Key Insights

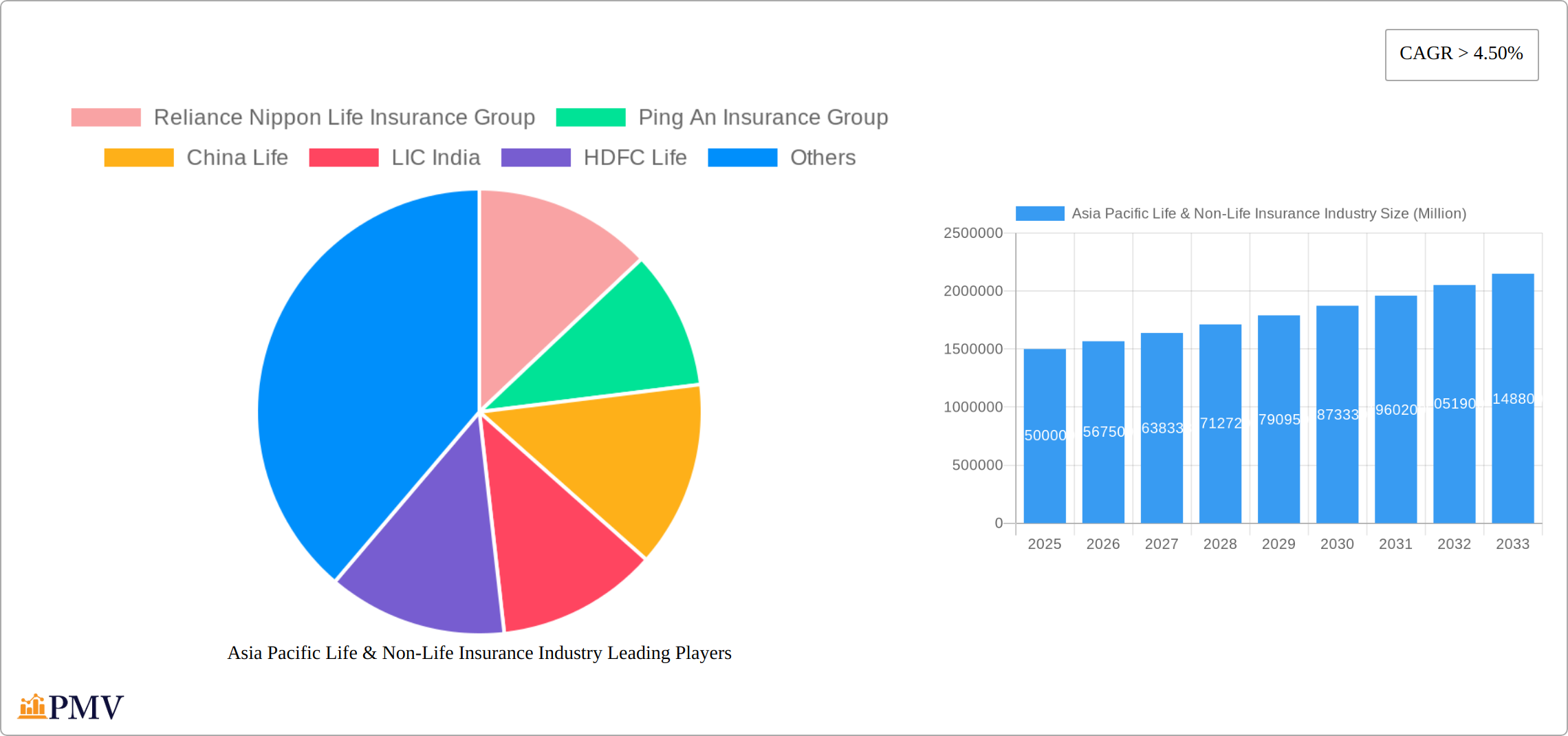

The Asia Pacific life and non-life insurance market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing awareness of insurance products, and a burgeoning middle class across the region. The market's Compound Annual Growth Rate (CAGR) exceeding 4.50% from 2019 to 2024 indicates a significant expansion. This growth is fueled by strong demand for life insurance, particularly in rapidly developing economies like India and China, where increasing life expectancy and a growing preference for financial security are driving adoption. The non-life insurance segment is also witnessing considerable growth, underpinned by rising urbanization, increasing vehicle ownership, and expanding industrial activities that necessitate property and casualty insurance. However, challenges remain, including regulatory hurdles, market penetration variations across different countries, and the need for enhanced technological infrastructure to support efficient operations and customer acquisition. The market is highly fragmented with a mix of global players and regional insurers vying for market share. Companies like Reliance Nippon Life Insurance, Ping An Insurance, China Life, LIC India, and HDFC Life are key players, while smaller regional insurers play an important role in specific markets. Future growth is likely to be shaped by technological advancements, particularly in the area of InsurTech, personalized insurance solutions, and increased digital engagement.

Further analysis suggests a significant potential for market expansion in underserved regions and demographic segments within the Asia Pacific region. The relatively high CAGR signifies that the market is ripe for innovation and disruption. The increasing adoption of digital platforms is expected to facilitate greater accessibility to insurance products, thereby driving wider penetration. However, addressing challenges related to consumer education and trust remains crucial for sustaining growth. The sector’s future depends on effectively balancing innovation, regulatory compliance, and maintaining a strong focus on customer needs. The overall trajectory suggests a sustained period of substantial growth for the Asia Pacific life and non-life insurance market, driven by favorable economic conditions and changing consumer behaviours.

Asia Pacific Life & Non-Life Insurance Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Asia Pacific life & non-life insurance industry, covering market structure, competitive dynamics, industry trends, and future growth prospects. The report utilizes data from the historical period (2019-2024), the base year (2025), and projects growth until the estimated year (2025) and forecast period (2025-2033). This in-depth analysis is crucial for industry players, investors, and stakeholders seeking to navigate this dynamic and rapidly evolving market.

Key Players Analyzed: Reliance Nippon Life Insurance Group, Ping An Insurance Group, China Life, LIC India, HDFC Life, Japan Post Insurance Co, Life Insurance Corporation of India, MS&AD Insurance Group Holding Inc, Tokia Marine Holdings Inc, Dai-ichi Life Holdings Co (List Not Exhaustive)

Asia Pacific Life & Non-Life Insurance Industry Market Structure & Competitive Dynamics

The Asia Pacific life & non-life insurance market is characterized by a complex interplay of factors influencing its structure and competitive dynamics. Market concentration varies significantly across countries, with some dominated by a few large players, while others exhibit a more fragmented landscape. Innovation ecosystems are emerging, driven by fintech advancements and the increasing adoption of digital technologies. Regulatory frameworks, while generally robust, differ across nations, creating varying operational landscapes. The presence of product substitutes, such as mutual funds and alternative investment vehicles, also shapes the competitive arena. End-user trends, including shifting demographics and evolving risk perceptions, influence demand for insurance products. Finally, mergers and acquisitions (M&A) activity plays a crucial role in shaping market consolidation and competitive positioning. For instance, in 2024, M&A deal values totaled approximately $xx Million, with a significant number of transactions focused on expanding regional footprints and diversifying product portfolios. The market share of the top 5 players is estimated at xx% in 2025, indicating a moderately concentrated market.

Asia Pacific Life & Non-Life Insurance Industry Industry Trends & Insights

The Asia Pacific life & non-life insurance market is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, exceeding the global average. This growth is fueled by rising disposable incomes, increasing awareness of insurance products, and government initiatives promoting financial inclusion. Technological disruptions, particularly the rise of InsurTech, are transforming the industry, improving efficiency, and creating new distribution channels. Consumer preferences are also evolving, with a growing demand for customized, digital-first solutions. Intensifying competition among established players and new entrants is driving innovation and enhancing customer experience. Market penetration, while relatively low in some regions, is expected to increase substantially over the forecast period, as affordability and accessibility improve. The increasing adoption of digital technologies is further driving efficiency and customer satisfaction, leading to a higher market penetration rate projected at xx% by 2033.

Dominant Markets & Segments in Asia Pacific Life & Non-Life Insurance Industry

The report identifies China as the dominant market within the Asia Pacific region, accounting for xx% of the total market value in 2025.

- Key Drivers of China's Dominance:

- Rapid economic growth and rising middle class.

- Expanding insurance awareness and penetration.

- Supportive government policies and regulations.

- Robust investment in infrastructure and digital technology.

China's dominance stems from its massive population, rapid economic growth, and increasing disposable incomes, driving demand for both life and non-life insurance products. The government's focus on developing the insurance sector further supports market expansion. While other countries like India, Japan, and Australia represent substantial markets, China's sheer size and growth trajectory solidify its position as the dominant market in the region. The non-life segment is expected to experience faster growth due to the increasing demand for motor and health insurance. The life insurance segment benefits from growing awareness of long-term financial security and savings.

Asia Pacific Life & Non-Life Insurance Industry Product Innovations

The Asia Pacific life & non-life insurance industry is witnessing a wave of product innovation driven by technological advancements and evolving customer needs. Microinsurance products are gaining traction, catering to low-income segments. Embedded insurance, integrating insurance coverage within other products and services, is rapidly expanding. Data analytics and AI are being leveraged to improve risk assessment, pricing, and customer service. The integration of blockchain technology promises enhanced security and transparency. These developments enhance customer experience and cater to the diverse needs of the region’s population.

Report Segmentation & Scope

This report segments the Asia Pacific life & non-life insurance market based on several key parameters: product type (life insurance, non-life insurance), distribution channel (online, offline), and geography (country-specific analysis of major markets). Each segment is analyzed in detail, including market size, growth projections, and competitive landscape. Growth projections vary significantly across segments, with digital channels and specific product categories, such as health insurance, experiencing the fastest growth.

Key Drivers of Asia Pacific Life & Non-Life Insurance Industry Growth

Several factors are driving the growth of the Asia Pacific life & non-life insurance industry. Technological advancements, such as the proliferation of InsurTech and the use of AI and data analytics, are leading to greater efficiency and personalized products. Economic growth, particularly in emerging economies, is increasing disposable incomes and demand for insurance coverage. Favorable government regulations and initiatives promoting financial inclusion are creating a conducive environment for market expansion. The increasing middle class and rising awareness of financial security also significantly drive the demand for insurance.

Challenges in the Asia Pacific Life & Non-Life Insurance Industry Sector

Despite the positive outlook, the Asia Pacific life & non-life insurance industry faces several challenges. Regulatory hurdles and inconsistencies across different jurisdictions can hinder market expansion. Supply chain disruptions and cybersecurity threats pose operational risks. Intense competition, both from established players and new entrants, necessitates constant innovation and efficiency improvements. The rising prevalence of fraudulent activities also presents a significant challenge that impacts the profitability of insurance companies.

Leading Players in the Asia Pacific Life & Non-Life Insurance Industry Market

- Reliance Nippon Life Insurance Group

- Ping An Insurance Group

- China Life

- LIC India

- HDFC Life

- Japan Post Insurance Co

- Life Insurance Corporation of India

- MS&AD Insurance Group Holding Inc

- Tokio Marine Holdings Inc

- Dai-ichi Life Holdings Co

Key Developments in Asia Pacific Life & Non-Life Insurance Industry Sector

- October 2023: Bolttech and Allianz Partners partnered to launch insurance solutions for embedded devices and appliances in the Asia Pacific. This partnership expands the reach of embedded insurance, a rapidly growing segment.

- October 2023: The Life Insurance Corporation of India (LIC) and SBI General Insurance entered into a corporate agency collaboration with BANKIT, an Indian FinTech company. This strategic alliance leverages technology to expand insurance reach into remote areas, improving financial inclusion.

Strategic Asia Pacific Life & Non-Life Insurance Industry Market Outlook

The Asia Pacific life & non-life insurance industry presents significant growth opportunities over the next decade. Continued economic growth, increasing insurance awareness, technological innovation, and supportive regulatory environments will drive market expansion. Strategic investments in digital technologies, product diversification, and regional expansion will be crucial for success. Companies that effectively leverage data analytics, personalize their offerings, and embrace innovative distribution channels are well-positioned to capitalize on the substantial market potential.

Asia Pacific Life & Non-Life Insurance Industry Segmentation

-

1. Insurance Type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Other Non-life Insurances

-

1.1. Life Insurance

-

2. Distribution channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution channels

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia-Pacific

Asia Pacific Life & Non-Life Insurance Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Rest of Asia Pacific

Asia Pacific Life & Non-Life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1 Non-Life Insurance Sector Dominates Asia-Pacific

- 3.4.2 Fueled by Rising Awareness and Urbanization

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia Pacific Life & Non-Life Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Other Non-life Insurances

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. China Asia Pacific Life & Non-Life Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6.1.1. Life Insurance

- 6.1.1.1. Individual

- 6.1.1.2. Group

- 6.1.2. Non-life Insurance

- 6.1.2.1. Home

- 6.1.2.2. Motor

- 6.1.2.3. Other Non-life Insurances

- 6.1.1. Life Insurance

- 6.2. Market Analysis, Insights and Forecast - by Distribution channel

- 6.2.1. Direct

- 6.2.2. Agency

- 6.2.3. Banks

- 6.2.4. Other Distribution channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7. Japan Asia Pacific Life & Non-Life Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7.1.1. Life Insurance

- 7.1.1.1. Individual

- 7.1.1.2. Group

- 7.1.2. Non-life Insurance

- 7.1.2.1. Home

- 7.1.2.2. Motor

- 7.1.2.3. Other Non-life Insurances

- 7.1.1. Life Insurance

- 7.2. Market Analysis, Insights and Forecast - by Distribution channel

- 7.2.1. Direct

- 7.2.2. Agency

- 7.2.3. Banks

- 7.2.4. Other Distribution channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8. India Asia Pacific Life & Non-Life Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8.1.1. Life Insurance

- 8.1.1.1. Individual

- 8.1.1.2. Group

- 8.1.2. Non-life Insurance

- 8.1.2.1. Home

- 8.1.2.2. Motor

- 8.1.2.3. Other Non-life Insurances

- 8.1.1. Life Insurance

- 8.2. Market Analysis, Insights and Forecast - by Distribution channel

- 8.2.1. Direct

- 8.2.2. Agency

- 8.2.3. Banks

- 8.2.4. Other Distribution channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9. Rest of Asia Pacific Asia Pacific Life & Non-Life Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9.1.1. Life Insurance

- 9.1.1.1. Individual

- 9.1.1.2. Group

- 9.1.2. Non-life Insurance

- 9.1.2.1. Home

- 9.1.2.2. Motor

- 9.1.2.3. Other Non-life Insurances

- 9.1.1. Life Insurance

- 9.2. Market Analysis, Insights and Forecast - by Distribution channel

- 9.2.1. Direct

- 9.2.2. Agency

- 9.2.3. Banks

- 9.2.4. Other Distribution channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Reliance Nippon Life Insurance Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ping An Insurance Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 China Life

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 LIC India

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 HDFC Life

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Japan Post Insurance Co

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Life Insurance corporation of India

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 MS&AD Insurance Group Holding Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Tokia marine holdings Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Dai-ichi Life holdings Co **List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Reliance Nippon Life Insurance Group

List of Figures

- Figure 1: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: China Asia Pacific Life & Non-Life Insurance Industry Revenue (Million), by Insurance Type 2024 & 2032

- Figure 3: China Asia Pacific Life & Non-Life Insurance Industry Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 4: China Asia Pacific Life & Non-Life Insurance Industry Revenue (Million), by Distribution channel 2024 & 2032

- Figure 5: China Asia Pacific Life & Non-Life Insurance Industry Revenue Share (%), by Distribution channel 2024 & 2032

- Figure 6: China Asia Pacific Life & Non-Life Insurance Industry Revenue (Million), by Geography 2024 & 2032

- Figure 7: China Asia Pacific Life & Non-Life Insurance Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 8: China Asia Pacific Life & Non-Life Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: China Asia Pacific Life & Non-Life Insurance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Japan Asia Pacific Life & Non-Life Insurance Industry Revenue (Million), by Insurance Type 2024 & 2032

- Figure 11: Japan Asia Pacific Life & Non-Life Insurance Industry Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 12: Japan Asia Pacific Life & Non-Life Insurance Industry Revenue (Million), by Distribution channel 2024 & 2032

- Figure 13: Japan Asia Pacific Life & Non-Life Insurance Industry Revenue Share (%), by Distribution channel 2024 & 2032

- Figure 14: Japan Asia Pacific Life & Non-Life Insurance Industry Revenue (Million), by Geography 2024 & 2032

- Figure 15: Japan Asia Pacific Life & Non-Life Insurance Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 16: Japan Asia Pacific Life & Non-Life Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Japan Asia Pacific Life & Non-Life Insurance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: India Asia Pacific Life & Non-Life Insurance Industry Revenue (Million), by Insurance Type 2024 & 2032

- Figure 19: India Asia Pacific Life & Non-Life Insurance Industry Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 20: India Asia Pacific Life & Non-Life Insurance Industry Revenue (Million), by Distribution channel 2024 & 2032

- Figure 21: India Asia Pacific Life & Non-Life Insurance Industry Revenue Share (%), by Distribution channel 2024 & 2032

- Figure 22: India Asia Pacific Life & Non-Life Insurance Industry Revenue (Million), by Geography 2024 & 2032

- Figure 23: India Asia Pacific Life & Non-Life Insurance Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 24: India Asia Pacific Life & Non-Life Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: India Asia Pacific Life & Non-Life Insurance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Rest of Asia Pacific Asia Pacific Life & Non-Life Insurance Industry Revenue (Million), by Insurance Type 2024 & 2032

- Figure 27: Rest of Asia Pacific Asia Pacific Life & Non-Life Insurance Industry Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 28: Rest of Asia Pacific Asia Pacific Life & Non-Life Insurance Industry Revenue (Million), by Distribution channel 2024 & 2032

- Figure 29: Rest of Asia Pacific Asia Pacific Life & Non-Life Insurance Industry Revenue Share (%), by Distribution channel 2024 & 2032

- Figure 30: Rest of Asia Pacific Asia Pacific Life & Non-Life Insurance Industry Revenue (Million), by Geography 2024 & 2032

- Figure 31: Rest of Asia Pacific Asia Pacific Life & Non-Life Insurance Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 32: Rest of Asia Pacific Asia Pacific Life & Non-Life Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of Asia Pacific Asia Pacific Life & Non-Life Insurance Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 3: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 4: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 7: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 8: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 9: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 11: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 12: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 15: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 16: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 19: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 20: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Global Asia Pacific Life & Non-Life Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Life & Non-Life Insurance Industry?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the Asia Pacific Life & Non-Life Insurance Industry?

Key companies in the market include Reliance Nippon Life Insurance Group, Ping An Insurance Group, China Life, LIC India, HDFC Life, Japan Post Insurance Co, Life Insurance corporation of India, MS&AD Insurance Group Holding Inc, Tokia marine holdings Inc, Dai-ichi Life holdings Co **List Not Exhaustive.

3. What are the main segments of the Asia Pacific Life & Non-Life Insurance Industry?

The market segments include Insurance Type, Distribution channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Non-Life Insurance Sector Dominates Asia-Pacific. Fueled by Rising Awareness and Urbanization.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2023, Bolttech and Allianz Partners partnered to launch insurance solutions for embedded devices and appliances in the Asia Pacific.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Life & Non-Life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Life & Non-Life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Life & Non-Life Insurance Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Life & Non-Life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence