Key Insights

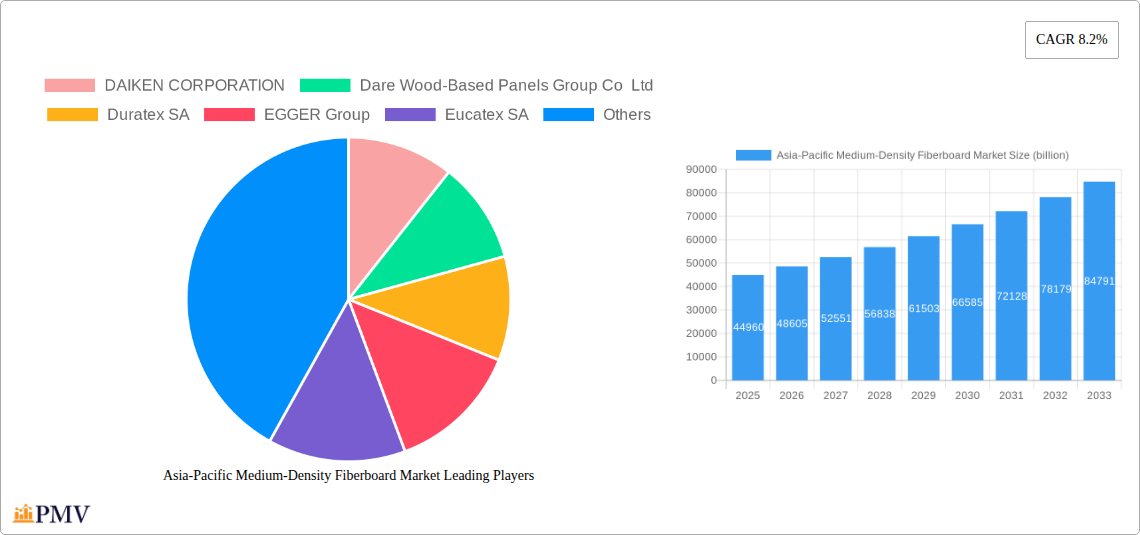

The Asia-Pacific Medium-Density Fiberboard (MDF) market is poised for substantial growth, projected to reach $44.96 billion in 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 8.2%, indicating sustained demand and innovation within the sector. Key market drivers include the escalating construction activities across the region, particularly in developing economies like India and Southeast Asian nations, coupled with a rising demand for aesthetically pleasing and cost-effective interior design solutions in both residential and commercial spaces. The furniture, cabinetry, and flooring segments are expected to remain the primary consumers of MDF, benefiting from its versatility, smooth surface for finishes, and consistent density. Furthermore, the increasing adoption of MDF in specialized applications, such as door and millwork manufacturing, along with innovative packaging systems, contributes significantly to its market traction. The growing consumer preference for durable, eco-friendly building materials also positions MDF favorably, especially as manufacturers increasingly incorporate sustainable practices and recycled content into their production processes.

Asia-Pacific Medium-Density Fiberboard Market Market Size (In Billion)

Despite the strong growth trajectory, the market faces certain restraints, including fluctuations in raw material prices, particularly wood pulp and resins, which can impact profit margins for manufacturers. Intense competition among established players like DAIKEN CORPORATION, EGGER Group, and WEYERHAEUSER COMPANY, alongside emerging regional manufacturers, necessitates continuous innovation in product development and cost optimization. However, the market is actively leveraging opportunities arising from the growing prominence of specialty MDF products, such as moisture-resistant and fire-retardant grades, catering to specific industry requirements. The dynamic landscape of the Asia-Pacific region, with its diverse economic profiles and evolving consumer needs, presents a fertile ground for the continued expansion of the MDF market. Emerging trends also point towards increased utilization of MDF in modular construction and prefabricated building components, further solidifying its importance in the construction and interior design industries.

Asia-Pacific Medium-Density Fiberboard Market Company Market Share

Unlock the full potential of the booming Asia-Pacific Medium-Density Fiberboard (MDF) market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025 and a detailed forecast for 2025-2033, this analysis provides critical insights into market size, growth drivers, competitive landscape, and emerging trends. Navigate the complexities of this dynamic sector, from furniture manufacturing to construction, and identify lucrative investment opportunities.

Asia-Pacific Medium-Density Fiberboard Market Market Structure & Competitive Dynamics

The Asia-Pacific Medium-Density Fiberboard (MDF) market is characterized by a moderately concentrated competitive landscape, with several global and regional players vying for market share. Key companies like DAIKEN CORPORATION, Dare Wood-Based Panels Group Co Ltd, Duratex SA, EGGER Group, Eucatex SA, Kastamonu Entegre, Nelson Pine Industries Ltd, SWISS KRONO AG, WEST FRASER TIMBER CO LTD, and WEYERHAEUSER COMPANY are at the forefront of innovation and production. Market concentration is influenced by factors such as access to raw materials, technological advancements in production, and economies of scale. The innovation ecosystem is robust, with continuous efforts focused on developing more sustainable MDF products, enhancing durability, and exploring novel applications. Regulatory frameworks, particularly concerning environmental standards and sustainable forestry practices, play a crucial role in shaping market entry and operational strategies. Product substitutes, such as Particleboard and Plywood, offer alternative solutions, though MDF's superior surface smoothness and machinability often give it a competitive edge. End-user trends, driven by the burgeoning construction and furniture industries across the region, significantly impact demand dynamics. Merger and acquisition (M&A) activities, while not extensively documented with specific deal values in publicly available data, are likely to play a role in consolidating market positions and expanding geographical reach. These activities aim to enhance product portfolios, gain access to new markets, and leverage synergistic benefits. The market's growth is further fueled by increasing investments in manufacturing facilities and a rising demand for interior design solutions.

Asia-Pacific Medium-Density Fiberboard Market Industry Trends & Insights

The Asia-Pacific Medium-Density Fiberboard (MDF) market is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. This expansion is primarily driven by the escalating demand from the furniture and construction sectors, fueled by rapid urbanization and a growing middle class across countries like China, India, and Southeast Asian nations. Technological disruptions are playing a pivotal role, with advancements in manufacturing processes leading to the production of higher quality, more environmentally friendly MDF. Innovations in low-emission formaldehyde binders and the development of moisture-resistant MDF are catering to increasingly discerning consumer preferences for healthier and more durable building materials. The rising trend towards interior decoration and home renovation projects also significantly contributes to market penetration. Consumer preferences are shifting towards sustainable and eco-friendly products, pushing manufacturers to invest in sustainable sourcing of wood fibers and eco-conscious production methods. Competitive dynamics are intense, with companies focusing on product differentiation, cost optimization, and expanding their distribution networks to capture market share. The increasing adoption of digital technologies in supply chain management and customer engagement is also a notable trend. Furthermore, the growing demand for custom-made furniture and interior fittings, where MDF's versatility shines, is a key market penetration driver. The Asia-Pacific region's economic development, coupled with supportive government policies promoting manufacturing and construction, further solidifies the positive outlook for the MDF market. The increasing availability of affordable housing projects and the demand for ready-to-assemble furniture are also significant factors contributing to the overall market growth and penetration.

Dominant Markets & Segments in Asia-Pacific Medium-Density Fiberboard Market

The Asia-Pacific Medium-Density Fiberboard (MDF) market is dominated by China, owing to its massive manufacturing base, significant construction activities, and a burgeoning furniture industry. Following closely are India and Southeast Asian countries, collectively driven by rapid urbanization, infrastructure development, and a growing disposable income.

Key Drivers of Dominance in China:

- Economic Policies: Supportive government initiatives promoting the manufacturing sector and domestic consumption.

- Infrastructure Development: Extensive investment in housing, commercial spaces, and public infrastructure projects.

- Manufacturing Hub: China's established role as a global manufacturing hub for furniture and building materials, with significant MDF production capacity.

- Large Consumer Base: A vast population with increasing demand for home furnishings and construction materials.

Dominance Analysis: The dominance of China in the Asia-Pacific MDF market can be attributed to its sheer scale of production and consumption. The country's industrial policies have consistently supported the wood-based panel industry, leading to the establishment of numerous large-scale MDF manufacturing plants. This has not only catered to domestic demand but also positioned China as a significant exporter of MDF products. The construction boom, driven by both residential and commercial projects, requires substantial quantities of MDF for various applications like flooring, cabinetry, and interior paneling. The furniture sector, a major global exporter, heavily relies on MDF for its cost-effectiveness and ease of fabrication.

Leading Segments:

Application:

- Furniture: This is the largest application segment, driven by the global demand for affordable, stylish, and customizable furniture. MDF's smooth surface, excellent finishing properties, and machinability make it ideal for producing cabinets, tables, beds, and other furniture components. The increasing popularity of flat-pack furniture and DIY furniture kits further bolsters demand.

- Cabinet: A significant sub-segment within furniture, cabinetry for kitchens and bathrooms heavily utilizes MDF due to its stability and ability to hold screws well.

- Flooring: MDF is increasingly used in laminate flooring and engineered wood flooring, offering durability and cost-effectiveness. Its ability to be manufactured with precise dimensions is crucial for this application.

- Molding, Door, and Millwork: MDF is a preferred material for decorative moldings, door cores, and various millwork applications due to its consistent density, smooth surface, and paintability, allowing for intricate designs.

End-user Industry:

- Residential: This is the primary end-user industry, encompassing new home construction, renovations, and interior décor projects. The growing demand for modern living spaces and aesthetically pleasing interiors drives MDF consumption.

- Commercial: This segment includes offices, retail spaces, hotels, and restaurants. The need for durable and visually appealing interior finishes, furniture, and fixtures contributes to MDF demand.

- Institutional: This segment covers schools, hospitals, and government buildings, where MDF is used for furniture, wall paneling, and other interior applications requiring durability and cost-effectiveness.

Asia-Pacific Medium-Density Fiberboard Market Product Innovations

Product innovations in the Asia-Pacific Medium-Density Fiberboard (MDF) market are primarily focused on enhancing sustainability, performance, and application versatility. Key developments include the production of low-emission MDF using formaldehyde-free binders, catering to growing health and environmental concerns. Advancements in moisture-resistant and fire-retardant MDF formulations are expanding its use in demanding environments like kitchens, bathrooms, and commercial spaces. Furthermore, manufacturers are exploring thinner MDF boards for specific applications and thicker boards for structural use, showcasing adaptability to diverse market needs. Surface treatments, such as high-gloss finishes and textured laminates, are also gaining traction, offering aesthetic appeal and reducing the need for secondary finishing processes, thus providing a competitive advantage in terms of cost and time savings.

Report Segmentation & Scope

This comprehensive report segments the Asia-Pacific Medium-Density Fiberboard (MDF) market across key dimensions to provide granular insights.

Application Segmentation:

- Cabinet: This segment encompasses MDF used for the construction of kitchen cabinets, bathroom cabinets, and general storage units, projecting steady growth driven by residential and commercial construction.

- Flooring: Covers MDF utilized in laminate flooring, engineered wood flooring, and underlayment, with projected growth influenced by the demand for durable and aesthetically pleasing residential and commercial flooring solutions.

- Furniture: This broad segment includes MDF for all types of furniture, from residential to office and hospitality, expected to see significant expansion due to evolving interior design trends and demand for affordable furnishings.

- Molding, Door, and Millwork: This segment includes decorative moldings, door cores, window frames, and other architectural elements, with growth tied to construction and renovation activities.

- Packaging System: Encompasses MDF used in industrial packaging and protective solutions, with growth driven by e-commerce and the need for robust shipping materials.

- Other Applications: Includes various niche uses of MDF not covered in the primary categories, expected to contribute modestly to overall market expansion.

End-user Industry Segmentation:

- Residential: This segment analyzes MDF demand from homeowners for new constructions, renovations, and interior design, representing the largest and most dynamic segment.

- Commercial: Covers MDF usage in office spaces, retail outlets, hotels, and restaurants, with growth influenced by business expansion and interior fit-out projects.

- Institutional: This segment focuses on MDF demand from educational institutions, healthcare facilities, and government buildings, where durability and cost-effectiveness are key considerations.

Key Drivers of Asia-Pacific Medium-Density Fiberboard Market Growth

The Asia-Pacific Medium-Density Fiberboard (MDF) market growth is propelled by several key drivers. Economically, the rapid urbanization and rising disposable incomes across emerging economies are fueling demand for furniture and housing, directly impacting MDF consumption. Technologically, advancements in manufacturing processes have led to more sustainable and higher-performance MDF products, such as low-emission and moisture-resistant variants. Regulatory frameworks supporting sustainable forestry and construction practices indirectly favor MDF produced from recycled wood fibers. Furthermore, the increasing demand for interior decoration and home renovation projects, coupled with the cost-effectiveness and versatility of MDF for various applications like furniture, cabinetry, and flooring, are significant growth accelerators for the Asia-Pacific MDF market.

Challenges in the Asia-Pacific Medium-Density Fiberboard Market Sector

Despite its strong growth trajectory, the Asia-Pacific Medium-Density Fiberboard (MDF) market faces several challenges. Fluctuations in raw material prices, particularly wood fiber and resins, can impact production costs and profit margins. Stringent environmental regulations regarding formaldehyde emissions and waste disposal, while promoting sustainability, can increase compliance costs for manufacturers. Supply chain disruptions, exacerbated by geopolitical factors and logistics complexities, can affect the timely delivery of finished products. Intense competition from alternative wood-based panels and engineered materials, as well as the presence of numerous small-scale manufacturers, can lead to price wars and pressure on profitability. Overcapacity in certain sub-regions can also pose a challenge, leading to price erosion.

Leading Players in the Asia-Pacific Medium-Density Fiberboard Market Market

- DAIKEN CORPORATION

- Dare Wood-Based Panels Group Co Ltd

- Duratex SA

- EGGER Group

- Eucatex SA

- Kastamonu Entegre

- Nelson Pine Industries Ltd

- SWISS KRONO AG

- WEST FRASER TIMBER CO LTD

- WEYERHAEUSER COMPANY

- CenturyPly

- Rushil Décor

Key Developments in Asia-Pacific Medium-Density Fiberboard Market Sector

- September 2022: CenturyPly invested INR 700 crores (USD 94.5 million) to build a medium-density fiberboard (MDF) manufacturing plant in Andhra Pradesh (India), with an annual capacity of 3.2 lakh cubic meters. This development is set to significantly boost regional supply and meet growing MDF demand.

- October 2021: Rushil Décor expanded its global operations by setting up a state-of-the-art, sustainable, first-of-a-kind, and environmentally friendly MDF-making plant in Andhra Pradesh, India. This expansion highlights a commitment to eco-conscious manufacturing and increased production capacity.

Strategic Asia-Pacific Medium-Density Fiberboard Market Market Outlook

The strategic outlook for the Asia-Pacific Medium-Density Fiberboard (MDF) market is highly promising, driven by continued economic development and evolving consumer preferences. The growing emphasis on sustainable and eco-friendly building materials presents a significant opportunity for manufacturers investing in low-emission and recycled-content MDF. Strategic initiatives focusing on product innovation, such as developing specialized MDF with enhanced properties like superior moisture resistance or acoustic insulation, will allow companies to tap into niche, high-value market segments. Expansion into emerging markets within Southeast Asia and further development within India will be crucial for capturing untapped demand. Collaborations and partnerships aimed at optimizing supply chains and enhancing distribution networks will also be vital for competitive advantage. The trend towards modular construction and ready-to-assemble furniture will continue to fuel demand, making strategic investments in production capacity and advanced manufacturing technologies essential for long-term success in this dynamic market.

Asia-Pacific Medium-Density Fiberboard Market Segmentation

-

1. Application

- 1.1. Cabinet

- 1.2. Flooring

- 1.3. Furniture

- 1.4. Molding, Door, and Millwork

- 1.5. Packaging System

- 1.6. Other Applications

-

2. End-user Industry

- 2.1. Residential

- 2.2. Commercial

- 2.3. Institutional

Asia-Pacific Medium-Density Fiberboard Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

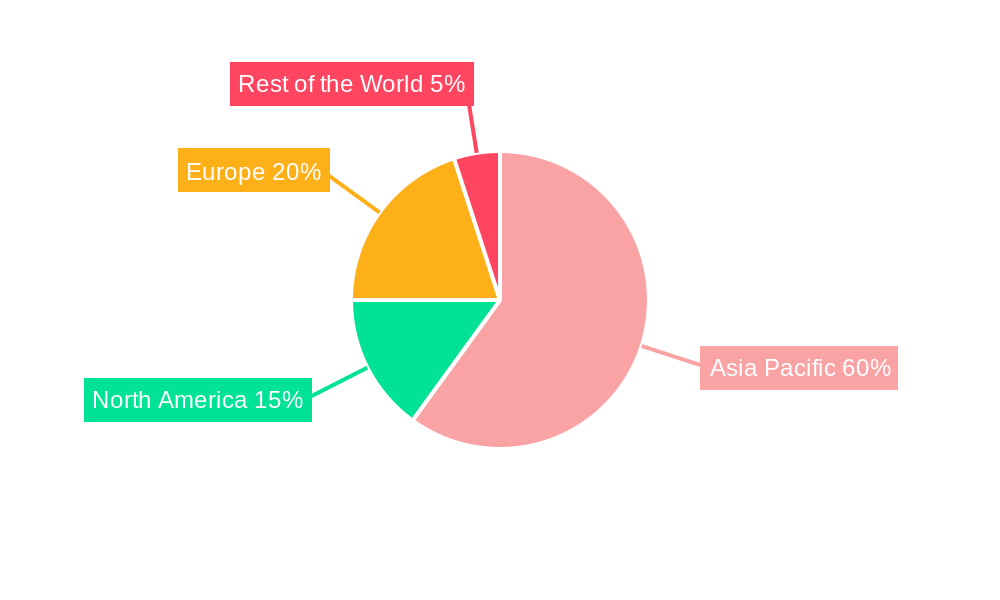

Asia-Pacific Medium-Density Fiberboard Market Regional Market Share

Geographic Coverage of Asia-Pacific Medium-Density Fiberboard Market

Asia-Pacific Medium-Density Fiberboard Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase MDF Demand for Furniture; Easy Availability of Raw Materials

- 3.3. Market Restrains

- 3.3.1. Increase MDF Demand for Furniture; Easy Availability of Raw Materials

- 3.4. Market Trends

- 3.4.1. The Residential Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Medium-Density Fiberboard Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cabinet

- 5.1.2. Flooring

- 5.1.3. Furniture

- 5.1.4. Molding, Door, and Millwork

- 5.1.5. Packaging System

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Institutional

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DAIKEN CORPORATION

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dare Wood-Based Panels Group Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Duratex SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EGGER Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eucatex SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kastamonu Entegre

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nelson Pine Industries Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SWISS KRONO AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 WEST FRASER TIMBER CO LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 WEYERHAEUSER COMPANY*List Not Exhaustive 6 5 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Growing Prominence for the Production of Specialty MD

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DAIKEN CORPORATION

List of Figures

- Figure 1: Asia-Pacific Medium-Density Fiberboard Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Medium-Density Fiberboard Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Medium-Density Fiberboard Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Medium-Density Fiberboard Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Asia-Pacific Medium-Density Fiberboard Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Medium-Density Fiberboard Market Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Asia-Pacific Medium-Density Fiberboard Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Asia-Pacific Medium-Density Fiberboard Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia-Pacific Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia-Pacific Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia-Pacific Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia-Pacific Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia-Pacific Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia-Pacific Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia-Pacific Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia-Pacific Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia-Pacific Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia-Pacific Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia-Pacific Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Medium-Density Fiberboard Market?

The projected CAGR is approximately 8.2%.

2. Which companies are prominent players in the Asia-Pacific Medium-Density Fiberboard Market?

Key companies in the market include DAIKEN CORPORATION, Dare Wood-Based Panels Group Co Ltd, Duratex SA, EGGER Group, Eucatex SA, Kastamonu Entegre, Nelson Pine Industries Ltd, SWISS KRONO AG, WEST FRASER TIMBER CO LTD, WEYERHAEUSER COMPANY*List Not Exhaustive 6 5 MARKET OPPORTUNITIES AND FUTURE TRENDS, Growing Prominence for the Production of Specialty MD.

3. What are the main segments of the Asia-Pacific Medium-Density Fiberboard Market?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 44.96 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase MDF Demand for Furniture; Easy Availability of Raw Materials.

6. What are the notable trends driving market growth?

The Residential Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Increase MDF Demand for Furniture; Easy Availability of Raw Materials.

8. Can you provide examples of recent developments in the market?

September 2022: CenturyPly Invested INR 700 crores (USD 94.5 million) to build a medium-density fiberboard (MDF) manufacturing plant in Andhra Pradesh (India), with an annual capacity of 3.2 lakh cubic meters. This development will meet the region's MDF demand in the future.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Medium-Density Fiberboard Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Medium-Density Fiberboard Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Medium-Density Fiberboard Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Medium-Density Fiberboard Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence