Key Insights

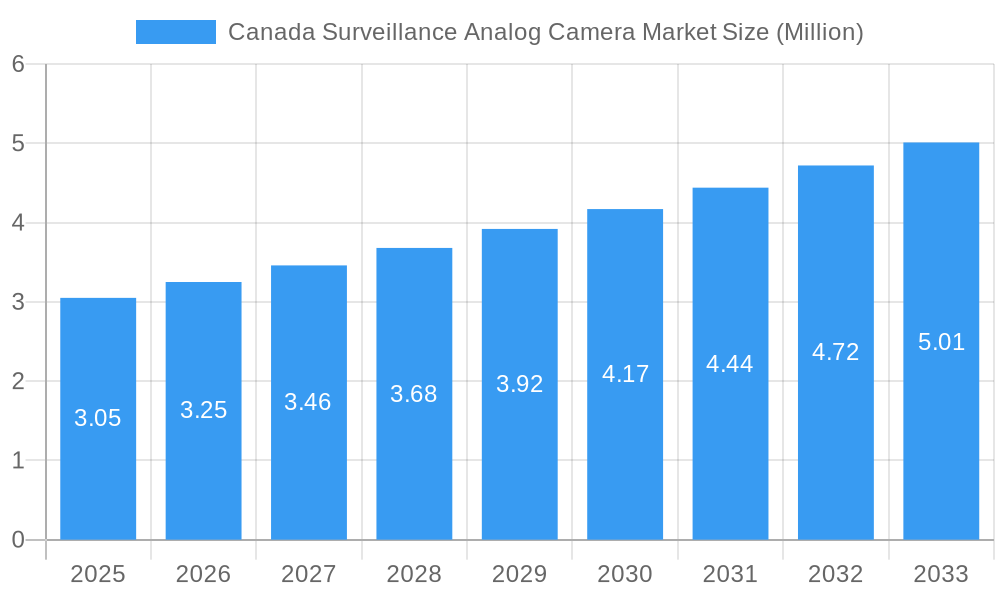

The Canada Surveillance Analog Camera Market is poised for steady growth, estimated to reach 3.05 Million in market size by 2025. This expansion is fueled by increasing security concerns across various sectors, including government, banking, healthcare, transportation, and industrial applications. The 6.53% CAGR projected for the forecast period (2025-2033) indicates sustained demand for analog surveillance solutions, likely driven by their cost-effectiveness, reliability, and ease of deployment, particularly in upgrade projects or for organizations with existing analog infrastructure. The dominance of these sectors in prioritizing safety and asset protection underscores the fundamental need for robust surveillance systems, making analog cameras a continued viable option for budget-conscious yet security-demanding entities.

Canada Surveillance Analog Camera Market Market Size (In Million)

Key drivers for the Canadian analog surveillance camera market include ongoing infrastructure development, the need for continuous monitoring in sensitive environments, and the proven durability of analog technology in diverse climatic conditions prevalent in Canada. Despite the rise of digital and IP-based systems, analog cameras maintain a strong foothold due to their lower initial investment and simpler integration with existing networks. Restraints might include the inherent limitations in image resolution and advanced features compared to newer technologies, and a gradual shift towards IP solutions for more sophisticated surveillance needs. However, the market is expected to benefit from maintenance and upgrade cycles of existing analog systems, along with new installations where cost is a primary consideration.

Canada Surveillance Analog Camera Market Company Market Share

Canada Surveillance Analog Camera Market: Comprehensive Industry Report 2025-2033

This in-depth report provides a detailed analysis of the Canada Surveillance Analog Camera Market, offering crucial insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025 to 2033, this report delves into historical trends, current market conditions, and future projections. Leveraging high-ranking keywords such as "analog security cameras Canada," "CCTV Canada," "surveillance solutions," "video surveillance market," and "security equipment Canada," this analysis is optimized for maximum search visibility and industry engagement. The report meticulously segments the market by end-user industry and highlights key developments and growth drivers shaping the Canadian video surveillance industry.

Canada Surveillance Analog Camera Market Market Structure & Competitive Dynamics

The Canada Surveillance Analog Camera Market is characterized by a moderate level of market concentration, with a blend of established global players and emerging local providers vying for market share. Innovation ecosystems are driven by the continuous need for cost-effective and reliable security solutions, particularly within budget-constrained sectors. Regulatory frameworks, while evolving to encompass digital privacy and data security, still offer a stable environment for analog camera deployment, especially for legacy systems and specific compliance requirements. Product substitutes, primarily IP-based cameras, present a significant competitive threat, yet analog cameras maintain a strong foothold due to lower upfront costs, existing infrastructure compatibility, and ease of installation. End-user trends indicate a sustained demand for robust, user-friendly, and budget-friendly surveillance systems. Mergers and acquisition (M&A) activities are moderate, with larger companies strategically acquiring smaller players to expand their product portfolios or gain access to new market segments. Key players are investing in R&D to enhance analog camera capabilities, focusing on improved resolution, low-light performance, and integration with emerging technologies. Market share is influenced by factors such as pricing, product reliability, and the strength of distribution networks. M&A deal values, while not universally disclosed, suggest strategic consolidations aimed at consolidating market presence and enhancing competitive offerings in the Canadian security camera market.

Canada Surveillance Analog Camera Market Industry Trends & Insights

The Canada Surveillance Analog Camera Market is experiencing a steady demand driven by its inherent advantages of cost-effectiveness, ease of installation, and compatibility with existing infrastructure. While the trend leans towards IP surveillance, analog technology continues to be a preferred choice for many businesses and government agencies in Canada due to its lower total cost of ownership and simplified upgrade paths for existing analog systems. The market penetration of analog cameras remains significant, particularly in sectors where budget considerations are paramount. Key growth drivers include the ongoing need for enhanced security across various end-user industries, including retail, hospitality, and small to medium-sized enterprises (SMEs), which often find analog solutions more financially accessible. Technological disruptions, while predominantly favoring IP, are also indirectly benefiting the analog market by pushing manufacturers to innovate within the analog space. This includes advancements in HD-over-analog technology, offering higher resolutions than traditional analog systems without requiring a complete overhaul of existing cabling. Consumer preferences are shifting towards smarter, more integrated security solutions, but the accessibility and reliability of analog cameras ensure their continued relevance. The competitive landscape is dynamic, with established players focusing on product differentiation through enhanced features like improved low-light performance and durability. The estimated compound annual growth rate (CAGR) for the analog surveillance camera market in Canada is projected to be in the range of 3.5% to 5.0% during the forecast period. This growth is underpinned by the need for cost-effective surveillance for public safety initiatives, commercial property protection, and infrastructure monitoring. The resilience of analog technology in challenging environments and its straightforward operational capabilities continue to make it a valuable component of the broader Canadian security infrastructure. The market penetration of analog cameras is expected to remain robust, particularly in sectors that prioritize affordability and ease of deployment.

Dominant Markets & Segments in Canada Surveillance Analog Camera Market

The Canada Surveillance Analog Camera Market exhibits distinct dominance across various end-user industries, each with unique drivers and growth trajectories.

- Government: This segment holds a significant market share due to the continuous need for public safety, border security, and law enforcement surveillance. Government initiatives focused on urban safety and crime reduction fuel the demand for reliable and cost-effective analog surveillance solutions. Economic policies supporting infrastructure development and public services indirectly bolster the demand for security equipment. The large-scale deployment of cameras in public spaces, transportation hubs, and critical infrastructure sites makes this sector a consistent contributor to market growth.

- Key Drivers: Public safety mandates, urban modernization projects, law enforcement needs, critical infrastructure protection.

- Banking: The financial sector prioritizes robust security to protect assets and customer data. Analog cameras are widely used in bank branches, ATMs, and administrative facilities for their proven reliability and cost-effectiveness in providing essential surveillance. Regulatory compliance requirements also necessitate continuous monitoring.

- Key Drivers: Asset protection, fraud prevention, regulatory compliance, customer trust, secure transactions.

- Healthcare: Hospitals, clinics, and other healthcare facilities require surveillance for patient safety, asset security, and access control. Analog cameras offer a practical solution for monitoring sensitive areas and ensuring a secure environment for patients and staff.

- Key Drivers: Patient safety, staff security, asset protection, access control, compliance with healthcare regulations.

- Transportation & Logistics: This segment encompasses airports, seaports, railway stations, and logistics hubs, all of which demand comprehensive surveillance for security, operational efficiency, and cargo monitoring. Analog cameras are deployed extensively to monitor traffic flow, secure perimeters, and detect unauthorized access.

- Key Drivers: Infrastructure security, cargo protection, traffic management, passenger safety, operational efficiency.

- Industrial: Manufacturing plants, warehouses, and industrial complexes utilize analog surveillance to monitor production processes, ensure worker safety, and secure high-value assets. The ruggedness and reliability of analog cameras in harsh industrial environments make them a suitable choice.

- Key Drivers: Worker safety, asset protection, process monitoring, perimeter security, theft prevention.

- Other End-user Industries: This broad category includes retail stores, educational institutions, hospitality businesses, and residential complexes. These segments often opt for analog cameras due to their affordability and ease of use, making them accessible for a wide range of security needs.

- Key Drivers: Retail security, educational campus safety, hospitality guest security, residential property monitoring.

The dominance of each segment is influenced by a combination of government funding, private investment, evolving security threats, and the inherent cost-benefit analysis of analog versus digital solutions within the Canadian context.

Canada Surveillance Analog Camera Market Product Innovations

Recent product innovations in the Canada Surveillance Analog Camera Market focus on enhancing the performance and utility of analog technology. Hikvision's recent releases, such as the Turbo HD 8.0 lineup and the ColorVu Fixed Turret and Bullet Cameras, exemplify these advancements. These innovations are driven by the need to offer improved image quality in challenging lighting conditions, expanded coverage, and more interactive features, directly addressing market demands for better value within the analog segment. The introduction of F1.0 aperture lenses in new models significantly boosts low-light performance, providing clear, full-color images even in near darkness, a crucial advantage for continuous surveillance. Enhanced night vision capabilities, coupled with 3D Digital Noise Reduction (DNR) technology, ensure sharper, less grainy footage. These developments allow for easier upgrades of existing analog infrastructure while delivering near-IP quality imaging, offering competitive advantages to users seeking cost-effective yet high-performance surveillance solutions.

Report Segmentation & Scope

This report segments the Canada Surveillance Analog Camera Market by end-user industry to provide granular insights into specific market dynamics. The key segments analyzed include:

- Government: This segment is expected to demonstrate robust growth driven by public safety initiatives and infrastructure development projects across Canada. Market size projections indicate a steady increase, with a focus on reliable and cost-effective surveillance solutions for federal, provincial, and municipal applications.

- Banking: The banking sector continues to be a significant consumer of analog cameras, valuing their proven track record in security and fraud prevention. Market growth is anticipated to be steady, driven by ongoing security upgrades and the need to maintain compliance with stringent financial regulations.

- Healthcare: The healthcare industry presents growing opportunities for analog surveillance, particularly in enhancing patient safety and securing sensitive medical equipment and facilities. Market size is projected to expand as healthcare providers invest in comprehensive security systems.

- Transportation & Logistics: This segment is a key driver of market growth, with demand fueled by the need for enhanced security at ports, airports, and logistics hubs. Market projections indicate strong expansion, driven by an increasing volume of goods and passenger traffic requiring robust surveillance.

- Industrial: The industrial sector, including manufacturing and resource extraction, represents a stable market for analog cameras due to their durability and reliability in challenging environments. Market size is expected to see consistent growth as companies invest in operational safety and asset protection.

- Other End-user Industries: This encompasses a diverse range of sectors such as retail, education, and hospitality. This segment is anticipated to experience moderate growth, driven by the widespread adoption of cost-effective surveillance solutions for general security and loss prevention.

Key Drivers of Canada Surveillance Analog Camera Market Growth

Several key factors are driving the growth of the Canada Surveillance Analog Camera Market. Foremost among these is the continued demand for cost-effective and reliable security solutions, particularly from small to medium-sized businesses and government agencies with budget constraints. The existing infrastructure in many Canadian organizations, built around analog cabling, makes the upgrade path to higher-resolution analog cameras more economical than a complete migration to IP systems. Technological advancements in analog camera technology, such as High Definition over Coaxial Cable (HD-TVI, HD-CVI, AHD), are significantly improving image quality, bridging the gap with IP cameras and revitalizing the market. Furthermore, the robust need for public safety, critical infrastructure protection, and crime prevention across Canada continues to fuel the demand for accessible and dependable surveillance systems. Regulatory mandates and industry-specific security requirements also contribute to sustained market growth.

Challenges in the Canada Surveillance Analog Camera Market Sector

Despite its strengths, the Canada Surveillance Analog Camera Market faces several challenges. The primary restraint is the accelerating adoption of IP-based surveillance systems, which offer superior features, scalability, and remote accessibility. The perception of analog cameras as outdated technology can also hinder adoption, despite recent technological improvements. Supply chain disruptions, global component shortages, and fluctuating raw material costs can impact pricing and availability, posing challenges for manufacturers and distributors. Intense price competition among vendors, especially for basic analog camera models, can squeeze profit margins. Furthermore, the increasing sophistication of cyber threats necessitates robust security measures, and while analog systems are generally less vulnerable to network-based attacks than IP systems, their integration with broader network security strategies can be complex. The ongoing need to demonstrate the value proposition of analog cameras against increasingly capable IP alternatives remains a key hurdle.

Leading Players in the Canada Surveillance Analog Camera Market Market

- Teledyne FLIR LLC

- Hangzhou Hikvision Digital Technology Co Ltd

- Hanwha Vision America

- ACTi Corporation

- Bosch Sicherheitssysteme GmbH

- Pelco

- Zhejiang Uniview Technologies Co Ltd

- IDIS Ltd

- Honeywell International Inc

- Zosi Technology Lt

Key Developments in Canada Surveillance Analog Camera Market Sector

- April 2024: Hikvision unveiled its cutting-edge Turbo HD 8.0 lineup, enhancing its analog security offerings. This latest iteration promises users an enriched and interactive security interface, empowering them to elevate their surveillance capabilities. Turbo HD 8.0 introduces four groundbreaking features: real-time communication, 180-degree video coverage, and an enhanced night vision capability.

- October 2023: Hikvision introduced the ColorVu Fixed Turret (DS-2CE70DF0T-MF) and Bullet (DS-2CE10DF0T-F) Cameras, pioneering the F1.0 aperture in this category. These 2 MP analog cameras offer continuous, high-quality, full-color imaging, support HD over analog cabling for easy upgrades, and feature 3D Digital Noise Reduction (DNR) technology. The F1.0 aperture on the ColorVu Cameras ensures vivid colors even in low-light settings. Coupled with 3D DNR technology, these cameras deliver enhanced image clarity by reducing interference and noise. With a white light distance of up to 65 feet, they excel in capturing detailed night scenes, ensuring no corner goes unnoticed even in the dark.

Strategic Canada Surveillance Analog Camera Market Market Outlook

The strategic outlook for the Canada Surveillance Analog Camera Market is one of continued relevance and strategic evolution. While the market is influenced by the rise of IP technology, analog cameras will persist as a vital component of the Canadian security infrastructure, particularly for organizations prioritizing cost-effectiveness, ease of integration with existing systems, and robust performance in specific applications. Growth accelerators include the ongoing need for public safety enhancements, the security requirements of SMEs, and government investments in critical infrastructure. Manufacturers that focus on delivering high-definition analog solutions, improved low-light capabilities, and enhanced durability will find sustained market opportunities. Strategic partnerships with system integrators and installers will be crucial for expanding market reach. The market's future lies in its ability to offer a compelling value proposition as a complementary solution or a cost-effective alternative to full IP migration, ensuring its enduring presence in the Canadian surveillance landscape.

Canada Surveillance Analog Camera Market Segmentation

-

1. End-user Industry

- 1.1. Government

- 1.2. Banking

- 1.3. Healthcare

- 1.4. Transportation & Logistics

- 1.5. Industrial

- 1.6. Other End-user Industries

Canada Surveillance Analog Camera Market Segmentation By Geography

- 1. Canada

Canada Surveillance Analog Camera Market Regional Market Share

Geographic Coverage of Canada Surveillance Analog Camera Market

Canada Surveillance Analog Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Effectiveness and Affordability; Increasing Crime Rate in Parts of the Country

- 3.3. Market Restrains

- 3.3.1. Cost Effectiveness and Affordability; Increasing Crime Rate in Parts of the Country

- 3.4. Market Trends

- 3.4.1. Ease of Use and Affordability is Driving the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Surveillance Analog Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Government

- 5.1.2. Banking

- 5.1.3. Healthcare

- 5.1.4. Transportation & Logistics

- 5.1.5. Industrial

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Teledyne FLIR LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hanwha Vision America

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ACTi Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bosch Sicherheitssysteme GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pelco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zhejiang Uniview Technologies Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IDIS Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Honeywell International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zosi Technology Lt

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Teledyne FLIR LLC

List of Figures

- Figure 1: Canada Surveillance Analog Camera Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Surveillance Analog Camera Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Surveillance Analog Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Canada Surveillance Analog Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Canada Surveillance Analog Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Canada Surveillance Analog Camera Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Canada Surveillance Analog Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Canada Surveillance Analog Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Canada Surveillance Analog Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Canada Surveillance Analog Camera Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Surveillance Analog Camera Market?

The projected CAGR is approximately 6.53%.

2. Which companies are prominent players in the Canada Surveillance Analog Camera Market?

Key companies in the market include Teledyne FLIR LLC, Hangzhou Hikvision Digital Technology Co Ltd, Hanwha Vision America, ACTi Corporation, Bosch Sicherheitssysteme GmbH, Pelco, Zhejiang Uniview Technologies Co Ltd, IDIS Ltd, Honeywell International Inc, Zosi Technology Lt.

3. What are the main segments of the Canada Surveillance Analog Camera Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Effectiveness and Affordability; Increasing Crime Rate in Parts of the Country.

6. What are the notable trends driving market growth?

Ease of Use and Affordability is Driving the Demand.

7. Are there any restraints impacting market growth?

Cost Effectiveness and Affordability; Increasing Crime Rate in Parts of the Country.

8. Can you provide examples of recent developments in the market?

April 2024: Hikvision unveiled its cutting-edge Turbo HD 8.0 lineup, enhancing its analog security offerings. This latest iteration promises users an enriched and interactive security interface, empowering them to elevate their surveillance capabilities. Turbo HD 8.0 introduces four groundbreaking features: real-time communication, 180-degree video coverage, and an enhanced night vision capability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Surveillance Analog Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Surveillance Analog Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Surveillance Analog Camera Market?

To stay informed about further developments, trends, and reports in the Canada Surveillance Analog Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence