Key Insights

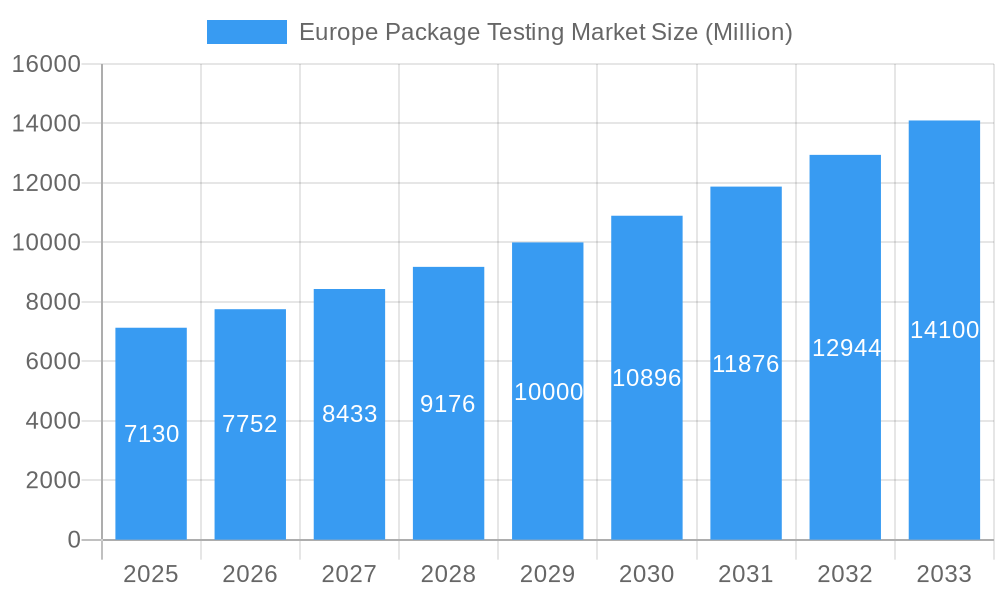

The European package testing market, valued at €7.13 billion in 2025, is projected to experience robust growth, driven by increasing regulatory scrutiny on product safety and sustainability, coupled with the rising demand for e-commerce and food & beverage products. This necessitates rigorous testing to ensure product integrity and compliance across various segments, including physical performance, chemical composition, and environmental impact. The market's expansion is fueled by a surge in demand for specialized testing services from diverse end-user verticals like healthcare, industrial manufacturing, and personal care, all striving for enhanced quality control and brand reputation. Growth is further accelerated by technological advancements in testing methodologies, enabling faster, more precise, and cost-effective analysis.

Europe Package Testing Market Market Size (In Billion)

Significant regional variations exist within Europe. Germany, France, and the UK are expected to dominate the market due to their robust manufacturing sectors and stringent regulatory frameworks. However, other countries like the Netherlands and Sweden are poised for significant growth, driven by increasing investments in research and development within packaging technologies. The market's segmentation highlights the importance of primary material (glass, paper, plastic, metal) and testing type (physical, chemical, environmental), enabling companies to tailor services to specific customer needs. Key players such as Intertek, SGS, and Bureau Veritas are strategically investing in expanding their testing capabilities and geographical reach, further consolidating their market position through acquisitions and partnerships. The predicted CAGR of 8.83% from 2025 to 2033 signifies a promising future for this sector.

Europe Package Testing Market Company Market Share

Europe Package Testing Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Europe Package Testing market, offering invaluable insights for stakeholders seeking to understand market dynamics, competitive landscapes, and future growth opportunities. The report covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The historical period analyzed is 2019-2024, while the forecast period spans 2025-2033. The market is segmented by primary material (Glass, Paper, Plastic, Metal), type of testing (Physical Performance Testing, Chemical Testing, Environmental Testing), and end-user vertical (Food and Beverage, Healthcare, Industrial, Personal and Household Products, Other End-user Verticals). The report values are expressed in Millions.

Europe Package Testing Market Market Structure & Competitive Dynamics

The European package testing market exhibits a moderately concentrated structure, with several large multinational players holding significant market share. The market is characterized by a dynamic innovation ecosystem, driven by advancements in testing methodologies and regulatory pressures towards enhanced product safety and sustainability. Stringent regulatory frameworks across different European nations significantly influence testing standards and compliance requirements, creating both opportunities and challenges for market participants. Product substitutes, such as biodegradable and eco-friendly packaging materials, are gaining traction, necessitating adaptable testing protocols. End-user trends, particularly the growing demand for sustainable and functional packaging across various industries, are shaping the market's growth trajectory.

Mergers and acquisitions (M&A) activity has played a considerable role in shaping the market's competitive landscape. For instance, Berlin Packaging's acquisition of Newpack (December 2020) demonstrates the strategic importance of expanding market reach and product offerings. While precise M&A deal values are not publicly available for all transactions, the overall impact suggests consolidation within the market. The total market value in 2024 was estimated at xx Million, with the top 5 players holding an estimated xx% market share collectively. The market is expected to show a steady increase in M&A activity in the coming years driven by the need for expansion and diversification.

Europe Package Testing Market Industry Trends & Insights

The European package testing market is experiencing robust growth, driven by several key factors. Stringent regulations regarding product safety and environmental impact are creating significant demand for comprehensive testing services. The rising adoption of innovative packaging materials necessitates the development of advanced testing techniques, further fueling market growth. Consumer preference for sustainable and eco-friendly packaging is also influencing market trends, pushing companies to adopt more stringent testing standards for recyclability and biodegradability. The increasing prevalence of e-commerce and the resultant need for robust and protective packaging are additional drivers. Technological advancements, such as automated testing systems and advanced analytical techniques, are improving efficiency and accuracy, thus impacting the market's dynamics. The Compound Annual Growth Rate (CAGR) for the market is projected to be xx% during the forecast period (2025-2033), with market penetration steadily increasing across various segments. Competitive dynamics are influenced by pricing strategies, technological capabilities, and the ability to meet stringent regulatory compliance requirements.

Dominant Markets & Segments in Europe Package Testing Market

The European package testing market demonstrates significant variations across regions and segments. While precise market share data for each region/country is difficult to obtain publicly, Germany, France, and the UK are expected to be among the leading markets due to their large manufacturing bases and stringent regulatory landscapes.

Key Drivers for Dominant Segments:

- Primary Material: Plastic packaging testing holds a significant market share due to its widespread use across various industries. The demand for testing the integrity and safety of plastic packaging is continuously growing, driving this segment's dominance. The ongoing shift toward sustainable materials is opening up new opportunities for testing materials such as biodegradable plastics.

- Type of Testing: Physical performance testing dominates the market due to its importance in ensuring product safety and quality throughout the supply chain.

- End-user Vertical: The food and beverage sector displays significant demand for package testing services owing to strict regulations and health concerns. The healthcare sector follows closely due to critical requirements for sterile and protective packaging.

Dominance Analysis: The dominance of specific segments stems from the regulatory environment, end-user needs, and the prevalence of particular packaging types within certain industries. For example, stringent food safety regulations in the EU are a major driver for the dominant position of food and beverage within the end-user segment.

Europe Package Testing Market Product Innovations

Recent innovations in the Europe Package Testing market include the development of advanced testing equipment, offering greater precision, efficiency, and automation in testing processes. The incorporation of AI and machine learning in data analysis is enhancing the speed and accuracy of test results. New testing methods are continuously being developed to address the growing demand for testing novel materials, such as biodegradable plastics and sustainable packaging alternatives. These innovations offer competitive advantages by improving testing capabilities, reducing turnaround time, and enhancing the overall quality of services. This, in turn, strengthens market competitiveness and enhances customer satisfaction.

Report Segmentation & Scope

The Europe Package Testing market is segmented by:

Primary Material: Glass, Paper, Plastic, Metal. Each material segment has unique testing requirements, resulting in varied market sizes and growth projections. Plastic currently holds the largest market share, followed by paper, glass, and metal.

Type of Testing: Physical Performance Testing, Chemical Testing, Environmental Testing. Physical performance testing constitutes the largest segment, followed by chemical and environmental testing. Growth is expected across all three segments driven by regulatory compliance and the introduction of new packaging materials.

End-user Vertical: Food and Beverage, Healthcare, Industrial, Personal and Household Products, Other End-user Verticals. The food and beverage, and healthcare sectors are the largest and fastest-growing segments, driven by stringent quality and safety regulations.

Key Drivers of Europe Package Testing Market Growth

Several factors are driving the growth of the Europe Package Testing market:

- Stringent regulations: Increasingly stringent regulations related to food safety, environmental protection, and product safety are pushing manufacturers to adopt comprehensive testing regimes.

- Growing consumer awareness: Heightened awareness of product quality and sustainability among consumers is driving demand for reliable testing services to ensure packaging meets high standards.

- Technological advancements: Innovations in testing technologies are leading to more efficient and accurate testing procedures, which in turn increases demand.

Challenges in the Europe Package Testing Market Sector

Despite the significant growth opportunities, the Europe Package Testing market faces challenges:

- High testing costs: The sophisticated nature of testing can lead to high costs, potentially limiting access for smaller enterprises.

- Complexity of regulations: Navigating the complexities of varying regulations across different European countries can pose significant challenges for companies operating across multiple jurisdictions.

- Competition: The market is competitive, with many players vying for market share, requiring constant innovation and improvement to maintain a competitive edge.

Leading Players in the Europe Package Testing Market Market

- Cryopak (Integreon Global)

- Intertek Group PLC

- Nefab Group

- Turner Packaging Limited

- IFP Institute for Product Quality GmbH

- Campden BRI

- Glass Technology Services

- TUV SUD AG

- SGS SA

- Bureau Veritas SA

- Eurofins Scientific SE

Key Developments in Europe Package Testing Market Sector

- December 2020: Berlin Packaging acquired Newpack, marking its tenth European acquisition since 2016, signifying a commitment to expanding its packaging supply chain across Europe.

- August 2020: ePac Holdings Europe established new digital-only production plants in Lyon, France, and Wrocław, Poland, demonstrating expansion into continental Europe.

Strategic Europe Package Testing Market Market Outlook

The future of the Europe Package Testing market appears promising, driven by continued growth in e-commerce, increasing demand for sustainable packaging, and the ongoing implementation of stringent regulatory frameworks. Strategic opportunities exist for companies that can offer innovative testing solutions, adapt to evolving regulatory landscapes, and effectively cater to the diverse needs of various end-user industries. Focus on automation, data analytics, and sustainability-focused testing will be crucial for success in the years to come.

Europe Package Testing Market Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Paper

- 1.3. Plastic

- 1.4. Metal

-

2. Type of Testing

- 2.1. Physical Performance Testing

- 2.2. Chemical Testing

- 2.3. Environmental Testing

-

3. End-user Vertical

- 3.1. Food and Beverage

- 3.2. Healthcare

- 3.3. Industrial

- 3.4. Personal and Household Products

- 3.5. Other End-user Verticals

Europe Package Testing Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Package Testing Market Regional Market Share

Geographic Coverage of Europe Package Testing Market

Europe Package Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of the Products Under Varying Conditions

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Package Testing

- 3.4. Market Trends

- 3.4.1. Glass Usage in Packaging Expected to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Package Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Paper

- 5.1.3. Plastic

- 5.1.4. Metal

- 5.2. Market Analysis, Insights and Forecast - by Type of Testing

- 5.2.1. Physical Performance Testing

- 5.2.2. Chemical Testing

- 5.2.3. Environmental Testing

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Food and Beverage

- 5.3.2. Healthcare

- 5.3.3. Industrial

- 5.3.4. Personal and Household Products

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cryopak (Integreon Global)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Intertek Group PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nefab Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Turner Packaging Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IFP Institute for Product Quality GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Campden BRI

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Glass Technology Services*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TUV SUD AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SGS SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bureau Veritas SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Eurofins Scientific SE

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Cryopak (Integreon Global)

List of Figures

- Figure 1: Europe Package Testing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Package Testing Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Package Testing Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 2: Europe Package Testing Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 3: Europe Package Testing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Europe Package Testing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Package Testing Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 6: Europe Package Testing Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 7: Europe Package Testing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Europe Package Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Package Testing Market?

The projected CAGR is approximately 8.83%.

2. Which companies are prominent players in the Europe Package Testing Market?

Key companies in the market include Cryopak (Integreon Global), Intertek Group PLC, Nefab Group, Turner Packaging Limited, IFP Institute for Product Quality GmbH, Campden BRI, Glass Technology Services*List Not Exhaustive, TUV SUD AG, SGS SA, Bureau Veritas SA, Eurofins Scientific SE.

3. What are the main segments of the Europe Package Testing Market?

The market segments include Primary Material, Type of Testing, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of the Products Under Varying Conditions.

6. What are the notable trends driving market growth?

Glass Usage in Packaging Expected to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

High Costs Associated with Package Testing.

8. Can you provide examples of recent developments in the market?

December 2020 - Berlin Packaging acquired Newpack and is it's tenth European acquisition since 2016. This step confirmsBerlin Packaging's commitment to supplying packaging across all geographies, substrates, and market verticals in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Package Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Package Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Package Testing Market?

To stay informed about further developments, trends, and reports in the Europe Package Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence