Key Insights

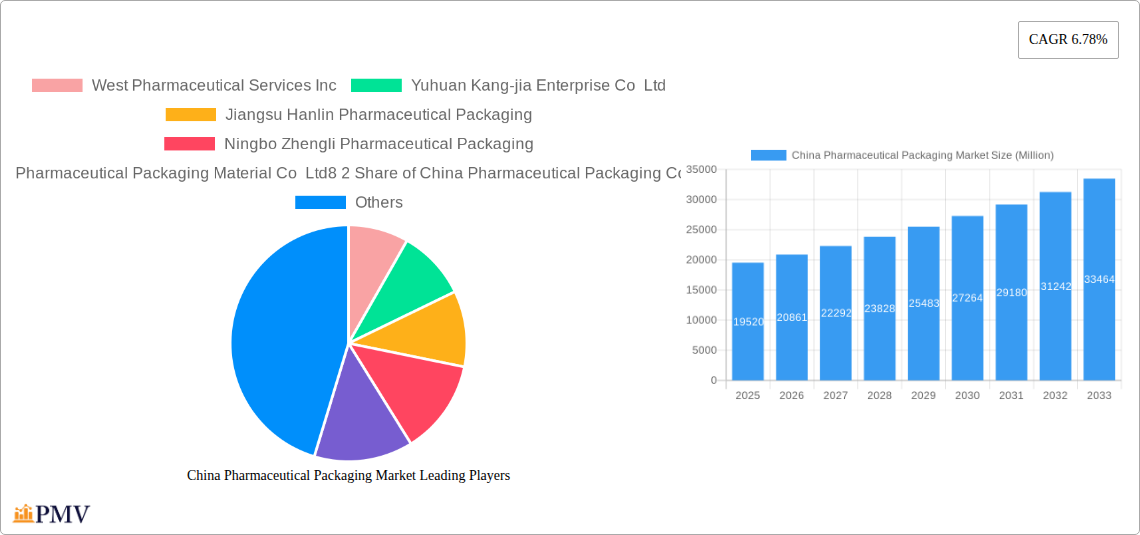

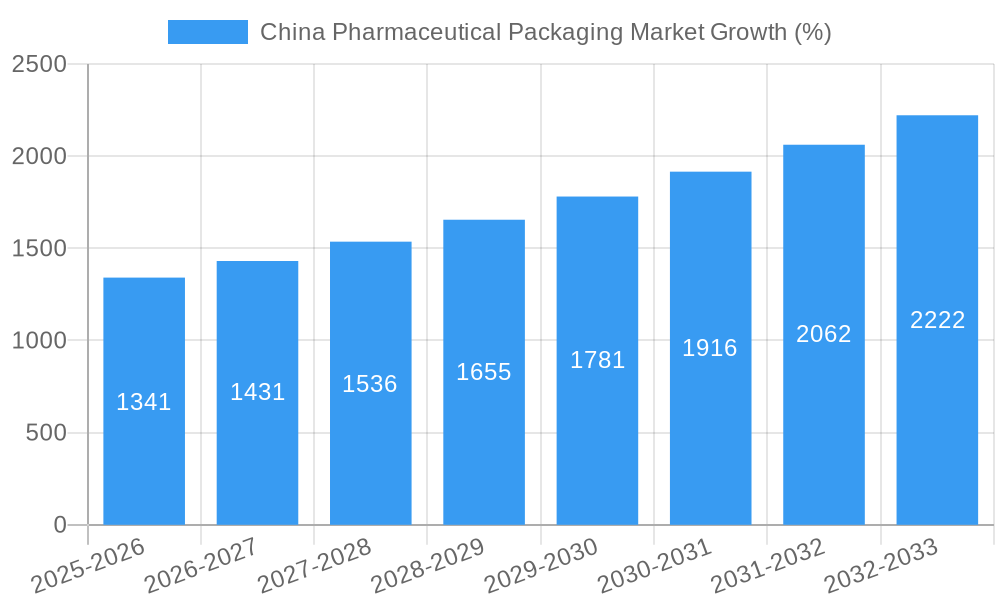

The China pharmaceutical packaging market, valued at $19.52 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.78% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing prevalence of chronic diseases and a burgeoning aging population in China are driving demand for pharmaceutical products, consequently boosting the need for effective and safe packaging solutions. Secondly, stringent government regulations regarding drug safety and efficacy are pushing manufacturers to adopt advanced packaging technologies, such as tamper-evident seals and child-resistant closures, thus stimulating market growth. Furthermore, the rising adoption of innovative packaging materials, including biodegradable and sustainable options, is creating new opportunities for market players. The market is segmented by primary packaging (bottles, blister packs, syringes, vials, etc.) and secondary packaging (cartons, corrugated containers, bags, etc.), with significant growth anticipated across both segments. Competition is intense, with both domestic and international players vying for market share. Key players like West Pharmaceutical Services, Amcor, and several prominent Chinese companies are investing heavily in research and development, capacity expansion, and strategic partnerships to maintain a competitive edge.

The forecast period of 2025-2033 promises continued market expansion, with the CAGR indicating substantial growth potential. However, challenges exist. These include fluctuating raw material prices, intense competition, and the need for continuous innovation to meet evolving regulatory requirements and consumer preferences. Successful players will need to demonstrate adaptability, invest strategically in technological advancements, and focus on developing cost-effective and sustainable packaging solutions to capitalize on the expanding opportunities within the Chinese pharmaceutical sector. The dominance of domestic companies in the market highlights a focus on localization and the importance of understanding the unique demands of the Chinese healthcare system. Future growth will be further propelled by the increasing adoption of personalized medicine and advancements in drug delivery systems, both of which will necessitate innovative packaging solutions.

China Pharmaceutical Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China pharmaceutical packaging market, offering invaluable insights for industry stakeholders. The study period covers 2019-2033, with a focus on 2025 as the base and estimated year, and a forecast period of 2025-2033. The report leverages extensive data analysis and industry expertise to offer a detailed understanding of market trends, competitive dynamics, and future growth prospects. The market is segmented by primary and secondary packaging types, allowing for granular analysis of specific product categories. Key players like West Pharmaceutical Services Inc., Amcor Group GMBH, and Gerresheimer AG are profiled, highlighting their market share and strategic initiatives.

China Pharmaceutical Packaging Market Market Structure & Competitive Dynamics

The China pharmaceutical packaging market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller domestic companies fosters competition. The industry is characterized by ongoing innovation, particularly in materials science and packaging technologies, driven by the increasing demand for sophisticated drug delivery systems. Regulatory frameworks, including those related to GMP (Good Manufacturing Practice) compliance and environmental regulations, significantly impact market operations. The market witnesses considerable M&A activity, with larger players consolidating their market position through acquisitions of smaller companies. The total value of M&A deals in the past five years is estimated at xx Million. Product substitutes, particularly in primary packaging, are limited due to strict regulatory requirements concerning material compatibility and drug stability. End-user trends, primarily driven by pharmaceutical companies' focus on enhanced drug efficacy, safety, and patient convenience, heavily influence market growth.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of market share in 2024.

- Innovation Ecosystems: Strong focus on developing sustainable and innovative packaging solutions.

- Regulatory Frameworks: Stringent GMP regulations and environmental standards drive product development.

- Product Substitutes: Limited due to strict regulatory requirements and material compatibility concerns.

- End-User Trends: Demand for improved drug delivery systems and patient convenience are key drivers.

- M&A Activities: Significant M&A activity, with a total deal value of approximately xx Million in the past five years.

China Pharmaceutical Packaging Market Industry Trends & Insights

The China pharmaceutical packaging market is witnessing robust growth, fueled by a burgeoning pharmaceutical industry, expanding healthcare infrastructure, and increasing disposable incomes. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was estimated at xx%, and is projected to reach xx% during the forecast period (2025-2033). Technological disruptions, particularly in automation and smart packaging, are transforming manufacturing processes and enhancing efficiency. Consumer preferences are shifting towards eco-friendly and sustainable packaging options. Competitive dynamics are intensifying, with companies investing heavily in R&D and strategic partnerships to gain a competitive edge. Market penetration of advanced packaging technologies like pre-fillable syringes and blister packs is increasing steadily. The market is also witnessing rising demand for specialized packaging solutions catering to the growing biopharmaceutical and personalized medicine segments.

Dominant Markets & Segments in China Pharmaceutical Packaging Market

The eastern coastal regions of China, including provinces like Jiangsu, Zhejiang, and Guangdong, dominate the pharmaceutical packaging market. This dominance is attributed to the high concentration of pharmaceutical manufacturers and advanced infrastructure in these areas.

By Primary Packaging:

- Pharmaceutical Plastic Bottles: This segment dominates due to cost-effectiveness and ease of use. Key drivers include the large-scale production of generic drugs and the growing demand for oral medications.

- Blister Packaging: Strong growth is driven by its convenience and tamper-evidence properties, particularly for solid dosage forms.

- Vials and Ampoules: This segment is driven by the demand for injectables and sterile drug delivery systems.

- Prefillable Syringes: Rapid growth fueled by increasing demand for convenience and reduced risk of contamination.

- Other Primary Packaging: Steady growth with diversification in pouches, tubes, caps, and closures reflecting the wide variety of pharmaceutical products.

By Secondary Packaging:

- Folding Boxes and Cartons (Paper-based): Remains the dominant segment due to cost-effectiveness and established supply chains.

- Corrugated Shipping Containers (Paper-based): Crucial for transportation and storage of pharmaceutical products.

- Other Secondary Packaging: Shows growth reflecting the increasing focus on customized solutions and enhanced product protection.

Key Drivers:

- Government Policies: Favorable regulations and incentives supporting pharmaceutical industry growth.

- Healthcare Infrastructure Development: Expansion of hospitals and clinics drives packaging demand.

- Economic Growth: Rising disposable incomes increase demand for high-quality pharmaceuticals.

China Pharmaceutical Packaging Market Product Innovations

Recent innovations include lightweight glass bottles that combine functionality with reduced carbon footprint (SGD Pharma), and next-generation borosilicate glass tubing for enhanced durability and suitability for complex pharmaceuticals (SCHOTT). These advancements address key industry trends of sustainability and the production of increasingly complex drugs. The market is witnessing a shift towards smart packaging solutions incorporating features like tamper-evidence and track-and-trace capabilities, enhancing product security and supply chain visibility.

Report Segmentation & Scope

This report segments the China pharmaceutical packaging market comprehensively by primary and secondary packaging types. The primary packaging segment includes pharmaceutical plastic bottles, bottles and jars, blister packaging, pre-fillable syringes, vials and ampoules, IV containers, prefillable inhalers, and other primary packaging products (pouches, tubes, caps, closures, etc.). The secondary packaging segment includes folding boxes and cartons, corrugated shipping containers, bags and pouches, clamshells, and other secondary packaging products (trays, labels, etc.). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail, providing a granular view of the market landscape.

Key Drivers of China Pharmaceutical Packaging Market Growth

The China pharmaceutical packaging market is driven by a confluence of factors. The expansion of the domestic pharmaceutical industry, coupled with rising healthcare expenditure and government initiatives promoting healthcare infrastructure development, are major catalysts. Technological advancements, such as the adoption of automation and smart packaging, also contribute significantly. Furthermore, stringent regulatory requirements regarding product safety and efficacy drive the demand for high-quality packaging solutions.

Challenges in the China Pharmaceutical Packaging Market Sector

Challenges include intense competition, particularly from lower-cost domestic manufacturers, fluctuating raw material prices, and potential supply chain disruptions. Stringent regulatory compliance requirements add complexity and increase costs. Environmental concerns and sustainability pressures drive demand for eco-friendly packaging solutions, requiring companies to invest in research and development.

Leading Players in the China Pharmaceutical Packaging Market Market

- West Pharmaceutical Services Inc. [West Pharmaceutical Services Inc.]

- Yuhuan Kang-jia Enterprise Co Ltd

- Jiangsu Hanlin Pharmaceutical Packaging

- Ningbo Zhengli Pharmaceutical Packaging

- Luoyang Dirante Pharmaceutical Packaging Material Co Ltd

- Shandong Pharmaceutical Glass Co Ltd

- JOTOP Glass

- Dongguan Fukang Plastic Products Co Ltd

- Gerresheimer Shuangfeng Pharmaceutical Glass (Danyang) Co Ltd (Gerresheimer AG)

- Amcor Group GMBH [Amcor Group GMBH]

- Hangzhou Xunda Packaging Co Ltd

- Perlen Packaging (Suzhou) Co Ltd

- Taishan Xinhua Pharmaceutical Packaging Co Ltd

Key Developments in China Pharmaceutical Packaging Market Sector

- November 2023: SGD Pharma launched lightweight glass bottles, combining functionality with reduced carbon footprint.

- October 2023: SCHOTT introduced next-generation type I Borosilicate glass tubing, supporting sustainable and complex pharmaceutical production.

Strategic China Pharmaceutical Packaging Market Market Outlook

The China pharmaceutical packaging market is poised for sustained growth, driven by continuous innovation, increasing demand for advanced drug delivery systems, and government support for the healthcare sector. Strategic opportunities exist for companies focusing on sustainable packaging solutions, smart packaging technologies, and specialized packaging for emerging therapeutic areas like biopharmaceuticals. The market's future hinges on adapting to evolving regulatory landscapes, managing supply chain complexities, and catering to the diverse needs of pharmaceutical manufacturers.

China Pharmaceutical Packaging Market Segmentation

-

1. Primary Packaging

- 1.1. Pharmaceutical Plastic Bottles

- 1.2. Bottles and Jars

- 1.3. Blister Packaging

- 1.4. Pre-fillable Syringes

- 1.5. Vials and Ampoules

- 1.6. IV Containers

- 1.7. Prefillable Inhalers

- 1.8. Other Pr

-

2. Secondary Packaging

- 2.1. Folding Boxes and Cartons (Paper-based)

- 2.2. Corrugated Shipping Containers (Paper-based)

- 2.3. Bags and Pouches (Flexible)

- 2.4. Clamshells (Paper and Plastic)

- 2.5. Other Se

China Pharmaceutical Packaging Market Segmentation By Geography

- 1. China

China Pharmaceutical Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Regulatory Standards on Packaging and Stringent Norms Against Counterfeit Products; Impact of Nanotechnology due to Innovative and New-generation Packaging Solutions

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Cost due to Suppliers’ Bargaining Power

- 3.4. Market Trends

- 3.4.1. Berlin Leads in Total Warehousing Take-up

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Pharmaceutical Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Primary Packaging

- 5.1.1. Pharmaceutical Plastic Bottles

- 5.1.2. Bottles and Jars

- 5.1.3. Blister Packaging

- 5.1.4. Pre-fillable Syringes

- 5.1.5. Vials and Ampoules

- 5.1.6. IV Containers

- 5.1.7. Prefillable Inhalers

- 5.1.8. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by Secondary Packaging

- 5.2.1. Folding Boxes and Cartons (Paper-based)

- 5.2.2. Corrugated Shipping Containers (Paper-based)

- 5.2.3. Bags and Pouches (Flexible)

- 5.2.4. Clamshells (Paper and Plastic)

- 5.2.5. Other Se

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Primary Packaging

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 West Pharmaceutical Services Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yuhuan Kang-jia Enterprise Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jiangsu Hanlin Pharmaceutical Packaging

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ningbo Zhengli Pharmaceutical Packaging

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Luoyang Dirante Pharmaceutical Packaging Material Co Ltd8 2 Share of China Pharmaceutical Packaging Companies in Global Marke

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shandong Pharmaceutical Glass Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JOTOP Glass

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dongguan Fukang Plastic Products Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gerresheimer Shuangfeng Pharmaceutical Glass (Danyang) Co Ltd (Gerresheimer AG)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amcor Group GMBH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hangzhou Xunda Packaging Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Perlen Packaging (Suzhou) Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Taishan Xinhua Pharmaceutical Packaging Co Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 West Pharmaceutical Services Inc

List of Figures

- Figure 1: China Pharmaceutical Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Pharmaceutical Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: China Pharmaceutical Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Pharmaceutical Packaging Market Revenue Million Forecast, by Primary Packaging 2019 & 2032

- Table 3: China Pharmaceutical Packaging Market Revenue Million Forecast, by Secondary Packaging 2019 & 2032

- Table 4: China Pharmaceutical Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Pharmaceutical Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Pharmaceutical Packaging Market Revenue Million Forecast, by Primary Packaging 2019 & 2032

- Table 7: China Pharmaceutical Packaging Market Revenue Million Forecast, by Secondary Packaging 2019 & 2032

- Table 8: China Pharmaceutical Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Pharmaceutical Packaging Market?

The projected CAGR is approximately 6.78%.

2. Which companies are prominent players in the China Pharmaceutical Packaging Market?

Key companies in the market include West Pharmaceutical Services Inc, Yuhuan Kang-jia Enterprise Co Ltd, Jiangsu Hanlin Pharmaceutical Packaging, Ningbo Zhengli Pharmaceutical Packaging, Luoyang Dirante Pharmaceutical Packaging Material Co Ltd8 2 Share of China Pharmaceutical Packaging Companies in Global Marke, Shandong Pharmaceutical Glass Co Ltd, JOTOP Glass, Dongguan Fukang Plastic Products Co Ltd, Gerresheimer Shuangfeng Pharmaceutical Glass (Danyang) Co Ltd (Gerresheimer AG), Amcor Group GMBH, Hangzhou Xunda Packaging Co Ltd, Perlen Packaging (Suzhou) Co Ltd, Taishan Xinhua Pharmaceutical Packaging Co Ltd.

3. What are the main segments of the China Pharmaceutical Packaging Market?

The market segments include Primary Packaging, Secondary Packaging.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Regulatory Standards on Packaging and Stringent Norms Against Counterfeit Products; Impact of Nanotechnology due to Innovative and New-generation Packaging Solutions.

6. What are the notable trends driving market growth?

Berlin Leads in Total Warehousing Take-up.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Cost due to Suppliers’ Bargaining Power.

8. Can you provide examples of recent developments in the market?

November 2023 - SGD Pharma introduced the market's primary packaging glass of lightweight glass bottles. The primary packaging combines the functionality of glass with the look and feel of glass while also reducing the carbon footprint associated with weight reduction. According to the Deputy General Manager of Industrial Operations at SGD Pharma's Zhanjiang plant, these bottles are innovated from the company's Zhanjiang plant in China, representing the high-class performance needed coupled with aesthetics and functionality.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Pharmaceutical Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Pharmaceutical Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Pharmaceutical Packaging Market?

To stay informed about further developments, trends, and reports in the China Pharmaceutical Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence