Key Insights

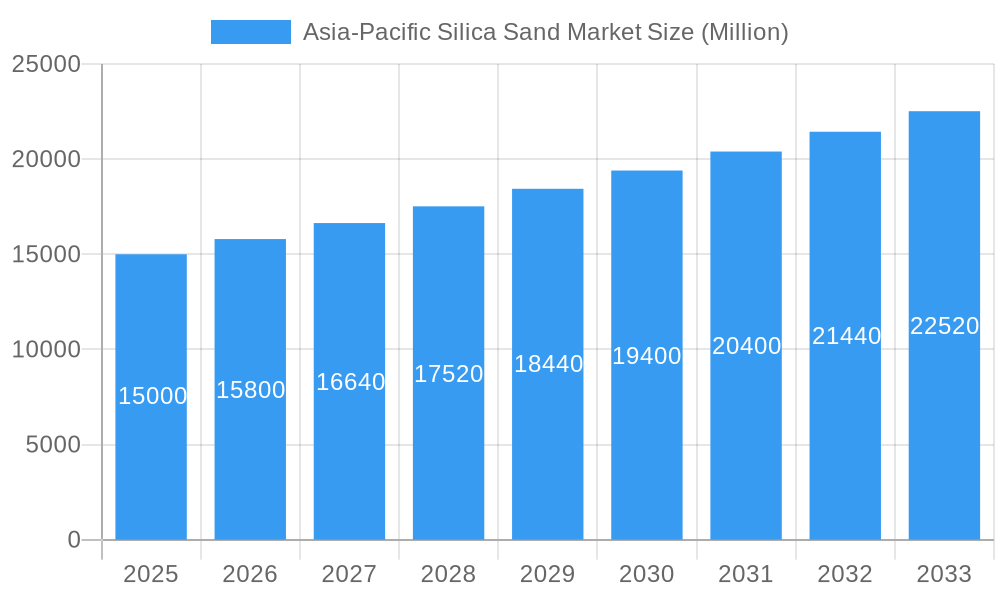

The Asia-Pacific silica sand market, valued at approximately $8.21 billion in its base year of 2025, is projected for significant expansion. Forecasted to grow at a compound annual growth rate (CAGR) of 6.8% from 2025 to 2033, this growth is propelled by robust regional development. Key drivers include the booming construction sector, especially in emerging economies like India and China, which fuels substantial demand for silica sand in cement, concrete, and glass production. The expanding glass manufacturing industry, spurred by urbanization and modern infrastructure needs, also significantly contributes to market advancement. Furthermore, the increasing utilization of silica sand in industrial applications such as foundry molding, water filtration, and oil & gas extraction reinforces this positive growth trend. However, environmental concerns associated with silica sand mining necessitate a strong focus on sustainable practices and regulatory compliance, encouraging responsible sourcing and the exploration of alternative materials. The market is segmented by application (construction, glass manufacturing, foundry), type (natural, processed), and geography. Leading market participants include Chongqing Changjiang River Moulding Material (Group) Co Ltd, Fairmount Santrol, and Mitsubishi Corporation, among others, who are actively pursuing market share through innovation and strategic alliances.

Asia-Pacific Silica Sand Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained market growth, primarily fueled by ongoing infrastructure development and industrial expansion throughout the Asia-Pacific region. Market growth dynamics may, however, be influenced by economic cycles and fluctuations in raw material costs. Competitive pressures are expected to remain intense, with companies prioritizing R&D for enhanced product quality, cost reduction, and the development of sustainable mining methodologies. Government regulations focused on promoting sustainable mining and mitigating environmental impacts will be pivotal in shaping the market's future. Ultimately, the industry's success will depend on the ability of companies to harmonize economic objectives with environmental stewardship, ensuring the long-term viability of the Asia-Pacific silica sand sector.

Asia-Pacific Silica Sand Market Company Market Share

Asia-Pacific Silica Sand Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific silica sand market, offering invaluable insights for businesses, investors, and stakeholders seeking to understand and navigate this dynamic sector. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report leverages rigorous data analysis and expert insights to deliver a holistic view of the market landscape. The report highlights key market trends, growth drivers, challenges, and opportunities, making it an essential resource for informed decision-making.

Asia-Pacific Silica Sand Market Structure & Competitive Dynamics

This section delves into the competitive dynamics of the Asia-Pacific silica sand market, examining market concentration, innovation ecosystems, regulatory frameworks, and the impact of substitutes, end-user trends, and M&A activities. The market is moderately fragmented, with several major players and numerous smaller regional operators. Key metrics like market share and M&A deal values are analyzed to illustrate the competitive landscape. The report highlights the increasing importance of innovation in product development and processing techniques, particularly focusing on the use of advanced technologies for improved purity and efficiency. Regulatory frameworks concerning environmental protection and resource management significantly influence market operations. The rising demand for high-purity silica sand in specific applications, coupled with the presence of substitute materials, adds complexity to the competitive landscape. Furthermore, the report analyzes recent M&A activities and their impacts on market consolidation and competitiveness, detailing significant deals and their respective values (e.g., a xx Million deal in 2022 between Company A and Company B reshaped the market share dynamics). Specific examples of market share distribution among key players are provided, such as Company X holding approximately xx% market share.

Asia-Pacific Silica Sand Market Industry Trends & Insights

The Asia-Pacific silica sand market is experiencing robust growth, fueled by a confluence of escalating demand from pivotal end-use sectors including glass manufacturing, the burgeoning construction industry, and critical water filtration applications. This dynamic market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period spanning 2025-2033. Key market drivers include rapid urbanization and infrastructure development across emerging economies, coupled with a sustained demand for specialized glass products in automotive, electronics, and solar energy sectors. Technological advancements are significantly reshaping the landscape, with innovations in extraction techniques, enhanced beneficiation processes, and sophisticated grading technologies contributing to improved purity, consistency, and reduced production costs. Evolving consumer preferences are increasingly leaning towards high-purity silica sand with precisely controlled particle size distribution and low impurity levels, particularly for applications in advanced manufacturing and electronics. The competitive arena is characterized by strategic collaborations, mergers and acquisitions, and a focus on developing sustainable and environmentally friendly mining practices. The market penetration rate for high-purity silica sand in niche applications like semiconductor manufacturing and advanced ceramics is projected to reach over 15% by 2033, underscoring the growing importance of specialized grades.

Dominant Markets & Segments in Asia-Pacific Silica Sand Market

This section identifies the dominant regions, countries, and segments within the Asia-Pacific silica sand market. A thorough analysis illuminates the factors contributing to their dominance.

- Key Drivers of Dominance:

- Robust economic growth driving infrastructure development.

- Favorable government policies supporting industrial expansion.

- Abundant natural resources and strategic geographical location.

- Well-established industrial clusters and supply chains.

- Expanding downstream industries, including glass, construction, and electronics.

China, for example, emerges as a dominant market due to its substantial construction activities and manufacturing base, accounting for approximately xx% of the regional market. India is another key market, demonstrating significant growth potential due to increasing infrastructure spending and rising demand from glass and construction sectors. Detailed analyses are presented for each leading region/country, explaining their dominance through economic indicators, infrastructure developments, and governmental policies.

Asia-Pacific Silica Sand Market Product Innovations

The Asia-Pacific silica sand market is witnessing significant product innovations driven by technological advancements. The focus is on enhancing silica sand purity, improving particle size distribution, and developing specialized products for niche applications. These innovations offer substantial competitive advantages, enabling manufacturers to cater to specific end-user requirements and command higher prices. For example, the development of high-purity silica sand with controlled grain size distribution is expanding applications in advanced electronics and semiconductors. The integration of new technologies into mining and processing operations enhances efficiency and reduces environmental impact.

Report Segmentation & Scope

This report segments the Asia-Pacific silica sand market by various parameters to provide a granular view of the market landscape. The key segmentation parameters include:

By Type: This section analyzes the market size and growth projections for different types of silica sand, such as natural silica sand, and processed silica sand, highlighting their respective market shares and competitive dynamics.

By Application: This section details the market size and growth forecast for different applications of silica sand, including glass manufacturing, construction, foundry, and others, outlining their respective growth trajectories and competitive landscapes.

By Region: This segment breaks down the market into key regions within Asia-Pacific, providing regional-specific growth projections and identifying dominant markets.

Key Drivers of Asia-Pacific Silica Sand Market Growth

The growth of the Asia-Pacific silica sand market is fueled by several key factors. Rapid industrialization and urbanization across the region are driving demand for silica sand in construction and infrastructure projects. The growing glass industry, particularly in emerging economies, is another major driver. Additionally, the increasing demand for high-purity silica sand in electronics and other specialized applications contributes significantly to market growth. Supportive government policies, promoting infrastructure development and industrial growth, further accelerate market expansion.

Challenges in the Asia-Pacific Silica Sand Market Sector

Despite its promising growth trajectory, the Asia-Pacific silica sand market confronts a spectrum of challenges. Stringent environmental regulations governing mining operations, including land reclamation and water usage, necessitate significant investment in compliance and can introduce operational complexities. Fluctuations in global commodity prices, coupled with potential supply chain disruptions stemming from geopolitical events, natural disasters, or logistical bottlenecks, can adversely impact profitability and market stability. The industry also faces intense competition from both established multinational corporations and a growing number of regional players, leading to price pressures. Uneven geological distribution of high-quality silica sand reserves across the vast Asia-Pacific region results in significant regional disparities in market development and access to premium raw materials. Furthermore, the inherent bulkiness of silica sand leads to escalating transportation costs, which are a substantial component of the overall expenditure, particularly for inland or cross-border distribution.

Leading Players in the Asia-Pacific Silica Sand Market

- Chongqing Changjiang River Moulding Material (Group) Co Ltd

- Fairmount Santrol (now part of Covia Holdings)

- Mitsubishi Corporation

- Mangal Minerals

- PUM GROUP

- JFE MINERAL Co LTD

- Raghav Productivity Enhancers Limited

- Sibelco

- Shivam Chemicals

- TOCHU CORPORATION

- Xinyi Golden Ruite Quartz Materials Co Ltd

- List Not Exhaustive

Key Developments in Asia-Pacific Silica Sand Market Sector

- [Month, Year]: Company X launched a new high-purity silica sand product for the electronics industry.

- [Month, Year]: Company Y acquired Company Z, expanding its market presence in Southeast Asia.

- [Month, Year]: New environmental regulations were implemented in Country A, impacting the mining operations of several companies.

- Further key developments are detailed in the complete study.

Strategic Asia-Pacific Silica Sand Market Outlook

The Asia-Pacific silica sand market exhibits substantial growth potential in the coming years. Continued infrastructure development, industrial expansion, and technological advancements are expected to drive demand. Strategic opportunities exist for companies focusing on high-purity silica sand production, sustainable mining practices, and value-added services. Expanding into new and emerging markets, and exploring strategic partnerships, will be crucial for success in this competitive landscape. The market is poised for steady growth, with opportunities for both established players and new entrants to capitalize on the region's expanding industrialization.

Asia-Pacific Silica Sand Market Segmentation

-

1. End User Industry

- 1.1. Glass Manufacturing

- 1.2. Foundry

- 1.3. Chemical Production

- 1.4. Construction

- 1.5. Paints and Coatings

- 1.6. Ceramics and Refractories

- 1.7. Filtration

- 1.8. Oil and Gas Recovery

- 1.9. Other End User Industries

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Indonesia

- 2.6. Thailand

- 2.7. Malaysia

- 2.8. Singapore

- 2.9. Philippines

- 2.10. Vietnam

Asia-Pacific Silica Sand Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Indonesia

- 6. Thailand

- 7. Malaysia

- 8. Singapore

- 9. Philippines

- 10. Vietnam

Asia-Pacific Silica Sand Market Regional Market Share

Geographic Coverage of Asia-Pacific Silica Sand Market

Asia-Pacific Silica Sand Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consistent Economic Growth Leading to Increase in Construction; Increasing Use in the Foundry Industry; Others Drivers

- 3.3. Market Restrains

- 3.3.1. Consistent Economic Growth Leading to Increase in Construction; Increasing Use in the Foundry Industry; Others Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Glass Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Glass Manufacturing

- 5.1.2. Foundry

- 5.1.3. Chemical Production

- 5.1.4. Construction

- 5.1.5. Paints and Coatings

- 5.1.6. Ceramics and Refractories

- 5.1.7. Filtration

- 5.1.8. Oil and Gas Recovery

- 5.1.9. Other End User Industries

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Indonesia

- 5.2.6. Thailand

- 5.2.7. Malaysia

- 5.2.8. Singapore

- 5.2.9. Philippines

- 5.2.10. Vietnam

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Indonesia

- 5.3.6. Thailand

- 5.3.7. Malaysia

- 5.3.8. Singapore

- 5.3.9. Philippines

- 5.3.10. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. China Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Glass Manufacturing

- 6.1.2. Foundry

- 6.1.3. Chemical Production

- 6.1.4. Construction

- 6.1.5. Paints and Coatings

- 6.1.6. Ceramics and Refractories

- 6.1.7. Filtration

- 6.1.8. Oil and Gas Recovery

- 6.1.9. Other End User Industries

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Indonesia

- 6.2.6. Thailand

- 6.2.7. Malaysia

- 6.2.8. Singapore

- 6.2.9. Philippines

- 6.2.10. Vietnam

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. India Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Glass Manufacturing

- 7.1.2. Foundry

- 7.1.3. Chemical Production

- 7.1.4. Construction

- 7.1.5. Paints and Coatings

- 7.1.6. Ceramics and Refractories

- 7.1.7. Filtration

- 7.1.8. Oil and Gas Recovery

- 7.1.9. Other End User Industries

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Indonesia

- 7.2.6. Thailand

- 7.2.7. Malaysia

- 7.2.8. Singapore

- 7.2.9. Philippines

- 7.2.10. Vietnam

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Japan Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Glass Manufacturing

- 8.1.2. Foundry

- 8.1.3. Chemical Production

- 8.1.4. Construction

- 8.1.5. Paints and Coatings

- 8.1.6. Ceramics and Refractories

- 8.1.7. Filtration

- 8.1.8. Oil and Gas Recovery

- 8.1.9. Other End User Industries

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Indonesia

- 8.2.6. Thailand

- 8.2.7. Malaysia

- 8.2.8. Singapore

- 8.2.9. Philippines

- 8.2.10. Vietnam

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. South Korea Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Glass Manufacturing

- 9.1.2. Foundry

- 9.1.3. Chemical Production

- 9.1.4. Construction

- 9.1.5. Paints and Coatings

- 9.1.6. Ceramics and Refractories

- 9.1.7. Filtration

- 9.1.8. Oil and Gas Recovery

- 9.1.9. Other End User Industries

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Indonesia

- 9.2.6. Thailand

- 9.2.7. Malaysia

- 9.2.8. Singapore

- 9.2.9. Philippines

- 9.2.10. Vietnam

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Indonesia Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Glass Manufacturing

- 10.1.2. Foundry

- 10.1.3. Chemical Production

- 10.1.4. Construction

- 10.1.5. Paints and Coatings

- 10.1.6. Ceramics and Refractories

- 10.1.7. Filtration

- 10.1.8. Oil and Gas Recovery

- 10.1.9. Other End User Industries

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Indonesia

- 10.2.6. Thailand

- 10.2.7. Malaysia

- 10.2.8. Singapore

- 10.2.9. Philippines

- 10.2.10. Vietnam

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Thailand Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End User Industry

- 11.1.1. Glass Manufacturing

- 11.1.2. Foundry

- 11.1.3. Chemical Production

- 11.1.4. Construction

- 11.1.5. Paints and Coatings

- 11.1.6. Ceramics and Refractories

- 11.1.7. Filtration

- 11.1.8. Oil and Gas Recovery

- 11.1.9. Other End User Industries

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. India

- 11.2.3. Japan

- 11.2.4. South Korea

- 11.2.5. Indonesia

- 11.2.6. Thailand

- 11.2.7. Malaysia

- 11.2.8. Singapore

- 11.2.9. Philippines

- 11.2.10. Vietnam

- 11.1. Market Analysis, Insights and Forecast - by End User Industry

- 12. Malaysia Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by End User Industry

- 12.1.1. Glass Manufacturing

- 12.1.2. Foundry

- 12.1.3. Chemical Production

- 12.1.4. Construction

- 12.1.5. Paints and Coatings

- 12.1.6. Ceramics and Refractories

- 12.1.7. Filtration

- 12.1.8. Oil and Gas Recovery

- 12.1.9. Other End User Industries

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. China

- 12.2.2. India

- 12.2.3. Japan

- 12.2.4. South Korea

- 12.2.5. Indonesia

- 12.2.6. Thailand

- 12.2.7. Malaysia

- 12.2.8. Singapore

- 12.2.9. Philippines

- 12.2.10. Vietnam

- 12.1. Market Analysis, Insights and Forecast - by End User Industry

- 13. Singapore Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by End User Industry

- 13.1.1. Glass Manufacturing

- 13.1.2. Foundry

- 13.1.3. Chemical Production

- 13.1.4. Construction

- 13.1.5. Paints and Coatings

- 13.1.6. Ceramics and Refractories

- 13.1.7. Filtration

- 13.1.8. Oil and Gas Recovery

- 13.1.9. Other End User Industries

- 13.2. Market Analysis, Insights and Forecast - by Geography

- 13.2.1. China

- 13.2.2. India

- 13.2.3. Japan

- 13.2.4. South Korea

- 13.2.5. Indonesia

- 13.2.6. Thailand

- 13.2.7. Malaysia

- 13.2.8. Singapore

- 13.2.9. Philippines

- 13.2.10. Vietnam

- 13.1. Market Analysis, Insights and Forecast - by End User Industry

- 14. Philippines Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by End User Industry

- 14.1.1. Glass Manufacturing

- 14.1.2. Foundry

- 14.1.3. Chemical Production

- 14.1.4. Construction

- 14.1.5. Paints and Coatings

- 14.1.6. Ceramics and Refractories

- 14.1.7. Filtration

- 14.1.8. Oil and Gas Recovery

- 14.1.9. Other End User Industries

- 14.2. Market Analysis, Insights and Forecast - by Geography

- 14.2.1. China

- 14.2.2. India

- 14.2.3. Japan

- 14.2.4. South Korea

- 14.2.5. Indonesia

- 14.2.6. Thailand

- 14.2.7. Malaysia

- 14.2.8. Singapore

- 14.2.9. Philippines

- 14.2.10. Vietnam

- 14.1. Market Analysis, Insights and Forecast - by End User Industry

- 15. Vietnam Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - by End User Industry

- 15.1.1. Glass Manufacturing

- 15.1.2. Foundry

- 15.1.3. Chemical Production

- 15.1.4. Construction

- 15.1.5. Paints and Coatings

- 15.1.6. Ceramics and Refractories

- 15.1.7. Filtration

- 15.1.8. Oil and Gas Recovery

- 15.1.9. Other End User Industries

- 15.2. Market Analysis, Insights and Forecast - by Geography

- 15.2.1. China

- 15.2.2. India

- 15.2.3. Japan

- 15.2.4. South Korea

- 15.2.5. Indonesia

- 15.2.6. Thailand

- 15.2.7. Malaysia

- 15.2.8. Singapore

- 15.2.9. Philippines

- 15.2.10. Vietnam

- 15.1. Market Analysis, Insights and Forecast - by End User Industry

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 Chongqing Changjiang River Moulding Material (Group) Co Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Fairmount Santrol

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Mitsubishi Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Mangal Minerals

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 PUM GROUP

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 JFE MINERAL Co LTD

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Raghav Productivity Enhancers Limited

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Sibelco

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Shivam Chemicals

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 TOCHU CORPORATION

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Xinyi Golden Ruite Quartz Materials Co Ltd *List Not Exhaustive

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Chongqing Changjiang River Moulding Material (Group) Co Ltd

List of Figures

- Figure 1: Global Asia-Pacific Silica Sand Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 3: China Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 4: China Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 5: China Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: China Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 7: China Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: India Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 9: India Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 10: India Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 11: India Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 12: India Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 13: India Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Japan Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 15: Japan Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 16: Japan Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 17: Japan Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Japan Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Japan Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South Korea Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 21: South Korea Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 22: South Korea Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: South Korea Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: South Korea Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South Korea Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Indonesia Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 27: Indonesia Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 28: Indonesia Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 29: Indonesia Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Indonesia Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Indonesia Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Thailand Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 33: Thailand Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 34: Thailand Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 35: Thailand Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 36: Thailand Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 37: Thailand Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Malaysia Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 39: Malaysia Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 40: Malaysia Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 41: Malaysia Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 42: Malaysia Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 43: Malaysia Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 44: Singapore Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 45: Singapore Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 46: Singapore Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 47: Singapore Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Singapore Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 49: Singapore Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Philippines Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 51: Philippines Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 52: Philippines Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 53: Philippines Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 54: Philippines Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 55: Philippines Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 56: Vietnam Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 57: Vietnam Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 58: Vietnam Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 59: Vietnam Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 60: Vietnam Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 61: Vietnam Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 8: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 11: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 17: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 20: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 21: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 23: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 26: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 27: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 29: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 32: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 33: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Silica Sand Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Asia-Pacific Silica Sand Market?

Key companies in the market include Chongqing Changjiang River Moulding Material (Group) Co Ltd, Fairmount Santrol, Mitsubishi Corporation, Mangal Minerals, PUM GROUP, JFE MINERAL Co LTD, Raghav Productivity Enhancers Limited, Sibelco, Shivam Chemicals, TOCHU CORPORATION, Xinyi Golden Ruite Quartz Materials Co Ltd *List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Silica Sand Market?

The market segments include End User Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.21 billion as of 2022.

5. What are some drivers contributing to market growth?

Consistent Economic Growth Leading to Increase in Construction; Increasing Use in the Foundry Industry; Others Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from the Glass Industry.

7. Are there any restraints impacting market growth?

Consistent Economic Growth Leading to Increase in Construction; Increasing Use in the Foundry Industry; Others Drivers.

8. Can you provide examples of recent developments in the market?

The recent developments pertaining to the major players in the market are covered in the complete study.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Silica Sand Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Silica Sand Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Silica Sand Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Silica Sand Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence