Key Insights

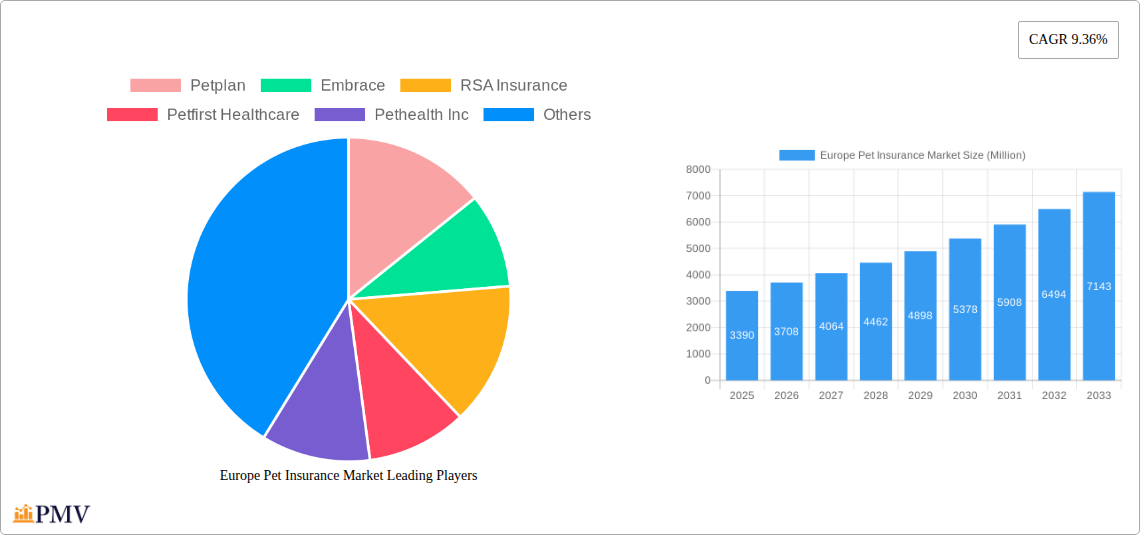

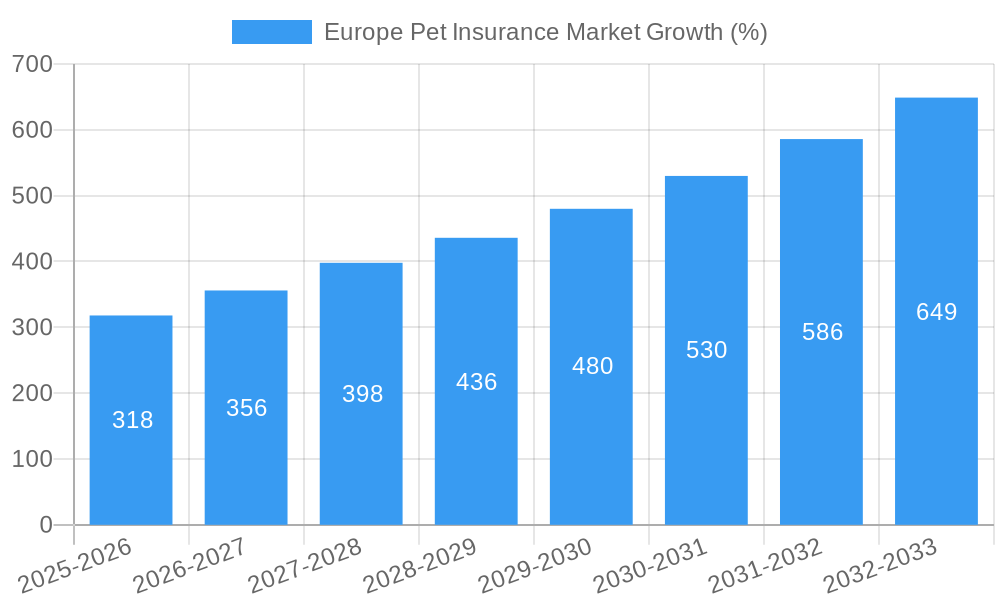

The European pet insurance market is experiencing robust growth, projected to reach a market size of €3.39 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 9.36% from 2019 to 2033. This expansion is driven by several key factors. Increasing pet ownership across Europe, coupled with rising pet humanization trends, is leading to greater willingness among owners to invest in comprehensive pet healthcare, including insurance. Furthermore, advancements in veterinary care and the availability of more sophisticated treatment options contribute to higher insurance claim values, boosting market revenue. A growing awareness of potential veterinary costs, especially for chronic conditions and unforeseen emergencies, further fuels demand for pet insurance. The market is segmented by various factors, including pet type (dogs, cats, others), insurance coverage level (basic, comprehensive), and distribution channel (online, offline). Competitive landscape analysis reveals key players such as Petplan, Embrace, RSA Insurance, and others, continually vying for market share through product innovation and strategic partnerships.

Looking forward to 2033, the European pet insurance market is poised for continued expansion. While economic fluctuations could present some challenges, the long-term trend indicates strong growth potential, driven by increasing pet ownership in emerging markets within Europe and the sustained focus on preventative care and wellness. Companies are likely to focus on personalized insurance plans, expanding their digital presence to improve customer experience, and leveraging data analytics to better understand and target specific customer segments. Regulatory changes and evolving consumer preferences will also play a significant role in shaping the market's future trajectory. The increasing availability of telemedicine and pet health monitoring technology creates opportunities for innovative insurance products and service offerings.

Europe Pet Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Pet Insurance Market, offering valuable insights for industry stakeholders, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market structure, competitive dynamics, growth drivers, challenges, and future outlook. The report utilizes a robust methodology incorporating historical data (2019-2024), current estimations (2025), and future projections (2025-2033) to deliver actionable intelligence. The total market size is projected to reach xx Million by 2033, presenting substantial growth opportunities.

Europe Pet Insurance Market Structure & Competitive Dynamics

The European pet insurance market exhibits a moderately consolidated structure, with several key players vying for market share. Market concentration is influenced by factors like regulatory frameworks varying across nations, the presence of established insurers with diversified portfolios, and the emergence of specialized pet insurance providers. Innovation is driven by technological advancements in claims processing, data analytics, and personalized pet insurance products. Mergers and acquisitions (M&A) activity is significant, indicating consolidation trends and a quest for enhanced market reach. For instance, Trupanion's acquisition of Royal Blue s.r.o. (parent company of PetExpert) in November 2022 exemplifies this trend. The deal value for this acquisition was xx Million. Product substitutes, such as savings plans for pet healthcare, exist but often lack the comprehensive coverage offered by insurance. End-user trends reveal a growing preference for comprehensive coverage, digital access to services, and personalized policy options.

- Market Share: Leading players like Petplan, Embrace, and RSA Insurance command significant market share, though precise figures are proprietary and vary by country.

- M&A Activity: The market has witnessed several significant M&A transactions, with deal values ranging from xx Million to xx Million in recent years. This trend is expected to continue.

- Regulatory Frameworks: Differing regulations across European nations impact market access and product offerings, creating both opportunities and challenges.

Europe Pet Insurance Market Industry Trends & Insights

The European pet insurance market is characterized by robust growth, driven by several key factors. Rising pet ownership, particularly in urban areas, coupled with increased pet humanization and a willingness to spend on pet healthcare, fuels market expansion. Technological advancements like telemedicine and AI-powered risk assessment tools are streamlining operations and improving service delivery. Consumer preferences are shifting towards comprehensive coverage, digital platforms, and personalized policies. The market is witnessing intense competitive activity, including new market entrants, product innovations, and strategic partnerships. The CAGR for the market during the forecast period (2025-2033) is estimated to be xx%, indicating sustained growth. Market penetration remains relatively low compared to some other regions, representing a substantial untapped potential.

Dominant Markets & Segments in Europe Pet Insurance Market

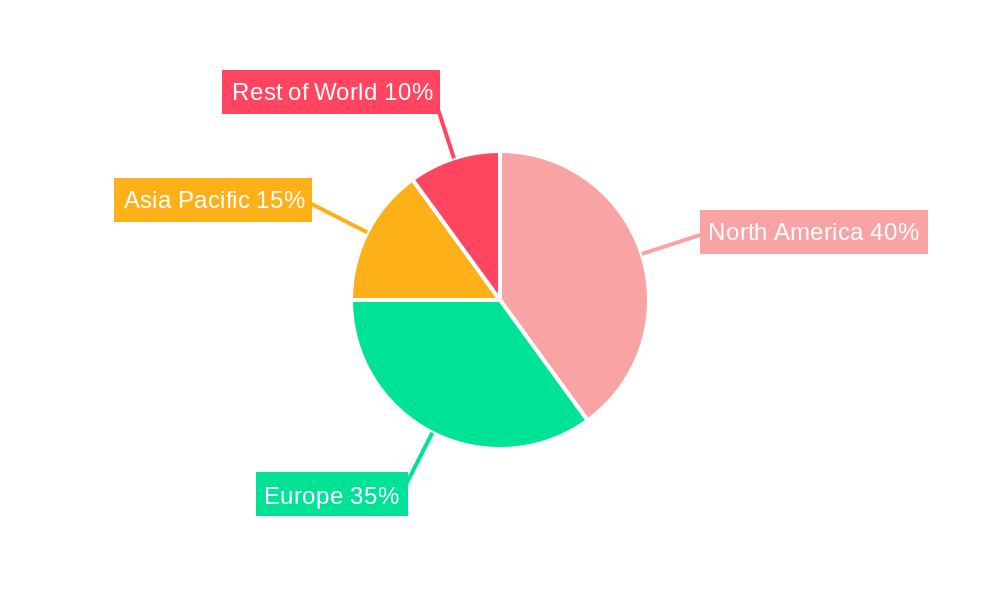

The UK, Germany, and France represent the dominant markets within Europe, driven by high pet ownership rates, strong economies, and favorable regulatory environments. Within these countries, dog and cat insurance remain the most significant segments, accounting for a significant portion of the overall market revenue.

- Key Drivers in Dominant Markets:

- UK: High pet ownership rates, robust pet healthcare infrastructure, and a developed insurance market.

- Germany: Growing pet ownership, increasing pet healthcare spending, and a sophisticated consumer base.

- France: Rising pet ownership, particularly in urban areas, and a growing awareness of pet insurance benefits.

- Dominance Analysis: The dominance of these markets is attributed to a combination of factors including higher pet ownership, greater disposable incomes, and more established insurance cultures. However, other countries in Europe are showing significant growth potential.

Europe Pet Insurance Market Product Innovations

Recent product innovations focus on enhancing policy customization, digital accessibility, and value-added services. This includes integrating telehealth platforms, providing wellness plans, and offering tailored coverage based on breed-specific health risks. These innovations aim to enhance customer experience, improve risk assessment, and gain a competitive edge. Technological trends such as AI-driven fraud detection and personalized risk profiling are also influencing product development.

Report Segmentation & Scope

This report segments the Europe Pet Insurance Market by animal type (dogs, cats, others), coverage type (accident-only, comprehensive), distribution channel (online, offline), and country. Each segment is analyzed with regards to market size, growth projections, and competitive dynamics. The growth of each segment is influenced by factors specific to that segment. For example, comprehensive coverage is showing faster growth than accident-only coverage because of the rising willingness to spend on pet healthcare.

Key Drivers of Europe Pet Insurance Market Growth

The growth of the European pet insurance market is fueled by several key drivers: increasing pet ownership, heightened pet humanization leading to increased spending on pet healthcare, technological advancements improving service delivery and efficiency, favorable regulatory environments in certain countries encouraging market entry and expansion, and growing awareness of the financial benefits of pet insurance.

Challenges in the Europe Pet Insurance Market Sector

Challenges include varying regulatory landscapes across European countries, creating complexities for market entry and expansion. Supply chain disruptions and inflationary pressures can also impact operational costs and profitability. Intense competition, including price wars and product differentiation challenges, adds further pressure on market players.

Leading Players in the Europe Pet Insurance Market

- Petplan

- Embrace

- RSA Insurance

- Petfirst Healthcare

- Pethealth Inc

- Protectapet

- AGILA

- Petsecure

- Hartville Group

- NSM Insurance Group

Key Developments in Europe Pet Insurance Market Sector

- February 2023: Launch of Agria Petinsure in the Irish market, highlighting the untapped potential in this region. The low penetration rate (10-15% for dogs, 5% for cats) suggests significant future growth potential.

- November 2022: Trupanion's acquisition of Royal Blue s.r.o. (PetExpert's parent company), signifying further consolidation within the European pet insurance market.

Strategic Europe Pet Insurance Market Outlook

The European pet insurance market presents a promising outlook, driven by sustained growth in pet ownership, increased pet healthcare spending, and technological advancements. Strategic opportunities lie in developing innovative products tailored to specific pet needs, expanding into underserved markets, and leveraging digital technologies for improved customer engagement and operational efficiency. The continued consolidation within the market also presents strategic acquisition opportunities for larger players.

Europe Pet Insurance Market Segmentation

-

1. Insurance Type

- 1.1. Accident & Illness

- 1.2. Accident Only

-

2. Policy Type

- 2.1. Lifetime Coverage

- 2.2. Non-Lifetime Coverage

-

3. Animal Type

- 3.1. Dogs

- 3.2. Cats

- 3.3. Other Animal Types

-

4. Provider

- 4.1. Public

- 4.2. Private

-

5. Distribution Channel

- 5.1. Insurance Agency

- 5.2. Bancassurance

- 5.3. Brokers

- 5.4. Direct Sales

Europe Pet Insurance Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Pet Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing trend of Dog Insurance Premiums in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pet Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Accident & Illness

- 5.1.2. Accident Only

- 5.2. Market Analysis, Insights and Forecast - by Policy Type

- 5.2.1. Lifetime Coverage

- 5.2.2. Non-Lifetime Coverage

- 5.3. Market Analysis, Insights and Forecast - by Animal Type

- 5.3.1. Dogs

- 5.3.2. Cats

- 5.3.3. Other Animal Types

- 5.4. Market Analysis, Insights and Forecast - by Provider

- 5.4.1. Public

- 5.4.2. Private

- 5.5. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.5.1. Insurance Agency

- 5.5.2. Bancassurance

- 5.5.3. Brokers

- 5.5.4. Direct Sales

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Petplan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Embrace

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RSA Insurance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Petfirst Healthcare

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pethealth Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Protectapet

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AGILA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Petsecure

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hartville Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 NSM Insurance Group**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Petplan

List of Figures

- Figure 1: Europe Pet Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Pet Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Pet Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Pet Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Europe Pet Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 4: Europe Pet Insurance Market Volume Billion Forecast, by Insurance Type 2019 & 2032

- Table 5: Europe Pet Insurance Market Revenue Million Forecast, by Policy Type 2019 & 2032

- Table 6: Europe Pet Insurance Market Volume Billion Forecast, by Policy Type 2019 & 2032

- Table 7: Europe Pet Insurance Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 8: Europe Pet Insurance Market Volume Billion Forecast, by Animal Type 2019 & 2032

- Table 9: Europe Pet Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 10: Europe Pet Insurance Market Volume Billion Forecast, by Provider 2019 & 2032

- Table 11: Europe Pet Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Europe Pet Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 13: Europe Pet Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Europe Pet Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 15: Europe Pet Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 16: Europe Pet Insurance Market Volume Billion Forecast, by Insurance Type 2019 & 2032

- Table 17: Europe Pet Insurance Market Revenue Million Forecast, by Policy Type 2019 & 2032

- Table 18: Europe Pet Insurance Market Volume Billion Forecast, by Policy Type 2019 & 2032

- Table 19: Europe Pet Insurance Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 20: Europe Pet Insurance Market Volume Billion Forecast, by Animal Type 2019 & 2032

- Table 21: Europe Pet Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 22: Europe Pet Insurance Market Volume Billion Forecast, by Provider 2019 & 2032

- Table 23: Europe Pet Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Europe Pet Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 25: Europe Pet Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Europe Pet Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: United Kingdom Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: United Kingdom Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Germany Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: France Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Italy Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Italy Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Spain Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Spain Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Netherlands Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Netherlands Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: Belgium Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Belgium Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 41: Sweden Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Sweden Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 43: Norway Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Norway Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 45: Poland Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Poland Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 47: Denmark Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Denmark Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pet Insurance Market?

The projected CAGR is approximately 9.36%.

2. Which companies are prominent players in the Europe Pet Insurance Market?

Key companies in the market include Petplan, Embrace, RSA Insurance, Petfirst Healthcare, Pethealth Inc, Protectapet, AGILA, Petsecure, Hartville Group, NSM Insurance Group**List Not Exhaustive.

3. What are the main segments of the Europe Pet Insurance Market?

The market segments include Insurance Type, Policy Type, Animal Type, Provider, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.39 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing trend of Dog Insurance Premiums in Europe.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: The new brand Agria Petinsure, formerly Petinsure, is entering the Irish market with a clear mission. Currently, the insurance rate for dogs in the Irish market is approximately 10%-15%, while the rate for cats is approximately 5%. It is estimated that 90% of dogs and 50% of cats in Sweden have pet insurance. Agria Petinsure believes that the same safety should be available for all Irish pets, and pet owners should enjoy peace of mind if their pet needs medical treatment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pet Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pet Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pet Insurance Market?

To stay informed about further developments, trends, and reports in the Europe Pet Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence