Key Insights

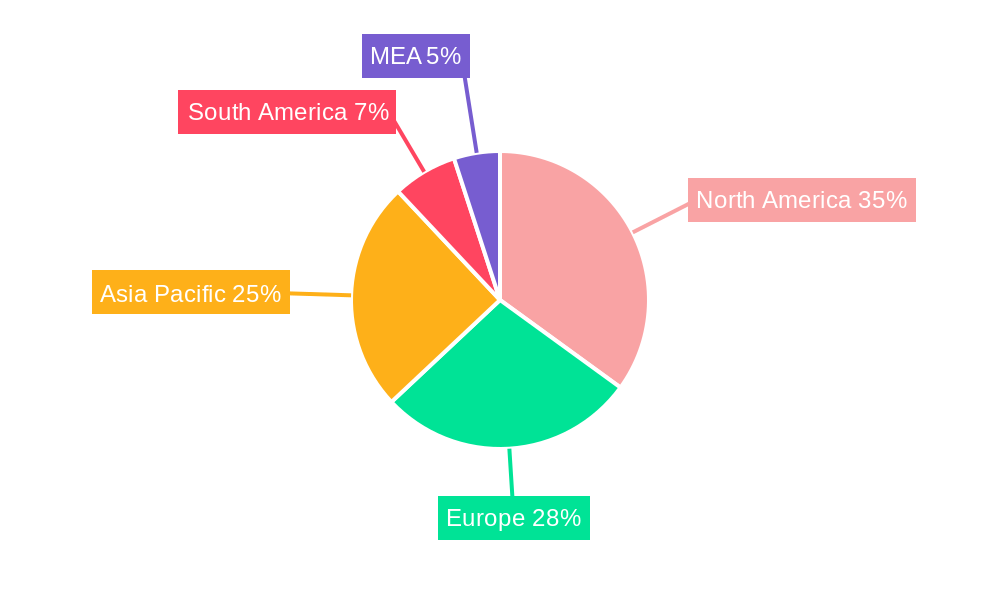

The consumer biometrics market is poised for substantial growth, propelled by the escalating demand for secure and intuitive authentication across diverse applications. Expected to reach $53.22 billion by 2025, this market, with a projected CAGR of 12.3% from 2025 to 2033, is driven by the widespread adoption of biometric-enabled smartphones, tablets, and wearables. Emerging opportunities are also surfacing in automotive applications and the expanding Internet of Things (IoT) ecosystem. Government-led digital identity initiatives further support market expansion. While fingerprint recognition leads in sensing modules, advancements in face and iris recognition are rapidly increasing their market share due to enhanced accuracy and user experience. North America and Asia Pacific currently lead in market dominance, attributed to high technology penetration and robust consumer electronics sectors.

Consumer Biometrics Industry Market Size (In Billion)

Despite positive growth trajectories, the market confronts challenges including data privacy concerns, implementation costs, and the inherent variability in biometric accuracy. Ongoing advancements in algorithms and hardware integration are crucial for addressing these limitations. Nevertheless, the long-term outlook remains optimistic, fueled by continuous innovation in multi-modal authentication, improved precision, and cost reduction, creating significant opportunities for both established and emerging companies.

Consumer Biometrics Industry Company Market Share

This report delivers an in-depth analysis of the global Consumer Biometrics market, providing critical insights into market dynamics, competitive landscapes, and future growth prospects. The analysis covers the period from 2019 to 2033, with 2025 as the base year. Segmentation includes sensing modules (fingerprint, face recognition, eye/iris recognition) and end-users (automotive, smartphone/tablet, PC/laptop, wearables, IoT devices, and others). The market size in 2025 is estimated at $53.22 billion.

Consumer Biometrics Industry Market Structure & Competitive Dynamics

The Consumer Biometrics market exhibits a moderately concentrated structure, with several key players commanding significant market share. The industry's innovation ecosystem is highly dynamic, fueled by continuous advancements in sensor technology, AI algorithms, and miniaturization. Regulatory frameworks, particularly concerning data privacy and security (e.g., GDPR, CCPA), significantly influence market dynamics. Product substitutes, such as traditional password-based authentication systems, pose a challenge, though their limitations are increasingly apparent. End-user trends show a strong preference for seamless and secure authentication solutions, driving demand for biometrics. Mergers and acquisitions (M&A) activity has been substantial, with deal values exceeding $xx Million in recent years. Key M&A activities include [Insert Specific M&A deals and values if available, otherwise use estimated figures and describe the nature of the deals]. For example, a significant deal involved the acquisition of [Company A] by [Company B] for an estimated $xx Million, leading to increased market consolidation. The market share distribution among top players is as follows: [Provide approximate market share for top 3-5 players. If unavailable, estimate based on publicly available information].

- High Market Concentration: Top 5 players hold approximately xx% of the market share.

- Significant M&A Activity: Deal values exceeding $xx Million in the last 5 years reflect industry consolidation.

- Stringent Regulatory Landscape: GDPR, CCPA, and other regulations impact data privacy and security considerations.

Consumer Biometrics Industry Industry Trends & Insights

The Consumer Biometrics market is experiencing robust growth, driven by several key factors. The increasing adoption of smartphones and other smart devices is a primary driver, fueling demand for secure and convenient authentication solutions. Technological advancements, such as improved sensor accuracy, faster processing speeds, and more sophisticated algorithms, are constantly enhancing the performance and reliability of biometric systems. Consumer preference for seamless user experiences and heightened security concerns are also significant growth catalysts. The compound annual growth rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, driven by factors such as the increasing adoption of biometric authentication in various applications, technological advancements, and rising security concerns. Market penetration is projected to reach xx% by 2033. Competitive dynamics are characterized by intense innovation, strategic partnerships, and M&A activities, leading to a rapidly evolving market landscape. The rise of AI and machine learning is improving biometric accuracy and security. [Provide specific examples of successful product launches and their impact on the market].

Dominant Markets & Segments in Consumer Biometrics Industry

The Smartphone/Tablet segment holds the largest market share within the end-user category, driven by the ubiquitous nature of these devices and the increasing integration of biometric authentication features. The Fingerprint sensing module segment dominates the overall market, due to its maturity, cost-effectiveness, and wide-spread adoption. Geographically, North America and Asia-Pacific regions are leading the market due to high technological advancements, increased smartphone penetration, and robust government support for biometric technology.

- Key Drivers for Smartphone/Tablet Segment:

- High Smartphone Penetration

- Growing Demand for Enhanced Security

- Integration with Mobile Payment Systems

- Key Drivers for Fingerprint Sensing Module:

- Cost-effectiveness

- High Accuracy and Reliability

- Established Technology

- Key Drivers for North America and Asia-Pacific:

- Strong technological infrastructure

- High consumer adoption of smart devices

- Favorable government regulations

Consumer Biometrics Industry Product Innovations

Recent product innovations are characterized by miniaturization, improved accuracy, and increased security features. Under-display fingerprint sensors, 3D facial recognition systems, and advanced iris scanning technologies are gaining traction. These innovations offer enhanced user experiences, improved security against spoofing attacks, and greater integration into diverse applications across various devices. The market is witnessing a shift towards multi-modal biometric systems, combining different biometric traits for enhanced security and reliability.

Report Segmentation & Scope

The report segments the consumer biometrics market by sensing module (fingerprint, face recognition, eye/iris recognition) and by end-user (automotive, smartphone/tablet, PC/laptop, wearables, IoT devices, other end-users). Each segment's growth projection, market size, and competitive dynamics are analyzed. The fingerprint segment is expected to witness significant growth due to its widespread adoption and cost-effectiveness. The face recognition segment is projected to experience substantial growth fueled by the increasing demand for secure access control in various applications. The eye/iris recognition segment is anticipated to exhibit moderate growth driven by its high level of security and accuracy. The smartphone/tablet segment is projected to remain the largest end-user segment driven by high device penetration and increasing demand for user authentication features. The automotive segment is projected to witness strong growth due to increasing adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles.

Key Drivers of Consumer Biometrics Industry Growth

Technological advancements in sensor technology, AI, and machine learning are key drivers. Increasing consumer demand for enhanced security and convenience in authentication further accelerates growth. Government initiatives promoting digital identity and supporting biometric technology adoption also contribute significantly. The rising adoption of IoT devices and smart home systems also expands the market.

Challenges in the Consumer Biometrics Industry Sector

Data privacy and security concerns pose major challenges. Supply chain disruptions and the cost of advanced technology can impact market growth. Competition among established and emerging players remains intense, requiring constant innovation and cost optimization. The potential for spoofing attacks necessitates ongoing advancements in security algorithms and sensor technology. Regulatory compliance across different jurisdictions creates complexity for manufacturers.

Leading Players in the Consumer Biometrics Industry Market

- IDEX Biometrics ASA

- Precise Biometrics AB

- NEXT Biometrics Group ASA

- Infineon Technologies

- Princeton Identity

- Omnivision Technologies

- Egis Technologies Inc

- STMicroelectronics NV

- Qualcomm Incorporated

- ON Semiconductor

- Synaptics Inc

- LG Innotek Co Ltd

- Idemia France SAS

- Knowles Electronics LLC

- Apple Inc

- Shenzhen Goodix Technology Co Ltd

- Assa Abloy AB

Key Developments in Consumer Biometrics Industry Sector

- Jan 2023: Company X launched a new under-display fingerprint sensor with improved accuracy.

- June 2022: Company Y announced a strategic partnership to develop a multi-modal biometric authentication system.

- Oct 2021: Company Z acquired Company A, expanding its market presence in the face recognition segment.

- [Add more developments with dates and brief descriptions of impact]

Strategic Consumer Biometrics Industry Market Outlook

The future of the Consumer Biometrics market is bright, driven by sustained technological advancements and the increasing integration of biometric authentication across various applications. Strategic opportunities exist for companies focusing on developing secure and user-friendly multi-modal systems, expanding into emerging markets, and leveraging AI and machine learning to enhance performance and address security concerns. The market is poised for substantial growth, driven by the growing demand for enhanced security, seamless user experiences, and expanding applications in diverse sectors. The increasing adoption of biometric authentication across various platforms, alongside the development of innovative solutions and technologies, is expected to drive the market's growth in the coming years.

Consumer Biometrics Industry Segmentation

-

1. Sensing Module

- 1.1. Fingerprint

- 1.2. Face Recognition

- 1.3. Eye/Iris Recognition

-

2. End Users

- 2.1. Automotive

- 2.2. Smartphone/Tablet

- 2.3. Pc/Laptop

- 2.4. Wearables

- 2.5. IoT Devices

- 2.6. Other End Users

Consumer Biometrics Industry Segmentation By Geography

- 1. North America: United States Canada Mexico

- 2. Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe

- 3. Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific

- 4. South America : Brazil, Argentina, Rest of South America

- 5. MEA: Middle East, Africa

Consumer Biometrics Industry Regional Market Share

Geographic Coverage of Consumer Biometrics Industry

Consumer Biometrics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Widening Applications of Biometrics; Technological Advancements in Biometrics

- 3.3. Market Restrains

- 3.3.1. ; Data Security and Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Fingerprint Sensing Modules to Hold the Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Consumer Biometrics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sensing Module

- 5.1.1. Fingerprint

- 5.1.2. Face Recognition

- 5.1.3. Eye/Iris Recognition

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. Automotive

- 5.2.2. Smartphone/Tablet

- 5.2.3. Pc/Laptop

- 5.2.4. Wearables

- 5.2.5. IoT Devices

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America: United States Canada Mexico

- 5.3.2. Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe

- 5.3.3. Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific

- 5.3.4. South America : Brazil, Argentina, Rest of South America

- 5.3.5. MEA: Middle East, Africa

- 5.1. Market Analysis, Insights and Forecast - by Sensing Module

- 6. North America: United States Canada Mexico Consumer Biometrics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sensing Module

- 6.1.1. Fingerprint

- 6.1.2. Face Recognition

- 6.1.3. Eye/Iris Recognition

- 6.2. Market Analysis, Insights and Forecast - by End Users

- 6.2.1. Automotive

- 6.2.2. Smartphone/Tablet

- 6.2.3. Pc/Laptop

- 6.2.4. Wearables

- 6.2.5. IoT Devices

- 6.2.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Sensing Module

- 7. Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Consumer Biometrics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sensing Module

- 7.1.1. Fingerprint

- 7.1.2. Face Recognition

- 7.1.3. Eye/Iris Recognition

- 7.2. Market Analysis, Insights and Forecast - by End Users

- 7.2.1. Automotive

- 7.2.2. Smartphone/Tablet

- 7.2.3. Pc/Laptop

- 7.2.4. Wearables

- 7.2.5. IoT Devices

- 7.2.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Sensing Module

- 8. Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Consumer Biometrics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sensing Module

- 8.1.1. Fingerprint

- 8.1.2. Face Recognition

- 8.1.3. Eye/Iris Recognition

- 8.2. Market Analysis, Insights and Forecast - by End Users

- 8.2.1. Automotive

- 8.2.2. Smartphone/Tablet

- 8.2.3. Pc/Laptop

- 8.2.4. Wearables

- 8.2.5. IoT Devices

- 8.2.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Sensing Module

- 9. South America : Brazil, Argentina, Rest of South America Consumer Biometrics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sensing Module

- 9.1.1. Fingerprint

- 9.1.2. Face Recognition

- 9.1.3. Eye/Iris Recognition

- 9.2. Market Analysis, Insights and Forecast - by End Users

- 9.2.1. Automotive

- 9.2.2. Smartphone/Tablet

- 9.2.3. Pc/Laptop

- 9.2.4. Wearables

- 9.2.5. IoT Devices

- 9.2.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Sensing Module

- 10. MEA: Middle East, Africa Consumer Biometrics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sensing Module

- 10.1.1. Fingerprint

- 10.1.2. Face Recognition

- 10.1.3. Eye/Iris Recognition

- 10.2. Market Analysis, Insights and Forecast - by End Users

- 10.2.1. Automotive

- 10.2.2. Smartphone/Tablet

- 10.2.3. Pc/Laptop

- 10.2.4. Wearables

- 10.2.5. IoT Devices

- 10.2.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Sensing Module

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 IDEX Biometrics ASA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Precise Biometrics AB

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NEXT Biometrics Group ASA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Infineon Technologies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Princeton Identity

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Omnivision Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Egis Technologies Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 STMicroelectronics NV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Qualcomm Incorporated

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ON Semiconductor

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Synaptics Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LG Innotek Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Idemia France SAS

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Knowles Electronics LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Apple Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Shenzhen Goodix Technology Co Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Assa Abloy AB

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 IDEX Biometrics ASA

List of Figures

- Figure 1: Global Consumer Biometrics Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America: United States Canada Mexico Consumer Biometrics Industry Revenue (billion), by Sensing Module 2025 & 2033

- Figure 3: North America: United States Canada Mexico Consumer Biometrics Industry Revenue Share (%), by Sensing Module 2025 & 2033

- Figure 4: North America: United States Canada Mexico Consumer Biometrics Industry Revenue (billion), by End Users 2025 & 2033

- Figure 5: North America: United States Canada Mexico Consumer Biometrics Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 6: North America: United States Canada Mexico Consumer Biometrics Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America: United States Canada Mexico Consumer Biometrics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Consumer Biometrics Industry Revenue (billion), by Sensing Module 2025 & 2033

- Figure 9: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Consumer Biometrics Industry Revenue Share (%), by Sensing Module 2025 & 2033

- Figure 10: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Consumer Biometrics Industry Revenue (billion), by End Users 2025 & 2033

- Figure 11: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Consumer Biometrics Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 12: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Consumer Biometrics Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Consumer Biometrics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Consumer Biometrics Industry Revenue (billion), by Sensing Module 2025 & 2033

- Figure 15: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Consumer Biometrics Industry Revenue Share (%), by Sensing Module 2025 & 2033

- Figure 16: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Consumer Biometrics Industry Revenue (billion), by End Users 2025 & 2033

- Figure 17: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Consumer Biometrics Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 18: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Consumer Biometrics Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Consumer Biometrics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America : Brazil, Argentina, Rest of South America Consumer Biometrics Industry Revenue (billion), by Sensing Module 2025 & 2033

- Figure 21: South America : Brazil, Argentina, Rest of South America Consumer Biometrics Industry Revenue Share (%), by Sensing Module 2025 & 2033

- Figure 22: South America : Brazil, Argentina, Rest of South America Consumer Biometrics Industry Revenue (billion), by End Users 2025 & 2033

- Figure 23: South America : Brazil, Argentina, Rest of South America Consumer Biometrics Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 24: South America : Brazil, Argentina, Rest of South America Consumer Biometrics Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America : Brazil, Argentina, Rest of South America Consumer Biometrics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: MEA: Middle East, Africa Consumer Biometrics Industry Revenue (billion), by Sensing Module 2025 & 2033

- Figure 27: MEA: Middle East, Africa Consumer Biometrics Industry Revenue Share (%), by Sensing Module 2025 & 2033

- Figure 28: MEA: Middle East, Africa Consumer Biometrics Industry Revenue (billion), by End Users 2025 & 2033

- Figure 29: MEA: Middle East, Africa Consumer Biometrics Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 30: MEA: Middle East, Africa Consumer Biometrics Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: MEA: Middle East, Africa Consumer Biometrics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Consumer Biometrics Industry Revenue billion Forecast, by Sensing Module 2020 & 2033

- Table 2: Global Consumer Biometrics Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 3: Global Consumer Biometrics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Consumer Biometrics Industry Revenue billion Forecast, by Sensing Module 2020 & 2033

- Table 5: Global Consumer Biometrics Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 6: Global Consumer Biometrics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Consumer Biometrics Industry Revenue billion Forecast, by Sensing Module 2020 & 2033

- Table 8: Global Consumer Biometrics Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 9: Global Consumer Biometrics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Consumer Biometrics Industry Revenue billion Forecast, by Sensing Module 2020 & 2033

- Table 11: Global Consumer Biometrics Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 12: Global Consumer Biometrics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Consumer Biometrics Industry Revenue billion Forecast, by Sensing Module 2020 & 2033

- Table 14: Global Consumer Biometrics Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 15: Global Consumer Biometrics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Consumer Biometrics Industry Revenue billion Forecast, by Sensing Module 2020 & 2033

- Table 17: Global Consumer Biometrics Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 18: Global Consumer Biometrics Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Consumer Biometrics Industry?

The projected CAGR is approximately 12.3%.

2. Which companies are prominent players in the Consumer Biometrics Industry?

Key companies in the market include IDEX Biometrics ASA, Precise Biometrics AB, NEXT Biometrics Group ASA, Infineon Technologies, Princeton Identity, Omnivision Technologies, Egis Technologies Inc, STMicroelectronics NV, Qualcomm Incorporated, ON Semiconductor, Synaptics Inc, LG Innotek Co Ltd, Idemia France SAS, Knowles Electronics LLC, Apple Inc, Shenzhen Goodix Technology Co Ltd, Assa Abloy AB.

3. What are the main segments of the Consumer Biometrics Industry?

The market segments include Sensing Module, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.22 billion as of 2022.

5. What are some drivers contributing to market growth?

; Widening Applications of Biometrics; Technological Advancements in Biometrics.

6. What are the notable trends driving market growth?

Fingerprint Sensing Modules to Hold the Major Share.

7. Are there any restraints impacting market growth?

; Data Security and Privacy Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Consumer Biometrics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Consumer Biometrics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Consumer Biometrics Industry?

To stay informed about further developments, trends, and reports in the Consumer Biometrics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence