Key Insights

The field-erected cooling towers market, projected to reach $2.93 billion by 2025, is anticipated to experience significant expansion at a Compound Annual Growth Rate (CAGR) of 5.65% through 2033. This growth trajectory is propelled by escalating demand for power generation, particularly from renewable energy sources necessitating efficient cooling infrastructure. Concurrently, the petrochemical and oil & gas sectors, driven by intensive energy consumption and thermal processes, are creating substantial demand for robust, large-scale cooling systems. Innovations in hybrid and dry cooling tower technologies are further stimulating market development, alongside stringent environmental regulations promoting reduced water usage and enhanced thermal efficiency.

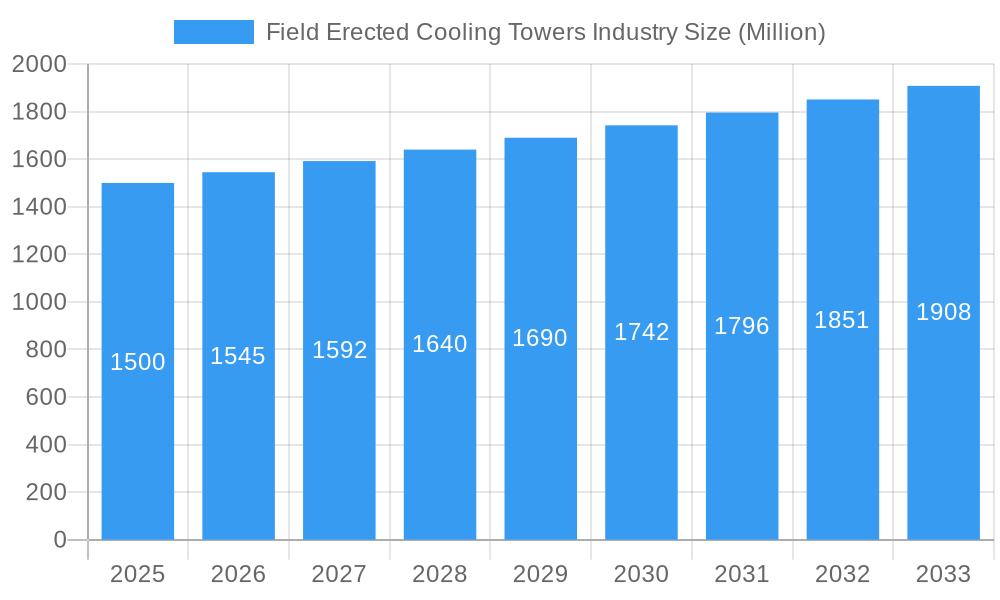

Field Erected Cooling Towers Industry Market Size (In Billion)

The market is segmented by end-user industries including power generation, petrochemicals, oil & gas, and others. Key type classifications encompass wet, dry, and hybrid cooling towers, with designs categorized as natural draft, induced draft, and forced draft. Geographically, North America, Europe, and Asia Pacific currently lead the market. Emerging economies within Asia Pacific and the Middle East & Africa are poised for considerable growth, fueled by ongoing industrialization and infrastructure development.

Field Erected Cooling Towers Industry Company Market Share

Potential challenges to market growth include substantial initial capital expenditures for field-erected cooling towers, which may present a hurdle for smaller enterprises. Fluctuations in raw material costs, such as steel, and broader economic conditions also influence market dynamics. Intense competition among established players necessitates continuous innovation and operational optimization to sustain market share. Despite these considerations, the indispensable role of cooling towers in critical industrial operations and the persistent drive for sustainable, energy-efficient solutions indicate a positive market outlook. The projected CAGR underscores robust market growth, especially within segments prioritizing eco-friendly designs and advanced energy-saving technologies.

This comprehensive report offers an in-depth analysis of the global field-erected cooling towers industry, providing critical insights for stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 serving as the base year, and a forecast period extending from 2025 to 2033. It meticulously examines market drivers, competitive landscapes, technological advancements, and future growth prospects. The global market size is estimated to reach $2.93 billion by 2025, with an anticipated CAGR of 5.65% during the forecast period.

Field Erected Cooling Towers Industry Market Structure & Competitive Dynamics

The field erected cooling towers market is characterized by a moderately concentrated structure with several key players holding significant market share. Leading companies, including SPX Cooling Technologies Inc., Evapco Inc., Watco Group Ltd., ENEXIO Management GmbH, Hamon & Cie International SA, Towertech Cooling System Pvt Ltd, Paharpur Cooling Towers Ltd, Cyrco Inc., Babcock & Wilcox Enterprises Inc., and Marley Flow Control Pty Ltd, compete intensely on factors such as product innovation, pricing strategies, and geographical reach. The market share of these companies varies significantly, with the top three controlling approximately xx% of the global market in 2024.

Innovation ecosystems are pivotal, driving the development of energy-efficient and sustainable cooling solutions. Regulatory frameworks, particularly those concerning environmental compliance and energy efficiency standards, heavily influence market dynamics. Product substitutes, such as air cooling systems and evaporative condensers, pose competitive challenges. The industry witnesses considerable end-user trends towards sustainable and efficient cooling technologies, pushing companies to invest in R&D and adopt eco-friendly materials. M&A activities have been relatively frequent in recent years, with deals primarily focused on expanding market reach, acquiring specialized technologies, and enhancing service offerings. For instance, the acquisition of Midwest Cooling Tower Services by SWAT in 2021 demonstrated a strategic move to strengthen the maintenance and repair sector. The total value of M&A deals in the sector during the historical period (2019-2024) is estimated at xx Million.

Field Erected Cooling Towers Industry Industry Trends & Insights

The field erected cooling towers market is experiencing robust growth, driven by the increasing demand for efficient cooling solutions across various industries. Key growth drivers include the expanding power generation sector, particularly renewable energy sources, and the growth of energy-intensive industries like petrochemicals and oil & gas. Technological advancements, such as the development of advanced materials and control systems, are significantly enhancing the efficiency and performance of cooling towers. Furthermore, the rising focus on environmental sustainability is promoting the adoption of energy-efficient and water-saving cooling technologies. Consumer preferences are shifting towards more eco-friendly and cost-effective options, leading to increased demand for hybrid and dry cooling towers. Intense competition among key players fuels innovation and drives prices down, benefiting end-users. The market penetration of advanced features like smart monitoring and control systems is growing steadily, with an estimated xx% penetration rate by 2025. This contributes to a significant improvement in operational efficiency and cost savings.

Dominant Markets & Segments in Field Erected Cooling Towers Industry

Leading Region/Country: The Asia-Pacific region holds the largest market share, driven by rapid industrialization and infrastructure development. China and India are major contributors to this growth.

Dominant End-User Segments: Power generation constitutes the largest end-user segment, followed by petrochemicals and oil & gas. The robust growth in these sectors directly correlates with cooling tower demand.

Dominant Type: Wet cooling towers currently dominate the market due to their cost-effectiveness. However, the demand for dry and hybrid cooling towers is increasing due to water scarcity concerns and environmental regulations.

Dominant Design: Induced-draft cooling towers are the most widely used design, owing to their efficiency and adaptability.

Key Drivers for Segment Dominance:

- Power Generation: Expansion of power plants, both conventional and renewable, fuels demand. Stringent emission regulations necessitate efficient cooling systems.

- Petrochemicals & Oil & Gas: Large-scale refining and processing activities require extensive cooling infrastructure.

- Asia-Pacific Region: Rapid industrialization, infrastructure development, and economic growth drive demand. Supportive government policies promote energy efficiency.

Field Erected Cooling Towers Industry Product Innovations

Recent product developments focus on enhancing energy efficiency, reducing water consumption, and minimizing environmental impact. Innovations include the incorporation of advanced materials, optimized designs, and smart control systems. For example, the launch of SPX Cooling Technologies' Marley MH Element Fluid Cooler showcases the industry's focus on closed-circuit, energy-efficient solutions for various applications. This addresses growing environmental concerns and the need for cost-effective cooling solutions. The market is witnessing a clear shift towards compact, modular designs, facilitating easier installation and maintenance.

Report Segmentation & Scope

This report segments the field erected cooling towers market across various parameters:

End-User: Power Generation, Petrochemicals, Oil & Gas, Other End Users (with individual growth projections and market size estimations for each). Competitive dynamics within each segment are also analyzed.

Type: Wet, Dry, Hybrid (with individual growth projections, market size estimations, and competitive dynamics for each). The report assesses the market share and future growth potential of each type.

Design: Natural, Induced, Forced (with individual growth projections, market size estimations, and competitive dynamics for each).

Key Drivers of Field Erected Cooling Towers Industry Growth

The growth of the field erected cooling towers industry is primarily driven by several factors:

Expanding power generation capacity: The global increase in energy demand fuels the need for efficient cooling solutions in power plants.

Growth of energy-intensive industries: The expansion of petrochemical and oil & gas sectors necessitates robust cooling infrastructure.

Stringent environmental regulations: Governments worldwide are implementing stricter regulations to curb water consumption and emissions, driving the adoption of energy-efficient cooling technologies.

Technological advancements: Innovations in design, materials, and control systems continuously enhance the efficiency and performance of cooling towers.

Challenges in the Field Erected Cooling Towers Industry Sector

The industry faces several challenges, including:

High initial investment costs: The setup of field-erected cooling towers involves substantial capital expenditure.

Water scarcity and environmental concerns: The considerable water consumption of conventional cooling towers poses significant environmental challenges.

Stringent regulatory compliance: Meeting stringent emission and environmental standards can be costly and complex.

Leading Players in the Field Erected Cooling Towers Industry Market

- SPX Cooling Technologies Inc.

- Evapco Inc.

- Watco Group Ltd.

- ENEXIO Management GmbH

- Hamon & Cie International SA

- Towertech Cooling System Pvt Ltd

- Paharpur Cooling Towers Ltd

- Cyrco Inc.

- Babcock & Wilcox Enterprises Inc.

- Marley Flow Control Pty Ltd

*List Not Exhaustive

Key Developments in Field Erected Cooling Towers Industry Sector

February 2020: SPX Cooling Technologies Inc. launched its new Marley MH Element Fluid Cooler, enhancing its product portfolio in the closed-circuit cooling tower market.

December 2021: The acquisition of Midwest Cooling Tower Services by SWAT expanded the service offerings in the maintenance and repair segment, increasing market consolidation.

Strategic Field Erected Cooling Towers Industry Market Outlook

The field erected cooling towers industry presents significant growth potential, driven by long-term trends in industrial expansion, energy demand, and environmental regulations. Strategic opportunities lie in developing innovative, sustainable, and cost-effective cooling solutions. Companies that invest in R&D, embrace sustainable practices, and offer comprehensive service packages are poised for significant growth. The focus will increasingly be on energy efficiency, water conservation, and reduced environmental impact, shaping the future landscape of the industry.

Field Erected Cooling Towers Industry Segmentation

-

1. Type

- 1.1. Wet

- 1.2. Dry

- 1.3. Hybrid

-

2. Design

- 2.1. Natural

- 2.2. Induced

- 2.3. Forced

-

3. End User

- 3.1. Power Generation

- 3.2. Petrochemicals

- 3.3. Oil & Gas

- 3.4. Other End Users

Field Erected Cooling Towers Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East

- 5. South America

Field Erected Cooling Towers Industry Regional Market Share

Geographic Coverage of Field Erected Cooling Towers Industry

Field Erected Cooling Towers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Lithium Batteries4.; Increased Adoption of Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Mismatch in Demand and Supply of Raw Materials for Battery Manufacturing

- 3.4. Market Trends

- 3.4.1. Wet Type Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Field Erected Cooling Towers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wet

- 5.1.2. Dry

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Design

- 5.2.1. Natural

- 5.2.2. Induced

- 5.2.3. Forced

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Power Generation

- 5.3.2. Petrochemicals

- 5.3.3. Oil & Gas

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Field Erected Cooling Towers Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wet

- 6.1.2. Dry

- 6.1.3. Hybrid

- 6.2. Market Analysis, Insights and Forecast - by Design

- 6.2.1. Natural

- 6.2.2. Induced

- 6.2.3. Forced

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Power Generation

- 6.3.2. Petrochemicals

- 6.3.3. Oil & Gas

- 6.3.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Field Erected Cooling Towers Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wet

- 7.1.2. Dry

- 7.1.3. Hybrid

- 7.2. Market Analysis, Insights and Forecast - by Design

- 7.2.1. Natural

- 7.2.2. Induced

- 7.2.3. Forced

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Power Generation

- 7.3.2. Petrochemicals

- 7.3.3. Oil & Gas

- 7.3.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Field Erected Cooling Towers Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wet

- 8.1.2. Dry

- 8.1.3. Hybrid

- 8.2. Market Analysis, Insights and Forecast - by Design

- 8.2.1. Natural

- 8.2.2. Induced

- 8.2.3. Forced

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Power Generation

- 8.3.2. Petrochemicals

- 8.3.3. Oil & Gas

- 8.3.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East Field Erected Cooling Towers Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wet

- 9.1.2. Dry

- 9.1.3. Hybrid

- 9.2. Market Analysis, Insights and Forecast - by Design

- 9.2.1. Natural

- 9.2.2. Induced

- 9.2.3. Forced

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Power Generation

- 9.3.2. Petrochemicals

- 9.3.3. Oil & Gas

- 9.3.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Field Erected Cooling Towers Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wet

- 10.1.2. Dry

- 10.1.3. Hybrid

- 10.2. Market Analysis, Insights and Forecast - by Design

- 10.2.1. Natural

- 10.2.2. Induced

- 10.2.3. Forced

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Power Generation

- 10.3.2. Petrochemicals

- 10.3.3. Oil & Gas

- 10.3.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SPX Cooling Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Evapco Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Watco Group Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ENEXIO Management GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hamon & Cie International SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Towertech Cooling System Pvt Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Paharpur Cooling Towers Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cyrco Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Babcock & Wilcox Enterprises Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Marley Flow Control Pty Ltd*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 SPX Cooling Technologies Inc

List of Figures

- Figure 1: Global Field Erected Cooling Towers Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Field Erected Cooling Towers Industry Volume Breakdown (Gigawatt, %) by Region 2025 & 2033

- Figure 3: North America Field Erected Cooling Towers Industry Revenue (billion), by Type 2025 & 2033

- Figure 4: North America Field Erected Cooling Towers Industry Volume (Gigawatt), by Type 2025 & 2033

- Figure 5: North America Field Erected Cooling Towers Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Field Erected Cooling Towers Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Field Erected Cooling Towers Industry Revenue (billion), by Design 2025 & 2033

- Figure 8: North America Field Erected Cooling Towers Industry Volume (Gigawatt), by Design 2025 & 2033

- Figure 9: North America Field Erected Cooling Towers Industry Revenue Share (%), by Design 2025 & 2033

- Figure 10: North America Field Erected Cooling Towers Industry Volume Share (%), by Design 2025 & 2033

- Figure 11: North America Field Erected Cooling Towers Industry Revenue (billion), by End User 2025 & 2033

- Figure 12: North America Field Erected Cooling Towers Industry Volume (Gigawatt), by End User 2025 & 2033

- Figure 13: North America Field Erected Cooling Towers Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Field Erected Cooling Towers Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Field Erected Cooling Towers Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Field Erected Cooling Towers Industry Volume (Gigawatt), by Country 2025 & 2033

- Figure 17: North America Field Erected Cooling Towers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Field Erected Cooling Towers Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Field Erected Cooling Towers Industry Revenue (billion), by Type 2025 & 2033

- Figure 20: Europe Field Erected Cooling Towers Industry Volume (Gigawatt), by Type 2025 & 2033

- Figure 21: Europe Field Erected Cooling Towers Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Field Erected Cooling Towers Industry Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Field Erected Cooling Towers Industry Revenue (billion), by Design 2025 & 2033

- Figure 24: Europe Field Erected Cooling Towers Industry Volume (Gigawatt), by Design 2025 & 2033

- Figure 25: Europe Field Erected Cooling Towers Industry Revenue Share (%), by Design 2025 & 2033

- Figure 26: Europe Field Erected Cooling Towers Industry Volume Share (%), by Design 2025 & 2033

- Figure 27: Europe Field Erected Cooling Towers Industry Revenue (billion), by End User 2025 & 2033

- Figure 28: Europe Field Erected Cooling Towers Industry Volume (Gigawatt), by End User 2025 & 2033

- Figure 29: Europe Field Erected Cooling Towers Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Field Erected Cooling Towers Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Field Erected Cooling Towers Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe Field Erected Cooling Towers Industry Volume (Gigawatt), by Country 2025 & 2033

- Figure 33: Europe Field Erected Cooling Towers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Field Erected Cooling Towers Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Field Erected Cooling Towers Industry Revenue (billion), by Type 2025 & 2033

- Figure 36: Asia Pacific Field Erected Cooling Towers Industry Volume (Gigawatt), by Type 2025 & 2033

- Figure 37: Asia Pacific Field Erected Cooling Towers Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific Field Erected Cooling Towers Industry Volume Share (%), by Type 2025 & 2033

- Figure 39: Asia Pacific Field Erected Cooling Towers Industry Revenue (billion), by Design 2025 & 2033

- Figure 40: Asia Pacific Field Erected Cooling Towers Industry Volume (Gigawatt), by Design 2025 & 2033

- Figure 41: Asia Pacific Field Erected Cooling Towers Industry Revenue Share (%), by Design 2025 & 2033

- Figure 42: Asia Pacific Field Erected Cooling Towers Industry Volume Share (%), by Design 2025 & 2033

- Figure 43: Asia Pacific Field Erected Cooling Towers Industry Revenue (billion), by End User 2025 & 2033

- Figure 44: Asia Pacific Field Erected Cooling Towers Industry Volume (Gigawatt), by End User 2025 & 2033

- Figure 45: Asia Pacific Field Erected Cooling Towers Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Field Erected Cooling Towers Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Field Erected Cooling Towers Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific Field Erected Cooling Towers Industry Volume (Gigawatt), by Country 2025 & 2033

- Figure 49: Asia Pacific Field Erected Cooling Towers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Field Erected Cooling Towers Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East Field Erected Cooling Towers Industry Revenue (billion), by Type 2025 & 2033

- Figure 52: Middle East Field Erected Cooling Towers Industry Volume (Gigawatt), by Type 2025 & 2033

- Figure 53: Middle East Field Erected Cooling Towers Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East Field Erected Cooling Towers Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East Field Erected Cooling Towers Industry Revenue (billion), by Design 2025 & 2033

- Figure 56: Middle East Field Erected Cooling Towers Industry Volume (Gigawatt), by Design 2025 & 2033

- Figure 57: Middle East Field Erected Cooling Towers Industry Revenue Share (%), by Design 2025 & 2033

- Figure 58: Middle East Field Erected Cooling Towers Industry Volume Share (%), by Design 2025 & 2033

- Figure 59: Middle East Field Erected Cooling Towers Industry Revenue (billion), by End User 2025 & 2033

- Figure 60: Middle East Field Erected Cooling Towers Industry Volume (Gigawatt), by End User 2025 & 2033

- Figure 61: Middle East Field Erected Cooling Towers Industry Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East Field Erected Cooling Towers Industry Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East Field Erected Cooling Towers Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: Middle East Field Erected Cooling Towers Industry Volume (Gigawatt), by Country 2025 & 2033

- Figure 65: Middle East Field Erected Cooling Towers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East Field Erected Cooling Towers Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Field Erected Cooling Towers Industry Revenue (billion), by Type 2025 & 2033

- Figure 68: South America Field Erected Cooling Towers Industry Volume (Gigawatt), by Type 2025 & 2033

- Figure 69: South America Field Erected Cooling Towers Industry Revenue Share (%), by Type 2025 & 2033

- Figure 70: South America Field Erected Cooling Towers Industry Volume Share (%), by Type 2025 & 2033

- Figure 71: South America Field Erected Cooling Towers Industry Revenue (billion), by Design 2025 & 2033

- Figure 72: South America Field Erected Cooling Towers Industry Volume (Gigawatt), by Design 2025 & 2033

- Figure 73: South America Field Erected Cooling Towers Industry Revenue Share (%), by Design 2025 & 2033

- Figure 74: South America Field Erected Cooling Towers Industry Volume Share (%), by Design 2025 & 2033

- Figure 75: South America Field Erected Cooling Towers Industry Revenue (billion), by End User 2025 & 2033

- Figure 76: South America Field Erected Cooling Towers Industry Volume (Gigawatt), by End User 2025 & 2033

- Figure 77: South America Field Erected Cooling Towers Industry Revenue Share (%), by End User 2025 & 2033

- Figure 78: South America Field Erected Cooling Towers Industry Volume Share (%), by End User 2025 & 2033

- Figure 79: South America Field Erected Cooling Towers Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: South America Field Erected Cooling Towers Industry Volume (Gigawatt), by Country 2025 & 2033

- Figure 81: South America Field Erected Cooling Towers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Field Erected Cooling Towers Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 3: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Design 2020 & 2033

- Table 4: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Design 2020 & 2033

- Table 5: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 7: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 9: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 11: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Design 2020 & 2033

- Table 12: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Design 2020 & 2033

- Table 13: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 15: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 17: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 19: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Design 2020 & 2033

- Table 20: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Design 2020 & 2033

- Table 21: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 22: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 23: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 25: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 27: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Design 2020 & 2033

- Table 28: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Design 2020 & 2033

- Table 29: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 30: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 31: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 33: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 35: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Design 2020 & 2033

- Table 36: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Design 2020 & 2033

- Table 37: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 38: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 39: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 41: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 42: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 43: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Design 2020 & 2033

- Table 44: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Design 2020 & 2033

- Table 45: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 46: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 47: Global Field Erected Cooling Towers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Global Field Erected Cooling Towers Industry Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Field Erected Cooling Towers Industry?

The projected CAGR is approximately 5.65%.

2. Which companies are prominent players in the Field Erected Cooling Towers Industry?

Key companies in the market include SPX Cooling Technologies Inc, Evapco Inc, Watco Group Ltd, ENEXIO Management GmbH, Hamon & Cie International SA, Towertech Cooling System Pvt Ltd, Paharpur Cooling Towers Ltd, Cyrco Inc, Babcock & Wilcox Enterprises Inc, Marley Flow Control Pty Ltd*List Not Exhaustive.

3. What are the main segments of the Field Erected Cooling Towers Industry?

The market segments include Type, Design, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.93 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Lithium Batteries4.; Increased Adoption of Renewable Energy.

6. What are the notable trends driving market growth?

Wet Type Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Mismatch in Demand and Supply of Raw Materials for Battery Manufacturing.

8. Can you provide examples of recent developments in the market?

In February 2020, SPX Cooling Technologies Inc. launched its new Marley MH Element Fluid Cooler, an induced-draft, crossflow closed-circuit cooling tower suitable for heating, ventilation, air conditioning (HVAC), industrial, and process cooling applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Field Erected Cooling Towers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Field Erected Cooling Towers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Field Erected Cooling Towers Industry?

To stay informed about further developments, trends, and reports in the Field Erected Cooling Towers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence