Key Insights

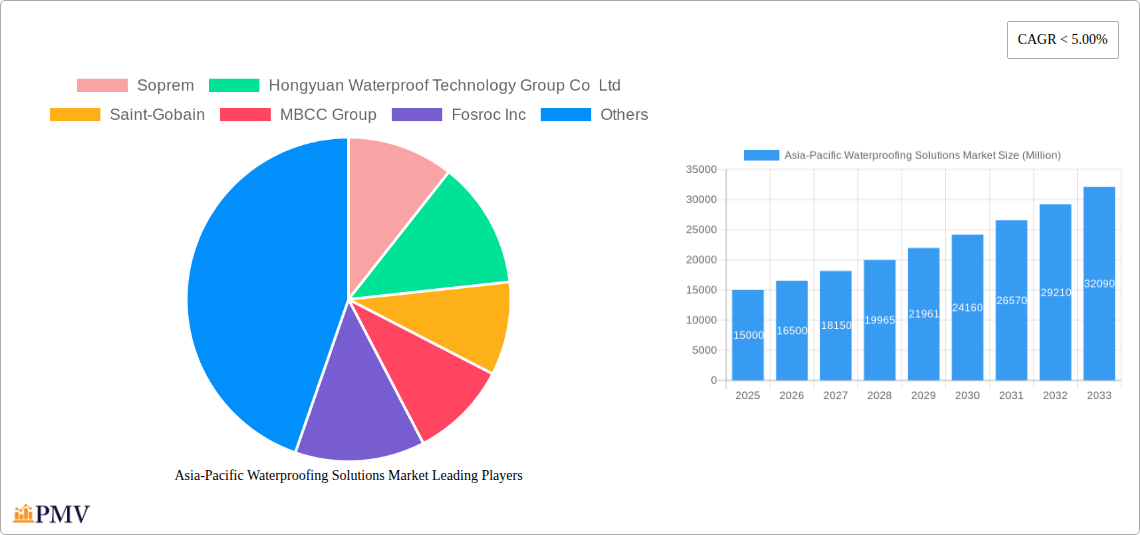

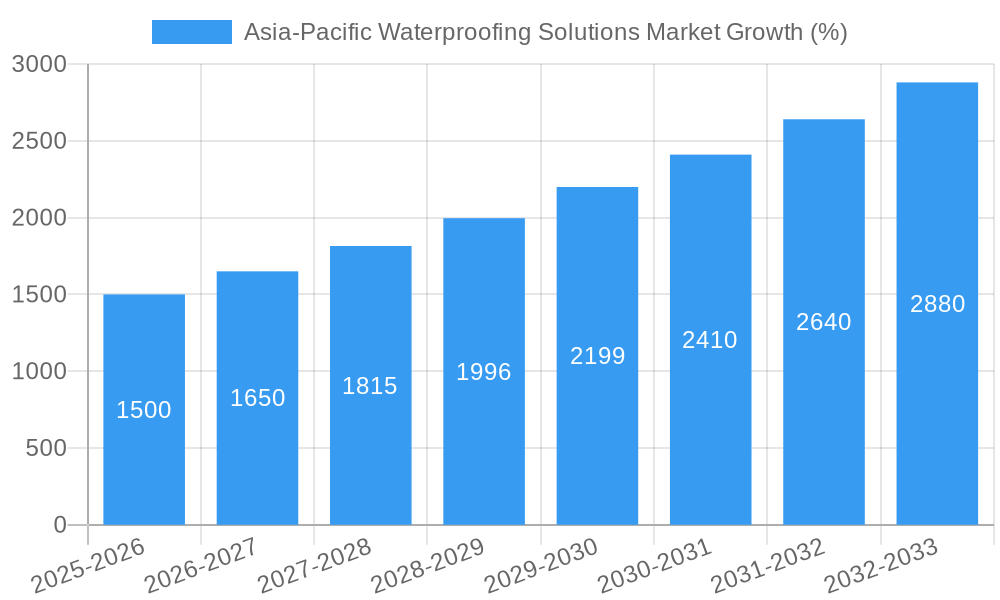

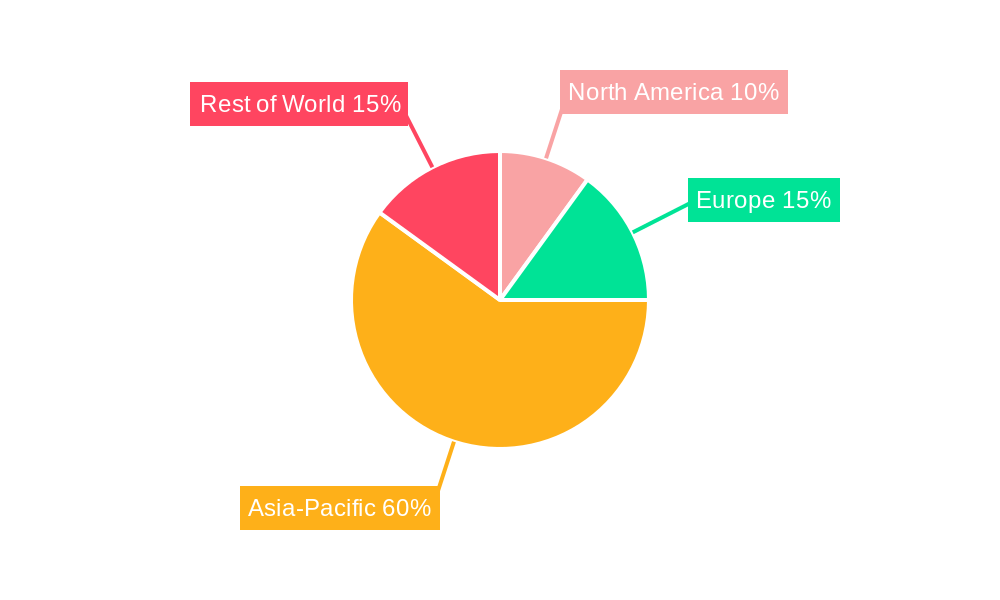

The Asia-Pacific waterproofing solutions market is experiencing robust growth, driven by escalating urbanization, infrastructure development, and rising awareness regarding building durability and longevity. The region's burgeoning construction sector, particularly in rapidly developing economies like India, China, and Indonesia, is a primary catalyst. Increased government spending on infrastructure projects, including residential, commercial, and industrial buildings, further fuels market expansion. Furthermore, the growing prevalence of extreme weather events, including heavy rainfall and flooding, is significantly impacting demand for effective waterproofing solutions to mitigate water damage and protect assets. The market encompasses a wide range of products, including membranes, coatings, sealants, and admixtures, each catering to specific application needs and construction materials. Technological advancements, such as the introduction of environmentally friendly and high-performance waterproofing materials, are contributing to market innovation and expansion. While the precise market size for 2025 isn't provided, based on a reasonable estimation considering global market trends and the APAC region's growth trajectory, we can assume a market size exceeding $15 billion USD for 2025. This estimate considers the significant contribution of major economies within the region and the robust growth observed in preceding years. The market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) throughout the forecast period (2025-2033), fueled by sustained construction activity and evolving consumer preferences towards durable and sustainable building materials.

The competitive landscape is characterized by both established multinational corporations and local players. Key players are focusing on strategic partnerships, acquisitions, and technological advancements to gain market share and expand their product portfolio. The increasing demand for sustainable and eco-friendly waterproofing solutions presents a significant opportunity for companies to innovate and develop products with reduced environmental impact. Market segmentation by product type, application, and end-user further highlights the diverse and evolving nature of this dynamic market. The rising adoption of green building practices and stricter building codes are also driving the demand for advanced and eco-conscious waterproofing solutions. This focus on sustainability is shaping both consumer choices and industry innovation, leading to the development of more effective and environmentally responsible products. Future growth will be underpinned by sustained economic growth across the Asia-Pacific region, favorable government policies supporting infrastructure development, and a growing understanding of the crucial role waterproofing plays in long-term building maintenance and preservation.

Asia-Pacific Waterproofing Solutions Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific waterproofing solutions market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Spanning the period from 2019 to 2033, with a focus on 2025, this report delves into market structure, competitive dynamics, industry trends, and future growth prospects. The report utilizes a robust methodology, incorporating both primary and secondary research, to present a reliable and actionable analysis of this dynamic market. The total market size in 2025 is estimated at xx Million, projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Asia-Pacific Waterproofing Solutions Market Market Structure & Competitive Dynamics

The Asia-Pacific waterproofing solutions market is characterized by a moderately concentrated landscape, with several multinational corporations and regional players competing for market share. Market concentration is influenced by factors such as technological advancements, regulatory compliance, and the increasing demand for sustainable and high-performance waterproofing solutions. The market exhibits a dynamic innovation ecosystem, with companies investing heavily in research and development to bring innovative and high-performance products to the market. Regulatory frameworks, varying across different countries in the region, play a significant role in shaping market dynamics, influencing product standards and environmental regulations. The market also faces competition from product substitutes, particularly in the low-end segments, impacting pricing strategies and product differentiation. End-user trends, including increasing awareness of sustainable construction practices and a growing preference for energy-efficient buildings, drive demand for eco-friendly waterproofing solutions. Mergers and acquisitions (M&A) activities are frequent, reflecting the strategic importance of this market. Recent notable M&A activities include the acquisition of MBCC Group by Sika in May 2023, which significantly altered the competitive landscape. The deal value is estimated at xx Million. Furthermore, the market share of the top five players accounts for approximately xx%.

- Key Metrics:

- Market concentration: Moderately concentrated

- Top 5 players market share: xx%

- Recent M&A deal value (Sika acquisition of MBCC Group): xx Million

Asia-Pacific Waterproofing Solutions Market Industry Trends & Insights

The Asia-Pacific waterproofing solutions market is experiencing robust growth driven by several key factors. The rapid urbanization and infrastructure development across the region, particularly in developing economies, fuel significant demand for waterproofing solutions in various sectors like residential, commercial, and infrastructure projects. The increasing awareness of building longevity and the adoption of stringent building codes further enhance the need for high-quality waterproofing materials. Technological advancements, such as the development of innovative waterproofing membranes and coatings with enhanced durability and performance, contribute to market expansion. Furthermore, changing consumer preferences towards sustainable and environmentally friendly construction materials are creating new opportunities for manufacturers. The market exhibits strong competitive dynamics, with companies constantly striving to enhance their product offerings, expand their geographic reach, and engage in strategic partnerships to gain a competitive edge. The market is witnessing significant technological disruptions with the emergence of novel materials, such as self-healing membranes and bio-based waterproofing solutions, which enhance sustainability and product lifecycle. The projected CAGR during the forecast period (2025-2033) is xx%, indicating a significant potential for growth. Market penetration remains high in developed economies but is rapidly increasing in emerging economies.

Dominant Markets & Segments in Asia-Pacific Waterproofing Solutions Market

The Asia-Pacific waterproofing solutions market is dominated by several key regions and segments. China is a leading market due to its extensive construction activity and rapid urbanization. India is another significant market, experiencing substantial growth driven by infrastructural projects and rising disposable incomes.

Dominant End-Use Sectors:

- Infrastructure: This segment is driven by large-scale infrastructure projects, including roads, bridges, tunnels, and dams, necessitating robust waterproofing solutions for long-term protection. Government investments in infrastructure development, including ambitious projects like high-speed railways and smart cities, are primary growth drivers.

- Commercial: This segment benefits from a growing commercial real estate sector, with significant developments in office buildings, shopping malls, and hotels. The demand for high-performance and aesthetic waterproofing solutions is high in this sector.

- Residential: The increasing urbanization and rising disposable incomes in several Asia-Pacific countries fuel the growth of the residential segment. This segment is further driven by government initiatives to improve housing standards and affordability.

Dominant Sub-Products:

- Chemicals: Chemical-based waterproofing solutions offer a wide range of functionalities, from water-repellent coatings to penetration sealants. This segment benefits from its adaptability and cost-effectiveness in various applications.

- Loose Laid Sheet: This segment is growing with the increasing preference for prefabricated waterproofing systems, characterized by ease of installation and faster project completion times.

Asia-Pacific Waterproofing Solutions Market Product Innovations

Recent product innovations in the Asia-Pacific waterproofing solutions market showcase a trend towards sustainable, high-performance, and user-friendly solutions. Companies are focusing on developing eco-friendly materials, such as bio-based polymers and recycled materials, reducing their environmental impact. Furthermore, advancements in nanotechnology are leading to the development of self-healing membranes with improved durability and longevity. These innovations aim to address the challenges of climate change and improve the lifecycle of structures. The focus on ease of installation and application is also evident, with the introduction of prefabricated systems and sprayable coatings reducing labor costs and project timelines. These innovations demonstrate a strong market fit, catering to the increasing demand for sustainable and efficient waterproofing solutions.

Report Segmentation & Scope

This report segments the Asia-Pacific waterproofing solutions market based on end-use sector (Commercial, Industrial and Institutional, Infrastructure, Residential) and sub-product (Chemicals, Loose Laid Sheet).

- End-Use Sector: Each sector demonstrates unique growth trajectories, influenced by distinct infrastructural developments, regulatory landscapes, and construction patterns within the Asia-Pacific region. Growth projections vary depending on the specific sector and regional dynamics, with the infrastructure segment expected to show robust growth due to ongoing infrastructure investments.

- Sub-Product: The Chemicals segment exhibits greater flexibility and adaptability across applications, leading to broader market reach and growth. Loose Laid Sheet offers prefabricated systems, leading to time and cost efficiencies, but may have limitations in terms of application flexibility.

Key Drivers of Asia-Pacific Waterproofing Solutions Market Growth

The growth of the Asia-Pacific waterproofing solutions market is primarily driven by several key factors. Rapid urbanization and infrastructure development across the region create a substantial demand for reliable waterproofing solutions. The increasing focus on sustainable construction practices and the need for energy-efficient buildings further propel market growth. Government initiatives and supportive policies aimed at improving housing standards and infrastructure development also play a significant role. Furthermore, technological advancements, leading to the development of innovative and high-performance waterproofing solutions, enhance market expansion.

Challenges in the Asia-Pacific Waterproofing Solutions Market Sector

The Asia-Pacific waterproofing solutions market faces certain challenges that could impact its growth trajectory. Varying regulatory frameworks across different countries in the region pose complexities for manufacturers navigating compliance requirements. Supply chain disruptions and fluctuations in raw material prices can impact production costs and profitability. Intense competition from both domestic and international players necessitates continuous innovation and product differentiation to maintain market share. Furthermore, fluctuating economic conditions can affect construction activity, thus influencing demand for waterproofing solutions. These challenges necessitate adaptive strategies and resilient business models for companies operating in this market.

Leading Players in the Asia-Pacific Waterproofing Solutions Market Market

- Soprem

- Hongyuan Waterproof Technology Group Co Ltd

- Saint-Gobain

- MBCC Group

- Fosroc Inc

- Ardex Group

- Sika AG

- Keshun Waterproof Technology Co ltd

- Lonseal Corporation

- Oriental Yuhong

Key Developments in Asia-Pacific Waterproofing Solutions Market Sector

- May 2023: Oriental Yuhong signed a strategic cooperation agreement with Hebei Aorun Shunda Group, expanding its research capabilities in waterproofing membranes and thermal insulation coatings. This move strengthens Oriental Yuhong's position in the market and enhances its technological expertise.

- May 2023: Sika acquired MBCC Group, significantly impacting the market dynamics through consolidation and expansion of product portfolios and market reach. This acquisition significantly increased Sika's market share and global presence.

- March 2023: Oriental Yuhong initiated a strategic cooperation agreement with Luoyang Longfeng Construction Investment Co., Ltd., aiming to enhance its building product portfolio, including waterproofing solutions, through resource sharing. This collaboration broadens Oriental Yuhong's market reach and product offerings.

Strategic Asia-Pacific Waterproofing Solutions Market Market Outlook

The Asia-Pacific waterproofing solutions market holds significant future potential, driven by continuous infrastructure development, urbanization, and the increasing adoption of sustainable construction practices. Strategic opportunities lie in developing innovative, eco-friendly, and high-performance products to cater to the evolving needs of the construction industry. Focusing on research and development, strategic partnerships, and expansion into emerging markets will be crucial for companies to capitalize on this growth potential. The market’s future hinges on addressing sustainability concerns, improving supply chain resilience, and adapting to dynamic regulatory landscapes.

Asia-Pacific Waterproofing Solutions Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Sub Product

-

2.1. Chemicals

-

2.1.1. By Technology

- 2.1.1.1. Epoxy-based

- 2.1.1.2. Polyurethane-based

- 2.1.1.3. Water-based

- 2.1.1.4. Other Technologies

-

2.1.1. By Technology

-

2.2. Membranes

- 2.2.1. Cold Liquid Applied

- 2.2.2. Fully Adhered Sheet

- 2.2.3. Hot Liquid Applied

- 2.2.4. Loose Laid Sheet

-

2.1. Chemicals

Asia-Pacific Waterproofing Solutions Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Waterproofing Solutions Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Banning/ Limiting Use of Plastics used in packaging applications

- 3.3. Market Restrains

- 3.3.1. ; Harmful Amines in Dyes; Paperless Green Initiatives

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Sub Product

- 5.2.1. Chemicals

- 5.2.1.1. By Technology

- 5.2.1.1.1. Epoxy-based

- 5.2.1.1.2. Polyurethane-based

- 5.2.1.1.3. Water-based

- 5.2.1.1.4. Other Technologies

- 5.2.1.1. By Technology

- 5.2.2. Membranes

- 5.2.2.1. Cold Liquid Applied

- 5.2.2.2. Fully Adhered Sheet

- 5.2.2.3. Hot Liquid Applied

- 5.2.2.4. Loose Laid Sheet

- 5.2.1. Chemicals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. China Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 10. Southeast Asia Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Soprem

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hongyuan Waterproof Technology Group Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Saint-Gobain

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 MBCC Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Fosroc Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Ardex Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Sika AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Keshun Waterproof Technology Co ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Lonseal Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Oriental Yuhong

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Soprem

List of Figures

- Figure 1: Asia-Pacific Waterproofing Solutions Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Waterproofing Solutions Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 4: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by End Use Sector 2019 & 2032

- Table 5: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Sub Product 2019 & 2032

- Table 6: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Sub Product 2019 & 2032

- Table 7: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: China Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Japan Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: India Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: South Korea Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Southeast Asia Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Southeast Asia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Australia Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 26: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by End Use Sector 2019 & 2032

- Table 27: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Sub Product 2019 & 2032

- Table 28: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Sub Product 2019 & 2032

- Table 29: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 31: China Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: China Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Japan Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Japan Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: South Korea Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Korea Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: India Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Australia Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Australia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: New Zealand Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: New Zealand Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Indonesia Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Indonesia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 45: Malaysia Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Malaysia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: Singapore Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Singapore Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 49: Thailand Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Thailand Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 51: Vietnam Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Vietnam Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 53: Philippines Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Philippines Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Waterproofing Solutions Market?

The projected CAGR is approximately < 5.00%.

2. Which companies are prominent players in the Asia-Pacific Waterproofing Solutions Market?

Key companies in the market include Soprem, Hongyuan Waterproof Technology Group Co Ltd, Saint-Gobain, MBCC Group, Fosroc Inc, Ardex Group, Sika AG, Keshun Waterproof Technology Co ltd, Lonseal Corporation, Oriental Yuhong.

3. What are the main segments of the Asia-Pacific Waterproofing Solutions Market?

The market segments include End Use Sector, Sub Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Banning/ Limiting Use of Plastics used in packaging applications.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Harmful Amines in Dyes; Paperless Green Initiatives.

8. Can you provide examples of recent developments in the market?

May 2023: Oriental Yuhong signed a strategic cooperation agreement with Hebei Aorun Shunda Group to collaborate on multi-dimensional research in the fields of waterproofing membranes and thermal insulation coatings, among other solutions.May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.March 2023: To further develop its portfolio of building products, including waterproofing solutions, Oriental Yuhong initiated a strategic cooperation agreement with Luoyang Longfeng Construction Investment Co., Ltd. This agreement is expected to result in the exchange of resources in the field of construction materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Waterproofing Solutions Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Waterproofing Solutions Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Waterproofing Solutions Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Waterproofing Solutions Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence