Key Insights

The European Sports Team and Clubs Market is projected for substantial growth, with a Compound Annual Growth Rate (CAGR) of 4.9% from 2025 to 2033. Key growth drivers include the escalating popularity of football, propelled by major leagues like La Liga, Premier League, and Bundesliga, alongside increased viewership for tennis and basketball. Lucrative sponsorship deals, broadcast rights, and a thriving merchandise sector further bolster financial performance. Strategic investments in youth development by prominent clubs enhance long-term competitiveness and investment appeal. Digital engagement and social media expansion also broaden fan bases and revenue streams. Potential challenges include economic downturns impacting revenue, intense competition for talent, and the necessity for continuous innovation to sustain fan engagement. Market segmentation includes revenue from broadcasting, sponsorship, merchandise, matchday operations, and player transfers.

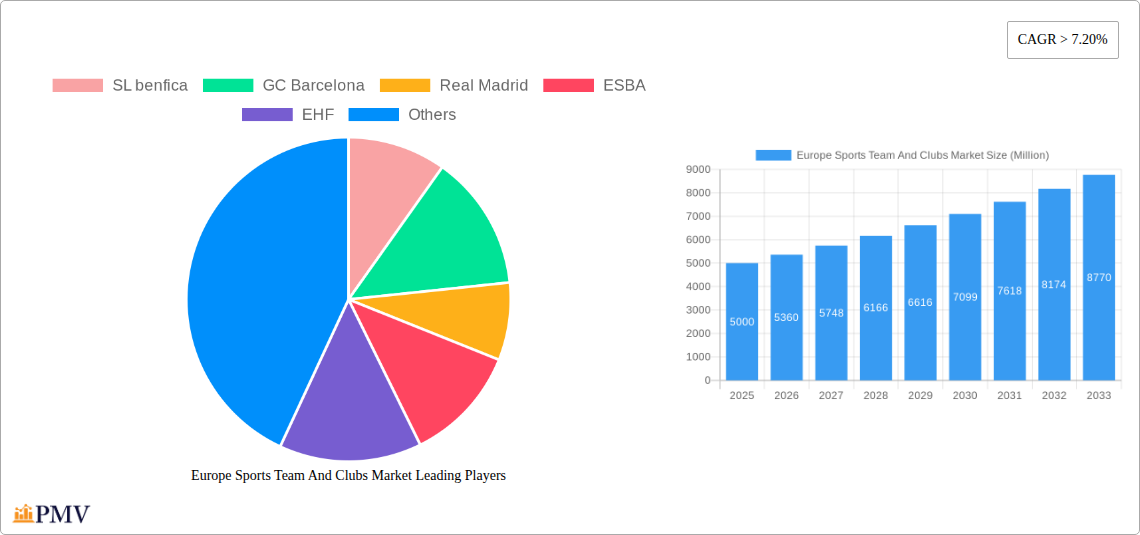

Europe Sports Team And Clubs Market Market Size (In Billion)

Geographically, the market exhibits significant regional variations. While specific data is not detailed, major football leagues in England, Spain, Germany, Italy, and France represent the largest segments. The presence of leading clubs in these regions highlights their substantial contribution to the market's overall value. The inclusion of organizations such as Tennis Europe and the European Handball Federation (EHF) indicates a broader market encompassing diverse sports and governing bodies. Future expansion relies on maintaining fan engagement, attracting new audiences through innovative digital strategies, and effective cost management. The forecast period of 2025-2033 offers significant opportunities for growth within this dynamic market. The market size was estimated at $17.4 billion in the base year 2025, with projections indicating continued expansion.

Europe Sports Team And Clubs Market Company Market Share

This comprehensive report analyzes the Europe Sports Team and Clubs Market, offering crucial insights for industry stakeholders. Covering the period from 2019 to 2033, with a specific focus on 2025, the report dissects market structure, competitive landscape, key trends, and future growth prospects. The scope encompasses a wide array of sports and clubs, from major football entities like Real Madrid and Bayern Munich to organizations such as EHF and Tennis Europe, providing a holistic industry overview. The report employs a robust methodology, integrating historical data and future projections for actionable strategic intelligence.

Europe Sports Team And Clubs Market Market Structure & Competitive Dynamics

The European Sports Team and Clubs Market is characterized by a dynamic interplay of established giants and emerging players. Market concentration is high, with a few dominant clubs and teams holding significant market share. However, the landscape is far from static. Innovative business models, technological advancements, and evolving fan engagement strategies are reshaping the competitive landscape. Regulatory frameworks, varying across different European nations, significantly influence market access and operational strategies. Product substitutes, such as esports and alternative entertainment options, pose a moderate competitive threat, albeit one that is currently manageable for established sports teams. M&A activity, as seen in recent years, plays a crucial role in consolidating market power and expanding reach. For example, the acquisition of Olympique Lyonnais by Eagle Football Holdings significantly altered the competitive landscape. The total value of M&A deals in the sector between 2019-2024 reached an estimated xx Million, with an average deal size of xx Million. Analyzing market share data reveals that top teams like Real Madrid and Bayern Munich command significant portions, while smaller clubs and teams compete for the remaining share.

- High Market Concentration: Dominated by a few large clubs.

- Significant M&A Activity: Deal values totaling xx Million between 2019 and 2024.

- Evolving Regulatory Frameworks: Varying regulations across European nations.

- Moderate Threat from Substitutes: Esports and other entertainment options represent a growing challenge.

- Innovation Ecosystems: Focus on fan engagement, digital platforms, and data analytics.

Europe Sports Team And Clubs Market Industry Trends & Insights

The European Sports Team and Clubs Market is experiencing robust growth, driven by several key factors. Increasing disposable incomes, coupled with rising popularity of sports and entertainment, fuel demand. Technological advancements, particularly in digital media and fan engagement platforms, are revolutionizing the way teams connect with supporters. The increasing penetration of streaming services and social media platforms further amplifies the market reach. Consumer preferences are shifting towards personalized experiences, requiring teams to invest in customized offerings. Competitive dynamics are intense, with teams vying for sponsorships, media rights, and talent acquisition. The market is projected to achieve a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. The integration of data analytics and personalized fan experiences is a key growth driver, enabling teams to optimize operations and enhance engagement. Competition for top talent and securing lucrative sponsorship deals remain key competitive challenges.

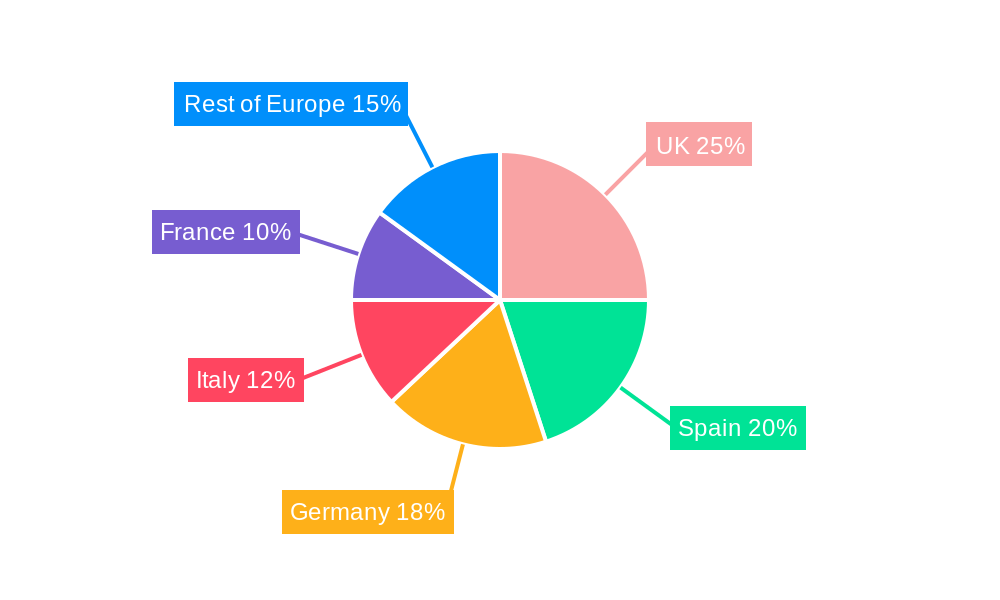

Dominant Markets & Segments in Europe Sports Team And Clubs Market

The United Kingdom and Spain consistently lead the European Sports Team and Clubs Market, propelled by the immense popularity of their domestic leagues like the Premier League and La Liga, and substantial media rights revenues. Germany also maintains a formidable presence, driven by the globally recognized Bundesliga and a strong tradition of sporting excellence. While football remains the undisputed revenue powerhouse, other sports such as basketball, tennis, and rugby are experiencing robust growth, benefiting from dedicated leagues, expanding fan bases, and increasing commercial interest.

- Key Drivers in UK & Spain:

- World-renowned domestic leagues (Premier League, La Liga) with massive global appeal.

- Extremely high media rights revenues, reflecting broad viewership and engagement.

- Deeply ingrained fan culture, leading to substantial matchday revenue and merchandise sales.

- Well-developed commercial infrastructure supporting lucrative sponsorship deals.

- Key Drivers in Germany:

- The highly competitive and popular Bundesliga, attracting significant domestic and international attention.

- A thriving sponsorship landscape with strong brand partnerships.

- Supportive government policies and investment in sports infrastructure and development.

- A strong emphasis on fan ownership models, fostering loyalty and engagement.

The sustained dominance of these regions is a result of a powerful synergy between robust economic conditions, meticulously established sporting infrastructures, extensive and impactful media coverage, and intensely passionate fan bases. These combined elements create an exceptionally fertile ground for generating substantial revenues and appreciating team valuations.

Europe Sports Team And Clubs Market Product Innovations

Recent product innovations center around enhanced fan experiences, including interactive apps, personalized content, and virtual reality (VR) experiences. These advancements aim to deepen fan engagement and generate additional revenue streams. Teams are also leveraging data analytics to optimize player performance, training programs, and strategic decision-making. The integration of technology improves operational efficiencies, allowing for more effective resource allocation. New merchandising strategies and brand collaborations further enhance the market appeal and offer additional revenue opportunities.

Report Segmentation & Scope

The report segments the market based on sport type (football, basketball, tennis, etc.), team type (professional, amateur), revenue stream (media rights, sponsorships, merchandise), and geographical region (UK, Spain, Germany, Italy, France, etc.). Each segment's growth projections, market size, and competitive dynamics are analyzed thoroughly. For example, the football segment is expected to maintain significant growth, while other sports like tennis and basketball display increasing market shares. Competitive dynamics differ greatly across segments, with larger teams holding more power in football, whereas the market shows more diversity in tennis and basketball.

Key Drivers of Europe Sports Team And Clubs Market Growth

Several interconnected factors are propelling the expansion of the European Sports Team and Clubs Market. Technological advancements are revolutionizing media consumption and fan engagement, unlocking novel revenue streams through digital platforms, virtual experiences, and data analytics. The increasing globalization of sports, facilitated by international tournaments and wider media distribution networks, significantly broadens market reach and appeal. Furthermore, generally favorable economic conditions across many European nations translate into higher disposable incomes, leading to increased consumer spending on entertainment and sports-related activities. Crucially, supportive government policies that promote sports development, invest in world-class infrastructure, and encourage grassroots participation also play a vital role in fostering market growth.

Challenges in the Europe Sports Team And Clubs Market Sector

The European Sports Team and Clubs Market faces a number of significant hurdles. Maintaining and enhancing fan engagement is an ongoing challenge in an era of diverse and readily available entertainment options. The industry must also contend with the potential for declining ticket sales and the volatility of broadcasting rights prices in an increasingly fragmented media landscape. Stricter regulatory environments, including the implementation and enforcement of financial fair play rules, place considerable pressure on team management to ensure fiscal responsibility. The intensifying competition for sponsorships and top talent is another critical challenge, as clubs vie for limited resources and premium athletes to achieve success. Moreover, economic downturns pose a substantial risk, as reduced disposable income can directly impact consumer spending on sports and related leisure activities. These multifaceted challenges collectively influence the market's overall profitability and long-term stability.

Leading Players in the Europe Sports Team And Clubs Market Market

- SL Benfica

- FC Barcelona

- Real Madrid

- ESBA

- EHF

- Eagle Football Holding

- The European Club

- Tennis Europe

- Bayern Munich

- Liverpool

- List Not Exhaustive

Key Developments in Europe Sports Team And Clubs Market Sector

- June 2023: The landmark merger between the PGA Tour and LIV Golf sent ripples across the professional sports world. This development has significant implications for the future of golf, potentially influencing investment strategies, sponsorship models, and competitive structures across other major sports.

- December 2022: Eagle Football Holdings' acquisition of a controlling stake in the prestigious French football club Olympique Lyonnais underscored the ongoing trend of consolidation and substantial private investment within the European football market, signaling a dynamic shift in club ownership and management.

- Ongoing Trend: Increased investment in women's sports leagues and teams, driven by growing viewership, commercial interest, and a push for gender equality, is a significant development reshaping the market landscape.

- Emerging Technology: The adoption of Artificial Intelligence (AI) and Augmented Reality (AR) in broadcasting, fan engagement, and player performance analysis is rapidly evolving, promising new revenue streams and enhanced spectator experiences.

Strategic Europe Sports Team And Clubs Market Market Outlook

The outlook for the European Sports Team and Clubs Market remains exceptionally positive, with continued and robust growth anticipated. Strategic opportunities abound for organizations that can effectively leverage technology to create immersive and personalized fan experiences, explore innovative new revenue streams beyond traditional ticketing and broadcasting, and implement efficient operational cost management strategies. A strong commitment to sustainability and social responsibility will not only enhance brand reputation but also resonate with an increasingly conscious consumer base. Furthermore, strategic initiatives focusing on international expansion and forging strategic partnerships will be crucial for tapping into underpenetrated markets and capitalizing on global sporting trends. As technological advancements continue to shape consumer preferences and media consumption habits, the market is poised for sustained dynamism and substantial growth, particularly in areas that embrace innovation and adaptability.

Europe Sports Team And Clubs Market Segmentation

-

1. Type

- 1.1. Football

- 1.2. Golf

- 1.3. Rugby Union

- 1.4. Cricket

- 1.5. Boxing

- 1.6. Other Types

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Tickets

- 2.4. Sponsorship

Europe Sports Team And Clubs Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Sports Team And Clubs Market Regional Market Share

Geographic Coverage of Europe Sports Team And Clubs Market

Europe Sports Team And Clubs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Number of Spectators Watching Sports; Increase in Number of Sports Event Post COVID-19

- 3.3. Market Restrains

- 3.3.1. Increase in Number of Spectators Watching Sports; Increase in Number of Sports Event Post COVID-19

- 3.4. Market Trends

- 3.4.1. Rising Football And Soccer Industry In Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Sports Team And Clubs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Football

- 5.1.2. Golf

- 5.1.3. Rugby Union

- 5.1.4. Cricket

- 5.1.5. Boxing

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Tickets

- 5.2.4. Sponsorship

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SL benfica

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GC Barcelona

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Real Madrid

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ESBA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 EHF

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eagel Football Holding

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The European Club

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tennis Europe

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bayern Munich

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Liverpool**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SL benfica

List of Figures

- Figure 1: Europe Sports Team And Clubs Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Sports Team And Clubs Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Sports Team And Clubs Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Sports Team And Clubs Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 3: Europe Sports Team And Clubs Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Sports Team And Clubs Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Europe Sports Team And Clubs Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 6: Europe Sports Team And Clubs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Sports Team And Clubs Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Europe Sports Team And Clubs Market?

Key companies in the market include SL benfica, GC Barcelona, Real Madrid, ESBA, EHF, Eagel Football Holding, The European Club, Tennis Europe, Bayern Munich, Liverpool**List Not Exhaustive.

3. What are the main segments of the Europe Sports Team And Clubs Market?

The market segments include Type, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Number of Spectators Watching Sports; Increase in Number of Sports Event Post COVID-19.

6. What are the notable trends driving market growth?

Rising Football And Soccer Industry In Europe.

7. Are there any restraints impacting market growth?

Increase in Number of Spectators Watching Sports; Increase in Number of Sports Event Post COVID-19.

8. Can you provide examples of recent developments in the market?

June 2023: The PGA Tour merged with LIV Golf, which is backed by the Saudi Arabia Public Investment Fund, an entity controlled by Saudi Crown Prince Mohammed bin Salman. PGA Tour exists as a membership organization for touring professional golfers and co-sanctioning tournaments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Sports Team And Clubs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Sports Team And Clubs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Sports Team And Clubs Market?

To stay informed about further developments, trends, and reports in the Europe Sports Team And Clubs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence