Key Insights

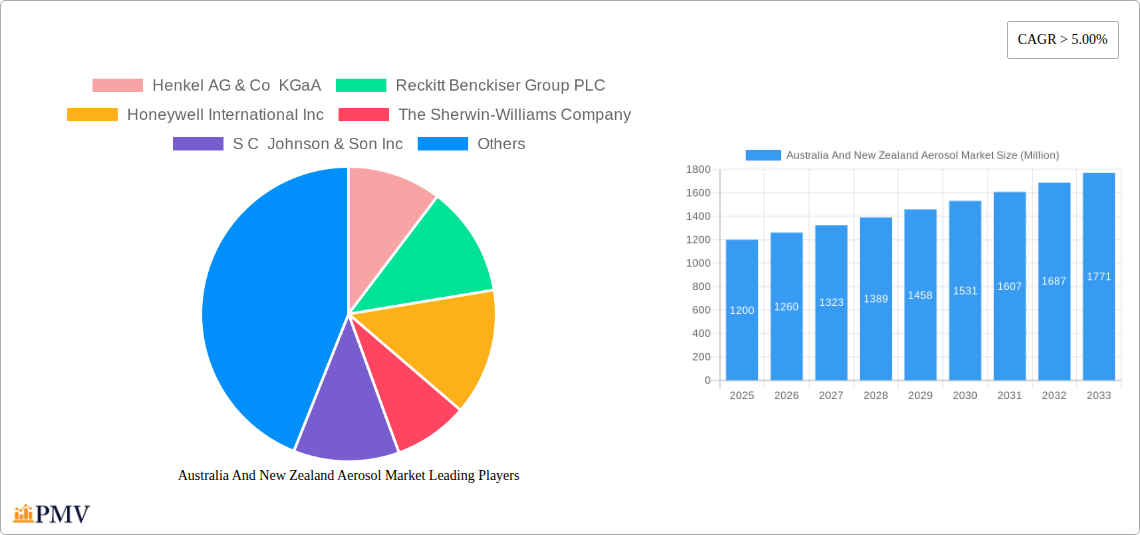

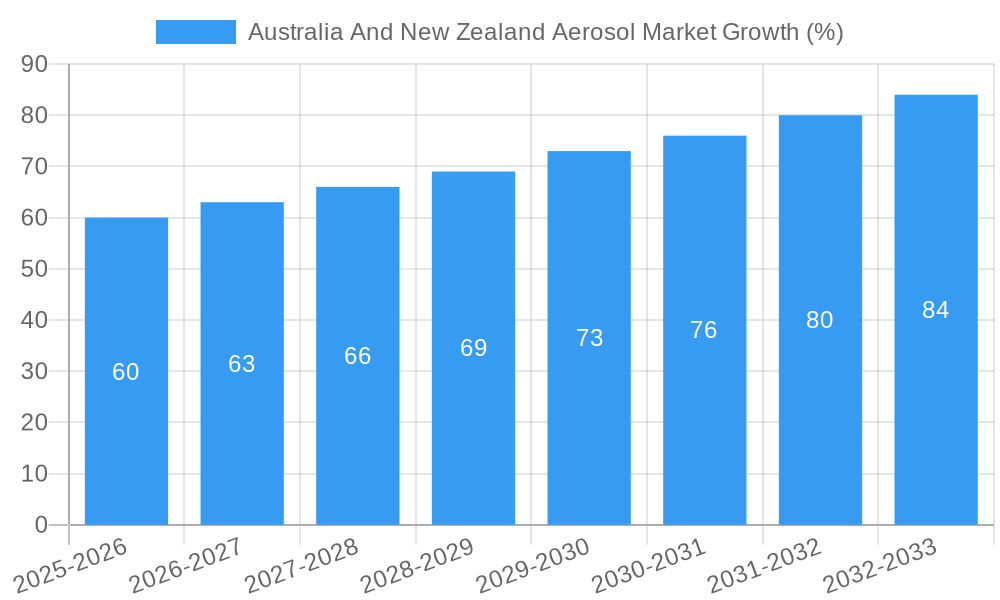

The Australia and New Zealand aerosol market, valued at $1.20 billion in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is driven by several key factors. Increasing demand across diverse applications, particularly in personal care, automotive, and household products, fuels market expansion. The convenience and efficiency of aerosol packaging contribute significantly to its popularity among consumers and manufacturers alike. Furthermore, ongoing innovations in aerosol technology, focusing on sustainable and eco-friendly formulations, are mitigating environmental concerns and attracting environmentally conscious consumers. Growth in the food products and insecticide sectors is further propelling market expansion. The market is segmented by material (steel, aluminum, and other materials) and application, reflecting the versatility of aerosol packaging across numerous industries. While regulatory pressures related to propellant composition and environmental impact pose a restraint, the overall market outlook remains positive, driven by consistent consumer demand and ongoing technological advancements. Major players like Henkel, Reckitt Benckiser, Honeywell, and Sherwin-Williams, along with regional manufacturers, are actively shaping the market dynamics through product innovation and strategic expansion. The anticipated growth trajectory indicates significant opportunities for investment and expansion within the Australian and New Zealand aerosol market.

The competitive landscape includes both multinational giants and regional players, reflecting the market's diverse needs and product offerings. The presence of established brands ensures quality and consistency, while smaller companies focus on niche segments or specialized applications. This dynamic balance fuels innovation and caters to a wide range of customer preferences. Significant growth is expected in sustainable and eco-friendly aerosol solutions in response to increasing environmental awareness. The market's segmentation by material and application highlights the versatility and adaptability of aerosol technology to meet the diverse demands of various industries. Looking ahead, the Australian and New Zealand aerosol market is poised for continued expansion, driven by consumer demand, technological progress, and the strategic actions of key players. However, sustained growth will depend on careful navigation of regulatory challenges and adaptation to evolving consumer preferences.

Australia and New Zealand Aerosol Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australia and New Zealand aerosol market, offering invaluable insights for businesses operating within or seeking to enter this dynamic sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report leverages data from the historical period (2019-2024) to project future market trends and opportunities, offering actionable intelligence to drive informed decision-making. The total market size in 2025 is estimated at xx Million.

Australia And New Zealand Aerosol Market Market Structure & Competitive Dynamics

The Australian and New Zealand aerosol market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. Key players such as Henkel AG & Co KGaA, Reckitt Benckiser Group PLC, Honeywell International Inc, The Sherwin-Williams Company, S C Johnson & Son Inc, BASF, Akzo Nobel NV, and PPG Industries Inc dominate the landscape. Smaller, specialized players like Colep Consumer Products, Damar, Liquid Engineering NZ, Chemz Limited, Unilever, MMP Industrial, and Aerosolve also contribute significantly, particularly in niche segments.

Market share is dynamic, influenced by product innovation, branding, and distribution strategies. Recent M&A activity has been relatively limited, with deal values in the xx Million range over the past five years. The regulatory framework, while generally supportive of sustainable practices, is also evolving to address environmental concerns associated with aerosol propellants. Consumer trends increasingly favor eco-friendly and sustainably-sourced products, putting pressure on manufacturers to adopt innovative solutions. Substitute products, such as pump sprays and other dispensing methods, also pose a competitive challenge. Innovation in packaging materials and propellant technology plays a crucial role in shaping the competitive dynamics. The overall competitive intensity is high, driven by both established players and emerging niche brands focusing on sustainable and premium formulations.

Australia And New Zealand Aerosol Market Industry Trends & Insights

The Australia and New Zealand aerosol market is experiencing steady growth, driven by rising consumer demand across various application segments. The market's Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected to be xx%, fueled primarily by the increasing popularity of personal care products, household goods, and paint and coatings. The market penetration of aerosol products is high in certain segments, particularly personal care and household, reflecting established consumer habits. Technological advancements, such as the development of sustainable propellants and recyclable packaging, are playing a critical role in shaping the market's trajectory. Changing consumer preferences, particularly towards environmentally friendly products, are prompting manufacturers to reformulate their offerings. This trend, alongside increasing awareness of the environmental impact of traditional aerosol propellants, is creating opportunities for eco-conscious brands. Competitive pressures are leading to increased investment in Research and Development (R&D) to develop innovative and sustainable aerosol products, influencing the market's dynamics significantly.

Dominant Markets & Segments in Australia And New Zealand Aerosol Market

The personal care segment represents the largest share of the Australia and New Zealand aerosol market, driven by increasing demand for deodorants, hairsprays, and other personal care products. The household products segment, including insecticides and air fresheners, also constitutes a substantial portion of the market. Within materials, steel remains the dominant packaging material due to its cost-effectiveness and strength, followed by aluminium.

- Key Drivers for Personal Care Dominance: Rising disposable incomes, evolving lifestyle choices, and greater emphasis on personal grooming.

- Key Drivers for Household Products: Growing awareness of hygiene, pest control needs, and convenience offered by aerosol formulations.

- Key Drivers for Steel Dominance: Cost-effectiveness and durability, making it suitable for various aerosol applications.

- Key Drivers for Aluminum Dominance: Lightweight yet strong, suitable for portability and consumer preference for recyclable packaging.

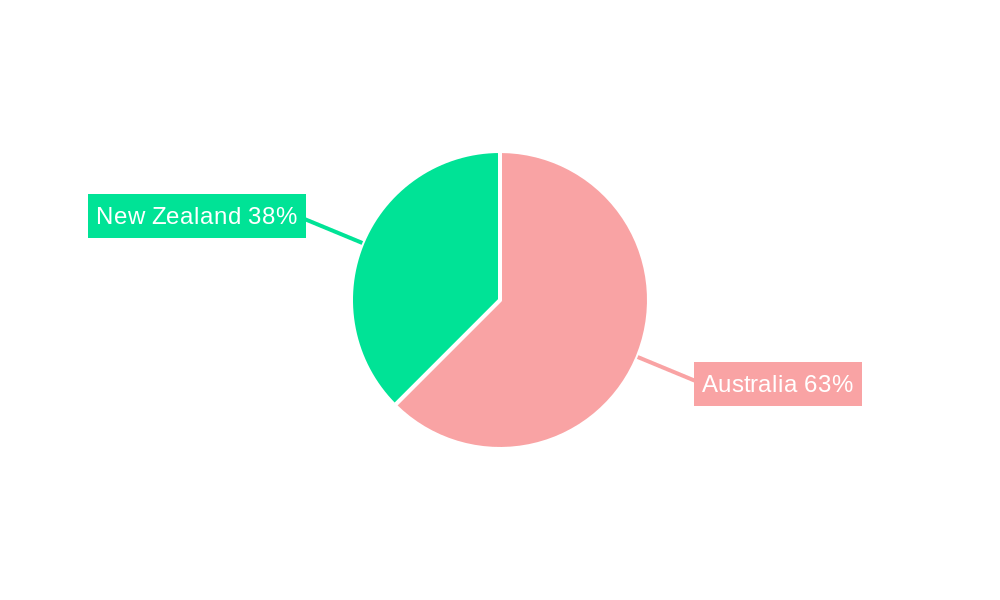

Geographically, major metropolitan areas in both Australia and New Zealand exhibit higher market penetration due to higher population density and increased consumer spending. Government regulations regarding the use of certain propellants continue to play a role, while infrastructure developments, particularly in logistics and distribution networks, support efficient product movement within these markets.

Australia And New Zealand Aerosol Market Product Innovations

Recent innovations in the Australia and New Zealand aerosol market focus on sustainable materials and environmentally friendly propellants. Several manufacturers are introducing aerosol products with recyclable cans and ozone-friendly propellants to meet increasing consumer demand for eco-conscious alternatives. This trend is creating a competitive advantage for brands that prioritize sustainability and aligns with evolving regulatory requirements in both countries. The market is also witnessing a surge in personalized and customized aerosol products that cater to the growing niche markets. The introduction of innovative dispensing mechanisms is also enhancing convenience and user experience, furthering market growth.

Report Segmentation & Scope

This report segments the Australia and New Zealand aerosol market by material (Steel, Aluminum, Other Materials) and application (Automotive, Personal Care, Food Products, Herbicide, Household Products, Insecticide, Industrial and Technical, Medical, Paint and Coatings, Other Applications). Each segment is analyzed based on market size, growth projections, and competitive dynamics. The report considers historical data and provides comprehensive forecasts, factoring in the influence of various market-shaping forces. The report provides an in-depth analysis of each of the identified segments, projecting their growth trajectory and assessing the current competitive dynamics.

Key Drivers of Australia And New Zealand Aerosol Market Growth

Several factors drive the growth of the Australia and New Zealand aerosol market: increased consumer disposable income, rising demand for convenient products, advancements in packaging technology (including sustainable alternatives), and expansion of the personal care and household products sectors. Government regulations promoting sustainable practices also play a supportive role. The introduction of innovative formulations and dispensing mechanisms further contributes to market growth.

Challenges in the Australia And New Zealand Aerosol Market Sector

The market faces challenges including rising raw material costs, stringent environmental regulations that affect propellant choices, and growing competition from substitute dispensing methods. Supply chain disruptions and fluctuations in the price of packaging materials can significantly impact manufacturers' profitability. These issues require proactive strategies for cost optimization, sustainable sourcing, and diversification of supply chains.

Leading Players in the Australia And New Zealand Aerosol Market Market

- Henkel AG & Co KGaA

- Reckitt Benckiser Group PLC

- Honeywell International Inc

- The Sherwin-Williams Company

- S C Johnson & Son Inc

- BASF

- Akzo Nobel NV

- PPG Industries Inc

- Colep Consumer Products

- Damar

- Liquid Engineering NZ

- Chemz Limited

- Unilever

- MMP Industrial

- Aerosolve

Key Developments in Australia And New Zealand Aerosol Market Sector

September 2022: Unilever launched its new certified natural aerosol deodorant brand, Schmidt's, in its first campaign in Australia and New Zealand. This launch underscores the growing demand for sustainable and eco-friendly products.

July 2022: Jamestrong Packaging announced a USD 6 Million investment to expand its aerosol can production facility. This indicates significant growth potential and anticipation of increasing demand.

Strategic Australia And New Zealand Aerosol Market Market Outlook

The Australia and New Zealand aerosol market presents significant opportunities for growth, particularly within the segments focused on sustainability and eco-friendly solutions. Companies that invest in R&D to develop innovative and sustainable products are well-positioned to capture significant market share. Focus on efficient supply chains and strategic partnerships will also be key to success in this competitive and ever-evolving market. The market’s growth will continue to be driven by the increasing demand for convenient and effective aerosol products across various applications and a rise in adoption of environmentally conscious options.

Australia And New Zealand Aerosol Market Segmentation

-

1. Material

- 1.1. Steel

- 1.2. Aluminium

- 1.3. Other Materials

-

2. Application

- 2.1. Automotive

- 2.2. Personal Care

- 2.3. Food Products

- 2.4. Herbicide

- 2.5. Household Products

- 2.6. Insecticide

- 2.7. Industrial and Technical

- 2.8. Medical

- 2.9. Paint and Coatings

- 2.10. Other Applications

-

3. Geography

- 3.1. Australia

- 3.2. New Zealand

Australia And New Zealand Aerosol Market Segmentation By Geography

- 1. Australia

- 2. New Zealand

Australia And New Zealand Aerosol Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Aerosol Cans from the Paint and Coatings Industry; Increasing Awareness of Hygiene and Personal Care

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations Related to Use of Aerosol

- 3.4. Market Trends

- 3.4.1. Increasing Awareness Regarding Hygiene and Personal Care

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia And New Zealand Aerosol Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Steel

- 5.1.2. Aluminium

- 5.1.3. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive

- 5.2.2. Personal Care

- 5.2.3. Food Products

- 5.2.4. Herbicide

- 5.2.5. Household Products

- 5.2.6. Insecticide

- 5.2.7. Industrial and Technical

- 5.2.8. Medical

- 5.2.9. Paint and Coatings

- 5.2.10. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Australia

- 5.3.2. New Zealand

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.4.2. New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Australia Australia And New Zealand Aerosol Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Steel

- 6.1.2. Aluminium

- 6.1.3. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive

- 6.2.2. Personal Care

- 6.2.3. Food Products

- 6.2.4. Herbicide

- 6.2.5. Household Products

- 6.2.6. Insecticide

- 6.2.7. Industrial and Technical

- 6.2.8. Medical

- 6.2.9. Paint and Coatings

- 6.2.10. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Australia

- 6.3.2. New Zealand

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. New Zealand Australia And New Zealand Aerosol Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Steel

- 7.1.2. Aluminium

- 7.1.3. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive

- 7.2.2. Personal Care

- 7.2.3. Food Products

- 7.2.4. Herbicide

- 7.2.5. Household Products

- 7.2.6. Insecticide

- 7.2.7. Industrial and Technical

- 7.2.8. Medical

- 7.2.9. Paint and Coatings

- 7.2.10. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Australia

- 7.3.2. New Zealand

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2024

- 8.2. Company Profiles

- 8.2.1 Henkel AG & Co KGaA

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Reckitt Benckiser Group PLC

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Honeywell International Inc

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 The Sherwin-Williams Company

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 S C Johnson & Son Inc

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 BASF

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Akzo Nobel NV

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 PPG Industries Inc

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Colep Consumer Products

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Damar

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 Liquid Engineering NZ

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 Chemz Limited

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.13 Unilever*List Not Exhaustive

- 8.2.13.1. Overview

- 8.2.13.2. Products

- 8.2.13.3. SWOT Analysis

- 8.2.13.4. Recent Developments

- 8.2.13.5. Financials (Based on Availability)

- 8.2.14 MMP Industrial

- 8.2.14.1. Overview

- 8.2.14.2. Products

- 8.2.14.3. SWOT Analysis

- 8.2.14.4. Recent Developments

- 8.2.14.5. Financials (Based on Availability)

- 8.2.15 Aerosolve

- 8.2.15.1. Overview

- 8.2.15.2. Products

- 8.2.15.3. SWOT Analysis

- 8.2.15.4. Recent Developments

- 8.2.15.5. Financials (Based on Availability)

- 8.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Australia And New Zealand Aerosol Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia And New Zealand Aerosol Market Share (%) by Company 2024

List of Tables

- Table 1: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Material 2019 & 2032

- Table 3: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Material 2019 & 2032

- Table 8: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Application 2019 & 2032

- Table 9: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Material 2019 & 2032

- Table 12: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia And New Zealand Aerosol Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Australia And New Zealand Aerosol Market?

Key companies in the market include Henkel AG & Co KGaA, Reckitt Benckiser Group PLC, Honeywell International Inc, The Sherwin-Williams Company, S C Johnson & Son Inc, BASF, Akzo Nobel NV, PPG Industries Inc, Colep Consumer Products, Damar, Liquid Engineering NZ, Chemz Limited, Unilever*List Not Exhaustive, MMP Industrial, Aerosolve.

3. What are the main segments of the Australia And New Zealand Aerosol Market?

The market segments include Material, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Aerosol Cans from the Paint and Coatings Industry; Increasing Awareness of Hygiene and Personal Care.

6. What are the notable trends driving market growth?

Increasing Awareness Regarding Hygiene and Personal Care.

7. Are there any restraints impacting market growth?

Stringent Regulations Related to Use of Aerosol.

8. Can you provide examples of recent developments in the market?

September 2022: Unilever launched its new certified natural aerosol deodorant brand, Schmidt's, in its first campaign in Australia and New Zealand. The brand's ozone-friendly aerosol products were announced just weeks after Unilever ANZ earned its B Corp status, making it one of the largest companies to win the Purpose Driven Business award.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia And New Zealand Aerosol Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia And New Zealand Aerosol Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia And New Zealand Aerosol Market?

To stay informed about further developments, trends, and reports in the Australia And New Zealand Aerosol Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence