Key Insights

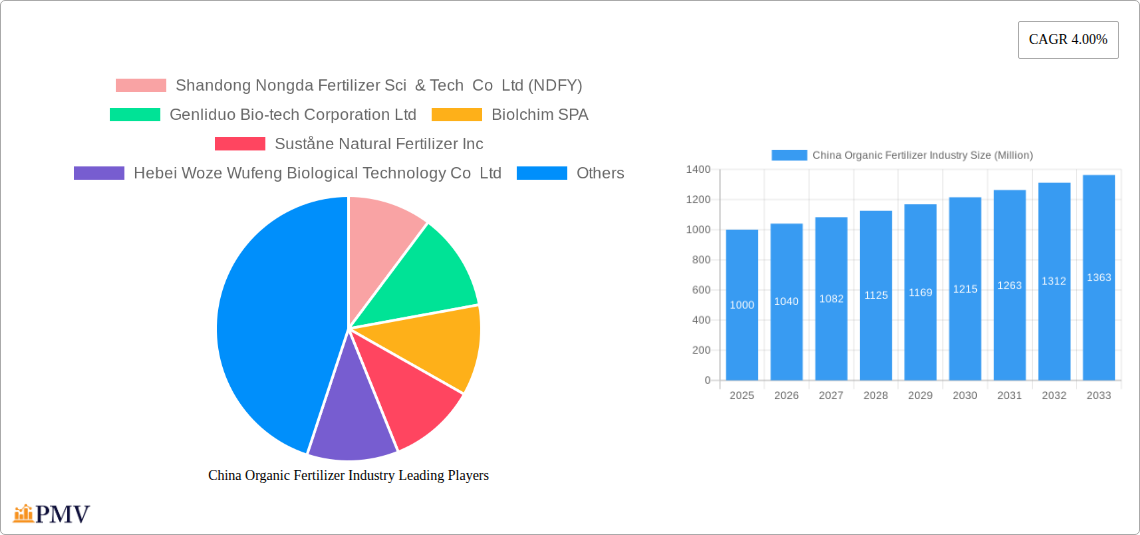

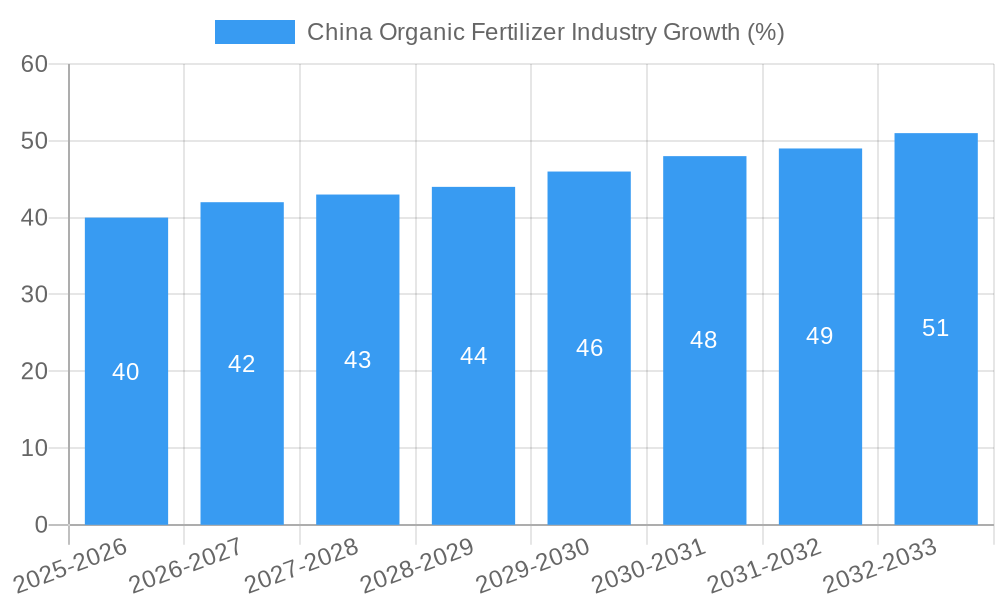

The China organic fertilizer market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.00% from 2025 to 2033. This expansion is driven by several key factors. Increasing consumer awareness of environmentally sustainable agricultural practices and the growing demand for organically produced food are major catalysts. Furthermore, stringent government regulations aimed at reducing chemical fertilizer usage and promoting eco-friendly farming methods are significantly bolstering market growth. The market segmentation reveals a diverse landscape, with cash crops, horticultural crops, and row crops representing significant application areas. Manure, meal-based fertilizers, and oilcakes dominate the product forms, indicating a preference for readily available and cost-effective organic options. While the market faces challenges such as the relatively higher cost of organic fertilizers compared to their chemical counterparts and the potential for inconsistent quality across various products, the overall positive trends outweigh these limitations. The presence of established players like Shandong Nongda Fertilizer Sci & Tech Co Ltd and emerging companies suggests a competitive yet dynamic market environment.

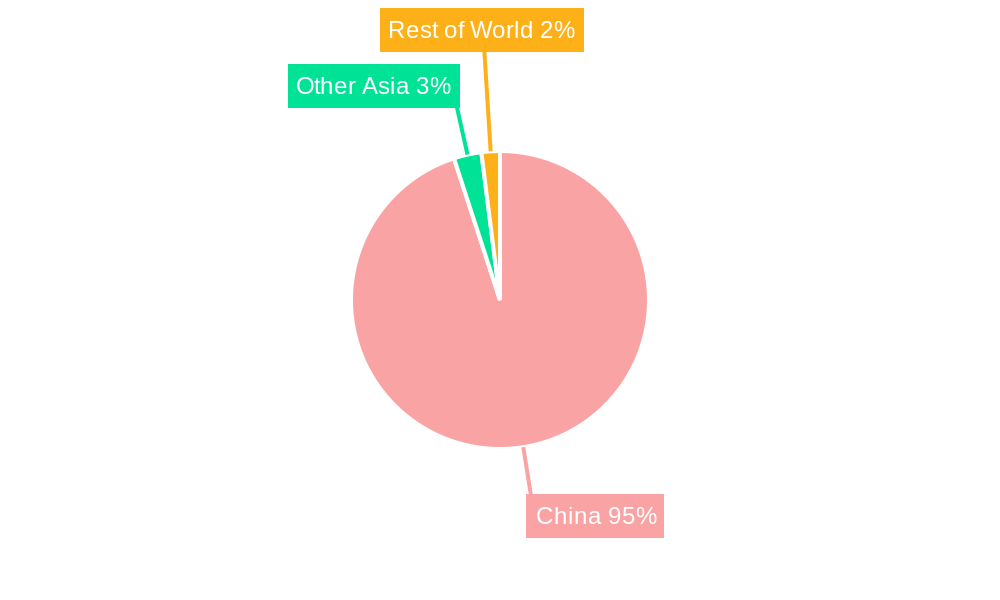

The forecast period (2025-2033) anticipates continued growth fueled by technological advancements in organic fertilizer production and distribution. Companies are likely to invest in research and development to improve the efficacy and consistency of their products, further driving adoption. The focus on sustainable agriculture, coupled with favorable government policies and increasing consumer demand for organic produce, is positioning the China organic fertilizer market for a period of sustained expansion. The regional concentration, currently heavily weighted towards China, suggests opportunities for expansion into other Asian markets which exhibit similar growth drivers. The competitive landscape will likely see further consolidation and innovation, with companies focusing on product diversification and strategic partnerships to gain a larger market share.

China Organic Fertilizer Industry: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the China organic fertilizer industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, competitive dynamics, and growth drivers to deliver actionable intelligence. The report values are expressed in Millions.

China Organic Fertilizer Industry Market Structure & Competitive Dynamics

This section analyzes the market concentration, innovation, regulatory landscape, substitution effects, end-user trends, and mergers & acquisitions (M&A) within the Chinese organic fertilizer market. The market is moderately concentrated, with a few major players holding significant shares. Shandong Nongda Fertilizer Sci & Tech Co Ltd (NDFY) currently holds an estimated xx% market share, while Genliduo Bio-tech Corporation Ltd holds approximately xx%. Smaller players contribute to the remaining market share.

Innovation in the sector is driven by the development of specialized organic fertilizers catering to specific crop needs and advancements in production techniques. The regulatory framework is undergoing evolution to promote sustainable agriculture, influencing the adoption of organic fertilizers. Competition from synthetic fertilizers remains a significant challenge, while consumer demand for organically grown produce is a key growth driver.

M&A activity has been moderate in recent years, with a total deal value of approximately xx Million in the period 2019-2024. These deals primarily involved smaller players consolidating to enhance market presence. Future M&A activity is anticipated to increase as larger companies seek to expand their market share and product portfolios.

- Market Concentration: Moderately concentrated, with Shandong Nongda Fertilizer Sci & Tech Co Ltd (NDFY) and Genliduo Bio-tech Corporation Ltd holding significant shares.

- Innovation Ecosystem: Driven by specialized fertilizer development and improved production methods.

- Regulatory Framework: Evolving towards stricter standards and promoting sustainable agriculture.

- Product Substitutes: Synthetic fertilizers represent the main substitute.

- End-User Trends: Growing demand for organically produced food fuels industry growth.

- M&A Activity: Moderate activity in recent years, projected to increase in the forecast period.

China Organic Fertilizer Industry Industry Trends & Insights

The China organic fertilizer industry is experiencing robust growth, driven by increasing consumer awareness of environmentally friendly farming practices and government support for sustainable agriculture. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 was estimated at xx%, and the market penetration rate is expected to reach xx% by 2033. Technological advancements such as precision farming techniques and improved biofertilizer production are further contributing to market expansion.

Consumer preferences are shifting towards organically grown produce, bolstering demand for organic fertilizers. Competitive dynamics are shaping the market through innovation in product offerings, pricing strategies, and distribution networks. The increasing adoption of organic farming techniques in various crop segments signifies a growing potential for market expansion. Challenges such as inconsistent quality control and higher production costs compared to synthetic fertilizers continue to impact overall market growth.

Dominant Markets & Segments in China Organic Fertilizer Industry

The organic fertilizer market in China exhibits strong growth across different segments. While precise data on regional dominance requires further analysis, the provinces with strong agricultural sectors are showing the highest demand.

Crop Type: Cash crops, specifically fruits and vegetables, and horticultural crops command the largest market share due to higher profitability and consumer preference for organic produce. Row crops are showing increasing adoption of organic fertilizers, albeit at a slower pace.

Form: Manure and meal-based fertilizers hold substantial market shares, but “Other Organic Fertilizers” (including bio-fertilizers and compost) are exhibiting the fastest growth due to innovation and increased awareness of their benefits. Oilcakes contribute a niche market share.

- Key Drivers for Cash Crops: High consumer demand for organic produce, higher profit margins driving adoption.

- Key Drivers for Horticultural Crops: Similar to Cash Crops, high demand for organic produce and intensive farming.

- Key Drivers for Row Crops: Growing awareness of sustainable agriculture practices, government incentives for organic farming.

- Key Drivers for Manure: Traditional farming methods, readily available, cost-effective.

- Key Drivers for Meal-Based Fertilizers: Nutrient richness, relatively easy application and improved soil health.

- Key Drivers for Oilcakes: Niche market; regionally specific demand.

- Key Drivers for Other Organic Fertilizers: Innovation in biofertilizers and compost, enhanced soil health, environmental consciousness.

China Organic Fertilizer Industry Product Innovations

Recent innovations focus on improving the efficacy and application of organic fertilizers. This includes advancements in biofertilizer technology, resulting in enhanced nutrient uptake by plants and improved soil health. The development of specialized blends caters to specific crop needs, enhancing yield and quality. These innovations provide competitive advantages by offering superior performance and sustainability compared to traditional methods.

Report Segmentation & Scope

This report segments the China organic fertilizer market by crop type (Cash Crops, Horticultural Crops, Row Crops) and fertilizer form (Manure, Meal-Based Fertilizers, Oilcakes, Other Organic Fertilizers). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. The report provides a detailed forecast for each segment up to 2033, considering the influence of various market drivers and challenges. The “Other Organic Fertilizers” segment is projected to experience the most significant growth.

Key Drivers of China Organic Fertilizer Industry Growth

Several factors drive the growth of the China organic fertilizer industry. Increased consumer demand for organically grown food is a primary factor, supported by rising awareness of the health and environmental benefits. Government policies promoting sustainable agriculture and the increasing adoption of organic farming practices also play a significant role. Furthermore, technological advancements in biofertilizer production are leading to improved efficiency and wider applicability.

Challenges in the China Organic Fertilizer Industry Sector

The industry faces challenges such as inconsistent quality control in organic fertilizer production, leading to variability in effectiveness. The higher production cost compared to synthetic fertilizers acts as a barrier to wider adoption. Competition from synthetic fertilizers, which are often cheaper, is an ongoing challenge. Furthermore, logistical and infrastructure constraints in certain regions hinder efficient distribution of organic fertilizers.

Leading Players in the China Organic Fertilizer Industry Market

- Shandong Nongda Fertilizer Sci & Tech Co Ltd (NDFY)

- Genliduo Bio-tech Corporation Ltd

- Biolchim SPA (Biolchim SPA)

- Suståne Natural Fertilizer Inc

- Hebei Woze Wufeng Biological Technology Co Ltd

- Binzhou Jingyang Biological Fertilizer Co Ltd

- Qingdao Future Group

Key Developments in China Organic Fertilizer Industry Sector

- 2022 Q3: Launch of a new biofertilizer by Genliduo Bio-tech Corporation Ltd focusing on enhanced nitrogen fixation.

- 2023 Q1: Shandong Nongda Fertilizer Sci & Tech Co Ltd acquired a smaller competitor, expanding its market presence.

- 2024 Q2: New government regulations regarding organic fertilizer standards were implemented.

Strategic China Organic Fertilizer Industry Market Outlook

The future of the China organic fertilizer industry appears promising, with considerable growth potential driven by sustained consumer demand for organic produce and government support for sustainable agriculture. Strategic opportunities lie in technological advancements, improved distribution networks, and the development of innovative and high-quality organic fertilizer products tailored to specific crop requirements. The expansion into niche markets and the exploration of new technologies will further enhance the growth prospects for this industry.

China Organic Fertilizer Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

China Organic Fertilizer Industry Segmentation By Geography

- 1. China

China Organic Fertilizer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. Increased Food Demand and Need for Increased Agricultural Food Productivity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Organic Fertilizer Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Shandong Nongda Fertilizer Sci & Tech Co Ltd (NDFY)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Genliduo Bio-tech Corporation Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Biolchim SPA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Suståne Natural Fertilizer Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hebei Woze Wufeng Biological Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Binzhou Jingyang Biological Fertilizer Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Qingdao Future Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Shandong Nongda Fertilizer Sci & Tech Co Ltd (NDFY)

List of Figures

- Figure 1: China Organic Fertilizer Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Organic Fertilizer Industry Share (%) by Company 2024

List of Tables

- Table 1: China Organic Fertilizer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Organic Fertilizer Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: China Organic Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: China Organic Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: China Organic Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: China Organic Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: China Organic Fertilizer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China Organic Fertilizer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: China Organic Fertilizer Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: China Organic Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: China Organic Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: China Organic Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: China Organic Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: China Organic Fertilizer Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Organic Fertilizer Industry?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the China Organic Fertilizer Industry?

Key companies in the market include Shandong Nongda Fertilizer Sci & Tech Co Ltd (NDFY), Genliduo Bio-tech Corporation Ltd, Biolchim SPA, Suståne Natural Fertilizer Inc, Hebei Woze Wufeng Biological Technology Co Ltd, Binzhou Jingyang Biological Fertilizer Co Ltd, Qingdao Future Group.

3. What are the main segments of the China Organic Fertilizer Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

Increased Food Demand and Need for Increased Agricultural Food Productivity.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Organic Fertilizer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Organic Fertilizer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Organic Fertilizer Industry?

To stay informed about further developments, trends, and reports in the China Organic Fertilizer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence