Key Insights

The Colombian automotive lubricants market, valued at approximately $XXX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.90% from 2025 to 2033. This growth is fueled by several key factors. The expanding automotive sector in Colombia, driven by increasing vehicle ownership and a growing middle class with greater disposable income, significantly boosts demand for lubricants. Furthermore, the rising adoption of advanced engine technologies, requiring specialized high-performance lubricants, contributes to market expansion. Government initiatives promoting infrastructure development and improvements to road networks also play a crucial role in fostering automotive activity and, consequently, lubricant consumption. However, challenges remain. Economic fluctuations and potential fuel price volatility could impact consumer spending on automotive maintenance, including lubricant purchases. Competition from both established international players like BP, Shell, and TotalEnergies, and smaller local brands, adds pressure on pricing and market share. The market is segmented by lubricant type (engine oil, transmission fluid, etc.), vehicle type (passenger cars, commercial vehicles), and distribution channels (dealers, wholesalers, retailers). Successful players will need to focus on building strong distribution networks, offering high-quality products tailored to the specific needs of the Colombian market, and effectively managing price points while adapting to changing consumer preferences and technological advancements in the automotive industry.

The competitive landscape is dominated by a mix of multinational corporations and regional players. International giants leverage their brand recognition and established distribution networks, while local companies compete on price and localized product offerings. Strategic partnerships and mergers & acquisitions will likely reshape the market dynamics in the coming years, leading to greater consolidation. Focus on sustainable and environmentally friendly lubricants is also gaining traction, driven by growing environmental concerns and government regulations. Future growth will depend on the sustained expansion of the Colombian economy, further development of the automotive sector, and the ongoing adaptation of lubricant manufacturers to meet evolving market needs and technological advancements.

Colombia Automotive Lubricants Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Colombia automotive lubricants industry, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. This report is essential for industry stakeholders, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic market. The report value is xx Million.

Colombia Automotive Lubricants Industry Market Structure & Competitive Dynamics

The Colombian automotive lubricants market presents a moderately concentrated structure, characterized by a dynamic interplay between multinational corporations and established domestic players. Multinational giants such as BP Plc (Castrol), Chevron Corporation, Royal Dutch Shell PLC, TotalEnergies, and Valvoline Inc hold significant market share, leveraging their globally recognized brands, extensive distribution networks, and advanced technological capabilities. These companies benefit from economies of scale and established brand loyalty. However, robust competition exists from regional players like Terpel, Petromil SA, and Primax, who demonstrate strong regional presence and cater to specific market segments with tailored offerings. A recent market analysis (2024 estimates) suggests a market share distribution as follows: Shell (20%), Castrol (18%), Chevron (15%), TotalEnergies (12%), Terpel (10%), with the remaining 25% distributed across other participants. This competitive landscape fosters innovation and price competitiveness, benefiting consumers.

Innovation in the Colombian market is strongly driven by the demand for enhanced fuel efficiency, reduced emissions, and extended lubricant lifespan. The regulatory environment, while constantly evolving, is increasingly focused on stricter environmental protection and elevated product quality standards. This regulatory push, coupled with growing environmental consciousness among consumers, is fueling the adoption of substitute products, such as bio-lubricants and other sustainable alternatives. The end-user landscape is diverse, comprising passenger vehicles, commercial vehicles, and industrial machinery, each segment presenting unique lubricant requirements and preferences. While mergers and acquisitions (M&A) activity within the period 2019-2024 has been relatively moderate (approximately xx Million in total deal value), strategic partnerships, exemplified by collaborations such as the Valvoline and Cummins agreement, are becoming increasingly prevalent as companies seek to expand their reach and technological capabilities.

Colombia Automotive Lubricants Industry Industry Trends & Insights

The Colombian automotive lubricants market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: the expanding automotive sector, driven by increasing vehicle ownership and infrastructure development; rising demand for high-performance lubricants, particularly in the commercial vehicle and industrial segments; and growing awareness of the importance of regular vehicle maintenance. Technological disruptions are evident in the increased adoption of synthetic lubricants, which offer superior performance and durability. Consumer preferences are shifting towards eco-friendly and high-quality lubricants, influencing product innovation and marketing strategies. Intense competition amongst established players and emerging brands is driving innovation and price optimization strategies. Market penetration of synthetic lubricants is approximately 35% in 2024, expected to reach 50% by 2033.

Dominant Markets & Segments in Colombia Automotive Lubricants Industry

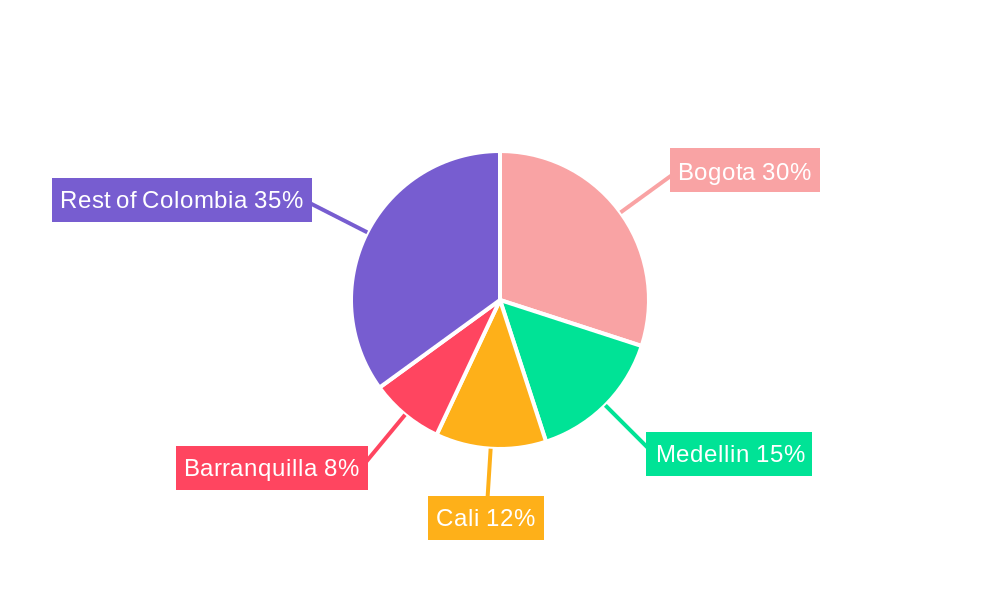

The Colombian automotive lubricants market demonstrates a geographically dispersed distribution, without any single region exhibiting overwhelming dominance. Nevertheless, major urban centers and industrial hubs, such as Bogotá, Medellín, and Cali, display higher lubricant demand due to concentrated automotive populations and robust industrial activities. These areas benefit from superior infrastructure, larger consumer bases, and higher concentrations of commercial and industrial enterprises.

- Key Drivers of Regional Dominance:

- High automotive sales volumes in major metropolitan areas.

- Well-developed transportation networks and infrastructure.

- Presence of significant industrial clusters requiring specialized lubricants.

- Government-led initiatives to stimulate growth within the automotive and industrial sectors.

In terms of vehicle type, the passenger vehicle segment currently captures the largest market share, followed by the commercial vehicle and industrial segments. The commercial vehicle segment’s growth is fueled by the expansion of the logistics and transportation sectors, reflecting the increasing demand for efficient and reliable transportation networks. Simultaneously, the industrial segment witnesses robust growth driven by ongoing industrialization and expanding manufacturing activities. This requires specialized lubricants optimized for diverse industrial machinery and processes.

Colombia Automotive Lubricants Industry Product Innovations

Recent product innovations focus on the development of advanced synthetic lubricants formulated to meet stringent emission standards and enhance fuel economy. Engine oils with improved viscosity modifiers and friction reduction additives are gaining prominence. Bio-based lubricants are emerging as a sustainable alternative, capitalizing on the growing demand for eco-friendly products. These innovations provide competitive advantages by offering superior performance, longer drain intervals, and reduced environmental impact, aligning with market trends towards sustainability and efficiency.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the Colombian automotive lubricants market based on key parameters: lubricant type (engine oils, gear oils, greases, transmission fluids, etc.), vehicle type (passenger cars, commercial vehicles, motorcycles, heavy-duty vehicles, etc.), and distribution channel (Original Equipment Manufacturers (OEMs), retail outlets, workshops, online channels, etc.). The report offers in-depth analysis of each segment, including growth projections, market size estimations, and competitive dynamics. For instance, the market size for engine oils is estimated at xx Million in 2025, with projections indicating growth to xx Million by 2033. While the passenger car segment demonstrates strong and consistent growth, the motorcycle segment also experiences significant expansion, reflecting the increasing popularity of motorcycles as a mode of personal transportation in Colombia.

Key Drivers of Colombia Automotive Lubricants Industry Growth

The growth trajectory of the Colombian automotive lubricants industry is driven by a confluence of factors. These include: a steadily increasing vehicle ownership rate coupled with a burgeoning middle class, resulting in greater demand for personal vehicles and a corresponding rise in vehicle maintenance needs; government initiatives designed to enhance road infrastructure and transportation networks; sustained industrialization and expansion within the manufacturing sector, driving increased demand for industrial lubricants; and the implementation of increasingly stringent emission regulations, stimulating demand for environmentally friendly and high-performance lubricants that meet stricter standards.

Challenges in the Colombia Automotive Lubricants Industry Sector

The Colombian automotive lubricants industry faces challenges such as fluctuating oil prices, affecting lubricant production costs and profitability; supply chain disruptions, particularly during periods of economic uncertainty or geopolitical instability; intense competition from both domestic and international players, requiring manufacturers to continually innovate and optimize their offerings; and regulatory complexities, potentially affecting product approvals and distribution processes.

Leading Players in the Colombia Automotive Lubricants Industry Market

- Biomax

- BP Plc (Castrol)

- Chevron Corporation

- Gulf Oil International

- Motul

- Petrobras

- Petromil SA

- Primax

- Royal Dutch Shell PLC

- Terpel

- TotalEnergies

- Valvoline Inc

Key Developments in Colombia Automotive Lubricants Industry Sector

- August 2021: Motul introduces a new and improved version of its flagship product, enhancing its market position through improved performance.

- August 2021: Megacomercial expands its Motul distribution network into the motorcycle segment, boosting market reach.

- October 2021: Valvoline and Cummins extend their partnership, strengthening Valvoline's distribution and market presence through Cummins' extensive network.

Strategic Colombia Automotive Lubricants Industry Market Outlook

The Colombian automotive lubricants market presents significant growth potential in the coming years. Strategic opportunities lie in catering to the increasing demand for higher-performance and environmentally friendly lubricants, particularly in the rapidly expanding commercial vehicle and industrial segments. Companies focusing on innovation, strategic partnerships, and effective distribution networks are well-positioned to capitalize on the market's growth trajectory. The focus on sustainability and technological advancements will be key differentiators in the future.

Colombia Automotive Lubricants Industry Segmentation

-

1. Vehicle Type

- 1.1. Commercial Vehicles

- 1.2. Motorcycles

- 1.3. Passenger Vehicles

-

2. Product Type

- 2.1. Engine Oils

- 2.2. Greases

- 2.3. Hydraulic Fluids

- 2.4. Transmission & Gear Oils

Colombia Automotive Lubricants Industry Segmentation By Geography

- 1. Colombia

Colombia Automotive Lubricants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Vehicle Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia Automotive Lubricants Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.2. Motorcycles

- 5.1.3. Passenger Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Engine Oils

- 5.2.2. Greases

- 5.2.3. Hydraulic Fluids

- 5.2.4. Transmission & Gear Oils

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Biomax

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BP Plc (Castrol)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chevron Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gulf Oil International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Motul

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Petrobras

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Petromil SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Primax

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Royal Dutch Shell PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Terpel

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 TotalEnergies

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Valvoline Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Biomax

List of Figures

- Figure 1: Colombia Automotive Lubricants Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Colombia Automotive Lubricants Industry Share (%) by Company 2024

List of Tables

- Table 1: Colombia Automotive Lubricants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Colombia Automotive Lubricants Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Colombia Automotive Lubricants Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Colombia Automotive Lubricants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Colombia Automotive Lubricants Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 6: Colombia Automotive Lubricants Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Colombia Automotive Lubricants Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia Automotive Lubricants Industry?

The projected CAGR is approximately 4.90%.

2. Which companies are prominent players in the Colombia Automotive Lubricants Industry?

Key companies in the market include Biomax, BP Plc (Castrol), Chevron Corporation, Gulf Oil International, Motul, Petrobras, Petromil SA, Primax, Royal Dutch Shell PLC, Terpel, TotalEnergies, Valvoline Inc.

3. What are the main segments of the Colombia Automotive Lubricants Industry?

The market segments include Vehicle Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Vehicle Type : Commercial Vehicles.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2021: Valvoline and Cummins extended their long-standing marketing and technology collaboration agreement for another five years. Cummins will endorse and promote Valvoline's Premium Blue engine oil for its heavy-duty diesel engines and generators and will distribute Valvoline products through its global distribution networks.August 2021: Motul introduces a new and improved version of its flagship product, with a revolutionary formula that once again pushes the boundaries of performance, which would be showcased at the 24 Hours of Le Mans, the world's most famous racing event.August 2021: Megacomercial has been a Motul Importers Network Member in the auto, industry, marine, and heavy categories since 2019. It would now do so for Antioquia, Chocó, and the Atlantic Coast in the motorcycle segment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia Automotive Lubricants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia Automotive Lubricants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia Automotive Lubricants Industry?

To stay informed about further developments, trends, and reports in the Colombia Automotive Lubricants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence