Key Insights

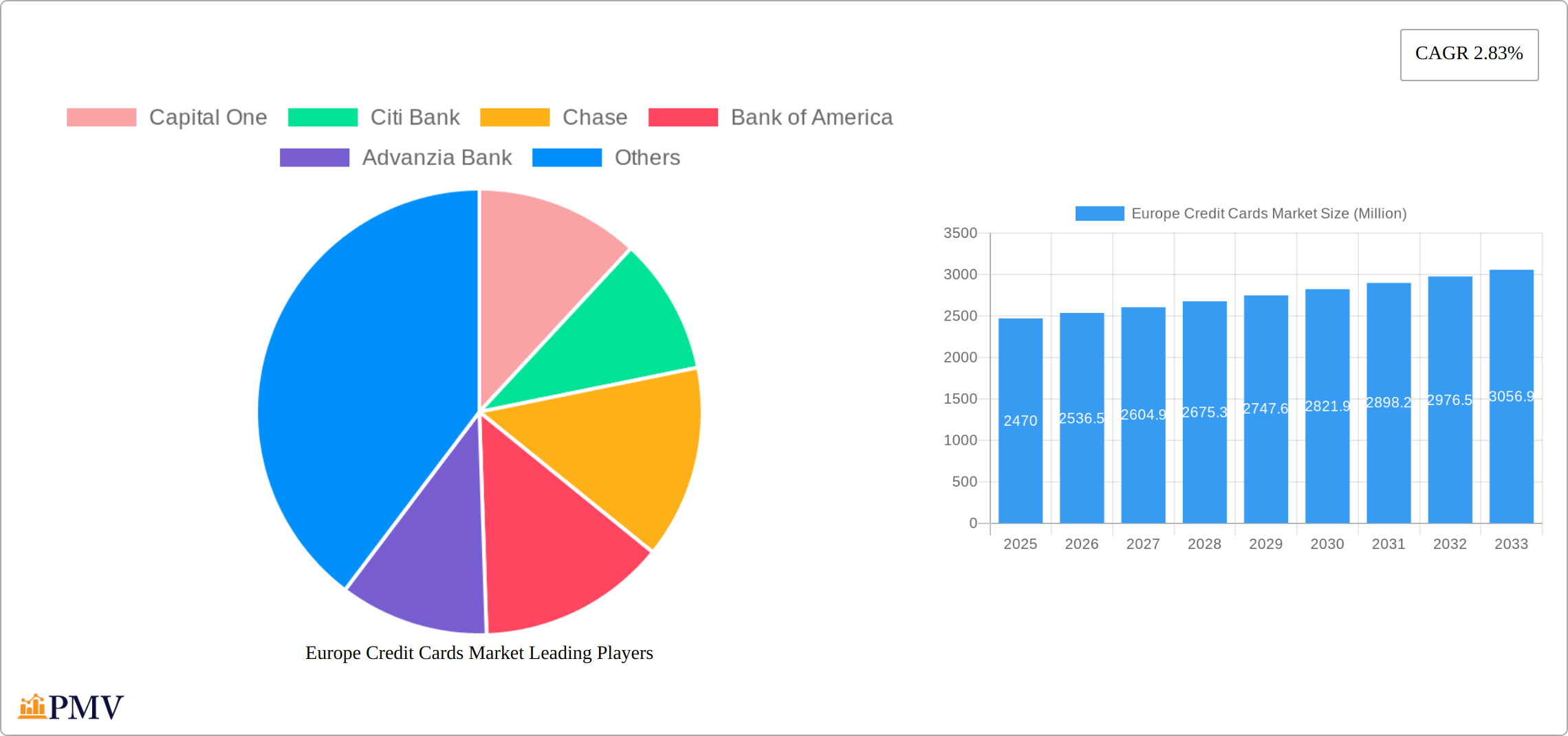

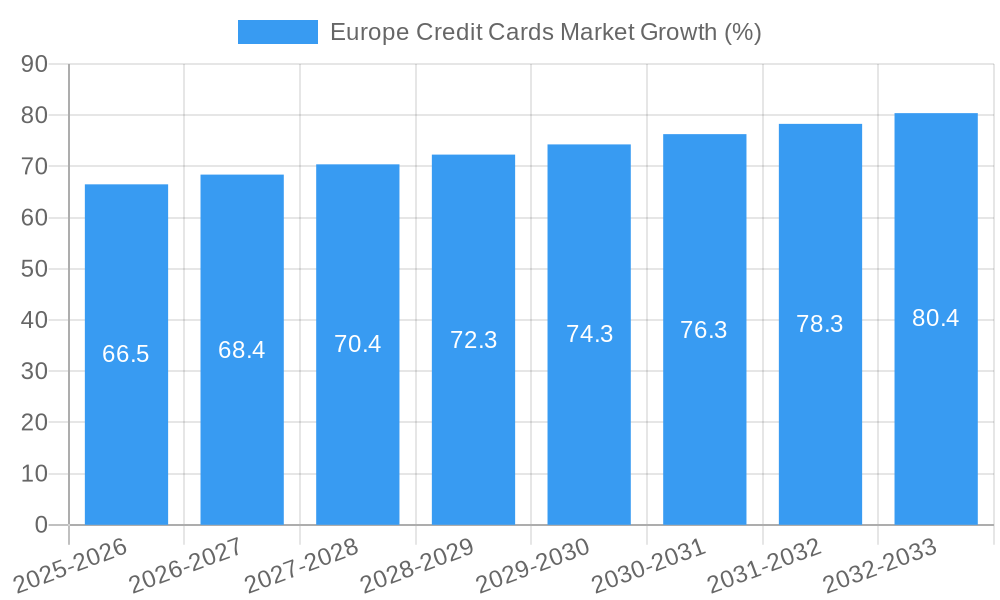

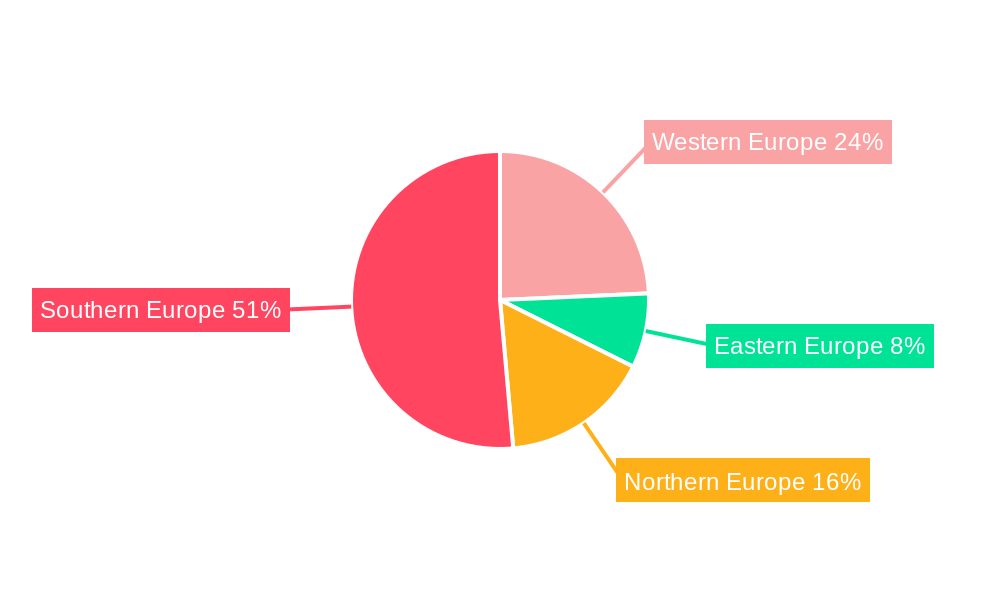

The European credit card market, valued at €2.47 billion in 2025, exhibits a steady growth trajectory, projected to expand at a compound annual growth rate (CAGR) of 2.83% from 2025 to 2033. This growth is fueled by several key factors. Increasing digitalization and the rise of e-commerce are driving a surge in contactless payments and online transactions, boosting credit card usage. Furthermore, the growing adoption of innovative payment technologies, such as mobile wallets and embedded finance solutions, is expanding the market's reach and convenience for consumers. Favorable regulatory environments in several European countries, promoting financial inclusion and facilitating access to credit, further contribute to market expansion. However, challenges remain, including concerns about consumer debt and the increasing prevalence of fraud, necessitating robust security measures from issuers. Competition among established players like Capital One, Citi Bank, Chase, Bank of America, and emerging fintech companies is intensifying, leading to innovative product offerings and competitive pricing strategies. The market's segmentation, while not explicitly detailed, likely encompasses various card types (e.g., rewards cards, secured cards, business cards) and customer demographics. Regional variations within Europe are expected, reflecting differences in economic development, consumer behavior, and regulatory landscapes.

The forecast period of 2025-2033 suggests a continued, albeit moderate, expansion of the European credit card market. Sustained economic growth across major European economies will be crucial in driving further adoption. The market’s future hinges on the successful navigation of emerging risks, including economic downturns, evolving consumer preferences, and the continuous adaptation to technological advancements in payment processing and security. Companies need to focus on offering personalized services, robust fraud prevention, and competitive rewards programs to maintain a strong market position. Strategic partnerships and mergers & acquisitions are likely to shape the competitive landscape in the coming years, potentially leading to market consolidation. The long-term outlook for the European credit card market remains positive, supported by the underlying trends of increasing digitalization and financial inclusion.

Europe Credit Cards Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe credit cards market, covering the period from 2019 to 2033. With a focus on market structure, competitive dynamics, industry trends, and future outlook, this report is an essential resource for industry professionals, investors, and strategic planners. The study period encompasses the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), providing a complete view of market evolution. The estimated market size for 2025 is xx Million.

Europe Credit Cards Market Market Structure & Competitive Dynamics

The European credit card market exhibits a moderately concentrated structure, with several major players holding significant market share. The market is characterized by intense competition, driven by both established financial institutions and new entrants leveraging technological advancements. Regulatory frameworks, varying across European nations, significantly impact market dynamics. Innovation ecosystems are thriving, with companies focusing on developing user-friendly interfaces, enhanced security features, and personalized rewards programs. Product substitutes, including debit cards and digital payment platforms, pose a competitive challenge, requiring credit card issuers to continuously innovate and offer compelling value propositions. End-user trends, particularly towards contactless payments and mobile banking, are reshaping market demands. M&A activities remain a significant aspect of market consolidation, with deal values reaching xx Million in recent years. Key players' market share is as follows (estimated 2025):

- Capital One: xx%

- Citi Bank: xx%

- Chase: xx%

- Bank of America: xx%

- Other Players: xx%

The largest M&A deal in the recent past was valued at xx Million. This deal involved (Company A) and (Company B), resulting in (mention specific impact on market share or innovation).

Europe Credit Cards Market Industry Trends & Insights

The European credit cards market is experiencing robust growth, driven by several key factors. Rising disposable incomes, expanding e-commerce penetration, and the increasing adoption of digital payment methods are primary growth drivers. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Technological disruptions, such as the proliferation of mobile wallets and contactless payment technologies, are fundamentally changing consumer behavior and payment preferences. Consumer preferences are shifting towards cards offering enhanced security features, personalized rewards, and seamless integration with digital platforms. Competitive dynamics remain intense, with companies vying for market share through product innovation, strategic partnerships, and aggressive marketing campaigns. Market penetration in major European markets is estimated to be around xx% in 2025.

Dominant Markets & Segments in Europe Credit Cards Market

The UK and Germany currently dominate the European credit card market, accounting for a combined xx% of the total market value.

Key Drivers of Dominance in the UK:

- Strong e-commerce infrastructure

- High consumer spending levels

- Favorable regulatory environment

Key Drivers of Dominance in Germany:

- Robust financial sector

- High consumer confidence

- Established digital payment infrastructure

Other significant markets include France, Spain, and Italy, each with unique market characteristics and growth trajectories. The premium credit card segment, characterized by high spending limits and exclusive rewards programs, is experiencing the fastest growth, driven by affluent consumers' demand for premium services.

Europe Credit Cards Market Product Innovations

Recent product innovations in the European credit cards market focus on enhanced security features, such as biometric authentication and advanced fraud detection systems. Contactless payment technology is becoming ubiquitous, with cards and mobile wallets offering convenient and fast transactions. Personalized reward programs, tailored to individual customer preferences, are gaining traction, improving customer loyalty. These innovations reflect the market's shift towards increased convenience, security, and personalized financial solutions.

Report Segmentation & Scope

The report segments the Europe credit cards market based on several key parameters:

By Card Type: Credit Cards, Debit Cards, Charge Cards, Prepaid Cards

By Issuer: Banks, Financial Institutions, Fintech companies

By Payment Network: Visa, Mastercard, American Express, Discover

By End-User: Individuals, Businesses

Each segment's growth projection, market size, and competitive dynamics are analyzed in detail in the report.

Key Drivers of Europe Credit Cards Market Growth

Several factors are driving the growth of the Europe credit cards market:

- Increased Adoption of Digital Payments: The shift toward contactless and online transactions fuels demand for credit cards.

- E-commerce Expansion: Online shopping necessitates convenient and secure payment methods, thereby boosting credit card usage.

- Favorable Regulatory Environment: Supportive government policies and regulations create a conducive environment for market expansion.

- Technological Advancements: Continuous innovation in security and convenience enhances consumer experience and market appeal.

Challenges in the Europe Credit Cards Market Sector

The Europe credit cards market faces several challenges:

- Stringent Regulations: Compliance with evolving regulations increases operational costs and complexity.

- Cybersecurity Threats: The increasing frequency of cyberattacks necessitates robust security measures, adding to operational expenses.

- Competition from Digital Payment Platforms: Alternative payment methods (e.g., mobile wallets) put pressure on traditional credit cards.

- Economic Downturns: Recessions can lead to decreased consumer spending and credit card usage.

Leading Players in the Europe Credit Cards Market Market

- Capital One

- Citi Bank

- Chase

- Bank of America

- Advanzia Bank

- AirPlus International

- Card Complete Group

- Cornèr Bank

- International Card Services BV

- RegioBank

List Not Exhaustive

Key Developments in Europe Credit Cards Market Sector

February 2023: ASOS and Capital One UK announced a new credit card partnership, expected to launch a co-branded card later in the year. This partnership is likely to significantly enhance Capital One's market share within the UK and attract new customers to the ASOS platform.

November 2022: CTS EVENTIM launched its branded credit card issued by Advanzia Bank, integrating a loyalty program and enhancing customer engagement. This development expands Advanzia Bank's reach into the entertainment sector and enhances the appeal of their credit card products.

Strategic Europe Credit Cards Market Market Outlook

The European credit cards market is poised for continued growth, driven by sustained economic expansion, rising consumer spending, and technological innovation. Strategic opportunities exist in expanding into underserved markets, focusing on niche segments, and leveraging data analytics to personalize offerings. Companies that effectively adapt to evolving consumer preferences, implement robust security measures, and leverage technological advancements are well-positioned to capitalize on future market growth. The increasing importance of sustainable finance initiatives presents both challenges and opportunities for credit card issuers to align with ESG goals.

Europe Credit Cards Market Segmentation

-

1. Card Type

- 1.1. General Purpose Credit Cards

- 1.2. Specialty & Other Credit Cards

-

2. Application

- 2.1. Food & Groceries

- 2.2. Health & Pharmacy

- 2.3. Restaurants & Bars

- 2.4. Consumer Electronics

- 2.5. Media & Entertainment

- 2.6. Travel & Tourism

- 2.7. Other Applications

-

3. Provider

- 3.1. Visa

- 3.2. MasterCard

- 3.3. Other Providers

Europe Credit Cards Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Credit Cards Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.83% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Usage of Credit Card give the bonus and reward points

- 3.3. Market Restrains

- 3.3.1. Usage of Credit Card give the bonus and reward points

- 3.4. Market Trends

- 3.4.1. Increasing Card Transactions in Europe have a Major Impact on Credit Card

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Credit Cards Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. General Purpose Credit Cards

- 5.1.2. Specialty & Other Credit Cards

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food & Groceries

- 5.2.2. Health & Pharmacy

- 5.2.3. Restaurants & Bars

- 5.2.4. Consumer Electronics

- 5.2.5. Media & Entertainment

- 5.2.6. Travel & Tourism

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Provider

- 5.3.1. Visa

- 5.3.2. MasterCard

- 5.3.3. Other Providers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Capital One

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Citi Bank

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chase

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bank of America

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Advanzia Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AirPlus International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Card complete Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cornèr Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 International Card Services BV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 RegioBank**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Capital One

List of Figures

- Figure 1: Europe Credit Cards Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Credit Cards Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Credit Cards Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Credit Cards Market Volume Trillion Forecast, by Region 2019 & 2032

- Table 3: Europe Credit Cards Market Revenue Million Forecast, by Card Type 2019 & 2032

- Table 4: Europe Credit Cards Market Volume Trillion Forecast, by Card Type 2019 & 2032

- Table 5: Europe Credit Cards Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Europe Credit Cards Market Volume Trillion Forecast, by Application 2019 & 2032

- Table 7: Europe Credit Cards Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 8: Europe Credit Cards Market Volume Trillion Forecast, by Provider 2019 & 2032

- Table 9: Europe Credit Cards Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Europe Credit Cards Market Volume Trillion Forecast, by Region 2019 & 2032

- Table 11: Europe Credit Cards Market Revenue Million Forecast, by Card Type 2019 & 2032

- Table 12: Europe Credit Cards Market Volume Trillion Forecast, by Card Type 2019 & 2032

- Table 13: Europe Credit Cards Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Europe Credit Cards Market Volume Trillion Forecast, by Application 2019 & 2032

- Table 15: Europe Credit Cards Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 16: Europe Credit Cards Market Volume Trillion Forecast, by Provider 2019 & 2032

- Table 17: Europe Credit Cards Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Credit Cards Market Volume Trillion Forecast, by Country 2019 & 2032

- Table 19: United Kingdom Europe Credit Cards Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United Kingdom Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 21: Germany Europe Credit Cards Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 23: France Europe Credit Cards Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 25: Italy Europe Credit Cards Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Italy Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 27: Spain Europe Credit Cards Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 29: Netherlands Europe Credit Cards Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Netherlands Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 31: Belgium Europe Credit Cards Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Belgium Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 33: Sweden Europe Credit Cards Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Sweden Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 35: Norway Europe Credit Cards Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Norway Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 37: Poland Europe Credit Cards Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Poland Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 39: Denmark Europe Credit Cards Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Denmark Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Credit Cards Market?

The projected CAGR is approximately 2.83%.

2. Which companies are prominent players in the Europe Credit Cards Market?

Key companies in the market include Capital One, Citi Bank, Chase, Bank of America, Advanzia Bank, AirPlus International, Card complete Group, Cornèr Bank, International Card Services BV, RegioBank**List Not Exhaustive.

3. What are the main segments of the Europe Credit Cards Market?

The market segments include Card Type, Application, Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Usage of Credit Card give the bonus and reward points.

6. What are the notable trends driving market growth?

Increasing Card Transactions in Europe have a Major Impact on Credit Card.

7. Are there any restraints impacting market growth?

Usage of Credit Card give the bonus and reward points.

8. Can you provide examples of recent developments in the market?

February 2023: ASOS, the global online fashion destination, and Capital One UK announced a new and exclusive credit card partnership. The partnership will likely launch a new ASOS credit card for eligible shoppers, available later this year. It is projected to provide a range of features and benefits that only come with using a credit card when they shop at ASOS and elsewhere, such as Section 75 protection on purchases over EUR 100.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Credit Cards Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Credit Cards Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Credit Cards Market?

To stay informed about further developments, trends, and reports in the Europe Credit Cards Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence