Key Insights

The Cold Chain Packaging Market is projected to reach a market size of $29.71 million by 2025, growing at a compound annual growth rate (CAGR) of 8.67% from 2025 to 2033. This growth is driven by increasing demand across various end-user applications, including food, dairy, pharmaceuticals, and other sectors. Key drivers include the rising need for temperature-sensitive product transportation, stringent regulatory standards, and the expansion of global trade. Trends in the market are leaning towards the adoption of advanced insulated containers and temperature monitoring solutions, which enhance the efficiency and reliability of cold chain logistics. Major players such as Cold Chain Technologies Inc, Sonoco Thermosafe, and Cryopak Industries Inc are investing heavily in innovative packaging solutions to meet these demands.

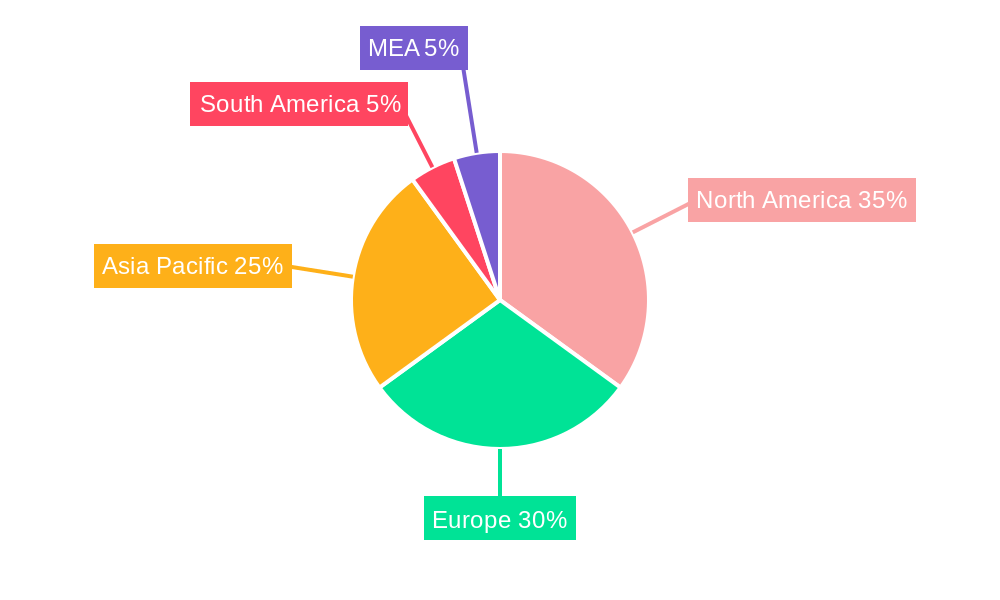

The market is segmented by product into insulated containers, refrigerants, and temperature monitoring systems, with insulated containers holding a significant share due to their critical role in maintaining product integrity. Regionally, North America, particularly the United States, leads the market due to its well-established pharmaceutical and food industries. Europe and the Asia Pacific are also key regions, with Europe driven by strict regulations and the Asia Pacific by rapid industrialization and increasing healthcare expenditure. Despite the promising growth, challenges such as high costs and the need for specialized handling and infrastructure may restrain market expansion. However, ongoing technological advancements and strategic collaborations among key market players are expected to mitigate these constraints and foster market growth over the forecast period.

Cold Chain Packaging Market Market Structure & Competitive Dynamics

The Cold Chain Packaging Market is characterized by a moderately concentrated structure, with key players such as Cold Chain Technologies Inc, Sonoco Thermosafe, and Cryopak Industries Inc holding significant market shares. The market's innovation ecosystem thrives on continuous advancements in packaging solutions to meet the stringent requirements of pharmaceuticals, food, and dairy industries. Regulatory frameworks play a crucial role, with compliance to standards like the International Air Transport Association (IATA) and the Food and Drug Administration (FDA) influencing product development and market entry.

Product substitutes, such as dry ice and gel packs, pose competitive threats, yet the specialized nature of cold chain packaging limits their impact. End-user trends indicate a growing demand for sustainable packaging solutions, driving companies to innovate with eco-friendly materials. Mergers and acquisitions are frequent, with deal values reaching up to $500 Million in recent years, aimed at expanding product portfolios and geographical reach. For instance, the acquisition of smaller regional players by larger firms like Pelican BioThermal LLC has been a strategic move to capture niche markets.

- Market Share: Top five companies collectively hold approximately 40% of the market.

- M&A Activities: Over 10 significant deals valued at more than $100 Million each in the last five years.

Cold Chain Packaging Market Industry Trends & Insights

The Cold Chain Packaging Market is poised for robust growth, driven by the increasing need for temperature-controlled logistics in pharmaceuticals, food, and dairy sectors. The market is expected to grow at a CAGR of 8.5% from 2025 to 2033, propelled by technological disruptions such as IoT-enabled monitoring systems and the adoption of advanced insulation materials. Consumer preferences are shifting towards sustainability, with a growing demand for biodegradable and reusable packaging solutions. This trend is reflected in the market penetration of eco-friendly products, which is projected to increase from 10% in 2025 to 15% by 2033.

Competitive dynamics are intensifying, with companies investing heavily in R&D to develop innovative packaging solutions that can maintain product integrity across varying temperature conditions. The pharmaceutical sector, in particular, is driving demand due to the rise in biologics and gene therapies requiring stringent temperature control. Technological advancements like real-time temperature monitoring and data analytics are becoming standard, enhancing the efficiency and reliability of cold chain logistics.

The integration of AI and machine learning for predictive analytics is also a significant trend, enabling companies to optimize supply chain operations and reduce waste. As the market evolves, companies are focusing on strategic partnerships and collaborations to expand their global footprint and enhance their service offerings. For instance, collaborations with logistics providers and technology firms are becoming increasingly common to offer end-to-end solutions.

Dominant Markets & Segments in Cold Chain Packaging Market

The pharmaceutical segment is the dominant end-user application in the Cold Chain Packaging Market, driven by the need for precise temperature control to maintain the efficacy of drugs and vaccines. The Asia-Pacific region, particularly countries like China and India, is emerging as a leading market due to rapid industrialization, growing healthcare infrastructure, and increasing demand for pharmaceuticals.

- Key Drivers:

- Economic Policies: Government initiatives promoting healthcare and pharmaceutical sectors.

- Infrastructure: Development of cold storage facilities and logistics networks.

- Regulatory Frameworks: Stringent regulations ensuring product safety and efficacy.

In terms of product segments, insulated containers hold a significant market share due to their versatility and effectiveness in maintaining temperature across various transportation modes. These containers are crucial for the pharmaceutical industry, which requires consistent temperature control during shipping and storage. The demand for insulated containers is expected to grow at a CAGR of 9% through the forecast period, driven by the expansion of global pharmaceutical supply chains.

Refrigerants and temperature monitoring systems are also critical segments, with the former seeing increased demand for eco-friendly alternatives and the latter benefiting from advancements in IoT and real-time tracking technologies. The growth in these segments is fueled by the need for reliable and efficient cold chain solutions to meet the rising demand for perishable goods and pharmaceuticals.

Cold Chain Packaging Market Product Innovations

Product innovations in the Cold Chain Packaging Market are driven by the need for more efficient and sustainable solutions. Recent developments include the use of phase change materials (PCMs) and vacuum insulation panels (VIPs) to enhance thermal performance. Companies are also focusing on integrating smart technologies, such as sensors and data loggers, for real-time monitoring and control. These innovations not only improve product quality but also align with market demands for eco-friendly and technologically advanced packaging solutions.

Report Segmentation & Scope

The Cold Chain Packaging Market is segmented by end-user applications and products.

By End User Applications: The pharmaceutical segment is expected to grow at a CAGR of 9.5%, reaching a market size of $xx Million by 2033. The food and dairy segments are also significant, with projected growth rates of 7.5% and 6.5%, respectively, driven by the need for quality preservation.

By Product: Insulated containers dominate the market, with a projected market size of $xx Million by 2033. Refrigerants and temperature monitoring systems are expected to see steady growth, with market sizes reaching $xx Million and $xx Million, respectively, by the end of the forecast period. Competitive dynamics in these segments are influenced by technological advancements and regulatory compliance.

Key Drivers of Cold Chain Packaging Market Growth

Key drivers of the Cold Chain Packaging Market include technological advancements, such as the integration of IoT for real-time monitoring, which enhance the efficiency and reliability of cold chain logistics. Economic factors, such as the growing pharmaceutical and food industries, are also significant, with global demand for temperature-sensitive products on the rise. Regulatory factors, including stringent guidelines for pharmaceutical transportation, further propel market growth. For instance, the FDA's strict requirements for maintaining drug efficacy drive the need for advanced cold chain solutions.

Challenges in the Cold Chain Packaging Market Sector

The Cold Chain Packaging Market faces several challenges, including regulatory hurdles that can delay product approvals and increase costs. Supply chain issues, such as disruptions due to natural disasters or pandemics, can impact the timely delivery of temperature-sensitive products. Competitive pressures are also intense, with companies needing to constantly innovate to maintain market share. These challenges can lead to a 5-10% reduction in market growth potential annually.

Leading Players in the Cold Chain Packaging Market Market

- Cold Chain Technologies Inc

- Sonoco Thermosafe

- Cryopak Industries Inc

- Intelsius (A DGP Company)

- Sofrigam Company

- Clip-Lok SimPak

- Softbox Systems Ltd

- Chill-Pak com *List Not Exhaustive

- Pelican BioThermal LLC

- Coolpac

Key Developments in Cold Chain Packaging Market Sector

- January 2022: Catalent increased its cold chain packaging capacity at its Philadelphia plant, adding seven new temperature-controlled processing suites and up to 20,000 square feet of space. This development enhances the company's ability to meet the growing demand for cell and gene therapies and biologic pharmaceuticals, impacting market dynamics by improving supply chain efficiency.

- March 2021: Sonoco Products Company collaborated with Unilode Aviation Solutions for the maintenance and handling of Sonoco ThermoSafe's temperature-controlled containers. This partnership strengthens the global transportation of pharmaceuticals and other temperature-sensitive products, influencing market dynamics by ensuring product safety and reliability.

Strategic Cold Chain Packaging Market Market Outlook

The Cold Chain Packaging Market is poised for significant growth, driven by technological advancements and increasing demand from the pharmaceutical and food industries. Future market potential lies in the adoption of sustainable packaging solutions and the integration of advanced monitoring technologies. Strategic opportunities include expanding into emerging markets, particularly in Asia-Pacific, and forming partnerships with logistics and technology firms to offer comprehensive cold chain solutions.

Cold Chain Packaging Market Segmentation

-

1. Product

- 1.1. Insulated Containers

- 1.2. Refrigerants

- 1.3. Temperature Monitoring

-

2. End User Applications

- 2.1. Food

- 2.2. Dairy

- 2.3. Pharmaceutical

- 2.4. Other End-user Applications

Cold Chain Packaging Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Cold Chain Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Pharmaceutical and Healthcare Sector to Boost the Market; Increasing Consumer Demand for Perishable Food

- 3.3. Market Restrains

- 3.3.1. Government Regulations Regarding the Use of Materials with Low Carbon; Rising Cost of Raw Material

- 3.4. Market Trends

- 3.4.1. Growth in Pharmaceutical Sector to Augment the Cold Chain Packaging Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cold Chain Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Insulated Containers

- 5.1.2. Refrigerants

- 5.1.3. Temperature Monitoring

- 5.2. Market Analysis, Insights and Forecast - by End User Applications

- 5.2.1. Food

- 5.2.2. Dairy

- 5.2.3. Pharmaceutical

- 5.2.4. Other End-user Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Cold Chain Packaging Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Insulated Containers

- 6.1.2. Refrigerants

- 6.1.3. Temperature Monitoring

- 6.2. Market Analysis, Insights and Forecast - by End User Applications

- 6.2.1. Food

- 6.2.2. Dairy

- 6.2.3. Pharmaceutical

- 6.2.4. Other End-user Applications

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Cold Chain Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Insulated Containers

- 7.1.2. Refrigerants

- 7.1.3. Temperature Monitoring

- 7.2. Market Analysis, Insights and Forecast - by End User Applications

- 7.2.1. Food

- 7.2.2. Dairy

- 7.2.3. Pharmaceutical

- 7.2.4. Other End-user Applications

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Cold Chain Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Insulated Containers

- 8.1.2. Refrigerants

- 8.1.3. Temperature Monitoring

- 8.2. Market Analysis, Insights and Forecast - by End User Applications

- 8.2.1. Food

- 8.2.2. Dairy

- 8.2.3. Pharmaceutical

- 8.2.4. Other End-user Applications

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Rest of the World Cold Chain Packaging Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Insulated Containers

- 9.1.2. Refrigerants

- 9.1.3. Temperature Monitoring

- 9.2. Market Analysis, Insights and Forecast - by End User Applications

- 9.2.1. Food

- 9.2.2. Dairy

- 9.2.3. Pharmaceutical

- 9.2.4. Other End-user Applications

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. North America Cold Chain Packaging Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Mexico

- 11. Europe Cold Chain Packaging Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Spain

- 11.1.5 Italy

- 11.1.6 Spain

- 11.1.7 Belgium

- 11.1.8 Netherland

- 11.1.9 Nordics

- 11.1.10 Rest of Europe

- 12. Asia Pacific Cold Chain Packaging Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 India

- 12.1.4 South Korea

- 12.1.5 Southeast Asia

- 12.1.6 Australia

- 12.1.7 Indonesia

- 12.1.8 Phillipes

- 12.1.9 Singapore

- 12.1.10 Thailandc

- 12.1.11 Rest of Asia Pacific

- 13. South America Cold Chain Packaging Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 Argentina

- 13.1.3 Peru

- 13.1.4 Chile

- 13.1.5 Colombia

- 13.1.6 Ecuador

- 13.1.7 Venezuela

- 13.1.8 Rest of South America

- 14. North America Cold Chain Packaging Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 United States

- 14.1.2 Canada

- 14.1.3 Mexico

- 15. MEA Cold Chain Packaging Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Cold Chain Technologies Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Sonoco Thermosafe

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Cryopak Industries Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Intelsius (A DGP Company)

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Sofrigam Company

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Clip-Lok SimPak

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Softbox Systems Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Chill-Pak com *List Not Exhaustive

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Pelican BioThermal LLC

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Coolpac

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Cold Chain Technologies Inc

List of Figures

- Figure 1: Global Cold Chain Packaging Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Cold Chain Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Cold Chain Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Cold Chain Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Cold Chain Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Cold Chain Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Cold Chain Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cold Chain Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Cold Chain Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Cold Chain Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Cold Chain Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Cold Chain Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Cold Chain Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Cold Chain Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 15: North America Cold Chain Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 16: North America Cold Chain Packaging Market Revenue (Million), by End User Applications 2024 & 2032

- Figure 17: North America Cold Chain Packaging Market Revenue Share (%), by End User Applications 2024 & 2032

- Figure 18: North America Cold Chain Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Cold Chain Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Cold Chain Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 21: Europe Cold Chain Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 22: Europe Cold Chain Packaging Market Revenue (Million), by End User Applications 2024 & 2032

- Figure 23: Europe Cold Chain Packaging Market Revenue Share (%), by End User Applications 2024 & 2032

- Figure 24: Europe Cold Chain Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Cold Chain Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cold Chain Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 27: Asia Pacific Cold Chain Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 28: Asia Pacific Cold Chain Packaging Market Revenue (Million), by End User Applications 2024 & 2032

- Figure 29: Asia Pacific Cold Chain Packaging Market Revenue Share (%), by End User Applications 2024 & 2032

- Figure 30: Asia Pacific Cold Chain Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Cold Chain Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Rest of the World Cold Chain Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 33: Rest of the World Cold Chain Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 34: Rest of the World Cold Chain Packaging Market Revenue (Million), by End User Applications 2024 & 2032

- Figure 35: Rest of the World Cold Chain Packaging Market Revenue Share (%), by End User Applications 2024 & 2032

- Figure 36: Rest of the World Cold Chain Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Rest of the World Cold Chain Packaging Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cold Chain Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Cold Chain Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Cold Chain Packaging Market Revenue Million Forecast, by End User Applications 2019 & 2032

- Table 4: Global Cold Chain Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Cold Chain Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Cold Chain Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Cold Chain Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Cold Chain Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Cold Chain Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Cold Chain Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Cold Chain Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Cold Chain Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 51: Global Cold Chain Packaging Market Revenue Million Forecast, by End User Applications 2019 & 2032

- Table 52: Global Cold Chain Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Cold Chain Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 54: Global Cold Chain Packaging Market Revenue Million Forecast, by End User Applications 2019 & 2032

- Table 55: Global Cold Chain Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Cold Chain Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 57: Global Cold Chain Packaging Market Revenue Million Forecast, by End User Applications 2019 & 2032

- Table 58: Global Cold Chain Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Cold Chain Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 60: Global Cold Chain Packaging Market Revenue Million Forecast, by End User Applications 2019 & 2032

- Table 61: Global Cold Chain Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cold Chain Packaging Market?

The projected CAGR is approximately 8.67%.

2. Which companies are prominent players in the Cold Chain Packaging Market?

Key companies in the market include Cold Chain Technologies Inc, Sonoco Thermosafe, Cryopak Industries Inc, Intelsius (A DGP Company), Sofrigam Company, Clip-Lok SimPak, Softbox Systems Ltd, Chill-Pak com *List Not Exhaustive, Pelican BioThermal LLC, Coolpac.

3. What are the main segments of the Cold Chain Packaging Market?

The market segments include Product, End User Applications.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Pharmaceutical and Healthcare Sector to Boost the Market; Increasing Consumer Demand for Perishable Food.

6. What are the notable trends driving market growth?

Growth in Pharmaceutical Sector to Augment the Cold Chain Packaging Market.

7. Are there any restraints impacting market growth?

Government Regulations Regarding the Use of Materials with Low Carbon; Rising Cost of Raw Material.

8. Can you provide examples of recent developments in the market?

January 2022 - Catalent, a provider of clinical supply services, has increased its capacity for cold chain packaging at the United States plant in Philadelphia. The company will be better able to satisfy the rising demand for the delivery of innovative cell and gene therapies and biologic pharmaceuticals. Seven new temperature-controlled processing suites have been added to the facility by Catalent, which has also added up to 20,000 square feet of additional space. The new suites include complete serialization capabilities and are primarily geared for modest commercial product quantities. The suites can be run in either refrigerated or frozen settings to precisely satisfy the needs of the pharmaceuticals being handled.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cold Chain Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cold Chain Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cold Chain Packaging Market?

To stay informed about further developments, trends, and reports in the Cold Chain Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence