Key Insights

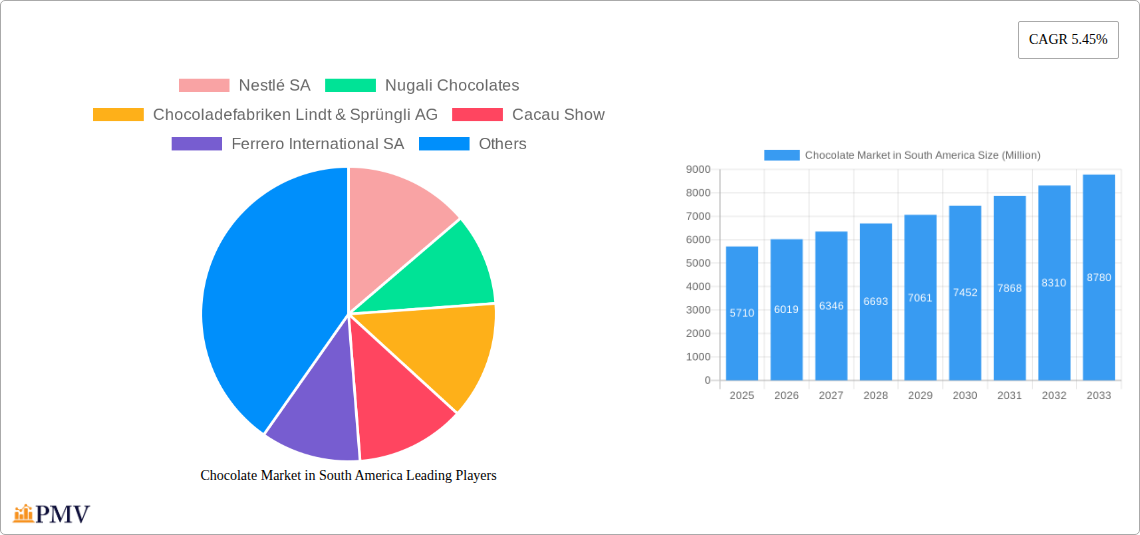

The South American chocolate market is poised for robust growth, projected to expand from a market size of 5710 million in 2025 at a Compound Annual Growth Rate (CAGR) of 5.45% through 2033. This upward trajectory is fueled by a confluence of factors, including rising disposable incomes across key nations like Brazil and Argentina, a growing appreciation for premium and artisanal chocolate products, and increasing urbanization leading to greater accessibility through diverse distribution channels. The market is segmented by confectionery variants, with Dark Chocolate, Milk and White Chocolate enjoying significant demand. Distribution channels are also diversifying, with Convenience Stores, Online Retail Stores, and Supermarkets/Hypermarkets playing crucial roles in reaching a broader consumer base. Consumer preferences are increasingly shifting towards ethically sourced and sustainable chocolate, a trend that key players are actively addressing.

Chocolate Market in South America Market Size (In Billion)

The competitive landscape features a mix of global giants such as Nestlé SA, Mondelēz International Inc., and Mars Incorporated, alongside strong regional players like Cacau Show and Confiteca CA. These companies are actively innovating in product development, focusing on healthier options, unique flavor profiles, and engaging marketing campaigns to capture consumer attention. Restraints such as fluctuating raw material prices and the presence of substitute confectionery products are being mitigated through strategic sourcing, product differentiation, and value-added offerings. The market's growth will be further propelled by advancements in e-commerce and the expansion of modern retail formats, making premium and specialty chocolates more attainable for a wider segment of the South American population.

Chocolate Market in South America Company Market Share

This in-depth report provides an exhaustive analysis of the South America chocolate market, offering crucial insights for industry stakeholders. Covering the historical period from 2019 to 2024, base year 2025, and a forecast period extending to 2033, this study delves into market dynamics, trends, competitive landscapes, and future outlook. The report is meticulously crafted to be SEO-optimized, incorporating high-ranking keywords to enhance search visibility and engage a broad spectrum of industry audiences, from manufacturers and distributors to investors and market researchers.

Chocolate Market in South America Market Structure & Competitive Dynamics

The South America chocolate market exhibits a moderate to high concentration, with Nestlé SA, Mondelēz International Inc, and Mars Incorporated holding significant market shares across key economies like Brazil and Argentina. The innovation ecosystem is vibrant, driven by local players such as Nugali Chocolates and Cacau Show who focus on premium and artisanal offerings, often utilizing ethically sourced cocoa. Regulatory frameworks primarily revolve around food safety, labeling standards, and import/export duties, with varying degrees of stringency across countries. Product substitutes include other confectionery items, biscuits, and ice cream, yet the inherent indulgence factor of chocolate provides a strong competitive moat. End-user trends are increasingly leaning towards healthier options, sugar-free variants, and ethically sourced, sustainable chocolate. Mergers & Acquisitions (M&A) activities are a key feature, illustrated by Ferrero's acquisition of Dori Alimentos (July 2023), a strategic move to bolster its presence in the Brazilian confectionery sector. While specific M&A deal values are often undisclosed, such transactions signal consolidation and the pursuit of expanded market reach. The market share of top players is estimated to be around 55-60%, with the remaining share fragmented among numerous regional and niche manufacturers.

Chocolate Market in South America Industry Trends & Insights

The South America chocolate market is experiencing robust growth, driven by an expanding middle class with increasing disposable incomes and a growing appetite for premium and indulgence products. The Compound Annual Growth Rate (CAGR) for the South America chocolate market is projected to be approximately 5.5% between 2025 and 2033. Key growth drivers include rising consumer demand for dark chocolate due to perceived health benefits, and the increasing popularity of artisanal and ethically sourced chocolate. Technological disruptions are primarily focused on improving production efficiency, sustainable sourcing practices, and novel product development. For instance, advancements in cocoa processing technology are leading to enhanced flavor profiles and textures. Consumer preferences are evolving, with a growing emphasis on health and wellness, leading to a surge in demand for sugar-free, low-calorie, and plant-based chocolate options. The penetration of premium chocolate brands is steadily increasing, especially in urban centers. Competitive dynamics are characterized by intense price competition in the mass-market segment and a battle for differentiation in the premium space through unique flavor combinations, sustainable sourcing narratives, and appealing packaging. The market penetration of chocolate confectionery currently stands at around 70% in major South American countries.

Dominant Markets & Segments in Chocolate Market in South America

The Brazilian chocolate market stands out as the dominant region within South America, accounting for an estimated 40% of the total market value. This dominance is propelled by a large population, a robust agricultural sector providing ample cocoa supply, and a well-established confectionery industry.

- Leading Country: Brazil

- Key Drivers: High population density, increasing disposable income, strong domestic production of cocoa beans, and significant presence of multinational and local chocolate manufacturers.

- Dominance Analysis: Brazil's market leadership is further solidified by aggressive marketing campaigns, diverse product offerings catering to various consumer segments, and a high consumption rate of both mass-market and premium chocolates.

- Dominant Variant: Milk and White Chocolate

- Key Drivers: These variants hold the largest market share due to their widespread appeal across all age groups, sweeter taste profiles, and established presence in traditional chocolate products.

- Dominance Analysis: The sheer volume of sales for milk and white chocolate products, from everyday bars to specialized confectionery, cements their dominant position. They form the backbone of product portfolios for most manufacturers.

- Dominant Distribution Channel: Supermarket/Hypermarket

- Key Drivers: These retail formats offer convenience, a wide product selection, and competitive pricing, making them the preferred shopping destination for the majority of consumers.

- Dominance Analysis: Supermarkets and hypermarkets provide optimal shelf space and visibility for a vast array of chocolate brands, facilitating impulse purchases and regular restocking. Their extensive reach across urban and semi-urban areas ensures broad accessibility.

- Growing Segment: Online Retail Store

- Key Drivers: Increasing internet penetration, the growth of e-commerce platforms, and the demand for convenient home delivery are propelling online sales. This channel is particularly effective for niche, premium, and specialty chocolate brands.

- Dominance Analysis: While currently smaller than supermarkets, online retail is experiencing rapid growth. It offers a platform for direct-to-consumer sales and allows brands to reach a wider geographic audience without the need for extensive physical retail networks.

Chocolate Market in South America Product Innovations

Product innovations in the South America chocolate market are increasingly focused on health-consciousness, ethical sourcing, and unique flavor experiences. Companies are introducing dark chocolate variants with higher cocoa percentages, appealing to health-aware consumers. Sugar-free and low-sugar options are gaining traction, utilizing natural sweeteners. Furthermore, there's a growing trend towards plant-based and vegan chocolates, expanding the market reach to a broader consumer base. Artisanal brands are experimenting with exotic local ingredients and flavor fusions, such as regional fruits and spices, to create distinctive products. These innovations are crucial for gaining competitive advantages by tapping into emerging consumer preferences and expanding market segments.

Report Segmentation & Scope

This report meticulously segments the South America chocolate market across several key dimensions, providing granular insights into each segment's performance and potential. The segmentation covers:

- Confectionery Variant:

- Dark Chocolate: This segment is characterized by growing demand from health-conscious consumers and its association with premium and artisanal offerings.

- Milk and White Chocolate: These variants continue to dominate due to their broad consumer appeal and versatility in various chocolate products.

- Distribution Channel:

- Convenience Store: This channel serves immediate consumption needs and impulse purchases, particularly in urban and high-traffic areas.

- Online Retail Store: Experiencing rapid growth, this channel offers convenience and access to a wider range of brands, especially for niche and premium products.

- Supermarket/Hypermarket: Remains the dominant channel, offering variety, competitive pricing, and accessibility to a vast consumer base.

- Others: This includes specialized confectionery stores, bakeries, and duty-free shops, catering to specific consumer needs and occasions.

Key Drivers of Chocolate Market in South America Growth

The growth of the South America chocolate market is propelled by several interconnected factors. Increasing disposable incomes across the region, particularly in countries like Brazil and Argentina, are allowing consumers to spend more on discretionary items like premium chocolates. The rising popularity of dark chocolate, driven by perceived health benefits and a growing appreciation for complex flavors, is a significant driver. Furthermore, a heightened focus on ethical sourcing and sustainability is creating demand for responsibly produced chocolate, attracting ethically-minded consumers. Technological advancements in production and distribution are also contributing to market expansion by improving efficiency and product quality.

Challenges in the Chocolate Market in South America Sector

Despite its promising growth trajectory, the South America chocolate market faces several challenges. Price volatility of cocoa beans, influenced by climate conditions and global supply dynamics, can impact profitability and consumer pricing. Supply chain disruptions, exacerbated by logistical complexities and geopolitical factors in some regions, pose a constant threat to timely product delivery. Intense competitive pressures, particularly in the mass-market segment, can lead to price wars and squeezed margins. Additionally, evolving consumer health trends demanding sugar-free and healthier alternatives require continuous product reformulation and innovation, which can be costly and time-consuming. Regulatory hurdles related to import duties and food standards across different South American countries also present operational complexities.

Leading Players in the Chocolate Market in South America Market

- Nestlé SA

- Nugali Chocolates

- Chocoladefabriken Lindt & Sprüngli AG

- Cacau Show

- Ferrero International SA

- Mars Incorporated

- Arcor S A I C

- Confiteca CA

- Mondelēz International Inc

- Grupo de Inversiones Suramericana SA

- The Peccin S

- The Hershey Company

Key Developments in Chocolate Market in South America Sector

- July 2023: Ferrero's sister company, Ferrara Candy Co., announced the acquisition of Brazilian snacks company Dori Alimentos, which sells a variety of chocolate and sugar confectionery brands, including Dori, Pettiz, and Jubes.

- December 2022: Mars Incorporated launched Snickers Caramelo & Bacon limited edition chocolate bars in Brazil.

- November 2022: Nestlé announced the establishment of a new Research & Development (R&D) Center for Latin America. The inauguration of the new center was in Santiago, Chile. This center will enable the development of tasty, nutritious, affordable, and sustainable products that are highly relevant to local consumers. The center will also strengthen the company's collaborations with universities, start-ups, and entrepreneurs across Latin America.

Strategic Chocolate Market in South America Market Outlook

The strategic outlook for the South America chocolate market remains highly optimistic, driven by sustained economic development and evolving consumer preferences. Growth accelerators include the increasing demand for premium and artisanal chocolates, with companies focusing on unique flavor profiles and ethically sourced ingredients. The expansion of e-commerce channels will continue to provide new avenues for market penetration and direct consumer engagement. Investments in local production capabilities and the development of healthier chocolate alternatives are crucial for long-term success. Strategic partnerships and acquisitions will likely shape the competitive landscape, enabling companies to expand their product portfolios and market reach. The focus on sustainability and transparency in the supply chain will increasingly differentiate brands and attract a growing segment of conscious consumers.

Chocolate Market in South America Segmentation

-

1. Confectionery Variant

- 1.1. Dark Chocolate

- 1.2. Milk and White Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

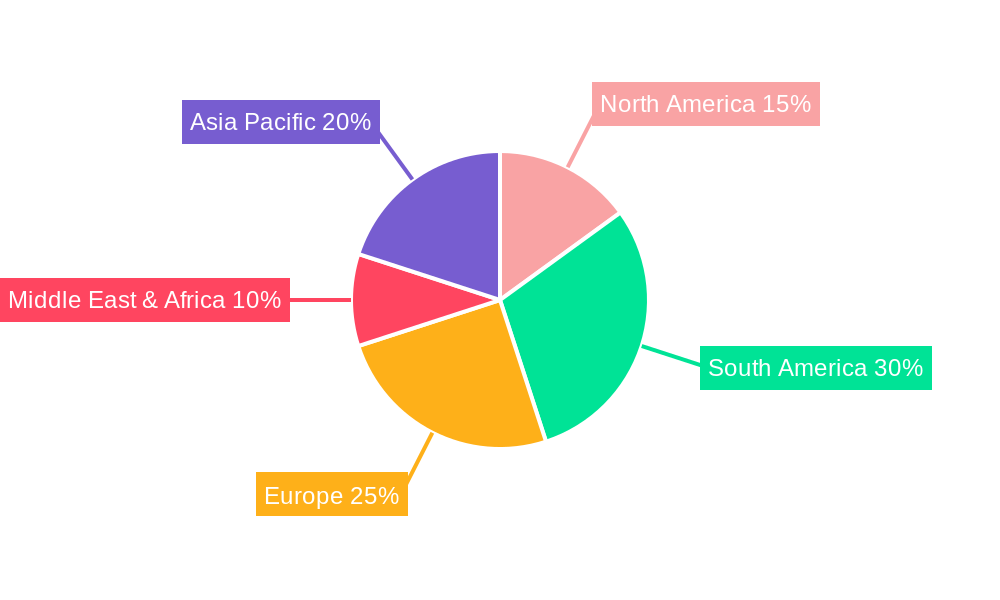

Chocolate Market in South America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Chocolate Market in South America Regional Market Share

Geographic Coverage of Chocolate Market in South America

Chocolate Market in South America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for meat alternatives

- 3.3. Market Restrains

- 3.3.1. Presence of numerous alternatives in the plant proteins

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chocolate Market in South America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Dark Chocolate

- 5.1.2. Milk and White Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. North America Chocolate Market in South America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6.1.1. Dark Chocolate

- 6.1.2. Milk and White Chocolate

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Convenience Store

- 6.2.2. Online Retail Store

- 6.2.3. Supermarket/Hypermarket

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 7. South America Chocolate Market in South America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 7.1.1. Dark Chocolate

- 7.1.2. Milk and White Chocolate

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Convenience Store

- 7.2.2. Online Retail Store

- 7.2.3. Supermarket/Hypermarket

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 8. Europe Chocolate Market in South America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 8.1.1. Dark Chocolate

- 8.1.2. Milk and White Chocolate

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Convenience Store

- 8.2.2. Online Retail Store

- 8.2.3. Supermarket/Hypermarket

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 9. Middle East & Africa Chocolate Market in South America Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 9.1.1. Dark Chocolate

- 9.1.2. Milk and White Chocolate

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Convenience Store

- 9.2.2. Online Retail Store

- 9.2.3. Supermarket/Hypermarket

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 10. Asia Pacific Chocolate Market in South America Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 10.1.1. Dark Chocolate

- 10.1.2. Milk and White Chocolate

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Convenience Store

- 10.2.2. Online Retail Store

- 10.2.3. Supermarket/Hypermarket

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestlé SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nugali Chocolates

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chocoladefabriken Lindt & Sprüngli AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cacau Show

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ferrero International SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mars Incorporated

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Arcor S A I C

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Confiteca CA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mondelēz International Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Grupo de Inversiones Suramericana SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The Peccin S

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Hershey Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Nestlé SA

List of Figures

- Figure 1: Global Chocolate Market in South America Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Chocolate Market in South America Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: North America Chocolate Market in South America Revenue (Million), by Confectionery Variant 2025 & 2033

- Figure 4: North America Chocolate Market in South America Volume (K Tons), by Confectionery Variant 2025 & 2033

- Figure 5: North America Chocolate Market in South America Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 6: North America Chocolate Market in South America Volume Share (%), by Confectionery Variant 2025 & 2033

- Figure 7: North America Chocolate Market in South America Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: North America Chocolate Market in South America Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 9: North America Chocolate Market in South America Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Chocolate Market in South America Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Chocolate Market in South America Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Chocolate Market in South America Volume (K Tons), by Country 2025 & 2033

- Figure 13: North America Chocolate Market in South America Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Chocolate Market in South America Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Chocolate Market in South America Revenue (Million), by Confectionery Variant 2025 & 2033

- Figure 16: South America Chocolate Market in South America Volume (K Tons), by Confectionery Variant 2025 & 2033

- Figure 17: South America Chocolate Market in South America Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 18: South America Chocolate Market in South America Volume Share (%), by Confectionery Variant 2025 & 2033

- Figure 19: South America Chocolate Market in South America Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 20: South America Chocolate Market in South America Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 21: South America Chocolate Market in South America Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: South America Chocolate Market in South America Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: South America Chocolate Market in South America Revenue (Million), by Country 2025 & 2033

- Figure 24: South America Chocolate Market in South America Volume (K Tons), by Country 2025 & 2033

- Figure 25: South America Chocolate Market in South America Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Chocolate Market in South America Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Chocolate Market in South America Revenue (Million), by Confectionery Variant 2025 & 2033

- Figure 28: Europe Chocolate Market in South America Volume (K Tons), by Confectionery Variant 2025 & 2033

- Figure 29: Europe Chocolate Market in South America Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 30: Europe Chocolate Market in South America Volume Share (%), by Confectionery Variant 2025 & 2033

- Figure 31: Europe Chocolate Market in South America Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 32: Europe Chocolate Market in South America Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 33: Europe Chocolate Market in South America Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Europe Chocolate Market in South America Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Europe Chocolate Market in South America Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Chocolate Market in South America Volume (K Tons), by Country 2025 & 2033

- Figure 37: Europe Chocolate Market in South America Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Chocolate Market in South America Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Chocolate Market in South America Revenue (Million), by Confectionery Variant 2025 & 2033

- Figure 40: Middle East & Africa Chocolate Market in South America Volume (K Tons), by Confectionery Variant 2025 & 2033

- Figure 41: Middle East & Africa Chocolate Market in South America Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 42: Middle East & Africa Chocolate Market in South America Volume Share (%), by Confectionery Variant 2025 & 2033

- Figure 43: Middle East & Africa Chocolate Market in South America Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Middle East & Africa Chocolate Market in South America Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 45: Middle East & Africa Chocolate Market in South America Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Middle East & Africa Chocolate Market in South America Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Middle East & Africa Chocolate Market in South America Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa Chocolate Market in South America Volume (K Tons), by Country 2025 & 2033

- Figure 49: Middle East & Africa Chocolate Market in South America Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Chocolate Market in South America Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Chocolate Market in South America Revenue (Million), by Confectionery Variant 2025 & 2033

- Figure 52: Asia Pacific Chocolate Market in South America Volume (K Tons), by Confectionery Variant 2025 & 2033

- Figure 53: Asia Pacific Chocolate Market in South America Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 54: Asia Pacific Chocolate Market in South America Volume Share (%), by Confectionery Variant 2025 & 2033

- Figure 55: Asia Pacific Chocolate Market in South America Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Asia Pacific Chocolate Market in South America Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 57: Asia Pacific Chocolate Market in South America Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Asia Pacific Chocolate Market in South America Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Asia Pacific Chocolate Market in South America Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Chocolate Market in South America Volume (K Tons), by Country 2025 & 2033

- Figure 61: Asia Pacific Chocolate Market in South America Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Chocolate Market in South America Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Chocolate Market in South America Revenue Million Forecast, by Confectionery Variant 2020 & 2033

- Table 2: Global Chocolate Market in South America Volume K Tons Forecast, by Confectionery Variant 2020 & 2033

- Table 3: Global Chocolate Market in South America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Chocolate Market in South America Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Chocolate Market in South America Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Chocolate Market in South America Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Chocolate Market in South America Revenue Million Forecast, by Confectionery Variant 2020 & 2033

- Table 8: Global Chocolate Market in South America Volume K Tons Forecast, by Confectionery Variant 2020 & 2033

- Table 9: Global Chocolate Market in South America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Chocolate Market in South America Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Chocolate Market in South America Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Chocolate Market in South America Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: United States Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Canada Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Mexico Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Global Chocolate Market in South America Revenue Million Forecast, by Confectionery Variant 2020 & 2033

- Table 20: Global Chocolate Market in South America Volume K Tons Forecast, by Confectionery Variant 2020 & 2033

- Table 21: Global Chocolate Market in South America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Chocolate Market in South America Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Chocolate Market in South America Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Chocolate Market in South America Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Brazil Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Argentina Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Global Chocolate Market in South America Revenue Million Forecast, by Confectionery Variant 2020 & 2033

- Table 32: Global Chocolate Market in South America Volume K Tons Forecast, by Confectionery Variant 2020 & 2033

- Table 33: Global Chocolate Market in South America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Chocolate Market in South America Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Chocolate Market in South America Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Chocolate Market in South America Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: Germany Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: France Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: Italy Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: Spain Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: Russia Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Benelux Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Nordics Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 55: Global Chocolate Market in South America Revenue Million Forecast, by Confectionery Variant 2020 & 2033

- Table 56: Global Chocolate Market in South America Volume K Tons Forecast, by Confectionery Variant 2020 & 2033

- Table 57: Global Chocolate Market in South America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global Chocolate Market in South America Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Chocolate Market in South America Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Chocolate Market in South America Volume K Tons Forecast, by Country 2020 & 2033

- Table 61: Turkey Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: Israel Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 65: GCC Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 67: North Africa Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 69: South Africa Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Global Chocolate Market in South America Revenue Million Forecast, by Confectionery Variant 2020 & 2033

- Table 74: Global Chocolate Market in South America Volume K Tons Forecast, by Confectionery Variant 2020 & 2033

- Table 75: Global Chocolate Market in South America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 76: Global Chocolate Market in South America Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 77: Global Chocolate Market in South America Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Chocolate Market in South America Volume K Tons Forecast, by Country 2020 & 2033

- Table 79: China Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 81: India Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 83: Japan Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 85: South Korea Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 89: Oceania Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Chocolate Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Chocolate Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chocolate Market in South America?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Chocolate Market in South America?

Key companies in the market include Nestlé SA, Nugali Chocolates, Chocoladefabriken Lindt & Sprüngli AG, Cacau Show, Ferrero International SA, Mars Incorporated, Arcor S A I C, Confiteca CA, Mondelēz International Inc, Grupo de Inversiones Suramericana SA, The Peccin S, The Hershey Company.

3. What are the main segments of the Chocolate Market in South America?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5710 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for meat alternatives.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of numerous alternatives in the plant proteins.

8. Can you provide examples of recent developments in the market?

July 2023: Ferrero's sister company, Ferrara Candy Co., announced the acquisition of Brazilian snacks company Dori Alimentos, which sells a variety of chocolate and sugar confectionery brands, including Dori, Pettiz, and Jubes.December 2022: Mars Incorporated launched Snickers Caramelo & Bacon limited edition chocolate bars in Brazil.November 2022: Nestlé announced the establishment of a new Research & Development (R&D) Center for Latin America. The inauguration of the new center was in Santiago, Chile. This center will enable the development of tasty, nutritious, affordable, and sustainable products that are highly relevant to local consumers. The center will also strengthen the company's collaborations with universities, start-ups, and entrepreneurs across Latin America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chocolate Market in South America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chocolate Market in South America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chocolate Market in South America?

To stay informed about further developments, trends, and reports in the Chocolate Market in South America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence