Key Insights

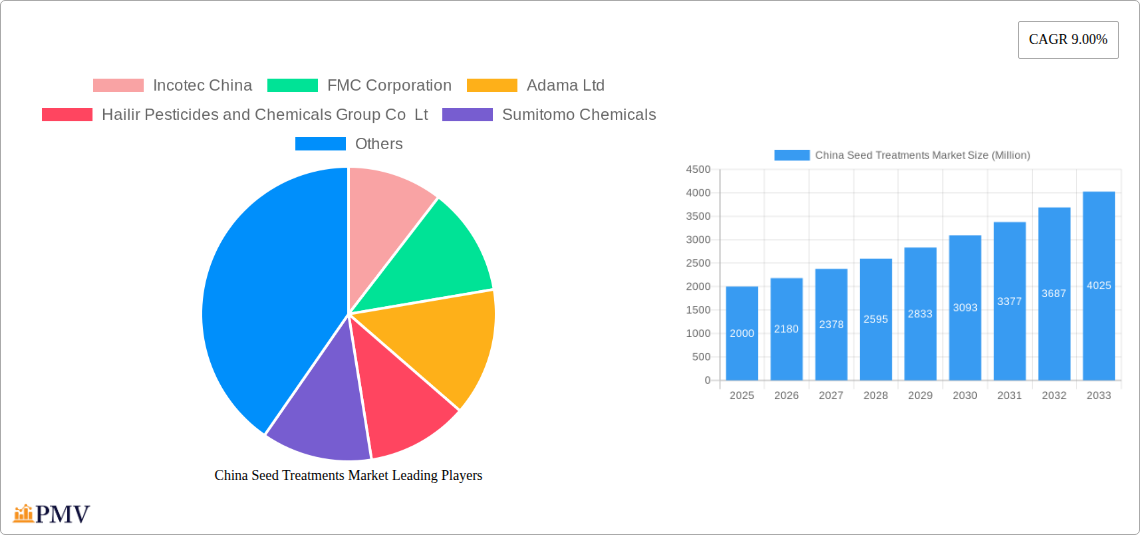

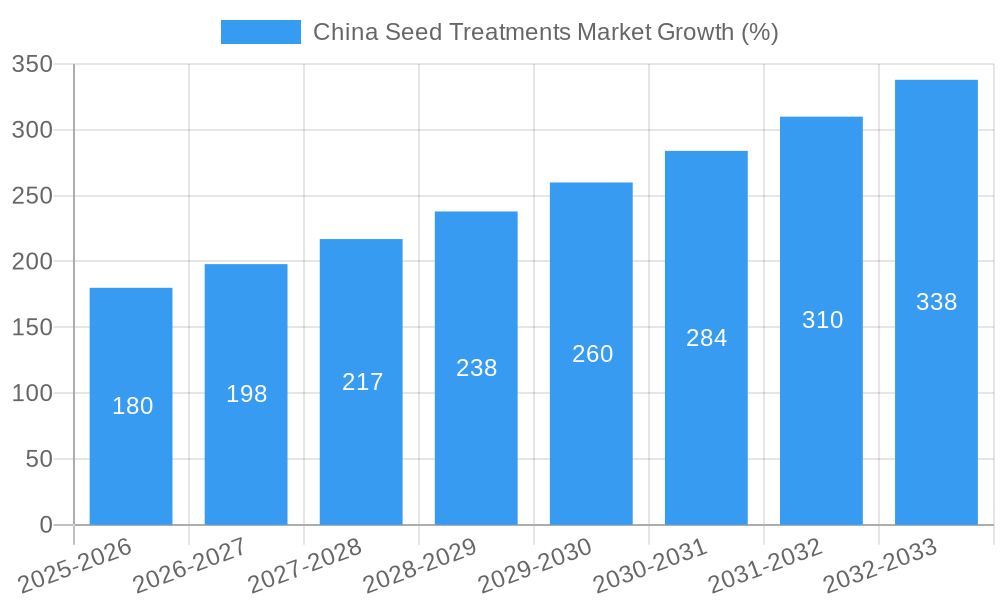

The China seed treatments market, valued at approximately $XX million in 2025 (assuming a logical extrapolation from the provided data and considering the 9.00% CAGR), is poised for significant growth throughout the forecast period (2025-2033). This robust expansion is driven primarily by increasing agricultural yields and the growing adoption of advanced farming techniques to enhance crop productivity. The rising demand for higher-quality and disease-resistant crops, coupled with stringent government regulations promoting sustainable agriculture, further fuels market expansion. Key segments driving growth include seed coating and pelleting techniques, predominantly used for grains and cereals, pulses, and oilseeds. Major players like Incotec China, FMC Corporation, and Syngenta are actively engaged in developing and supplying innovative seed treatment products to meet the growing needs of Chinese farmers. Competition is intense, with both domestic and international companies vying for market share through product differentiation, strategic partnerships, and technological advancements.

The market's growth trajectory is expected to continue at a healthy pace, with the CAGR of 9.00% projected through 2033. However, challenges such as fluctuating raw material prices and potential environmental concerns associated with certain chemical seed treatments could pose constraints. The increasing adoption of non-chemical seed treatments, driven by sustainability concerns and consumer demand for organic produce, presents both a challenge and an opportunity for market participants. Companies are focusing on research and development to create more effective and environmentally friendly seed treatment solutions to navigate this dynamic landscape. Regional variations within China will also play a role, with more developed regions potentially exhibiting faster growth than less developed areas. This requires companies to tailor their strategies to specific regional needs and agricultural practices.

This in-depth report provides a comprehensive analysis of the China seed treatments market, covering market size, growth drivers, challenges, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers actionable insights for industry stakeholders, including manufacturers, distributors, and investors. The market is segmented by chemical origin (chemical, non-chemical), application technique (seed coating, seed pelleting, seed dressing, others), and crop type (grains and cereals, pulses, fruits & vegetables, oilseeds, other crops). This analysis reveals substantial growth opportunities, particularly within specific segments and regions of China.

China Seed Treatments Market Market Structure & Competitive Dynamics

The China seed treatments market exhibits a moderately concentrated structure, with a few multinational corporations and several domestic players vying for market share. In 2025, the top five companies are estimated to hold approximately xx% of the market, indicating a degree of oligopolistic competition. Innovation is driven by both domestic and international companies, focusing on developing novel formulations with enhanced efficacy and environmental friendliness. The regulatory framework in China, while increasingly stringent, presents both opportunities and challenges for market participants. The market faces pressure from both bio-pesticides and traditional chemical alternatives. M&A activity has been relatively modest in recent years, with deal values averaging approximately xx Million USD annually. End-user trends are shifting towards greater adoption of advanced seed treatment technologies, driven by the need for improved crop yields and reduced reliance on chemical inputs. Key aspects include:

- Market Concentration: Top 5 players hold approximately xx% market share in 2025.

- Innovation Ecosystem: Focus on efficacy, environmental sustainability, and novel delivery systems.

- Regulatory Framework: Stringent regulations influence product development and registration.

- Product Substitutes: Bio-pesticides and traditional chemical treatments present competitive pressure.

- M&A Activity: Average annual deal values around xx Million USD (2019-2024).

- End-User Trends: Demand for improved crop yields and sustainable agricultural practices is driving market growth.

China Seed Treatments Market Industry Trends & Insights

The China seed treatments market is experiencing robust growth, driven by increasing agricultural production, government initiatives promoting modern farming techniques, and rising awareness of sustainable agriculture. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Technological advancements, particularly in precision agriculture and bio-pesticides, are reshaping the competitive landscape. Consumer preferences are evolving toward environmentally friendly seed treatments, creating opportunities for companies offering sustainable solutions. The market penetration of advanced seed treatment technologies remains relatively low, indicating significant untapped potential. Key factors influencing the market include:

- Market Growth Drivers: Increased agricultural production, government support for modern farming, and rising demand for sustainable solutions.

- Technological Disruptions: Advancements in precision agriculture and bio-pesticides are transforming the market.

- Consumer Preferences: Shift towards environmentally friendly seed treatments.

- Competitive Dynamics: Intense competition among domestic and international players.

- Market Penetration: Significant untapped potential for advanced technologies.

Dominant Markets & Segments in China Seed Treatments Market

The grains and cereals segment dominates the China seed treatments market, accounting for the largest share in 2025 (approximately xx%). This is due to the significant acreage dedicated to these crops in China. The chemical segment within chemical origin holds the largest market share among the chemical origin, owing to the established efficacy and cost-effectiveness of these treatments. The seed coating application technique is the most widely adopted, owing to its ease of use and effectiveness. Geographically, the dominant region is the North China Plain, driven by its intensive agricultural activity and favorable climatic conditions.

- Key Drivers for Grains and Cereals Segment: Large cultivated area, government support for grain production.

- Key Drivers for Chemical Segment: Established efficacy and cost-effectiveness.

- Key Drivers for Seed Coating Segment: Ease of application and effectiveness.

- Key Drivers for North China Plain Region: Intensive agriculture, favorable climate conditions, and strong government support for agricultural development.

China Seed Treatments Market Product Innovations

Recent innovations in the China seed treatments market include the development of novel formulations with enhanced efficacy against specific pests and diseases, as well as improved seed protection against environmental stressors like drought and salinity. Companies are increasingly focusing on developing bio-pesticides and other environmentally friendly seed treatments to meet growing consumer demand for sustainable agricultural practices. These innovations enhance crop yield, improve crop quality, and minimize environmental impact, thereby ensuring a better market fit.

Report Segmentation & Scope

This report segments the China seed treatments market across several key parameters:

Chemical Origin: Chemical and Non-chemical segments, with market size and growth projections for each. Competition is fierce, with both segments displaying innovation.

Application Technique: Seed Coating, Seed Pelleting, Seed Dressing, and Others, each with detailed analysis of market dynamics. Seed coating dominates.

Crop Type: Grains and Cereals, Pulses, Fruits & Vegetables, Oilseeds, and Other Crops; each segment reflects different market dynamics and growth rates. Grain and Cereals holds the largest market share.

Key Drivers of China Seed Treatments Market Growth

The growth of the China seed treatments market is driven by several factors. These include the increasing adoption of modern farming techniques, government initiatives promoting agricultural productivity, rising demand for high-yield crops, and a growing focus on sustainable agriculture. Technological advancements, such as the development of improved seed treatment formulations, also play a significant role. Furthermore, favorable government policies and increased investments in agricultural infrastructure are fostering market expansion.

Challenges in the China Seed Treatments Market Sector

The China seed treatments market faces several challenges, including stringent regulatory requirements, potential supply chain disruptions due to geopolitical factors, and intense competition from both domestic and international players. Price fluctuations in raw materials and fluctuating agricultural yields also impact profitability. The complex regulatory landscape can add costs and delay product launches.

Leading Players in the China Seed Treatments Market Market

- Incotec China

- FMC Corporation

- Adama Ltd

- Hailir Pesticides and Chemicals Group Co Lt

- Sumitomo Chemicals

- Shandong Weifang Rainbow Chemical Co Ltd

- Syngenta

- Novozymes A/S

- Bayer CropScience AG

- BASF SE

Key Developments in China Seed Treatments Market Sector

- January 2023: Syngenta launches a new seed treatment product for rice.

- March 2024: BASF acquires a smaller Chinese seed treatment company.

- June 2024: New regulations on pesticide registration are implemented.

Strategic China Seed Treatments Market Market Outlook

The China seed treatments market presents significant growth opportunities in the coming years. Further penetration of advanced technologies, particularly in bio-pesticides and precision agriculture, is expected. Government support for sustainable agriculture and increased investments in agricultural infrastructure will continue to drive market expansion. Companies that can adapt to evolving consumer preferences and regulatory requirements will be best positioned for success. The market is primed for innovation and consolidation in the coming years.

China Seed Treatments Market Segmentation

-

1. Function

- 1.1. Fungicide

- 1.2. Insecticide

- 1.3. Nematicide

-

2. Crop Type

- 2.1. Commercial Crops

- 2.2. Fruits & Vegeatbles

- 2.3. Grains and Cereals

- 2.4. Pulses & Oilseeds

- 2.5. Turf & Ornamental Crops

-

3. Function

- 3.1. Fungicide

- 3.2. Insecticide

- 3.3. Nematicide

-

4. Crop Type

- 4.1. Commercial Crops

- 4.2. Fruits & Vegeatbles

- 4.3. Grains and Cereals

- 4.4. Pulses & Oilseeds

- 4.5. Turf & Ornamental Crops

China Seed Treatments Market Segmentation By Geography

- 1. China

China Seed Treatments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Rising Cost of High Quality Seeds

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Seed Treatments Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Fungicide

- 5.1.2. Insecticide

- 5.1.3. Nematicide

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Commercial Crops

- 5.2.2. Fruits & Vegeatbles

- 5.2.3. Grains and Cereals

- 5.2.4. Pulses & Oilseeds

- 5.2.5. Turf & Ornamental Crops

- 5.3. Market Analysis, Insights and Forecast - by Function

- 5.3.1. Fungicide

- 5.3.2. Insecticide

- 5.3.3. Nematicide

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Commercial Crops

- 5.4.2. Fruits & Vegeatbles

- 5.4.3. Grains and Cereals

- 5.4.4. Pulses & Oilseeds

- 5.4.5. Turf & Ornamental Crops

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Incotec China

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FMC Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Adama Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hailir Pesticides and Chemicals Group Co Lt

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sumitomo Chemicals

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shandong Weifang Rainbow Chemical Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Syngenta

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Novozymes A/S

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bayer CropScience AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Incotec China

List of Figures

- Figure 1: China Seed Treatments Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Seed Treatments Market Share (%) by Company 2024

List of Tables

- Table 1: China Seed Treatments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Seed Treatments Market Revenue Million Forecast, by Function 2019 & 2032

- Table 3: China Seed Treatments Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 4: China Seed Treatments Market Revenue Million Forecast, by Function 2019 & 2032

- Table 5: China Seed Treatments Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 6: China Seed Treatments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: China Seed Treatments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Seed Treatments Market Revenue Million Forecast, by Function 2019 & 2032

- Table 9: China Seed Treatments Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 10: China Seed Treatments Market Revenue Million Forecast, by Function 2019 & 2032

- Table 11: China Seed Treatments Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 12: China Seed Treatments Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Seed Treatments Market?

The projected CAGR is approximately 9.00%.

2. Which companies are prominent players in the China Seed Treatments Market?

Key companies in the market include Incotec China, FMC Corporation, Adama Ltd, Hailir Pesticides and Chemicals Group Co Lt, Sumitomo Chemicals, Shandong Weifang Rainbow Chemical Co Ltd, Syngenta, Novozymes A/S, Bayer CropScience AG, BASF SE.

3. What are the main segments of the China Seed Treatments Market?

The market segments include Function, Crop Type, Function, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Rising Cost of High Quality Seeds.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Seed Treatments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Seed Treatments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Seed Treatments Market?

To stay informed about further developments, trends, and reports in the China Seed Treatments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence