Key Insights

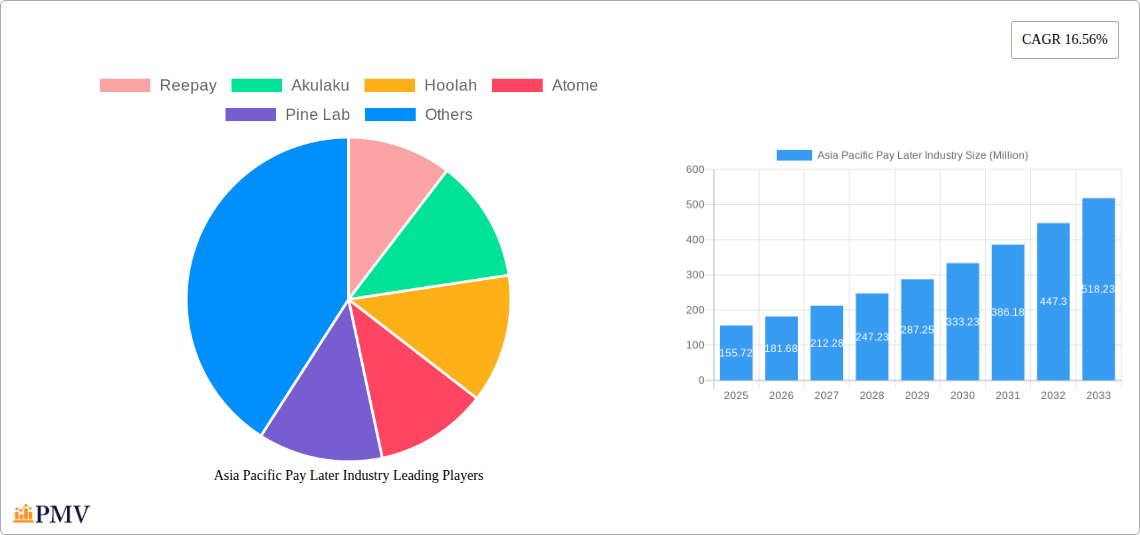

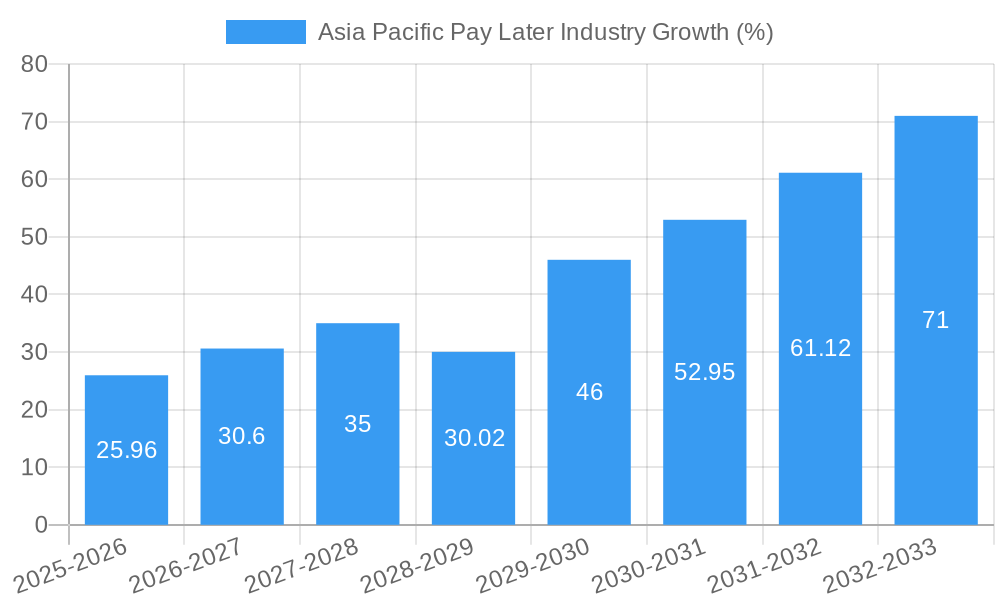

The Asia Pacific Buy Now, Pay Later (BNPL) market is experiencing explosive growth, projected to reach \$155.72 million in 2025 and maintain a robust Compound Annual Growth Rate (CAGR) of 16.56% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes, particularly among younger demographics, coupled with increased smartphone penetration and e-commerce adoption, are creating a fertile ground for BNPL services. Consumers are increasingly attracted to the convenience and flexibility offered by these payment options, particularly for smaller purchases and online shopping. Furthermore, the competitive landscape, characterized by a mix of established players like Reepay and Akulaku, and newer entrants like Atome and Hoolah, is driving innovation and accessibility, further fueling market growth. The strategic partnerships forged between BNPL providers and merchants expand reach and user acquisition.

However, the market also faces certain challenges. Regulatory uncertainty and concerns around consumer debt management represent significant hurdles. The increasing competition necessitates continuous innovation and differentiation to maintain market share. Effective risk management strategies and robust fraud prevention measures are crucial for sustainability. Geographic variations in consumer behavior and regulatory frameworks also present complexities for expansion and market penetration. Nevertheless, the overall outlook remains positive, driven by the enduring consumer demand for flexible payment solutions and the ongoing technological advancements within the fintech sector. The market is poised for significant expansion in the coming years, driven by the rising adoption of e-commerce and a growing preference for convenient payment solutions across the Asia-Pacific region.

Asia Pacific Pay Later Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Asia Pacific Pay Later industry, covering market structure, competitive dynamics, key trends, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period encompasses 2019-2024. The report offers actionable insights for businesses, investors, and stakeholders navigating this rapidly evolving market. The market size is projected to reach xx Million by 2033.

Asia Pacific Pay Later Industry Market Structure & Competitive Dynamics

This section analyzes the market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities within the Asia Pacific Pay Later industry.

The Asia Pacific Pay Later market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. However, the market is characterized by a high level of dynamism due to ongoing innovation and the emergence of new entrants. Market share data for 2024 reveals that the top five players hold approximately xx% of the market, while the remaining share is distributed among numerous smaller players and startups. The average M&A deal value in the past five years has been approximately xx Million, indicating significant investor interest and consolidation efforts within the sector.

- Market Concentration: Moderately concentrated, with top five players holding xx% market share in 2024.

- Innovation Ecosystems: Strong presence of fintech startups and established players fostering innovation.

- Regulatory Frameworks: Varying regulatory landscapes across different countries in the region, influencing market growth and competitiveness.

- Product Substitutes: Traditional credit cards and other forms of consumer financing pose a competitive threat.

- End-User Trends: Growing adoption of e-commerce and digital payment methods fuels market demand.

- M&A Activities: Frequent M&A activity indicates consolidation and expansion within the industry.

Asia Pacific Pay Later Industry Industry Trends & Insights

The Asia Pacific Pay Later industry is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) is estimated at xx% during the forecast period (2025-2033), reflecting strong consumer adoption and increasing merchant adoption. Market penetration rates vary across countries, with higher penetration in more mature markets like Australia and Singapore compared to developing economies. Technological disruptions, such as advancements in AI-powered risk assessment and embedded finance, are shaping the industry's landscape. Consumer preferences for flexible payment options and seamless digital experiences are also pivotal drivers. Intense competition among existing players and new entrants further fuels innovation and market expansion.

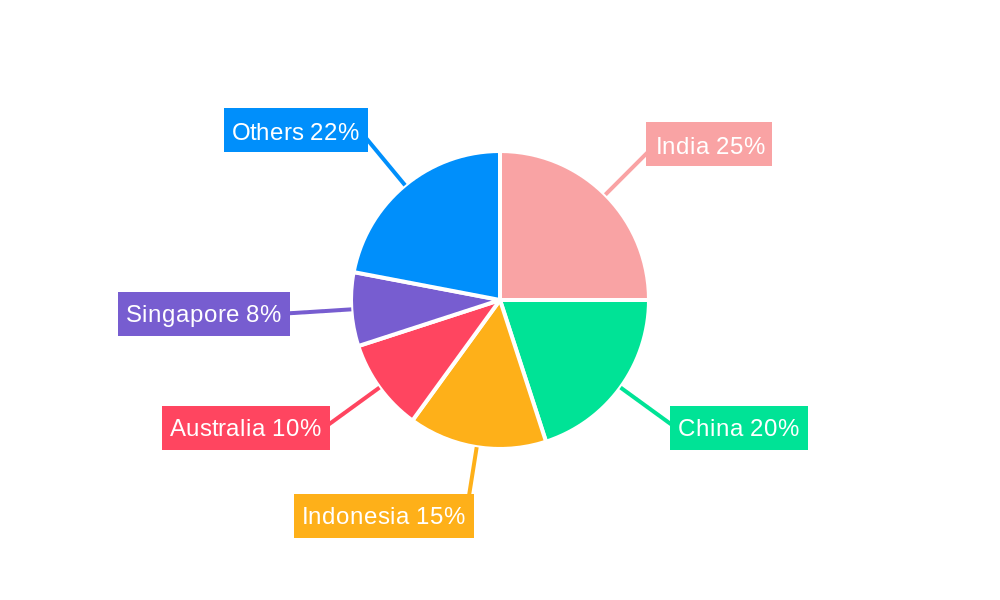

Dominant Markets & Segments in Asia Pacific Pay Later Industry

This section identifies leading regions, countries, and segments within the Asia Pacific Pay Later industry. Detailed analysis reveals that India and Australia currently lead in terms of market size and growth.

India's Dominance:

- Key Drivers: Rapid growth of e-commerce, increasing smartphone penetration, and a large young population.

- Economic Policies: Government initiatives promoting digital payments and financial inclusion boost market growth.

- Infrastructure: Expanding digital infrastructure supports the seamless functioning of BNPL services.

Australia's Dominance:

- Key Drivers: High level of digital literacy and adoption of online shopping among consumers.

- Economic Policies: Supportive regulatory environment encourages the growth of the BNPL sector.

- Infrastructure: Robust payment infrastructure facilitates seamless transactions.

Other key markets include Singapore, China, and Indonesia, each with unique market dynamics and growth trajectories. The report dives deep into regional and segment-specific analysis, providing granular insights into each market’s characteristics and potential.

Asia Pacific Pay Later Industry Product Innovations

Recent product innovations focus on enhancing user experience, improving risk management, and expanding into new verticals. Technologies such as AI, machine learning, and blockchain are being integrated to optimize credit scoring, fraud detection, and payment processing. New product features such as flexible repayment options, loyalty programs, and integrated shopping experiences are gaining traction to enhance customer value and encourage market penetration. This competitive innovation landscape is essential for maintaining market leadership and capturing growth.

Report Segmentation & Scope

The report segments the Asia Pacific Pay Later market based on several factors:

- By Type: This segment includes analysis of various BNPL offerings such as point-of-sale financing, online financing, and installment payment plans, along with their respective market sizes and growth projections.

- By End-User: This analyzes the market across different sectors, like e-commerce, retail, travel and hospitality, along with expected growth variations across these sectors.

- By Region: This delves into the specific market dynamics of key countries within the Asia Pacific region. Each country's unique regulatory framework, consumer behavior and economic strength influence growth prospects.

Key Drivers of Asia Pacific Pay Later Industry Growth

Several factors drive the growth of the Asia Pacific Pay Later industry:

- Rising E-commerce Adoption: The surging popularity of online shopping fuels the demand for flexible payment options.

- Increasing Smartphone Penetration: Wider smartphone access enhances accessibility to BNPL services.

- Favorable Regulatory Environment (in select markets): Supportive government policies in several countries facilitate market expansion.

- Technological Advancements: Innovations in AI, machine learning, and data analytics improve risk assessment and efficiency.

Challenges in the Asia Pacific Pay Later Industry Sector

The Asia Pacific Pay Later industry faces several challenges:

- Regulatory Uncertainty: Varying regulatory frameworks across the region create uncertainty and compliance complexities for businesses. This can impact the cost of operations and limit market access. For example, some regions have stringent regulations on interest rates and data privacy, potentially affecting business profitability.

- Credit Risk Management: High default rates pose a significant challenge for BNPL providers, requiring robust risk assessment models.

- Competition: Intense competition among existing and new players necessitates continuous innovation and efficiency improvements.

Leading Players in the Asia Pacific Pay Later Industry Market

- Reepay

- Akulaku

- Hoolah

- Atome

- Pine Lab

- Zest Money BNPL

- Openpay (Australia)

- Rely (Singapore)

- Limepay (Australia)

- PayRight (Australia)

- List Not Exhaustive

Key Developments in Asia Pacific Pay Later Industry Sector

- June 2022: Kuaishou launched Sesame Credit's BNPL service in China, enabling users with a Sesame score of 550 and above to try before they buy.

- February 2023: CRED launched its BNPL service in India, expanding its payment options across various partner merchants.

Strategic Asia Pacific Pay Later Industry Market Outlook

The Asia Pacific Pay Later industry holds immense future potential. Continued growth is anticipated, driven by rising e-commerce adoption, expanding digital infrastructure, and increasing financial inclusion. Strategic opportunities exist for players who can effectively manage credit risk, leverage technological advancements, and adapt to evolving regulatory landscapes. Expansion into underserved markets, development of innovative products and services, and strategic partnerships will be key for achieving sustained growth and market leadership in the coming years.

Asia Pacific Pay Later Industry Segmentation

-

1. Channel

- 1.1. Online

- 1.2. POS

-

2. Enterprise

- 2.1. Large Enterprises

- 2.2. Small & Medium Enterprises

- 2.3. Others

-

3. End User

- 3.1. Consmer electronics

- 3.2. Fashion & garments

- 3.3. Healthcare

- 3.4. Leisure & entertainment

- 3.5. Retail

- 3.6. Others

Asia Pacific Pay Later Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Pay Later Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Lack Of Credit Availability In Small Transaction Driving BNPL Services; Rise In The Value Of Digital Transaction In Asia Pacific

- 3.3. Market Restrains

- 3.3.1. Lack Of Credit Availability In Small Transaction Driving BNPL Services; Rise In The Value Of Digital Transaction In Asia Pacific

- 3.4. Market Trends

- 3.4.1. Rising Digital Payments

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Pay Later Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Online

- 5.1.2. POS

- 5.2. Market Analysis, Insights and Forecast - by Enterprise

- 5.2.1. Large Enterprises

- 5.2.2. Small & Medium Enterprises

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Consmer electronics

- 5.3.2. Fashion & garments

- 5.3.3. Healthcare

- 5.3.4. Leisure & entertainment

- 5.3.5. Retail

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Reepay

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Akulaku

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hoolah

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Atome

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pine Lab

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zest Money BNPL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Openpay (Australia)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rely (Singapore)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Limepay (Australia)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PayRight (Australia)**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Reepay

List of Figures

- Figure 1: Asia Pacific Pay Later Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Pay Later Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Pay Later Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Pay Later Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Asia Pacific Pay Later Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 4: Asia Pacific Pay Later Industry Volume Billion Forecast, by Channel 2019 & 2032

- Table 5: Asia Pacific Pay Later Industry Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 6: Asia Pacific Pay Later Industry Volume Billion Forecast, by Enterprise 2019 & 2032

- Table 7: Asia Pacific Pay Later Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Asia Pacific Pay Later Industry Volume Billion Forecast, by End User 2019 & 2032

- Table 9: Asia Pacific Pay Later Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Asia Pacific Pay Later Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Asia Pacific Pay Later Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 12: Asia Pacific Pay Later Industry Volume Billion Forecast, by Channel 2019 & 2032

- Table 13: Asia Pacific Pay Later Industry Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 14: Asia Pacific Pay Later Industry Volume Billion Forecast, by Enterprise 2019 & 2032

- Table 15: Asia Pacific Pay Later Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Asia Pacific Pay Later Industry Volume Billion Forecast, by End User 2019 & 2032

- Table 17: Asia Pacific Pay Later Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia Pacific Pay Later Industry Volume Billion Forecast, by Country 2019 & 2032

- Table 19: China Asia Pacific Pay Later Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: China Asia Pacific Pay Later Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Japan Asia Pacific Pay Later Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Asia Pacific Pay Later Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: South Korea Asia Pacific Pay Later Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Asia Pacific Pay Later Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: India Asia Pacific Pay Later Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: India Asia Pacific Pay Later Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Australia Asia Pacific Pay Later Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Australia Asia Pacific Pay Later Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: New Zealand Asia Pacific Pay Later Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: New Zealand Asia Pacific Pay Later Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Indonesia Asia Pacific Pay Later Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Indonesia Asia Pacific Pay Later Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Malaysia Asia Pacific Pay Later Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Malaysia Asia Pacific Pay Later Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Singapore Asia Pacific Pay Later Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Singapore Asia Pacific Pay Later Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Thailand Asia Pacific Pay Later Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Thailand Asia Pacific Pay Later Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: Vietnam Asia Pacific Pay Later Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Vietnam Asia Pacific Pay Later Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 41: Philippines Asia Pacific Pay Later Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Philippines Asia Pacific Pay Later Industry Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Pay Later Industry?

The projected CAGR is approximately 16.56%.

2. Which companies are prominent players in the Asia Pacific Pay Later Industry?

Key companies in the market include Reepay, Akulaku, Hoolah, Atome, Pine Lab, Zest Money BNPL, Openpay (Australia), Rely (Singapore), Limepay (Australia), PayRight (Australia)**List Not Exhaustive.

3. What are the main segments of the Asia Pacific Pay Later Industry?

The market segments include Channel, Enterprise, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 155.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Lack Of Credit Availability In Small Transaction Driving BNPL Services; Rise In The Value Of Digital Transaction In Asia Pacific.

6. What are the notable trends driving market growth?

Rising Digital Payments.

7. Are there any restraints impacting market growth?

Lack Of Credit Availability In Small Transaction Driving BNPL Services; Rise In The Value Of Digital Transaction In Asia Pacific.

8. Can you provide examples of recent developments in the market?

In June 2022, China E-commerce firm Kuaishou launched Sesame Credit's buy now and pay later (BNPL) service. Under the service users with a Sesame score of 550 and above will be able to order, receive, and try the products before paying on its e-commerce platform allowing its customers to easily return and exchange goods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Pay Later Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Pay Later Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Pay Later Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Pay Later Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence