Key Insights

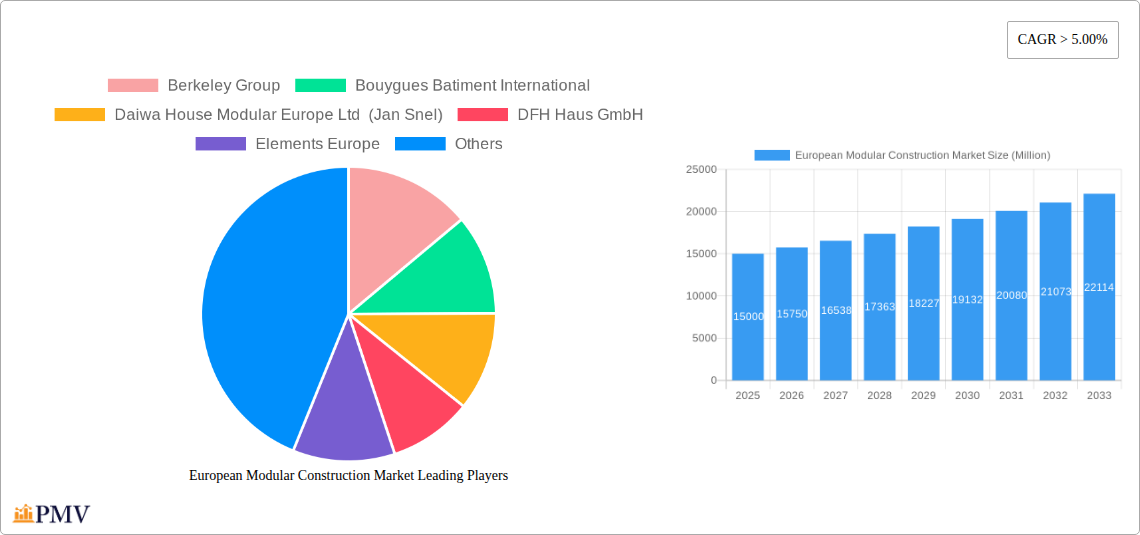

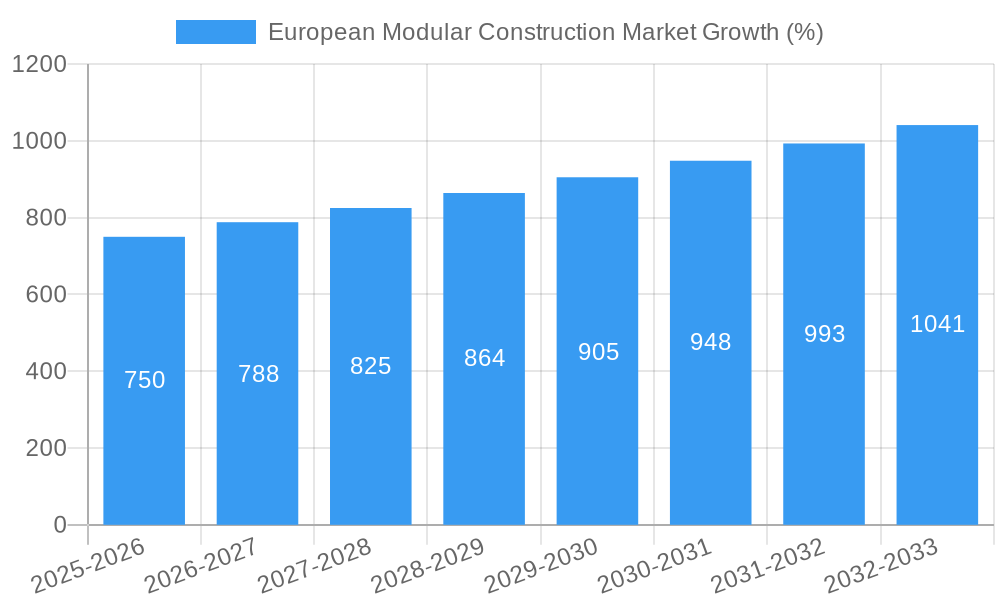

The European modular construction market is experiencing robust growth, driven by increasing demand for sustainable and efficient building solutions. A compound annual growth rate (CAGR) exceeding 5% from 2019 to 2033 indicates a significant expansion, fueled by several key factors. The rising adoption of prefabrication methods offers faster project completion times, reduced labor costs, and improved quality control, making it particularly attractive to developers facing tight deadlines and rising construction costs. Furthermore, the growing emphasis on sustainable building practices aligns perfectly with the environmental benefits of modular construction, which minimizes waste and reduces carbon emissions. Government initiatives promoting sustainable infrastructure and affordable housing further stimulate market growth. Key players like Berkeley Group, Bouygues Batiment International, and Skanska AB are driving innovation and expanding their market share through strategic partnerships, technological advancements, and diversification into new segments like healthcare and education facilities. The market is segmented based on building type (residential, commercial, industrial), material type (steel, concrete, wood), and geographic location. While challenges remain, including regulatory hurdles and public perception, the overall outlook for the European modular construction market is strongly positive, suggesting continued expansion and market consolidation in the coming years.

The market's expansion is projected to continue throughout the forecast period (2025-2033), with specific growth rates influenced by macroeconomic factors, technological breakthroughs, and evolving building codes. The residential segment is likely to dominate, driven by growing urbanization and the need for affordable housing solutions. However, increasing demand from the commercial and industrial sectors, coupled with the rising popularity of hybrid modular construction approaches, is expected to contribute significantly to the overall market value. Companies are investing heavily in research and development to improve modular design and construction techniques, optimize supply chains, and explore new materials for increased efficiency and sustainability. This innovation, alongside supportive government policies and a growing awareness of the environmental advantages, positions the European modular construction market for substantial growth and further consolidation within the foreseeable future.

European Modular Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European Modular Construction Market, covering the period 2019-2033. It offers invaluable insights into market structure, competitive dynamics, industry trends, and future growth potential, equipping stakeholders with actionable intelligence to navigate this rapidly evolving sector. The report utilizes data from the historical period (2019-2024), the base year (2025), and provides estimations for 2025, with forecasts extending to 2033. The market size is expressed in Millions throughout.

European Modular Construction Market Market Structure & Competitive Dynamics

The European modular construction market exhibits a moderately consolidated structure, with several large players commanding significant market share. However, the presence of numerous smaller, specialized firms contributes to a dynamic competitive landscape. Innovation ecosystems are flourishing, driven by technological advancements in prefabrication, digital design, and sustainable building materials. Regulatory frameworks vary across European nations, influencing adoption rates and posing both opportunities and challenges. Product substitutes, such as traditional construction methods, still hold a considerable share but face increasing pressure from the efficiency and cost-effectiveness of modular construction. End-user trends reveal a growing preference for sustainable, faster, and more cost-effective building solutions. M&A activity is relatively frequent, with deal values ranging from xx Million to xx Million, reflecting consolidation efforts and strategic expansion strategies.

- Market Concentration: Moderately Consolidated

- Key Players' Market Share: (Specific data unavailable, requires further research) Modulaire Group, Skanska AB and Laing O'Rourke hold significant shares.

- M&A Activity: Frequent, with deal values ranging from xx Million to xx Million.

- Innovation Ecosystems: Flourishing, driven by advancements in prefabrication and digital design.

European Modular Construction Market Industry Trends & Insights

The European modular construction market is experiencing robust growth, driven by several key factors. Increasing urbanization and infrastructure development across Europe are generating a high demand for efficient and rapid construction solutions. Technological disruptions, such as Building Information Modeling (BIM) and advanced manufacturing techniques, enhance productivity and precision. Consumer preferences are shifting towards sustainable and environmentally friendly building practices, with modular construction offering advantages in terms of reduced waste and carbon footprint. The market is witnessing a strong increase in the adoption of modular construction for various applications, such as residential, commercial, and infrastructure projects. The CAGR for the forecast period (2025-2033) is estimated at xx%, reflecting a significant market expansion. Market penetration is expected to increase by xx% during the same period. Competitive dynamics are shaped by technological innovation, strategic partnerships, and a push towards sustainable practices.

Dominant Markets & Segments in European Modular Construction Market

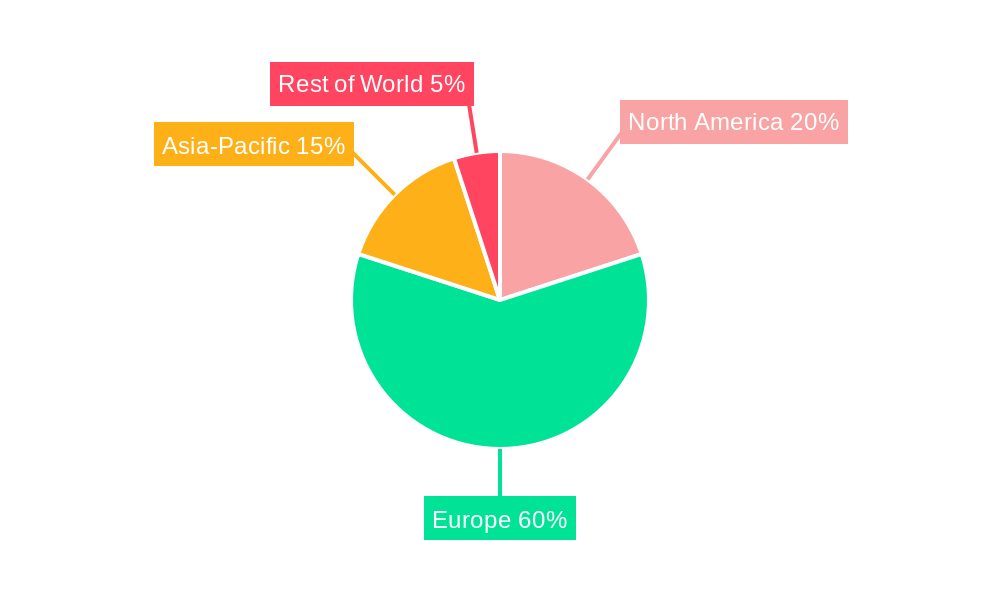

The UK and Germany currently represent the leading markets within the European modular construction sector. Their dominance is attributed to robust economic growth, substantial infrastructure investments, and supportive regulatory environments. The residential segment holds the largest market share, owing to high demand for affordable housing solutions. Other significant segments include commercial and infrastructure projects.

- Key Drivers in the UK: Strong government investment in infrastructure projects, including HS2.

- Key Drivers in Germany: Focus on sustainable building practices and robust construction sector.

- Residential Segment Dominance: Driven by the need for cost-effective and efficient housing solutions.

- Commercial Segment Growth: Fueled by demand for flexible and adaptable workspace solutions.

- Infrastructure Segment Potential: High demand for rapid construction of transportation and utility infrastructure.

European Modular Construction Market Product Innovations

Recent product innovations focus on enhancing modularity, sustainability, and design flexibility. Prefabricated components are increasingly incorporating smart technologies and sustainable materials, leading to improved energy efficiency and reduced environmental impact. Modular designs are becoming more adaptable, allowing for customization and integration with surrounding architecture. The focus is on creating modular systems compatible with various project needs, enhancing the overall value proposition.

Report Segmentation & Scope

This report segments the European modular construction market based on several key factors:

- By Product Type: This segment includes various types of modular buildings, such as residential units, commercial structures, and infrastructure components. Each segment exhibits unique growth projections based on market demand and construction trends. Competitive dynamics vary based on product specialization and technological expertise.

- By Application: The market is segmented by application types, including residential, commercial, healthcare, and industrial. Each segment exhibits different growth trajectories depending on market demand and regulatory factors. Competitive landscapes vary across each application, with specialized companies dominating some areas.

- By Material Type: The market is further segmented by the materials used, such as steel, concrete, timber, and hybrid structures. Each segment demonstrates unique characteristics concerning sustainability, cost, and structural performance. Market dynamics are driven by innovation and the adoption of new materials.

- By Region: The report provides regional-level analysis, focusing on key markets across Europe and offering a detailed analysis of the respective growth rates, market sizes, and competition factors.

Key Drivers of European Modular Construction Market Growth

Several key factors are driving the growth of the European modular construction market:

- Government Initiatives: Favorable policies and incentives promoting sustainable and efficient construction practices are accelerating market growth.

- Technological Advancements: Innovations in design, manufacturing, and materials are enhancing the efficiency and cost-effectiveness of modular construction.

- Demand for Sustainable Solutions: Increasing environmental concerns are driving the adoption of sustainable and environmentally-friendly construction methods.

- Shorter Construction Times: The ability to expedite construction projects offers a significant advantage in competitive markets, reducing overall project costs.

Challenges in the European Modular Construction Market Sector

Despite significant growth potential, the European modular construction market faces several challenges:

- Regulatory Hurdles: Varying building codes and regulations across different European countries can hinder standardization and increase project complexity. These regulatory differences account for a projected xx% delay in project completion in certain regions.

- Supply Chain Disruptions: Global supply chain disruptions can impact the availability of materials and components, leading to project delays and cost overruns. This effect is predicted to reduce overall market growth by approximately xx% in the short term.

- Skills Gap: A shortage of skilled labor, specifically in design, manufacturing, and installation, limits the capacity to meet the increasing market demand. This is expected to constrain growth by xx% by 2030.

Leading Players in the European Modular Construction Market Market

- Berkeley Group

- Bouygues Batiment International

- Daiwa House Modular Europe Ltd (Jan Snel)

- DFH Haus GmbH

- Elements Europe

- Karmod Prefabricated Technologies

- Laing O'Rourke Corpt Ltd

- Modulaire Group

- Modubuild

- Moelven Industrier ASA

- Skanska AB

- *List Not Exhaustive

Key Developments in European Modular Construction Market Sector

- October 2022: Daiwa House's joint venture with Capital Bay signals increased investment and expansion of modular construction across Europe. This is expected to significantly increase market penetration in the coming years.

- June 2022: Laing O'Rourke's contract for the HS2 Interchange Station demonstrates the growing adoption of modular construction in large-scale infrastructure projects, showcasing the technology's capabilities and potential in the infrastructure sector.

Strategic European Modular Construction Market Market Outlook

The European modular construction market is poised for sustained growth, driven by ongoing urbanization, infrastructure development, and the increasing adoption of sustainable building practices. Strategic opportunities lie in technological innovation, focusing on prefabrication, smart technologies, and sustainable materials. Companies that leverage digital technologies for design and construction management, and those offering holistic sustainable solutions, are expected to gain a competitive edge. The market presents significant potential for both established players and new entrants seeking to capitalize on the rising demand for efficient and environmentally responsible construction solutions.

European Modular Construction Market Segmentation

-

1. Type

- 1.1. Permanent

- 1.2. Relocatable

-

2. Material

- 2.1. Steel

- 2.2. Concrete

- 2.3. Wood

- 2.4. Plastic

-

3. End-user Industry

- 3.1. Commercial

- 3.2. Industrial/Institutional

- 3.3. Residential

European Modular Construction Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

European Modular Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Demand for Modular Construction in Commercial Segment; Rising Demand for Higher-quality

- 3.2.2 Eco-friendly Homes

- 3.3. Market Restrains

- 3.3.1 Growing Demand for Modular Construction in Commercial Segment; Rising Demand for Higher-quality

- 3.3.2 Eco-friendly Homes

- 3.4. Market Trends

- 3.4.1. Commercial Sector Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global European Modular Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Permanent

- 5.1.2. Relocatable

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Steel

- 5.2.2. Concrete

- 5.2.3. Wood

- 5.2.4. Plastic

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Commercial

- 5.3.2. Industrial/Institutional

- 5.3.3. Residential

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany European Modular Construction Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Permanent

- 6.1.2. Relocatable

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Steel

- 6.2.2. Concrete

- 6.2.3. Wood

- 6.2.4. Plastic

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Commercial

- 6.3.2. Industrial/Institutional

- 6.3.3. Residential

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom European Modular Construction Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Permanent

- 7.1.2. Relocatable

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Steel

- 7.2.2. Concrete

- 7.2.3. Wood

- 7.2.4. Plastic

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Commercial

- 7.3.2. Industrial/Institutional

- 7.3.3. Residential

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France European Modular Construction Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Permanent

- 8.1.2. Relocatable

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Steel

- 8.2.2. Concrete

- 8.2.3. Wood

- 8.2.4. Plastic

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Commercial

- 8.3.2. Industrial/Institutional

- 8.3.3. Residential

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy European Modular Construction Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Permanent

- 9.1.2. Relocatable

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Steel

- 9.2.2. Concrete

- 9.2.3. Wood

- 9.2.4. Plastic

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Commercial

- 9.3.2. Industrial/Institutional

- 9.3.3. Residential

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Europe European Modular Construction Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Permanent

- 10.1.2. Relocatable

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Steel

- 10.2.2. Concrete

- 10.2.3. Wood

- 10.2.4. Plastic

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Commercial

- 10.3.2. Industrial/Institutional

- 10.3.3. Residential

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Berkeley Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bouygues Batiment International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Daiwa House Modular Europe Ltd (Jan Snel)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DFH Haus GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Elements Europe

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Karmod Prefabricated Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Laing O'Rourke Corpt Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Modulaire Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Modubuild

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Moelven Industrier ASA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Skanska AB*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Berkeley Group

List of Figures

- Figure 1: Global European Modular Construction Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Germany European Modular Construction Market Revenue (Million), by Type 2024 & 2032

- Figure 3: Germany European Modular Construction Market Revenue Share (%), by Type 2024 & 2032

- Figure 4: Germany European Modular Construction Market Revenue (Million), by Material 2024 & 2032

- Figure 5: Germany European Modular Construction Market Revenue Share (%), by Material 2024 & 2032

- Figure 6: Germany European Modular Construction Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 7: Germany European Modular Construction Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 8: Germany European Modular Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Germany European Modular Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: United Kingdom European Modular Construction Market Revenue (Million), by Type 2024 & 2032

- Figure 11: United Kingdom European Modular Construction Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: United Kingdom European Modular Construction Market Revenue (Million), by Material 2024 & 2032

- Figure 13: United Kingdom European Modular Construction Market Revenue Share (%), by Material 2024 & 2032

- Figure 14: United Kingdom European Modular Construction Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: United Kingdom European Modular Construction Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: United Kingdom European Modular Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 17: United Kingdom European Modular Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: France European Modular Construction Market Revenue (Million), by Type 2024 & 2032

- Figure 19: France European Modular Construction Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: France European Modular Construction Market Revenue (Million), by Material 2024 & 2032

- Figure 21: France European Modular Construction Market Revenue Share (%), by Material 2024 & 2032

- Figure 22: France European Modular Construction Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 23: France European Modular Construction Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 24: France European Modular Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 25: France European Modular Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Italy European Modular Construction Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Italy European Modular Construction Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Italy European Modular Construction Market Revenue (Million), by Material 2024 & 2032

- Figure 29: Italy European Modular Construction Market Revenue Share (%), by Material 2024 & 2032

- Figure 30: Italy European Modular Construction Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 31: Italy European Modular Construction Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 32: Italy European Modular Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Italy European Modular Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of Europe European Modular Construction Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Rest of Europe European Modular Construction Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Rest of Europe European Modular Construction Market Revenue (Million), by Material 2024 & 2032

- Figure 37: Rest of Europe European Modular Construction Market Revenue Share (%), by Material 2024 & 2032

- Figure 38: Rest of Europe European Modular Construction Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Rest of Europe European Modular Construction Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Rest of Europe European Modular Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of Europe European Modular Construction Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global European Modular Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global European Modular Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global European Modular Construction Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: Global European Modular Construction Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Global European Modular Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global European Modular Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Global European Modular Construction Market Revenue Million Forecast, by Material 2019 & 2032

- Table 8: Global European Modular Construction Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 9: Global European Modular Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global European Modular Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Global European Modular Construction Market Revenue Million Forecast, by Material 2019 & 2032

- Table 12: Global European Modular Construction Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 13: Global European Modular Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global European Modular Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global European Modular Construction Market Revenue Million Forecast, by Material 2019 & 2032

- Table 16: Global European Modular Construction Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global European Modular Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global European Modular Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global European Modular Construction Market Revenue Million Forecast, by Material 2019 & 2032

- Table 20: Global European Modular Construction Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global European Modular Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global European Modular Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global European Modular Construction Market Revenue Million Forecast, by Material 2019 & 2032

- Table 24: Global European Modular Construction Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 25: Global European Modular Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Modular Construction Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the European Modular Construction Market?

Key companies in the market include Berkeley Group, Bouygues Batiment International, Daiwa House Modular Europe Ltd (Jan Snel), DFH Haus GmbH, Elements Europe, Karmod Prefabricated Technologies, Laing O'Rourke Corpt Ltd, Modulaire Group, Modubuild, Moelven Industrier ASA, Skanska AB*List Not Exhaustive.

3. What are the main segments of the European Modular Construction Market?

The market segments include Type, Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Modular Construction in Commercial Segment; Rising Demand for Higher-quality. Eco-friendly Homes.

6. What are the notable trends driving market growth?

Commercial Sector Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Growing Demand for Modular Construction in Commercial Segment; Rising Demand for Higher-quality. Eco-friendly Homes.

8. Can you provide examples of recent developments in the market?

October 2022 : Japan's largest homebuilder, Daiwa House, announced their joint venture with Capital Bay to deliver modular construction across Europe. The JV will result in Capital Bay using modular construction units for its own projects and operator brands, but will also be offered to third-party customers in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Modular Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Modular Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Modular Construction Market?

To stay informed about further developments, trends, and reports in the European Modular Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence