Key Insights

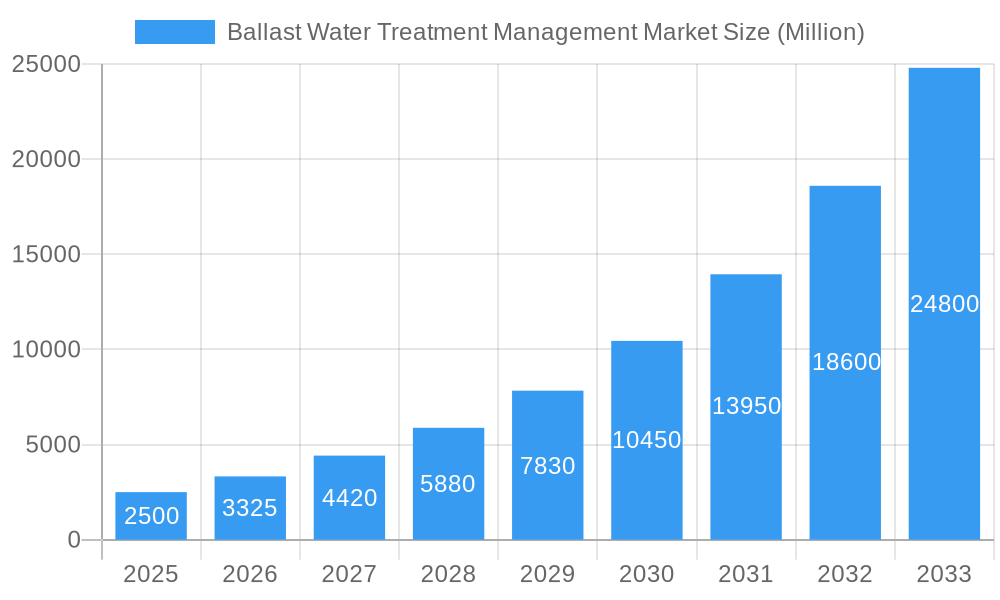

The Ballast Water Treatment Management market is experiencing robust growth, projected to exceed a market size of $XX million in 2025, with a Compound Annual Growth Rate (CAGR) of over 32% from 2025 to 2033. This expansion is driven by stringent international regulations aimed at preventing the spread of invasive aquatic species through ballast water discharge. The increasing awareness of environmental protection and the associated penalties for non-compliance further fuel market demand. The market is segmented by fleet type (oil tankers, bulk carriers, general cargo ships, container ships, and others) and treatment method (physical and chemical). Container ships currently dominate the market due to their high volume of ballast water exchange, but the other segments are expected to witness significant growth driven by stricter regulations impacting all vessel types. Technological advancements, such as the development of more efficient and cost-effective treatment systems, are also contributing to market growth. While the initial investment costs for ballast water management systems can be high, the long-term benefits of compliance and reduced environmental risks are incentivizing adoption across the shipping industry. The market is geographically diverse, with North America, Europe, and Asia Pacific representing major contributors, driven by robust shipping activity and environmental regulations within these regions.

Ballast Water Treatment Management Market Market Size (In Billion)

Geographical distribution reflects the concentration of shipping lanes and regulatory environments. North America and Europe currently hold significant market share due to stricter regulations and established infrastructure. However, the Asia-Pacific region is projected to experience substantial growth owing to increasing shipping activity and the adoption of stricter regulations in key countries like China and India. Market restraints include the high initial investment costs for ballast water management systems and the ongoing research and development required to improve system efficiency and reduce operational costs. Nevertheless, the compelling regulatory landscape and growing environmental consciousness suggest this market will continue its strong upward trajectory, with significant opportunities for both established players and emerging technologies within the forecast period.

Ballast Water Treatment Management Market Company Market Share

Ballast Water Treatment Management Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Ballast Water Treatment Management market, offering invaluable insights for industry stakeholders. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report meticulously examines market dynamics, competitive landscapes, technological advancements, and future growth projections, covering key segments and leading players. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Ballast Water Treatment Management Market Market Structure & Competitive Dynamics

The Ballast Water Treatment Management market exhibits a moderately concentrated structure, with several key players commanding significant market share. Market concentration is influenced by factors such as technological capabilities, regulatory compliance, and established distribution networks. The innovation ecosystem is dynamic, with ongoing research and development efforts focused on improving treatment efficiency, reducing operational costs, and enhancing regulatory compliance. Stringent international regulations, such as the IMO Ballast Water Management Convention, significantly impact market dynamics, driving adoption of compliant technologies. The market also faces competition from alternative methods for managing ballast water, although these are often less effective or more costly. End-user trends reveal a growing preference for automated, efficient, and cost-effective solutions. M&A activities are a significant factor, shaping market consolidation and driving technological innovation. For example:

- January 2023: Xylem's acquisition of Evoqua for USD 7.5 Billion signifies a major consolidation event, creating a dominant player with enhanced capabilities. This deal significantly impacted market share distribution.

- June 2021: ERMA FIRST's acquisition of RWO GmbH strengthened its position in the market by acquiring specialized technology and market expertise. This deal is estimated to have boosted ERMA FIRST's market share by approximately xx%.

Further analysis reveals that the top 5 players collectively hold approximately xx% of the global market share in 2025, with DESMI A/S, Xylem, and Wärtsilä among the leading players. The average M&A deal value in the past five years has been approximately xx Million, indicating a significant level of investment in the sector.

Ballast Water Treatment Management Market Industry Trends & Insights

The Ballast Water Treatment Management market is experiencing robust growth fueled by several key factors. The stringent implementation of the IMO Ballast Water Management Convention is a primary driver, mandating the adoption of treatment systems across the global fleet. Technological advancements, such as the development of more efficient and cost-effective treatment technologies, are further accelerating market growth. Increasing environmental awareness and the need to minimize the spread of invasive species are also contributing factors. Consumer preferences are shifting towards systems with lower operational costs, reduced maintenance requirements, and improved reliability. Competitive dynamics are characterized by innovation, strategic partnerships, and mergers and acquisitions, leading to a continuously evolving landscape. The market penetration of ballast water treatment systems is steadily increasing, driven by the expanding global shipping fleet and stricter regulatory enforcement. This market is projected to exhibit a CAGR of xx% from 2025 to 2033.

Dominant Markets & Segments in Ballast Water Treatment Management Market

The Ballast Water Treatment Management market is geographically diverse, with significant regional variations in adoption rates and market size. However, Asia-Pacific is currently the dominant region due to its substantial shipping fleet and robust economic growth. Within fleet types, the Container Ships segment shows the strongest growth due to the high volume of cargo transported and stringent environmental regulations.

Key Drivers for Asia-Pacific Dominance:

- Rapid expansion of the shipping industry.

- Stringent environmental regulations enforced by regional governing bodies.

- Significant investment in port infrastructure and technological upgrades.

- Growing awareness of environmental concerns.

Dominant Fleet Type: Container Ships demonstrate the highest demand for ballast water treatment due to their large size and frequent transoceanic voyages. The Chemical method type holds a significant market share due to its proven effectiveness and relatively wide application across different vessel sizes.

Ballast Water Treatment Management Market Product Innovations

Recent innovations focus on enhancing treatment efficacy, lowering operational costs, and simplifying maintenance. Electrochlorination and UV-based systems are gaining popularity due to their effectiveness against a broad spectrum of organisms. Miniaturization and modular designs are improving adaptability and lowering installation costs, particularly beneficial for smaller vessels. These advancements cater to the increasing demand for more efficient and cost-effective solutions, aligning with the market's preference for optimized technology.

Report Segmentation & Scope

This report segments the Ballast Water Treatment Management market based on fleet type and method type.

Fleet Type: Oil Tankers, Bulk Carriers, General Cargo, Container Ships, Other Fleet Types. Each segment shows unique growth trajectories driven by factors like vessel size, operational patterns, and regulatory pressures. Container ships are predicted to show the fastest growth due to stringent regulations and large fleet size.

Method Type: Physical and Chemical. Chemical methods (e.g., electrochlorination) currently dominate due to established efficacy. However, physical methods (e.g., UV) are gaining traction due to innovations focused on improving efficiency and reducing operational costs. Both segments are expected to experience significant growth during the forecast period. Competitive dynamics vary across segments, with some seeing heightened competition and others exhibiting more consolidated structures.

Key Drivers of Ballast Water Treatment Management Market Growth

The market's growth is primarily driven by the mandatory implementation of the IMO Ballast Water Management Convention. Stringent environmental regulations, coupled with increasing awareness of the ecological impact of invasive species, are strong catalysts. Technological advancements, resulting in more efficient and cost-effective treatment systems, are also pivotal. Further growth is propelled by the expansion of global trade and the continued growth of the shipping industry.

Challenges in the Ballast Water Treatment Management Market Sector

Despite robust growth, the Ballast Water Treatment Management market faces challenges. High initial investment costs for installation and maintenance can deter adoption, particularly for smaller vessels. The complexity of regulatory compliance across different jurisdictions adds to operational burdens. Furthermore, competition among established and emerging players can create price pressures, impacting profitability. Supply chain disruptions can also hinder the timely delivery of systems and components. These factors may collectively slow down market expansion by approximately xx% in specific regions.

Leading Players in the Ballast Water Treatment Management Market Market

- DESMI A/S

- Xylem

- Wärtsilä

- PANASIA COLTD

- Optimarin

- Scienco/FAST (BioMicrobics)

- ALFA LAVAL

- Wuxi Brightsky Electronic Co Ltd

- Ecochlor

- Industrie De Nora S p A

- GEA Group Aktiengesellschaft

- BIO-UV Group

- MITSUBISHI HEAVY INDUSTRIES LTD

- Headway Technology Group (Qingdao) Co Ltd

- JFE Engineering Corporation

- ATLANTIUM TECHNOLOGIES LTD

- ERMA FIRST ESK Engineering S A

Key Developments in Ballast Water Treatment Management Market Sector

- January 2023: Xylem's acquisition of Evoqua significantly alters the competitive landscape, creating a larger, more integrated player with broader technological capabilities. This deal is projected to increase Xylem's market share by approximately xx%.

- June 2021: ERMA FIRST's acquisition of RWO GmbH expands its product portfolio and market reach, enhancing its competitiveness. This acquisition improved ERMA FIRST's market share by approximately xx%.

Strategic Ballast Water Treatment Management Market Market Outlook

The Ballast Water Treatment Management market is poised for continued growth, driven by stricter environmental regulations and technological advancements. Strategic opportunities exist for companies to focus on developing more efficient, cost-effective, and user-friendly systems. Partnerships and collaborations can facilitate faster innovation and broader market penetration. Expansion into emerging markets and exploration of new technologies will be critical for future success. The market is expected to witness a further consolidation as larger players continue to acquire smaller companies, leading to increased market concentration in the coming years.

Ballast Water Treatment Management Market Segmentation

-

1. Fleet Type

- 1.1. Oil Tankers

- 1.2. Bulk Carriers

- 1.3. General Cargo

- 1.4. Container Ships

- 1.5. Other Fleet Types

-

2. Method Type

- 2.1. Physical

- 2.2. Chemical

Ballast Water Treatment Management Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Ballast Water Treatment Management Market Regional Market Share

Geographic Coverage of Ballast Water Treatment Management Market

Ballast Water Treatment Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 32.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Physical Disinfection Technology for Treatment of Ballast Water; Growing Focus on Preserving and Protecting the Marine Ecosystem

- 3.3. Market Restrains

- 3.3.1. Massive Expense on Installation and Maintenance; Other Restraints

- 3.4. Market Trends

- 3.4.1. Bulk Carriers by Fleet Type to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ballast Water Treatment Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fleet Type

- 5.1.1. Oil Tankers

- 5.1.2. Bulk Carriers

- 5.1.3. General Cargo

- 5.1.4. Container Ships

- 5.1.5. Other Fleet Types

- 5.2. Market Analysis, Insights and Forecast - by Method Type

- 5.2.1. Physical

- 5.2.2. Chemical

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Fleet Type

- 6. North America Ballast Water Treatment Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fleet Type

- 6.1.1. Oil Tankers

- 6.1.2. Bulk Carriers

- 6.1.3. General Cargo

- 6.1.4. Container Ships

- 6.1.5. Other Fleet Types

- 6.2. Market Analysis, Insights and Forecast - by Method Type

- 6.2.1. Physical

- 6.2.2. Chemical

- 6.1. Market Analysis, Insights and Forecast - by Fleet Type

- 7. Europe Ballast Water Treatment Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fleet Type

- 7.1.1. Oil Tankers

- 7.1.2. Bulk Carriers

- 7.1.3. General Cargo

- 7.1.4. Container Ships

- 7.1.5. Other Fleet Types

- 7.2. Market Analysis, Insights and Forecast - by Method Type

- 7.2.1. Physical

- 7.2.2. Chemical

- 7.1. Market Analysis, Insights and Forecast - by Fleet Type

- 8. Asia Pacific Ballast Water Treatment Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fleet Type

- 8.1.1. Oil Tankers

- 8.1.2. Bulk Carriers

- 8.1.3. General Cargo

- 8.1.4. Container Ships

- 8.1.5. Other Fleet Types

- 8.2. Market Analysis, Insights and Forecast - by Method Type

- 8.2.1. Physical

- 8.2.2. Chemical

- 8.1. Market Analysis, Insights and Forecast - by Fleet Type

- 9. Rest of the World Ballast Water Treatment Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fleet Type

- 9.1.1. Oil Tankers

- 9.1.2. Bulk Carriers

- 9.1.3. General Cargo

- 9.1.4. Container Ships

- 9.1.5. Other Fleet Types

- 9.2. Market Analysis, Insights and Forecast - by Method Type

- 9.2.1. Physical

- 9.2.2. Chemical

- 9.1. Market Analysis, Insights and Forecast - by Fleet Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 DESMI A/S

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Xylem (Evoqua Water Technologies LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Wärtsilä

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PANASIA COLTD

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Optimarin

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Scienco/FAST (BioMicrobics)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ALFA LAVAL

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Wuxi Brightsky Electronic Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ecochlor

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Industrie De Nora S p A

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 GEA Group Aktiengesellschaft

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 BIO-UV Group

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 MITSUBISHI HEAVY INDUSTRIES LTD

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Headway Technology Group (Qingdao) Co Ltd

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 JFE Engineering Corporation

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 ATLANTIUM TECHNOLOGIES LTD

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 ERMA FIRST ESK Engineering S A

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.1 DESMI A/S

List of Figures

- Figure 1: Global Ballast Water Treatment Management Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Ballast Water Treatment Management Market Revenue (Million), by Fleet Type 2025 & 2033

- Figure 3: North America Ballast Water Treatment Management Market Revenue Share (%), by Fleet Type 2025 & 2033

- Figure 4: North America Ballast Water Treatment Management Market Revenue (Million), by Method Type 2025 & 2033

- Figure 5: North America Ballast Water Treatment Management Market Revenue Share (%), by Method Type 2025 & 2033

- Figure 6: North America Ballast Water Treatment Management Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Ballast Water Treatment Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Ballast Water Treatment Management Market Revenue (Million), by Fleet Type 2025 & 2033

- Figure 9: Europe Ballast Water Treatment Management Market Revenue Share (%), by Fleet Type 2025 & 2033

- Figure 10: Europe Ballast Water Treatment Management Market Revenue (Million), by Method Type 2025 & 2033

- Figure 11: Europe Ballast Water Treatment Management Market Revenue Share (%), by Method Type 2025 & 2033

- Figure 12: Europe Ballast Water Treatment Management Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Ballast Water Treatment Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Ballast Water Treatment Management Market Revenue (Million), by Fleet Type 2025 & 2033

- Figure 15: Asia Pacific Ballast Water Treatment Management Market Revenue Share (%), by Fleet Type 2025 & 2033

- Figure 16: Asia Pacific Ballast Water Treatment Management Market Revenue (Million), by Method Type 2025 & 2033

- Figure 17: Asia Pacific Ballast Water Treatment Management Market Revenue Share (%), by Method Type 2025 & 2033

- Figure 18: Asia Pacific Ballast Water Treatment Management Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Ballast Water Treatment Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Ballast Water Treatment Management Market Revenue (Million), by Fleet Type 2025 & 2033

- Figure 21: Rest of the World Ballast Water Treatment Management Market Revenue Share (%), by Fleet Type 2025 & 2033

- Figure 22: Rest of the World Ballast Water Treatment Management Market Revenue (Million), by Method Type 2025 & 2033

- Figure 23: Rest of the World Ballast Water Treatment Management Market Revenue Share (%), by Method Type 2025 & 2033

- Figure 24: Rest of the World Ballast Water Treatment Management Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Ballast Water Treatment Management Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ballast Water Treatment Management Market Revenue Million Forecast, by Fleet Type 2020 & 2033

- Table 2: Global Ballast Water Treatment Management Market Revenue Million Forecast, by Method Type 2020 & 2033

- Table 3: Global Ballast Water Treatment Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Ballast Water Treatment Management Market Revenue Million Forecast, by Fleet Type 2020 & 2033

- Table 5: Global Ballast Water Treatment Management Market Revenue Million Forecast, by Method Type 2020 & 2033

- Table 6: Global Ballast Water Treatment Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Ballast Water Treatment Management Market Revenue Million Forecast, by Fleet Type 2020 & 2033

- Table 8: Global Ballast Water Treatment Management Market Revenue Million Forecast, by Method Type 2020 & 2033

- Table 9: Global Ballast Water Treatment Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Ballast Water Treatment Management Market Revenue Million Forecast, by Fleet Type 2020 & 2033

- Table 11: Global Ballast Water Treatment Management Market Revenue Million Forecast, by Method Type 2020 & 2033

- Table 12: Global Ballast Water Treatment Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Ballast Water Treatment Management Market Revenue Million Forecast, by Fleet Type 2020 & 2033

- Table 14: Global Ballast Water Treatment Management Market Revenue Million Forecast, by Method Type 2020 & 2033

- Table 15: Global Ballast Water Treatment Management Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ballast Water Treatment Management Market?

The projected CAGR is approximately > 32.00%.

2. Which companies are prominent players in the Ballast Water Treatment Management Market?

Key companies in the market include DESMI A/S, Xylem (Evoqua Water Technologies LLC, Wärtsilä, PANASIA COLTD, Optimarin, Scienco/FAST (BioMicrobics), ALFA LAVAL, Wuxi Brightsky Electronic Co Ltd, Ecochlor, Industrie De Nora S p A, GEA Group Aktiengesellschaft, BIO-UV Group, MITSUBISHI HEAVY INDUSTRIES LTD, Headway Technology Group (Qingdao) Co Ltd, JFE Engineering Corporation, ATLANTIUM TECHNOLOGIES LTD, ERMA FIRST ESK Engineering S A.

3. What are the main segments of the Ballast Water Treatment Management Market?

The market segments include Fleet Type , Method Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Physical Disinfection Technology for Treatment of Ballast Water; Growing Focus on Preserving and Protecting the Marine Ecosystem.

6. What are the notable trends driving market growth?

Bulk Carriers by Fleet Type to Drive the Market.

7. Are there any restraints impacting market growth?

Massive Expense on Installation and Maintenance; Other Restraints.

8. Can you provide examples of recent developments in the market?

January 2023: Xylem and Evoqua announced that the two companies have entered into a definitive agreement under which Xylem will acquire Evoqua in an all-stock transaction that reflects an implied enterprise value of approximately USD 7.5 billion. The acquisition aims to create a transformative platform to address the world's most critical water challenges.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ballast Water Treatment Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ballast Water Treatment Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ballast Water Treatment Management Market?

To stay informed about further developments, trends, and reports in the Ballast Water Treatment Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence