Key Insights

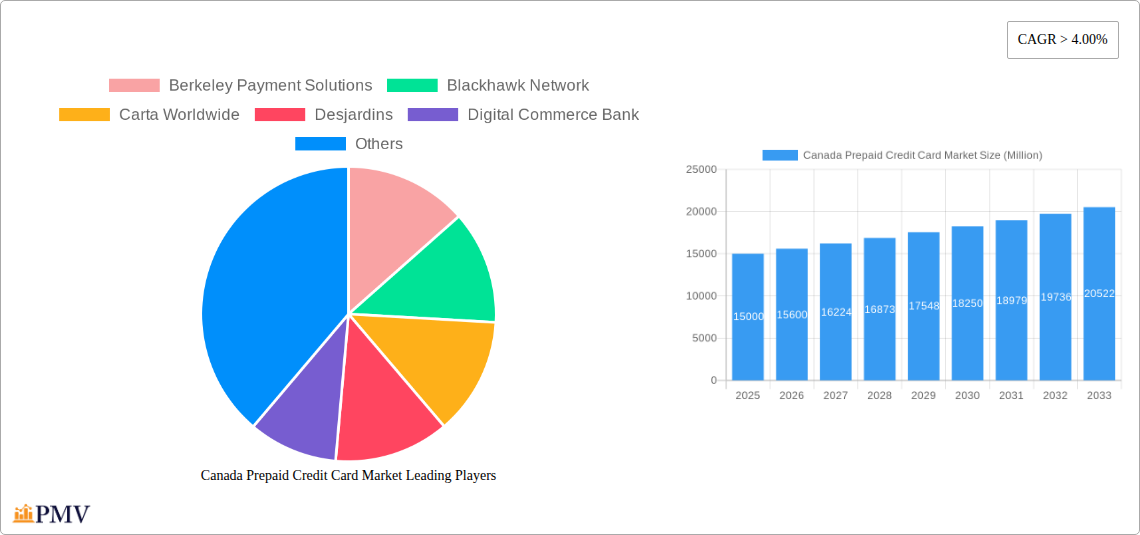

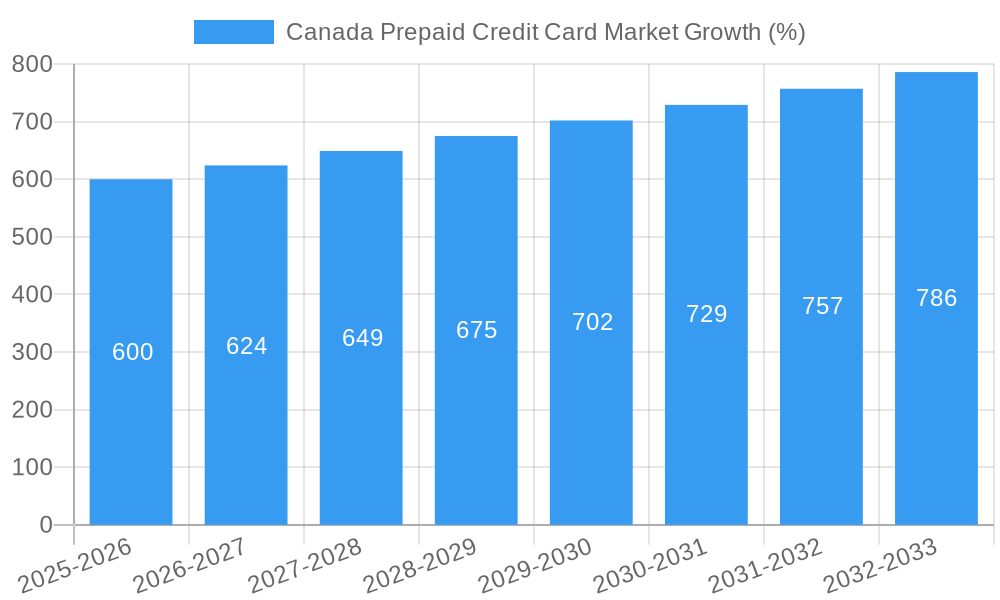

The Canadian prepaid credit card market is experiencing robust growth, fueled by a rising preference for cashless transactions and the increasing adoption of digital payment methods. The market, valued at approximately $15 billion CAD in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4% through 2033. This expansion is driven by several key factors. Firstly, the growing popularity of online shopping and digital services necessitates convenient and secure payment options, with prepaid cards offering a compelling alternative to traditional credit cards for budget management and online security. Secondly, an expanding unbanked and underbanked population in Canada finds prepaid cards as accessible financial tools, fostering inclusion and expanding the market base. Furthermore, government initiatives promoting financial literacy and digital adoption indirectly contribute to the uptake of prepaid cards. Finally, the competitive landscape, featuring established players like Mastercard and newer entrants like Koho and Mogo, fosters innovation and drives market expansion through competitive pricing and product diversification.

Despite these positive trends, challenges remain. Regulatory complexities surrounding KYC/AML compliance and the potential for fraud represent obstacles to continued market expansion. Furthermore, consumer education regarding the advantages and limitations of prepaid cards remains crucial. Competition from other digital payment methods such as mobile wallets may also pose a challenge to market growth. However, the overall outlook for the Canadian prepaid credit card market remains positive, driven by sustained technological innovation, increased consumer demand, and the ongoing expansion of the digital economy. The market is segmented by card type (general-purpose reloadable, single-use, etc.), distribution channels (online, retail, etc.), and target demographic (students, immigrants, etc.), offering ample opportunity for growth and market diversification among existing players and new entrants.

Canada Prepaid Credit Card Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada Prepaid Credit Card Market, offering valuable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth projections. The study incorporates detailed analysis of key market segments, leading players, and emerging trends, equipping readers with actionable intelligence for informed decision-making. The market size in 2025 is estimated at XX Million.

Canada Prepaid Credit Card Market Structure & Competitive Dynamics

The Canadian prepaid credit card market exhibits a moderately concentrated structure, with a handful of dominant players alongside numerous smaller niche competitors. Market share is dynamic, influenced by technological innovation, strategic partnerships, and regulatory shifts. The innovation ecosystem is vibrant, with significant investment in digital solutions and mobile payment technologies. Regulatory frameworks, including those governing financial transactions and data privacy, significantly impact market operations. Product substitutes, such as debit cards and mobile payment apps, exert competitive pressure. End-user trends, particularly the growing adoption of digital financial services, are reshaping market demand. Mergers and acquisitions (M&A) activity has been moderate, with deal values ranging from XX Million to XX Million in recent years.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- M&A Activity: A total of xx M&A deals were recorded between 2019 and 2024, with an average deal value of XX Million.

- Key Regulatory Factors: Compliance with federal and provincial regulations related to financial services, data security, and consumer protection.

- Innovation Ecosystem: Strong presence of fintech companies driving innovation in mobile payment solutions and digital wallets.

Canada Prepaid Credit Card Market Industry Trends & Insights

The Canadian prepaid credit card market is experiencing robust growth, driven by several key factors. The increasing adoption of digital financial services, coupled with rising demand for convenient and secure payment solutions, fuels market expansion. Technological advancements, such as the proliferation of mobile wallets and contactless payment options, further enhance market growth. Consumer preferences are shifting towards greater flexibility and control over financial management, leading to higher demand for prepaid cards. The competitive landscape is dynamic, with existing players constantly innovating and new entrants disrupting the market. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, with market penetration expected to reach xx% by 2033.

Dominant Markets & Segments in Canada Prepaid Credit Card Market

While a precise breakdown by region isn't available, the market is expected to be dominated by urban centers due to higher concentration of population and digital literacy. The growth is driven by increased financial inclusion initiatives, higher smartphone penetration, and growing e-commerce activity.

- Key Drivers:

- High Smartphone Penetration: Facilitates easy access to digital payment platforms.

- Growing E-commerce: Fuels demand for online payment solutions.

- Government Initiatives: Promoting financial inclusion drives adoption amongst underserved populations.

- Robust Infrastructure: Supports seamless digital transactions.

The market is segmented by card type (general-purpose reloadable, single-use, gift cards), user demographics (students, immigrants, unbanked), and distribution channels (online, retail). The general-purpose reloadable segment is the largest, with significant growth potential driven by its flexibility and utility.

Canada Prepaid Credit Card Market Product Innovations

Recent innovations focus on enhancing user experience and security. This includes the integration of mobile wallets, biometric authentication, and advanced fraud prevention measures. The emergence of virtual prepaid cards and embedded finance solutions further expands the market's reach and functionality, offering seamless integration with existing financial applications and platforms. These technological advances cater to the growing demand for convenient, secure, and personalized financial services.

Report Segmentation & Scope

This report segments the market based on card type (general-purpose reloadable, single-use, gift cards), user demographics (students, immigrants, unbanked), and distribution channels (online, retail). Each segment's growth projections, market size estimates, and competitive dynamics are analyzed individually, offering a granular understanding of market opportunities. For example, the general-purpose reloadable segment is anticipated to experience significant growth due to its versatility, while the gift card segment is driven by seasonal demand and promotional activities.

Key Drivers of Canada Prepaid Credit Card Market Growth

Several factors drive the market’s growth. The rise of digital payments and e-commerce has created a significant demand for convenient and secure payment solutions. The increasing number of unbanked and underbanked individuals in Canada further fuels the adoption of prepaid cards as an accessible financial tool. Moreover, government initiatives focused on promoting financial inclusion are positively impacting market growth. Technological advancements such as mobile wallets and contactless payments are also contributing to market expansion.

Challenges in the Canada Prepaid Credit Card Market Sector

The market faces challenges such as increasing competition from other digital payment methods, regulatory compliance requirements, and the risk of fraud. Maintaining cost-effectiveness and operational efficiency is also a key concern. These factors can impact the profitability and sustainability of the prepaid credit card industry in Canada. Stringent regulatory frameworks necessitate continuous investment in compliance, and the threat of fraud requires robust security measures, impacting operational costs.

Leading Players in the Canada Prepaid Credit Card Market

- Berkeley Payment Solutions

- Blackhawk Network

- Carta Worldwide

- Desjardins

- Digital Commerce Bank

- FSS Powering Payments

- Koho

- Mastercard

- EML Payments EML Payments

- Galileo

- Incomm

- Marqeta

- Mogo Inc Mogo (List Not Exhaustive)

Key Developments in Canada Prepaid Credit Card Market Sector

- April 2022: EML partnered with Zayzoon, enabling employees to easily sign up for a Visa prepaid card and receive wages immediately through the Zayzoon app.

- February 2022: Simplii Financial launched a digital gift card marketplace, allowing clients to send prepaid Visa gift cards up to USD 250.

Strategic Canada Prepaid Credit Card Market Outlook

The Canadian prepaid credit card market holds significant future potential, driven by continued digitalization, growing demand for financial inclusion, and ongoing technological innovation. Strategic opportunities exist for players focusing on niche segments, personalized services, and enhanced security features. Investment in advanced technologies and strategic partnerships are crucial for sustainable growth and market leadership. The focus on user experience and addressing specific market needs will drive differentiation and competitiveness in this evolving landscape.

Canada Prepaid Credit Card Market Segmentation

-

1. Offering

- 1.1. General Purpose Card

- 1.2. Gift card

- 1.3. Government Benefit card

- 1.4. Incentive/Payroll card

- 1.5. Others

-

2. Card type

- 2.1. Closed-loop card

- 2.2. Open-loop card

-

3. End-user

- 3.1. Retail

- 3.2. Corporate

- 3.3. Government

Canada Prepaid Credit Card Market Segmentation By Geography

- 1. Canada

Canada Prepaid Credit Card Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Emerging Digital Gift Card Solutions Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Prepaid Credit Card Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. General Purpose Card

- 5.1.2. Gift card

- 5.1.3. Government Benefit card

- 5.1.4. Incentive/Payroll card

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Card type

- 5.2.1. Closed-loop card

- 5.2.2. Open-loop card

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. Retail

- 5.3.2. Corporate

- 5.3.3. Government

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Berkeley Payment Solutions

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Blackhawk Network

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Carta Worldwide

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Desjardins

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Digital Commerce Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FSS Powering Payments

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Koho

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mastercard

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 EML

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Galileo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Incomm

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Marqeta

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Mogo Inc**List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Berkeley Payment Solutions

List of Figures

- Figure 1: Canada Prepaid Credit Card Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Prepaid Credit Card Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Prepaid Credit Card Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Prepaid Credit Card Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 3: Canada Prepaid Credit Card Market Revenue Million Forecast, by Card type 2019 & 2032

- Table 4: Canada Prepaid Credit Card Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 5: Canada Prepaid Credit Card Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Canada Prepaid Credit Card Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 7: Canada Prepaid Credit Card Market Revenue Million Forecast, by Card type 2019 & 2032

- Table 8: Canada Prepaid Credit Card Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 9: Canada Prepaid Credit Card Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Prepaid Credit Card Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Canada Prepaid Credit Card Market?

Key companies in the market include Berkeley Payment Solutions, Blackhawk Network, Carta Worldwide, Desjardins, Digital Commerce Bank, FSS Powering Payments, Koho, Mastercard, EML, Galileo, Incomm, Marqeta, Mogo Inc**List Not Exhaustive.

3. What are the main segments of the Canada Prepaid Credit Card Market?

The market segments include Offering, Card type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Emerging Digital Gift Card Solutions Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On April 19, 2022, EML partnered with Zayzoon. This partnership will help its employees. They can easily sign-up for a Visa prepaid card within the ZayZoon app and receive their earned wages immediately.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Prepaid Credit Card Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Prepaid Credit Card Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Prepaid Credit Card Market?

To stay informed about further developments, trends, and reports in the Canada Prepaid Credit Card Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence