Key Insights

The Asia-Pacific Omega-3 products market, valued at $2.11 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 7.77% from 2025 to 2033. This growth is propelled by heightened consumer awareness of Omega-3 fatty acids' health benefits, including cardiovascular support, cognitive function enhancement, and anti-inflammatory properties. The rising incidence of chronic conditions such as heart disease and diabetes in the region further stimulates demand. The increasing adoption of functional foods, dietary supplements, and healthier lifestyle choices are also significant contributors. Key market segments, notably functional foods and dietary supplements, are experiencing robust growth due to consumer preference for convenient Omega-3 sources. Leading companies are actively innovating and expanding their product portfolios to capitalize on these trends. A broad spectrum of distribution channels, including retail, pharmacies, and online platforms, ensures widespread market accessibility.

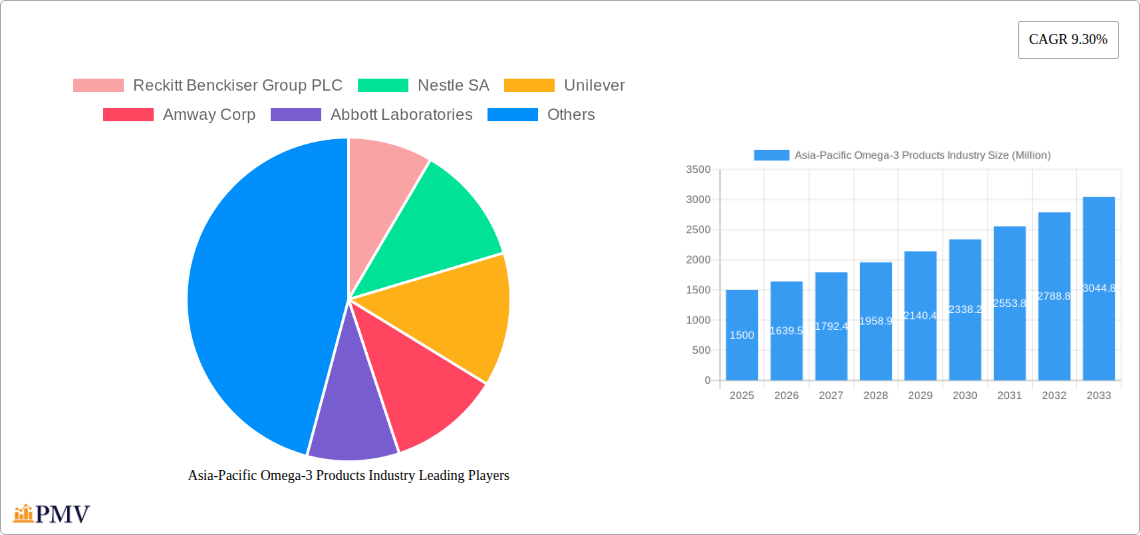

Asia-Pacific Omega-3 Products Industry Market Size (In Billion)

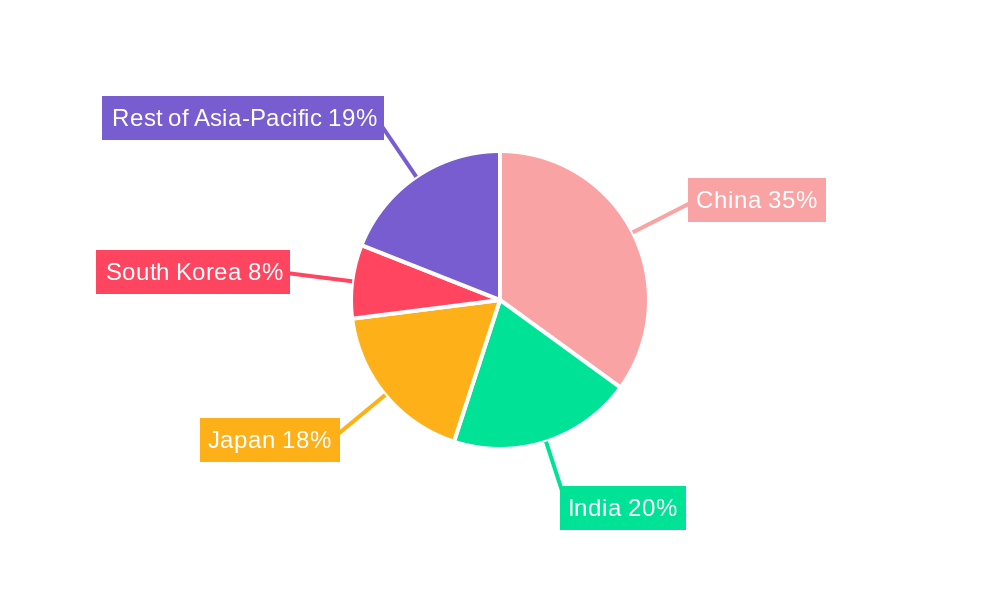

Market growth varies across Asia-Pacific nations, with China, India, and Japan being key markets due to their substantial populations and expanding middle class with enhanced purchasing power. Potential restraints to market expansion include raw material price volatility and regulatory complexities concerning food and supplement labeling. Despite these challenges, the long-term outlook for the Asia-Pacific Omega-3 products market is optimistic, driven by enduring consumer focus on health and wellness and continuous industry innovation. Future growth will likely be fueled by product diversification, emphasizing improved bioavailability and specialized health benefits.

Asia-Pacific Omega-3 Products Industry Company Market Share

Asia-Pacific Omega-3 Products Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific Omega-3 Products industry, offering valuable insights for businesses, investors, and stakeholders. The study covers the period from 2019 to 2033, with 2025 as the base and estimated year. The report segments the market by product type (Functional Food, Dietary Supplements, Infant Nutrition, Pet Food and Feed, Pharmaceuticals) and distribution channel (Grocery Retailers, Pharmacies and Drug Stores, Internet Retailing, Other Distribution Channels), providing detailed market sizing and growth forecasts. Key players like Reckitt Benckiser Group PLC, Nestle SA, Unilever, Amway Corp, Abbott Laboratories, Herbalife Nutrition, and Healthvit are analyzed for their market share, strategies, and competitive positioning.

Asia-Pacific Omega-3 Products Industry Market Structure & Competitive Dynamics

The Asia-Pacific Omega-3 products market exhibits a moderately concentrated structure, with a few major multinational corporations holding significant market share. Reckitt Benckiser Group PLC, Nestle SA, and Unilever collectively account for approximately xx% of the market in 2025. However, the presence of numerous smaller regional players and emerging brands creates a dynamic competitive landscape. The industry's innovation ecosystem is driven by advancements in extraction technologies, formulation techniques, and delivery systems, fostering the development of novel omega-3 products. Regulatory frameworks vary across different countries in the region, influencing product labeling, claims, and safety standards. The market also faces competition from alternative sources of omega-3 fatty acids, including certain plant-based oils. End-user trends, particularly the increasing awareness of health and wellness, are significantly boosting demand. M&A activities have been relatively frequent in recent years, with deal values exceeding xx Million in 2024, primarily driven by larger players seeking to expand their product portfolios and geographical reach.

- Market Concentration: Oligopolistic, with top 3 players holding xx% market share in 2025.

- Innovation: Focus on sustainable sourcing, improved bioavailability, and novel delivery systems.

- Regulatory Landscape: Varies across countries, impacting labeling and claims.

- M&A Activity: Significant activity in 2024 with deal values exceeding xx Million.

Asia-Pacific Omega-3 Products Industry Industry Trends & Insights

The Asia-Pacific Omega-3 products market is experiencing robust growth, driven by several key factors. Rising health consciousness among consumers, particularly in urban areas, is fueling demand for products with proven health benefits. Increasing disposable incomes in many parts of the region are further boosting consumption. Technological advancements in omega-3 extraction and processing are leading to higher quality, more sustainable, and cost-effective products. Consumer preferences are shifting towards natural and organic options, influencing product formulations and marketing strategies. The competitive landscape is characterized by both intense rivalry among established players and the emergence of innovative start-ups. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), with significant market penetration in key segments. Specific trends include a growing preference for convenient formats like capsules and gummies, as well as increased demand for omega-3 fortified foods and beverages. The market penetration of omega-3 supplements is expected to reach xx% by 2033.

Dominant Markets & Segments in Asia-Pacific Omega-3 Products Industry

The dietary supplements segment dominates the Asia-Pacific Omega-3 products market, accounting for the largest share in 2025. This dominance is driven by the rising awareness of the health benefits of omega-3s and the convenience of supplement consumption. China and India are the leading national markets, fuelled by their large populations and increasing health consciousness. Within distribution channels, grocery retailers are the leading segment, benefiting from their extensive reach and established consumer base.

Key Drivers:

- China & India: Large populations, growing middle class, and increasing health awareness.

- Dietary Supplements: High consumer preference for convenience and targeted benefits.

- Grocery Retailers: Wide reach and established distribution networks.

Dominance Analysis: The dietary supplements segment’s dominance stems from its ease of consumption and targeted benefits, while China and India benefit from large, health-conscious populations and growing disposable incomes. Grocery retailers' dominance is due to their wide distribution networks and established customer bases.

Asia-Pacific Omega-3 Products Industry Product Innovations

Recent innovations in the Asia-Pacific Omega-3 products industry focus on enhancing bioavailability, taste, and sustainability. New delivery systems, such as liposomal formulations and microencapsulation, are improving the absorption of omega-3 fatty acids. Formulators are also focusing on masking the fishy taste and odor associated with some omega-3 products, using natural flavors and masking agents. Sustainable sourcing practices are becoming increasingly important, with a focus on responsible fishing and alternative sources of omega-3s. These innovations are enhancing the market appeal and competitiveness of omega-3 products.

Report Segmentation & Scope

This report segments the Asia-Pacific Omega-3 products market by product type: Functional Food, Dietary Supplements, Infant Nutrition, Pet Food and Feed, and Pharmaceuticals. Each segment displays unique growth trajectories and competitive dynamics. For example, the Infant Nutrition segment shows high growth potential due to increasing awareness of the importance of omega-3s for infant brain development. The market is further segmented by distribution channel: Grocery Retailers, Pharmacies and Drug Stores, Internet Retailing, and Other Distribution Channels. E-commerce is emerging as a significant distribution channel, fueled by the increasing adoption of online shopping and convenient home delivery. Each segment's market size and growth projections are thoroughly analyzed in the full report, along with a detailed competitive landscape.

Key Drivers of Asia-Pacific Omega-3 Products Industry Growth

Several factors are driving the growth of the Asia-Pacific Omega-3 products market. The rising prevalence of chronic diseases, such as heart disease and diabetes, is boosting demand for omega-3s, which are known to offer several health benefits. Government initiatives promoting healthy diets and lifestyles are also contributing to market growth. Furthermore, technological advancements in omega-3 extraction and processing are making products more affordable and accessible. The growing awareness of the importance of omega-3s for brain health and cognitive function is another key growth driver, particularly among the aging population.

Challenges in the Asia-Pacific Omega-3 Products Industry Sector

The Asia-Pacific Omega-3 products industry faces several challenges. Fluctuations in raw material prices can impact the cost of production and profitability. Stringent regulatory requirements regarding labeling, claims, and safety standards can increase compliance costs. Competition from other dietary supplements and functional foods can limit market share growth. Ensuring the sustainability of omega-3 sourcing is another crucial challenge, requiring responsible fishing practices and exploration of alternative sources. These factors can significantly impact the overall market dynamics and require careful consideration by industry players.

Leading Players in the Asia-Pacific Omega-3 Products Industry Market

Key Developments in Asia-Pacific Omega-3 Products Industry Sector

- January 2023: Unilever launches a new range of omega-3 fortified yogurts targeting the health-conscious consumer segment.

- March 2024: Reckitt Benckiser Group PLC acquires a smaller omega-3 supplement manufacturer, expanding its product portfolio.

- June 2025: Nestle SA invests in research and development for sustainable omega-3 sourcing.

Strategic Asia-Pacific Omega-3 Products Industry Market Outlook

The Asia-Pacific Omega-3 products market is poised for continued growth, driven by increasing health awareness, rising disposable incomes, and technological advancements. Strategic opportunities exist in developing innovative product formulations, expanding into emerging markets, and focusing on sustainable sourcing practices. Companies that can effectively address consumer demand for convenient, high-quality, and sustainably produced omega-3 products are expected to gain a competitive advantage. The market's future potential is significant, with strong growth projections for the coming years.

Asia-Pacific Omega-3 Products Industry Segmentation

-

1. Product Type

- 1.1. Functional Food

- 1.2. Dietary Supplements

- 1.3. Infant Nutrition

- 1.4. Pet Food and Feed

- 1.5. Pharmaceuticals

-

2. Distribution Channel

- 2.1. Grocery Retailers

- 2.2. Pharmacies and Drug Store

- 2.3. Internet Retailing

- 2.4. Other Distribution Channels

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. China

- 3.1.2. India

- 3.1.3. Japan

- 3.1.4. Australia

- 3.1.5. Rest of Asia-Pacific

-

3.1. Asia-Pacific

Asia-Pacific Omega-3 Products Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. Australia

- 1.5. Rest of Asia Pacific

Asia-Pacific Omega-3 Products Industry Regional Market Share

Geographic Coverage of Asia-Pacific Omega-3 Products Industry

Asia-Pacific Omega-3 Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing awareness of the health benefits of Omega-3 fatty acids; Rising Prevalence of Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. Omega-3 supplements can be expensive compared to other nutritional products

- 3.4. Market Trends

- 3.4.1. Growing interest in plant-based diets and veganism is driving demand for plant-derived Omega-3 sources

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Omega-3 Products Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food

- 5.1.2. Dietary Supplements

- 5.1.3. Infant Nutrition

- 5.1.4. Pet Food and Feed

- 5.1.5. Pharmaceuticals

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Grocery Retailers

- 5.2.2. Pharmacies and Drug Store

- 5.2.3. Internet Retailing

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. China

- 5.3.1.2. India

- 5.3.1.3. Japan

- 5.3.1.4. Australia

- 5.3.1.5. Rest of Asia-Pacific

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Reckitt Benckiser Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Unilever

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amway Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abbott Laboratories

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Herbalife Nutrition

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Healthvit

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Reckitt Benckiser Group PLC

List of Figures

- Figure 1: Asia-Pacific Omega-3 Products Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Omega-3 Products Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Omega-3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Omega-3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Japan Asia-Pacific Omega-3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Australia Asia-Pacific Omega-3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Asia-Pacific Omega-3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Omega-3 Products Industry?

The projected CAGR is approximately 7.77%.

2. Which companies are prominent players in the Asia-Pacific Omega-3 Products Industry?

Key companies in the market include Reckitt Benckiser Group PLC, Nestle SA, Unilever, Amway Corp, Abbott Laboratories, Herbalife Nutrition, Healthvit.

3. What are the main segments of the Asia-Pacific Omega-3 Products Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.11 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing awareness of the health benefits of Omega-3 fatty acids; Rising Prevalence of Chronic Diseases.

6. What are the notable trends driving market growth?

Growing interest in plant-based diets and veganism is driving demand for plant-derived Omega-3 sources.

7. Are there any restraints impacting market growth?

Omega-3 supplements can be expensive compared to other nutritional products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Omega-3 Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Omega-3 Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Omega-3 Products Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Omega-3 Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence