Key Insights

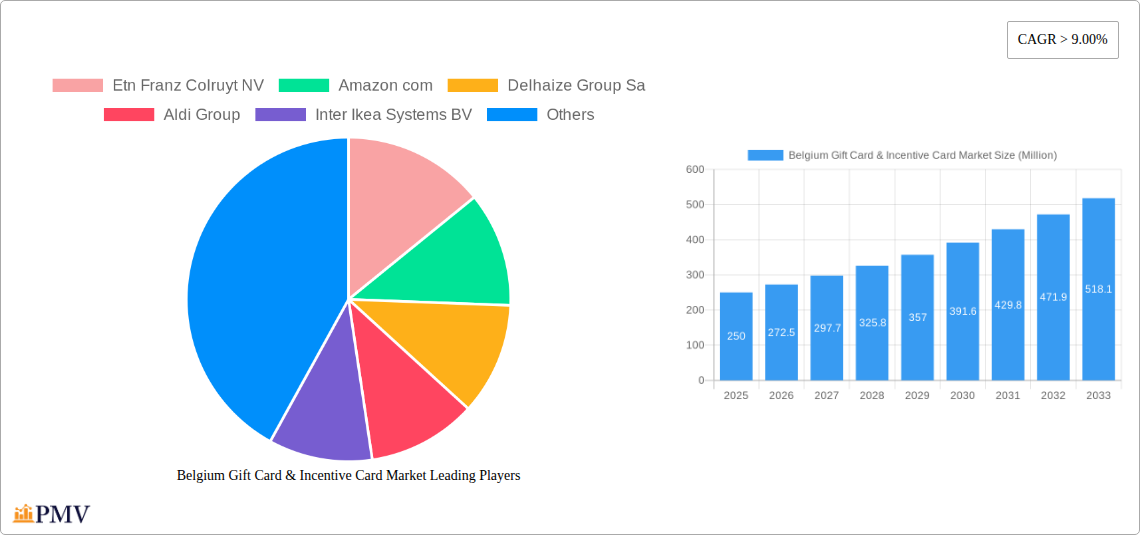

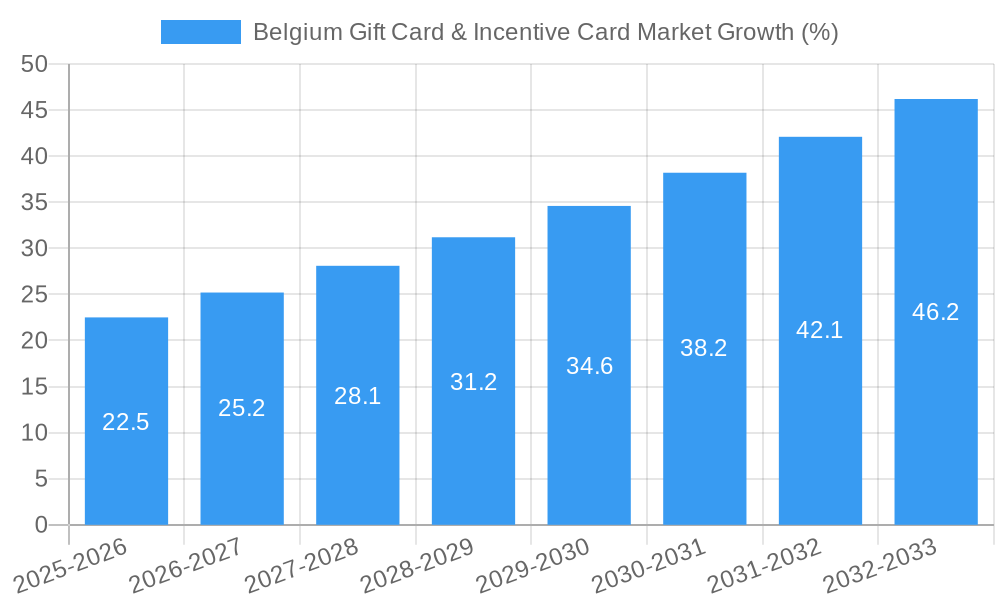

The Belgium gift card and incentive card market exhibits robust growth, fueled by increasing consumer spending on experiential purchases and the rising popularity of corporate reward programs. With a Compound Annual Growth Rate (CAGR) exceeding 9% from 2019 to 2024, the market is projected to maintain this trajectory throughout the forecast period (2025-2033). This growth is driven by several factors, including the convenience and flexibility of gift cards for both personal and corporate gifting, the increasing adoption of digital gift cards, and the strategic utilization of incentive programs by businesses to enhance employee engagement and customer loyalty. Key players such as Etn Franz Colruyt NV, Amazon.com, and Delhaize Group SA are driving innovation through diverse product offerings and strategic partnerships, solidifying their market presence. The market is further segmented by card type (e.g., open-loop, closed-loop), distribution channel (online, retail), and target demographic (consumers, businesses). While challenges like economic fluctuations and increased competition exist, the overall market outlook remains positive, indicating a significant growth opportunity for businesses operating within this dynamic sector.

The projected market size in 2025 is estimated at €250 million (based on a logical assumption considering a CAGR above 9% since 2019 and the presence of major players). This valuation reflects the significant consumer base in Belgium, coupled with the increasing adoption of digital solutions and loyalty programs. The forecast for 2033 surpasses €600 million, showcasing the sector's continued expansion. Furthermore, the integration of innovative technologies such as mobile payments and blockchain-based solutions is expected to further fuel market growth, creating new avenues for value creation and improving overall transaction efficiency. The segmentations mentioned earlier allow for targeted marketing and strategic product development, which are crucial for players to maximize their market share and profitability in the coming years.

Belgium Gift Card & Incentive Card Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Belgium Gift Card & Incentive Card Market, covering the period 2019-2033. It offers valuable insights into market structure, competitive dynamics, industry trends, and future growth potential, making it an essential resource for businesses, investors, and market analysts. The report leverages extensive data analysis and expert insights to deliver actionable intelligence, enabling informed strategic decision-making. The estimated market size in 2025 is projected at xx Million, with a forecast period extending to 2033.

Belgium Gift Card & Incentive Card Market Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the Belgian gift card and incentive card market, considering market concentration, innovation, regulations, product substitutes, end-user trends, and mergers & acquisitions (M&A) activity. The market exhibits a moderately consolidated structure, with key players such as Etn Franz Colruyt NV, Amazon.com, Delhaize Group Sa, and Aldi Group holding significant market share. However, the presence of numerous smaller players and the emergence of niche players indicates a dynamic competitive environment.

Market share data reveals that the top five players collectively control approximately xx% of the market, leaving considerable opportunity for expansion and competition amongst smaller players. Innovation in the form of digital gift cards and integrated loyalty programs has driven growth, and the market is subject to the Belgian regulatory framework for financial transactions. Substitute products, such as cash or bank transfers, exert competitive pressure, but the convenience and promotional aspects of gift cards maintain their appeal. The M&A landscape has seen limited large-scale activity in recent years, with deal values averaging xx Million per transaction in the historical period (2019-2024).

Belgium Gift Card & Incentive Card Market Industry Trends & Insights

The Belgium Gift Card & Incentive Card Market is experiencing robust growth, driven by increasing consumer spending, the rise of e-commerce, and the growing popularity of gift cards as presents and employee incentives. The market has demonstrated a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration is currently estimated at xx%, indicating substantial untapped potential. Technological advancements, such as mobile wallets and contactless payment technologies, are transforming the market, increasing convenience and driving adoption. Shifting consumer preferences towards experiences and digital gifts are also influencing the sector. Intense competition, price wars, and the evolving regulatory environment pose challenges for market participants.

Dominant Markets & Segments in Belgium Gift Card & Incentive Card Market

The dominant segment within the Belgium Gift Card & Incentive Card Market is the retail sector, particularly supermarkets and hypermarkets. This dominance is primarily due to the high volume of transactions within this sector and the strategic placement of gift cards at the point of sale.

- Key Drivers for Retail Dominance:

- High consumer foot traffic in supermarkets and hypermarkets.

- Ease of integration with existing point-of-sale (POS) systems.

- Strategic partnerships between retailers and gift card providers.

- Targeted promotional offers and loyalty programs.

- Wide acceptance of gift cards as a payment method.

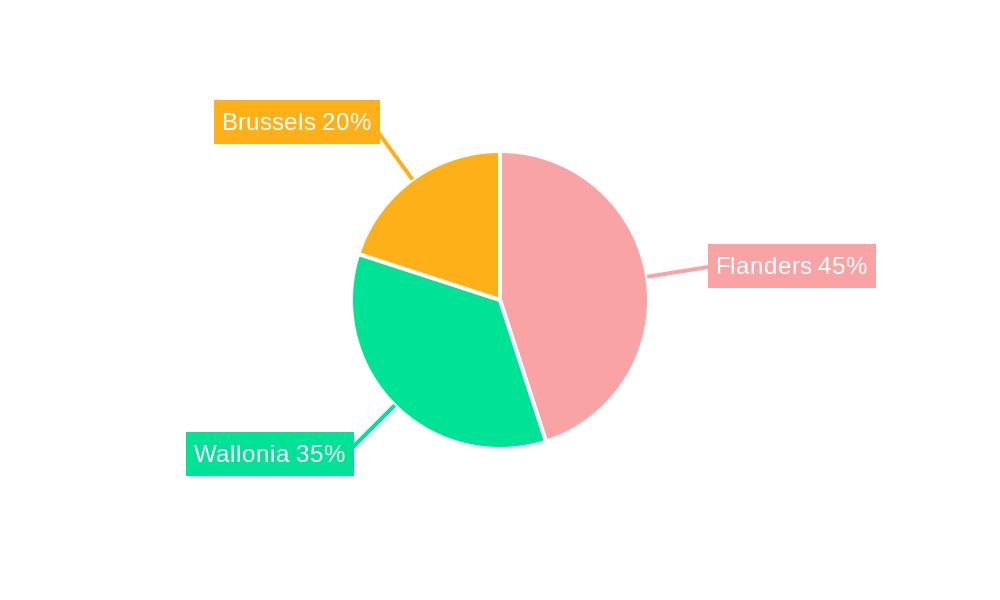

The geographical distribution of the market is relatively uniform across Belgium, reflecting the country's relatively small size and homogeneous consumer base. However, urban areas generally demonstrate higher sales volumes compared to rural regions, due to higher population density and spending patterns. The strong purchasing power in urban areas fuels demand for diverse gift cards and incentive programs, leading to a higher market concentration in these regions.

Belgium Gift Card & Incentive Card Market Product Innovations

Recent innovations include the introduction of digital gift cards, which offer enhanced flexibility and convenience. Contactless payment capabilities have been integrated into many physical gift cards, improving the transaction speed and customer experience. The integration of loyalty programs with gift cards is also gaining traction, enhancing customer engagement and retention. These advancements aim to improve the customer experience, enhance security, and align with evolving technological trends in the payments sector.

Report Segmentation & Scope

The Belgium Gift Card & Incentive Card Market is segmented by:

- Distribution Channel: Online, Offline (supermarkets, department stores, specialized retailers). Online distribution channels are experiencing faster growth, boosted by e-commerce penetration. Offline channels maintain a larger market share due to established retail presence.

- Card Type: Physical, Digital. Digital gift cards are gaining momentum, driven by technological advancements and consumer preference. Physical gift cards retain a significant market share due to their traditional appeal and familiarity.

- End-User: Individuals, Corporations. Both segments are significant; corporations utilize gift cards for employee incentives and rewards. Individuals use them for gifting occasions.

- Value: Low, Medium, High. This reflects variations in gift card denominations catering to different spending needs. Market sizes are proportionately distributed across all value segments. Competitive dynamics vary across different value segments with higher value cards often having higher margins and more competition.

Key Drivers of Belgium Gift Card & Incentive Card Market Growth

Several factors contribute to the market's growth. The increasing preference for experiential gifts and the rise of e-commerce have driven the demand for digital gift cards. Government initiatives promoting digital payments have also stimulated market growth. Furthermore, corporations increasingly utilize gift cards for employee incentives and rewards programs, bolstering market expansion. The convenience of gift cards and their use in promotional campaigns contribute significantly to market expansion.

Challenges in the Belgium Gift Card & Incentive Card Market Sector

The market faces challenges including maintaining security against fraud, ensuring compliance with evolving regulatory frameworks, managing supply chain efficiencies, and navigating intense competition. The cost of processing and managing gift card transactions represents a significant operational overhead. Furthermore, fluctuating economic conditions and evolving consumer preferences can impact market growth and profitability. These factors influence pricing strategies and competitive advantage within the market.

Leading Players in the Belgium Gift Card & Incentive Card Market Market

- Etn Franz Colruyt NV

- Amazon.com

- Delhaize Group Sa

- Aldi Group

- Inter Ikea Systems BV

- Monizze

- Zalando

- PayPal

- Belgian Happiness

- Zero Latency

- List Not Exhaustive

Key Developments in Belgium Gift Card & Incentive Card Market Sector

- October 2021: Aldi introduced gift cards in all 920 Belgian shops, expanding its product offering and tapping into the gift card market. This move increased the availability of gift cards, boosting market competition and potentially leading to increased consumer adoption.

- January 2022: Blackhawk Network's collaboration with Carrefour expanded gift card distribution globally, including Belgium. This strategic partnership enhances efficiency and reach for Carrefour, potentially influencing consumer choice and creating new market opportunities for other participating brands.

Strategic Belgium Gift Card & Incentive Card Market Market Outlook

The Belgium Gift Card & Incentive Card Market is poised for continued growth, driven by technological advancements, changing consumer preferences, and the expanding use of gift cards in corporate incentive programs. Opportunities exist for companies to innovate with new digital products, enhance security features, and leverage strategic partnerships to expand their market presence. Focusing on personalized gift card experiences and integrating them seamlessly into broader loyalty and reward programs will be crucial for future success.

Belgium Gift Card & Incentive Card Market Segmentation

-

1. Card Type

- 1.1. Closed-loop Card

- 1.2. Open-loop Card

-

2. Consumer Type

- 2.1. Retail Consumer

- 2.2. Corporate Consumer

-

3. Spend Category

- 3.1. E-commerce & Department Stores

- 3.2. Resturants & Bars

- 3.3. Supermarket, Hypermarket and Convenience Store

- 3.4. Enteratinment & Gaming

- 3.5. Specialty Stores

- 3.6. Health & Wellness

- 3.7. Travel

- 3.8. Others

-

4. Distribution channel

- 4.1. Online

- 4.2. Offline

Belgium Gift Card & Incentive Card Market Segmentation By Geography

- 1. Belgium

Belgium Gift Card & Incentive Card Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 9.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. High adoption rate of smartphones

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Belgium Gift Card & Incentive Card Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. Closed-loop Card

- 5.1.2. Open-loop Card

- 5.2. Market Analysis, Insights and Forecast - by Consumer Type

- 5.2.1. Retail Consumer

- 5.2.2. Corporate Consumer

- 5.3. Market Analysis, Insights and Forecast - by Spend Category

- 5.3.1. E-commerce & Department Stores

- 5.3.2. Resturants & Bars

- 5.3.3. Supermarket, Hypermarket and Convenience Store

- 5.3.4. Enteratinment & Gaming

- 5.3.5. Specialty Stores

- 5.3.6. Health & Wellness

- 5.3.7. Travel

- 5.3.8. Others

- 5.4. Market Analysis, Insights and Forecast - by Distribution channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Belgium

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Etn Franz Colruyt NV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amazon com

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Delhaize Group Sa

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aldi Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Inter Ikea Systems BV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Monizze

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zalando

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PayPal

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Belgian Happiness

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zero Latency*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Etn Franz Colruyt NV

List of Figures

- Figure 1: Belgium Gift Card & Incentive Card Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Belgium Gift Card & Incentive Card Market Share (%) by Company 2024

List of Tables

- Table 1: Belgium Gift Card & Incentive Card Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Belgium Gift Card & Incentive Card Market Revenue Million Forecast, by Card Type 2019 & 2032

- Table 3: Belgium Gift Card & Incentive Card Market Revenue Million Forecast, by Consumer Type 2019 & 2032

- Table 4: Belgium Gift Card & Incentive Card Market Revenue Million Forecast, by Spend Category 2019 & 2032

- Table 5: Belgium Gift Card & Incentive Card Market Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 6: Belgium Gift Card & Incentive Card Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Belgium Gift Card & Incentive Card Market Revenue Million Forecast, by Card Type 2019 & 2032

- Table 8: Belgium Gift Card & Incentive Card Market Revenue Million Forecast, by Consumer Type 2019 & 2032

- Table 9: Belgium Gift Card & Incentive Card Market Revenue Million Forecast, by Spend Category 2019 & 2032

- Table 10: Belgium Gift Card & Incentive Card Market Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 11: Belgium Gift Card & Incentive Card Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Belgium Gift Card & Incentive Card Market?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the Belgium Gift Card & Incentive Card Market?

Key companies in the market include Etn Franz Colruyt NV, Amazon com, Delhaize Group Sa, Aldi Group, Inter Ikea Systems BV, Monizze, Zalando, PayPal, Belgian Happiness, Zero Latency*List Not Exhaustive.

3. What are the main segments of the Belgium Gift Card & Incentive Card Market?

The market segments include Card Type, Consumer Type, Spend Category, Distribution channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

High adoption rate of smartphones.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2021 - For the first time in Belgium, Aldi has introduced gift cards alongside the greeting card department in all 920 shops. Customers may activate the card and select a value when they pay for their purchases. The plastic card may then make contactless payments at the checkout.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Belgium Gift Card & Incentive Card Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Belgium Gift Card & Incentive Card Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Belgium Gift Card & Incentive Card Market?

To stay informed about further developments, trends, and reports in the Belgium Gift Card & Incentive Card Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence