Key Insights

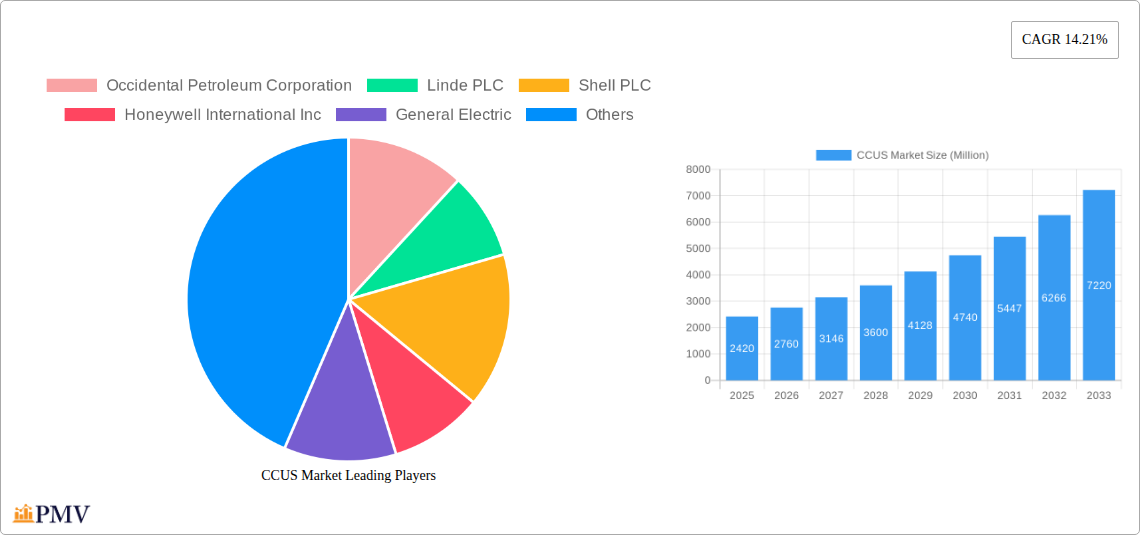

The Carbon Capture, Utilization, and Storage (CCUS) market is experiencing robust growth, projected to reach \$2.42 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 14.21% from 2025 to 2033. This expansion is driven by increasing global concerns about climate change and the urgent need to reduce greenhouse gas emissions. Stringent environmental regulations, coupled with government incentives and carbon pricing mechanisms, are further propelling market adoption. The energy sector, particularly oil and gas, coal, and biomass power plants, forms a significant portion of the demand, followed by industries like iron and steel, chemicals, and cement. Technological advancements in pre-combustion, oxy-fuel combustion, and post-combustion capture methods are enhancing efficiency and cost-effectiveness, making CCUS a more viable solution for various industries. Geographic distribution shows strong growth across North America, particularly in the United States, driven by substantial investments in infrastructure and policy support. However, high initial capital costs and the technological complexities involved in CCUS deployment remain key restraints.

CCUS Market Market Size (In Billion)

The competitive landscape is marked by a mix of established energy giants like Occidental Petroleum, Shell, and ExxonMobil, alongside technology providers such as Honeywell and General Electric. Specialized engineering and construction companies like Fluor and Aker Solutions also play crucial roles. The market’s future growth will depend significantly on further technological breakthroughs, reduced costs, improved regulatory frameworks, and widespread industry collaboration to overcome operational challenges and secure long-term funding for large-scale CCUS projects. The continuous innovation in capture technologies, storage solutions, and CO2 utilization pathways will be crucial in expanding the addressable market and driving broader adoption across various sectors. Furthermore, the increasing demand for carbon-neutral fuels and the development of CO2-based products will create new market opportunities for CCUS.

CCUS Market Company Market Share

CCUS Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Carbon Capture, Utilization, and Storage (CCUS) market, offering invaluable insights for industry stakeholders, investors, and policymakers. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, technological advancements, competitive landscapes, and future growth potential. The study incorporates data from key players like Occidental Petroleum Corporation, Linde PLC, Shell PLC, Honeywell International Inc, General Electric, Exxon Mobil Corporation, Japan CCS Co Ltd, SLB, Fluor Corporation, Baker Hughes Company, Halliburton, Aker Solutions, Dakota Gasification Company, JX Nippon Oil & Gas Exploration Corporation, Siemens Energy, Air Liquide, and Mitsubishi Heavy Industries Ltd. However, this list is not exhaustive. The report segments the market by end-user industry (Oil and Gas, Coal and Biomass Power Plant, Iron and Steel, Chemical, Cement) and by technology (Pre-combustion Capture, Oxy-fuel Combustion Capture, Post-combustion Capture).

CCUS Market Structure & Competitive Dynamics

The CCUS market exhibits a moderately concentrated structure, with a few major players holding significant market share. The market share distribution is dynamic, influenced by factors such as technological innovation, M&A activity, and regulatory changes. Innovation ecosystems are developing rapidly, with significant investment in R&D across various CCUS technologies. Regulatory frameworks, including carbon pricing mechanisms and government incentives, play a crucial role in shaping market growth. Product substitutes, such as renewable energy sources, exert competitive pressure, while end-user trends towards decarbonization drive demand for CCUS solutions. M&A activity is significant, with deal values reaching xx Million in the last five years, consolidating market players and fostering technological integration.

- Market Concentration: The top 5 players account for approximately xx% of the market share.

- Innovation Ecosystems: Active collaboration between research institutions, technology providers, and end-users is driving technological advancements.

- Regulatory Frameworks: Stringent emission reduction targets and carbon pricing policies are key growth drivers.

- M&A Activity: Consolidation within the industry leads to increased efficiency and broader market reach.

CCUS Market Industry Trends & Insights

The CCUS market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). Market growth is driven by several factors including stringent environmental regulations aimed at reducing greenhouse gas emissions, the increasing demand for cleaner energy sources, and technological advancements that are making CCUS more cost-effective. The growing awareness of climate change and its consequences is further accelerating the adoption of CCUS technologies. Consumer preferences are shifting towards environmentally friendly products and services, creating a strong pull for CCUS solutions. Competitive dynamics are characterized by intense rivalry among major players, who are investing heavily in R&D and expansion to gain market share. Market penetration of CCUS technologies in various industries is gradually increasing, especially within the oil and gas sector, which is the largest end-user segment, but still represents a relatively small share of overall emissions reduction efforts.

Dominant Markets & Segments in CCUS Market

The Oil and Gas sector currently represents the largest segment within the CCUS market, primarily driven by enhanced oil recovery (EOR) applications. Geographically, North America and Europe are currently leading the CCUS market due to stringent environmental regulations, established infrastructure, and significant investments in CCS projects. However, Asia-Pacific is expected to witness substantial growth in the coming years, fueled by increasing industrial activity and government initiatives to curb carbon emissions.

Leading Region: North America (with xx Million market value in 2025)

Leading Segment (By End-user Industry): Oil and Gas (holding xx% of market share in 2025)

Leading Segment (By Technology): Post-combustion Capture (due to its adaptability to existing power plants)

Key Drivers (North America): Stringent environmental regulations, substantial government funding for CCS projects, well-established oil and gas infrastructure.

Key Drivers (Asia-Pacific): Rapid industrialization, growing concerns about air quality, government support for renewable energy and CCS initiatives.

CCUS Market Product Innovations

Recent advancements in CCUS technologies are focusing on improving capture efficiency, reducing energy consumption, and lowering overall costs. This includes developments in solvent-based capture technologies, membrane separation techniques, and advanced mineralisation methods for CO2 storage. New applications are emerging in various industries, beyond oil and gas, including direct air capture (DAC) and utilization of captured CO2 in industrial processes. These innovations are creating new competitive advantages for CCUS technology providers, offering more efficient, cost-effective, and sustainable solutions.

Report Segmentation & Scope

The report segments the CCUS market by end-user industry, encompassing Oil and Gas, Coal and Biomass Power Plant, Iron and Steel, Chemical, and Cement sectors. Each segment’s growth is analyzed based on specific industry demands and technological feasibility. A further segmentation by technology includes Pre-combustion Capture, Oxy-fuel Combustion Capture, and Post-combustion Capture. Market size projections, competitive dynamics, and technological trends are provided for each segment, offering a granular view of the market. Growth projections vary significantly across segments, with Oil and Gas showing the highest growth potential but facing the challenge of high costs.

Key Drivers of CCUS Market Growth

Several factors drive the growth of the CCUS market, notably:

- Stringent Environmental Regulations: Government policies mandating emission reductions are compelling industries to adopt CCUS technologies.

- Technological Advancements: Innovations are reducing costs and improving the efficiency of CCUS technologies.

- Carbon Pricing Mechanisms: Carbon taxes and emissions trading schemes create economic incentives for deploying CCUS.

- Investment in Research and Development: Significant funding is directed towards improving CCUS technologies.

Challenges in the CCUS Market Sector

The CCUS market faces considerable challenges, including:

- High Capital Costs: The initial investment in CCUS infrastructure is substantial, acting as a barrier to entry for some companies.

- Energy Intensity: Some CCUS processes are energy-intensive, offsetting some of the emission reductions.

- Storage Capacity and Security: Finding suitable storage sites with sufficient capacity and ensuring long-term security is crucial.

- Regulatory Uncertainties: The evolving regulatory landscape in different regions can hinder investment decisions.

Leading Players in the CCUS Market Market

- Occidental Petroleum Corporation

- Linde PLC

- Shell PLC

- Honeywell International Inc

- General Electric

- Exxon Mobil Corporation

- Japan CCS Co Ltd

- SLB

- Fluor Corporation

- Baker Hughes Company

- Halliburton

- Aker Solutions

- Dakota Gasification Company

- JX Nippon Oil & Gas Exploration Corporation

- Siemens Energy

- Air Liquide

- Mitsubishi Heavy Industries Ltd

Key Developments in CCUS Market Sector

- March 2024: JX Nippon Oil & Gas Exploration Corporation and Chevron New Energies signed a memorandum of understanding to explore CO2 export from Japan to Australia and other Asia-Pacific nations for CCS initiatives, expanding market footprint.

- March 2024: Shell and ONGC collaborated on a storage study and EOR assessment in India, advancing CCUS adoption for emissions mitigation and enhanced oil production.

- February 2024: Fluor Corporation and Chevron New Energies signed a license agreement for Fluor's Econamine FG PlusSM technology to reduce CO2 emissions at Chevron’s Eastridge Cogeneration facility, demonstrating technological advancement and market uptake.

Strategic CCUS Market Outlook

The CCUS market exhibits significant future potential, driven by escalating climate concerns, supportive government policies, and technological progress. Strategic opportunities lie in developing innovative and cost-effective CCUS solutions, expanding into new markets, and fostering partnerships across the value chain. Focusing on carbon utilization pathways, improving storage capacity, and creating robust regulatory frameworks will be pivotal in unlocking the full potential of the CCUS market and its role in achieving global decarbonization targets.

CCUS Market Segmentation

-

1. Technology

- 1.1. Pre-combustion Capture

- 1.2. Oxy-fuel Combustion Capture

- 1.3. Post-combustion Capture

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Coal and Biomass Power Plant

- 2.3. Iron and Steel

- 2.4. Chemical

- 2.5. Cement

CCUS Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. Australia

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Norway

- 3.5. Netherlands

- 3.6. Rest of Europe

- 4. Rest of the World

CCUS Market Regional Market Share

Geographic Coverage of CCUS Market

CCUS Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emerging Demand for CO2 Injection Technique for Enhanced Oil Recovery (EOR); Strict Government Norms Toward GHG Emissions

- 3.3. Market Restrains

- 3.3.1. Huge CCS Technology Implementation Costs; Growth in Shale Investments

- 3.4. Market Trends

- 3.4.1. Oil and Gas Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. CCUS Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Pre-combustion Capture

- 5.1.2. Oxy-fuel Combustion Capture

- 5.1.3. Post-combustion Capture

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Coal and Biomass Power Plant

- 5.2.3. Iron and Steel

- 5.2.4. Chemical

- 5.2.5. Cement

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Asia Pacific CCUS Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Pre-combustion Capture

- 6.1.2. Oxy-fuel Combustion Capture

- 6.1.3. Post-combustion Capture

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas

- 6.2.2. Coal and Biomass Power Plant

- 6.2.3. Iron and Steel

- 6.2.4. Chemical

- 6.2.5. Cement

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. North America CCUS Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Pre-combustion Capture

- 7.1.2. Oxy-fuel Combustion Capture

- 7.1.3. Post-combustion Capture

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas

- 7.2.2. Coal and Biomass Power Plant

- 7.2.3. Iron and Steel

- 7.2.4. Chemical

- 7.2.5. Cement

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Europe CCUS Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Pre-combustion Capture

- 8.1.2. Oxy-fuel Combustion Capture

- 8.1.3. Post-combustion Capture

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas

- 8.2.2. Coal and Biomass Power Plant

- 8.2.3. Iron and Steel

- 8.2.4. Chemical

- 8.2.5. Cement

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of the World CCUS Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Pre-combustion Capture

- 9.1.2. Oxy-fuel Combustion Capture

- 9.1.3. Post-combustion Capture

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and Gas

- 9.2.2. Coal and Biomass Power Plant

- 9.2.3. Iron and Steel

- 9.2.4. Chemical

- 9.2.5. Cement

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Occidental Petroleum Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Linde PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Shell PLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Honeywell International Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 General Electric

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Exxon Mobil Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Japan CCS Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SLB*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Fluor Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Baker Hughes Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Halliburton

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Aker Solutions

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Dakota Gasification Company

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 JX Nippon Oil & Gas Exploration Corporation

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Siemens Energy

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Air Liquide

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Mitsubishi Heavy Industries Ltd

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.1 Occidental Petroleum Corporation

List of Figures

- Figure 1: CCUS Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: CCUS Market Share (%) by Company 2025

List of Tables

- Table 1: CCUS Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: CCUS Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 3: CCUS Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: CCUS Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: CCUS Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: CCUS Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: CCUS Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 8: CCUS Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 9: CCUS Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: CCUS Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 11: CCUS Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: CCUS Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China CCUS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China CCUS Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: India CCUS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India CCUS Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Japan CCUS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan CCUS Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Australia CCUS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Australia CCUS Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific CCUS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific CCUS Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: CCUS Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 24: CCUS Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 25: CCUS Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 26: CCUS Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 27: CCUS Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: CCUS Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 29: United States CCUS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United States CCUS Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Canada CCUS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Canada CCUS Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Mexico CCUS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico CCUS Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: CCUS Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 36: CCUS Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 37: CCUS Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 38: CCUS Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 39: CCUS Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: CCUS Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Germany CCUS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Germany CCUS Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom CCUS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom CCUS Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: France CCUS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: France CCUS Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: Norway CCUS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Norway CCUS Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Netherlands CCUS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Netherlands CCUS Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Rest of Europe CCUS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Europe CCUS Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: CCUS Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 54: CCUS Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 55: CCUS Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 56: CCUS Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 57: CCUS Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: CCUS Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the CCUS Market?

The projected CAGR is approximately 14.21%.

2. Which companies are prominent players in the CCUS Market?

Key companies in the market include Occidental Petroleum Corporation, Linde PLC, Shell PLC, Honeywell International Inc, General Electric, Exxon Mobil Corporation, Japan CCS Co Ltd, SLB*List Not Exhaustive, Fluor Corporation, Baker Hughes Company, Halliburton, Aker Solutions, Dakota Gasification Company, JX Nippon Oil & Gas Exploration Corporation, Siemens Energy, Air Liquide, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the CCUS Market?

The market segments include Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Emerging Demand for CO2 Injection Technique for Enhanced Oil Recovery (EOR); Strict Government Norms Toward GHG Emissions.

6. What are the notable trends driving market growth?

Oil and Gas Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Huge CCS Technology Implementation Costs; Growth in Shale Investments.

8. Can you provide examples of recent developments in the market?

March 2024: JX Nippon Oil & Gas Exploration Corporation and Chevron New Energies, a division of Chevron U.S.A. Inc., entered into a memorandum of understanding aimed at assessing the potential export of carbon dioxide from Japan to carbon capture and storage (CCS) initiatives situated in Australia and other nations across Asia-Pacific. This agreement enhances the company's market footprint.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "CCUS Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the CCUS Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the CCUS Market?

To stay informed about further developments, trends, and reports in the CCUS Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence