Key Insights

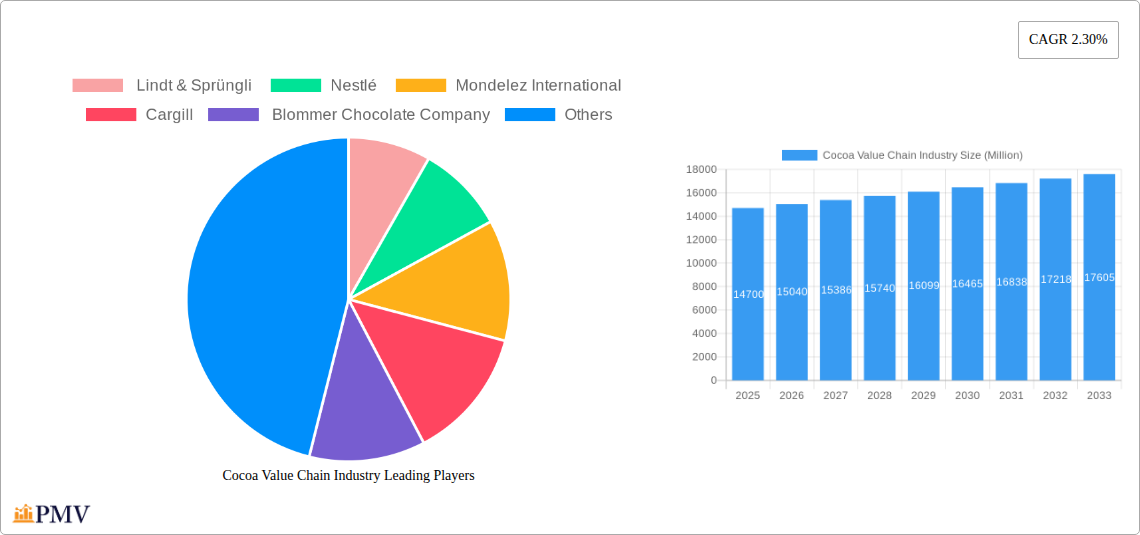

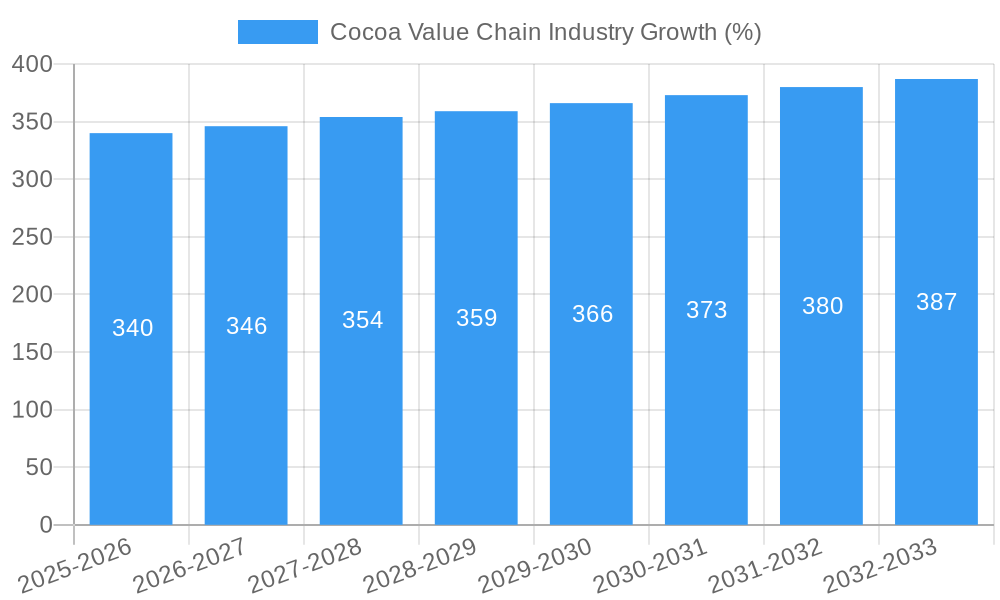

The global cocoa value chain industry, valued at $14.70 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 2.30% from 2025 to 2033. This growth is driven by several factors. Rising global demand for chocolate confectionery, fueled by increasing disposable incomes and changing consumer preferences in emerging markets like Asia-Pacific and particularly in countries such as India and China, is a significant catalyst. Furthermore, the increasing popularity of cocoa-based beverages and health food products, leveraging the recognized health benefits of cocoa flavanols, contributes to market expansion. Innovation within the industry, including the development of new cocoa-infused products and sustainable sourcing practices, also plays a crucial role. However, challenges remain. Fluctuations in cocoa bean prices due to climate change, geopolitical instability in major cocoa-producing regions, and increasing concerns regarding deforestation and child labor in cocoa farming pose significant constraints to industry growth. Effective strategies for mitigating these risks, such as investments in sustainable farming practices and supply chain traceability, are vital for long-term market stability and growth. Segmentation reveals a diverse market, with pelagic, demersal, freshwater fish, and shellfish alongside cocoa products indicating a potential diversification or miscategorization in the original data, requiring further clarification. Key players such as Lindt & Sprüngli, Nestlé, and Mondelez International are strategically positioning themselves to capitalize on evolving market demands, leading to increased competition and ongoing industry consolidation.

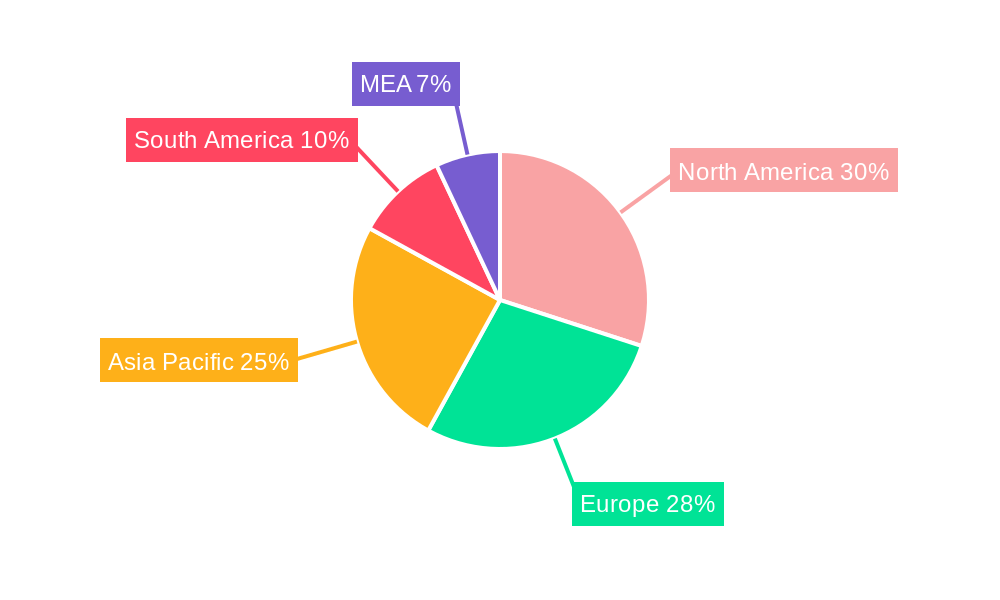

The regional landscape shows a varied distribution of market share. North America and Europe, with their established chocolate consumption habits, are expected to maintain significant market positions. However, the Asia-Pacific region is anticipated to witness the most rapid growth due to its expanding middle class and increasing chocolate consumption. South America, a major cocoa producer, is likely to see moderate growth driven by both domestic consumption and exports. The Middle East and Africa region's market growth will likely depend on factors such as economic development and changing dietary habits. The industry's future trajectory hinges on successfully navigating the interplay between rising demand, sustainability concerns, price volatility, and evolving consumer preferences. Strategic investments in research and development, sustainable supply chain management, and effective marketing campaigns targeting specific regional preferences will be crucial for achieving continued success in this dynamic and competitive market.

Cocoa Value Chain Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global cocoa value chain industry, covering the period 2019-2033. It offers actionable insights into market structure, competitive dynamics, dominant segments, technological innovations, and future growth prospects. The report is crucial for industry stakeholders, investors, and anyone seeking to understand this dynamic market. The base year is 2025, with estimations for 2025 and forecasts spanning 2025-2033. The historical period covered is 2019-2024.

Cocoa Value Chain Industry Market Structure & Competitive Dynamics

The global cocoa value chain is characterized by a concentrated market structure dominated by a few multinational corporations. Key players such as Lindt & Sprüngli, Nestlé, Mondelez International, Cargill, Blommer Chocolate Company, Meiji Holdings Co., Ltd., Hershey's, Mars, Barry Callebaut, and Olam International control a significant portion of the market share. Precise market share figures for each company vary year to year and are unavailable in the public domain. However, the top 10 companies together hold an estimated xx% market share.

The industry witnesses frequent mergers and acquisitions (M&A) activity, driven by consolidation and expansion strategies. Recent deals, while precise values are unavailable, have involved significant investments in cocoa processing facilities and supply chain infrastructure. For example, Cargill's USD 100 Million expansion in Côte d'Ivoire exemplifies this trend. The regulatory landscape, characterized by varying standards for sustainability and ethical sourcing, significantly influences competitive dynamics. Innovation, focused on improving efficiency, product quality, and sustainability, also plays a pivotal role. End-user preferences are shifting toward more sustainably sourced cocoa, creating both opportunities and challenges for industry participants.

- Market Concentration: High, with top 10 players holding an estimated xx% market share.

- M&A Activity: Frequent, with significant investments in capacity expansion. Total M&A deal value in the past 5 years is estimated at xx Million USD.

- Regulatory Framework: Increasing focus on sustainability and ethical sourcing.

- Product Substitutes: Limited direct substitutes, but consumer preferences are shifting toward healthier alternatives.

Cocoa Value Chain Industry Industry Trends & Insights

The global cocoa value chain industry is experiencing steady growth, driven by increasing global demand for chocolate and cocoa products. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Key drivers include rising disposable incomes in developing economies and changing consumer preferences toward premium chocolate products. Technological advancements in cocoa processing and production are improving efficiency and product quality. However, challenges remain, including fluctuations in cocoa bean prices, concerns about sustainability and ethical sourcing, and the impact of climate change on cocoa production. Market penetration of sustainable cocoa products is steadily increasing, but remains below xx% in many regions. Competitive pressures are intense, leading companies to invest heavily in research and development, brand building, and supply chain optimization.

Dominant Markets & Segments in Cocoa Value Chain Industry

West Africa, specifically Côte d'Ivoire and Ghana, remains the dominant region for cocoa bean production. This dominance is attributed to favorable climatic conditions and established farming practices.

- Key Drivers of West African Dominance:

- Favorable climatic conditions for cocoa cultivation.

- Long history of cocoa production and established farming communities.

- Relatively lower production costs compared to other regions.

- Government support for cocoa farming through subsidies and infrastructure development.

While the report does not specifically cover the segments: Pelagic Fish, Barracuda, Pomfret, Tilapia, Scallop, Lobster, Shrimp, and Caviar, these are unrelated to the cocoa value chain. The focus remains on cocoa bean production, processing, and the subsequent value-added chocolate and cocoa product industries. The "Other Types" segment in the context of this report is assumed to refer to other cocoa products such as cocoa powder, cocoa butter, and cocoa nibs.

Cocoa Value Chain Industry Product Innovations

Recent innovations focus on enhancing cocoa processing techniques to improve product quality, reduce waste, and enhance sustainability. Advances in fermentation and drying methods are leading to higher-quality cocoa beans. Furthermore, companies are investing in technologies that promote traceability and transparency throughout the supply chain, responding to growing consumer demand for ethically sourced cocoa. These innovations are crucial to maintaining market competitiveness and meeting evolving consumer preferences.

Report Segmentation & Scope

The report segments the cocoa value chain into various stages: production (farming), processing (grinding, refining), manufacturing (chocolate and cocoa products), and distribution. Each segment's market size and growth projections are analyzed separately, providing detailed insights into the dynamics of each stage. Furthermore, the report considers geographical segmentation, focusing on major cocoa-producing regions, such as West Africa, South America, and Southeast Asia. Competitive dynamics within each segment are also carefully analyzed. (Note: Pelagic Fish, Barracuda, etc. are irrelevant to cocoa and are not included in segmentation).

Key Drivers of Cocoa Value Chain Industry Growth

The cocoa value chain industry's growth is fueled by several factors, including rising global demand for chocolate and cocoa products, particularly in emerging markets. Technological advancements in cocoa processing and farming practices are increasing efficiency and yields. Furthermore, growing consumer awareness of the importance of sustainability and ethical sourcing is driving demand for sustainably produced cocoa. Government initiatives promoting cocoa farming and supporting the industry also contribute to growth.

Challenges in the Cocoa Value Chain Industry Sector

The cocoa value chain faces several significant challenges. Fluctuations in cocoa bean prices pose a considerable risk to profitability, affecting both producers and processors. Sustainability concerns, including deforestation and child labor, are increasingly scrutinized by consumers and regulatory bodies, putting pressure on companies to adopt ethical and sustainable practices. Furthermore, climate change poses a significant threat to cocoa production, impacting yields and quality.

Leading Players in the Cocoa Value Chain Industry Market

- Lindt & Sprüngli

- Nestlé

- Mondelez International

- Cargill

- Blommer Chocolate Company

- Meiji Holdings Co., Ltd.

- Hershey's

- Mars

- Barry Callebaut

- Olam International

Key Developments in Cocoa Value Chain Industry Sector

- November 2021: Cargill completed a USD 100 Million expansion of its cocoa processing facilities in Yopougon, Côte d'Ivoire, significantly increasing its cocoa-grinding capacity.

- March 2022: Ivory Coast launched a pilot project to trace cocoa beans from farm to market, aiming to address deforestation and child labor issues.

- September 2022: Pronatec Swiss became the country's first 100% organic cocoa processing plant, with an annual capacity of approximately 15,000 metric tons of organic cocoa.

- October 2022: Niche Cocoa Industry (Ghana) collaborated with Omanhene Cocoa Bean Co. (USA), establishing its first US cocoa processing plant, strengthening the US cocoa food and beverage industry.

Strategic Cocoa Value Chain Industry Market Outlook

The future of the cocoa value chain industry looks promising, with ongoing growth driven by increasing global demand and innovation. Strategic opportunities exist in enhancing supply chain transparency, adopting sustainable farming practices, and developing innovative cocoa-based products. Companies that prioritize sustainability, ethical sourcing, and product innovation are expected to thrive in the increasingly competitive market. The focus on premiumization and diversification into new cocoa-based products presents considerable opportunities for market expansion and growth during the forecast period.

Cocoa Value Chain Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Cocoa Value Chain Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cocoa Value Chain Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production

- 3.3. Market Restrains

- 3.3.1. Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis

- 3.4. Market Trends

- 3.4.1. Sustainable Sourcing to Improve Economies for Stakeholders

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cocoa Value Chain Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Cocoa Value Chain Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Cocoa Value Chain Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Cocoa Value Chain Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Cocoa Value Chain Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Cocoa Value Chain Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. South America Cocoa Value Chain Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Brazil

- 11.1.2 Argentina

- 11.1.3 Rest of South America

- 12. North America Cocoa Value Chain Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Asia Pacific Cocoa Value Chain Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Taiwan

- 13.1.6 Australia

- 13.1.7 Rest of Asia-Pacific

- 14. Europe Cocoa Value Chain Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Germany

- 14.1.2 France

- 14.1.3 Italy

- 14.1.4 United Kingdom

- 14.1.5 Netherlands

- 14.1.6 Rest of Europe

- 15. MEA Cocoa Value Chain Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Middle East

- 15.1.2 Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Lindt & Sprüngli

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Nestlé

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Mondelez International

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Cargill

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Blommer Chocolate Company

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Meiji Holdings Co. Ltd.

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Hershey's

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Mars

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Barry Callebaut

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Olam International

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Lindt & Sprüngli

List of Figures

- Figure 1: Global Cocoa Value Chain Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: South America Cocoa Value Chain Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: South America Cocoa Value Chain Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Cocoa Value Chain Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: North America Cocoa Value Chain Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Cocoa Value Chain Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Cocoa Value Chain Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Europe Cocoa Value Chain Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Europe Cocoa Value Chain Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA Cocoa Value Chain Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: MEA Cocoa Value Chain Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Cocoa Value Chain Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 13: North America Cocoa Value Chain Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 14: North America Cocoa Value Chain Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 15: North America Cocoa Value Chain Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 16: North America Cocoa Value Chain Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 17: North America Cocoa Value Chain Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 18: North America Cocoa Value Chain Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 19: North America Cocoa Value Chain Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 20: North America Cocoa Value Chain Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 21: North America Cocoa Value Chain Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 22: North America Cocoa Value Chain Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: North America Cocoa Value Chain Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: South America Cocoa Value Chain Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 25: South America Cocoa Value Chain Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 26: South America Cocoa Value Chain Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 27: South America Cocoa Value Chain Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 28: South America Cocoa Value Chain Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 29: South America Cocoa Value Chain Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 30: South America Cocoa Value Chain Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 31: South America Cocoa Value Chain Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 32: South America Cocoa Value Chain Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 33: South America Cocoa Value Chain Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 34: South America Cocoa Value Chain Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Cocoa Value Chain Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Europe Cocoa Value Chain Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 37: Europe Cocoa Value Chain Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 38: Europe Cocoa Value Chain Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 39: Europe Cocoa Value Chain Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 40: Europe Cocoa Value Chain Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 41: Europe Cocoa Value Chain Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 42: Europe Cocoa Value Chain Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 43: Europe Cocoa Value Chain Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 44: Europe Cocoa Value Chain Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 45: Europe Cocoa Value Chain Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 46: Europe Cocoa Value Chain Industry Revenue (Million), by Country 2024 & 2032

- Figure 47: Europe Cocoa Value Chain Industry Revenue Share (%), by Country 2024 & 2032

- Figure 48: Middle East & Africa Cocoa Value Chain Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 49: Middle East & Africa Cocoa Value Chain Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 50: Middle East & Africa Cocoa Value Chain Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 51: Middle East & Africa Cocoa Value Chain Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 52: Middle East & Africa Cocoa Value Chain Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 53: Middle East & Africa Cocoa Value Chain Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 54: Middle East & Africa Cocoa Value Chain Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 55: Middle East & Africa Cocoa Value Chain Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 56: Middle East & Africa Cocoa Value Chain Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 57: Middle East & Africa Cocoa Value Chain Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 58: Middle East & Africa Cocoa Value Chain Industry Revenue (Million), by Country 2024 & 2032

- Figure 59: Middle East & Africa Cocoa Value Chain Industry Revenue Share (%), by Country 2024 & 2032

- Figure 60: Asia Pacific Cocoa Value Chain Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 61: Asia Pacific Cocoa Value Chain Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 62: Asia Pacific Cocoa Value Chain Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 63: Asia Pacific Cocoa Value Chain Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 64: Asia Pacific Cocoa Value Chain Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 65: Asia Pacific Cocoa Value Chain Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 66: Asia Pacific Cocoa Value Chain Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 67: Asia Pacific Cocoa Value Chain Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 68: Asia Pacific Cocoa Value Chain Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 69: Asia Pacific Cocoa Value Chain Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 70: Asia Pacific Cocoa Value Chain Industry Revenue (Million), by Country 2024 & 2032

- Figure 71: Asia Pacific Cocoa Value Chain Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cocoa Value Chain Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Cocoa Value Chain Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Global Cocoa Value Chain Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Global Cocoa Value Chain Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Global Cocoa Value Chain Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Global Cocoa Value Chain Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Global Cocoa Value Chain Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Cocoa Value Chain Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Brazil Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Argentina Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of South America Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Cocoa Value Chain Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Cocoa Value Chain Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Taiwan Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Cocoa Value Chain Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Germany Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: France Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Italy Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: United Kingdom Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Netherlands Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Cocoa Value Chain Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Middle East Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Africa Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Cocoa Value Chain Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 35: Global Cocoa Value Chain Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 36: Global Cocoa Value Chain Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 37: Global Cocoa Value Chain Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 38: Global Cocoa Value Chain Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 39: Global Cocoa Value Chain Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: United States Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Canada Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Mexico Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Cocoa Value Chain Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 44: Global Cocoa Value Chain Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 45: Global Cocoa Value Chain Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 46: Global Cocoa Value Chain Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 47: Global Cocoa Value Chain Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 48: Global Cocoa Value Chain Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: Brazil Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Argentina Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of South America Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Cocoa Value Chain Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 53: Global Cocoa Value Chain Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 54: Global Cocoa Value Chain Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 55: Global Cocoa Value Chain Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 56: Global Cocoa Value Chain Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 57: Global Cocoa Value Chain Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: United Kingdom Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Germany Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: France Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Italy Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Spain Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Russia Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Benelux Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Nordics Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of Europe Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Global Cocoa Value Chain Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 68: Global Cocoa Value Chain Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 69: Global Cocoa Value Chain Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 70: Global Cocoa Value Chain Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 71: Global Cocoa Value Chain Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 72: Global Cocoa Value Chain Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 73: Turkey Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Israel Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: GCC Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: North Africa Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: South Africa Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Rest of Middle East & Africa Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 79: Global Cocoa Value Chain Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 80: Global Cocoa Value Chain Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 81: Global Cocoa Value Chain Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 82: Global Cocoa Value Chain Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 83: Global Cocoa Value Chain Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 84: Global Cocoa Value Chain Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 85: China Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: India Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 87: Japan Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: Oceania Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 91: Rest of Asia Pacific Cocoa Value Chain Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cocoa Value Chain Industry?

The projected CAGR is approximately 2.30%.

2. Which companies are prominent players in the Cocoa Value Chain Industry?

Key companies in the market include Lindt & Sprüngli , Nestlé , Mondelez International , Cargill, Blommer Chocolate Company, Meiji Holdings Co., Ltd., Hershey's , Mars , Barry Callebaut, Olam International .

3. What are the main segments of the Cocoa Value Chain Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production.

6. What are the notable trends driving market growth?

Sustainable Sourcing to Improve Economies for Stakeholders.

7. Are there any restraints impacting market growth?

Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis.

8. Can you provide examples of recent developments in the market?

October 2022: A wholly-owned Ghanaian company, Niche Cocoa Industry, has collaborated with Omanhene Cocoa Bean Co., of Milwaukee, in a leased 44,000-square-foot cocoa processing plant in the Franklin Business Park, United States. It is the first United States facility for Niche, in which the largest cocoa processor in Ghana has entered the United States to strengthen the cocoa food and beverage industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cocoa Value Chain Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cocoa Value Chain Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cocoa Value Chain Industry?

To stay informed about further developments, trends, and reports in the Cocoa Value Chain Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence