Key Insights

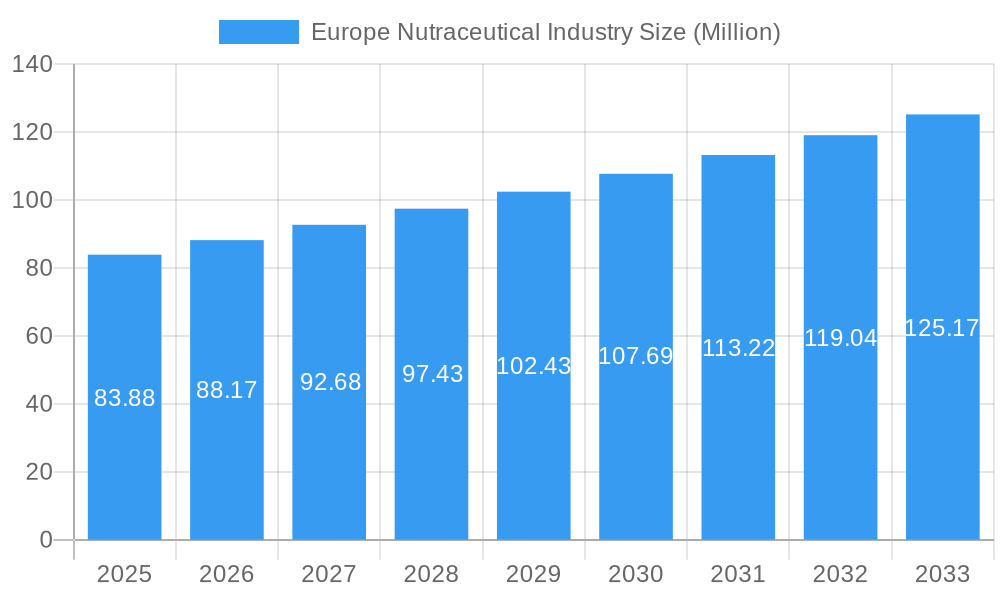

The European nutraceutical market, valued at €83.88 million in 2025, is projected to experience robust growth, driven by increasing health consciousness among consumers and a rising prevalence of chronic diseases. This €83.88 million figure represents a significant portion of the global market, indicating Europe's substantial role in nutraceutical consumption. The market's Compound Annual Growth Rate (CAGR) of 4.91% from 2025 to 2033 suggests a steady expansion, fueled by several key factors. The increasing demand for functional foods and beverages, particularly those promoting immunity and digestive health, is a major driver. Furthermore, the growing popularity of online retail channels provides convenient access to a wider range of nutraceutical products, further stimulating market growth. However, challenges exist, such as stringent regulatory frameworks and concerns regarding product efficacy and safety. Nevertheless, the continuous innovation in product formulations and the expansion of distribution networks through supermarkets, convenience stores, and specialty stores are mitigating these challenges and fostering market expansion. The segmentation within the market, including functional foods, functional beverages, and dietary supplements, demonstrates the diversity of consumer preferences and product offerings within the European nutraceutical landscape. Key players like PepsiCo, Nestlé, and Amway are strategically positioned to capitalize on the market's growth potential through product diversification and targeted marketing campaigns. Specific regional variations within Europe (Germany, France, UK, etc.) likely reflect differences in consumer preferences, regulatory landscapes, and economic factors, creating diverse opportunities for industry players. Continued market expansion is anticipated, reflecting a long-term upward trend in the health and wellness sector within Europe.

Europe Nutraceutical Industry Market Size (In Million)

The competitive landscape features both established multinational corporations and specialized nutraceutical companies, each employing various strategies for market penetration and expansion. The success of established players depends on their ability to innovate and adapt to changing consumer demands. This includes developing new product lines that address emerging health concerns and adopting sustainable practices that align with environmentally conscious consumers. Emerging companies may focus on niche markets or capitalize on specialized health solutions. Overall, the market dynamics are characterized by a strong interplay of innovation, consumer trends, and competitive strategies, ensuring continuous evolution within this growing sector. The projected growth indicates significant opportunities for investment and expansion within the European nutraceutical market throughout the forecast period.

Europe Nutraceutical Industry Company Market Share

Europe Nutraceutical Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe nutraceutical industry, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The report is crucial for businesses, investors, and stakeholders seeking a clear understanding of this dynamic market valued at xx Million.

Europe Nutraceutical Industry Market Structure & Competitive Dynamics

This section analyzes the market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities within the European nutraceutical industry. The market exhibits a moderately consolidated structure, with key players holding significant market share. However, the presence of numerous smaller players and a constant influx of new entrants contributes to competitive intensity. The industry displays a strong innovation ecosystem with substantial R&D investment focused on developing functional foods, beverages, and dietary supplements. The regulatory framework varies across European countries, influencing product labeling, claims, and safety standards. Consumers show an increasing preference for natural and organic products, driving innovation in this area.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025, indicating a moderately concentrated market.

- M&A Activity: The historical period (2019-2024) witnessed xx Million in M&A deal value, primarily driven by consolidation efforts and expansion into new product categories. The forecast period is expected to see further M&A activity, with a projected xx Million in deal value.

- Innovation Ecosystems: Significant investments in research and development are driving innovation in areas such as personalized nutrition, targeted delivery systems, and novel ingredient development.

- Regulatory Frameworks: Stringent regulations concerning labeling, claims, and safety standards vary across the European Union, creating both opportunities and challenges for market players.

Europe Nutraceutical Industry Industry Trends & Insights

The European nutraceutical market is experiencing robust growth, driven by several key factors. Health-conscious consumers are increasingly seeking natural solutions to improve their well-being, leading to higher demand for functional foods, beverages, and dietary supplements. Technological advancements in ingredient extraction, formulation, and delivery systems further support market expansion. The aging population and rising prevalence of chronic diseases are significant factors contributing to the demand for nutraceuticals. The market is also witnessing a shift towards personalized nutrition, with products tailored to specific needs and lifestyles gaining popularity. Competitive dynamics remain intense, with companies focusing on product innovation, brand building, and strategic partnerships to capture market share. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, with market penetration reaching xx% by 2033.

Dominant Markets & Segments in Europe Nutraceutical Industry

The European nutraceutical market is segmented by product type (functional foods, functional beverages, dietary supplements) and distribution channel (supermarkets/hypermarkets, convenience stores, specialty stores, online retail stores, other). Germany, France, and the UK are currently leading markets, driven by factors such as strong economic growth, high disposable incomes, and increasing health awareness. The dietary supplements segment is projected to maintain its dominance, exhibiting the highest CAGR due to growing consumer demand for targeted health benefits. Online retail is expected to be the fastest-growing distribution channel due to increased internet penetration and consumer convenience.

- Key Drivers for Dominant Markets:

- Germany: Strong economy, high health consciousness, established regulatory framework.

- France: High disposable incomes, growing preference for natural products.

- UK: Large population, well-developed retail infrastructure, strong online retail presence.

- Dominant Segment Analysis: The dietary supplements segment holds the largest market share due to its effectiveness in delivering specific health benefits, contributing significantly to market growth. The online distribution channel is rapidly expanding due to its convenience and accessibility to a wider customer base.

Europe Nutraceutical Industry Product Innovations

Recent product innovations reflect a focus on personalized nutrition, functional ingredients, and improved delivery systems. Companies are increasingly incorporating scientifically-backed ingredients with demonstrable health benefits into their products. Technological advancements in encapsulation, microencapsulation, and targeted delivery systems improve product efficacy and absorption. New product applications are emerging in areas such as sports nutrition, weight management, and cognitive health, aligning with evolving consumer preferences.

Report Segmentation & Scope

This report offers comprehensive segmentation of the European nutraceutical industry. Product type segmentation includes functional foods, functional beverages, and dietary supplements, each with individual growth projections and market size analysis. Distribution channel segmentation comprises supermarkets/hypermarkets, convenience stores, specialty stores, online retail stores, and other channels, providing insights into market dynamics across various retail models. Competitive analysis within each segment outlines market share, pricing strategies, and innovative approaches adopted by leading players.

- Functional Food: xx Million in 2025, xx% CAGR.

- Functional Beverage: xx Million in 2025, xx% CAGR.

- Dietary Supplement: xx Million in 2025, xx% CAGR.

- Supermarkets/Hypermarkets: xx Million in 2025, xx% CAGR.

- Convenience Stores: xx Million in 2025, xx% CAGR.

- Specialty Stores: xx Million in 2025, xx% CAGR.

- Online Retail Stores: xx Million in 2025, xx% CAGR.

- Other Distribution Channels: xx Million in 2025, xx% CAGR.

Key Drivers of Europe Nutraceutical Industry Growth

The growth of the European nutraceutical market is propelled by several key factors. The rising prevalence of chronic diseases like heart disease, diabetes, and obesity is driving consumer demand for products that support health and well-being. The increasing health awareness among consumers, fueled by readily available health information and government initiatives promoting healthy lifestyles, is another significant factor. Technological advancements, including novel ingredient extraction techniques and sophisticated delivery systems, are continuously enhancing the quality and efficacy of nutraceutical products. Favorable economic conditions across many European countries are supporting consumer spending on health and wellness products.

Challenges in the Europe Nutraceutical Industry Sector

Despite its robust growth, the European nutraceutical industry faces several challenges. Stringent regulatory frameworks and varying labeling requirements across different European countries create complexities for companies operating across multiple markets. Maintaining a stable and reliable supply chain is crucial, particularly given potential disruptions due to geopolitical factors or natural calamities. Intense competition necessitates ongoing product innovation and effective marketing strategies to differentiate products and attract consumers. The market faces challenges related to consumer skepticism about product efficacy, unsubstantiated health claims, and difficulties establishing clear efficacy data.

Leading Players in the Europe Nutraceutical Industry Market

- PepsiCo Inc (Naked Juice)

- Amway Corporation

- Sanofi

- General Mills Inc

- Nestlé S A (Milo Garden Gourmet)

- Nutraceuticals Group

- The Coca-Cola Company (Aquarius)

- The Kraft Heinz Company

- The Kellogg's Company (Morningstar)

- Herbalife Nutrition U S

- Nature's Bounty Inc (Sundown Ester-C Solgar)

- Bioiberica

Key Developments in Europe Nutraceutical Industry Sector

- October 2021: Nexira launched Heptura, a new ingredient for hepatoprotection and detoxification.

- January 2022: DFE Pharma expanded its nutraceutical excipient offering with the Nutrofeli starch portfolio.

- April 2022: Bioiberica partnered with Apsen to develop innovative mobility products for the Brazilian market.

Strategic Europe Nutraceutical Industry Market Outlook

The European nutraceutical market presents significant growth potential. Continued innovation in product development, focusing on personalized nutrition and scientifically-backed ingredients, will be crucial for success. Strategic partnerships and acquisitions will play a key role in consolidating market share and expanding into new product categories. Companies that effectively leverage digital marketing channels and build strong brands will be best positioned to capitalize on the market's growth trajectory. The market's future is bright, driven by increasing consumer health awareness and a growing demand for natural solutions to improve health and well-being.

Europe Nutraceutical Industry Segmentation

-

1. Product Type

- 1.1. Functional Food

- 1.2. Functional Beverage

- 1.3. Dietary Supplement

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Speciality Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Europe Nutraceutical Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Nutraceutical Industry Regional Market Share

Geographic Coverage of Europe Nutraceutical Industry

Europe Nutraceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Convenience Food in the Region; Increasing Demand for Gluten-free Pasta and Noodles

- 3.3. Market Restrains

- 3.3.1. Growing Competition from Other Convenience Foods

- 3.4. Market Trends

- 3.4.1. Germany Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food

- 5.1.2. Functional Beverage

- 5.1.3. Dietary Supplement

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Speciality Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PepsiCo Inc (Naked Juice)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amway Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sanofi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 General Mills Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nestlé S A (Milo Garden Gourmet)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nutraceuticals Group*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Coca-Cola Company (Aquarius)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Kraft Heinz Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Kellogg's Company (Morningstar)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Herbalife Nutrition U S

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Nature's Bounty Inc (Sundown Ester-C Solgar)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Bioiberica

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 PepsiCo Inc (Naked Juice)

List of Figures

- Figure 1: Europe Nutraceutical Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Nutraceutical Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Nutraceutical Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Nutraceutical Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Nutraceutical Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Nutraceutical Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Europe Nutraceutical Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Nutraceutical Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Nutraceutical Industry?

The projected CAGR is approximately 4.91%.

2. Which companies are prominent players in the Europe Nutraceutical Industry?

Key companies in the market include PepsiCo Inc (Naked Juice), Amway Corporation, Sanofi, General Mills Inc, Nestlé S A (Milo Garden Gourmet), Nutraceuticals Group*List Not Exhaustive, The Coca-Cola Company (Aquarius), The Kraft Heinz Company, The Kellogg's Company (Morningstar), Herbalife Nutrition U S, Nature's Bounty Inc (Sundown Ester-C Solgar), Bioiberica.

3. What are the main segments of the Europe Nutraceutical Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 83.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Convenience Food in the Region; Increasing Demand for Gluten-free Pasta and Noodles.

6. What are the notable trends driving market growth?

Germany Dominates the Market.

7. Are there any restraints impacting market growth?

Growing Competition from Other Convenience Foods.

8. Can you provide examples of recent developments in the market?

April 2022: Bioiberica, a global life science company based in Spain, partnered with multinational health and pharmaceutical expert Apsen to develop innovative mobility products for the Brazilian market. Apsen's Motilex HA combines two of Bioiberica's leading joint health ingredients, b-2 Cool native type II collagen and Mobilee.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Nutraceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Nutraceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Nutraceutical Industry?

To stay informed about further developments, trends, and reports in the Europe Nutraceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence