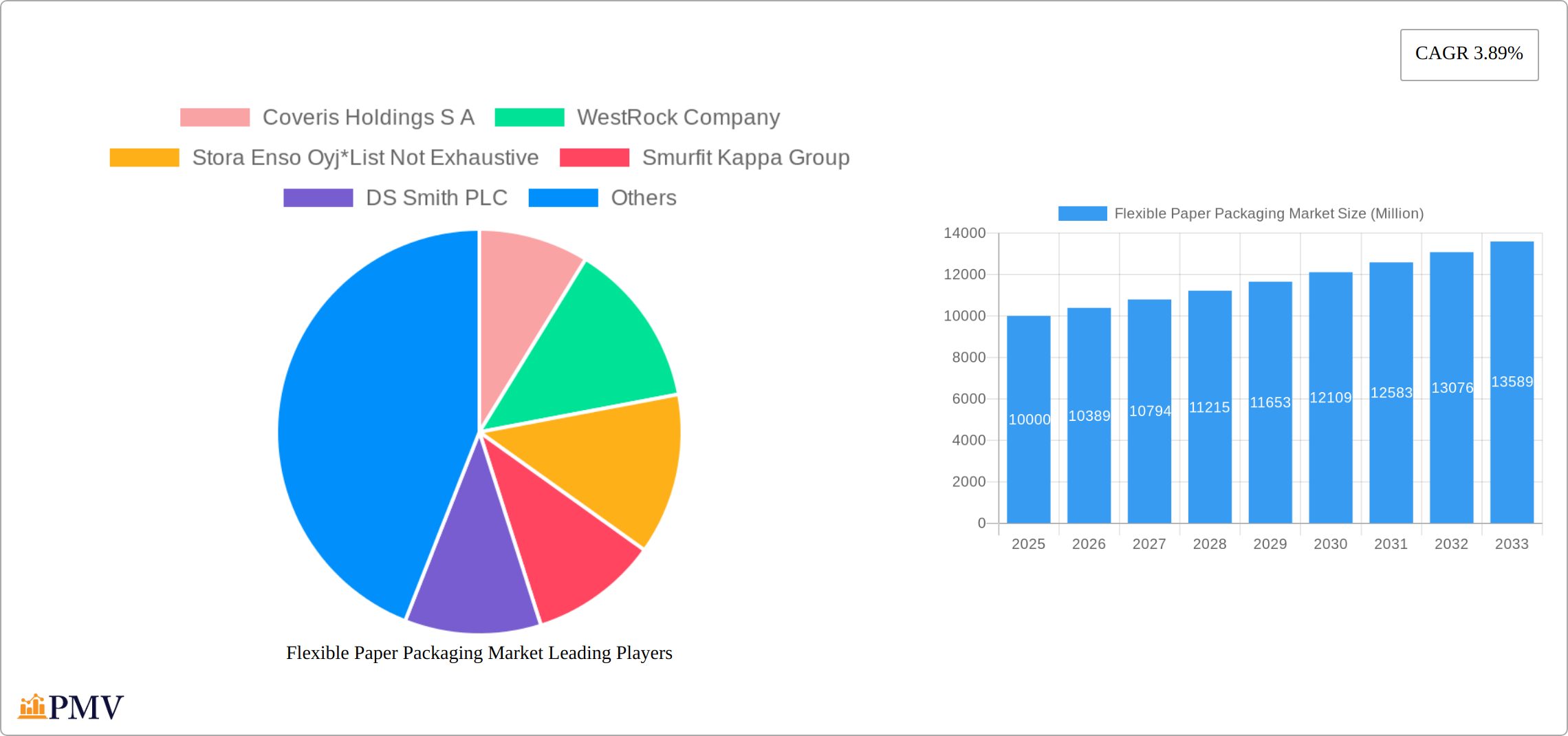

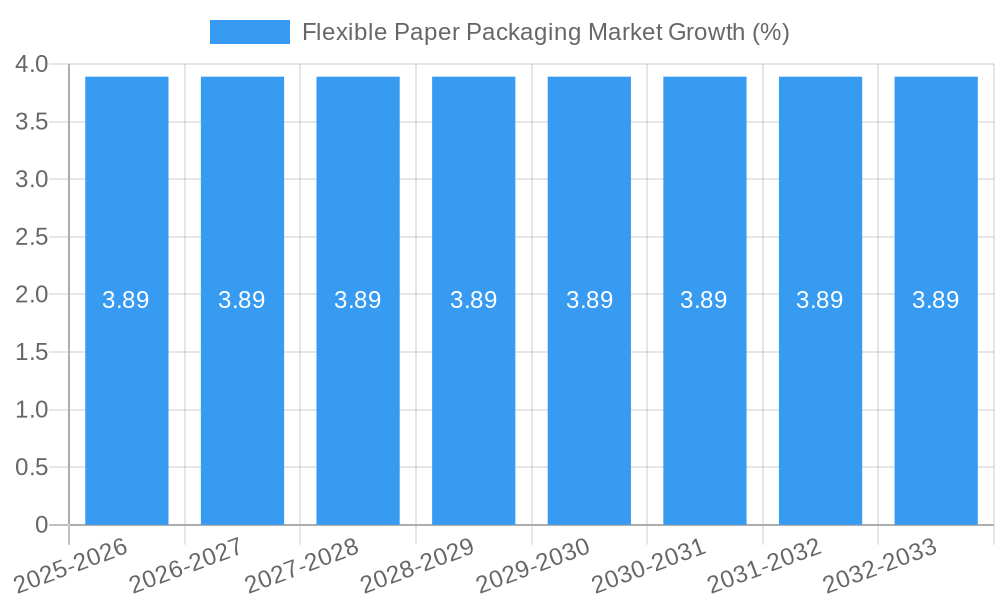

The Flexible Paper Packaging Market is poised for steady growth with a projected Compound Annual Growth Rate (CAGR) of 3.89% from 2025 to 2033. This market, valued at approximately $XX million in 2025, is expected to reach $XX million by 2033, driven by increasing demand across various sectors including food & beverages, healthcare, and beauty & personal care. Key drivers include the growing emphasis on sustainable packaging solutions, as flexible paper packaging is seen as a more environmentally friendly alternative to traditional plastics. Additionally, advancements in packaging technology and the rise of e-commerce are further propelling market expansion. The market is segmented by packaging type into pouches, roll stock, shrink sleeves, wraps, and others like bags and envelopes, with pouches currently holding the largest share due to their versatility and convenience.

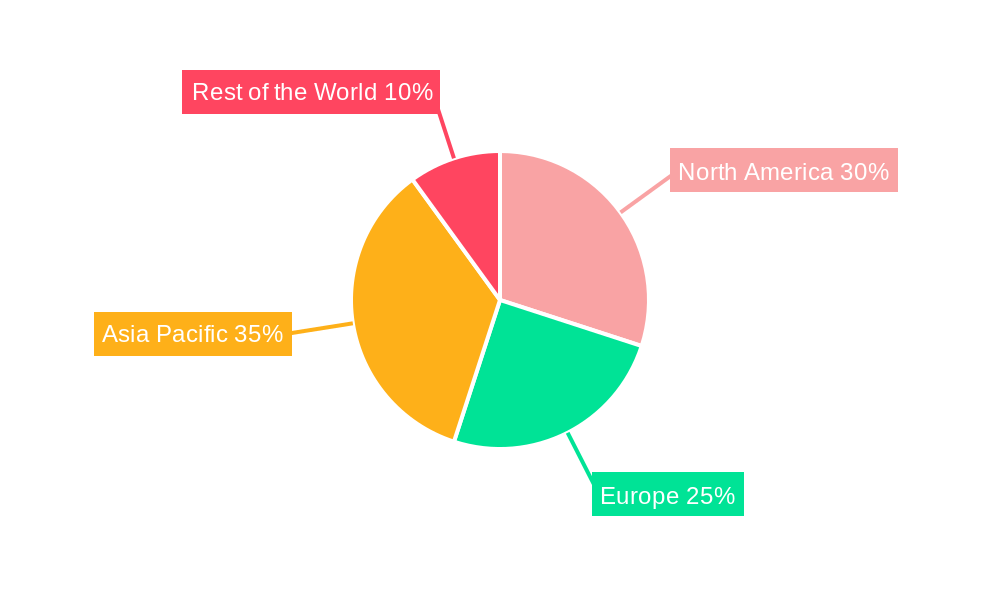

Trends shaping the Flexible Paper Packaging Market include the adoption of smart packaging technologies and the increasing use of biodegradable materials. However, the market faces restraints such as fluctuating raw material prices and challenges in recycling complex multi-layered packaging. Geographically, North America and Europe are leading markets due to stringent regulations promoting sustainable packaging, while the Asia Pacific region is expected to witness the fastest growth due to rapid industrialization and rising consumer awareness about eco-friendly products. Major players in the market, such as Coveris Holdings S.A., WestRock Company, and Amcor Limited, are investing in research and development to innovate new products and enhance their market presence. The competitive landscape is characterized by strategic partnerships, mergers, and acquisitions aimed at expanding product portfolios and geographical reach.

Flexible Paper Packaging Market Market Structure & Competitive Dynamics

The Flexible Paper Packaging Market is characterized by a blend of established players and innovative startups, creating a dynamic competitive landscape. Market concentration is moderate, with key players like Coveris Holdings S.A., WestRock Company, and Smurfit Kappa Group holding significant market shares, estimated at around 10-15% each. The innovation ecosystem is thriving, driven by the need for sustainable packaging solutions. Regulatory frameworks are increasingly favoring eco-friendly materials, which has spurred the development of substitutes like biodegradable plastics. End-user trends indicate a shift towards flexible packaging due to its convenience and reduced environmental impact. The market has witnessed several M&A activities, with deal values ranging from $50 Million to $200 Million, aimed at enhancing technological capabilities and expanding market reach. These activities are indicative of a sector that is rapidly evolving to meet the demands of a more environmentally conscious consumer base.

- Market Share: Key players hold 10-15% of the market.

- Innovation Ecosystem: Focused on sustainability and technological advancements.

- Regulatory Frameworks: Increasingly supportive of eco-friendly materials.

- Product Substitutes: Biodegradable plastics gaining traction.

- End-User Trends: Shift towards flexible, sustainable packaging.

- M&A Activities: Deal values between $50 Million and $200 Million.

Flexible Paper Packaging Market Industry Trends & Insights

The Flexible Paper Packaging Market is poised for significant growth, driven by several key factors. The global push towards sustainability is a primary growth driver, with consumers increasingly preferring eco-friendly packaging solutions. This has led to a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033. Technological disruptions, such as the development of high-barrier paper materials, are reshaping the market. These innovations allow for the replacement of traditional plastic packaging with more sustainable alternatives, enhancing market penetration in sectors like food & beverages, where the market share of flexible paper packaging is expected to reach 30% by 2033. Consumer preferences are also evolving, with a growing demand for packaging that offers both functionality and environmental benefits. This shift is compelling companies to invest in research and development, leading to competitive dynamics that favor those who can offer innovative and sustainable solutions. The competitive landscape is further intensified by the entry of new players, particularly from the Asia-Pacific region, where economic policies and infrastructure development support the growth of the packaging industry. Overall, the Flexible Paper Packaging Market is at a pivotal point, where technological advancements and consumer trends are driving a shift towards more sustainable packaging options.

Dominant Markets & Segments in Flexible Paper Packaging Market

The Flexible Paper Packaging Market is witnessing significant growth across various segments and regions. The leading segment in terms of packaging type is Pouches, driven by their versatility and convenience. Pouches are expected to grow at a CAGR of 6% during the forecast period, capturing a market size of $xx Million by 2033. The Food & Beverages application segment is the dominant user of flexible paper packaging, with a projected market share of 40% by 2033. This dominance is attributed to the increasing demand for sustainable packaging solutions in the food industry.

- Economic Policies: Supportive of sustainable packaging in regions like Europe and North America.

- Infrastructure: Development in Asia-Pacific facilitating market growth.

- Consumer Trends: Increasing preference for eco-friendly packaging.

In terms of regional dominance, Europe is at the forefront, driven by stringent regulations on plastic use and a strong consumer push for sustainability. The European market is expected to reach $xx Million by 2033, with a CAGR of 5.8%. The region's focus on reducing plastic waste and promoting recyclable materials has led to a surge in demand for flexible paper packaging. Additionally, the presence of key players like Mondi Group and DS Smith PLC further strengthens Europe's position in the market. In Asia-Pacific, rapid industrialization and urbanization are key drivers, with countries like China and India witnessing significant market growth due to increasing consumer awareness and government initiatives promoting sustainable packaging.

Flexible Paper Packaging Market Product Innovations

Recent product innovations in the Flexible Paper Packaging Market are centered around enhancing sustainability and performance. Mondi's partnership with beck packautomaten to launch a flexible paper-based packaging solution for eCommerce, and Klabin's introduction of EkoFlex, a paper for flexible packaging, highlight the industry's focus on reducing plastic use. Flair Flexible's Real Touch, Paper tactile packaging further demonstrates the market's move towards customizable and eco-friendly solutions. These innovations are aligning with consumer demand for sustainable packaging and are expected to drive market growth by offering competitive advantages through improved performance and environmental benefits.

Report Segmentation & Scope

The Flexible Paper Packaging Market is segmented by Packaging Type and Application. The Packaging Type segment includes Pouches, Roll Stock, Shrink Sleeves, Wraps, and Others (Bags, Envelopes). Pouches are expected to lead with a projected market size of $xx Million by 2033, growing at a CAGR of 6%. Roll Stock and Shrink Sleeves are also significant, with market sizes projected at $xx Million and $xx Million respectively by 2033. The Application segment includes Food & Beverages, Healthcare, Beauty & Personal Care, and Other Applications. Food & Beverages is the largest segment, expected to reach a market size of $xx Million by 2033, driven by the need for sustainable packaging solutions. Competitive dynamics within these segments are intense, with companies vying to offer innovative and eco-friendly products.

Key Drivers of Flexible Paper Packaging Market Growth

The Flexible Paper Packaging Market is driven by several key factors. Technological advancements in paper manufacturing, such as the development of high-barrier papers, are enabling the replacement of plastic packaging with more sustainable alternatives. Economic factors, including the rising demand for eco-friendly products, are pushing companies to invest in flexible paper packaging. Regulatory pressures, particularly in regions like Europe, are also significant drivers, with policies aimed at reducing plastic use and promoting recyclable materials. These drivers are collectively fueling market growth and encouraging innovation in the sector.

Challenges in the Flexible Paper Packaging Market Sector

Despite its growth, the Flexible Paper Packaging Market faces several challenges. Regulatory hurdles, such as varying standards across different regions, can complicate market entry and operations. Supply chain issues, including the availability of raw materials like sustainable fibers, pose significant barriers to scaling production. Additionally, competitive pressures are intense, with companies needing to continually innovate to maintain market share. These challenges can impact the market's growth trajectory, with potential delays in product launches and increased costs affecting overall market dynamics.

Leading Players in the Flexible Paper Packaging Market Market

- Coveris Holdings S.A.

- WestRock Company

- Stora Enso Oyj

- Smurfit Kappa Group

- DS Smith PLC

- Mondi Group

- International Paper Company

- Amcor Limited

- Sealed Air Corporation

- Huhtamaki Oyj

Key Developments in Flexible Paper Packaging Market Sector

- May 2022: Mondi partnered with beck packautomaten to launch a flexible paper-based packaging solution for eCommerce. The solution uses 95% paper and is recyclable across all European paper waste streams. They also launched the Functional Barrier Paper solution, enabling online retailers to reduce plastic use.

- May 2022: Klabin launched EkoFlex, its first paper for flexible packaging. EkoFlex, produced from softwood, offers better performance and resistance, suitable for applications like pillow bags and stand-up pouches.

- March 2022: Flair Flexible launched Real Touch, Paper tactile packaging. This customizable solution offers various styles, enhancing the artisanal feel of products.

Strategic Flexible Paper Packaging Market Market Outlook

The Flexible Paper Packaging Market is poised for robust growth, with strategic opportunities emerging across various segments. The market's future potential lies in its ability to meet the growing demand for sustainable packaging solutions. Key growth accelerators include technological innovations that enhance the performance of paper-based packaging, increasing consumer awareness, and supportive regulatory environments. Companies that can leverage these trends to offer innovative, eco-friendly products are likely to gain a competitive edge. The market's outlook is promising, with opportunities for expansion into new applications and regions, driven by the global shift towards sustainability.

Flexible Paper Packaging Market Segmentation

-

1. Packaging Type

- 1.1. Pouches

- 1.2. Roll Stock

- 1.3. Shrink Sleeves

- 1.4. Wraps

- 1.5. Others (Bags, Envelopes)

-

2. Application

- 2.1. Food & Beverages

- 2.2. Healthcare

- 2.3. Beauty & Personal Care

- 2.4. Other Applications

Flexible Paper Packaging Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Flexible Paper Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.89% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumers Preference for Sustainable Packaging; Increasing E-Commerce Sales and Demand from End User Verticals

- 3.3. Market Restrains

- 3.3.1. Availablity of Substitute in the Market

- 3.4. Market Trends

- 3.4.1. Consumers’ Preference for Sustainable Packaging

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Flexible Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Pouches

- 5.1.2. Roll Stock

- 5.1.3. Shrink Sleeves

- 5.1.4. Wraps

- 5.1.5. Others (Bags, Envelopes)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food & Beverages

- 5.2.2. Healthcare

- 5.2.3. Beauty & Personal Care

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. North America Flexible Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6.1.1. Pouches

- 6.1.2. Roll Stock

- 6.1.3. Shrink Sleeves

- 6.1.4. Wraps

- 6.1.5. Others (Bags, Envelopes)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food & Beverages

- 6.2.2. Healthcare

- 6.2.3. Beauty & Personal Care

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Packaging Type

- 7. Europe Flexible Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Packaging Type

- 7.1.1. Pouches

- 7.1.2. Roll Stock

- 7.1.3. Shrink Sleeves

- 7.1.4. Wraps

- 7.1.5. Others (Bags, Envelopes)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food & Beverages

- 7.2.2. Healthcare

- 7.2.3. Beauty & Personal Care

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Packaging Type

- 8. Asia Pacific Flexible Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Packaging Type

- 8.1.1. Pouches

- 8.1.2. Roll Stock

- 8.1.3. Shrink Sleeves

- 8.1.4. Wraps

- 8.1.5. Others (Bags, Envelopes)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food & Beverages

- 8.2.2. Healthcare

- 8.2.3. Beauty & Personal Care

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Packaging Type

- 9. Rest of the World Flexible Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Packaging Type

- 9.1.1. Pouches

- 9.1.2. Roll Stock

- 9.1.3. Shrink Sleeves

- 9.1.4. Wraps

- 9.1.5. Others (Bags, Envelopes)

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food & Beverages

- 9.2.2. Healthcare

- 9.2.3. Beauty & Personal Care

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Packaging Type

- 10. North America Flexible Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Flexible Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Flexible Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Flexible Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Coveris Holdings S A

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 WestRock Company

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Stora Enso Oyj*List Not Exhaustive

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Smurfit Kappa Group

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 DS Smith PLC

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Mondi Group

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 International Paper Company

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Amcor Limited

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Sealed Air Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Huhtamaki Oyj

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Coveris Holdings S A

List of Figures

- Figure 1: Global Flexible Paper Packaging Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Flexible Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Flexible Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Flexible Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Flexible Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Flexible Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Flexible Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Flexible Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Flexible Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Flexible Paper Packaging Market Revenue (Million), by Packaging Type 2024 & 2032

- Figure 11: North America Flexible Paper Packaging Market Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 12: North America Flexible Paper Packaging Market Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Flexible Paper Packaging Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Flexible Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Flexible Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Flexible Paper Packaging Market Revenue (Million), by Packaging Type 2024 & 2032

- Figure 17: Europe Flexible Paper Packaging Market Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 18: Europe Flexible Paper Packaging Market Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Flexible Paper Packaging Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Flexible Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Flexible Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Flexible Paper Packaging Market Revenue (Million), by Packaging Type 2024 & 2032

- Figure 23: Asia Pacific Flexible Paper Packaging Market Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 24: Asia Pacific Flexible Paper Packaging Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Asia Pacific Flexible Paper Packaging Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Asia Pacific Flexible Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Flexible Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Flexible Paper Packaging Market Revenue (Million), by Packaging Type 2024 & 2032

- Figure 29: Rest of the World Flexible Paper Packaging Market Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 30: Rest of the World Flexible Paper Packaging Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Rest of the World Flexible Paper Packaging Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Rest of the World Flexible Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Flexible Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Flexible Paper Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Flexible Paper Packaging Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 3: Global Flexible Paper Packaging Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Flexible Paper Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Flexible Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Flexible Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Flexible Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Flexible Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Flexible Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Flexible Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Flexible Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Flexible Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Flexible Paper Packaging Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 14: Global Flexible Paper Packaging Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global Flexible Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Flexible Paper Packaging Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 17: Global Flexible Paper Packaging Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Global Flexible Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Flexible Paper Packaging Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 20: Global Flexible Paper Packaging Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Flexible Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Flexible Paper Packaging Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 23: Global Flexible Paper Packaging Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Flexible Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flexible Paper Packaging Market?

The projected CAGR is approximately 3.89%.

2. Which companies are prominent players in the Flexible Paper Packaging Market?

Key companies in the market include Coveris Holdings S A, WestRock Company, Stora Enso Oyj*List Not Exhaustive, Smurfit Kappa Group, DS Smith PLC, Mondi Group, International Paper Company, Amcor Limited, Sealed Air Corporation, Huhtamaki Oyj.

3. What are the main segments of the Flexible Paper Packaging Market?

The market segments include Packaging Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumers Preference for Sustainable Packaging; Increasing E-Commerce Sales and Demand from End User Verticals.

6. What are the notable trends driving market growth?

Consumers’ Preference for Sustainable Packaging.

7. Are there any restraints impacting market growth?

Availablity of Substitute in the Market.

8. Can you provide examples of recent developments in the market?

May 2022 - Mondi partnered with beck packautomaten to launch a strong, flexible paper-based packaging solution dedicated to the eCommerce industry. The solution uses 95% paper and is recyclable across all European paper waste streams. Together both launched the Functional Barrier Paper solution dedicated to automated eCommerce packaging. Functional Barrier Paper enables online retailers to continue reducing the use of unnecessary plastic.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Flexible Paper Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Flexible Paper Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Flexible Paper Packaging Market?

To stay informed about further developments, trends, and reports in the Flexible Paper Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence