Key Insights

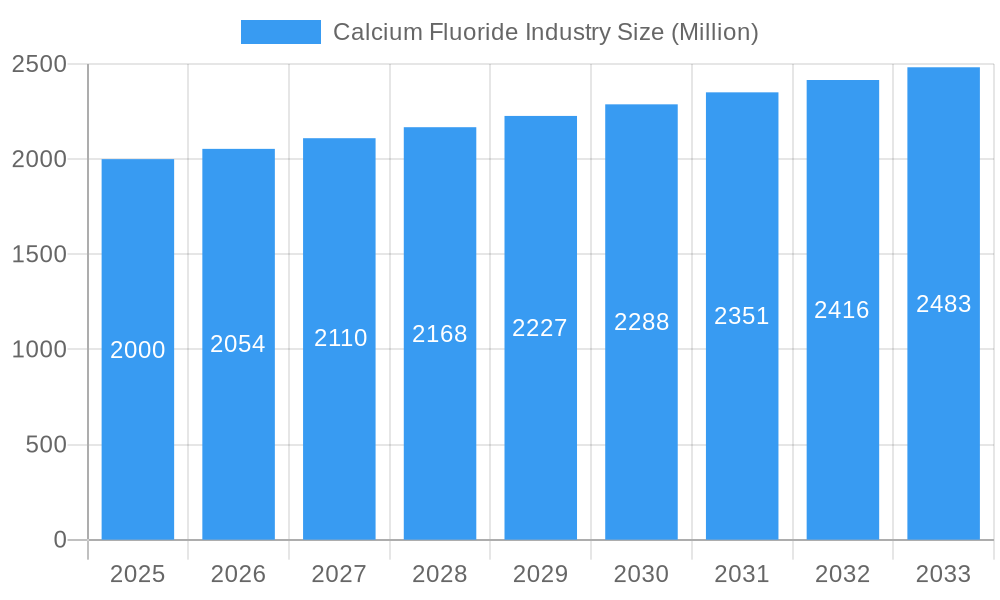

The calcium fluoride market, valued at approximately $XX million in 2025 (assuming a logical estimation based on the provided 2019-2024 data and 2.76% CAGR), is projected to experience steady growth throughout the forecast period (2025-2033). This growth is primarily driven by the increasing demand for calcium fluoride in various applications, notably in the steel, aluminum, and glass industries as a fluxing agent. Further expansion is anticipated due to its use in the production of hydrofluoric acid, a crucial chemical in numerous manufacturing processes. The rising adoption of environmentally friendly manufacturing practices, coupled with stringent regulations regarding hazardous materials, is indirectly bolstering the market's expansion as calcium fluoride offers a relatively safer alternative in certain applications. However, price fluctuations in raw materials and potential environmental concerns related to its extraction and processing pose challenges to market growth.

Calcium Fluoride Industry Market Size (In Billion)

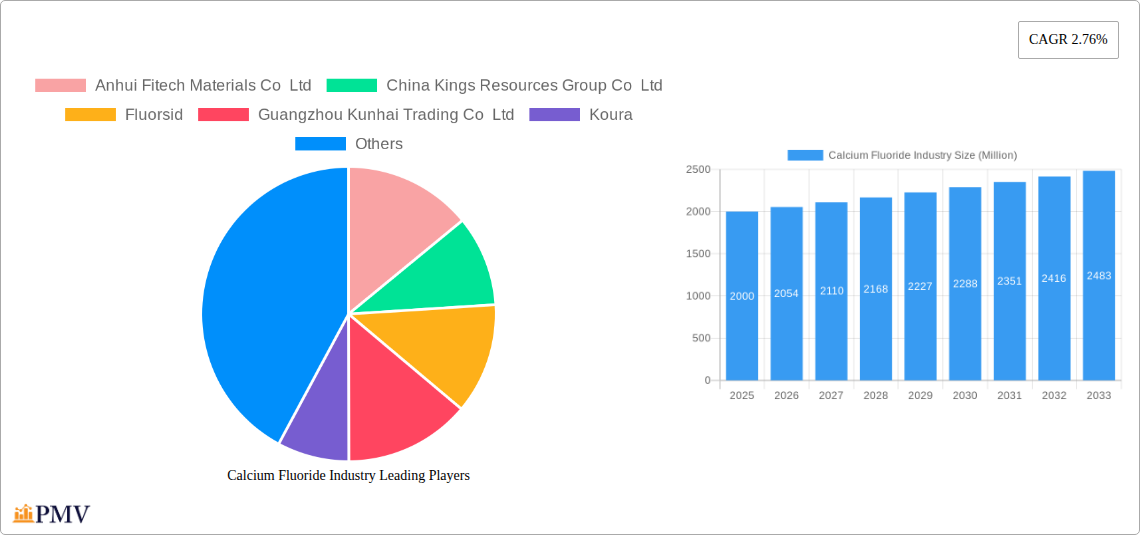

Several key players, including Anhui Fitech Materials Co Ltd, China Kings Resources Group Co Ltd, and Fluorsid, dominate the market landscape, exhibiting diverse geographical footprints and production capabilities. Competitive dynamics are influenced by factors such as economies of scale, technological advancements in extraction techniques, and the ability to meet stringent quality standards for various applications. The market segmentation, while not explicitly detailed, likely includes various grades of calcium fluoride based on purity and applications, resulting in differing price points and market shares within each segment. Future growth will depend on factors such as the overall health of the steel, aluminum, and glass industries, innovation in fluorochemical manufacturing, and the ongoing development of sustainable mining practices. Analyzing regional data and specific segment breakdowns (if obtainable) would provide a more granular understanding of market dynamics and growth prospects.

Calcium Fluoride Industry Company Market Share

Calcium Fluoride Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global Calcium Fluoride (Fluorspar) industry, offering invaluable insights for stakeholders, investors, and industry professionals. The study covers the period 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report utilizes a robust methodology incorporating extensive primary and secondary research to deliver accurate and actionable market intelligence. Expect detailed analysis of market size (in Millions), CAGR, competitive landscape, segment-wise growth projections, and key industry trends.

Calcium Fluoride Industry Market Structure & Competitive Dynamics

The global calcium fluoride market exhibits a moderately concentrated structure, with several key players holding significant market share. However, the presence of numerous smaller regional players contributes to competitive intensity. Market concentration is further influenced by factors such as geographic location of mines, access to resources, and technological capabilities. Innovation ecosystems within the industry are driven by ongoing research into enhanced extraction techniques, beneficiation processes, and the development of new applications for calcium fluoride. Regulatory frameworks, varying significantly across regions, impact production costs and market access. The availability of substitute materials, such as synthetic fluorides, exerts competitive pressure, particularly in certain applications. End-user trends, notably in the steel and aluminum industries, significantly shape demand patterns. The market has witnessed moderate M&A activity in recent years.

- Market Share: The top 5 players collectively hold approximately xx% of the global market share (2024).

- M&A Activity: Significant deals in the last 3 years have involved a combined value of approximately $xx Million, driven by consolidation efforts and the pursuit of strategic assets. Examples include the acquisition of Canada Fluorspar Inc. in 2023.

Calcium Fluoride Industry Industry Trends & Insights

The calcium fluoride market is experiencing steady growth, driven by increasing demand from various sectors. The CAGR for the forecast period (2025-2033) is estimated at xx%. This growth is fuelled by factors such as the expansion of the steel and aluminum industries, the increasing adoption of calcium fluoride in the chemical and optical sectors, and the growing use of fluorochemicals. Technological disruptions are evident in the adoption of more efficient mining and processing techniques, leading to improved yields and reduced costs. Consumer preferences are increasingly focused on sustainability and ethical sourcing, prompting a greater focus on environmental stewardship within the industry. Competitive dynamics are characterized by both price competition and differentiation based on product quality, geographic reach, and supply chain efficiency. Market penetration of calcium fluoride in new applications, such as in lithium-ion batteries and specialized ceramics, presents significant growth opportunities.

Dominant Markets & Segments in Calcium Fluoride Industry

China currently holds the dominant position in the global calcium fluoride market, driven primarily by its substantial reserves, robust manufacturing sector, and significant domestic consumption.

- Key Drivers for China's Dominance:

- Abundant domestic fluorspar reserves.

- Well-established chemical and metallurgical industries.

- Favorable government policies supporting mining and manufacturing.

- Extensive downstream processing capabilities.

Other key regions include India, Mexico, and South Africa, each exhibiting varying levels of market maturity and growth potential. The market is segmented by grade (acid grade, metallurgical grade), application (metallurgy, chemicals, ceramics), and region. The metallurgical grade segment currently holds the largest share, reflecting the dominant use of calcium fluoride in steelmaking and aluminum production.

Calcium Fluoride Industry Product Innovations

Recent innovations in calcium fluoride production focus on enhancing purity and consistency to meet increasingly stringent quality requirements from various industries. Advanced beneficiation techniques are being implemented to improve yield and reduce waste. New applications for calcium fluoride are being explored in specialized areas such as high-performance ceramics, optical components, and advanced materials. The development of sustainable mining and processing methods is also gaining traction in response to growing environmental concerns.

Report Segmentation & Scope

This report provides a granular segmentation of the calcium fluoride market based on several key parameters:

By Grade: Acid grade, metallurgical grade, ceramic grade. Growth projections for each segment are based on anticipated demand from various end-use industries. Competitive dynamics vary depending on the specific grade, with some segments characterized by more intense competition than others.

By Application: Metallurgy (steel, aluminum), chemicals (fluorochemicals, hydrofluoric acid), ceramics, optics. Market sizes and growth rates for each application segment are projected based on industry forecasts and end-use demand. Competitive landscape differs depending on application.

By Region: North America, Europe, Asia-Pacific, South America, Africa, and the Middle East. Regional market analysis incorporates factors such as resource availability, economic development, and regulatory policies.

Key Drivers of Calcium Fluoride Industry Growth

Several factors contribute to the sustained growth of the calcium fluoride industry. The robust expansion of the steel and aluminum industries globally remains a key driver, as calcium fluoride is a crucial fluxing agent in these processes. The growing demand for fluorochemicals in various applications, including refrigerants, propellants, and pharmaceuticals, further fuels market growth. Technological advancements in extraction and processing techniques are also contributing to improved efficiency and reduced costs, while governmental support for mining and associated industries in certain regions creates a favorable environment for industry expansion.

Challenges in the Calcium Fluoride Industry Sector

The calcium fluoride industry faces several challenges including fluctuating raw material prices, the impact of environmental regulations on mining operations, and the potential for competition from synthetic substitutes. Supply chain disruptions can significantly impact production and pricing, and intense competition from established players can pressure margins. Stringent environmental regulations and safety requirements necessitate substantial investments in compliance measures, contributing to increased operating costs.

Leading Players in the Calcium Fluoride Industry Market

- Anhui Fitech Materials Co Ltd

- China Kings Resources Group Co Ltd

- Fluorsid

- Guangzhou Kunhai Trading Co Ltd

- Koura

- Luoyang Fengrui Fluorine Industry Co Ltd

- Masan High-Tech Materials Corporation

- Minchem Impex India Private Limited

- Minersa Group

- Mongolrostsvetmet LLC

- Sallies Industrial Minerals

- Seaforth Mineral & Ore Co

- SR Group

- *List Not Exhaustive

Key Developments in Calcium Fluoride Industry Sector

April 2024: Lithium Corporation expands its portfolio by staking a new fluorspar property, signifying diversification and potential new supply.

July 2023: Acquisition of Canada Fluorspar Inc. by AMED Funds strengthens industry consolidation and expands distribution networks.

April 2022: GMDC plans a new fluorspar beneficiation plant in India, increasing local processing capacity and potentially impacting regional supply dynamics.

Strategic Calcium Fluoride Industry Market Outlook

The calcium fluoride market is poised for continued growth driven by increasing industrial demand, particularly in emerging economies. Strategic opportunities exist for companies that can leverage technological innovation to improve efficiency, enhance product quality, and establish sustainable sourcing practices. Focus on expanding into new applications and regions, as well as strategic partnerships and acquisitions, will be crucial for future success in this dynamic market. The increasing emphasis on environmental sustainability will necessitate a proactive approach to compliance and the development of eco-friendly mining and processing technologies.

Calcium Fluoride Industry Segmentation

-

1. Grade

- 1.1. Acid Grade

- 1.2. Ceramic Grade

- 1.3. Metallurgical Grade

- 1.4. Optical Grade

- 1.5. Lapidary Grade

-

2. Variety

- 2.1. Antozonite

- 2.2. Blue John

- 2.3. Chlorophane

- 2.4. Yttrocerite

- 2.5. Yttrofluorite

- 2.6. Other Varieties

-

3. Application

- 3.1. Metallurgical

- 3.2. Ceramics

- 3.3. Chemicals

- 3.4. Other Applications

Calcium Fluoride Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Thailand

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. NORDIC Countries

- 3.7. Turkey

- 3.8. Russia

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Qatar

- 5.3. United Arab Emirates

- 5.4. Nigeria

- 5.5. Egypt

- 5.6. South Africa

- 5.7. Rest of Middle East and Africa

Calcium Fluoride Industry Regional Market Share

Geographic Coverage of Calcium Fluoride Industry

Calcium Fluoride Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Fluorspar from Fluorspar Extracted Chemicals; Increasing Steel Production Driving the Demand; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Fluorspar from Fluorspar Extracted Chemicals; Increasing Steel Production Driving the Demand; Other Drivers

- 3.4. Market Trends

- 3.4.1. Metallurgy Expected to be the Fastest-growing Application

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Calcium Fluoride Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 5.1.1. Acid Grade

- 5.1.2. Ceramic Grade

- 5.1.3. Metallurgical Grade

- 5.1.4. Optical Grade

- 5.1.5. Lapidary Grade

- 5.2. Market Analysis, Insights and Forecast - by Variety

- 5.2.1. Antozonite

- 5.2.2. Blue John

- 5.2.3. Chlorophane

- 5.2.4. Yttrocerite

- 5.2.5. Yttrofluorite

- 5.2.6. Other Varieties

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Metallurgical

- 5.3.2. Ceramics

- 5.3.3. Chemicals

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 6. Asia Pacific Calcium Fluoride Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 6.1.1. Acid Grade

- 6.1.2. Ceramic Grade

- 6.1.3. Metallurgical Grade

- 6.1.4. Optical Grade

- 6.1.5. Lapidary Grade

- 6.2. Market Analysis, Insights and Forecast - by Variety

- 6.2.1. Antozonite

- 6.2.2. Blue John

- 6.2.3. Chlorophane

- 6.2.4. Yttrocerite

- 6.2.5. Yttrofluorite

- 6.2.6. Other Varieties

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Metallurgical

- 6.3.2. Ceramics

- 6.3.3. Chemicals

- 6.3.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 7. North America Calcium Fluoride Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 7.1.1. Acid Grade

- 7.1.2. Ceramic Grade

- 7.1.3. Metallurgical Grade

- 7.1.4. Optical Grade

- 7.1.5. Lapidary Grade

- 7.2. Market Analysis, Insights and Forecast - by Variety

- 7.2.1. Antozonite

- 7.2.2. Blue John

- 7.2.3. Chlorophane

- 7.2.4. Yttrocerite

- 7.2.5. Yttrofluorite

- 7.2.6. Other Varieties

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Metallurgical

- 7.3.2. Ceramics

- 7.3.3. Chemicals

- 7.3.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 8. Europe Calcium Fluoride Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 8.1.1. Acid Grade

- 8.1.2. Ceramic Grade

- 8.1.3. Metallurgical Grade

- 8.1.4. Optical Grade

- 8.1.5. Lapidary Grade

- 8.2. Market Analysis, Insights and Forecast - by Variety

- 8.2.1. Antozonite

- 8.2.2. Blue John

- 8.2.3. Chlorophane

- 8.2.4. Yttrocerite

- 8.2.5. Yttrofluorite

- 8.2.6. Other Varieties

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Metallurgical

- 8.3.2. Ceramics

- 8.3.3. Chemicals

- 8.3.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 9. South America Calcium Fluoride Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 9.1.1. Acid Grade

- 9.1.2. Ceramic Grade

- 9.1.3. Metallurgical Grade

- 9.1.4. Optical Grade

- 9.1.5. Lapidary Grade

- 9.2. Market Analysis, Insights and Forecast - by Variety

- 9.2.1. Antozonite

- 9.2.2. Blue John

- 9.2.3. Chlorophane

- 9.2.4. Yttrocerite

- 9.2.5. Yttrofluorite

- 9.2.6. Other Varieties

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Metallurgical

- 9.3.2. Ceramics

- 9.3.3. Chemicals

- 9.3.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 10. Middle East and Africa Calcium Fluoride Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 10.1.1. Acid Grade

- 10.1.2. Ceramic Grade

- 10.1.3. Metallurgical Grade

- 10.1.4. Optical Grade

- 10.1.5. Lapidary Grade

- 10.2. Market Analysis, Insights and Forecast - by Variety

- 10.2.1. Antozonite

- 10.2.2. Blue John

- 10.2.3. Chlorophane

- 10.2.4. Yttrocerite

- 10.2.5. Yttrofluorite

- 10.2.6. Other Varieties

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Metallurgical

- 10.3.2. Ceramics

- 10.3.3. Chemicals

- 10.3.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Anhui Fitech Materials Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 China Kings Resources Group Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fluorsid

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Guangzhou Kunhai Trading Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Koura

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Luoyang Fengrui Fluorine Industry Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Masan High-Tech Materials Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Minchem Impex India Private Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Minersa Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mongolrostsvetmet LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sallies Industrial Minerals

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Seaforth Mineral & Ore Co

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 SR Group*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Anhui Fitech Materials Co Ltd

List of Figures

- Figure 1: Global Calcium Fluoride Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Calcium Fluoride Industry Revenue (Million), by Grade 2025 & 2033

- Figure 3: Asia Pacific Calcium Fluoride Industry Revenue Share (%), by Grade 2025 & 2033

- Figure 4: Asia Pacific Calcium Fluoride Industry Revenue (Million), by Variety 2025 & 2033

- Figure 5: Asia Pacific Calcium Fluoride Industry Revenue Share (%), by Variety 2025 & 2033

- Figure 6: Asia Pacific Calcium Fluoride Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Asia Pacific Calcium Fluoride Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific Calcium Fluoride Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Asia Pacific Calcium Fluoride Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Calcium Fluoride Industry Revenue (Million), by Grade 2025 & 2033

- Figure 11: North America Calcium Fluoride Industry Revenue Share (%), by Grade 2025 & 2033

- Figure 12: North America Calcium Fluoride Industry Revenue (Million), by Variety 2025 & 2033

- Figure 13: North America Calcium Fluoride Industry Revenue Share (%), by Variety 2025 & 2033

- Figure 14: North America Calcium Fluoride Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: North America Calcium Fluoride Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: North America Calcium Fluoride Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Calcium Fluoride Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Calcium Fluoride Industry Revenue (Million), by Grade 2025 & 2033

- Figure 19: Europe Calcium Fluoride Industry Revenue Share (%), by Grade 2025 & 2033

- Figure 20: Europe Calcium Fluoride Industry Revenue (Million), by Variety 2025 & 2033

- Figure 21: Europe Calcium Fluoride Industry Revenue Share (%), by Variety 2025 & 2033

- Figure 22: Europe Calcium Fluoride Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Europe Calcium Fluoride Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Calcium Fluoride Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Calcium Fluoride Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Calcium Fluoride Industry Revenue (Million), by Grade 2025 & 2033

- Figure 27: South America Calcium Fluoride Industry Revenue Share (%), by Grade 2025 & 2033

- Figure 28: South America Calcium Fluoride Industry Revenue (Million), by Variety 2025 & 2033

- Figure 29: South America Calcium Fluoride Industry Revenue Share (%), by Variety 2025 & 2033

- Figure 30: South America Calcium Fluoride Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: South America Calcium Fluoride Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Calcium Fluoride Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Calcium Fluoride Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Calcium Fluoride Industry Revenue (Million), by Grade 2025 & 2033

- Figure 35: Middle East and Africa Calcium Fluoride Industry Revenue Share (%), by Grade 2025 & 2033

- Figure 36: Middle East and Africa Calcium Fluoride Industry Revenue (Million), by Variety 2025 & 2033

- Figure 37: Middle East and Africa Calcium Fluoride Industry Revenue Share (%), by Variety 2025 & 2033

- Figure 38: Middle East and Africa Calcium Fluoride Industry Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Calcium Fluoride Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Calcium Fluoride Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Calcium Fluoride Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Calcium Fluoride Industry Revenue Million Forecast, by Grade 2020 & 2033

- Table 2: Global Calcium Fluoride Industry Revenue Million Forecast, by Variety 2020 & 2033

- Table 3: Global Calcium Fluoride Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Calcium Fluoride Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Calcium Fluoride Industry Revenue Million Forecast, by Grade 2020 & 2033

- Table 6: Global Calcium Fluoride Industry Revenue Million Forecast, by Variety 2020 & 2033

- Table 7: Global Calcium Fluoride Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Calcium Fluoride Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Malaysia Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Thailand Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Vietnam Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Asia Pacific Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Calcium Fluoride Industry Revenue Million Forecast, by Grade 2020 & 2033

- Table 19: Global Calcium Fluoride Industry Revenue Million Forecast, by Variety 2020 & 2033

- Table 20: Global Calcium Fluoride Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Calcium Fluoride Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: United States Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Canada Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Mexico Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Calcium Fluoride Industry Revenue Million Forecast, by Grade 2020 & 2033

- Table 26: Global Calcium Fluoride Industry Revenue Million Forecast, by Variety 2020 & 2033

- Table 27: Global Calcium Fluoride Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Calcium Fluoride Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Germany Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: France Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Italy Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Spain Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: NORDIC Countries Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Turkey Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Europe Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Global Calcium Fluoride Industry Revenue Million Forecast, by Grade 2020 & 2033

- Table 39: Global Calcium Fluoride Industry Revenue Million Forecast, by Variety 2020 & 2033

- Table 40: Global Calcium Fluoride Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 41: Global Calcium Fluoride Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Brazil Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Argentina Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Colombia Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Global Calcium Fluoride Industry Revenue Million Forecast, by Grade 2020 & 2033

- Table 47: Global Calcium Fluoride Industry Revenue Million Forecast, by Variety 2020 & 2033

- Table 48: Global Calcium Fluoride Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 49: Global Calcium Fluoride Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Saudi Arabia Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Qatar Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: United Arab Emirates Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: Nigeria Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Egypt Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Africa Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Middle East and Africa Calcium Fluoride Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Calcium Fluoride Industry?

The projected CAGR is approximately 2.76%.

2. Which companies are prominent players in the Calcium Fluoride Industry?

Key companies in the market include Anhui Fitech Materials Co Ltd, China Kings Resources Group Co Ltd, Fluorsid, Guangzhou Kunhai Trading Co Ltd, Koura, Luoyang Fengrui Fluorine Industry Co Ltd, Masan High-Tech Materials Corporation, Minchem Impex India Private Limited, Minersa Group, Mongolrostsvetmet LLC, Sallies Industrial Minerals, Seaforth Mineral & Ore Co, SR Group*List Not Exhaustive.

3. What are the main segments of the Calcium Fluoride Industry?

The market segments include Grade, Variety, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Fluorspar from Fluorspar Extracted Chemicals; Increasing Steel Production Driving the Demand; Other Drivers.

6. What are the notable trends driving market growth?

Metallurgy Expected to be the Fastest-growing Application.

7. Are there any restraints impacting market growth?

Growing Demand for Fluorspar from Fluorspar Extracted Chemicals; Increasing Steel Production Driving the Demand; Other Drivers.

8. Can you provide examples of recent developments in the market?

April 2024: Lithium Corporation, a North American exploration mining company, broadened its portfolio by staking a new property prospective for hosting fluorspar mineralization.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Calcium Fluoride Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Calcium Fluoride Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Calcium Fluoride Industry?

To stay informed about further developments, trends, and reports in the Calcium Fluoride Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence