Key Insights

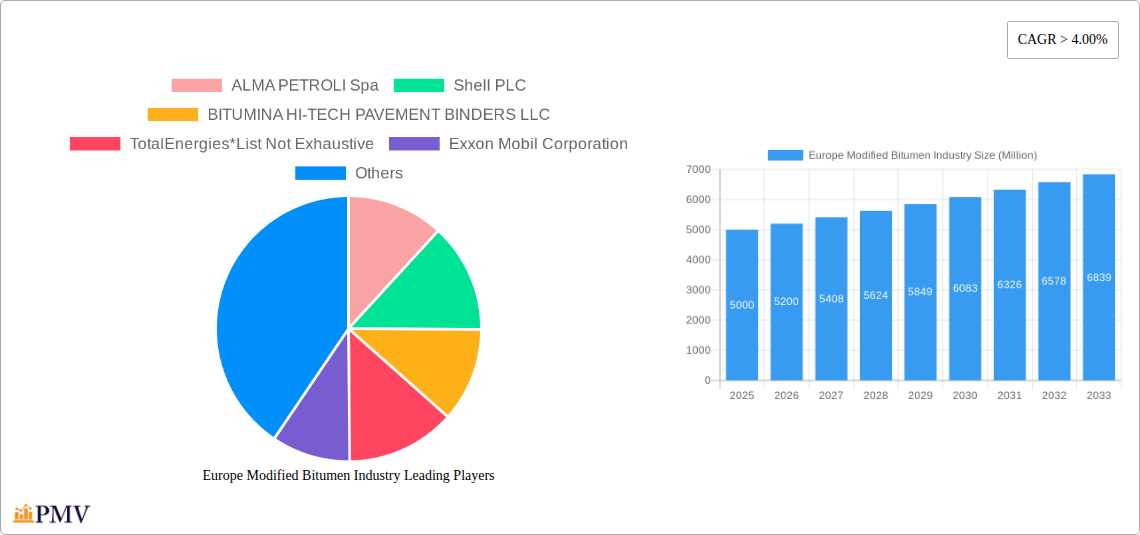

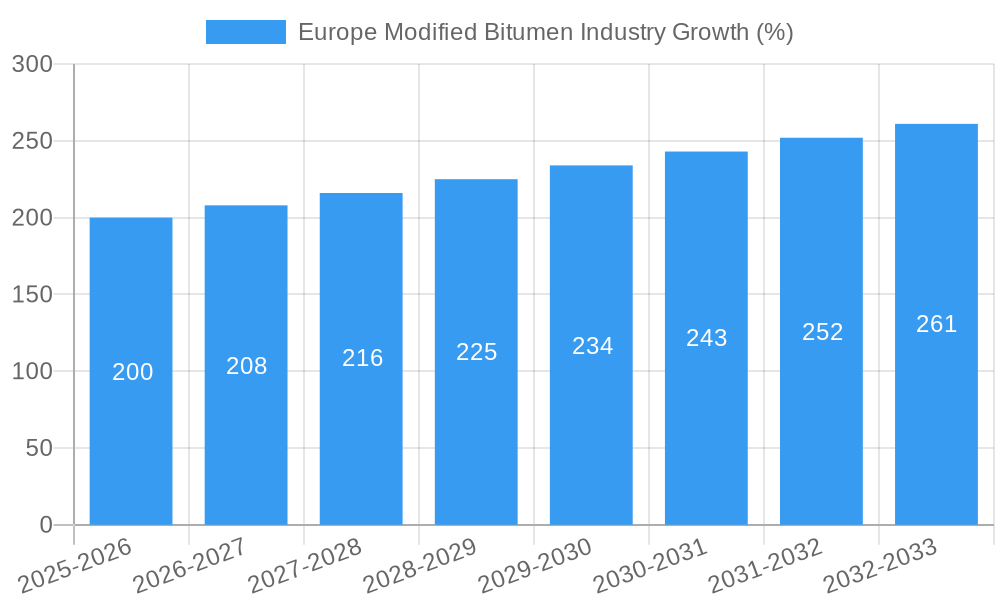

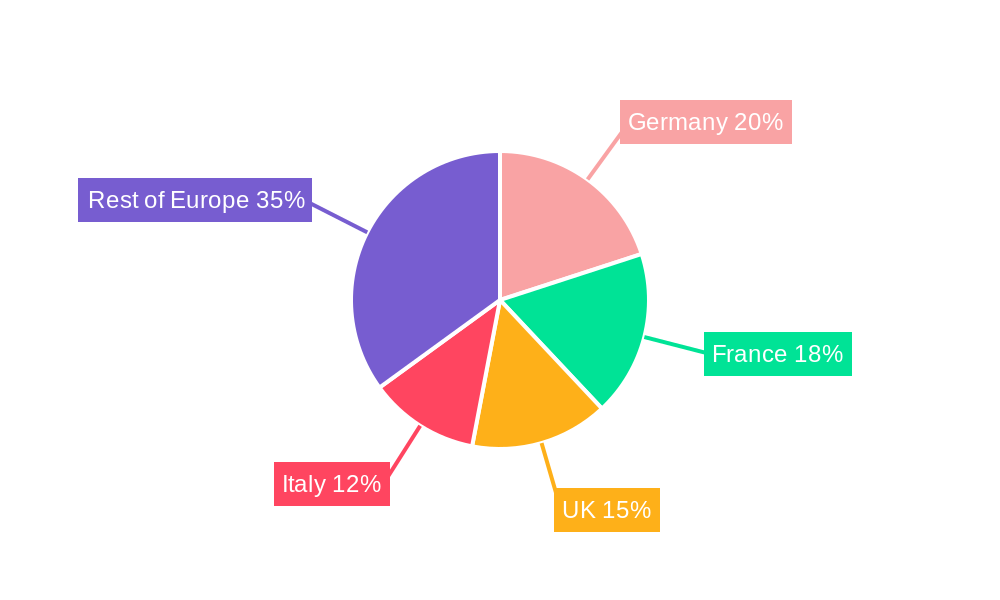

The European modified bitumen market, currently valued at an estimated €[Estimate based on market size XX and currency conversion, e.g., €5 billion] in 2025, is experiencing robust growth, projected to expand at a CAGR exceeding 4.00% from 2025 to 2033. This growth is driven primarily by the increasing demand for infrastructure development, particularly road construction projects across major European economies like Germany, France, and the UK. The rising popularity of sustainable and durable roofing solutions in residential and commercial sectors further fuels market expansion. Furthermore, the growing adoption of modified bitumen in piping applications for enhanced performance and longevity contributes significantly to the market's upward trajectory. Key trends shaping the market include the increasing preference for environmentally friendly modifiers like crumb rubber and natural rubber, aligning with sustainability initiatives. Technological advancements in application methods, particularly cold asphalt application which reduces environmental impact, are also driving market growth. However, the market faces certain restraints including fluctuating bitumen prices influenced by crude oil volatility and potential regulatory changes impacting construction materials. The market is segmented by application (road construction, roofing & piping, others), modifier type (SBS, APP, crumb rubber, natural rubber, others), and application method (hot asphalt, cold asphalt, torch-applied). Leading players like Shell, TotalEnergies, ExxonMobil, and others are actively engaged in innovation and expansion to capitalize on the growing market opportunities.

The competitive landscape in Europe is characterized by a mix of multinational corporations and regional players. These companies are focusing on strategic collaborations, capacity expansion, and product diversification to maintain a competitive edge. The market’s future growth hinges on sustained infrastructure investment, technological innovations leading to enhanced product performance and environmental sustainability, and successful mitigation of raw material price fluctuations. Further market segmentation analysis, based on specific country data within Europe (Germany, France, Italy, UK, Netherlands, Sweden, and Rest of Europe), would offer a granular understanding of regional variations in market dynamics and growth potential. Detailed analysis of the impact of government policies and environmental regulations is crucial for forecasting accurate future market trends and identifying high-growth segments.

Europe Modified Bitumen Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe Modified Bitumen Industry, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, competitive landscapes, and future growth prospects. The report encompasses a market size valuation of xx Million in 2025, projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Europe Modified Bitumen Industry Market Structure & Competitive Dynamics

The European modified bitumen market exhibits a moderately consolidated structure, with several major players vying for market share. Key players such as Shell PLC, TotalEnergies, Exxon Mobil Corporation, Repsol, and others hold significant positions, though the exact market share distribution fluctuates based on product innovation, pricing strategies, and regional demand. The industry is characterized by a dynamic innovation ecosystem, driven by advancements in modifier types and application methods to enhance performance and sustainability. Regulatory frameworks concerning environmental impact and product safety are crucial factors shaping the industry's trajectory. Product substitutes, such as synthetic polymers, pose a moderate competitive threat. End-user trends, especially in infrastructure development and green building initiatives, are impacting demand. M&A activities in the sector have been relatively frequent, with deal values averaging xx Million in recent years, reflecting the industry’s consolidation and expansion efforts. Several recent deals have focused on acquiring companies specializing in specific modifier types or geographic regions, further concentrating market power.

- Market Concentration: Moderately consolidated, with a few dominant players.

- Innovation Ecosystem: Dynamic, with focus on sustainable and high-performance products.

- Regulatory Framework: Stringent environmental and safety regulations are key influencers.

- Product Substitutes: Synthetic polymers pose a moderate threat.

- End-User Trends: Infrastructure development and green building drive demand.

- M&A Activities: Moderate level of activity, with deal values averaging xx Million.

Europe Modified Bitumen Industry Industry Trends & Insights

The European modified bitumen market is experiencing steady growth fueled by several factors. Increased investment in infrastructure projects, particularly road construction, is a significant driver. The rising adoption of sustainable building practices is another key factor, with modified bitumen finding increasing applications in green roofing. Technological advancements, such as the development of novel modifier types with enhanced performance characteristics, are also contributing to market expansion. Consumer preferences are shifting toward environmentally friendly and durable products, which presents both challenges and opportunities. The competitive landscape is intense, with companies investing heavily in R&D and strategic partnerships to maintain market share. The market penetration of modified bitumen in various applications is steadily increasing, reflecting its versatility and superior performance compared to traditional bitumen. This is evident in the rising use of modified bitumen in specialized applications like waterproofing membranes and pipe coatings. The CAGR is projected to remain at xx% over the forecast period, driven by sustained infrastructure development and increasing demand for high-performance roofing materials.

Dominant Markets & Segments in Europe Modified Bitumen Industry

- Dominant Region: Western Europe, driven by robust infrastructure development and high construction activity.

- Dominant Application: Road Construction, due to high volume usage in road paving and maintenance.

- Dominant Modifier Type: Styrene-butadiene-styrene (SBS), favored for its superior performance and flexibility.

- Dominant Application Method: Hot Asphalt, owing to established infrastructure and ease of application.

Key Drivers for Dominant Segments:

- Road Construction: Government investment in infrastructure, increasing vehicle traffic, and stringent road safety regulations.

- SBS Modifier: Superior properties like flexibility, durability and resistance to cracking compared to other modifiers.

- Hot Asphalt: Well-established infrastructure, ease of application, and suitability for large-scale projects.

Western Europe’s robust construction industry and government investments in infrastructure contribute significantly to the dominance of this region. The road construction segment benefits from large-scale projects and continuous maintenance requirements. SBS modifiers are preferred for their superior performance and suitability across various applications. The established infrastructure for hot asphalt application maintains its widespread use despite advancements in cold asphalt technologies.

Europe Modified Bitumen Industry Product Innovations

Recent innovations focus on enhancing the durability, sustainability, and performance of modified bitumen. New modifier types, such as bio-based polymers, are being developed to reduce reliance on petroleum-based materials. Improved manufacturing processes are leading to more efficient and cost-effective production. Innovations in application methods, like spray-applied systems, aim to improve application efficiency and reduce environmental impact. These innovations aim to cater to the increasing demand for sustainable and high-performance solutions in various applications.

Report Segmentation & Scope

This report segments the market by:

Application: Road Construction, Roofing and Piping, Other Applications. Road construction holds the largest market share, while roofing and piping segments show steady growth. Other applications include waterproofing membranes and industrial uses.

Modifier Type: Styrene-butadiene-styrene (SBS), Atactic Polypropylene (APP), Crumb Rubber, Natural Rubber, Other Modifier Types. SBS and APP dominate, but crumb rubber and other sustainable options are gaining traction.

Application Method: Hot Asphalt, Cold Asphalt, Torch-applied. Hot asphalt retains the largest share, but cold asphalt and torch-applied methods are gaining traction due to improved convenience and efficiency.

Each segment's market size and growth projections are detailed in the full report. Competitive dynamics vary across segments, with established players dominating some areas while newer entrants explore niches.

Key Drivers of Europe Modified Bitumen Industry Growth

The growth of the European modified bitumen industry is driven by several key factors: substantial infrastructure development projects across Europe, increasing demand for sustainable building materials reducing the carbon footprint, and government regulations promoting the use of environmentally friendly construction materials. These factors, combined with ongoing technological advancements in modifier types and application methods, are expected to fuel significant market expansion in the coming years.

Challenges in the Europe Modified Bitumen Industry Sector

The Europe modified bitumen industry faces several challenges. Fluctuations in crude oil prices significantly impact raw material costs, while environmental regulations are increasing pressure on manufacturers to adopt more sustainable practices. Competition from alternative waterproofing and roofing materials also impacts growth. Supply chain disruptions can cause delays and increased costs, presenting challenges to consistent production and timely delivery.

Leading Players in the Europe Modified Bitumen Industry Market

- ALMA PETROLI Spa

- Shell PLC

- BITUMINA HI-TECH PAVEMENT BINDERS LLC

- TotalEnergies

- Exxon Mobil Corporation

- Cepsa

- ROSNEFT

- ORLEN Asfalt Sp ZOO

- Repsol

- Gazprom Neft PJSC

- Nynas AB

- GRUPA LOTOS S A

- Eni S p A

- OMV Aktiengesellschaft

- Puma

- Colas SA

Key Developments in Europe Modified Bitumen Industry Sector

- 2022 Q4: Shell PLC announced a new sustainable modified bitumen product line.

- 2023 Q1: Repsol launched a new production facility for APP modified bitumen in Spain.

- 2023 Q2: A merger between two smaller modified bitumen manufacturers in Germany resulted in a new market entrant. (Further developments will be included in the full report.)

Strategic Europe Modified Bitumen Industry Market Outlook

The future of the European modified bitumen industry appears promising, with sustained growth anticipated driven by continued infrastructure investment and increasing adoption of sustainable construction practices. Strategic opportunities lie in developing innovative, eco-friendly products and expanding into emerging application areas. Companies that focus on sustainability, technological innovation, and efficient supply chains are poised for significant growth in the coming years.

Europe Modified Bitumen Industry Segmentation

-

1. Modifier Type

- 1.1. Styrene-butadiene-styrene (SBS)

- 1.2. Atactic Polypropylene (APP)

- 1.3. Crumb Rubber

- 1.4. Natural Rubber

- 1.5. Other Modifier Types

-

2. Application Method

- 2.1. Hot Asphalt

- 2.2. Cold Asphalt

- 2.3. Torch-applied

-

3. Application

- 3.1. Road Construction

- 3.2. Roofing and Piping

- 3.3. Other Applications

Europe Modified Bitumen Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. France

- 5. Spain

- 6. Rest of Europe

Europe Modified Bitumen Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Road Construction and Repair Activities; Increasing Building Renovation and Remodeling; Superior Quality of Modified Bitumen over Normal Bitumen

- 3.3. Market Restrains

- 3.3.1. Occupation Health Hazards Regarding Asphalt; Risk of Fire during Installation; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Road Construction Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Modified Bitumen Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Modifier Type

- 5.1.1. Styrene-butadiene-styrene (SBS)

- 5.1.2. Atactic Polypropylene (APP)

- 5.1.3. Crumb Rubber

- 5.1.4. Natural Rubber

- 5.1.5. Other Modifier Types

- 5.2. Market Analysis, Insights and Forecast - by Application Method

- 5.2.1. Hot Asphalt

- 5.2.2. Cold Asphalt

- 5.2.3. Torch-applied

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Road Construction

- 5.3.2. Roofing and Piping

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. Italy

- 5.4.4. France

- 5.4.5. Spain

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Modifier Type

- 6. Germany Europe Modified Bitumen Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Modifier Type

- 6.1.1. Styrene-butadiene-styrene (SBS)

- 6.1.2. Atactic Polypropylene (APP)

- 6.1.3. Crumb Rubber

- 6.1.4. Natural Rubber

- 6.1.5. Other Modifier Types

- 6.2. Market Analysis, Insights and Forecast - by Application Method

- 6.2.1. Hot Asphalt

- 6.2.2. Cold Asphalt

- 6.2.3. Torch-applied

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Road Construction

- 6.3.2. Roofing and Piping

- 6.3.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Modifier Type

- 7. United Kingdom Europe Modified Bitumen Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Modifier Type

- 7.1.1. Styrene-butadiene-styrene (SBS)

- 7.1.2. Atactic Polypropylene (APP)

- 7.1.3. Crumb Rubber

- 7.1.4. Natural Rubber

- 7.1.5. Other Modifier Types

- 7.2. Market Analysis, Insights and Forecast - by Application Method

- 7.2.1. Hot Asphalt

- 7.2.2. Cold Asphalt

- 7.2.3. Torch-applied

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Road Construction

- 7.3.2. Roofing and Piping

- 7.3.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Modifier Type

- 8. Italy Europe Modified Bitumen Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Modifier Type

- 8.1.1. Styrene-butadiene-styrene (SBS)

- 8.1.2. Atactic Polypropylene (APP)

- 8.1.3. Crumb Rubber

- 8.1.4. Natural Rubber

- 8.1.5. Other Modifier Types

- 8.2. Market Analysis, Insights and Forecast - by Application Method

- 8.2.1. Hot Asphalt

- 8.2.2. Cold Asphalt

- 8.2.3. Torch-applied

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Road Construction

- 8.3.2. Roofing and Piping

- 8.3.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Modifier Type

- 9. France Europe Modified Bitumen Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Modifier Type

- 9.1.1. Styrene-butadiene-styrene (SBS)

- 9.1.2. Atactic Polypropylene (APP)

- 9.1.3. Crumb Rubber

- 9.1.4. Natural Rubber

- 9.1.5. Other Modifier Types

- 9.2. Market Analysis, Insights and Forecast - by Application Method

- 9.2.1. Hot Asphalt

- 9.2.2. Cold Asphalt

- 9.2.3. Torch-applied

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Road Construction

- 9.3.2. Roofing and Piping

- 9.3.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Modifier Type

- 10. Spain Europe Modified Bitumen Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Modifier Type

- 10.1.1. Styrene-butadiene-styrene (SBS)

- 10.1.2. Atactic Polypropylene (APP)

- 10.1.3. Crumb Rubber

- 10.1.4. Natural Rubber

- 10.1.5. Other Modifier Types

- 10.2. Market Analysis, Insights and Forecast - by Application Method

- 10.2.1. Hot Asphalt

- 10.2.2. Cold Asphalt

- 10.2.3. Torch-applied

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Road Construction

- 10.3.2. Roofing and Piping

- 10.3.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Modifier Type

- 11. Rest of Europe Europe Modified Bitumen Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Modifier Type

- 11.1.1. Styrene-butadiene-styrene (SBS)

- 11.1.2. Atactic Polypropylene (APP)

- 11.1.3. Crumb Rubber

- 11.1.4. Natural Rubber

- 11.1.5. Other Modifier Types

- 11.2. Market Analysis, Insights and Forecast - by Application Method

- 11.2.1. Hot Asphalt

- 11.2.2. Cold Asphalt

- 11.2.3. Torch-applied

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Road Construction

- 11.3.2. Roofing and Piping

- 11.3.3. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Modifier Type

- 12. Germany Europe Modified Bitumen Industry Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Modified Bitumen Industry Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Modified Bitumen Industry Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Modified Bitumen Industry Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Modified Bitumen Industry Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Modified Bitumen Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Modified Bitumen Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 ALMA PETROLI Spa

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Shell PLC

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 BITUMINA HI-TECH PAVEMENT BINDERS LLC

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 TotalEnergies*List Not Exhaustive

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Exxon Mobil Corporation

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Cepsa

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 ROSNEFT

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 ORLEN Asfalt Sp ZOO

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Repsol

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Gazprom Neft PJSC

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.11 Nynas AB

- 19.2.11.1. Overview

- 19.2.11.2. Products

- 19.2.11.3. SWOT Analysis

- 19.2.11.4. Recent Developments

- 19.2.11.5. Financials (Based on Availability)

- 19.2.12 GRUPA LOTOS S A

- 19.2.12.1. Overview

- 19.2.12.2. Products

- 19.2.12.3. SWOT Analysis

- 19.2.12.4. Recent Developments

- 19.2.12.5. Financials (Based on Availability)

- 19.2.13 Eni S p A

- 19.2.13.1. Overview

- 19.2.13.2. Products

- 19.2.13.3. SWOT Analysis

- 19.2.13.4. Recent Developments

- 19.2.13.5. Financials (Based on Availability)

- 19.2.14 OMV Aktiengesellschaft

- 19.2.14.1. Overview

- 19.2.14.2. Products

- 19.2.14.3. SWOT Analysis

- 19.2.14.4. Recent Developments

- 19.2.14.5. Financials (Based on Availability)

- 19.2.15 Puma

- 19.2.15.1. Overview

- 19.2.15.2. Products

- 19.2.15.3. SWOT Analysis

- 19.2.15.4. Recent Developments

- 19.2.15.5. Financials (Based on Availability)

- 19.2.16 Colas SA

- 19.2.16.1. Overview

- 19.2.16.2. Products

- 19.2.16.3. SWOT Analysis

- 19.2.16.4. Recent Developments

- 19.2.16.5. Financials (Based on Availability)

- 19.2.1 ALMA PETROLI Spa

List of Figures

- Figure 1: Europe Modified Bitumen Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Modified Bitumen Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Modified Bitumen Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Modified Bitumen Industry Revenue Million Forecast, by Modifier Type 2019 & 2032

- Table 3: Europe Modified Bitumen Industry Revenue Million Forecast, by Application Method 2019 & 2032

- Table 4: Europe Modified Bitumen Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Europe Modified Bitumen Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Modified Bitumen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Modified Bitumen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Modified Bitumen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Modified Bitumen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Modified Bitumen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Modified Bitumen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Modified Bitumen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Modified Bitumen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Modified Bitumen Industry Revenue Million Forecast, by Modifier Type 2019 & 2032

- Table 15: Europe Modified Bitumen Industry Revenue Million Forecast, by Application Method 2019 & 2032

- Table 16: Europe Modified Bitumen Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Europe Modified Bitumen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Modified Bitumen Industry Revenue Million Forecast, by Modifier Type 2019 & 2032

- Table 19: Europe Modified Bitumen Industry Revenue Million Forecast, by Application Method 2019 & 2032

- Table 20: Europe Modified Bitumen Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Europe Modified Bitumen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Modified Bitumen Industry Revenue Million Forecast, by Modifier Type 2019 & 2032

- Table 23: Europe Modified Bitumen Industry Revenue Million Forecast, by Application Method 2019 & 2032

- Table 24: Europe Modified Bitumen Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Europe Modified Bitumen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Europe Modified Bitumen Industry Revenue Million Forecast, by Modifier Type 2019 & 2032

- Table 27: Europe Modified Bitumen Industry Revenue Million Forecast, by Application Method 2019 & 2032

- Table 28: Europe Modified Bitumen Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Europe Modified Bitumen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Modified Bitumen Industry Revenue Million Forecast, by Modifier Type 2019 & 2032

- Table 31: Europe Modified Bitumen Industry Revenue Million Forecast, by Application Method 2019 & 2032

- Table 32: Europe Modified Bitumen Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Europe Modified Bitumen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Modified Bitumen Industry Revenue Million Forecast, by Modifier Type 2019 & 2032

- Table 35: Europe Modified Bitumen Industry Revenue Million Forecast, by Application Method 2019 & 2032

- Table 36: Europe Modified Bitumen Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 37: Europe Modified Bitumen Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Modified Bitumen Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Europe Modified Bitumen Industry?

Key companies in the market include ALMA PETROLI Spa, Shell PLC, BITUMINA HI-TECH PAVEMENT BINDERS LLC, TotalEnergies*List Not Exhaustive, Exxon Mobil Corporation, Cepsa, ROSNEFT, ORLEN Asfalt Sp ZOO, Repsol, Gazprom Neft PJSC, Nynas AB, GRUPA LOTOS S A, Eni S p A, OMV Aktiengesellschaft, Puma, Colas SA.

3. What are the main segments of the Europe Modified Bitumen Industry?

The market segments include Modifier Type, Application Method, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Road Construction and Repair Activities; Increasing Building Renovation and Remodeling; Superior Quality of Modified Bitumen over Normal Bitumen.

6. What are the notable trends driving market growth?

Increasing Demand from Road Construction Activities.

7. Are there any restraints impacting market growth?

Occupation Health Hazards Regarding Asphalt; Risk of Fire during Installation; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Modified Bitumen Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Modified Bitumen Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Modified Bitumen Industry?

To stay informed about further developments, trends, and reports in the Europe Modified Bitumen Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence