Key Insights

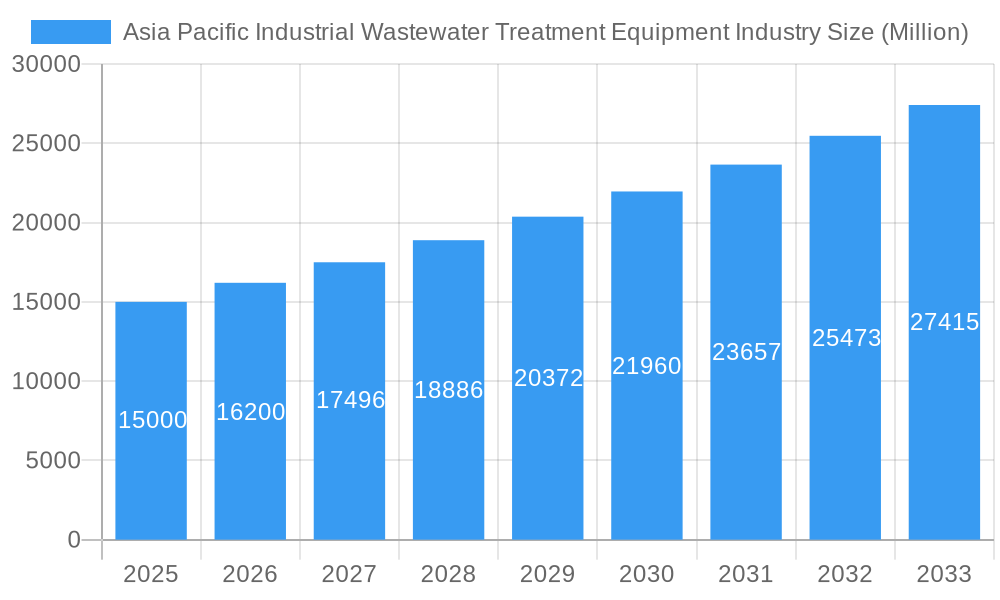

The Asia Pacific Industrial Wastewater Treatment Equipment market is poised for significant expansion, driven by stringent environmental mandates, accelerating industrial development, and heightened awareness of regional water scarcity. The market, valued at $71.01 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 5.3% from 2025 to 2033. This growth is underpinned by escalating industrialization in key economies, necessitating sophisticated wastewater management. Furthermore, robust government regulations across the region are compelling industries to adopt advanced treatment practices. The increasing imperative to conserve water resources also fuels demand for water-efficient technologies and wastewater recycling solutions. The adoption of advanced filtration technologies, coupled with strong demand from sectors such as chemicals, food & beverage, and pulp & paper, will further propel market growth. The competitive landscape is characterized by innovation and strategic alliances among leading global and regional players.

Asia Pacific Industrial Wastewater Treatment Equipment Industry Market Size (In Billion)

While the market demonstrates a positive growth trajectory, challenges such as substantial initial investment costs and a deficit in skilled labor and technical expertise may impede widespread adoption, particularly among smaller enterprises. Nevertheless, continuous technological innovation and supportive governmental policies are anticipated to overcome these obstacles, ensuring sustained market advancement. The market exhibits robust demand across all technology segments, including microfiltration, ultrafiltration, nanofiltration, and reverse osmosis, with reverse osmosis expected to dominate due to its superior efficacy in pollutant removal. Diverse end-user industries, especially chemicals, food & beverage, and pulp & paper, are significant contributors to this growth.

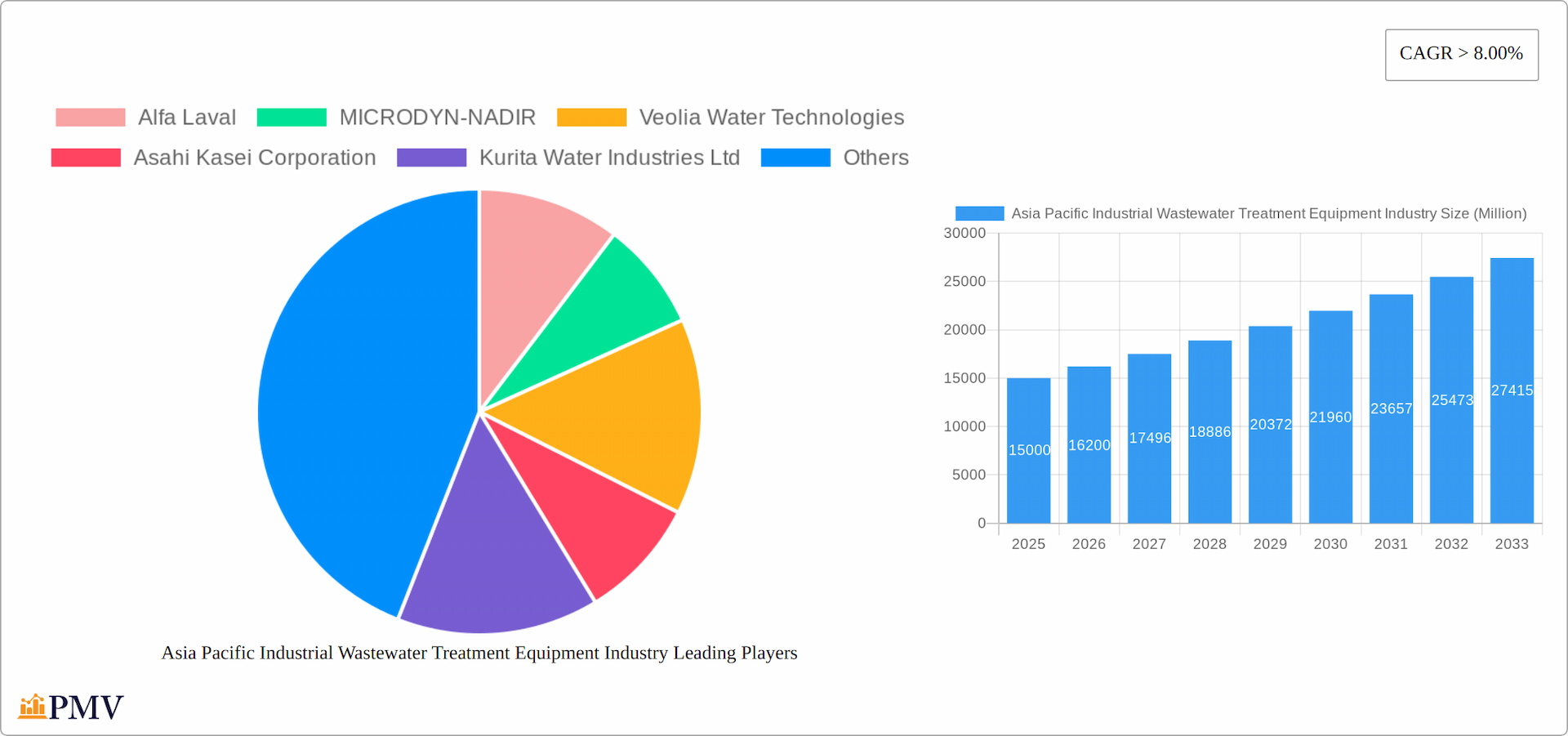

Asia Pacific Industrial Wastewater Treatment Equipment Industry Company Market Share

Asia Pacific Industrial Wastewater Treatment Equipment Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Asia Pacific industrial wastewater treatment equipment market from 2019 to 2033. It offers valuable insights into market dynamics, competitive landscapes, technological advancements, and future growth prospects, equipping stakeholders with actionable intelligence for strategic decision-making. The report covers key segments including microfiltration, ultrafiltration, nanofiltration, and reverse osmosis technologies, across diverse end-user industries such as municipal, pulp and paper, chemicals, food and beverage, healthcare, and power. With a base year of 2025 and a forecast period spanning 2025-2033, this report is an indispensable resource for industry professionals, investors, and researchers seeking to navigate this rapidly evolving market. The market size is estimated to reach xx Million by 2033.

Asia Pacific Industrial Wastewater Treatment Equipment Industry Market Structure & Competitive Dynamics

The Asia Pacific industrial wastewater treatment equipment market exhibits a moderately concentrated structure, with a few major players holding significant market share. Key players like Alfa Laval, Veolia Water Technologies, and Suez compete fiercely, leveraging their established brand reputations and extensive service networks. However, the market also features several regional players and specialized niche providers, contributing to a dynamic competitive landscape.

Market concentration is influenced by factors such as technological expertise, geographical reach, and the scale of operations. The industry's innovation ecosystem is characterized by continuous R&D investments in advanced membrane technologies, automation, and digitalization. Stringent regulatory frameworks related to wastewater discharge standards and environmental regulations are significant drivers shaping market dynamics. Product substitutes, such as biological treatment methods, exist but are often less efficient for specific industrial applications.

End-user trends, particularly the growing adoption of sustainable practices within various industries, are creating significant demand for advanced wastewater treatment solutions. The market witnesses frequent M&A activities, with larger companies acquiring smaller, specialized firms to expand their technology portfolios and market reach. For example, recent M&A deal values have averaged around xx Million, demonstrating strategic investments in market consolidation and expansion.

Asia Pacific Industrial Wastewater Treatment Equipment Industry Industry Trends & Insights

The Asia Pacific industrial wastewater treatment equipment market is experiencing robust growth, driven by several key factors. Stringent environmental regulations across the region are compelling industries to adopt advanced wastewater treatment technologies to meet increasingly stringent discharge standards. Rapid industrialization and urbanization are generating a surge in wastewater volume, fueling demand for efficient and reliable treatment solutions. Furthermore, growing awareness of water scarcity and the need for water reuse is creating a positive market environment. The market is expected to register a CAGR of xx% during the forecast period (2025-2033).

Technological disruptions are profoundly impacting the industry. The increasing adoption of membrane-based technologies such as reverse osmosis and ultrafiltration, owing to their high efficiency and adaptability, is driving market expansion. Furthermore, the integration of automation, IoT, and AI is improving operational efficiency, reducing costs, and enhancing the overall performance of wastewater treatment plants. Consumer preferences are shifting towards sustainable and environmentally friendly solutions, boosting demand for energy-efficient and low-impact technologies. Competitive dynamics are shaped by technological innovation, pricing strategies, and the ability to provide comprehensive service packages. Market penetration of advanced technologies is increasing, with a projected xx% penetration rate by 2033.

Dominant Markets & Segments in Asia Pacific Industrial Wastewater Treatment Equipment Industry

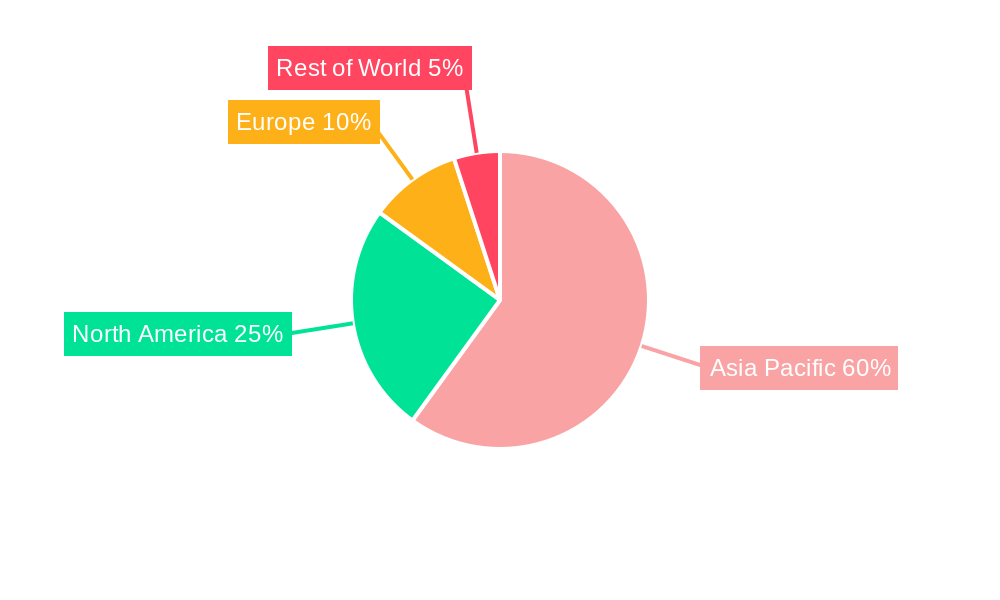

Within the Asia Pacific region, China and India are currently the dominant markets, driven by rapid industrialization, urbanization, and substantial investments in infrastructure development. These countries also benefit from supportive government policies and initiatives aimed at promoting sustainable water management practices. Japan and South Korea also represent significant market segments characterized by technological advancement and robust environmental regulations.

- Leading Technology: Reverse osmosis holds a dominant market share due to its high efficiency in removing contaminants and its suitability for a wide range of industrial applications.

- Dominant End-user Industry: The municipal segment is currently the largest end-user, primarily due to the large-scale investments in municipal wastewater treatment infrastructure. However, the chemicals and pulp and paper industries are also experiencing significant growth in demand due to stringent regulatory requirements.

Key Drivers:

- Economic Growth: Rapid economic expansion in several Asia Pacific countries fuels industrial growth and, subsequently, wastewater generation.

- Infrastructure Development: Significant investments in water and wastewater infrastructure projects contribute substantially to market growth.

- Government Regulations: Stringent environmental regulations and policies encourage the adoption of advanced wastewater treatment solutions.

Asia Pacific Industrial Wastewater Treatment Equipment Industry Product Innovations

Recent years have witnessed a wave of groundbreaking innovations in industrial wastewater treatment equipment, marked by the development of significantly more efficient and durable membrane technologies, sophisticated automated control systems, and highly energy-efficient designs. The strategic integration of IoT and AI capabilities is empowering real-time monitoring, predictive maintenance, and intelligent control, thereby optimizing operational efficiency and drastically minimizing downtime. The utilization of novel materials and advanced membrane configurations is not only elevating treatment performance but also concurrently reducing energy consumption and overall operational expenditures. These cutting-edge innovations are directly addressing the escalating demand for sustainable, cost-effective, and environmentally responsible wastewater treatment solutions, aligning perfectly with the evolving and increasingly sophisticated needs of the Asia Pacific industrial sector.

Report Segmentation & Scope

This report segments the Asia Pacific industrial wastewater treatment equipment market by technology (microfiltration, ultrafiltration, nanofiltration, reverse osmosis) and end-user industry (municipal, pulp and paper, chemicals, food and beverage, healthcare, power, others). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail, providing granular insights into market opportunities and challenges. The report further explores regional variations within Asia Pacific, considering the specific regulatory environments, economic conditions, and infrastructural developments in each key market.

Key Drivers of Asia Pacific Industrial Wastewater Treatment Equipment Industry Growth

The Asia Pacific industrial wastewater treatment equipment market's growth is primarily propelled by stringent environmental regulations aimed at minimizing pollution, coupled with rapid industrialization and urbanization leading to increased wastewater generation. Technological advancements, such as the development of more efficient and cost-effective treatment technologies, also contribute significantly. Moreover, government initiatives promoting sustainable water management and the growing adoption of water reuse practices further fuel market expansion. Economic growth and rising disposable incomes also indirectly contribute to the growth by facilitating greater investments in wastewater treatment infrastructure.

Challenges in the Asia Pacific Industrial Wastewater Treatment Equipment Industry Sector

The Asia Pacific industrial wastewater treatment equipment market faces several challenges, including high initial capital costs for advanced technologies, the complexities involved in managing diverse wastewater streams from different industries, and the fluctuating costs of raw materials and energy. Furthermore, regulatory complexities across different countries and regions can impede market expansion. Supply chain disruptions and skilled labor shortages also pose significant obstacles to industry growth. These challenges necessitate strategic planning and innovative solutions for industry players to navigate effectively. The total estimated impact of these challenges on market growth is projected to be around xx Million annually.

Leading Players in the Asia Pacific Industrial Wastewater Treatment Equipment Industry Market

Key Developments in Asia Pacific Industrial Wastewater Treatment Equipment Industry Sector

- June 2022: Evoqua Water Technologies LLC inaugurated a state-of-the-art production facility in Singapore, underscoring their commitment and significant investment in the Asia-Pacific region to proactively meet the escalating demand for advanced water treatment solutions and technologies.

- October 2022: Suez was awarded a substantial contract valued at USD 745.53 Million by the Municipal Corporation of Greater Mumbai for the development of a large-scale, critical wastewater treatment plant, a strategic win that further solidifies its prominent position in the international market and its capabilities in executing major infrastructure projects.

Strategic Asia Pacific Industrial Wastewater Treatment Equipment Industry Market Outlook

The Asia Pacific industrial wastewater treatment equipment market is strategically positioned for continued and accelerated growth, driven by an intensifying focus on environmental sustainability, the enforcement of stringent environmental regulations, and the ongoing expansion of industrial activities across the region. Significant strategic opportunities are emerging for forward-thinking companies that can adeptly leverage technological advancements, innovate to develop cost-effective and high-performance solutions, and effectively navigate the complex and evolving regulatory landscape. A core emphasis on sustainable practices and the development of energy-efficient technologies will be absolutely critical for achieving enduring success and market leadership. Furthermore, fostering robust partnerships and strategic collaborations across the entire value chain will be paramount for optimizing resource utilization, enhancing operational synergies, and ultimately driving broader market penetration and positive environmental impact.

Asia Pacific Industrial Wastewater Treatment Equipment Industry Segmentation

-

1. Technology

- 1.1. Microfiltration

- 1.2. Ultrafiltration

- 1.3. Nanofiltration

- 1.4. Reverse Osmosis

-

2. End-user Industry

- 2.1. Municipal

- 2.2. Pulp and Paper

- 2.3. Chemicals

- 2.4. Food and Beverage

- 2.5. Healthcare

- 2.6. Power

- 2.7. Others

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia-Pacific

Asia Pacific Industrial Wastewater Treatment Equipment Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia Pacific Industrial Wastewater Treatment Equipment Industry Regional Market Share

Geographic Coverage of Asia Pacific Industrial Wastewater Treatment Equipment Industry

Asia Pacific Industrial Wastewater Treatment Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Low-pressure Membrane Technologies; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Poor Fouling Resistance of Nano porous Membranes; Other Restraints

- 3.4. Market Trends

- 3.4.1. Municipal Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Industrial Wastewater Treatment Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Microfiltration

- 5.1.2. Ultrafiltration

- 5.1.3. Nanofiltration

- 5.1.4. Reverse Osmosis

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Municipal

- 5.2.2. Pulp and Paper

- 5.2.3. Chemicals

- 5.2.4. Food and Beverage

- 5.2.5. Healthcare

- 5.2.6. Power

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. China Asia Pacific Industrial Wastewater Treatment Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Microfiltration

- 6.1.2. Ultrafiltration

- 6.1.3. Nanofiltration

- 6.1.4. Reverse Osmosis

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Municipal

- 6.2.2. Pulp and Paper

- 6.2.3. Chemicals

- 6.2.4. Food and Beverage

- 6.2.5. Healthcare

- 6.2.6. Power

- 6.2.7. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. India Asia Pacific Industrial Wastewater Treatment Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Microfiltration

- 7.1.2. Ultrafiltration

- 7.1.3. Nanofiltration

- 7.1.4. Reverse Osmosis

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Municipal

- 7.2.2. Pulp and Paper

- 7.2.3. Chemicals

- 7.2.4. Food and Beverage

- 7.2.5. Healthcare

- 7.2.6. Power

- 7.2.7. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Japan Asia Pacific Industrial Wastewater Treatment Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Microfiltration

- 8.1.2. Ultrafiltration

- 8.1.3. Nanofiltration

- 8.1.4. Reverse Osmosis

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Municipal

- 8.2.2. Pulp and Paper

- 8.2.3. Chemicals

- 8.2.4. Food and Beverage

- 8.2.5. Healthcare

- 8.2.6. Power

- 8.2.7. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South Korea Asia Pacific Industrial Wastewater Treatment Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Microfiltration

- 9.1.2. Ultrafiltration

- 9.1.3. Nanofiltration

- 9.1.4. Reverse Osmosis

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Municipal

- 9.2.2. Pulp and Paper

- 9.2.3. Chemicals

- 9.2.4. Food and Beverage

- 9.2.5. Healthcare

- 9.2.6. Power

- 9.2.7. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Rest of Asia Pacific Asia Pacific Industrial Wastewater Treatment Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Microfiltration

- 10.1.2. Ultrafiltration

- 10.1.3. Nanofiltration

- 10.1.4. Reverse Osmosis

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Municipal

- 10.2.2. Pulp and Paper

- 10.2.3. Chemicals

- 10.2.4. Food and Beverage

- 10.2.5. Healthcare

- 10.2.6. Power

- 10.2.7. Others

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Alfa Laval

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MICRODYN-NADIR

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Veolia Water Technologies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Asahi Kasei Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kurita Water Industries Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kemira

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Evoqua Water Technologies LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aquatech International LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Koch Membrane Systems Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TORAY INDUSTRIES INC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Suez

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Alfa Laval

List of Figures

- Figure 1: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Industrial Wastewater Treatment Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 3: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 5: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 10: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 11: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 13: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 18: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 19: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 21: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 26: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 27: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 29: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 34: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 35: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 36: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 37: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 41: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 42: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 43: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 44: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 45: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 46: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 47: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Industrial Wastewater Treatment Equipment Industry?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Asia Pacific Industrial Wastewater Treatment Equipment Industry?

Key companies in the market include Alfa Laval, MICRODYN-NADIR, Veolia Water Technologies, Asahi Kasei Corporation, Kurita Water Industries Ltd, Kemira, Evoqua Water Technologies LLC, Aquatech International LLC, Koch Membrane Systems Inc, TORAY INDUSTRIES INC, Suez.

3. What are the main segments of the Asia Pacific Industrial Wastewater Treatment Equipment Industry?

The market segments include Technology, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 71.01 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Low-pressure Membrane Technologies; Other Drivers.

6. What are the notable trends driving market growth?

Municipal Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Poor Fouling Resistance of Nano porous Membranes; Other Restraints.

8. Can you provide examples of recent developments in the market?

In June 2022, Evoqua Water Technologies LLC a market leader in mission-critical water treatment systems, opened a new production plant in Singapore, marking the company's continued investment in Asia-Pacific, where there is a rising need for cutting-edge water treatment technologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Industrial Wastewater Treatment Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Industrial Wastewater Treatment Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Industrial Wastewater Treatment Equipment Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Industrial Wastewater Treatment Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence