Key Insights

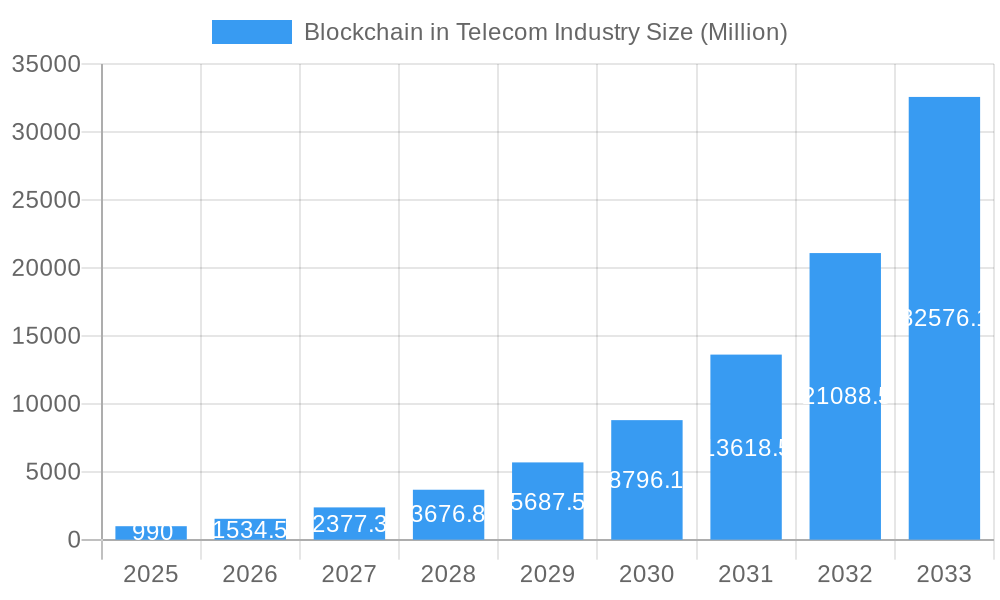

The Blockchain in Telecom market is experiencing explosive growth, projected to reach a market size of $0.99 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 55.13%. This surge is driven by the increasing need for secure and transparent data management within the telecommunications sector. Key applications fueling this expansion include identity management, enabling secure and verifiable user identities; payment and billing systems, improving efficiency and reducing fraud; smart contracts, automating agreements and streamlining processes; and connectivity provisioning, enhancing network security and optimizing resource allocation. Leading players like Blockchain Foundry Inc., Microsoft, Huawei, Oracle, and SAP are actively investing in this space, developing innovative solutions and driving market penetration. The robust growth is further fueled by the rising adoption of 5G technology, which necessitates enhanced security protocols that blockchain technology can effectively provide. North America and Europe currently hold significant market shares, but the Asia-Pacific region is poised for rapid expansion, driven by increasing digitalization and government initiatives promoting blockchain adoption. While challenges remain, such as regulatory uncertainties and the need for wider industry standardization, the long-term outlook for Blockchain in Telecom remains overwhelmingly positive, indicating substantial opportunities for both established players and emerging startups.

Blockchain in Telecom Industry Market Size (In Million)

The forecast period from 2025 to 2033 promises even more significant growth, with various regions contributing differently. North America's established technological infrastructure and early adoption of blockchain technology likely ensure its continued dominance. However, the Asia-Pacific region's massive population and rapid technological advancements suggest its market share will grow significantly faster. Europe will likely maintain steady growth, driven by ongoing digital transformation and increasing data security concerns. Meanwhile, emerging markets in South America and the Middle East and Africa will experience gradual but consistent growth as digital infrastructure improves and awareness of blockchain's benefits increases. Specific growth rates will depend on factors like regulatory changes, technological advancements, and the success of specific blockchain implementations within different telecom companies. The segment with the highest growth potential is likely to be Identity Management, given the increasing concerns around data privacy and security in the telecom sector.

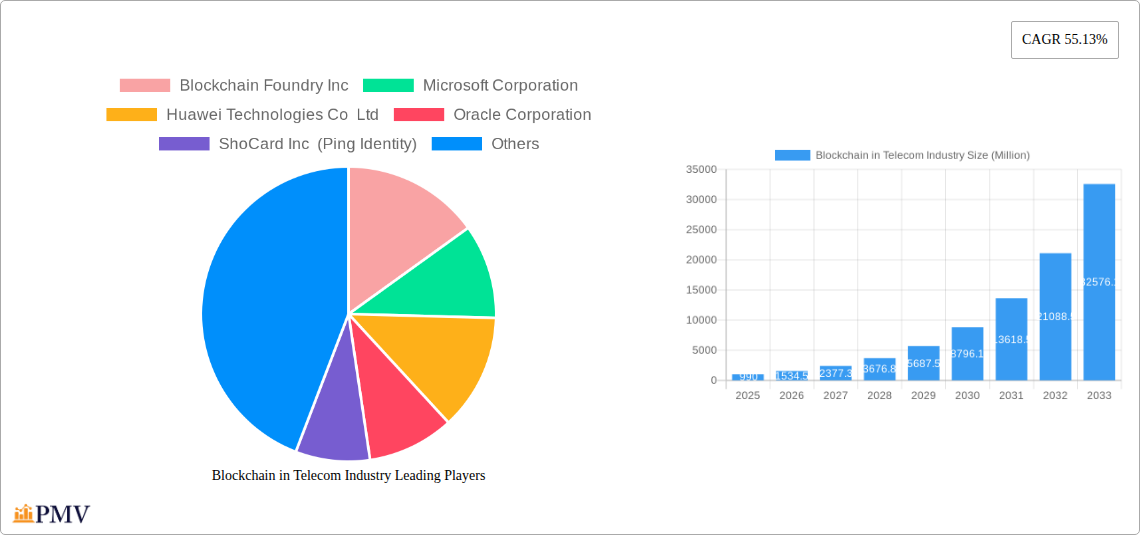

Blockchain in Telecom Industry Company Market Share

Blockchain in Telecom Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Blockchain in Telecom Industry market, covering the period 2019-2033, with a focus on the estimated year 2025. The report offers actionable insights into market structure, competitive dynamics, industry trends, and future growth potential, providing crucial information for businesses operating in or considering entry into this rapidly evolving sector. The market is projected to reach xx Million by 2033, with a CAGR of xx% during the forecast period (2025-2033).

Blockchain in Telecom Industry Market Structure & Competitive Dynamics

The Blockchain in Telecom Industry market exhibits a moderately consolidated structure, with key players like Microsoft Corporation, Huawei Technologies Co Ltd, Oracle Corporation, SAP SE, and Blockchain Foundry Inc holding significant market share. However, the emergence of innovative startups and the increasing adoption of blockchain technology across various telecom segments are fostering a dynamic competitive landscape.

Market concentration is measured by the Herfindahl-Hirschman Index (HHI) at xx, indicating a moderately competitive market. Recent M&A activities have involved smaller players being acquired by larger corporations to expand their blockchain capabilities and market reach. The total value of M&A deals within the sector during the historical period (2019-2024) was approximately xx Million. This trend is expected to continue during the forecast period. Regulatory frameworks, varying across different geographical regions, significantly influence market dynamics. The increasing demand for secure and transparent telecom services drives end-user trends, encouraging the adoption of blockchain solutions. Product substitutes, such as traditional centralized systems, present ongoing competitive pressure.

- Market Share: Microsoft Corporation: xx%, Huawei Technologies Co Ltd: xx%, Oracle Corporation: xx%, SAP SE: xx%, Blockchain Foundry Inc: xx%, Others: xx%

- M&A Deal Value (2019-2024): Approximately xx Million

Blockchain in Telecom Industry Industry Trends & Insights

The Blockchain in Telecom Industry market is experiencing robust growth driven by several key factors. The increasing need for enhanced security and trust in telecom networks, coupled with the rising demand for efficient and transparent billing systems, fuels market expansion. Technological disruptions, such as the development of more scalable and interoperable blockchain platforms, are further accelerating adoption. Consumer preferences for secure and privacy-preserving communication services also contribute to the market's growth trajectory. The market is witnessing increased adoption of blockchain for various applications, including Identity Management, Payment and Billing, Smart Contracts, and Connectivity Provisioning.

The global market is expected to show a significant growth trajectory, with a compound annual growth rate (CAGR) of xx% during the forecast period. Market penetration is currently at xx% and is projected to reach xx% by 2033. Competitive dynamics are characterized by both established players and emerging startups vying for market share, driving innovation and price competition. The rapid evolution of 5G and other advanced technologies creates synergistic opportunities for blockchain integration.

Dominant Markets & Segments in Blockchain in Telecom Industry

The Asia-Pacific region currently dominates the Blockchain in Telecom Industry market, driven by rapid technological advancements, supportive government initiatives, and a large and growing telecom subscriber base. Within this region, India stands out due to its significant population and growing digital economy.

Key Drivers in the Asia-Pacific Region:

- Robust government support for technological innovation and digital transformation initiatives.

- High smartphone penetration and increasing data consumption.

- Favorable regulatory environment in certain countries.

- Extensive investment in telecom infrastructure.

Segment Dominance Analysis:

- Identity Management: This segment holds a substantial share, driven by the demand for secure and verifiable digital identities in the telecom sector.

- Payment and Billing: Blockchain's ability to provide secure, transparent, and efficient billing processes is propelling the growth of this segment.

- Smart Contracts: Automated contract execution and reduced operational costs contribute to this segment's increasing adoption.

- Connectivity Provisioning: This segment benefits from enhanced security and improved network management provided by blockchain technology.

Blockchain in Telecom Industry Product Innovations

Recent product innovations focus on developing scalable, interoperable, and secure blockchain solutions tailored to the specific needs of the telecom industry. These include improved identity management systems, automated billing platforms, secure data sharing mechanisms, and efficient network management tools. Companies are emphasizing user-friendly interfaces and seamless integration with existing telecom infrastructure to boost market adoption. The integration of blockchain with other technologies, such as AI and IoT, is a significant trend shaping product development.

Report Segmentation & Scope

This report segments the Blockchain in Telecom Industry market by application:

Identity Management: This segment encompasses solutions for secure user authentication, identity verification, and data privacy management within telecom networks. The market size is projected to reach xx Million by 2033.

Payment and Billing: This segment covers blockchain-based solutions for streamlining billing processes, automating payments, and improving transaction security in the telecom sector. The market size is projected to reach xx Million by 2033.

Smart Contracts: This segment focuses on using smart contracts to automate agreements, enforce compliance, and improve efficiency in various telecom processes. The market size is projected to reach xx Million by 2033.

Connectivity Provisioning: This segment includes blockchain solutions for managing network resources, optimizing connectivity, and ensuring secure access for users. The market size is projected to reach xx Million by 2033.

Key Drivers of Blockchain in Telecom Industry Growth

Several factors propel the growth of the Blockchain in Telecom Industry market. Technological advancements, like improved scalability and interoperability of blockchain platforms, are key drivers. The increasing demand for secure and efficient telecom services pushes adoption. Government regulations promoting the use of blockchain in various sectors also contribute to market growth. For example, the Indian government's initiative to curb spam calls and messages using blockchain technology demonstrates the positive impact of regulatory support.

Challenges in the Blockchain in Telecom Industry Sector

Despite its potential, the Blockchain in Telecom Industry market faces challenges. Regulatory uncertainty in certain jurisdictions presents a significant hurdle. The complexity of implementing blockchain solutions across large, established telecom networks hinders widespread adoption. Competition from established telecom providers offering alternative security and efficiency solutions also creates pressure. Scalability limitations of some blockchain platforms restrict the handling of large transaction volumes encountered in the telecom sector. The lack of standardization and interoperability between different blockchain platforms can hinder seamless integration and collaboration.

Leading Players in the Blockchain in Telecom Industry Market

- Blockchain Foundry Inc

- Microsoft Corporation

- Huawei Technologies Co Ltd

- Oracle Corporation

- ShoCard Inc (Ping Identity)

- SAP SE

Key Developments in Blockchain in Telecom Industry Sector

- February 2022: Global Telecom launches MERCURY series tri-connectivity modules with added blockchain security. This development signifies the integration of blockchain for enhanced security in hardware and network connectivity.

- November 2022: The Telecom Regulatory Authority of India (TRAI) collaborates with telecom service providers (TSPs) to explore blockchain technology for curbing spam calls and messages. This initiative highlights the potential of blockchain for addressing significant challenges in the telecom sector. The formation of a Joint Committee of Regulators (JCOR) further underscores the regulatory focus on leveraging technology to improve the sector.

Strategic Blockchain in Telecom Industry Market Outlook

The Blockchain in Telecom Industry market holds immense future potential. Continued technological advancements, coupled with increasing regulatory support and rising consumer demand for secure and transparent services, will drive significant growth. Strategic opportunities exist for companies to develop innovative blockchain solutions addressing specific needs within the sector. Collaboration between telecom providers and blockchain technology companies is crucial for successful implementation and market penetration. The integration of blockchain with other emerging technologies like AI and IoT will unlock further opportunities for innovation and value creation.

Blockchain in Telecom Industry Segmentation

-

1. Application

- 1.1. Identity Management

- 1.2. Payment and Billing

- 1.3. Smart Contract

- 1.4. Connectivity Provisioning

Blockchain in Telecom Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Blockchain in Telecom Industry Regional Market Share

Geographic Coverage of Blockchain in Telecom Industry

Blockchain in Telecom Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 55.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Focus on Telecom Fraud Detection and Prevention is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Industry Standards

- 3.4. Market Trends

- 3.4.1. Smart Contract to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blockchain in Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Identity Management

- 5.1.2. Payment and Billing

- 5.1.3. Smart Contract

- 5.1.4. Connectivity Provisioning

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Blockchain in Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Identity Management

- 6.1.2. Payment and Billing

- 6.1.3. Smart Contract

- 6.1.4. Connectivity Provisioning

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Blockchain in Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Identity Management

- 7.1.2. Payment and Billing

- 7.1.3. Smart Contract

- 7.1.4. Connectivity Provisioning

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Blockchain in Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Identity Management

- 8.1.2. Payment and Billing

- 8.1.3. Smart Contract

- 8.1.4. Connectivity Provisioning

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Blockchain in Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Identity Management

- 9.1.2. Payment and Billing

- 9.1.3. Smart Contract

- 9.1.4. Connectivity Provisioning

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Blockchain Foundry Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Microsoft Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Huawei Technologies Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Oracle Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ShoCard Inc (Ping Identity)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 SAP SE

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Blockchain Foundry Inc

List of Figures

- Figure 1: Global Blockchain in Telecom Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Blockchain in Telecom Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Blockchain in Telecom Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Blockchain in Telecom Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Blockchain in Telecom Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Blockchain in Telecom Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Blockchain in Telecom Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Blockchain in Telecom Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Blockchain in Telecom Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Blockchain in Telecom Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific Blockchain in Telecom Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Blockchain in Telecom Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Blockchain in Telecom Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Blockchain in Telecom Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Rest of the World Blockchain in Telecom Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Rest of the World Blockchain in Telecom Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Blockchain in Telecom Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Blockchain in Telecom Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Blockchain in Telecom Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Blockchain in Telecom Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Blockchain in Telecom Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Blockchain in Telecom Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Blockchain in Telecom Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Blockchain in Telecom Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Blockchain in Telecom Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Blockchain in Telecom Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Blockchain in Telecom Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blockchain in Telecom Industry?

The projected CAGR is approximately 55.13%.

2. Which companies are prominent players in the Blockchain in Telecom Industry?

Key companies in the market include Blockchain Foundry Inc, Microsoft Corporation, Huawei Technologies Co Ltd, Oracle Corporation, ShoCard Inc (Ping Identity), SAP SE.

3. What are the main segments of the Blockchain in Telecom Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Focus on Telecom Fraud Detection and Prevention is Driving the Market Growth.

6. What are the notable trends driving market growth?

Smart Contract to Dominate the Market.

7. Are there any restraints impacting market growth?

Lack of Industry Standards.

8. Can you provide examples of recent developments in the market?

November 2022 - In collaboration with TSPs, Trai intended to bring new blockchain tech to curb spam calls and messages. It is working on various technologies to detect spam calls and messages using blockchain technology. Along with this, the regulator is taking action to form a joint committee of regulators (JCOR) consisting of the Telecom Regulatory Authority of India (Trai), Reserve Bank of India (RBI), Securities & Exchanges Board of India (SEBI), and the ministry of consumer affairs (MoCA).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blockchain in Telecom Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blockchain in Telecom Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blockchain in Telecom Industry?

To stay informed about further developments, trends, and reports in the Blockchain in Telecom Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence