Key Insights

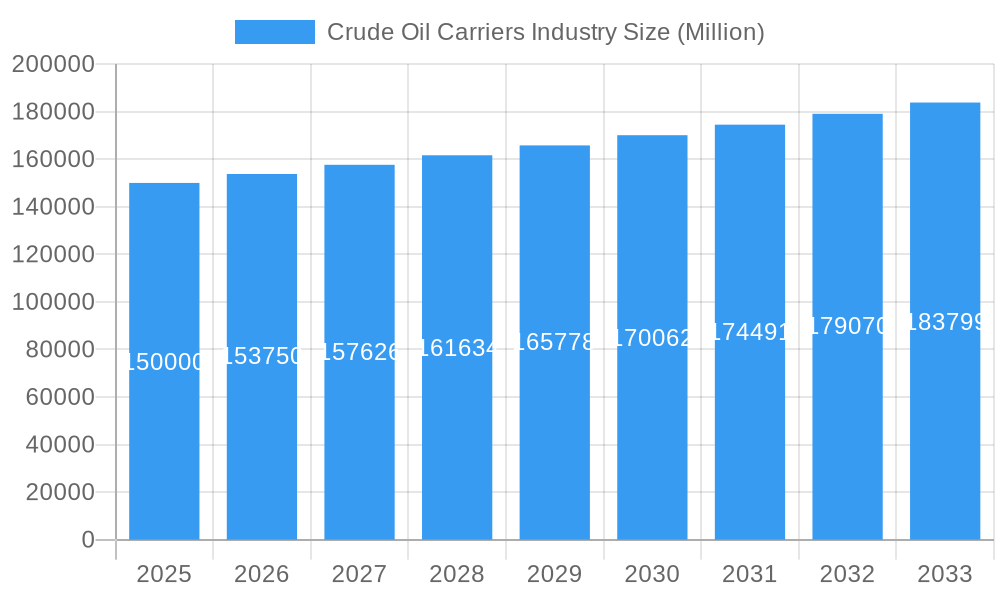

The global crude oil carrier market, valued at $225142.8 million in 2025, is poised for significant expansion with a compound annual growth rate (CAGR) of 4.6% from 2025 to 2033. This growth is propelled by escalating worldwide demand for crude oil, driven by economic development in emerging economies and the ongoing reliance on oil for energy. The industry also benefits from a trend towards larger vessels, such as VLCCs and ULCCs, for enhanced economies of scale. Technological advancements in vessel design and operational efficiency, including fuel efficiency and emission reduction, are further shaping the market. However, challenges persist, including volatile oil prices, geopolitical instability affecting trade routes, and increasing environmental regulations.

Crude Oil Carriers Industry Market Size (In Billion)

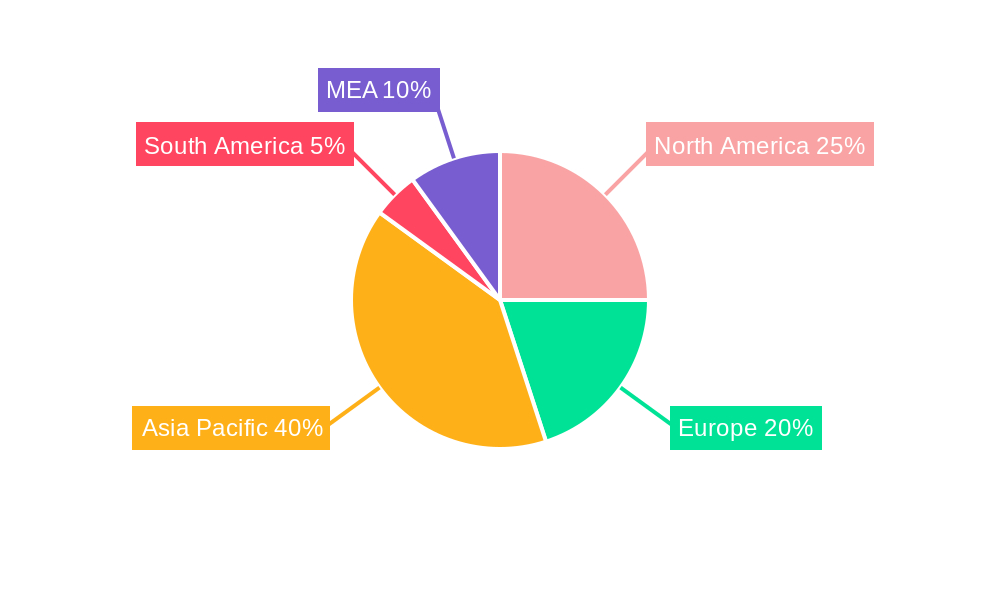

The market is segmented by vessel size, including Medium Range, Panamax, Aframax, Suezmax, VLCC, and ULCC. Larger vessels are dominant in long-haul crude oil transportation. The competitive landscape features a blend of major multinational corporations and specialized operators. Key players vie for market share through operational efficiency, fleet size, and strategic collaborations. Significant market share is anticipated in the Asia-Pacific region, fueled by demand from China and India, while North America and Europe will remain crucial due to their established energy infrastructure. The Middle East and Africa, as major oil-producing regions, will maintain a strong presence. Future growth will depend on balancing supply and demand, the global economic climate, and effectively addressing environmental risks and regulatory compliance. Strategic partnerships, technological investments, and a commitment to sustainable practices will be vital for success.

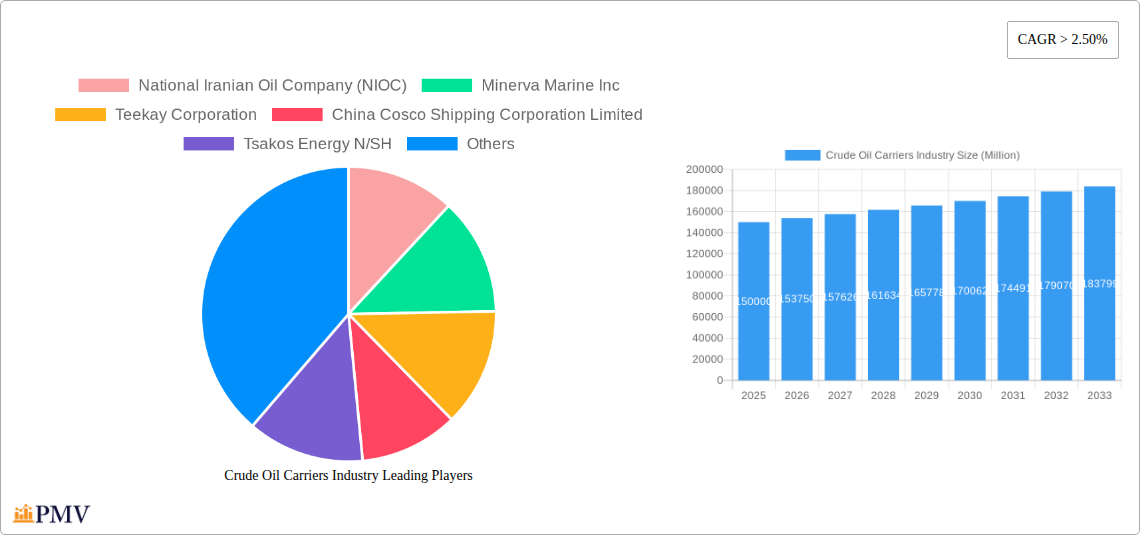

Crude Oil Carriers Industry Company Market Share

This report offers a comprehensive analysis of the crude oil carriers industry, examining market structure, competitive dynamics, industry trends, dominant segments, product innovations, and future prospects. The study covers the period from 2019 to 2033, with 2025 as the base year and 2025-2033 as the forecast period. It is an indispensable resource for industry professionals, investors, and stakeholders seeking detailed insights into this critical sector.

Crude Oil Carriers Industry Market Structure & Competitive Dynamics

The global crude oil carriers market exhibits a moderately concentrated structure, with several major players commanding significant market share. The industry is characterized by intense competition, driven by factors including fluctuating oil prices, vessel capacity, and evolving regulatory landscapes. Key players such as Teekay Corporation, China Cosco Shipping Corporation Limited, Euronav NV, and others compete fiercely on price, service quality, and fleet size. Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values averaging xx Million annually during the historical period (2019-2024).

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Innovation Ecosystems: Focus is on enhancing vessel efficiency (fuel consumption, emissions), digitalization of operations, and improved safety standards.

- Regulatory Frameworks: IMO 2020 regulations and other environmental concerns significantly impact operational costs and investment decisions.

- Product Substitutes: While limited direct substitutes exist, alternative transportation methods such as pipelines and rail are considered in certain contexts.

- End-User Trends: Demand is heavily influenced by global oil production and consumption patterns, geopolitical events, and economic growth.

- M&A Activities: While xx Million in M&A activity was observed in 2024, future activity is projected to increase driven by consolidation and expansion strategies.

Crude Oil Carriers Industry Industry Trends & Insights

The crude oil carriers market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by increasing global oil demand, particularly in emerging economies, and the ongoing need for efficient oil transportation. However, the industry faces challenges from volatile oil prices, fluctuating demand, and tightening environmental regulations. Market penetration of new technologies like scrubber systems and alternative fuels is expected to increase, driven by stricter emission standards and growing environmental awareness. This is also influencing vessel design and construction, impacting the lifecycle of existing vessels and overall market dynamics. Competitive dynamics remain intense, with companies focusing on fleet modernization, cost optimization, and strategic partnerships.

Dominant Markets & Segments in Crude Oil Carriers Industry

The Very Large Crude Carriers (VLCC) segment continues to be the cornerstone of the crude oil carriers market, projected to account for approximately 60-65% of the total market volume in 2025. This sustained dominance is a direct consequence of their unparalleled cargo-carrying capacity, rendering them the most cost-effective solution for transporting vast quantities of crude oil over extensive international routes.

- Key Drivers for VLCC Dominance:

- Economies of Scale: VLCCs offer the lowest transportation cost per barrel, making them indispensable for high-volume trade.

- Strategic Infrastructure: Major global ports and refining hubs are specifically designed and equipped to accommodate the logistical requirements of VLCC operations.

- Global Trade Route Suitability: Their size and efficiency are perfectly aligned with the demands of long-haul crude oil transportation, connecting major production centers to key consumption markets.

Beyond VLCCs, other significant segments include Suezmax, Aframax, Panamax, and Medium Range (MR) vessels, each serving distinct trade routes and cargo sizes. Geographically, demand is heavily concentrated in pivotal oil-producing regions such as the Middle East, and major consuming areas in the Asia-Pacific and North America. While this regional distribution is expected to remain largely stable, evolving energy policies, emerging production sources, and geopolitical shifts may necessitate dynamic adjustments in vessel deployment strategies to meet localized demand surges.

Crude Oil Carriers Industry Product Innovations

The contemporary landscape of crude oil carriers is characterized by a robust wave of innovations centered on enhancing fuel efficiency, significantly reducing emissions, and elevating operational safety. This proactive approach is driven by evolving regulatory frameworks and increasing environmental consciousness. Notable advancements include the widespread adoption of scrubbers to comply with International Maritime Organization (IMO) 2020 sulfur emission regulations, the pioneering development of dual-fuel vessels capable of utilizing cleaner alternatives like Liquefied Natural Gas (LNG) alongside traditional heavy fuel oil, and the sophisticated integration of advanced digital technologies for real-time vessel monitoring, predictive maintenance, and route optimization. These innovations are instrumental in improving the environmental footprint and operational efficacy of crude oil carriers, ensuring alignment with stringent industry standards and growing market expectations for sustainable shipping practices.

Report Segmentation & Scope

This comprehensive report segments the crude oil carriers market by vessel size, encompassing: Medium Range (MR), Panamax, Aframax, Suezmax, Very Large Crude Carriers (VLCC), and Ultra Large Crude Carriers (ULCC). Each segment is subjected to a detailed analysis of its market size, projected growth trajectories, and the prevailing competitive dynamics. While the MR segment is anticipated to experience modest, steady growth, the VLCC and ULCC segments are projected to maintain their market leadership. However, their growth rates are expected to decelerate beyond 2028, influenced by increasing fleet capacities and the overarching impact of global environmental considerations. The Aframax and Suezmax segments are forecast to exhibit consistent and stable growth, catering to specific regional and cargo demands. The Panamax segment, while important for certain trade lanes, is expected to remain a more niche market in comparison to the larger vessel classes.

Key Drivers of Crude Oil Carriers Industry Growth

The crude oil carriers industry is propelled by a confluence of robust economic and operational factors:

- Sustained and Rising Global Oil Demand: A fundamental driver, particularly fueled by the expanding industrial and transportation needs of emerging economies and developing nations.

- Increased Global Oil Production: The exploration and exploitation of new oil reserves and the revitalization of existing fields worldwide contribute to a greater volume of crude oil requiring transportation.

- Expansion of Global Trade: A growing interconnectedness of economies necessitates the efficient and large-scale movement of essential commodities like crude oil across continents.

- Technological Advancements: Continuous innovation in vessel design, propulsion systems, and operational technologies significantly enhances fuel efficiency, reduces environmental impact, and improves overall safety and reliability.

Challenges in the Crude Oil Carriers Industry Sector

Despite its growth, the crude oil carriers industry grapples with several significant challenges:

- Oil Price Volatility: Fluctuations in crude oil prices have a direct and substantial impact on the profitability of shipping operations, affecting charter rates and investment decisions.

- Stringent Environmental Regulations: The increasing imposition of strict environmental standards, such as emission control areas and ballast water management systems, necessitates significant capital investment and can increase operational costs.

- Geopolitical Risks: Instability in key oil-producing regions, trade disputes, and conflicts can disrupt supply chains, impact trade routes, and create uncertainty for shipping operations.

- Fleet Overcapacity: In certain vessel segments, particularly VLCCs and ULCCs, an imbalance between fleet size and demand can lead to downward pressure on freight rates, impacting profitability and market stability.

Leading Players in the Crude Oil Carriers Industry Market

- National Iranian Oil Company (NIOC)

- Minerva Marine Inc

- Teekay Corporation

- China Cosco Shipping Corporation Limited

- Tsakos Energy N/SH

- China Merchants Group Ltd

- Euronav NV

- Petroliam Nasional Berhad (PETRONAS)

- The National Shipping Co Saudi Arabia

- Angelicoussis Shipping Group Ltd

Key Developments in Crude Oil Carriers Industry Sector

- 2022 Q4: Increased investment in LNG-fueled vessels by major players.

- 2023 Q1: Implementation of stricter emission standards by several port authorities.

- 2024 Q2: Significant M&A activity involving consolidation of smaller players.

- 2025 Q1: Launch of several newbuild VLCCs equipped with advanced technologies.

Strategic Crude Oil Carriers Industry Market Outlook

The future of the crude oil carriers industry is characterized by a confluence of factors. While the demand for crude oil is expected to remain strong in the medium term, it will be significantly impacted by the global transition to renewable energy sources. This transition will likely necessitate a shift towards more sustainable and environmentally friendly operations, including investments in alternative fuels and emission reduction technologies. The industry will need to adapt and innovate to stay competitive, navigating the evolving regulatory landscape and optimizing vessel operations to maintain profitability. Strategic opportunities lie in investing in modern, efficient vessels equipped for stricter environmental norms, leveraging technological advancements, and forming strategic partnerships to access new markets and improve efficiency.

Crude Oil Carriers Industry Segmentation

-

1. Size

- 1.1. Medium Range

- 1.2. Panaxax

- 1.3. Aframax

- 1.4. Suezmax

- 1.5. Very Lar

Crude Oil Carriers Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East

Crude Oil Carriers Industry Regional Market Share

Geographic Coverage of Crude Oil Carriers Industry

Crude Oil Carriers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Electricity Demand; Rising Investments in the Coal Industry

- 3.3. Market Restrains

- 3.3.1. Increasing Installation of Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Very Large Crude Carrier to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Crude Oil Carriers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Size

- 5.1.1. Medium Range

- 5.1.2. Panaxax

- 5.1.3. Aframax

- 5.1.4. Suezmax

- 5.1.5. Very Lar

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Size

- 6. North America Crude Oil Carriers Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Size

- 6.1.1. Medium Range

- 6.1.2. Panaxax

- 6.1.3. Aframax

- 6.1.4. Suezmax

- 6.1.5. Very Lar

- 6.1. Market Analysis, Insights and Forecast - by Size

- 7. Europe Crude Oil Carriers Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Size

- 7.1.1. Medium Range

- 7.1.2. Panaxax

- 7.1.3. Aframax

- 7.1.4. Suezmax

- 7.1.5. Very Lar

- 7.1. Market Analysis, Insights and Forecast - by Size

- 8. Asia Pacific Crude Oil Carriers Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Size

- 8.1.1. Medium Range

- 8.1.2. Panaxax

- 8.1.3. Aframax

- 8.1.4. Suezmax

- 8.1.5. Very Lar

- 8.1. Market Analysis, Insights and Forecast - by Size

- 9. South America Crude Oil Carriers Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Size

- 9.1.1. Medium Range

- 9.1.2. Panaxax

- 9.1.3. Aframax

- 9.1.4. Suezmax

- 9.1.5. Very Lar

- 9.1. Market Analysis, Insights and Forecast - by Size

- 10. Middle East Crude Oil Carriers Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Size

- 10.1.1. Medium Range

- 10.1.2. Panaxax

- 10.1.3. Aframax

- 10.1.4. Suezmax

- 10.1.5. Very Lar

- 10.1. Market Analysis, Insights and Forecast - by Size

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 National Iranian Oil Company (NIOC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Minerva Marine Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Teekay Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Cosco Shipping Corporation Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tsakos Energy N/SH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China Merchants Group Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Euronav NV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Petroliam Nasional Berhad (PETRONAS)*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The National Shipping Co Saudi Arabia

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Angelicoussis Shipping Group Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 National Iranian Oil Company (NIOC)

List of Figures

- Figure 1: Global Crude Oil Carriers Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Crude Oil Carriers Industry Volume Breakdown (metric tonnes, %) by Region 2025 & 2033

- Figure 3: North America Crude Oil Carriers Industry Revenue (million), by Size 2025 & 2033

- Figure 4: North America Crude Oil Carriers Industry Volume (metric tonnes), by Size 2025 & 2033

- Figure 5: North America Crude Oil Carriers Industry Revenue Share (%), by Size 2025 & 2033

- Figure 6: North America Crude Oil Carriers Industry Volume Share (%), by Size 2025 & 2033

- Figure 7: North America Crude Oil Carriers Industry Revenue (million), by Country 2025 & 2033

- Figure 8: North America Crude Oil Carriers Industry Volume (metric tonnes), by Country 2025 & 2033

- Figure 9: North America Crude Oil Carriers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Crude Oil Carriers Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Crude Oil Carriers Industry Revenue (million), by Size 2025 & 2033

- Figure 12: Europe Crude Oil Carriers Industry Volume (metric tonnes), by Size 2025 & 2033

- Figure 13: Europe Crude Oil Carriers Industry Revenue Share (%), by Size 2025 & 2033

- Figure 14: Europe Crude Oil Carriers Industry Volume Share (%), by Size 2025 & 2033

- Figure 15: Europe Crude Oil Carriers Industry Revenue (million), by Country 2025 & 2033

- Figure 16: Europe Crude Oil Carriers Industry Volume (metric tonnes), by Country 2025 & 2033

- Figure 17: Europe Crude Oil Carriers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Crude Oil Carriers Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Crude Oil Carriers Industry Revenue (million), by Size 2025 & 2033

- Figure 20: Asia Pacific Crude Oil Carriers Industry Volume (metric tonnes), by Size 2025 & 2033

- Figure 21: Asia Pacific Crude Oil Carriers Industry Revenue Share (%), by Size 2025 & 2033

- Figure 22: Asia Pacific Crude Oil Carriers Industry Volume Share (%), by Size 2025 & 2033

- Figure 23: Asia Pacific Crude Oil Carriers Industry Revenue (million), by Country 2025 & 2033

- Figure 24: Asia Pacific Crude Oil Carriers Industry Volume (metric tonnes), by Country 2025 & 2033

- Figure 25: Asia Pacific Crude Oil Carriers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Crude Oil Carriers Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: South America Crude Oil Carriers Industry Revenue (million), by Size 2025 & 2033

- Figure 28: South America Crude Oil Carriers Industry Volume (metric tonnes), by Size 2025 & 2033

- Figure 29: South America Crude Oil Carriers Industry Revenue Share (%), by Size 2025 & 2033

- Figure 30: South America Crude Oil Carriers Industry Volume Share (%), by Size 2025 & 2033

- Figure 31: South America Crude Oil Carriers Industry Revenue (million), by Country 2025 & 2033

- Figure 32: South America Crude Oil Carriers Industry Volume (metric tonnes), by Country 2025 & 2033

- Figure 33: South America Crude Oil Carriers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Crude Oil Carriers Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East Crude Oil Carriers Industry Revenue (million), by Size 2025 & 2033

- Figure 36: Middle East Crude Oil Carriers Industry Volume (metric tonnes), by Size 2025 & 2033

- Figure 37: Middle East Crude Oil Carriers Industry Revenue Share (%), by Size 2025 & 2033

- Figure 38: Middle East Crude Oil Carriers Industry Volume Share (%), by Size 2025 & 2033

- Figure 39: Middle East Crude Oil Carriers Industry Revenue (million), by Country 2025 & 2033

- Figure 40: Middle East Crude Oil Carriers Industry Volume (metric tonnes), by Country 2025 & 2033

- Figure 41: Middle East Crude Oil Carriers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East Crude Oil Carriers Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Crude Oil Carriers Industry Revenue million Forecast, by Size 2020 & 2033

- Table 2: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Size 2020 & 2033

- Table 3: Global Crude Oil Carriers Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Region 2020 & 2033

- Table 5: Global Crude Oil Carriers Industry Revenue million Forecast, by Size 2020 & 2033

- Table 6: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Size 2020 & 2033

- Table 7: Global Crude Oil Carriers Industry Revenue million Forecast, by Country 2020 & 2033

- Table 8: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Country 2020 & 2033

- Table 9: Global Crude Oil Carriers Industry Revenue million Forecast, by Size 2020 & 2033

- Table 10: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Size 2020 & 2033

- Table 11: Global Crude Oil Carriers Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Country 2020 & 2033

- Table 13: Global Crude Oil Carriers Industry Revenue million Forecast, by Size 2020 & 2033

- Table 14: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Size 2020 & 2033

- Table 15: Global Crude Oil Carriers Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Country 2020 & 2033

- Table 17: Global Crude Oil Carriers Industry Revenue million Forecast, by Size 2020 & 2033

- Table 18: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Size 2020 & 2033

- Table 19: Global Crude Oil Carriers Industry Revenue million Forecast, by Country 2020 & 2033

- Table 20: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Country 2020 & 2033

- Table 21: Global Crude Oil Carriers Industry Revenue million Forecast, by Size 2020 & 2033

- Table 22: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Size 2020 & 2033

- Table 23: Global Crude Oil Carriers Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: Global Crude Oil Carriers Industry Volume metric tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Crude Oil Carriers Industry?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Crude Oil Carriers Industry?

Key companies in the market include National Iranian Oil Company (NIOC), Minerva Marine Inc, Teekay Corporation, China Cosco Shipping Corporation Limited, Tsakos Energy N/SH, China Merchants Group Ltd, Euronav NV, Petroliam Nasional Berhad (PETRONAS)*List Not Exhaustive, The National Shipping Co Saudi Arabia, Angelicoussis Shipping Group Ltd.

3. What are the main segments of the Crude Oil Carriers Industry?

The market segments include Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 225142.8 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Electricity Demand; Rising Investments in the Coal Industry.

6. What are the notable trends driving market growth?

Very Large Crude Carrier to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Installation of Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Crude Oil Carriers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Crude Oil Carriers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Crude Oil Carriers Industry?

To stay informed about further developments, trends, and reports in the Crude Oil Carriers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence