Key Insights

The Asia-Pacific neo-banking market is poised for significant expansion, propelled by a rapidly evolving digital economy, widespread smartphone adoption, and a youthful, tech-savvy demographic embracing digital financial services. The market is projected to grow at a robust CAGR of 47% from its base year of 2025, reaching a market size of 261.4 billion by 2033. Key growth drivers include the demand for accessible, convenient financial solutions, particularly in underbanked regions. The proliferation of mobile payments and digital wallets further accelerates this trend. Emerging innovations such as embedded finance, AI-powered personalized financial tools, and machine learning integrations are revolutionizing customer experiences and fostering sector-wide innovation. Despite regulatory challenges and cybersecurity concerns, the market outlook remains highly positive, with continuous technological advancements set to enhance neo-banking services and drive further growth.

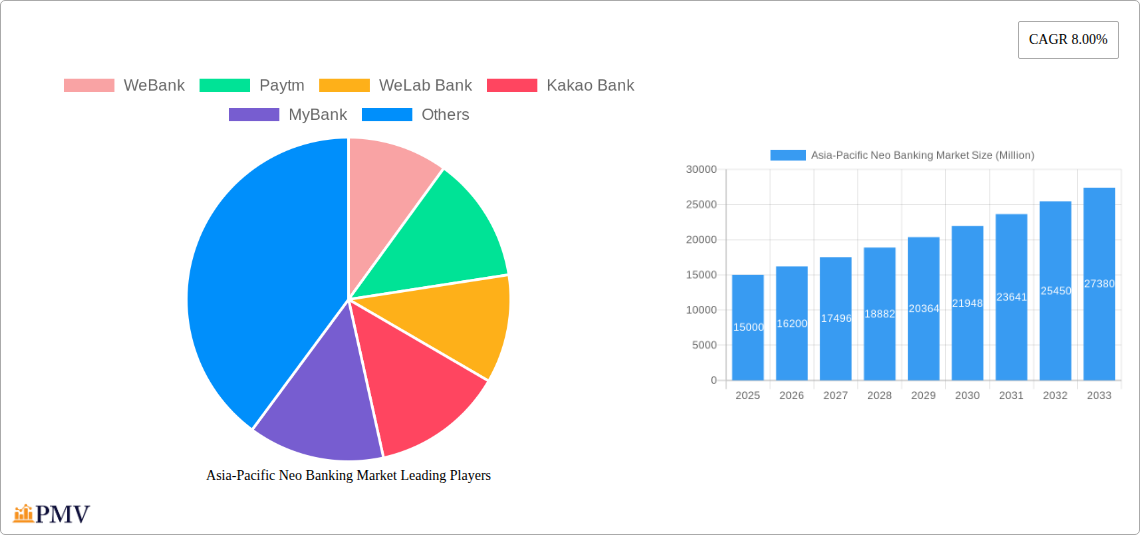

Asia-Pacific Neo Banking Market Market Size (In Billion)

Intense competition characterizes the Asia-Pacific neo-banking landscape, featuring established players like WeBank and Paytm alongside disruptive fintech innovators such as Toss Bank and Douugh. This dynamic environment stimulates innovation and pushes the boundaries of digital financial services. The expansion of mobile infrastructure and enhanced digital literacy will continue to fuel market growth across diverse segments, creating substantial opportunities for stakeholders.

Asia-Pacific Neo Banking Market Company Market Share

Neo-banks' success in Asia-Pacific hinges on their ability to tailor services to local market nuances and regulations. Customizing offerings to meet the varied financial needs across different countries is essential. Strategic alliances with local businesses and technology providers will be crucial for expanding market reach. Robust cybersecurity protocols and effective risk management are paramount for building and maintaining customer trust. The market will remain dynamic, shaped by evolving government policies, technological advancements, and shifting customer expectations. A sustained focus on transparent, secure, and user-friendly services will define long-term success. Future market evolution is expected to include consolidation and the emergence of novel business models, driving continued innovation and competition.

Asia-Pacific Neo Banking Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic Asia-Pacific neo banking market, offering invaluable insights for industry stakeholders, investors, and strategists. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, competitive landscapes, and future growth potential. Key players such as WeBank, Paytm, WeLab Bank, Kakao Bank, MyBank, Douugh, Crypto.com, Toss Bank, InstantPay, and Kyash are analyzed, among others. The report leverages high-ranking keywords like "Asia-Pacific neo banking market," "digital banking," "virtual banks," "fintech," and "mobile banking" to enhance search visibility and industry engagement. The total market size is predicted to reach xx Million by 2033.

Asia-Pacific Neo Banking Market Market Structure & Competitive Dynamics

The Asia-Pacific neo banking market is characterized by a highly competitive landscape with varying degrees of market concentration across different countries. While some nations showcase a few dominant players, others exhibit a more fragmented structure. Innovation ecosystems vary significantly, driven by factors like government support, technological infrastructure, and consumer adoption rates. Regulatory frameworks, while evolving, continue to influence market entry and operational strategies. Product substitutes, such as traditional banking services and alternative financial technologies, exert competitive pressure. End-user trends, particularly the growing preference for digital financial services among younger demographics, fuel market growth. M&A activities are frequent, with deal values ranging from xx Million to xx Million, shaping the competitive landscape and driving consolidation. Key metrics, including market share and M&A deal values for major players, are presented in detail within the report. Analysis of market concentration reveals that the market is moderately concentrated, with the top five players holding approximately xx% of the market share in 2024. Furthermore, the report documents significant M&A activity, with a total deal value exceeding xx Million in the past five years.

Asia-Pacific Neo Banking Market Industry Trends & Insights

The Asia-Pacific neo banking market exhibits robust growth, driven by increasing smartphone penetration, rising internet usage, and a growing preference for digital financial services. Technological disruptions, such as the adoption of AI, blockchain, and open banking APIs, are transforming the industry. Consumer preferences shift towards personalized financial products and seamless user experiences, putting pressure on neo-banks to innovate and enhance their offerings. Competitive dynamics are intense, with established players and new entrants vying for market share. The market is projected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. The report provides a detailed analysis of each of these trends, including granular market data to support each assertion. Specific examples of technological disruptions are discussed, including the impact of AI-powered fraud detection systems and the adoption of blockchain technology for enhanced security and transparency.

Dominant Markets & Segments in Asia-Pacific Neo Banking Market

- China: Remains the largest market in the Asia-Pacific region, driven by robust economic growth, high smartphone penetration, and a large digitally-savvy population.

- India: Shows significant growth potential, fueled by a burgeoning young population and increasing financial inclusion initiatives.

- South Korea: Is a technologically advanced market with high adoption rates of mobile banking and fintech solutions.

- Singapore: Acts as a regional hub for innovation and technological advancement in the financial sector.

- Other key markets: Include Australia, Japan, Indonesia, and Malaysia.

The dominance of these markets is largely attributed to strong economic growth, supportive regulatory environments, and advanced digital infrastructure. China’s dominance stems from its massive population and rapid technological advancements. India's potential is fueled by its large young population and its government's push for financial inclusion. Detailed analysis of the economic policies, infrastructure development, and consumer behavior in each of these countries provides a deeper understanding of their market dynamics.

Asia-Pacific Neo Banking Market Product Innovations

Neo-banks are constantly innovating, introducing features like AI-powered personalized financial management tools, sophisticated fraud detection systems, and seamless cross-border payment solutions. These advancements enhance user experience, improve security, and offer competitive advantages. The integration of blockchain technology is also gaining traction, promising increased transparency and security. The success of these products hinges on their ability to meet evolving consumer needs and preferences while adhering to regulatory requirements.

Report Segmentation & Scope

This report segments the Asia-Pacific neo banking market based on various factors including banking services offered (payments, lending, investments), target customer segments (individuals, businesses), deployment mode (mobile, web), and geographic regions. Each segment's growth projection, market size, and competitive dynamics are analyzed in detail. The report provides insights into the unique challenges and opportunities within each segment. For example, the business banking segment faces unique challenges related to regulatory compliance and security concerns, while the consumer segment is characterized by fierce competition and rapid innovation.

Key Drivers of Asia-Pacific Neo Banking Market Growth

Several factors contribute to the growth of the Asia-Pacific neo banking market. Technological advancements, such as AI and machine learning, enhance efficiency and personalization. Favorable economic conditions and increasing disposable incomes boost demand for financial services. Supportive government policies that encourage fintech innovation further accelerate market growth. Examples include initiatives promoting financial inclusion and the relaxation of regulations surrounding digital banking.

Challenges in the Asia-Pacific Neo Banking Market Sector

Challenges include stringent regulatory hurdles that vary across countries, complexities in navigating diverse market conditions, and intense competition from established players and other fintech companies. These factors may impact market expansion and adoption rates. Data security and privacy concerns are additional barriers. Cybersecurity threats and the need for robust compliance measures pose significant hurdles.

Leading Players in the Asia-Pacific Neo Banking Market Market

- WeBank

- Paytm

- WeLab Bank

- Kakao Bank

- MyBank

- Douugh

- Crypto.com

- Toss Bank

- InstantPay

- Kyash

List Not Exhaustive

Key Developments in Asia-Pacific Neo Banking Market Sector

- April 2022: WeLab Bank becomes the first virtual bank in Hong Kong granted permission to provide digital wealth advising services, launching GoWealth.

- December 2021: Kakao Bank signs an MOU with Kyobo Life Insurance, Kyobo Bookstore, and Kyobo Securities for data cooperation and partnerships.

These developments illustrate the evolving nature of the neo banking landscape and the increasing focus on diversification and expansion of service offerings.

Strategic Asia-Pacific Neo Banking Market Market Outlook

The Asia-Pacific neo banking market holds immense future potential. Continued technological advancements, increasing digital adoption, and supportive government policies will drive significant growth. Strategic opportunities exist for neo-banks to expand their product offerings, improve customer experience, and leverage emerging technologies. Focusing on niche markets, strategic partnerships, and international expansion will be crucial for success in this competitive landscape.

Asia-Pacific Neo Banking Market Segmentation

-

1. Account Type

- 1.1. Business Account

- 1.2. Saving Account

-

2. Service

- 2.1. Mobile Banking

- 2.2. Payments and Tranfer

- 2.3. Loans

- 2.4. Others

-

3. Application

- 3.1. Enterprise

- 3.2. Personal

- 3.3. Others

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Australia

- 4.4. Singapore

- 4.5. Hongkong

- 4.6. Rest of Asia-Pacific

Asia-Pacific Neo Banking Market Segmentation By Geography

- 1. China

- 2. India

- 3. Australia

- 4. Singapore

- 5. Hongkong

- 6. Rest of Asia Pacific

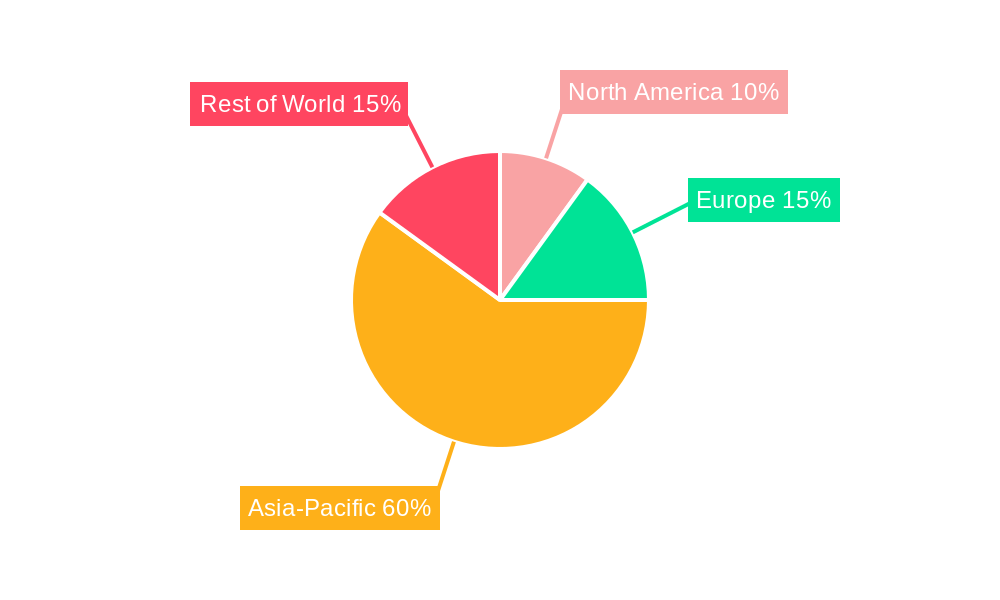

Asia-Pacific Neo Banking Market Regional Market Share

Geographic Coverage of Asia-Pacific Neo Banking Market

Asia-Pacific Neo Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Number of Customers for Neo Banking is Raising Significantly in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 5.1.1. Business Account

- 5.1.2. Saving Account

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Mobile Banking

- 5.2.2. Payments and Tranfer

- 5.2.3. Loans

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Enterprise

- 5.3.2. Personal

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Australia

- 5.4.4. Singapore

- 5.4.5. Hongkong

- 5.4.6. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Australia

- 5.5.4. Singapore

- 5.5.5. Hongkong

- 5.5.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 6. China Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Account Type

- 6.1.1. Business Account

- 6.1.2. Saving Account

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Mobile Banking

- 6.2.2. Payments and Tranfer

- 6.2.3. Loans

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Enterprise

- 6.3.2. Personal

- 6.3.3. Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Australia

- 6.4.4. Singapore

- 6.4.5. Hongkong

- 6.4.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Account Type

- 7. India Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Account Type

- 7.1.1. Business Account

- 7.1.2. Saving Account

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Mobile Banking

- 7.2.2. Payments and Tranfer

- 7.2.3. Loans

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Enterprise

- 7.3.2. Personal

- 7.3.3. Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Australia

- 7.4.4. Singapore

- 7.4.5. Hongkong

- 7.4.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Account Type

- 8. Australia Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Account Type

- 8.1.1. Business Account

- 8.1.2. Saving Account

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Mobile Banking

- 8.2.2. Payments and Tranfer

- 8.2.3. Loans

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Enterprise

- 8.3.2. Personal

- 8.3.3. Others

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Australia

- 8.4.4. Singapore

- 8.4.5. Hongkong

- 8.4.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Account Type

- 9. Singapore Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Account Type

- 9.1.1. Business Account

- 9.1.2. Saving Account

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Mobile Banking

- 9.2.2. Payments and Tranfer

- 9.2.3. Loans

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Enterprise

- 9.3.2. Personal

- 9.3.3. Others

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Australia

- 9.4.4. Singapore

- 9.4.5. Hongkong

- 9.4.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Account Type

- 10. Hongkong Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Account Type

- 10.1.1. Business Account

- 10.1.2. Saving Account

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Mobile Banking

- 10.2.2. Payments and Tranfer

- 10.2.3. Loans

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Enterprise

- 10.3.2. Personal

- 10.3.3. Others

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. India

- 10.4.3. Australia

- 10.4.4. Singapore

- 10.4.5. Hongkong

- 10.4.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Account Type

- 11. Rest of Asia Pacific Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Account Type

- 11.1.1. Business Account

- 11.1.2. Saving Account

- 11.2. Market Analysis, Insights and Forecast - by Service

- 11.2.1. Mobile Banking

- 11.2.2. Payments and Tranfer

- 11.2.3. Loans

- 11.2.4. Others

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Enterprise

- 11.3.2. Personal

- 11.3.3. Others

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. China

- 11.4.2. India

- 11.4.3. Australia

- 11.4.4. Singapore

- 11.4.5. Hongkong

- 11.4.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Account Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 WeBank

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Paytm

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 WeLab Bank

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kakao Bank

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 MyBank

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Douugh

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Crypto com

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Toss Bank

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 InstantPay

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Kyash**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 WeBank

List of Figures

- Figure 1: Global Asia-Pacific Neo Banking Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 3: China Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 4: China Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 5: China Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: China Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 7: China Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: China Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 9: China Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: China Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 11: China Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: India Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 13: India Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 14: India Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 15: India Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 16: India Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 17: India Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: India Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 19: India Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 20: India Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 21: India Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 23: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 24: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 25: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 26: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 27: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 29: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 33: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 34: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 35: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 36: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 37: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 39: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 43: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 44: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 45: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 46: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 47: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 48: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 49: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 52: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 53: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 54: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 55: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 56: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 57: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 59: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 60: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 61: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 2: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 3: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 7: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 8: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 12: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 13: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 17: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 22: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 23: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 27: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 28: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 32: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 33: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 35: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Neo Banking Market?

The projected CAGR is approximately 47%.

2. Which companies are prominent players in the Asia-Pacific Neo Banking Market?

Key companies in the market include WeBank, Paytm, WeLab Bank, Kakao Bank, MyBank, Douugh, Crypto com, Toss Bank, InstantPay, Kyash**List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Neo Banking Market?

The market segments include Account Type, Service, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 261.4 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Number of Customers for Neo Banking is Raising Significantly in the Region.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In April 2022, WeLab Bank has become the first virtual bank in Hong Kong to be granted permission to provide digital wealth advising services. The Bank soft-launched its intelligent wealth solution GoWealth Digital Wealth Advisory (GoWealth) for selected customers after receiving Type 1 (Dealing in securities) and Type 4 (Advising on securities) licenses from the Hong Kong Securities and Futures Commission (HKSFC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Neo Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Neo Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Neo Banking Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Neo Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence