Key Insights

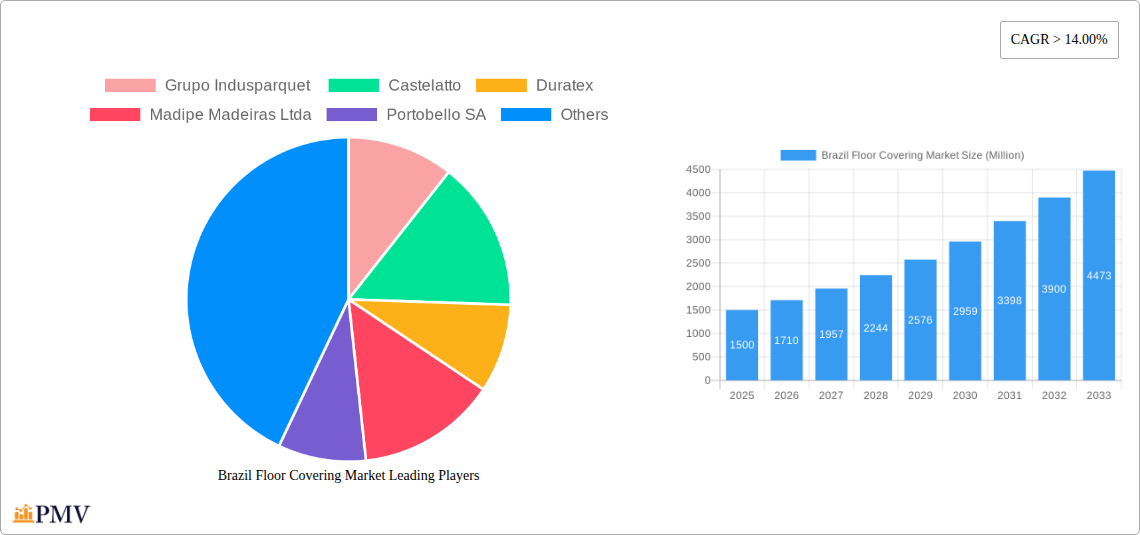

Brazil's floor covering market is poised for significant expansion, with a projected CAGR of 11.78% from 2025 to 2033. The estimated market size is 7.8 billion in the base year of 2025. This growth is propelled by a dynamic construction sector, with new residential and commercial projects driving demand for flooring solutions. Concurrently, a growing middle class with enhanced purchasing power is fueling renovations and upgrades in existing properties. A heightened preference for durable, aesthetically appealing flooring, coupled with government support for sustainable construction, further bolsters market momentum. The market comprises both hard flooring (e.g., ceramic) and soft flooring (e.g., carpet, resilient materials), with ceramic expected to lead due to its longevity and cost-effectiveness. Distribution is multifaceted, serving contractors, dealers (B2B), and retail consumers (B2C). Key industry leaders including Grupo Indusparquet, Castelatto, and Portobello SA are strategically positioned to capitalize on this growth, leveraging their brand recognition and comprehensive product offerings.

Brazil Floor Covering Market Market Size (In Billion)

Despite the positive outlook, the market faces potential headwinds. Economic volatility in Brazil could affect construction and consumer spending. Intense competition from domestic and international entities necessitates ongoing innovation and competitive pricing. Furthermore, fluctuations in raw material costs and supply chain disruptions present persistent risks. Nevertheless, sustained population growth, urbanization trends, and improving living standards underpin a favorable long-term market trajectory. Strategic segmentation presents opportunities for tailored marketing and product development to address diverse end-user and construction requirements. Companies adept at navigating these challenges and adapting to evolving consumer preferences are well-positioned for substantial success in this expanding market.

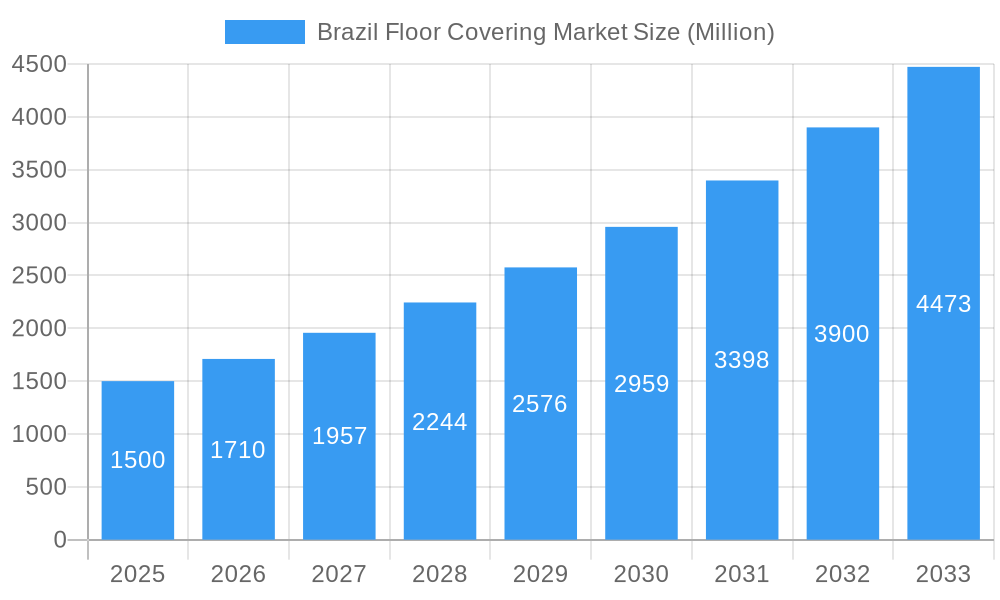

Brazil Floor Covering Market Company Market Share

Brazil Floor Covering Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil floor covering market, offering invaluable insights for businesses, investors, and industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, competitive dynamics, industry trends, and future growth potential. The report leverages extensive data analysis and expert insights to deliver actionable intelligence for strategic decision-making.

Brazil Floor Covering Market Market Structure & Competitive Dynamics

The Brazilian floor covering market is characterized by a moderately concentrated structure, with key players like Grupo Indusparquet, Castelatto, Duratex, Madipe Madeiras Ltda, Portobello SA, Ceramica Almeida, Grupo Cedasa, Ceramica Aurora S A, Grupo Embramaco, and Eucatex holding significant market share. The market exhibits a dynamic innovation ecosystem, driven by technological advancements in materials and manufacturing processes. Regulatory frameworks, including building codes and environmental regulations, play a significant role in shaping market trends. Product substitution is a factor, with consumers increasingly considering alternatives based on price, durability, and aesthetic appeal. End-user preferences are shifting towards sustainable and aesthetically pleasing options, influencing product development. The market has witnessed notable M&A activity, with recent examples including Mohawk Industries' acquisition of Elizabeth Revestimentos Ltda in February 2023. While precise market share figures and M&A deal values for all companies are unavailable publicly, analysis suggests a xx% market share for the top five players. The total M&A deal volume in the sector from 2019-2024 is estimated at xx Million.

- Market Concentration: Moderately concentrated, with top players holding xx% market share.

- Innovation Ecosystem: Active, driven by material and manufacturing advancements.

- Regulatory Framework: Significant influence on product selection and market dynamics.

- Product Substitution: Consumers increasingly explore diverse options based on various factors.

- End-User Trends: Preference shifting towards sustainable and aesthetically pleasing floor coverings.

- M&A Activity: Notable activity observed, impacting market consolidation.

Brazil Floor Covering Market Industry Trends & Insights

The Brazil floor covering market is projected to experience robust growth during the forecast period (2025-2033), driven by several key factors. The expanding construction sector, particularly in new residential and commercial projects, fuels significant demand. Rising disposable incomes and improving living standards contribute to increased consumer spending on home improvements and renovations, further boosting market growth. Technological disruptions, such as the adoption of advanced manufacturing techniques and the introduction of innovative materials (e.g., resilient flooring with enhanced durability and water resistance), are reshaping the competitive landscape. Consumer preferences are evolving, with a growing preference for eco-friendly, low-maintenance, and aesthetically diverse flooring options. The market is witnessing intensified competition, with companies focusing on product differentiation, branding, and strategic partnerships to gain a competitive edge. The CAGR for the market during 2025-2033 is estimated at xx%, with market penetration in new construction projects reaching xx% by 2033. Furthermore, the replacement and renovation segment contributes substantially, representing an estimated xx% of the overall market in 2025.

Dominant Markets & Segments in Brazil Floor Covering Market

The Brazilian floor covering market demonstrates strong growth across various segments. The residential segment holds the largest share, reflecting the substantial housing market in the country. The South and Southeast regions of Brazil represent dominant markets, driven by higher population density and robust economic activity. New construction constitutes a significant segment, with a large share of the market due to ongoing infrastructure development and urbanization. The B2C/retail channel plays a prominent role in distribution.

Key Drivers for Residential Segment:

- Rising disposable incomes and improved living standards

- Growing preference for home improvements and renovations

- Urbanization and population growth in major cities

Key Drivers for New Construction Segment:

- Government initiatives focused on infrastructure development and affordable housing

- Expansion of the construction industry and real estate market

Key Drivers for B2C/Retail Channel:

- Increased consumer preference for personalized shopping experiences and direct product selection.

Brazil Floor Covering Market Product Innovations

Recent innovations in the Brazilian floor covering market center on enhanced durability, water resistance, and aesthetic versatility. Manufacturers are introducing technologically advanced materials, such as high-performance laminates and resilient flooring options with improved wear resistance. Focus is also on eco-friendly and sustainable products, catering to growing environmental consciousness. These innovations aim to fulfill consumer demands for practicality, style, and environmental responsibility.

Report Segmentation & Scope

This report segments the Brazil floor covering market based on construction type (new construction and replacement & renovation), end-user (residential and commercial), distribution channel (B2C/retail and B2B/contractors/dealers), and product type (carpet and area rugs, hard/non-resilient floor covering, and ceramic flooring/soft/resilient floor covering). Each segment's growth projection, market size, and competitive dynamics are detailed. For example, the ceramic flooring segment is expected to show robust growth due to its affordability and design versatility. The B2B channel is expected to maintain significant relevance due to the construction industry's substantial role. Growth projections for each segment vary depending on macroeconomic conditions, construction activity, and consumer trends.

Key Drivers of Brazil Floor Covering Market Growth

The Brazilian floor covering market's growth is primarily fueled by the country's expanding construction sector, rising disposable incomes, and increasing urbanization. Government initiatives aimed at improving housing infrastructure and promoting economic development contribute significantly to market expansion. Moreover, technological advancements in materials and manufacturing processes lead to the development of innovative and sustainable products that cater to evolving consumer preferences.

Challenges in the Brazil Floor Covering Market Sector

The Brazil floor covering market faces challenges including fluctuating raw material prices and potential supply chain disruptions impacting production costs and market stability. Furthermore, intense competition necessitates constant product innovation and effective marketing strategies. Economic volatility and changing consumer preferences also present challenges to manufacturers in maintaining market share and profitability.

Leading Players in the Brazil Floor Covering Market Market

- Grupo Indusparquet

- Castelatto

- Duratex

- Madipe Madeiras Ltda

- Portobello SA

- Ceramica Almeida

- Grupo Cedasa

- Ceramica Aurora S A

- Grupo Embramaco

- Eucatex

Key Developments in Brazil Floor Covering Market Sector

- May 2023: The Cedasa Group launched its new Liverpool Polido and Matte tiles.

- February 2023: Mohawk Industries, Inc. acquired Elizabeth Revestimentos Ltda in Brazil.

Strategic Brazil Floor Covering Market Market Outlook

The Brazil floor covering market presents significant opportunities for growth, driven by sustained economic expansion and urbanization. Strategic investments in product innovation, sustainable manufacturing practices, and effective marketing strategies will be crucial for success. Companies that adapt to changing consumer preferences and proactively address supply chain challenges will be well-positioned to capture market share and enhance profitability in the coming years.

Brazil Floor Covering Market Segmentation

-

1. Type

- 1.1. Carpet and Area Rugs

-

1.2. Hard/Non-Resilient Floor Covering

- 1.2.1. Wood Flooring

- 1.2.2. Laminate Flooring

- 1.2.3. Stone/Marble Flooring?

- 1.2.4. Ceramic Flooring

-

1.3. Soft/Resilient Floor Covering

- 1.3.1. Vinyl Sheets

- 1.3.2. Luxury Vinyl Tiles

- 1.3.3. Rubber

- 1.3.4. Linoleum

-

2. Construction Type

- 2.1. New Construction

- 2.2. Replacement & Renovation

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

-

4. Distribution Channel

-

4.1. B2C/Retail Channels

- 4.1.1. Specialty Stores

- 4.1.2. Home Centers

- 4.1.3. Online

- 4.1.4. Other Distribution Channels

- 4.2. B2B/Contractors/Dealers

-

4.1. B2C/Retail Channels

Brazil Floor Covering Market Segmentation By Geography

- 1. Brazil

Brazil Floor Covering Market Regional Market Share

Geographic Coverage of Brazil Floor Covering Market

Brazil Floor Covering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Construction Sector is Driving the Floor Covering Market; Growing Urbanization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Skill Gap and Labor Shortages Strikes as Major Restraints For Floor Covering Manufacturing And Maintenance

- 3.4. Market Trends

- 3.4.1. The Increasing Population in Brazil is Driving the Flooring Covering Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Floor Covering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carpet and Area Rugs

- 5.1.2. Hard/Non-Resilient Floor Covering

- 5.1.2.1. Wood Flooring

- 5.1.2.2. Laminate Flooring

- 5.1.2.3. Stone/Marble Flooring?

- 5.1.2.4. Ceramic Flooring

- 5.1.3. Soft/Resilient Floor Covering

- 5.1.3.1. Vinyl Sheets

- 5.1.3.2. Luxury Vinyl Tiles

- 5.1.3.3. Rubber

- 5.1.3.4. Linoleum

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. New Construction

- 5.2.2. Replacement & Renovation

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. B2C/Retail Channels

- 5.4.1.1. Specialty Stores

- 5.4.1.2. Home Centers

- 5.4.1.3. Online

- 5.4.1.4. Other Distribution Channels

- 5.4.2. B2B/Contractors/Dealers

- 5.4.1. B2C/Retail Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Grupo Indusparquet

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Castelatto

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Duratex

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Madipe Madeiras Ltda

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Portobello SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ceramica Almeida

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Grupo Cedasa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ceramica Aurora S A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Grupo Embramaco

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eucatex

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Grupo Indusparquet

List of Figures

- Figure 1: Brazil Floor Covering Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Floor Covering Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Floor Covering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Brazil Floor Covering Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Brazil Floor Covering Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 4: Brazil Floor Covering Market Volume K Unit Forecast, by Construction Type 2020 & 2033

- Table 5: Brazil Floor Covering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Brazil Floor Covering Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 7: Brazil Floor Covering Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Brazil Floor Covering Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 9: Brazil Floor Covering Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Brazil Floor Covering Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Brazil Floor Covering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Brazil Floor Covering Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 13: Brazil Floor Covering Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 14: Brazil Floor Covering Market Volume K Unit Forecast, by Construction Type 2020 & 2033

- Table 15: Brazil Floor Covering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 16: Brazil Floor Covering Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 17: Brazil Floor Covering Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Brazil Floor Covering Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 19: Brazil Floor Covering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Brazil Floor Covering Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Floor Covering Market?

The projected CAGR is approximately 11.78%.

2. Which companies are prominent players in the Brazil Floor Covering Market?

Key companies in the market include Grupo Indusparquet , Castelatto, Duratex, Madipe Madeiras Ltda, Portobello SA, Ceramica Almeida, Grupo Cedasa, Ceramica Aurora S A, Grupo Embramaco, Eucatex.

3. What are the main segments of the Brazil Floor Covering Market?

The market segments include Type, Construction Type, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Construction Sector is Driving the Floor Covering Market; Growing Urbanization is Driving the Market.

6. What are the notable trends driving market growth?

The Increasing Population in Brazil is Driving the Flooring Covering Market.

7. Are there any restraints impacting market growth?

Skill Gap and Labor Shortages Strikes as Major Restraints For Floor Covering Manufacturing And Maintenance.

8. Can you provide examples of recent developments in the market?

In May 2023, The Cedasa Group, renowned in the ceramic tile sector, announced the launch of its latest creation, Liverpool Polidoand Matte tiles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Floor Covering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Floor Covering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Floor Covering Market?

To stay informed about further developments, trends, and reports in the Brazil Floor Covering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence